National Australia Bank to Spin Off, List U.K. Business by February

December 06 2015 - 11:31PM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--National Australia Bank Ltd. (NAB.AU) aims

to spin off and list its U.K. business by early February as the

lender tightens its focus on more profitable operations in

Australia and New Zealand.

Investors will be asked to vote at a meeting scheduled for Jan.

27 on a plan to hand 75% of the business to shareholders and sell

the remainder to institutional investors via an initial public

offering, the bank said Monday.

If the move is approved, shareholders will receive one share in

the U.K. banking business for every four NAB shares they own.

Analysts and shareholders have long expected NAB to quit the

U.K., where it failed over the last decade to consummate a sizable

acquisition and which its management believes lacks the scale to

compete effectively.

Andrew Thorburn, who took over as NAB's chief executive in

August last year, has hastened the bank's exit from overseas

markets. He has already led the bank's exit from the U.S., selling

the remainder of regional bank Great Western Bancorp Inc. earlier

this year after selling a minority stake via an IPO in 2014.

On Monday, the bank said Chairman Michael Chaney and directors

unanimously recommend shareholders vote in favor of a sale of the

business, known as CYBG PLC. An independent export also concluded

the demerger is in the best interests of shareholders, it said.

"The demerger provides eligible shareholders with separate

investments in NAB and CYBG and if they choose to retain their CYBG

securities, the ability to benefit from any improvement in the U.K.

economy and CYBG's strategy and performance going forward," Mr.

Chaney said.

For NAB, the exit from the U.K. is expected to improve its

return on equity and capital generation as the bank focuses on

more-profitable core businesses, Mr. Thorburn said.

NAB bought Glasgow-based Clydesdale Bank in 1987 for 420 million

pounds (US$635 million) before picking up Yorkshire Bank in 1990

for about GBP900 million. The businesses were hard hit by soured

property loans and rising funding costs as the U.K. struggled

through recession. In recent years the division has racked up

provision charges for legacy misconduct allegations for wrongly

selling certain financial products.

In April, the U.K. operation was fined by the U.K.'s Financial

Conduct Authority for how its how it dealt with customer complaints

over the sale of payment-protection insurance. NAB moved in May to

shore up its capital base and ease its exit from the U.K. with a

A$5.5 billion rights issue, helping meet a call by the U.K.

prudential regulator to inject GBP1.7 billion in capital before

listing the business to cover possible losses.

In addition to support from shareholders, the plan is

conditional on court and final regulatory approvals.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

December 06, 2015 23:16 ET (04:16 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

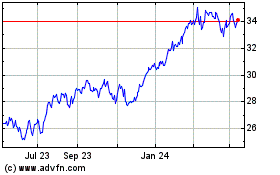

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Jun 2024 to Jul 2024

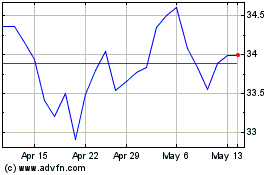

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Jul 2023 to Jul 2024