MARKET COMMENT: S&P/ASX 200 Remains Down 0.5% After China PMI

February 28 2013 - 8:56PM

Dow Jones News

0125 GMT [Dow Jones] Australia's S&P/ASX 200 remains down

0.5% at 5078 after China's official manufacturing PMI for February

came in at 50.1, below the 50.4 reading for January, yet near

enough to the 50.5 level expected by the market. Still, the fall

could renew concerns about momentum in the world's second-largest

economy, after growth began rebounding in the fourth quarter last

year. Resources are still weighing on the market, with BHP

(BHP.AU), Rio Tinto (RIO.AU), Newcrest (NCM.AU) and Woodside

(WPL.AU) down 0.8%-3.4%. Banks are outperofrming, with CBA

(CBA.AU), NAB (NAB.AU) and Westpac (WBC.AU) up 0.2%-0.7%. HSBC's

final PMI is due at 0145 GMT. (david.rogers1@wsj.com)

Contact us in Singapore. 65 64154 140; MarketTalk@dowjones.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

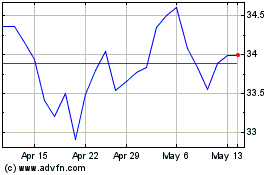

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Jun 2024 to Jul 2024

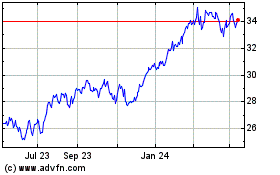

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Jul 2023 to Jul 2024