Bitcoin NVT Golden Cross Hits 60-Day Low: Is This Bullish?

January 24 2025 - 5:30AM

NEWSBTC

On-chain data shows the Bitcoin Network Value to Transactions (NVT)

Golden Cross has plummeted recently. Here’s what this could mean

for BTC’s price. Bitcoin NVT Golden Cross Has Plunged Into Bottom

Zone Recently As explained by an analyst in a CryptoQuant Quicktake

post, the BTC NVT Golden Cross has declined to the lowest level in

two months recently. The “NVT Ratio” refers to an indicator that

keeps track of the ratio between the Bitcoin market cap and

transaction volume. When the value of this metric is high, it means

the value of the network (that is, the market cap) is high compared

to its ability to transact coins (the transaction volume). Such a

trend implies the asset may be overvalued. Related Reading: Bitcoin

Capital Inflows See Notable Slowdown, But Is This A Worry? On the

other hand, the indicator being low suggests the cryptocurrency

could be due to a bullish rebound as its volume is high compared to

its market cap. In the context of the current topic, the normal

version of the NVT Ratio isn’t of interest, but rather a modified

form known as the NVT Golden Cross. This metric compares the

short-term trend of the NVT Ratio with its long-term one to

determine whether its value is near a top or bottom. The NVT Golden

Cross uses the 10-day moving average (MA) of the NVT Ratio to track

short-term trends and the 30-day MA for long-term ones. Now, here

is a chart that shows the trend in the Bitcoin NVT Golden Cross

over the last couple of months: In the graph, the quant has

highlighted two zones that have historically proven to be relevant

to the Bitcoin NVT Golden Cross. The red zone, situated above a

value of 2.2, is where the indicator has been the most likely to

see a reversion to the mean zero level. Similarly, the green zone

corresponding to values under -1.6 is where bottoms in the metric

have tended to form. As the color coding already implies, ventures

into these zones have often meant a bullish and bearish outcome for

BTC, respectively. From the chart, it’s apparent that the NVT

Golden Cross surged into the overheated territory around the time

of last month’s price top. Since then, the indicator has gradually

been making its way down, with its value today finding itself

submerged in the undervalued region. Related Reading: Arbitrum

(ARB) Primed For 46% Rally If This Happens, Analyst Reveals The

current value of -2.21 is the lowest that the metric has been in

around 60 days. Given the historical pattern, it’s possible that

this could imply Bitcoin may be near a local bottom, if one isn’t

already in. BTC Price Bitcoin has settled into a phase of sideways

movement during the last few days as its price is still trading

around the $105,200 mark. Featured image from iStock.com,

CryptoQuant.com, chart from TradingView.com

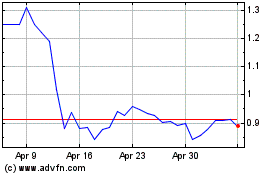

Flow (COIN:FLOWUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Flow (COIN:FLOWUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025