By Mike Cherney

Two years ago, Australian shopping-center operator Mirvac Group

launched a new effort to help retain customers amid rising

competition from online retailers: combine a trip to the mall with

a scenic boat ride in iconic Sydney Harbour.

The so-called Shopper Hopper service has ferried 23,000

customers to two Mirvac malls along the coast, part of a continuing

initiative to convince shoppers that a mall visit offers unique

experiences that can't be found in front of a computer.

Mirvac had good reason to beef up its defenses against online

retail competition. In December, the biggest and baddest online

retailer of them all, Amazon.com Inc., launched its full retail

website in Australia and opened its first local warehouse in the

country.

Previously, Australians had to shop on Amazon's U.S. and U.K.

websites for most products, which meant hefty shipping fees and

long delivery times. Although other big online retailers such as

eBay Inc. have been popular in Australia, up until recently the

country's consumers have been mostly hooked on bricks-and-mortar

stores.

Now, the launch of full service by Amazon has sparked concerns

that Australian shopping centers face the same carnage that has

undermined many a retail landlord in countries that got hit early

by the online shopping juggernaut. Indeed, shares of Scentre Group

Ltd., the largest listed retail property company in Australia, have

been trading at about 4 Australian dollars (US$3) recently, down

from about A$5.40 in mid-2016.

But the Shopper Hopper service and other efforts by Australian

retail landlords to make trips to the mall more fun are a sign that

they're not going to be a pushover for Amazon and other online

retail giants. Investors and analysts say mall operators here have

spent the past few years adding amenities and remixing tenants to

keep shoppers interested, which should insulate them from some of

the pain.

"Australian shopping center owners and retailers are watching

closely what the impact of Amazon has been around the world, and

they are acting to cope with that," said John Sears, Australia

research director at Cushman & Wakefield.

Moreover, key structural differences between Australian and U.S.

retail also make it unlikely that Australian malls will struggle as

much as their U.S. counterparts, some say. Online sales in

Australia last year made up 8.8% of all retail, compared with 11.8%

in the U.S., according to market-research firm Euromonitor

International.

At the same time, Australia doesn't suffer from the same retail

space glut as does the U.S., which has more than 2.5 times the

retail space per capita, according to Cushman & Wakefield. Mr.

Sears and others attribute that difference to stricter planning

guidelines in Australia that made it more difficult to build large

malls.

The battle between bricks and clicks in Australian retailing

mirrors the way it is playing out in developed countries throughout

the world. Increasingly, landlords who are holding their own are

those who are giving shoppers a wide range of reasons to make the

trip to the mall.

Australian shopping centers also are in better shape because

they have less space devoted to department stores, which have

proved to be vulnerable to online shopping. APN Funds Management,

which invests in Australian real-estate investment trusts, cites

figures from Citigroup Global Markets that show U.S. shopping

centers devoted 46% of space to department stores, compared with

about 20% in Australia.

Meanwhile, entertainment, restaurant and other nonretail

attractions get 19% of Australian retail space, compared with 14%

in the U.S., according to Citi.

"The retail mix of tenants has changed over the years," said

Grant MacKenzie, a senior portfolio manager at Freehold Investment

Management, another Australian fund manager that invests in

property securities. "You're getting a lot more entertainment, al

fresco dining and the like."

The strategy is paying off: Occupancy rates for major Australian

shopping-center owners have been "consistently high for many

years," says Cushman & Wakefield's Mr. Sears.

Scentre Group, which runs some of Australia's top malls, said

its vacancy rate last year was less than 0.5%. The rate hasn't

changed from 2014, when Scentre split from Westfield Corp.

Amazon's expansion in Australia comes as the company is looking

to beef up its global logistics network and could be positive for

industrial properties. Similar to the U.S. and Europe, more

warehouses will be needed for quick deliveries to urban areas.

Amazon's main Australian fulfillment center is a roughly

260,000-square-foot facility near Melbourne in an industrial park

operated by private-company Pellicano Pty. Goodman Group, the

largest listed industrial property company in Australia, said its

occupancy rate at the end of last year was 98%, up from 96% at the

end of 2014.

Amazon is still likely to present some challenges to traditional

landlords. Guaranteeing same-day delivery to customers in some of

Australia's more remote areas will be difficult. But Amazon could

still be a threat in the big east coast cities like Sydney and

Melbourne, where population density is comparable to large U.S.

cities, Andrew Jones, a credit analyst at National Australia Bank,

wrote in a report last year.

Second-tier shopping centers, which may not be big enough for

nonretail attractions, could also be at risk. There is also a limit

to how many restaurants shopping centers can support, given that at

a certain point new food tenants take away sales from existing

ones.

As e-commerce grows, some mall operators are tailoring their

tenant mix to give people more reasons than shopping to visit. At

Chadstone, a mall near Melbourne that is run by Vicinity Centres

and bills itself as the largest shopping center in the country, a

Legoland Discovery Centre opened last year that includes two indoor

rides and a 4-D cinema. A high-quality hotel is also planned at the

mall.

At Mirvac, head of retail Susan MacDonald highlighted how an

Audi automobile service center has been a strong addition to one of

the company's malls in Sydney. "That drives hundreds of people into

that center," she said.

Write to Mike Cherney at mike.cherney@wsj.com

(END) Dow Jones Newswires

May 01, 2018 09:14 ET (13:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

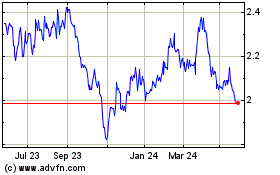

Mirvac (ASX:MGR)

Historical Stock Chart

From Nov 2024 to Dec 2024

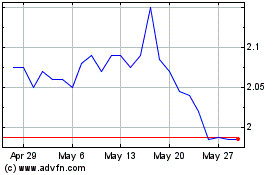

Mirvac (ASX:MGR)

Historical Stock Chart

From Dec 2023 to Dec 2024