Blockchain Company LBRY Shuts Down After Legal Battle With SEC

October 21 2023 - 3:10PM

NEWSBTC

LBRY Inc., a cryptocurrency platform, announced its closure due to

a court failure against the Securities and Exchange Commission

(SEC). The SEC charged LBRY with making an unregistered securities

offering by selling its native LBC tokens. The fallout from this

legal fight has prompted worries about unequal access to justice

and regulatory overreach in the crypto business, which has

disproportionately impacted smaller startups with minimal financial

resources. LBRY Inc. reported that the company was compelled to

discontinue operations because of obligations owed to the SEC,

legal team, and private creditors totaling several million dollars.

LBRY Inc. is winding down. The LBRY network is unaffected. Odysee

and other assets will undergo a legal process to satisfy debts, but

Odysee has a bright future ahead. Thank you to everyone who fought

with us for online freedom. A final goodbye post is in the first

reply. — LBRY 🚀 (@LBRYcom) October 19, 2023 LBRY’s Financial

Struggles The SEC first sought a $22 million penalties, which was

later lowered to $111,614. This lowered fine was a major financial

blow for LBRY, making it impossible for the company to continue

operations. Related Reading: Bulls Thrust Solana To $25 – What

Traders Should Expect Next The scenario exemplifies the

difficulties that crypto businesses can face when they are pursued

by regulatory agencies, particularly smaller startups with minimal

financial resources. The SEC has been accused of regulatory

overreach in pursuing LBRY, with critics suggesting that the agency

should focus on big issues in the crypto business rather than minor

instances of securities noncompliance. However, this case

highlights the SEC’s ability to control the cryptocurrency market

through enforcement proceedings. Ripple’s Contrasting Legal Victory

The downfall of LBRY contrasts sharply with Ripple’s recent court

success in its ongoing struggle with the SEC. Ripple acquired

funding from a multibillion-dollar corporation, allowing it to

continue its legal battle. Crypto total market cap currently at

$1.10 trillion. Chart: TradingView.com While LBRY Inc.’s controlled

operations are ending, the LBRY blockchain, an open-source

initiative, may continue to exist if sufficient user engagement is

obtained. However, the business stated that decentralization may

only succeed if active development and user participation are

present. With millions of registered users and a large volume of

published material, the LBRY blockchain acted as a decentralized

file-sharing network. Odysee, a decentralized social networking

platform built on the LBRY blockchain, has a substantial user base.

However, its future is now in doubt. In a broader sense, the legal

disputes in the crypto business are altering the securities law

landscape. Both LBRY and Ripple have been accused with selling

unregistered securities, but their outcomes have set developing

precedents. Related Reading: Stacks (STX) Rockets 26% Higher In A

Single Week: The Factors At Play These results have prompted

concerns about the SEC’s capacity to win legal battles against

other crypto businesses. As LBRY succumbs to regulatory pressure,

it represents the obstacles encountered by smaller crypto

businesses, as well as the broader issue of unequal access to

justice in the cryptocurrency industry’s growing regulatory

context. Featured image from Conseils Crypto

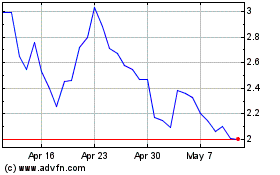

Stacks (COIN:STXUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

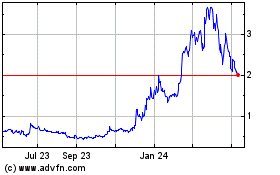

Stacks (COIN:STXUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024