National Australia Bank Prices CYBG IPO

February 03 2016 - 5:20AM

Dow Jones News

LONDON—National Australia Bank Ltd. Wednesday priced the initial

public offering of CYBG PLC, the holding company of Clydesdale Bank

PLC and Yorkshire Bank, at 180 pence a share, the lower end of the

indicated range set last month, marking a milestone in NAB's

efforts to exit struggling overseas businesses to focus on its core

Australian and New Zealand franchises.

The Australian bank is selling 219.83 million CYBG shares, or

25% of its issued share capital in the IPO, and expects to make up

to £ 396 million ($570.6 million) gross. The remaining 75% is being

spun off to the Australian lender's shareholders.

CYBG shares initially rose to 184.25 pence as it started

conditional trading in London, but have slipped back to 181.25

pence at 0825 GMT, implying a market capitalization of £ 1.59

billion. Unconditional trading is expected to start in London on

Feb. 8 and on the ASX Feb. 4.

"CYBG is in great shape to begin this exciting new chapter. With

the IPO process successfully behind us, all of our energy will be

dedicated to delivering industry leading service for our customers

and improved and sustainable returns for our new and future

shareholders from around the world," Chief Executive David Duffy

said.

Pricing of the IPO, and unconditional trading in London was

originally due Feb. 2 and trading on the ASX Feb. 3. However the

company was Tuesday forced to delay the IPO of CYBG by one day

after receiving a request from a ratings agency "for certain

financial information relating to its assessment of Clydesdale

Bank's short- and/or long-term deposit rating." CYBG said Tuesday

it doesn't anticipate a downgrade to have any material impact on

its ability to raise funding, the overall cost of funding, or the

financial outlook for CYBG.

On Jan. 18, National Australia Bank priced CYBG at between 175

pence to 235 pence each, valuing the U.K. group at £ 1.54 billion

to £ 2.07 billion.

The demerger of CYBG PLC was approved by the Supreme Court of

Victoria on Monday, following shareholder approval at the meetings

on Jan. 27. NAB had said back on Nov. 27 that it was planning a

demerger of CYBG and stock sale to institutional investors.

"We are pleased with the response from institutional investors

to the IPO, including from NAB shareholders, despite the recent

significant market volatility," NAB Group Chief Executive Andrew

Thorburn said.

"Our NAB strategy is focused on our home markets and on

delivering a great customer experience, particularly in key

segments where we have strong capability and where we see growth,"

he added.

Write to Ian Walker at ian.walker@wsj.com and Robb M. Stewart at

robb.stewart@wsj.com

(END) Dow Jones Newswires

February 03, 2016 05:05 ET (10:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

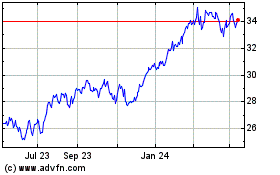

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Jun 2024 to Jul 2024

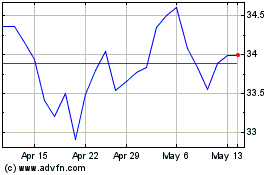

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Jul 2023 to Jul 2024