PancakeSwap To Burn 300 Million CAKE, Why Is This Whale Moving Coins?

December 28 2023 - 12:00PM

NEWSBTC

Amidst PancakeSwap’s proposal to burn 300 million CAKE and reduce

the total supply from 750 million to 450 million CAKE, on-chain

data indicates that a whale has been moving a significant amount of

CAKE, the decentralized exchange’s governance token. Whale Is

Moving Tokens As Key PancakeSwap Voting Event Proceeds According to

a report from Scopescan, a blockchain analytics platform, a

whale has moved approximately 1.7 million CAKE worth $1.3 million

in the past week from Binance, Gate.io, and Bitget to a series of

crypto addresses. The timing of this transfer is noteworthy since

it coincides with key voting that would permanently shape

PancakeSwap’s tokenomics. The proposed token burn is gathering

significant support, with over 90% of CAKE holders in agreement.

According to the proposer, reducing the total supply to 450

million CAKE is reasonable. It would also ensure sufficient supply

for future growth while achieving “ultrasound CAKE.” Herein, the

idea is to make CAKE deflationary over the long term, and this may

support prices as PancakeSwap continues to play a vital role in

token swapping in the broader BNB Chain ecosystem. Related

Reading: Axie Infinity Springs Back To Life With Surprise 35% Rally

– Details According to DeFiLlama data, PancakeSwap is the largest

DEX in the BNB Chain ecosystem, with a total value locked (TVL) of

$1.6 billion, commanding roughly half of the network’s TVL of

around $3.5 billion. Notably, PancakeSwap has been resilient and

continues to evolve, shaking off competition even after the

deployment of Uniswap v3 on the BNB Chain. In the past 24 hours,

PancakeSwap has generated over $815,000 in fees, more than 7.5X

that of Venus, a lending protocol, the second largest in the BNB

Chain ecosystem. Is CAKE Ready For $10? Notably, the token

burn proposal also comes when PancakeSwap is undergoing significant

changes, including the recent introduction of veCAKE and

Voting gauges, whose voting concluded on November 22. With this

proposal passing with over 99% community support, veCAKE holders

can now vote on where future CAKE farm emissions will be directed.

This gives CAKE holders greater governance influence. Supporters

maintain that this crucial decision makes the DEX more

decentralized and community-facing. Related Reading: MicroStrategy

Spends Another $615 Million On Bitcoin, Do They Know Something You

Don’t? Ahead of PancakeSwap’s plans to burn 300 million CAKE,

prices have been rallying. From the weekly chart, CAKE is up by

over 260% from 2023 lows, roaring as demand increases. While

bullish, bulls are yet to reverse losses of this year. A critical

resistance level remains at around $5. A solid, high-volume break

above this line could propel CAKE to around $10 in the coming

months. Feature image from Canva, chart from TradingView

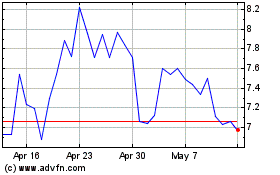

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024