Fisher (James) & Sons plc Trading Update (4505E)

November 06 2020 - 1:40PM

UK Regulatory

TIDMFSJ

RNS Number : 4505E

Fisher (James) & Sons plc

06 November 2020

6 November 2020

James Fisher and Sons plc

Trading Update

James Fisher and Sons plc (FSJ.L) ('James Fisher' or 'the

Group'), the UK's leading marine services company, today publishes

its trading update for the quarter ended 30 September 2020 ('third

quarter' or 'the period').

Trading in the third quarter continued to be challenging as the

Group did not see the improvement to trading conditions and the

seasonal uplift it had been anticipating at the Half Year Results.

As a result, revenue for the nine months ended 30 September 2020

was 17% lower than the comparable period last year. Stringent cost

control has reduced selling, general and administration costs by

17% to date compared to 2019. The Board now anticipates underlying

operating profit for the full year, before separately disclosed

items, to be in the range of GBP35m-GBP40m.

Due in large part to Covid-19 restrictions, especially in the

UK, the Middle East and southern Africa, revenue in Marine Support

continued to be impacted by project delays and cancellations in

subsea projects in both Renewables and Oil & Gas. In response a

further restructuring programme has been implemented in Marine

Support and the carrying value of the asset base is under

review.

Elsewhere, the Group performed with resilience in the period.

Within Marine Support, ship-to-ship traded in line with our

expectations in the quarter. In Specialist Technical, good progress

was made on approval and testing milestones on the supply of six

swimmer delivery vehicles and separately a 500-metre saturation

diving system. Offshore Oil remained resilient in the quarter and

performed in line with management expectations. Tankships improved

month on month following the sharp drop in utilisation in April due

to lockdown, and fleet utilisation was just below 90% in

September.

Net borrowings were in line with expectations at 30 September

and headroom under committed revolving credit facilities was c.

GBP96m.

The Group is diversified geographically and by end market and

continues to be resilient and profitable in the most challenging of

market conditions. Swift actions taken to reduce costs and to

improve liquidity, position James Fisher for an improvement in

market conditions and the Group remains well placed to deliver

future growth for its shareholders.

Contacts

James Fisher and Eoghan O'Lionaird CEO

Sons plc Stuart Kilpatrick Group Finance Director 020 7614 9508

FTI Consulting Richard Mountain 0203 727 1374

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUPGRCGUPUPPA

(END) Dow Jones Newswires

November 06, 2020 13:40 ET (18:40 GMT)

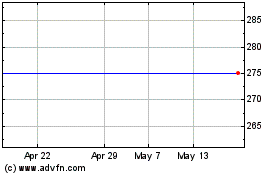

Fisher James And Sons (AQSE:FSJ.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

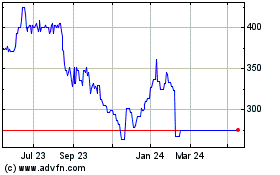

Fisher James And Sons (AQSE:FSJ.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025