TIDMTRT

RNS Number : 5605F

Transense Technologies PLC

11 July 2023

The information contained within this announcement is deemed by

the Company to constitute inside information pursuant to Article 7

of EU Regulation 596/2014 as it forms part of UK domestic law by

virtue of the European Union (Withdrawal) Act 2018 as amended.

11 July 2023

Transense Technologies plc

("Transense" or the "Company")

Year end trading update

Transense Technologies plc, the provider of specialist sensor

technology and measurement systems, is pleased to provide a trading

update for the financial year ended 30 June 2023 based on unaudited

management information.

Highlights

-- Adjusted EBITDA* for the year expected to be around GBP1.4m,

in line with market expectations (FY22: GBP0.6m)

-- Total revenue for the year increased by more than 35% to in

excess of GBP3.5m, in line with market expectations (FY22:

GBP2.6m)

o Revenues excluding iTrack royalty income ahead of management

expectations, up by 41% to exceed GBP1.5m (FY22: GBP1.1m)

o SAWsense revenue ahead of management expectations, more than

doubled to GBP0.5m (FY22: GBP0.2m)

o ITrack royalty up 30% to GBP2.0m (FY22: GBP1.6m), which was

lower than management expectations, but exit annual run rate

exceeds GBP2.3 m (FY22: GBP1.9m)

-- Cash balance maintained at GBP1.0m, despite outgoings of

GBP0.4m on share buyback programme and GBP0.2m of non-recurring

reorganisation costs

o The post year end quarterly iTrack royalty receivable in July is around GBP0.6m

Revenue, Adjusted EBITDA* & Cash

Total revenue for the year increased by more than 35% to over

GBP3.5m, which is in line with market expectations (FY22:

GBP2.6m).

The increase in the number of installed units generating royalty

income was consistent with each of the two previous years, however,

most of the growth in the current year arose in Q4 leaving the

overall total iTrack royalty income for the year short of

expectations. Significantly, far stronger than expected growth was

generated from both SAWsense and Translogik which outweighed the

royalty shortfall.

Adjusted EBITDA* is expected to be around GBP1.4m, also in line

with market expectations, and more than double the prior year level

(FY22: GBP0.6m). Profit after tax may exceed market expectations as

a consequence of an increased tax credit arising from extending the

recognition of deferred tax assets arising from prior years'

losses.

Net cash balances at 30 June 2023 amounted to GBP1.0m (FY22:

GBP1.0m). Trading continued to be cash generative, enabling the

Company to invest a further GBP0.4m in the ongoing share buyback

programme (FY22: GBP0.3m). Royalties for the final quarter of the

financial year receivable at the end of July 2023 are expected to

be around GBP0.6m, further strengthening the available cash

position of the Company.

SAWsense

Revenues were more than double those of the prior year at

GBP0.5m (FY22: GBP0.2m) from increased sales of motorsport

equipment, combined with significant new income from customer

funded feasibility and applications development projects in

aerospace and automotive electric motors and drives. In addition,

the Company realised income from claims under the Technology

Developer Accelerator Programme ("TDAP") grant announced in May

2022 of GBP0.1m (FY22: GBP 0.0m).

Business development activities have continued to generate a

healthy pipeline of new incoming enquiries, and the conversion of

these into chargeable feasibility and applications development

projects is accelerating. Recent changes in management structure,

repositioning the cost base towards customer-facing engineering and

project management specialists, gave rise to non-recurring

reorganisation costs of GBP0.2m towards the end of the financial

year. It is anticipated that these changes will deliver

productivity gains in future, enabling the business segment to

generate sufficient income to cover its own costs more quickly.

Translogik

Revenues continued to deliver annual growth above 17% and have

exceeded GBP1m for the first time (FY22: GBP0.9m). Much of this

success is attributable to our market leading product range

generating increased demand from established blue-chip customers,

reacting to market factors such as greater call for digitisation of

data and vehicle safety regulatory compliance. This leads us to

believe that increased overhead investment in business development

and marketing infrastructure, planned for FY24, will deliver rapid

results in further acceleration of market penetration through both

current and new channels to market.

iTrack Royalties

Royalty income for the financial year from iTrack in Sterling

terms increased by 30% to GBP2.0m (FY22: GBP1.6m), w hich was below

the expected growth rate of around 45 % . This ha d been signalled

during the year and was primarily due to new installations

converting late in our financial year rather than uniformly, and

most strongly in the final quarter.

The annualised run rate of royalty income exceeded GBP 2.3m by

the end of FY23, an increase of 23 % over the FY23 opening rate of

GBP1.9m per annum.

Outlook and Audited Results

The Board is pleased with the momentum in the ongoing commercial

pipeline, both for SAWsense and Translogik, which provides

confidence in the prospects for the current financial year.

Final audited results for the year ended 30 June 2023, and a

more detailed update on trading and outlook, are expected to be

announced around the end of September 2023.

*Adjusted EBITDA refers to net earnings before interest,

taxation, depreciation and amortisation adjusted for the cost of

share based payments of GBP0.1m and non-recurring reorganisation

costs of GBP0.2m.

** iTrack Royalties are based on the closing rate at 7 July

2023, however this may vary if there is a material change in rates

at the end of July 2023 when the quarterly royalties are invoiced

and paid.

For further information please visit www.transense.com or

contact:

Transense Technologies plc Via Walbrook PR

Nigel Rogers (Executive Chairman)

Melvyn Segal (CFO)

Allenby Capital (Nominated Adviser Tel: +44 (0)20 3328 5656

and Broker)

Jeremy Porter / George Payne (Corporate

Finance)

Tony Quirke/Jos Pinnington (Sales and

Corporate Broking)

Walbrook PR Tel: +44 (0)20 7933 8780

Tom Cooper / Nick Rome Transense@walbrookpr.com

Notes to Editors:

Transense is headquartered in Oxfordshire, UK and its shares are

traded on AIM, a market operated by the London Stock Exchange (AIM:

TRT). The Company develops and supplies advanced sensor technology

and measurement solutions used by some of the world's leading

companies to improve performance, efficiency and safety in

demanding, mission critical applications. Transense currently

operates through two active business segments:

-- SAWsense - designs, supplies and licences advanced sensor

solutions based on proven, patent protected Surface Acoustic Wave

(SAW) technology to world leading companies in aerospace, electric

motors and drives, industrial machinery (including robotics) and

motor sport. Key customers include GE Aerospace, Parker Meggitt,

McLaren Applied and several other confidential Tier One automotive

and aerospace suppliers.

-- Translogik - develops smart, connected commercial vehicle

tyre inspection equipment to many of the world's leading tyre

suppliers, fleet operators and service centres. That accurately

measure and digitally capture safety-critical tyre condition data,

used to reduce operating costs, improve safety and provide audit

records for regulatory compliance. Key customers include

Bridgestone, Goodyear, Continental and Prometeon (Pirelli), and

leading independent providers of vehicle fleet maintenance

management software.

Transense earns residual royalty income from iTrack - a tyre

monitoring system for off-highway vehicles that was designed,

developed and supplied by Translogik and sold under subscription to

leading global mining companies. The associated sales, support and

development infrastructure were sold to Bridgestone Corporation

Japan, the world's largest tyre producer, in June 2020, and the

intellectual property was licence exclusively to Bridgestone under

a ten-year deal expiring in 2030.

For further information please contact

transense@walbrookpr.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTURVNRONUBAAR

(END) Dow Jones Newswires

July 11, 2023 02:00 ET (06:00 GMT)

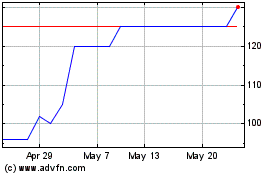

Transense Technologies (AQSE:TRT.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Transense Technologies (AQSE:TRT.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024