Will become a leading player in rapidly growing

US online real estate sector

Move to benefit from News Corp’s scale and

reach

News Corp and Move, Inc. (“Move”) announced today that News Corp

has agreed to acquire Move, a leading online real estate business

that brings consumers and Realtors® together to facilitate the sale

and rental of real estate in the United States.

REA Group Limited (“REA”), which is 61.6% owned by News Corp and

is the operator of the leading Australian residential property

website, realestate.com.au, plans to hold a 20% stake in Move with

80% held by News Corp.

Through realtor.com® and its mobile applications, Move displays

more than 98% of all for-sale properties listed in the US, sourced

directly from relationships with more than 800 Multiple Listing

Services (“MLS”) across the country. As a result, Move has the most

up-to-date and accurate for-sale listings of any online real estate

company in America. The Move Network of websites, which also

includes Move.com, reaches approximately 35 million people per

month, who spend an average of 22 minutes each on its sites1.

Move’s content advantage makes it well positioned to capitalize

on the fast-growing US online real estate sector and the world’s

largest residential real estate market. More than five million

homes in the United States are bought and sold each year,

representing more than $1 trillion in annual transaction volume.

Agents and brokers are expected to spend approximately $14 billion

in 2014 marketing homes (up from approximately $11 billion in

2012), and an additional $11 billion will be spent by mortgage

providers2.

Under the acquisition agreement, which has been unanimously

approved by the board of directors of Move, News Corp will acquire

all the outstanding shares of Move for $21 per share, or

approximately $950 million (net of Move’s existing cash balance),

via an all-cash tender offer. This represents a premium of 37% over

Move’s closing stock price on September 29, 2014. REA’s share will

be acquired for approximately US$200 million. News Corp intends to

commence a tender offer for all of the shares of common stock of

Move within 10 business days, followed by a merger to acquire any

untendered shares.

"This acquisition will accelerate News Corp's digital and global

expansion and contribute to the transformation of our company,

making online real estate a powerful pillar of our portfolio,” said

Robert Thomson, Chief Executive of News Corp. “We intend to use our

media platforms and compelling content to turbo-charge traffic

growth and create the most successful real estate website in the

US. We are building on our existing real estate expertise and

expect to leverage the potential of Move and its valuable

connections with Realtors® and consumers around the country."

“In addition to boosting Move’s subscription, advertising and

software services, this acquisition will give News Corp a

significant marketing platform for our media assets, which will

benefit from the high-quality geographic data generated by real

estate searches,” said Mr. Thomson. “We certainly expect this deal

to amount to far more than the sum of the parts.”

“News Corp’s acquisition of Move speaks powerfully to the

quality and value of our content, audience and industry

relationships,” said Steve Berkowitz, Chief Executive Officer of

Move. “We provide people with the information, tools and

professional expertise they need to make the best and most informed

real estate decisions, and we work to uphold the indispensable role

of the professional in the real estate experience. News Corp shares

our vision, which is one of the many reasons this combination is

such good news for our customers, consumers and the industry as a

whole.”

REA Group Chief Executive Tracey Fellows said: “This is a

fantastic opportunity for REA Group to invest in a leading player

in the largest real estate market in the world. We see strong

growth potential for Move, given the size of the US market, the

significant proportion of real estate advertising yet to move

online, and recent industry consolidation. We believe that our

digital real estate know-how, combined with News Corp’s content,

distribution and marketing strengths, will be a winning combination

for Move and for our shareholders.”

Move has an exclusive, strategic relationship with the National

Association of Realtors® (“NAR”), the largest trade organization in

the United States, with more than one million members, and NAR has

given its consent to the acquisition. Move is focused on providing

high ROI for agents and benefits from their invaluable marketing

support and high quality listings for vendors and potential

purchasers.

“This partnership will help shape the future of real estate,”

said National Association of Realtors® President Steve Brown. “News

Corp’s ability to reach and engage consumers, combined with

realtor.com®’s quality content and the real insights

Realtors® provide will transform the current landscape.

Working together, Realtors®, Move and News Corp will truly make

home happen.”

Move owns ListHub, a digital platform that aggregates and

syndicates MLS data to more than 130 online publishers, reaching

approximately 900 websites.

The Move audience is highly engaged and transaction ready; over

90% of page views on their websites are on ‘for sale’ properties,3

helping generate the highest conversion rate of qualified leads in

the industry4. The connection between agents and customers is

strengthened by robust web and mobile-based customer-relationship

management offerings to help facilitate transactions. Approximately

60% of traffic for Move websites comes from mobile devices.

For the year ended December 31, 2013, Move reported $227 million

in revenues, and $29 million in adjusted EBITDA5, and generated the

highest revenue per unique user in the industry.

Move will become an operating business of News Corp and remain

headquartered in San Jose, California. The company, started in

1993, has 913 employees.

Some of the expected key benefits of the transaction

include:

- Broadened reach for Move through

News Corp’s robust platform including WSJ Digital Network

(approximately 500 million average monthly page views6) and News

America Marketing (nearly 74 million households)

- Increased sales and marketing

support to drive higher brand awareness and traffic

- Cross-platform promotion and

audience monetization expertise

- Leverage of News Corp’s and REA’s

real estate and digital expertise to drive improved product

innovation, consumer engagement and audience growth

- Boost traffic and digital dwell

times with high quality News Corp content

###

In addition to its leading position in Australia, REA’s

operations and investments include leading online real estate

websites in Italy (casa.it) and Luxembourg (atHome.lu) with

presence also in regional France. In Asia, REA

operates MyFun.com for the Chinese market and

squarefoot.com.hk in Hong Kong and recently acquired a 17.22%

stake in iProperty, the leading online real estate advertising

business across South East Asia.

Along with its connection to REA, News Corp also has substantial

expertise in real estate via its newspaper holdings, including The

Wall Street Journal and the New York Post. In 2012, the Journal

began publishing Mansion, a successful global luxury real estate

section, under the leadership of Mr. Thomson, who was then the

Journal’s Managing Editor. News Corp’s UK publications also provide

readers with online access to home and apartment listings

throughout Great Britain. The Times of London’s lucrative Bricks

& Mortar section was also commissioned and overseen by Mr.

Thomson while he was Editor of that publication.

“We have great faith in America’s potential and the long-term

asset value of housing, which is continuing its recovery and has

yet to regain its full potency,” said Mr. Thomson. “It is forecast

that the number of Millennial households will increase from 13.3

million in 2013 to 21.6 million in 2018, and they will spend more

than $2 trillion on home purchases and rent by 20187. Many will

begin their search online and use tools and content on

realtor.com®. Buying a home is the most important investment

decision any family will make.”

The acquisition is subject to the satisfaction of customary

closing conditions, including regulatory approvals and a minimum

tender of at least a majority of the outstanding Move shares, and

is expected to close by the end of calendar year 2014.

Advisors on the transaction include Goldman Sachs, as financial

advisor, and Skadden, Arps, Slate, Meagher and Flom LLP, as legal

advisor, for News Corp and Morgan Stanley, as financial advisor,

and Cooley LLP, as legal advisor, for Move.

####

Conference Call for Analysts and Media

News Corp will host a call with analysts and media to discuss

the proposed acquisition at 8:30 a.m. EDT (Sydney: 10:30 p.m.

AEST), September 30, 2014. Reporters are invited to join the call

on a listen-only basis.

A live audio webcast of the call will be available via:

http://investors.newscorp.com.

The call can also be accessed by dialing:

US Participants: 1-800-967-7188Non-US

Participants: 1-719-325-2138Passcode: 6791228

A replay will be available approximately three hours following

the conclusion of the call and for 10 business days thereafter by

dialing:

US Participants: 1-888-203-1112Non-US

Participants: 1-719-457-0820Passcode: 6791228

Forward- Looking

Statements

This document contains forward-looking statements based on

current expectations or beliefs, as well as a number of assumptions

about future events, and these statements are subject to factors

and uncertainties that could cause actual results to differ

materially from those described in the forward-looking statements.

Forward-looking statements can often be identified by words such as

“anticipates,” “expects,” “intends,” “plans,” “predicts,”

“believes,” “seeks,” “estimates,” “may,” “will,” “should,” “would,”

“could,” “potential,” “continue,” “ongoing,” similar expressions,

and variations or negatives of these words. The reader is cautioned

not to place undue reliance on these forward-looking statements,

which are not a guarantee of future performance and are subject to

a number of uncertainties, risks, assumptions and other factors,

many of which are outside the control of News Corporation (“News

Corp”) and Move. The forward-looking statements in this document

address a variety of subjects including, for example, the expected

date of closing of the acquisition and the potential benefits of

the proposed acquisition, including integration plans and expected

synergies. The following factors, among others, could cause actual

results to differ materially from those described in these

forward-looking statements: the risk that Move’s business will not

be successfully integrated with News Corp’s business; matters

arising in connection with the parties’ efforts to comply with and

satisfy applicable regulatory approvals and closing conditions

relating to the transaction; and other events that could adversely

impact the completion of the transaction, including industry or

economic conditions outside of our control. In addition, actual

results are subject to other risks and uncertainties that relate

more broadly to News Corp’s overall business, including those more

fully described in News Corp’s filings with the U.S. Securities and

Exchange Commission (“SEC”) including its annual report on Form

10-K for the fiscal year ended June 30, 2014, and its quarterly

reports filed on Form 10-Q for the current fiscal year, and Move’s

overall business and financial condition, including those more

fully described in Move’s filings with the SEC including its annual

report on Form 10-K for the fiscal year ended December 31, 2013,

and its quarterly reports filed on Form 10-Q for the current fiscal

year. The forward-looking statements in this document speak only as

of this date. We expressly disclaim any current intention to update

or revise any forward-looking statements contained in this document

to reflect any change of expectations with regard thereto or to

reflect any change in events, conditions, or circumstances on which

any such forward-looking statement is based, in whole or in

part.

Additional Information Regarding the

Proposed Transaction

This communication does not constitute an offer to buy or a

solicitation of an offer to sell any securities. No tender offer

for the shares of Move has commenced at this time. In connection

with the proposed transaction, News Corp intends to file tender

offer documents with the SEC. Any definitive tender offer documents

will be mailed to shareholders of Move. INVESTORS AND SECURITY

HOLDERS OF MOVE ARE URGED TO READ THESE AND OTHER DOCUMENTS FILED

WITH THE SEC CAREFULLY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED

TRANSACTION. Investors and security holders will be able to

obtain free copies of these documents (if and when available) and

other documents filed with the SEC by News Corp through the SEC

website at http://www.sec.gov or through the News Corp website at

http://investors.newscorp.com.

About News Corp

News Corp (NASDAQ: NWS, NWSA; ASX: NWS, NWSLV) is a global,

diversified media and information services company focused on

creating and distributing authoritative and engaging content to

consumers throughout the world. The company comprises businesses

across a range of media, including: news and information services,

cable network programming in Australia, digital real estate

services, book publishing, digital education, and pay-TV

distribution in Australia. Headquartered in New York, the

activities of News Corp are conducted primarily in the United

States, Australia, and the United Kingdom. More information:

http://www.newscorp.com.

About Move, Inc.

Move, Inc. (NASDAQ:MOVE), a leading provider of online real

estate services, operates realtor.com®, which connects people to

the essential, accurate information needed to identify their

perfect home and to the REALTORS® whose expertise guides consumers

through buying and selling. As the official website for the

National Association of REALTORS®, realtor.com® empowers

consumers to make smart home buying, selling and renting decisions

by leveraging its direct, real-time connections with more than 800

multiple listing services (MLS) via all types of computers, tablets

and smart telephones. Realtor.com® is where home happens. Move

is based in the heart of the Silicon Valley — San Jose, CA.

REALTOR® and REALTOR.COM® are trademarks of the National

Association of REALTORS® and are used with its permission.

About REA Group

REA Group Limited ACN 068 349 066 (ASX:REA) is a leading digital

advertising business specialising in property. REA Group operates

Australia’s No.1 residential and commercial property websites,

realestate.com.au and realcommercial.com.au, as well as the

market-leading Italian property site, casa.it, squarefoot.com.hk in

Hong Kong, myfun.com in China and other property sites and apps

across Europe. www.rea-group.com.

1 Move, Inc. Internal data (August 2014).2 Borrell Associates

(August 27, 2014).3 Move, Inc. Internal data (August 2014).4 PAA

Research Independent Study.5 Adjusted EBITDA excludes stock-based

compensation.6 Adobe Omniture, for the year ended June 30, 2014.7

2013 Demand Institute Housing & Community Survey.

News CorpJim Kennedy, 212-416-4064Chief Communications

Officerjkennedy@newscorp.com@jimkennedy250orMike Florin,

212-416-3248SVP, Head of Investor

Relationsmflorin@newscorp.comorMove, Inc.Christie Farrell,

408-558-7115Director of Corporate

CommunicationsChristie.farrell@move.comorREA GroupJennifer Parker,

+61 427 900 402Senior Communications

Managerjennifer.parker@rea-group.comorThe National Association of

Realtors®David Greer, 202-383-1128 (o) / 202-997-8897 (m)Vice

President, Media and Consumer Communicationsdgreer@realtors.org

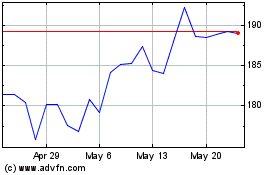

Rea (ASX:REA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Rea (ASX:REA)

Historical Stock Chart

From Jan 2024 to Jan 2025