Bitcoin’s Make-or-Break Moment: What’s Holding Back the Next Big Rally?

February 19 2025 - 9:00PM

NEWSBTC

Bitcoin’s price has gradually increased, climbing from $96,000 to

nearly $97,000 as of today. Although still shy of the coveted

$100,000 mark, the leading cryptocurrency shows signs of

resilience. This recovery is unfolding against the backdrop of

mixed market signals, prompting analysts to weigh the potential for

continued bullish momentum versus the risk of a near-term pullback.

Related Reading: Bitcoin Faces Persistent Resistance at $100K,

Analyst Eyes Next Step Bitcoin’s Market Momentum at a Crossroads

One recent analysis from Onchain Edge, a contributor to

CryptoQuant’s QuickTake platform, highlights Bitcoin’s current

“critical decision zone.” Using two key indicators—the Taker

Buy/Sell Ratio and the MVRV Ratio—Onchain Edge’s findings suggest a

market that is not yet overvalued, though caution flags remain.

While the overall on-chain data leans more positive, the

contrasting signals highlight the precarious position of Bitcoin’s

current rally. From a bullish perspective, the MVRV Ratio—an

indicator that compares Bitcoin’s market value to its realized

value—stands at 2.21, well below the levels that typically signal

market tops (3.5–4.0). This suggests that Bitcoin’s current

valuation is not overstretched, leaving room for further upside.

Moreover, other indicators such as the Puell Multiple reinforce the

notion that Bitcoin has not yet reached overbought conditions.

According to the CryptoQuant analyst, if these macro indicators

hold steady and buyers return in force, Bitcoin could continue its

upward trajectory, potentially reclaiming six-figure territory

before any substantial correction sets in. Possible Bearish Signals

on the Horizon Despite these promising signs, the Taker Buy/Sell

Ratio, which gauges market sentiment by comparing aggressive buy

and sell orders, stands at 0.96—below the 0.98 threshold often

associated with bullish strength. Onchain Edge reveals that

historically, levels around this range have preceded market

corrections, as was the case during peaks in March and November of

2021. Should Bitcoin fail to break above resistance, this ratio

could hint at a short-term top. A sustained failure to climb past

current levels may trigger a temporary pullback, providing a

cooling-off period before any subsequent rally. As Bitcoin hovers

near this pivotal price point, the market remains finely balanced

between cautious optimism and potential downside risk. Onchain Edge

concludes that maintaining a level above $95,000, combined with a

resurgence in buying activity, could pave the way for a move to new

highs. Related Reading: Bitcoin Meets Fiscal Reality: Fidelity’s

Timmer Predicts What’s Next Conversely, a decline below critical

support might lead to a healthy correction before the market

regains upward momentum. While the bull cycle appears intact, the

coming days may determine whether Bitcoin’s current rally has

enough fuel to continue, or if a pause is on the horizon. Featured

image created with DALL-E, Chart from TradingView

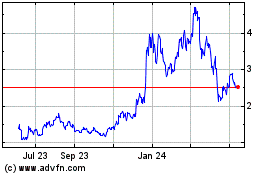

Optimism (COIN:OPUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

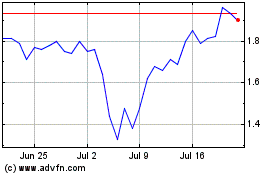

Optimism (COIN:OPUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025