Hedge Fund Predicts Stacks (STX) As Best Altcoin In Upcoming Months

December 05 2023 - 3:15AM

NEWSBTC

North Rock Digital, a player in the digital assets hedge fund

arena, recently made a bold prediction regarding the altcoin Stacks

(STX). In a statement released on X, the fund highlighted its

investment strategy and reasoning for STX being the best altcoin to

long at the moment. “When looking for long ideas, we target those

with strong fundamentals, supportive tokenomics, and significant

upcoming catalysts. STX stands out with the most compelling

catalyst path over the next few months and the greatest chance to

rerate,” the fund stated. In-Depth Analysis Of Stacks’ Prospects

North Rock Digital’s full thesis, published on Medium, delves into

the details underpinning their positive outlook on STX. The thesis

asserts, “Key developments have brought our initial STX thesis into

further focus […] demand for Bitcoin block-space has solidified,

increasing the demand for the product STX is building.” Related

Reading: Stacks (STX) Fired Up Along With Top Coins With 26% Rally

Significant is the Nakamoto upgrade, scheduled before the Bitcoin

halving in April. This upgrade is seen as a pivotal moment for STX,

promising dramatic improvements in speed and efficiency, including

5-second block times and support for sBTC, a secure version of

wrapped Bitcoin. This development, according to North Rock Digital,

positions STX closer to being a true Bitcoin L2. The hedge fund

also points out the broader context within the Bitcoin ecosystem

that favors STX. The rising demand for Bitcoin’s block space,

notably with a 50x spike in network average gas fees this year,

alongside the development of Ordinals, indicates a growing interest

in utilizing Bitcoin beyond just a store of value. These

developments, coupled with the anticipated US spot Bitcoin ETF

approval, are expected to boost the demand for STX’s offerings.

Furthermore, STX has been somewhat overlooked recently, providing

what North Rock Digital sees as a unique investment opportunity.

“Despite these positive developments, attention on STX has declined

[…] leaving us with a unique opportunity,” the thesis

elaborates. Notably, the Stacks developer team’s progress

towards the Nakamoto upgrade is on track, with the Mockamoto

milestone already completed. The fund also emphasizes Stacks’

international partnerships and upcoming initiatives. These include

the launch of a marketing campaign in Asia and the roll-out of the

second Nakamoto testnet by January. “Stacks is expanding their

footprint globally… They will run a marketing campaign to raise

awareness for Bitcoin L2s in the first quarter of ’24 with a focus

in South Korea, Singapore, Hong Kong and Dubai,” the fund explains.

Related Reading: Stacks (STX) Rockets 26% Higher In A Single Week:

The Factors At Play “Stacks is expanding their footprint globally…

They will run a marketing campaign to raise awareness for Bitcoin

L2s in the first quarter of ’24 with a focus in South Korea,

Singapore, Hong Kong and Dubai,” the hedge fund explained.

Moreover, the introduction of new Bitcoin L1 tools like BitVM is

also seen as a significant step towards realizing a true Bitcoin L2

vision without needing changes to Bitcoin L1. STX Valuation In

terms of valuation, STX is currently seen as undervalued,

especially when compared to other L1/L2 ecosystems. With the

Nakamoto upgrade and the proximity to the next BTC halving, STX is

expected to narrow its valuation discount relative to other assets,

North Rock Digital claims. Post-Nakamoto, STX is anticipated to

enable a range of applications, including a performant

BTC-denominated NFT marketplace and traditional DeFi applications.

The potential for these applications, combined with the strong

BTC-centric community of STX, presents a compelling case for its

future growth. At press time, STX stood near its yearly high and

was trading at $1.15. Featured image from Shutterstock, chart from

TradingView.com

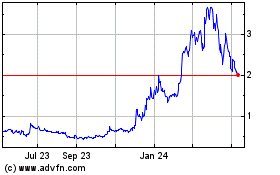

Stacks (COIN:STXUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

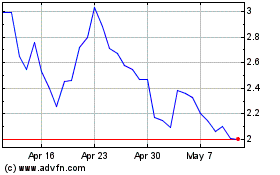

Stacks (COIN:STXUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024