illimity Creates b-ilty

via InvestorWire -- illimity today presents

b-ilty, the

first digital business store of financial services and credit for

small- and medium-sized businesses

(“

SMEs”) – those having a turnover of indicatively

10 to 2 million euro – with high growth potential.

A bank created with the aim of simplifying a

businessman’s life, thanks to the latest generation

platform that combines specialist expertise and cutting-edge

technology and provides its customers with the products

and services of a complete bank, with the immediacy and ease that

only an evolved user experience can ensure.

b-ilty is a digital platform 100%

focused on SMEs, created with entrepreneurs for

entrepreneurs, aiming to simplify the management of daily

activities. It gathers all banking operations together in a

single ecosystem, integrating tools to support customer

growth with solutions that are adapted to the needs of the

individual business and the individual sectors of the economy.

It is precisely for this reason that it has been

designed on the basis of models typical of the most widespread

digital solutions, to bring means of relating and interacting

normally used on non-financial platforms to the world of credit and

financial services for the first time. The b-ilty business store,

which envisages an “all-inclusive” subscription, will be

progressively enriched with additional features, products and

services, that will be automatically integrated and updated in the

platform, available to subscribers.

A BANKING PLATFORM DEDICATED TO

SMEs

b-ilty is a banking platform of financial

services and credit that has been constructed on the basis of the

suggestions received from hundreds of entrepreneurs. It includes

all the most widely used banking transactions, credit and debit

cards, short-term credit, factoring to fund working capital,

medium-term credit to fund investments, insurance cover to protect

the entrepreneur and the business and many other products and

services provided directly by the illimity Group or by qualified

partners. The range of products and services will be constantly

updated and gradually extended to take into account the specific

needs of the various sectors of the economy.

FAST LENDING DECISIONS

b-ilty provides short and medium to long-term

credit. b-ilty is aware that entrepreneurs want an immediate and

clear response, whatever it may be. b-ilty is aware that every

sector is different from the others. Thanks to a strongly

data-driven approach and the business expertise of illimity’s

Growth Credit division, it proposes a credit offer constructed by

assessing the characteristics of the various businesses and the

specific sectors in which they operate. Thanks to evolved LendTech

systems and experts in the sector to be increasingly added, b-ilty

is able to rapidly analyse dozens of indicators that will gradually

be adapted to the features of each individual economic sector and

shared with customers.

FULLY DIGITAL BUT ALSO

PERSONAL

b-ilty is created fully digital, and easy to use

to enable the entrepreneur, the CFO and the accountant to manage

the business’s finances from their own office, without paper or the

need to go to a branch without depending on other people’s

availability. At the same time, it is also made up of people: every

b-ilty customer will have a clear Relationship Manager with name

and surname, as well as a professional call centre - Smart Care -

available 7 days a week.

ALL ACCOUNTS IN ONE PLACE AND A WEALTH

OF INFORMATION

Thanks to PSD2 functionalities, b-ilty also

allows businesses to make a better use of the other bank accounts:

the balances and movements of all the current accounts a company

holds with other intermediaries can also be viewed on the b-ilty

platform and the company can carry out transactions on all its

accounts from this platform.

b-ilty knows how important it is to have

detailed and comprehensible information available for managing a

company and for this reason it puts the information it has

available on the financial performance of each business and the

sector to which it belongs at its customer’s disposal.

It is then at the discretion of the Head of the

company to decide which information should be shared with which

internal workers and with which external professionals. The

platform undoubtedly simplifies work within the company itself and

relations with its own accountant or other external professionals.

It is an open platform that adapts to the operating needs of every

business.

ALL-INCLUSIVE TRY & BUY

SUBSCRIPTION

b-ilty not only allows customers to tailor the

use of their bank, but also removes any doubt about the

transparency of the applicable conditions.

In this respect the b-ilty platform is available

as an “all-inclusive” subscription, meaning without operating

limits, at a monthly cost of 40 euro.

The first three months are free of charge, after

which the monthly subscription can be interrupted at any time.

Today starts the Beta Phase of b-ilty, in which

access to services will be restricted to a limited number of SMEs,

that will be gradually increased to ensure that our customers

always receive the best possible service.

Corrado Passera, CEO and

Founder of illimity, commented:

“From its very beginnings, illimity has been very focused on

providing credit to SMEs. In three years, we have created a new

paradigm Bank that ended 2021 with assets of almost 5 billion euro,

an operating income of 111 million euro, a ROE of 10% and a capital

base and credit quality at the very top of the sector. In these

three years we have inevitably concentrated on medium-sized

businesses, but in these three years we have also invested in order

to take our technological platforms, our valuation and credit

structuring ability and our knowledge of the sector to all SMEs.

b-ilty is precisely that: it brings illimity to a

market consisting of at least a million SMEs. We see an enormous

potential for growth and improved services in this

large world, something fundamental for our country.”

Carlo Panella, Head of Direct

Banking in illimity, stated:

“b-ilty represents something

different in the banking offer dedicated to small and medium-sized

businesses. It combines the best of new technologies with a highly

tailored proposal based on modern paradigms of use, with relations

and support ensured by a team that will be the customer’s point of

reference. Created by listening to what entrepreneurs in the

various sectors had to say, b-ilty’s aim is to

respond, for the first time, to the growing need for an offer

exclusively dedicated to them. b-ilty’s digital

business store is moreover an example of real open banking based on

a model that does not only consist of illimity’s products but also

those of selected partners, with the aim of constantly including

the best available offers. In this respect, in order to create

b-ilty we have gone beyond the financial world,

taking inspiration from everyday digital platforms that are

easy-to-use, transparent in their conditions and always updated in

the offer. Our promise is to be complete in an offer that is

easy-to-use and fast in the answers, always ensuring the human

touch, thanks to a team of enthusiastic professionals.”

FOR FURTHER INFORMATION

Investor

Relations illimity Silvia Benzi: +39.349.7846537

- +44.7741.464948 – silvia.benzi@illimity.com

|

Ufficio Stampa & Comunicazione illimity |

|

| Isabella Falautano, Francesca

d’Amico |

Sara Balzarotti, Ad Hoc

Communication Advisors |

| +39.340.1989762

press@illimity.com |

+39.335.1415584

sara.balzarotti@ahca.it |

Wire Service Contact:InvestorWire (IW)Los

Angeles, Californiawww.InvestorWire.com212.418.1217

OfficeEditor@InvestorWire.com

illimity Bank S.p.A.

illimity is the high-tech

banking group founded and headed by Corrado Passera created with

the aim of responding to specific market needs by way of an

innovative and specialist business model. More specifically,

illimity extends financing to high-potential SMEs, purchases

distressed corporate loans and manages these through its platform

neprix, and provides digital direct banking services through

illimitybank.com. illimity SGR, which sets up and manages

alternative investment funds, the first of which dedicated to UTP

loans, is also a member of the Group. The story of the illimity

Group began in January 2018 with the launch of the special purpose

acquisition company SPAXS S.p.A., which ended with a record 600

million euro being raised on the market. SPAXS subsequently

acquired Banca Interprovinciale S.p.A., with the resulting merger

between the two giving rise to “illimity Bank S.p.A.” which has

been listed on the Italian Stock Exchange since 5 March 2019

(ticker “ILTY”), first on the MTA exchange and since September 2020

on the STAR Segment (now Euronext STAR Milan). The banking group,

headquartered in Milan, can already count on over 700 employees and

closed its financial statements as of December 31, 2021 with assets

of around 4.7 billion euro.

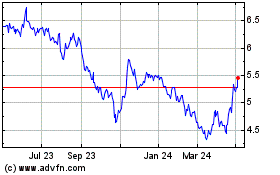

Illimity Bank (BIT:ILTY)

Historical Stock Chart

From Nov 2024 to Dec 2024

Illimity Bank (BIT:ILTY)

Historical Stock Chart

From Dec 2023 to Dec 2024