National Australia Bank Plans Cut-Price Spinoff of U.K. Business

January 18 2016 - 6:40AM

Dow Jones News

National Australia Bank Group Ltd said on Monday it plans to

spin off its U.K. business at a cut-price valuation in early

February.

NAB proposed an initial public offering price of between £ 1.75

and £ 2.35 per share for CYBG PLC. The pricing values the business

up to £ 2.07 billion. This is still well below what the bank values

the U.K. unit at on its books.

Last year NAB outlined plans to hand 75% of the U.K. business to

shareholders and sell the remainder to institutional investors via

an initial public offering. The bank was to focus on its

more-profitable operations in Australia and New Zealand.

NAB plans to list the shares on Feb. 2. However it warned on

Monday that it "may elect not to proceed with the IPO or to only

proceed with a partial IPO."

NAB bought Glasgow-based Clydesdale Bank in 1987 for £ 420

million (US$598 million) before picking up Yorkshire Bank in 1990

for about £ 900 million.

The businesses were hit hard by soured property loans and rising

funding costs as the U.K. struggled through recession. In recent

years the division has racked up provision charges for legacy

misconduct allegations for wrongly selling certain financial

products.

Write to Max Colchester at max.colchester@wsj.com

(END) Dow Jones Newswires

January 18, 2016 06:25 ET (11:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

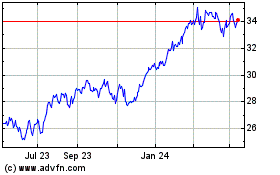

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Jun 2024 to Jul 2024

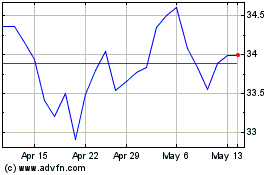

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Jul 2023 to Jul 2024