Vancouver, British Columbia, Canada -- March 27, 2025 --

InvestorsHub NewsWire -- LaFleur Minerals Inc.

(CSE:

LFLR) (OTCQB:

LFLRF) (FSE: 3WK0) ("LaFleur

Minerals" or the "Company") is pleased to

announce that it has entered into a Memorandum of Understanding

("MOU") with Granada Gold Mine Inc.

("Granada") (collectively, the

"Parties") dated March 25, 2025 to assess the

design criteria for processing mineralized material from the

Granada Gold Project ("Granada Gold" or the

"Project") at the Company's 100%-owned and fully

permitted Beacon Gold Mill, located in Val-d'Or, Québec,

Canada.

If off-site processing of Granada Gold mineralized material at

the Beacon Gold Mill is deemed viable by both parties as part of

the MOU, the Parties have the option to enter into a commercial

agreement and may undertake a mining and economic study to further

evaluate the processing of Granada Gold mineralized material at the

Beacon Gold Mill. This study would consider mine design, mining

methodology, mining and processing rates, gold production profile,

facilities requirements, development schedules, and determine the

overall project economics.

Paul Teniere, CEO of LaFleur Minerals commented,

"Hub-and-spoke mining and milling arrangements have long been a

feature of mining in the Abitibi Gold Belt in Québec. With the

price of gold having risen from USD$2,000 per ounce to a current

price approaching USD$3,000 per ounce over the past 12 months, we

are excited to look at potentially custom milling mineralized

material from the Granada Gold deposit. Today, we are announcing

the first step in assessing the viability of such an arrangement

for the Granada Gold deposit as part of the Beacon Gold Mill

restart project. The MOU with Granada will facilitate the

preliminary technical work required to assess the compatibility of

the Granada Gold deposit with the Beacon Gold Mill. The Beacon Gold

Mill is directly accessible to the Granada Gold deposit via truck

hauling on paved highway, and possibly rail shipping. With offsite

processing and tailings disposal, the Granada Gold deposit could

potentially be a low-cost, low-impact, and highly profitable mining

operation. The MOU with Granada Gold contains no commercial terms

regarding how mineralized material from the Granada Gold deposit to

Beacon Gold Mill would be arranged. However, further discussions

between the two parties are contemplated upon the successful

completion of this preliminary technical work."

TERMS OF

THE MOU

The MOU facilitates the exchange of technical data between

LaFleur Minerals and Granada Gold regarding metallurgy, flow-sheet

configuration, potential mill modifications, and future processing

and tailings disposal capacity. Each Party will be responsible for

its own costs associated with this work. To conduct the assessment,

LaFleur Minerals has retained ABF Mines Inc., and a program of

metallurgical work has already commenced at the Granada Gold

deposit. The MOU is non-binding and non-exclusive and contains no

specific terms around potential commercial arrangements between the

Parties. There is no certainty that any arrangement between the

Parties will result from their dealings pursuant to the MOU.

LAFLEUR

MINERALS CORE ASSETS:

BEACON

GOLD MILL

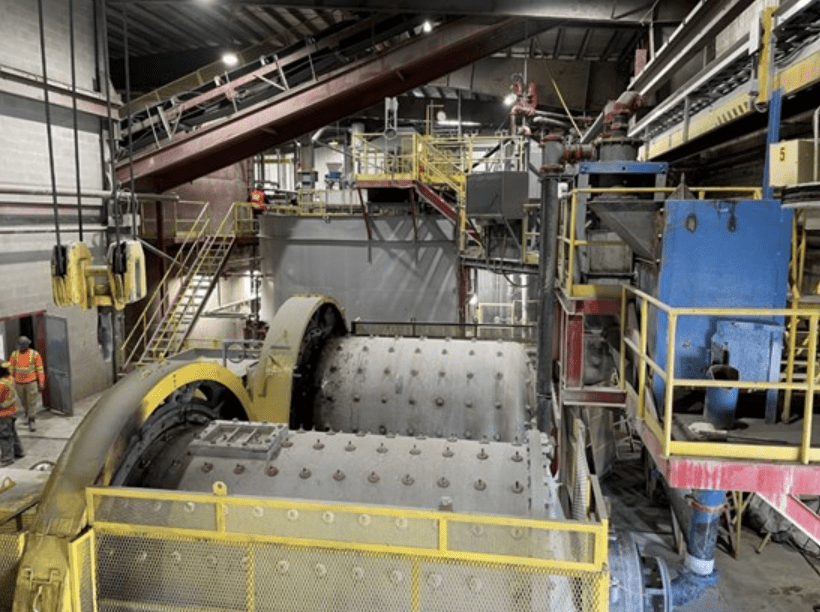

Fully-refurbished, permitted Beacon Gold Mill, capable of

processing over 750 tonnes per day (Figure 1 and

2).

The entirely refurbished Beacon Gold Mill was last fully

operational in early 2023 when the price of gold was USD$1,800 per

ounce and has been under care and maintenance since that time. As

gold approaches a record price of USD$3,000 per ounce, the goal of

restarting the Beacon Gold Mill in the coming months is an

exceptional opportunity for LaFleur Minerals to also target the

custom milling of mineralized material from nearby gold deposits

that surround the Beacon Mill. LaFleur Minerals demonstrates

significant upside potential by ultimately generating revenue at

the current elevated gold prices, with the restart of the Beacon

Mill targeting a potential annual production scenario of

approximately 30,000 to 40,000 ounces of gold based on the current

mill capacity. The Company is currently finalizing the restart

costs for the Beacon Mill and expects to have all permits and

updates completed by the end of 2025.

Figure 1: Photo of interior of Beacon Mill currently

undergoing detailed inspections for restart

Figure 2: Photo of exterior of Beacon Mill in

Val-d'Or, Québec

SWANSON

GOLD PROJECT

The Swanson Gold Project is over 16,000 hectares in size and

includes several prospects rich in gold and critical metals

previously held by Monarch Mining, Abcourt Mines, and Globex

Mining. The Swanson Gold Project covers a major structural break

that hosts the Swanson Gold Deposit, and Bartec, and Jolin gold

targets and numerous other showings which make up the Swanson Gold

Project. The Swanson Gold Project is easily accessible by road with

a rail line running through the property, allowing direct access to

several nearby gold mills and further enhancing its development

potential. The Swanson gold project has had in excess of 36,000m of

historical drilling.

(MRE source: NI 43-101 technical report, effective September

17, 2024, filed on the Company's SEDAR+ profile).

Figure 3: Swanson Gold Project and other gold

deposits within 50 km of the Beacon Gold Mill

LaFleur Minerals' strategy combines advancing the Swanson Gold

Deposit resource estimate, custom milling at the Beacon Gold Mill,

and leveraging regional infrastructure to maximize value.

QUALIFIED

PERSON STATEMENT

All scientific and technical information in this news release

has been prepared and approved by Louis Martin, P.Geo., Technical

Advisor to the Company and considered a Qualified Person for the

purposes of NI 43-101.

About LaFleur Minerals Inc.

LaFleur Minerals Inc. (CSE: LFLR) (OTCQB: LFLRF) (FSE: 3WK0) is

focused on the development of district-scale gold projects in the

Abitibi Gold Belt near Val-d'Or, Québec. Our mission is to advance

mining projects with a laser focus on our resource-stage Swanson

Gold Project and the Beacon Gold Mill, which have significant

potential to deliver long-term value. The Swanson Gold Project is

over 16,000 hectares (160 km2) in size and includes

several prospects rich in gold and critical metals previously held

by Monarch Mining, Abcourt Mines, and Globex Mining. LaFleur has

recently consolidated a large land package along a major structural

break that hosts the Swanson, Bartec, and Jolin gold deposits and

several other showings which make up the Swanson Gold Project. The

Swanson Gold Project is easily accessible by road with a rail line

running through the property allowing direct access to several

nearby gold mills, further enhancing its development potential.

Lafleur Minerals' fully-refurbished and permitted Beacon Gold Mill

is capable of processing over 750 tonnes per day and is being

considered for processing mineralized material at Swanson and for

custom milling operations for other nearby gold projects.

ON BEHALF OF LAFLEUR MINERALS INC.

LaFleur Minerals Inc.

1500-1055 West Georgia Street

Vancouver, BC V6E 4N7

Neither the Canadian Securities Exchange nor its

Regulation Services Provider accepts responsibility for the

adequacy or accuracy of this news release.

Cautionary Statement Regarding "Forward-Looking"

Information

This news release includes certain statements that may be

deemed "forward-looking statements". All statements in this new

release, other than statements of historical facts, that address

events or developments that the Company expects to occur, are

forward-looking statements. Forward-looking statements are

statements that are not historical facts and are generally, but not

always, identified by the words "expects", "plans", "anticipates",

"believes", "intends", "estimates", "projects", "potential" and

similar expressions, or that events or conditions "will", "would",

"may", "could" or "should" occur. Forward-looking statements in

this news release include, without limitation, statements related

to the use of proceeds from the Offering. Although the Company

believes the expectations expressed in such forward-looking

statements are based on reasonable assumptions, such statements are

not guarantees of future performance and actual results may differ

materially from those in the forward-looking statements. Factors

that could cause the actual results to differ materially from those

in forward-looking statements include market prices, continued

availability of capital and financing, and general economic, market

or business conditions. Investors are cautioned that any such

statements are not guarantees of future performance and actual

results or developments may differ materially from those projected

in the forward-looking statements. Forward-looking statements are

based on the beliefs, estimates and opinions of the Company's

management on the date the statements are made. Except as required

by applicable securities laws, the Company undertakes no obligation

to update these forward-looking statements in the event that

management's beliefs, estimates or opinions, or other factors,

should change.

Lafleur Minerals (QB) (USOTC:LFLRF)

Historical Stock Chart

From Mar 2025 to Apr 2025

Lafleur Minerals (QB) (USOTC:LFLRF)

Historical Stock Chart

From Apr 2024 to Apr 2025