TIDMHSP

RNS Number : 7457N

Hargreaves Services PLC

25 January 2023

HARGREAVES SERVICES PLC

(the "Group", the "Company" or "Hargreaves")

Interim Results for the six months ended 30 November 2022

Hargreaves Services plc (AIM: HSP), a diversified group

delivering key projects and services to the industrial and property

sectors, announces its interim results for the six months ended 30

November 2022, having achieved strong trading throughout the

period, profitable growth across all business sectors and reporting

an increase in the interim dividend of 7.1%.

KEY FINANCIAL RESULTS Unaudited Unaudited

Six Months Six Months

ended ended

30 Nov 2022 30 Nov 2021

Revenue GBP116.5m GBP76.1m

Profit before tax ("PBT") GBP18.7m GBP10.4m

EPS 52.2p 31.0p

Interim Dividend 3.0p 2.8p

Cash in hand GBP18.1m GBP8.5m

Leasing debt GBP30.6m GBP11.5m

Net Asset Value GBP196.2m GBP149.2m

Net Assets per Share 603p 462p

HIGHLIGHTS

-- Strong revenue growth in Services, leading to an overall

increase of 53% year on year, primarily due to HS2

-- Growth in PBT across all business units, delivering an overall increase of 80%

-- Interim dividend increased by 7.1% to 3.0p

-- Cash in hand of GBP18.1m, up from GBP8.5m in Nov 2021.

-- Increase in leasing debt due to investment in plant to

support HS2 driven growth in revenue and PBT

-- Net assets per share have increased by 31% over the last twelve months.

Commenting on the interim results, Chairman Roger McDowell said:

"I am delighted to report very strong results for our half-year.

The outcome is both a result of great work by our team and a

vindication of our strategy. Whilst conscious of the macro-economic

challenges we remain confident in the strength of the

business."

CEO video Q&A

Your browser does not support HTML5 video.

For further details:

Hargreaves Services www.hsgplc.co.uk

Gordon Banham, Chief Executive Officer Tel: 0191 373 4485

John Samuel, Group Finance Director

Walbrook PR (Financial PR & IR) Tel: 020 7933 8780 or hargreavesservices@walbrookpr.com

Paul McManus / Lianne Applegarth / Louis Ashe-Jepson Mob: 07980 541 893 / 07584 391 303 / 07747 515 393

Singer Capital Markets (Nomad and Corporate Broker) Tel: 020 7496 3000

Sandy Fraser/ Justin McKeegan

About Hargreaves Services plc ( www.hsgplc.co.uk )

Hargreaves Services plc is a diversified group delivering

services to the industrial and property sectors, supporting key

industries within the UK and South East Asia. The Company's three

business segments are Services, Hargreaves Land and an investment

in a German joint venture, Hargreaves Raw Materials Services GmbH

("HRMS"). Services provides critical support to many core

industries including Energy, Environmental, UK Infrastructure and

certain manufacturing industries through the provision of materials

handling, mechanical and electrical contracting services, logistics

and major earthworks. Hargreaves Land is focused on the sustainable

development of brownfield sites for both residential and commercial

purposes. HRMS trades in specialist commodity markets and owns DK

Recycling, a specialist recycler of steel waste material.

Hargreaves is headquartered in County Durham and has operational

centres across the UK, as well as in Hong Kong and a joint venture

in Duisburg, Germany.

CHAIRMAN'S STATEMENT

Introduction

The last six months have seen an increased level of operations

on the HS2 contract within Services, continuing land sales at

Blindwells in Hargreaves Land and further strong trading at HRMS.

This has delivered profitable growth across all business sectors,

despite the well-publicised challenges posed by the inflationary

environment.

I am pleased that the Group has remained resilient throughout

this period and continued to create opportunities to deliver value

for our shareholders.

Resilience and growth

The past 12 months have seen a substantial increase in the cost

of goods and services, which has put many businesses and industries

under pressure, not to mention the wider population. Against this

backdrop, the Group has demonstrated its resilience, particularly

within the Services business, to withstand these pressures and to

deliver profitable growth. With over 50 term and framework

contracts in Services, most of which have inflation related

escalation clauses, the Group is well insulated against the impact

of inflation.

During the period, activity levels on the HS2 contract have

increased, which has provided substantial growth in revenue and

profitability both in earthmoving and mechanical and electrical

engineering services. Even discounting the impact of HS2

earthmoving activities, revenue grew by 8.7% across the Services

business due primarily to the success of the engineering projects

work.

Hargreaves Land has completed another sale at Blindwells, which

continues to demonstrate the recurrent nature of the revenue from

that site.

Our German Joint Venture, HRMS, benefited in the prior year from

very favourable commodity markets, and they have been able to

continue to trade well in volatile market conditions.

Results

Group revenue increased by 53% to GBP116.5m (2021: GBP76.1m)

primarily due to increased activity on the HS2 contract. The

Group's PBT has increased substantially by 80% from GBP10.4m to

GBP18.7m. EBITDA has increased to GBP12.9m (Nov 2021: GBP3.7m) as

more profit is derived from Services and Land business segments.

Whilst much of this improvement is due to the HS2 contract, the

first half has also seen some non-recurring asset realisations

yielding a profit of GBP2.0m. As a result, the full year results

are likely to be weighted towards the first half.

Cash and debt

The Group held cash in hand of GBP18.1m on 30 November 2022

compared to GBP13.8m on 31 May 2022 (Nov 2021: GBP8.5m). This cash

increase is due, in part, to the repayment of the short-term

working capital funding that was provided to HRMS in the prior

year, offset by investment into Hargreaves Land assets.

The only debt held by the Group is leasing debt for specific

plant items. At 30 November 2022 the Group had leasing debt of

GBP30.6m, which is a substantial increase on the 31 May 2022

leasing debt of GBP18.4m (Nov 2021: GBP11.5m). This increase is due

to the acquisition of plant and equipment to support the HS2

contract. The total amount of leasing debt is expected to increase

further before the end of the financial year as the final plant

deliveries for HS2 are due to be received in the second half.

Net asset value

The net asset per share of the Group has increased to 603p from

462p representing an increase of 31% in a year.

Dividend

Following the continued strong performance of the Group, the

Board is announcing a 7.1% increase in the interim dividend to 3.0p

(2021: 2.8p). The interim dividend will be paid on 6(th) April 2023

to shareholders on the register at 24(th) March 2023.

Board changes

John Samuel has informed the Board of his intention to step down

as Group Finance Director and Board Director on 31 July 2023.

John will be succeeded as Group Finance Director and Board

Director (the latter subject to satisfactory completion of

customary due diligence and approval by the Company's nominated

advisor) by Stephen Craigen,(39), with effect from 1 August 2023.

Stephen has been with the Group for nine years and has held the

role of Group Financial Controller since 2017. The Board has great

confidence in Stephen and that there will be a seamless transition

of responsibilities.

Strategy and Shareholder Value

The Group has developed three strong, defined businesses through

which it aims to create, deliver and realise value for

shareholders.

Services

The Services business is building a sustainable and resilient

profit stream through term contracts and framework agreements in

the Energy, Environmental, Infrastructure and Industrial sectors.

The Group currently has over 50 such contracts in place to support

future performance. The business is concentrated on organic,

profitable growth, with a particular focus on contract selectivity

and higher margin activities. The current year has seen a notable

increase in its level of operations with the ramp up at HS2 and

there is a solid foundation for further sustainable growth.

Additionally. I am pleased to announce that our specialist

earthmoving subsidiary, Blackwell, expects to be appointed to

support Balfour Beatty to deliver the 'Roads North of the Thames'

package of works for the proposed Lower Thames Crossing, on behalf

of National Highways. Contractual arrangements will be clarified in

due course. Designed to be the greenest road project ever built in

the UK, the Lower Thames Crossing will create a new connection

under the River Thames, increasing road capacity and easing

congestion in the South of England.

Hargreaves Land

This business is focused on maximising the inherent value of its

existing portfolio, including Blindwells and the Unity joint

venture, as well as developing a strong pipeline of new

opportunities. In addition, the business is now starting to deliver

returns from its renewable energy land portfolio.

HRMS

This business has taken advantage of strong trading conditions

although, as expected, these seem likely to weaken in the second

half of the financial year. It is focused on sustaining the

structural improvement in profitability achieved in DK Recycling

und Roheisen GmbH ("DK") and securing contracts to increase the

utilisation of its Carbon Pulverisation Plant ("CPP") whilst

continuing to take advantage of trading opportunities in the

minerals commodity markets.

Outlook

The first six months of the year have been positive for the

Group during a period of inflationary pressures and other economic

uncertainties. The Board has a clear focus on the creation,

delivery and realisation of value for shareholders in each business

unit. The Group has demonstrated its resilience and its ability to

drive organic profitable growth. I look forward to reporting

further progress in the second half of the financial year and the

Board is confident that results for the year will be in line with

market expectations.

Roger McDowell

Chairman

25 January 2023

CHIEF EXECUTIVE'S REVIEW

GBP'm Land HRMS Central Total

Services Costs

Revenue (Nov 2022) 107.8 8.7 - - 116.5

---------- ----- ----- -------- ------

Revenue (Nov 2021) 70.2 5.9 - - 76.1

---------- ----- ----- -------- ------

Profit/(loss) before tax

(Nov 2022) 8.5 1.6 10.8 (2.2) 18.7

---------- ----- ----- -------- ------

Profit/(loss) before tax

(Nov 2021) 3.1 0.5 9.0 (2.2) 10.4

---------- ----- ----- -------- ------

Services

The Services business recorded revenue of GBP107.8m (2021:

GBP70.2m) and Profit before tax of GBP8.5m (2021: GBP3.1m). The

increase in revenue is due in large part to the HS2 project, which

commenced in the second half of the prior financial year. The

increase in revenue attributable to earthmoving at HS2 is GBP31.5m

and the remaining revenue increase of GBP6.1m represents a growth

of 8.7% due to the successful award of certain engineering project

works.

Profit before tax in the first half of the year includes a

non-recurring gain of GBP2.0m from asset realisations, which is

likely to mean that market expectations for the full year

performance of this business segment will be similarly exceeded.

Excluding this gain, the improvement in Profit before tax is due

primarily to the HS2 contract and represents a 110% increase. The

result for the full year is likely to be heavily weighted to the

first half because the earthmoving season for HS2 falls into the

Group's H1 and the GBP1m annual receipt from Tungsten West plc

("TW") is also a first half event.

The Services business continues to deliver good quality,

resilient profits and remains focused on delivering services to our

four key market sectors, Energy, Environmental, Industrial and

Infrastructure.

Contract success

During the period the Group has been awarded a 10-year contract

with Durham County Council and a 5-year contract with Scottish

Water, both of which will help to provide a base of further

Environmental business development. Elsewhere the Services business

has seen success with the renewal of several other contracts in all

of its key markets ranging from 1 to 5 year extensions.

The earthmoving part of the business, Blackwell, has been

awarded a short-term contract to assist in the creation of a nature

reserve, which is associated with the Sizewell C nuclear project.

This provides an ideal opportunity to demonstrate capability on a

project that will require significant future earthworks to be

undertaken.

The business is carrying out the major earthworks on part of the

HS2 project, working for the EKFB Joint Venture. This contract is

individually significant and represents a substantial growth in the

revenue and profitability of the Group as a whole. I am pleased to

confirm that the project is going well and at peak operation the

Group had over 400 workers on site.

In addition to the earthmoving activity, the Group has also

developed and installed a five section 650m conveyor system, which

will reduce the carbon emissions on HS2 by over 5,000 tonnes in

total through the removal of approximately 1.15 million miles of

HGV traffic from the local roads, thus reducing diesel consumption

by 1.6 million litres, as well as any traffic disturbances to the

local community. This innovative solution has been recognised

through the team winning the EKFB C23 project of the year award in

the best environmental and sustainable initiative category.

The Group has now received the second of eight annual GBP1m

payments from TW relating to maintaining our capabilities on site.

TW has informed the market of their progress in restarting

operations at the Tungsten mine at Hemerdon in Devon. The Group

continues to maintain a close relationship with TW and retains the

exclusive contract for the provision of mining services should the

project come to fruition.

Inflation has been high throughout the period and this has

presented significant challenges for many businesses. We have

reported previously that Hargreaves is well insulated against such

inflationary pressures, due to many of the term contracts

containing specific escalation clauses. I am pleased to confirm

that during the first half, these measures have been successful in

protecting the Group against loss of value through inflation as

demonstrated by the strong profits recorded.

Looking to the medium term, the contract wins and renewals

secured in the period as well as the recent announcement of the

Balfour Beatty on Lower Thames Crossing, we continue to strengthen

the sustainable and resilient revenue streams in the Services

business. The business is continuing to develop its mechanical and

electrical engineering offering building on the successful conveyor

installation at HS2 as well as exploring opportunities for carbon

sequestration on some of our Scottish land assets.

Services remains the core generator of revenue and cash flow for

the Group. With a strong book of recurring contracted revenue, the

business is in a strong position to deal with the ongoing economic

and political uncertainties.

Hargreaves Land

Land

Hargreaves Land recorded revenue of GBP8.7m (2021: GBP5.9m) and

a Profit before tax of GBP1.6m (2021: GBP0.5m). The growth in both

revenue and Profit before tax is due to the timing of sales at

Blindwells.

The first half saw the completion of the sale of 4.5 acres to

Ogilvie Homes generating revenue of GBP3.4m. This development of 77

new homes, including 23 affordable, has now commenced and Ogilvie

is the fourth housebuilder now onsite at Blindwells. Out of 480

housing plots sold to date, including 144 affordable, 100 have now

been built.

At the Unity joint venture, the 650-acre mixed use development

in Doncaster, work has commenced on the forward funded 191,000 sq

ft logistics unit following the grant of detailed planning

permission at the end of last year with the completion of this

initial phase of commercial development expected to be achieved in

the second half of FY24.

As reported elsewhere, market conditions tightened across

virtually all sectors in the second half of 2022. However, demand

from house builders for serviced development sites with planning

permission in prime locations has remained resilient, although

unsurprisingly we are not expecting the continuation of the

aggressive land price inflation that was experienced in early 2022.

We expect demand for quality residential land to return to a more

normalised level in the coming year, underpinned by a shortage of

available residential opportunities in the areas we operate in.

In the commercial sectors where we operate, primarily

industrial/logistics and retail warehousing, occupier demand has

remained reasonably robust for well-located opportunities, although

investment values began to moderate from mid-2022 reflecting

increased interest rates and greater uncertainty over wider

economic conditions.

Hargreaves Land is currently working on contracted pipeline

opportunities with an estimated Gross Development Value of over

GBP200m, ranging from residential to industrial and mixed

commercial use.

Renewables

I am pleased to confirm that infrastructure work is nearing

completion at our site in Westfield, which has seen a capital

investment of GBP5m in the period. This work is being undertaken to

service an initial phase of 50 acres of consented employment land

on the site. The construction of an Energy from Waste ("EfW") plant

at Westfield by Brockwell Energy is underway and Hargreaves Land is

receiving associated rental income on a 35-year minimum term lease,

which will increase to GBP0.4m p.a. index linked at the end of the

first 3 years of the lease term.

The development at Westfield is a major step in the delivery of

value from our renewable land portfolio. In addition to Westfield,

the Group owns circa 3,000 acres of land, which will be developed

for the purpose of renewable energy generation, primarily

windfarms, solar farms and battery storage. Hargreaves Land will

not build out any of these projects but will be the landlord in any

arrangement. Dalquhandy, the first of the windfarm projects, has

now been completed and is expected to be fully operational in early

2023, with the construction of another wind farm at Broken Cross in

South Lanarkshire now being developed out.

Investment in HRMS

HRMS recorded a post tax profit of GBP10.8m (2021: GBP9.0m) for

the six months ended 30 November 2022. Whilst minerals trading has

been strong in the first half, and ahead of the comparative period,

it has not been at the level experienced in the second half of last

financial year, as commodity prices and global demand have

softened.

The HRMS trading business has always been skilled at maximising

opportunities whilst minimising the risk profile taken. We have

seen this again in the first half of the year. I can also confirm

that GBP12.5m of the temporary GBP15m loan from Hargreaves Services

plc that was in place on 31 May 2022 has now been repaid.

Visibility remains relatively short term for the trading team

but it is likely that the second half of the financial year will be

less strong than the first half as markets are expected to soften

further.

The steel waste recycling business, DK has seen another good

performance in the first half, albeit lower than the previous six

months, as pig iron prices have reduced. Due to an unusually

extended period of maintenance on the power plant additional costs

were incurred on energy amounting to EUR3m. As a result, it is

probable that the full year results for HRMS will be approximately

GBP1.5m lower than market expectations.

Having proved the concept of the CPP and delivered high quality

product, the conflict in Ukraine has impacted heavily on the

pricing of raw materials, which has restricted sales of the product

to new customers as brown lignite coal dust is more competitively

priced. The Board of HRMS remains confident in the future of the

plant, which is breaking even at present, and once markets return

to a more sustainable level, expects to see return from this

investment.

ESG

The Group's Cross-Business Working Group ("ESG Group") is now

well established and has previously set out the following three

targets for FY2023:

-- to reduce electricity and gas usage per office based employee by 2% per annum;

-- to improve the kilometres per litre attained by the haulage fleet by 3% per annum; and

-- to reduce the idling time in yellow plant by 6% per annum.

The ESG Group is monitoring the Group's performance against

these targets and will report the outcomes in the 2023 Annual

Report and Accounts.

Further, in 2022, the Group was pleased to be awarded an A "Very

Good" ESG rating from Integrum ESG, an independent ratings

advisor.

Summary

The contract wins and renewals in the Services business provide

further resilience to the Group's profitability as we head into the

second half of the financial year and beyond. Whilst there is

uncertainty within the UK housing and property market more

generally, I remain confident in the viability of the Hargreaves

Land portfolio as we continue to see strong demand for schemes

brought to market. Finally, HRMS has performed well in the last six

months, however, some commodity markets have softened recently and

visibility remains limited. As expected, it is likely that the

contribution from HRMS in the second half will be lower than that

for the first six months of the year.

I am pleased with the profitable growth the Group has delivered

in the period within each of its business segments, during a period

of challenging economic conditions.

Gordon Banham

Group Chief Executive

25 January 2023

Condensed Consolidated Statement of Profit and Loss and Other

Comprehensive Income

for the six months ended 30 November 2022

Unaudited Unaudited Audited

six months six months year

ended ended ended

30 November 30 November 31

May

2022 2021 2022

Note GBP000 GBP000 GBP000

--------------------------------------------------------- ----- ------------ ------------ ----------

Revenue 116,475 76,082 177,908

Cost of sales (94,782) (64,196) (148,458)

--------------------------------------------------------- ----- ------------ ------------ ----------

Gross profit 21,693 11,886 29,450

Other operating income 2,844 542 1,298

Administrative expenses (16,561) (11,369) (24,520)

--------------------------------------------------------- ----- ------------ ------------ ----------

Operating profit 7,976 1,059 6,228

Operating profit (before exceptional items) 7,976 1,059 4,474

Exceptional items 5 - - 1,754

--------------------------------------------------------- ----- ------------ ------------ ----------

Operating profit 7,976 1,059 6,228

--------------------------------------------------------- ----- ------------ ------------ ----------

Finance income 504 361 823

Finance expense (823) (292) (770)

Share of profit in joint ventures (net of tax) 11,053 9,269 28,200

--------------------------------------------------------- ----- ------------ ------------ ----------

Profit before tax 18,710 10,397 34,481

Taxation 6 (1,562) (386) 347

--------------------------------------------------------- ----- ------------ ------------ ----------

Profit for the period from continuing operations 17,148 10,011 34,828

--------------------------------------------------------- ----- ------------ ------------ ----------

Discontinued operations

Profit for the period from discontinued operations - - 2,000

--------------------------------------------------------- ----- ------------ ------------ ----------

Profit for the period 17,148 10,011 36,828

--------------------------------------------------------- ----- ------------ ------------ ----------

Other comprehensive income/(expense)

Items that will not be reclassified to profit

or loss

Remeasurements of defined benefit pension plans - - 5,955

Tax recognised on items that will not be reclassified

to profit or loss - - (1,488)

Items that are or may be reclassified subsequently

to profit or loss

Foreign exchange translation differences 1,406 45 313

Effective portion of changes in fair value of

cash flow hedges - 35 41

Tax recognised on items that are or may be reclassified

subsequently to profit or loss - (7) (8)

Share of other comprehensive income of joint ventures

(net of tax) - - 3,070

--------------------------------------------------------- ----- ------------ ------------ ----------

Other comprehensive income for the period, net

of tax 1,406 73 7,883

Total comprehensive income for the period 18,554 10,084 44,711

--------------------------------------------------------- ----- ------------ ------------ ----------

Profit/(loss) attributable to:

Equity holders of the company 16,962 10,029 37,040

Non-controlling interest 186 (18) (212)

--------------------------------------------------------- ----- ------------ ------------ ----------

Profit for the period 17,148 10,011 36,828

--------------------------------------------------------- ----- ------------ ------------ ----------

Total comprehensive income/(expense) for the

period attributable to:

Equity holders of the company 18,368 10,102 44,923

Non-controlling interest 186 (18) (212)

--------------------------------------------------------- ----- ------------ ------------ ----------

Total comprehensive income for the period 18,554 10,084 44,711

--------------------------------------------------------- ----- ------------ ------------ ----------

GAAP measures

Basic earnings per share (pence) 8 52.15 31.04 113.80

Diluted earnings per share (pence) 8 51.09 30.15 110.44

Condensed Consolidated Balance Sheet

as at 30 November 2022

Unaudited Unaudited Audited

30 November 30 November 31 May

2022 2021 2022

Note GBP000 GBP000 GBP000

---------------------------------- ----- ------------ ------------ -----------

Non-current assets

Property, plant and equipment 10,392 11,995 9,938

Right of use assets 35,305 15,040 22,062

Investment property 13,672 7,286 8,298

Intangible assets including

goodwill 5,949 4,824 4,824

Investments in joint ventures 10 70,541 39,873 58,383

Deferred tax assets 9,657 9,662 11,063

Trade receivables 4,224 - 4,224

Retirement benefit surplus 11,467 3,600 10,382

---------------------------------- ----- ------------ ------------ -----------

161,207 92,280 129,174

---------------------------------- ----- ------------ ------------ -----------

Current assets

Other financial assets - 2 -

Inventories 33,872 31,117 30,476

Trade and other receivables 86,109 87,102 88,574

Income tax asset - 629 -

Contract assets 6,081 2,667 6,752

Cash and cash equivalents 18,102 8,509 13,773

---------------------------------- ----- ------------ ------------ -----------

144,164 130,026 139,575

---------------------------------- ----- ------------ ------------ -----------

Total assets 305,371 222,306 268,749

---------------------------------- ----- ------------ ------------ -----------

Non-current liabilities

Other Interest-bearing loans

and borrowings ( 17,460) (8,354) (11,045)

Retirement benefit obligations ( 2,666) (2,831) (2,703)

Provisions ( 5,898) - (2,344)

Deferred tax liabilities (2,419) - (1,920)

---------------------------------- ----- ------------ ------------ -----------

(28,443) (11,185) (18,012)

---------------------------------- ----- ------------ ------------ -----------

Current liabilities

Other Interest-bearing loans

and borrowings ( 13,140) (3,192) (7,326)

Trade and other payables ( 58,792) (52,714) (50,727)

Provisions ( 8,844) (6,021) (9,440)

Income tax liability - - (108)

Other financial liabilities - (7) -

---------------------------------- ----- ------------ ------------ -----------

(80,776) (61,934) (67,601)

---------------------------------- ----- ------------ ------------ -----------

Total liabilities (109,219) (73,119) (85,613)

---------------------------------- ----- ------------ ------------ -----------

Net assets 196,152 149,187 183,136

---------------------------------- ----- ------------ ------------ -----------

Condensed Consolidated Balance Sheet (continued)

as at 30 November 2022

Unaudited Unaudited Audited

30 November 30 November 31 May

2022 2021 2022

Note GBP000 GBP000 GBP000

------------------------------------------ --------- ------------ ------------ ----------

Equity attributable to

equity holders of the parent

Share capital 3,314 3,314 3,314

Share premium 73,972 73,955 73,972

Other reserves 211 211 211

Translation reserve (41 3) (2,087) (1,819)

Merger reserve 1,022 1,022 1,022

Hedging reserve 318 313 318

Capital redemption reserve 1,530 1,530 1,530

Share-based payment reserve 2,216 1,818 2,029

Retained earnings 114,018 69,139 102,781

------------------------------------------ --------- ------------ ------------ ----------

196,188 149,215 183,358

Non-controlling interest (36) (28) (222)

------------------------------------------ --------- ------------ ------------ ----------

Total equity 196,152 149,187 183,136

------------------------------------------ --------- ------------ ------------ ----------

Condensed Consolidated Statement of Changes in Equity

for the six months ended 30 November 2021

Share Share Translation Hedging Other Capital Merger Share-based Retained Total Non-controlling Total

capital premium reserve reserve reserves redemption reserve payment earnings parent interest Equity

reserve reserve equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1 June

2021 3,314 73,955 (2,132) 285 211 1,530 1,022 1,680 64,441 144,306 (10) 144,296

-------- -------- ------------- -------- --------- ----------- -------- ------------ --------- -------- ---------------- --------

Total

comprehensive

income and

expense for the

period

Profit/(loss) for

the period - - - - - - - - 10,029 10,029 (18) 10,011

Other

comprehensive

income/(expense)

Foreign exchange

translation

differences - - 45 - - - - - - 45 - 45

Effective portion

of changes in

fair value of

cash flow hedges - - - 35 - - - - - 35 - 35

Tax recognised on

other

comprehensive

income - - - (7) - - - - - (7) - (7)

-------- -------- ------------- -------- --------- ----------- -------- ------------ --------- -------- ---------------- --------

Total other

comprehensive

income - - 45 28 - - - - - 73 - 73

-------- -------- ------------- -------- --------- ----------- -------- ------------ --------- -------- ---------------- --------

Total

comprehensive

income and

expense for the

period - - 45 28 - - - - 10,029 10,102 (18) 10,084

-------- -------- ------------- -------- --------- ----------- -------- ------------ --------- -------- ---------------- --------

Transactions with

owners recorded

directly in equity

Equity settled

share-based

payment

transactions - - - - - - - 138 - 138 - 138

Dividends paid - - - - - - - - (5,331) (5,331) - (5,331)

-------- -------- ------------- -------- --------- ----------- -------- ------------ --------- -------- ---------------- --------

Total

contributions by

and

distributions to

owners - - - - - - - 138 (5,331) (5,193) - (5,193)

Balance at 30

November 2021 3,314 73,955 (2,087) 313 211 1,530 1,022 1,818 69,139 149,215 (28) 149,187

-------- -------- ------------- -------- --------- ----------- -------- ------------ --------- -------- ---------------- --------

Condensed Consolidated Statement of Changes in Equity

for the six months ended 30 November 2022

Share Share Translation Hedging Other Capital Merger Share-based Retained Total Non-controlling Total

capital premium reserve reserve reserves redemption reserve payment earnings parent interest Equity

reserve reserve equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1

June 2022 3,314 73,972 (1,819) 318 211 1,530 1,022 2,029 102,781 183,358 (222) 183,136

-------- --------- ------------- -------- --------- ----------- -------- ------------ --------- -------- ---------------- --------

Total

comprehensive

income

for the period

Profit for the

period - - - - - - - - 16,962 16,962 186 17,148

Other

comprehensive

income

Foreign

exchange

translation

differences - - 1,406 - - - - - - 1,406 - 1,406

-------- --------- ------------- -------- --------- ----------- -------- ------------ --------- -------- ---------------- --------

Total other

comprehensive

income - - 1,406 - - - - - - 1,406 - 1,406

-------- --------- ------------- -------- --------- ----------- -------- ------------ --------- -------- ---------------- --------

Total

comprehensive

income

for the period - - 1,406 - - - - - 16,962 18,368 186 18,554

-------- --------- ------------- -------- --------- ----------- -------- ------------ --------- -------- ---------------- --------

Transactions

with owners

recorded

directly in

equity

Equity settled

share-based

payment

transactions - - - - - - - 187 - 187 - 187

Dividends paid - - - - - - - - (5,725) (5,725) - (5,725)

Total

contributions

by and

distributions

to owners - - - - - - - 187 (5,725) (5,538) - (5,538)

Balance at 30

November 2022 3,314 73,972 (413) 318 211 1,530 1,022 2,216 114,018 196,188 (36) 196,152

-------- --------- ------------- -------- --------- ----------- -------- ------------ --------- -------- ---------------- --------

Condensed Consolidated Cash Flow Statement

for the six months ended 30 November 2022

Unaudited Unaudited

six months six months Audited

ended ended year

ended

30 30 November 31

November May

2022 2021 2022

GBP000 GBP000 GBP000

-------------------------------------------------------- ------------ ---------

Cash flows from operating activities

Profit for the period from continuing operations 17,148 10,011 34,828

Adjustments for:

Depreciation and impairment of property, plant

and equipment and right-of-use assets 4,932 2,598 8,666

Net finance expense/(income) 319 (69) (53)

Share of profit in joint ventures (net of tax) (11,053) (9,269) (28,200)

Profit on sale of property, plant and equipment,

investment property and right-of-use assets (2,844) (602) (1,298)

Equity settled share-based payment expense 187 138 349

Income tax expense/(credit) 1,562 386 (347)

Contributions to defined benefit pension schemes (1,170) (768) (2,002)

Retranslation of foreign denominated assets and

liabilities 31 764 202

-------------------------------------------------------- ----------- ------------ ---------

9,112 3,189 12,145

Change in inventories (3,398) (3,949) (3,308)

Change in trade and other receivables 4,314 (10,495) (19,256)

Change in trade and other payables 6,622 (581) 903

Change in provisions and employee benefits 2,867 (1,380) 1,000

-------------------------------------------------------- ----------- ------------ ---------

19,517 (13,216) (8,516)

Interest (paid)/received (271) 299 34

Income tax received/(paid) 28 - (44)

-------------------------------------------------------- ----------- ------------ ---------

Net cash inflow/(outflow) from operating activities 19,274 (12,917) (8,526)

-------------------------------------------------------- ----------- ------------ ---------

Cash flows from investing activities

Proceeds from sale of property, plant and equipment 4,565 640 801

Proceeds from sale of investment property 146 786 1,407

Proceeds from sale of ROU assets 54 33 78

Acquisition of property, plant and equipment (1,730) (224) (1,479)

Acquisition of investment property (5,377) (15) (1,070)

Acquisition of right of use assets (54) - (163)

Acquisition of subsidiaries (1,447) - -

Dividends received from joint ventures - - 3,917

-------------------------------------------------------- ----------- ------------ ---------

Net cash (outflow)/inflow from investing activities

in continuing operations (3,843) 1,220 3,491

-------------------------------------------------------- ----------- ------------ ---------

Net cash inflow from investing activities in

discontinued operations - - 2,000

----------- ------------

Net cash (outflow)/inflow from investing activities (3,843) 1,220 5,491

-------------------------------------------------------- ----------- ------------ ---------

Cash flows from financing activities

Principal elements of lease payments (5,519) (2,755) (5,531)

Dividends paid (5,725) (5,331) (6,237)

-------------------------------------------------------- ----------- ------------ ---------

Net cash outflow from financing activities (11,244) (8,086) (11,768)

-------------------------------------------------------- ----------- ------------ ---------

Net increase/(decrease) in cash and cash equivalents 4,187 (19,783) (14,803)

Cash and cash equivalents at the start of the

period 13,773 28,303 28,303

Effect of exchange rate fluctuations on cash

held 142 (11) 273

-------------------------------------------------------- ----------- ------------ ---------

Cash and cash equivalents at the end of the

period 18,102 8,509 13,773

-------------------------------------------------------- ----------- ------------ ---------

Notes to the CONDENSED CONSOLIDATED Interim FINANCIAL

INFORMATION

1. Basis of preparation

The condensed consolidated interim financial information set out

in this statement for the six months ended 30 November 2022 and the

comparative figures for the six months ended 30 November 2021 is

unaudited. This financial information does not constitute statutory

accounts as defined in Section 435 of the Companies Act 2006. It

does not comply with IAS 34 'Interim Financial Reporting', as is

permissible under the rules of the Alternative Investment

Market.

The condensed consolidated interim financial information, which

is neither audited nor reviewed, has been prepared in accordance

with the measurement and recognition criteria of UK-adopted

international accounting standards. This statement does not include

all the information required for the annual financial statements

and should be read in conjunction with the financial statements of

the Group as at and for the year ended 31 May 2022.

There are no new IFRS which apply to the condensed consolidated

interim financial information.

2. Accounting policies

The accounting policies applied in preparing the condensed

consolidated interim financial information are the same as those

applied in the preparation of the annual financial statements for

the year ended 31 May 2022, as described in those financial

statements.

3. Status of financial information

The comparative figures for the financial year ended 31 May 2022

are not the Group's statutory consolidated financial statements for

that financial year. The statutory financial accounts for the

financial year ended 31 May 2022 have been reported on by the

company's auditor and delivered to the Registrar of Companies. The

report of the auditor was (i) unqualified, (ii) did not include a

reference to any matters to which the auditor drew attention by way

of emphasis without qualifying their report, and (iii) did not

contain a statement under section 498 (2) or (3) of the Companies

Act 2006.

4. Principal risks and uncertainties

The principal risks and uncertainties affecting the Group are

unchanged from those set out in the Group's accounts for the year

ended 31 May 2022. The Directors have reviewed financial forecasts

and are satisfied that the Group has adequate resources to continue

in operational existence for the foreseeable future. Accordingly,

the Group continues to adopt the going concern basis in preparing

the condensed consolidated interim financial information .

5. Exceptional items

Six months Six months Year

ended ended 30 ended

30 November November 31 May

2022 2021 2022

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

----------------------------------------------- -------------- ------------ --------

Exceptional items in Administrative expenses

Release of accrual relating to liability from

the year ended 31 May 2015 - - 1,754

Total exceptional items in Administrative

expenses - - 1,754

----------------------------------------------- -------------- ------------ --------

There are no exceptional items in the six month period ended 30

November 2022 (30 November 2021: GBPnil).

In the year ending 31 May 2022, an aged accrual dating from the

year ended 31 May 2015 totalling GBP1,754,000 was released as the

potential for payment had lapsed due to time.

6. Taxation

UK income tax for the period is charged at 19% (2021: 19%). The

effective tax rate, after removing the impact of jointly controlled

entities is 20.4% (2021: 34.2%), representing an estimate of the

annual effective rate for the full year to 31 May 2023. This rate

is higher than the standard rate of UK income tax due to the effect

on deferred tax of the forthcoming rise in the corporate tax rate

to 25% and the impact of accounting for tax related to the Unity

Joint Venture, which is a Limited Liability Partnership.

7. Dividends

The final dividend of 5.6p and additional dividend of 12p per

ordinary share, proposed in the 2022 annual accounts and approved

by the shareholders at the Annual General Meeting on 27 October

2022, was paid on 31 October 2022. The directors have proposed an

interim dividend of 3.0p per share (2021: 2.8p) which will be paid

on 6 April 2023 to shareholders on the register at the close of

business on 24 March 2023. This will be paid out of the Company's

available distributable reserves. In accordance with IAS 1,

dividends are recorded only when paid and are shown as a movement

in equity rather than as a charge in the income statement.

8. Earnings per share

Six months ended Six months ended Year ended 31

30 November 2022 30 November 2021 May 2022

Unaudited Unaudited Audited

Earnings EPS DEPS Earnings EPS DEPS Earnings EPS DEPS

GBP000 Pence Pence GBP000 Pence Pence GBP000 Pence Pence

Underlying earnings per

share 16,962 52.15 51.09 10,029 31.04 30.15 33,407 103.23 100.18

Exceptional items and

amortisation

(net of tax) - - - - - - 1,421 4.39 4.26

------------------------------- --------- ------- ------- --------- ------- ------- --------- ------- -------

Continuing basic earnings

per share 16,962 52.15 51.09 10,029 31.04 30.15 34,828 107.62 104.44

Discontinued operations - - - - - - 2,000 6.18 6.00

------------------------------- --------- ------- ------- --------- ------- ------- --------- ------- -------

Basic earnings per share 16,962 52.15 51.09 10,029 31.04 30.15 36,828 113.80 110.44

--------- ------- ------- --------- ------- ------- --------- ------- -------

Weighted average number

of shares 32,528 33,200 32,316 33,267 32,362 33,347

------------------------------- --------- ------- ------- --------- ------- ------- --------- ------- -------

The calculation of diluted earnings per share is based on the

profit for the period attributable to equity holders of the Company

and on the weighted average number of ordinary shares in issue in

the period adjusted for the dilutive effect of the share options

outstanding. The effect on the weighted average number of shares is

672,000 (2021: 951,000), the effect on continuing basic earnings

per ordinary share is 1.06p (2021: 0.89p).

9. Segmental information

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision-maker.

The chief operating decision-maker has been identified as the Board

of Directors since they are responsible for strategic decisions.

HSEL represents Hargreaves Services Europe Limited, the holding

company for the Group's investment in its German Joint Venture.

Services Hargreaves Unallocated HSEL Total

Land

Unaudited Unaudited Unaudited Unaudited Unaudited

30 November 30 November 30 November 30 November 30 November

2022 2022 2022 2022 2022

GBP000 GBP000 GBP000 GBP000 GBP000

----------------------------------- ------------ ------------ ------------ ------------ ------------

Revenue

Total revenue 108,000 8,700 - - 116,700

Intra-segment revenue (225) - - - (225)

------------------------------------------ ------------ ------------ ------------ ------------ ------------

Revenue from external customers 107,775 8,700 - - 116,475

------------------------------------------ ------------ ------------ ------------ ------------ ------------

Operating profit/(loss) 9,147 1,331 (2,502) - 7,976

Share of profit in joint ventures

(net of tax) - 242 - 10,811 11,053

Net finance (expense)/income (642) 28 295 - (319)

Profit/(loss) before tax 8,505 1,601 (2,207) 10,811 18,710

------------------------------------------ ------------ ------------ ------------ ------------ ------------

Services Hargreaves Unallocated HSEL Total

Land

Unaudited Unaudited Unaudited Unaudited Unaudited

30 30 30 30 30

November November November November November

2021 2021 2021 2021 2021

GBP000 GBP000 GBP000 GBP000 GBP000

----------------------------------- ------------ ------------ ------------ ------------ ------------

Revenue

Total revenue 71,043 5,846 - - 76,889

Intra-segment revenue (807) - - - (807)

------------------------------------------ ------------ ------------ ------------ ------------ ------------

Revenue from external customers 70,236 5,846 - - 76,082

------------------------------------------ ------------ ------------ ------------ ------------ ------------

Operating profit/(loss) 3,149 169 (2,259) - 1,059

Share of profit in joint ventures

(net of tax) 292 - 8,977 9,269

Net finance income - - 69 - 69

Profit/(loss) before tax 3,149 461 (2,190) 8,977 10,397

------------------------------------------ ------------ ------------ ------------ ------------ ------------

10. Investments in joint ventures

Tower Hargreaves Waystone Interests Total

Regeneration Services Hargreaves in immaterial

Limited Europe LLP joint

Limited ventures

GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------ --------------- ----------- ------------ --------------- -------

At 1 June 2022 - 53,547 4,910 (74) 58,383

Group's share of profit in

joint ventures (net of tax) - 10,811 241 1 11,053

Exchange differences - 1,112 - (7) 1,105

At 30 November 2022 - 65,470 5,151 (80) 70,541

------------------------------ --------------- ----------- ------------ --------------- -------

11. Condensed consolidated interim financial information

The condensed consolidated interim financial information was

approved by the Board of Directors on 25 January 2023. Copies of

this interim statement will be sent to all shareholders and will be

available to the public from the Group's registered office.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR VZLFLXFLLBBF

(END) Dow Jones Newswires

January 25, 2023 02:00 ET (07:00 GMT)

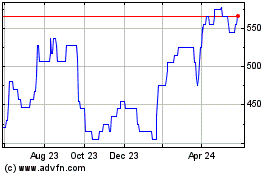

Hargreaves Services (AQSE:HSP.GB)

Historical Stock Chart

From Feb 2025 to Mar 2025

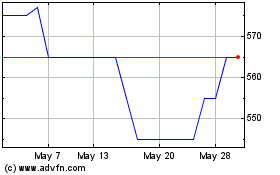

Hargreaves Services (AQSE:HSP.GB)

Historical Stock Chart

From Mar 2024 to Mar 2025