Luna Classic Adds Over 50% In 24H After Interpol’s Red Notice Slammed Its Price

September 26 2022 - 7:31PM

NEWSBTC

Early hours of Monday, September 26, Interpol issued a Red Notice

against the founder of Luna Classic, DO Kwon. This issuance

resulted from Do Kwon losing more than $60 billion in investors’

wealth. The prosecutors in South Korea explained that Kwon is

facing charges for the erosion of investors’ money. In addition to

his charges, Do Kwon stands accused of violating the ‘Capital

Markets Law,’ with multiple breaches cited. Related Reading:

Bitcoin Shows Resilience In Dollar-Driven Bloodbath | BTCUSD

September 26, 2022 This issue has created conversations in the

crypto market regarding the future of Terra firm and the

algorithmic stablecoins. This article details events surrounding Do

Kwon and how he made it into Interpol’s most wanted List.

Earlier Developments Leading To Kwon’s Red Notice Earlier

this year, the Terra ecosystem collapsed, unheard of in an evolving

Defi space. The crash hurt the crypto market, with other financial

markets feeling its effects. Crypto Analysts believe that investors

lost over $45 billion in wealth. After the crash, he

relocated Terra Headquarters from South Korea to Singapore due to

being under investigation for tax evasion charges in South Korea.

In an interview, the Terra founder said he would cooperate with

investigative agencies in the Terra crash and has nothing to hide.

Further, Do Kwon acclaimed that he is a man with an “extremely high

bar of integrity.” However, South Korean prosecutors explicitly

refute Do Kwon’s statement claiming he was not cooperating and was

obviously on the run. As a result, Interpol has issued a Red Notice

on the Terra founder in over 196 countries. Terra Classic Price

Crash And Reversal Following the news of Interpol’s Red Notice on

Do Kwon, the downtrend price of Terra Classic continued. Taking

effect of the notice, the $LUNC price declined by nearly 20%

immediately after the news, leaving investors disturbed. The

crash of the Terra Classic token has also led to the collapse of a

high-profile crypto hedge fund called Three Arrows Capital. This

issue has also impacted several crypto lenders offering LUNC in the

market. But unexpectedly, the $LUNC has reversed in price

action as there is an uptrend in the price. Per coinmarketcap.com,

LUNC has gained over 50% in the last 24 hours and currently trades

at $0.0003074. Investors should be wary as it could lead to a

classic pump and dump scheme. The crypto community awaits further

development in price as the search for Do Kwon intensifies. What Is

The Future Of LUNC A spokesperson for South Korea explained that

the Red Notice against Kwon would set a wrong precedence for the

crypto industry and may cripple future innovations in the market.

Related Reading: Avalanche Struggle To Break Downtrend, Is $20 Mark

Possible? The collapse of Terra stablecoin will lead to greater

regulatory scrutiny in the crypto market. Reports from last week

indicate the House of Financial Services Committee has issued a

bill introducing a two-year ban on creating and issuing algorithmic

stablecoins like Terra. Featured image from Pixabay and chart

from TradingView.com

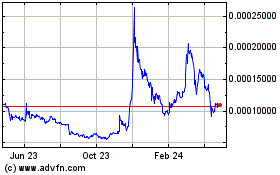

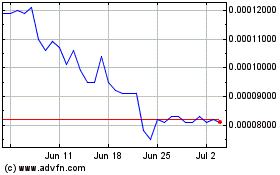

Terra Luna Classic (COIN:LUNCUSD)

Historical Stock Chart

From Aug 2024 to Sep 2024

Terra Luna Classic (COIN:LUNCUSD)

Historical Stock Chart

From Sep 2023 to Sep 2024