UPDATE: Ten Network 1st Half Profit Plunges 70%, Pins Hopes On New Shows

April 12 2012 - 2:50AM

Dow Jones News

Australian television broadcaster Ten Network Holdings Ltd.

(TEN.AU) posted a 70% plunge in first half net profit Thursday as

weak ratings and a tough advertising market hit earnings.

Ten is banking on a raft of new and returning programs to turn

around its ratings, which are currently languishing in third place

at 24.7% behind Australia's two other commercial networks, leader

Seven and second placed Nine.

The network is hoping its soon-to-return Master Chef program,

one of Australia's most popular ever programs, will boost ratings,

along with new episodes of popular U.S. sitcom Modern Family and

new reality shows Don't Tell The Bride and The Shire.

Australia's television stations are battling for ratings to

claim a share of a shrinking advertising market, which has been hit

by poor retail conditions driven by cautious consumers reluctant to

spend.

Chief Executive James Warburton, who replaced interim CEO

Lachlan Murdoch, the eldest son of News Corp. (NWS) Chairman Rupert

Murdoch in the role in January, said in a statement the company was

focusing on ratings and revenue.

"We are making good progress on both fronts, but the full

benefits of the turnaround will take some time to filter through to

results," he said.

Lewis Fellowes, Patersons Securities state manager in Western

Australia, told Dow Jones Newswires that Warburton was "hedging his

bets" on new programs for Ten.

"Some of these programs are going to be hit or miss," Fellowes

said, adding that while many viewers would likely tune in for an

opening episode, the question remained whether they would continue

watching.

Warburton told analysts that 2012 would be a difficult year for

Ten given market conditions and the upcoming London Olympics which

will be broadcast in Australia on the Nine Network.

Ten booked a net profit of 14.8 million Australian dollars

(US$14.8 million) for the six months to Feb. 29, down from the

previous corresponding period's A$49.5 million. Earnings before

interest, tax, depreciation and amortization were A$63.9 million,

down 40% on year, but in line with the company's guidance. It

didn't declare a dividend.

Television EBITDA was A$56.8 million for the half year, down 40%

on year from A$95 million, while EBITDA from its outdoor

advertising division, Eye Corp., was A$7.1 million, down 36% on

year from A$95 million.

Warburton told analysts that a change of strategy put in place

in 2011 by Lachlan Murdoch, who is now the company's chairman,

aimed at returning it to its youth-based, irreverent brand, had

given the company a lower cost base. The company said it expects

television costs for fiscal 2012 to be about 5% down on the

previous year.

The company's strategic review of Eye Corp. is continuing and a

"range of parties" have expressed an interest in acquiring the

division, Warburton said. Analysts at Commonwealth Bank have valued

Eye Corp around A$122 million.

-By Gavin Lower, Dow Jones Newswires; 61-3-9292-2095;

gavin.lower@dowjones.com

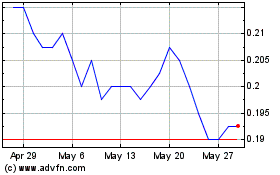

Seven West Media (ASX:SWM)

Historical Stock Chart

From Dec 2024 to Jan 2025

Seven West Media (ASX:SWM)

Historical Stock Chart

From Jan 2024 to Jan 2025