Sound Results for illimity Also in the Second Quarter of 2022

August 05 2022 - 7:32AM

Sound Results for illimity Also in the Second Quarter of 2022

via InvestorWire -- Chaired by Rosalba Casiraghi, the Board of

Directors of illimity Bank S.p.A. (“

illimity” or

the “

Bank”) approved yesterday the illimity

Group’s results at 30 June 2022.

illimity continued on its

growth path driven by a further expansion in business

volumes, posting

a net profit of 15.8 million euro

in the second quarter of 2022 (+6% y/y), to reach

a total of 31.5 million euro in the first half of

2022, representing an increase of 15% over the first half

of 2021 (27.4 million euro).More specifically, the quarter was

characterised by:

- the best second quarter in

terms of new business volumes, with around 394

million euro of originated business between loans and

investments, a rise of 51% over the figure for the second

quarter of the previous year. The Bank’s business Divisions all

displayed great vivacity and can count on a particularly

significant pipeline for the next few months. Taken overall, net

customer loans rose to almost 3.2 billion euro at 30 June 2022, an

increase of 37% over the same period of the previous year and 13%

over March 2022;

- steady growth in revenue to

reach 80.6 million euro (+3% q/q, +13% y/y) in the second

quarter of 2022, taking total revenue for the first half of

2022 to 159.0 million euro (+25% y/y), while keeping a

good balance between net interest income and other revenue

components. The Distressed Credit Division continued to be the

leading contributor, generating 68% of total revenues for the half

year, while the Growth Credit Division posted significant growth,

with revenues almost double those of the first half of 2021, taking

its contribution to consolidated revenues to ca. 20%, to which

should be added the Investment Banking Division contributing a

further 5%. Taken as a whole, the revenue generated by illimity

with SME customers in the Growth Credit and Investment Banking

Divisions together reached 39.5 million euro in the first half of

2022, nearly double the corresponding figure for the previous

year;

- a Cost income ratio

standing at 60% in the second quarter of 2022, a rise of

three percentage points over the previous quarter as a

result of the investments made in new initiatives -

including b-ilty and Quimmo –

whose contribution in terms of revenue will only be seen over the

coming months. The Cost income ratio stood at 59% in the

first half of 2022, a decrease of approximately one

percentage point over the same period of the previous year;

- as a result of the above dynamics,

operating profit reached 32.1 million

euro in the second quarter of 2022, a rise on an annual

basis (+4% over the figure of 30.7 million euro posted in the

second quarter of 2021). Operating profit accordingly

amounted to ca. 65.6 million euro in the first

half of 2022, representing an increase of ca. 31% over the

first half of 2021;

- a pre-tax profit of 24.0

million euro for the second quarter of 2022, representing

an increase of 7% on an annual basis and substantially in line with

the figure of 24.1 million euro posted in the previous quarter;

pre-tax profit for the half year therefore

amounted to 48.1 million euro, a rise of ca. 16%

over the first half of the previous year;

- excellent organic credit

quality: on 30 June 2022 the ratio between gross doubtful

organic loans and total gross organic loans originated since the

start of illimity’s operations remained contained at 0.9%, a figure

becoming 2.2% if the loan portfolio of the former Banca

Interprovinciale, which is gradually running off, is included. The

annualised organic cost of risk4 for the quarter stood at 49

bps;

- a robust capital

base with ratios positioned at top levels of the system –

a phased-in CET1 ratio of 16.1% (17.7% pro-forma taking into

account the amendment to article 127 of the CRR which had effect

from 11 July 2022 and the inclusion of the special shares which

will be automatically converted to ordinary shares in the current

quarter), a phased-in Total Capital Ratio of 21.3% (23.3% pro-forma

taking into account the amendment to article 127 of the CRR and

including the special shares) – and a solid liquidity

position (of approximately 600 million euro), available

for reinvestment in future business opportunities.

In line with the execution of 2021-25 Strategic

Plan, work continued in the second quarter of 2022 on

implementing initiatives with high technological features

developed in markets synergic with or complementary to the Bank’s

core business. Once these activities have become fully operational

and reached significant size, they will act as an important driver

for the creation of shareholder value.

- illimitybank.com,

the retail banking platform, the first in Italy to

provide Open Banking functionalities, reached around 1.5 billion

euro deposits at the end of June 2022 from a loyal customer base,

as confirmed by its Net Promoter Score5, one of the highest in the

system;

- b-ilty, the first digital

business store for credit and financial services developed by

illimity for Small Corporates, which is completing its

test phase (“beta phase”) and building up its commercial

network;

- HYPE, the leading fintech

challenger in Italy by number of users which consolidated

its leadership in the second quarter of 2022, reaching over 1.6

million customers and constantly enhancing its product offer;

- Quimmo,

the innovative proptech, an evolution of neprix

Sales and already a remarketing leader on the judicial real

estate market, has entered the open real estate

market with a new platform and a new brand and sold 689

properties in the second quarter of 2022, taking the number of

properties sold since the beginning of the year to over 1,250.

In addition, on 30 June illimity completed the

acquisition of Aurora Recovery Capital S.p.A.

(“Arec”), a company specialised in the management

of Unlikely to Pay (“UTP”) loans with a focus on the large-ticket

corporate real estate segment, which will be merged into neprix –

the illimity Group’s servicing platform. This operation strengthens

the market positioning of neprix, taking its managed loans to

around 10.3 billion euro6, and will provide a valuable contribution

to the generation of third party servicing mandates, increasingly

establishing its position as a market servicer and, in particular,

as the third operator specialising in the management of UTP

corporate real estate loans. On 30 June 2022, all the conditions

for completing the acquisition had been met and the business

combination became effective as of that date. As a result, the

business combination was recognised in illimity’s consolidated

balance sheet on 30 June 2022, while the economic results will be

visible starting from the current quarter.Lastly, as confirmation

of its considerable commitment in the sustainability field,

illimity has recently received an especially important

uplift in its ESG ratings:

- MSCI, one of the

world’s leading index and benchmark providers, increased its rating

from “B” to “A”, also as recognition of illimity’s leadership in

corporate governance matters;

- Standard Ethics,

one of the leading independent rating agencies on sustainability

issues, lifted its rating from “E” to “EE-”, thanks, in particular,

to illimity’s alignment with the United Nations, OECD and European

Union guidance, as well as to its integrated sustainability

management model.

Corrado Passera,

CEO and Founder of

illimity, commented: “We are very satisfied with

the sound results posted in the second quarter of the year, the

best in terms of business generation. The robust pipeline for the

next few months confirms the dynamism of all the Divisions, which

are ready to grasp the opportunities arising from the constant

expansion of the markets in which we operate. The two highly

technological initiatives launched over the past few months -

b-ilty, the complete digital platform for credit and financial

services for SMEs, and Quimmo, the innovative proptech - are

proceeding as planned. If together with these new initiatives with

a “tech” soul, we also consider illimitybank.com, which provides

customers with top quality direct banking retail services, and

HYPE, which continues to consolidate its leadership in the Italian

fintech market, we can say that illimity is making significant

additional strides in its ability to create technological

platforms, which will be the driver of further growth and value

creation for all our stakeholders. At the same time, the

acquisition of Arec is an important step in reinforcing our

positioning in UTP loan management with particular focus on the

large-ticket corporate real estate segment and puts us in the right

position for grasping the important business opportunities arising

on this market in the future. Lastly, I am especially pleased with

the new ESG ratings assigned to us by MSCI and Standard Ethics,

which confirm the value of the decisions we have taken on

sustainability issues from the start of the Bank’s activities and

represent a stimulus to do even better”.

For more details view the entire announcement:

https://assets.ctfassets.net/0ei02du1nnrl/4QpUWvlIvDBvvLTRn1egqn/ca3c2edf36477be623690ec31f513171/illimity_2Q22_1H22_Results.pdf

For further information:

Investor RelationsSilvia Benzi:

+39.349.7846537 - +44.7741.464948 - silvia.benzi@illimity.com

|

Press & Communication illimity |

|

|

Vittoria La Porta |

Sara Balzarotti, Ad Hoc Communication Advisors |

|

+39.393.4340394 press@illimity.com |

+39.335.1415584 sara.balzarotti@ahca.it |

Wire Service Contact:InvestorWire

(IW)Los Angeles,

Californiawww.InvestorWire.comEditor@InvestorWire.com

_____________________________

1 Related to the business originated by

illimity, excluding the loan portfolio of the former Banca

Interprovinciale.2 A pro-forma phased-in CET1 ratio to take account

of the amendment to article 127 of Regulation (EU) No.575/2013 (the

“CRR”) on the weighting of unsecured NPEs effective from the

beginning of July 2022 with an estimated impact of ca. 271 million

euro on the basis of the balance at 30 June 2022.3 Source: “The

Italian NPE Market – Wind of Change” issued in July 2022, data

referred at 31 December 2021.4 Calculated as the ratio between loan

loss provisions and net organic loans to customers at 30 June 2022

(2,031 million euro) for the Factoring, Cross-over, Acquisition

Finance, Turnaround and b-ilty segments and loans purchased as part

of investments in distressed credit portfolios that have undergone

a passage of accounting status subsequent to acquisition or

disbursement (excluding loans purchased as bad loans), the loan

portfolio of the former Banca Interprovinciale and Senior Financing

to non-financial investors in distressed loans. 5 Net Promoter

Score (“NPS”) of illimitybank.com equal to 43 in second quarter

2022 (with market average equal to 1).6 Considering also deals

signed on 4 August 2022, whose execution is subject to the positive

conclusion of the authorisation process with the Supervisory

Authority.

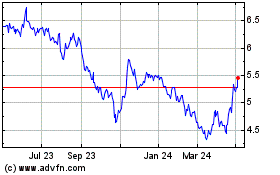

Illimity Bank (BIT:ILTY)

Historical Stock Chart

From Nov 2024 to Dec 2024

Illimity Bank (BIT:ILTY)

Historical Stock Chart

From Dec 2023 to Dec 2024