TIDMTRAF

RNS Number : 0443X

Trafalgar Property Group PLC

15 December 2023

15 December 2023

TRAFALGAR PROPERTY GROUP PLC

("Trafalgar", the "Company" or "Group")

Interim Results

for the six months ended 30 September 2023

Trafalgar (AIM: TRAF), the AIM quoted residential property

developer operating in southeast England, announces its interim

results for the six months ended 30 September 2023 (the

"Period").

Key financials:

-- Turnover for the Period was GBPnil, (H1 2022: GBP17,798);

-- Gross profit of GBPnil, (H1 2022: gross profit GBP17,798),

giving a loss before tax of GBP214,270 (H1 2022: pre-tax loss:

GBP444,137);

-- EPS of (0.07p) (H1 2022 (0.20p); and

-- Cash in bank at period end was GBP237,808 (H1 2022:

GBP152,897); at 11 December 2023 cash at bank was GBP12,876***

-- Paul Treadaway, Chairman of Trafalgar, said: "The

construction industry in general continues to be difficult and

trying to find suitable development sites for the right price is

becoming harder. The continued high inflation and high interest

rates also impacts the general market conditions for property.

However, the results for the six months to 30 September 2023

show some positive activity with the sale of the Group's final

investment property and the continuation of the development of the

site at Speldhurst ."

Copies of the interim report will be available later today on

the Company's website, www.trafalgarproperty.group

Enquiries:

Trafalgar Property Group Plc

Paul Treadway +44 (0) 1732 700 000

Spark Advisory Partners Ltd - AIM Nominated

Adviser

Matt Davis +44 (0) 20 3368 3550

Peterhouse Capital Limited - Broker

Duncan Vasey/Lucy Williams +44(0)20 7409 0930

Notes to Editors:

Trafalgar Property Plc is the holding company of Trafalgar New

Homes Limited, Selmat Limited and Trafalgar Retirement+ Limited,

residential property developers operating in the southeast of

England. The founders have a long track record of developing new

and refurbished homes, principally in Kent and Surrey.

The Company's focus is on the select acquisition of land for

residential property development. The Company outsources all

development activities, for example the obtaining of planning

permission, design and construction, and uses fixed price build

contracts, enabling it to tightly control its development and

overhead costs.

For further information visit www.trafalgarproperty.group .

TRAFALGAR PROPERTY GROUP PLC

INTERIM REPORT FOR THE SIX MONTHSED 30 SEPTEMBER 2023

CHIEF EXECUTIVE'S REPORT

I present the Company's Interim Results for the six month period

to 30 September 2023. Revenue for the period was GBPnil and cost of

sales was GBPnil giving a gross profit for the period of

GBPnil.

Mortgage and private loan interest was paid during the period of

GBP31,589of which GBP14,810 was capitalized as part of inventory as

relating to the development at Speldhurst with a further GBP38,643

of loan note equity interest being accrued in the period.

The result of the above is a loss before taxation for the period

of GBP214,270.

The directors continue to consider relevant information

including the current cost-of-living crisis, higher interest rates

and higher inflation, which are driving a challenging market and

have performed a robust analysis of future cash flows.

Based on their assessments and having regard to resources

available to the entity, the directors have concluded that they can

continue to adopt the going concern basis in preparing the

financial statements.

A summary of activities in the 6 months to 30 September 2023 for

the Group are as follows:

- Trafalgar New Homes has continued to develop the site at

Speldhurst and the building of a single dwelling is progressing

well with no adverse issues affecting the planned completion by the

end of the year.

- Selmat sold the final investment property in Hildenborough in

September 2023 for GBP940,000 before costs.

- A placing of shares was carried out in September 2023 raising

a gross amount of GBP125,000, before costs, to be used for working

capital purposes.

- The Group continues to look for opportunities in vertical

farming but the cost of energy in the UK has meant the Group are

widening its search to areas outside of the UK.

Paul Treadaway

Chief Executive

15 December 2023

TRAFALGAR PROPERTY GROUP PLC

CONSOLIDATED UNAUDITED INTERIM RESULTS FOR THE

SIX MONTHSED 30 SEPTEMBER 2023

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

6 month 6 month Year

period period ended

ended ended

30 September 30 September 31 March

2023 2022

(Unaudited) (Unaudited) 2023

(Audited)

Note GBP'000 GBP'000 GBP'000

Revenue - 18 18

Cost of sales - (-) (31)

--------------- -------------- -----------

Gross profit - 18 (13)

Fair value movement on investment

property - - (123)

(Loss) on disposal of investment

property - (6) (12)

Administrative expenses (159) (380) (572)

--------------- -------------- -----------

Underlying operating (loss) (159) (368) (720)

Interest payable and similar

charges (55) (76) (124)

--------------- -------------- -----------

(Loss) before taxation (214) (444) (844)

Tax payable on profit on ordinary 4 - - -

activities

--------------- -------------- -----------

(Loss) after taxation for the

period (214) (444) (844)

--------------- -------------- -----------

Other comprehensive income

Total comprehensive (loss)

for the period (214) (444) (844)

(Loss) attributable to:

Equity holders of the parent (214) (444) (844)

--------------- -------------- -----------

Total comprehensive (loss)

for the period attributable

to:

Equity holders of the parent (214) (444) (844)

(LOSS) PER ORDINARY SHARE;

Basic/Diluted 5 (0.07)p (0.20)p (0.34)p

--------------- -------------- -----------

All results in the current and preceding financial period derive

from continuing operations.

TRAFALGAR PROPERTY GROUP PLC

CONSOLIDATED UNAUDITED INTERIM RESULTS FOR THE

SIX MONTHSED 30 SEPTEMBER 2023

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

30 September 30 September 31 March

2023 2022

(Unaudited) (Unaudited) 2023

(Audited)

Note GBP'000 GBP'000 GBP'000

Non-current assets

Tangible fixed assets 26 1 26

26 1 26

Current assets

Inventory 496 339 318

Trade and other receivables 25 54 34

Investment properties 6 - 1,375 927

Cash at bank and in hand 238 153 17

-------------- ------------- -----------

759 1,921 1,296

-------------- ------------- -----------

Total assets 785 1,922 1,322

============== ============= ===========

EQUITIES AND LIABILITIES

Current liabilities

Trade and other payables 166 468 223

Borrowings 875 760 875

-------------- ------------- -----------

1,041 1,228 1,098

Non-current liabilities

Borrowings 3,191 3,886 3,573

-------------- ------------- -----------

Total liabilities 4,232 5,114 4,671

-------------- ------------- -----------

Equity attributable to equity

holders of the Company

7 &

Called up share capital 8 2,985 2,860 2,860

Share premium account 3,476 3,485 3,485

Loan note equity 7 69 145 107

Reverse acquisition reserve (2,818) (2,818) (2,818)

Capital contribution reserve 9 400 158 400

Profit and loss account (7,559) (7,022) (7,383)

-------------- ------------- -----------

Total Equity (3,447) (3,192) (3,349)

-------------- ------------- -----------

Total Equity and Liabilities 785 1,922 1,322

============== ============= ===========

TRAFALGAR PROPERTY GROUP PLC

CONSOLIDATED UNAUDITED INTERIM RESULTS FOR THE

SIX MONTHSED 30 SEPTEMBER 2023

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share Share Loan Reverse Retained Capital Total

capital premium Note acquisition profits contribution equity

equity reserve /(losses) reserve

Reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April 2023 2,860 3,485 107 (2,818) (7,383) 400 (3,349)

(Loss)/Profit

for period - - - - (214) - (214)

Other comprehensive - - - - - - -

income for the

period

---------------------- --------- --------- --------- ------------- ----------- -------------- --------

Total comprehensive

income for the

period - - - - (214) - (214)

Issue of shares - - - -

Shares issued

during the period

net of costs 125 (9) - - - - 116

Loan note equity (38) - 38 - -

-Movement in loan - - - - - -

note equity reserve

At 30 September

2023 2,985 3,476 69 (2,818) (7,559) 400 (3,447)

========= ========= ========= ============= =========== ============== ========

For the purpose of preparing the consolidated financial

statement of the Group, the share capital represents the nominal

value of the issued share capital of 0.1p per share. Share premium

represents the excess over nominal value of the fair value

consideration received for equity shares net of expenses of the

share issue.

The reverse acquisition reserve related to the reverse

acquisition between Trafalgar Property Group plc and Trafalgar New

Homes Limited on 11 November 2011.

Loan note equity further details are provided in Note 7. Capital

contribution reserve details are further provided in Note 9.

TRAFALGAR PROPERTY GROUP PLC

CONSOLIDATED UNAUDITED INTERIM RESULTS FOR THE

SIX MONTHSED 30 SEPTEMBER 2023

CONSOLIDATED STATEMENT OF CASH FLOWS

6 month 6 month Year

period ended period ended ended

30 September 30 September 31 March

2023

(Unaudited) 2022 2023

(Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Cash flow from operating

activities

Operating (loss)/profit (214) (444) (844)

Depreciation charges - - -

Loss on sale of investment

property - 6 12

Fair value movements

on investment property - - 123

(Increase)/decrease in

stocks (178) (313) (322)

(Increase)/decrease in

debtors 9 (14) 7

Increase/(Decrease) in

creditors (57) 98 95

Write-off of Inventory - - 30

Loan note equity movement (39) - 157

Interest payable 55 76 124

--------------- -------------- ----------------------------

Net cash inflow/(outflow)

from operating (424) (591) (618)

Activities

Investing activities

Disposal of investment

property & revaluation 927 331 650

Disposal / (Purchase)

of tangible fixed assets - (25)

--------------- -------------- ----------------------------

Net cash used in investing

activities 927 331 625

Taxation - -

Financing activities

Issue of shares 125 400 368

Share issue costs (9) (32) -

New loan borrowings 156 91 105

Related party new loan

borrowings 141 - 189

Related party loan repayment - - (260)

Loan note equity movement 115

Repayment loan borrowings (678) (140) (270)

Repayment other borrowings - - (90)

Interest paid (17) (34) (44)

Net cash flow from financing (282) 400 (2)

Increase/(decrease)

in cash and cash equivalents 221 140 4

--------------- -------------- ----------------------------

in the period

Cash and cash equivalents

at the beginning of the

year 17 13 13

Cash and cash equivalents

at the end of the year 238 153 17

--------------- -------------- ----------------------------

TRAFALGAR PROPERTY GROUP PLC

CONSOLIDATED UNAUDITED INTERIM RESULTS FOR THE

SIX MONTHSED 30 SEPTEMBER 2023

NOTES TO THE FINANCIAL INFORMATION

1. GENERAL INFORMATION

This financial information is for Trafalgar Property Group Plc

("the Company") and its subsidiary undertakings. The Company is

incorporated in England and Wales.

2. BASIS OF PREPARATION

The interim consolidated financial information has been prepared

with regard to International Financial Reporting Standards (IFRS)

as adopted for use in the United Kingdom (UK IFRS) and those parts

of the Companies Act 2006 that are relevant to companies, which

report in accordance with IFRS. The interim financial information

incorporates the results for the Group for the six month period

from 1 April 2023 to 30 September 2023. The results for the year

ended 31 March 2023 have been extracted from the statutory

financial statements for the Group for the year ended 31 March

2023. The financial information set out in these interim

consolidated financial information does not constitute statutory

accounts as defined in S434 of the Companies Act 2006. They do not

include all of the information required for full annual financial

statements and should be read in conjunction with the consolidated

financial statements of the Group for the year ended 31 March 2023,

which contained an unqualified audit report and have been filed

with the Registrar of Companies. They did not contain statements

under S498 of the Companies Act 2006.

The same accounting policies, presentation and methods of

computation have been followed in these unaudited interim financial

statements as those which were applied in the preparation of the

group's annual financial statements for the year ended 31 March

2023.

The interim consolidated financial information incorporates the

financial statements of Trafalgar Property Group Plc and its

subsidiaries.

The interim financial information for the six months ended 30

September 2023 was approved by the directors on 15 December

2023.

3. SEGMENTAL REPORTING

For the purpose of IFRS 8, the chief operating decision maker

("CODM") takes the form of the Board of Directors. The Directors'

opinion of the business of the Group is that the principal activity

of the Group was residential property development and there is

considered to be one reportable geographical segment, that of

property development carried on in the UK. The internal and

external reporting is on a consolidated basis with transactions

between Group companies eliminated on consolidation. Therefore, the

financial information of the single segment is the same as that set

out in the consolidated statement of comprehensive income, the

consolidated statement of changes in equity, the consolidated

statement of financial position and cash-flows.

TRAFALGAR PROPERTY GROUP PLC

CONSOLIDATED UNAUDITED INTERIM RESULTS FOR THE

SIX MONTHSED 30 SEPTEMBER 2023

NOTES TO THE FINANCIAL INFORMATION

4. TAXATION

6 month 6 month Year

period ended period ended ended

30 September 30 September 31 March

2023 2022

(Unaudited) (Unaudited) 2023

(Audited)

GBP'000 GBP'000 GBP'000

Current tax - - -

--------------- -------------- -----------

Tax charge/(credit) - - -

--------------- -------------- -----------

Loss/(profit) on ordinary activities

before tax (214) (444) (844)

Based on profit for the period:

Tax at 25% (2022: 19%) (54) (84) (160)

Effect of:

Losses utilized 54 84 160

--------------- -------------- -----------

Tax charge for the period - - -

--------------- -------------- -----------

No tax provision has been made on account of brought forward

losses.

5. PROFIT/(LOSS) PER ORDINARY SHARE

The calculation of profit/ (loss) per ordinary share is based on

the following (losses) and number of shares:

6 month 6 month Year

period ended period ended Ended

30 September 30 September 31 March

2023 2022

(Unaudited (Unaudited) 2023

(Audited)

GBP'000 GBP'000 GBP'000

(Loss)/profit for the period (214) (444) (844)

--------------- -------------- ------------

Weighted average number of shares

for basic 304,548,666 224,850,000 249,525,835

--------------- -------------- ------------

(loss)/profit per share

Weighted average number of shares

for diluted 304,548,666 224,850,000 249,525,835

--------------- -------------- ------------

profit/(loss) per share

(LOSS)/PROFIT PER ORDINARY SHARE;

Basic (0.07)p (0.20)p (0.34)p

--------------- -------------- ------------

Diluted (0.07)p (0.20)p (0.34)p

TRAFALGAR PROPERTY GROUP PLC

CONSOLIDATED UNAUDITED INTERIM RESULTS FOR THE

SIX MONTHSED 30 SEPTEMBER 2023

NOTES TO THE FINANCIAL INFORMATION

6. INVESTMENT PROPERTIES

FAIR VALUE 30 September 31 March 2023

2023

GBP'000 GBP'000

b/fwd 1 April 2023 927 1,712

Additions - -

Disposals (927) (662)

Revaluation - (123)

------------- --------------

31 March - 927

------------- --------------

Net Book Value

-------------

At 30 September 2023 - -

------------- --------------

At 31 March 2023 927

--------------

Fair value at 30 September 2023

is represented by

Remaining value in 2023 (2023:

at revalued amount) - 927

------------- --------------

LOSS ON DISPOSAL

Fair value 927 662

Disposal proceeds including costs

of sale 927 650

------------- --------------

Loss on disposal - 12

------------- --------------

Properties have been assessed at Fair value basis at 31 March

2023 by using level 3 fair value hierarchy and using the selling

price achieved following the sale of one leasehold property in

September 2023 for GBP927,249.

7. SHARE CAPITAL

Authorised Share Capital

30 September 31 March

2023 2023

Number Number

Ordinary shares of 0.1p each 275,852,371 142,519,038

Issued in year:

Ordinary shares of 0.1p 125,000,000 133,333,330

Total ordinary shares of 0.1p in

issue 400,852,371 275,852,371

------------- ------------

Deferred shares of 0.9p in issue 287,144,228 287,144,228

Deferred shares issued of 0.9p - -

------------- ------------

Total deferred shares of 0.9p in

issue 287,144,228 287,144,228

------------- ------------

TRAFALGAR PROPERTY GROUP PLC

CONSOLIDATED UNAUDITED INTERIM RESULTS FOR THE

SIX MONTHSED 30 SEPTEMBER 2023

NOTES TO THE FINANCIAL INFORMATION

Equating to: 30 September 31 March

2023 2023

GBP'000 GBP'000

Ordinary shares 276 143

Deferred shares 2,584 2,584

Iss ued in period - ordin ary s h

a res 125 133

Issued in period - deferred shares

------------- ---------

2,985 2,860

------------- ---------

Authorised Share Capital 30 September 31 March

2023 2023

GBP'000 GBP'000

Called up share capital 2,985 2,860

Share premium 3,476 3,485

Loan notes equity reserve 107 107

For the purposes of preparing the consolidated interims for the

Group, share capital represents the nominal value of the issued

share capital of 0.1p per share (2022:0.1p per share). Share

premium represents the excess over nominal value of the fair value

consideration received for equity shares net of expenses plus

deferred shares of 0.9p after issued share capital of 1p

On 12 September 2023, the Company issued 125,000,000 new

ordinary shares at 0.1p fully paid up in cash at 0.1p per share

under a placing which was announced on 18 August 2023, raising

GBP125,000 before expenses.

On the 31 July 2022 the Company agreed with Mr C C Johnson a

consolidation and variation of terms of the two unsecured

convertible loan notes and direct debt held by him. The conversion

of the total amount owed to him by the Company (GBP905,000) has

resulted in the issue to Mr C C Johnson of a new unsecured

conversation loan note for an aggregate amount of GBP905,000,

expiring 31 July 2024.

The new unsecured convertible loan note is convertible in full

into 226,250,000 ordinary shares of 0.4p per ordinary share and can

be converted by Mr Johnson, subject inter alia to his entire

holding being less than 29.99 per cent of the voting rights in

issue in the Company.

The new unsecured convertible loan note carried the right upon a

conversion, to the grant of warrants to subscribe for ordinary

shares on a one for one basis, exercisable at the conversion price

for a period of two year from the date of grant.

Loan note equity reserve is the amount that has been provided

for in respect of the difference between the cash value and

liability element of the loan notes.

The convertible loan notes have been accounted for as having

both a debt and an equity element. This results in the creation of

a loan note equity reserve at the point of issue. This loan note

equity reserve is the difference between the loan note value

received by the company of GBP905,000 (2022 GBP800,000) and the

fair value of a debt only instrument with a 10% imputed interest

rate and a final settlement figure of GBP905,000 in July 2024. This

10% imputed interest rate of GBP38,643 (2022: GBP24,242), is

managements' best estimate as to the interest rate that would be

expected from the market for an unsecured loan of GBP905,000

without a conversion element.

Defer red sh a res do n ot entitle the h old er to r eceive

notice of and to attend or v o te at a ny gener al meeting of the C

o m pany or to receive div i den ds or other distrib u tio n s. U

pon win ding up or dis s olu tion of the C o m pany the h o l d e

rs of defer r ed shares shall be entitled to r eceive an am o unt

eq ual to the n o minal am ou nt paid up th e r e o n, b ut o nly

after h o l d e rs of o r din a ry shares have r eceived GBP10 0 ,

0 00 p er o r dinary share. H o l d ers of def e r red sh a res are

not entitled to any further rights of participation in the assets

of the Company. The Company has the right to purchase the deferred

shares in issue at any time for no consideration.

TRAFALGAR PROPERTY GROUP PLC

CONSOLIDATED UNAUDITED INTERIM RESULTS FOR THE

SIX MONTHS ENDED 30 SEPTEMBER 2023

NOTES TO THE FINANCIAL INFORMATION

8. SHARE WARRANTS

Share warrants as at the year end relate to the convertible loan

note with Mr C C Johnson, details of this arrangement are given in

Note 7 to these accounts.

9. CAPITAL CONTRIBUTION RESERVE

The capital contribution reserve of GBP400,147 related to the

renegotiation of interest accruing on loans to Mr G Howard - a

related party on the year to 31 March 2023. Interest has reduced

from 10% pa to 5% pa for the entire term of the loans and is now

non compound. However, interest has been paid on one loan of

GBP100,000 at the rate of 10% pa and this has not been affected and

continues to be paid monthly.

10. SUBSEQUENT EVENTS

There are no subsequent events to date.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DZMMZVKNGFZM

(END) Dow Jones Newswires

December 15, 2023 11:49 ET (16:49 GMT)

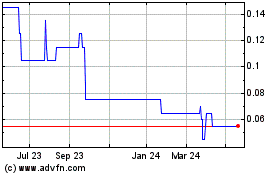

Trafalgar Property (AQSE:TRAF.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

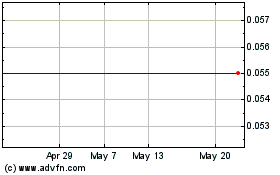

Trafalgar Property (AQSE:TRAF.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025