TIDMFDM

RNS Number : 9907S

FDM Group (Holdings) plc

15 March 2023

FDM Group (Holdings) plc

Preliminary Results

FDM Group (Holdings) plc ("the Company") and its subsidiaries

(together "the Group" or "FDM"), today announces its results for

the year ended 31 December 2022.

31 December 31 December % change

2022 2021

Revenue GBP330.0m GBP267.4m +23%

------------ ------------ ---------

Adjusted operating profit(1) GBP52.2m GBP47.3m +10%

------------ ------------ ---------

Profit before tax GBP45.7m GBP41.4m +10%

------------ ------------ ---------

Adjusted profit before

tax(1) GBP52.0m GBP46.7m +11%

------------ ------------ ---------

Basic earnings per share 32.0p 29.1p +10%

------------ ------------ ---------

Adjusted basic earnings

per share(1) 37.3p 33.2p +12%

------------ ------------ ---------

Cash flow generated from

operations GBP49.7m GBP52.1m -5%

------------ ------------ ---------

Cash conversion(2) 108.3% 124.1% -13%

------------ ------------ ---------

Adjusted cash conversion(1) 95.1% 110.3% -14%

------------ ------------ ---------

Cash position at period

end GBP45.5m GBP53.1m -14%

------------ ------------ ---------

Dividend per share 36.0p 33.0p +9%

------------ ------------ ---------

-- Good performance by FDM in 2022, in line with the Board's expectations.

-- Consultants assigned to clients at week 52(3) stood at 4,905

(2021: 4,033), up 22% against the prior year.

-- North America delivered excellent growth, with both US and

Canada performing well; Consultant headcount grew by 48%.

-- Good progress in APAC, where FDM is gaining the critical mass

to take advantage of the upfront investment committed over recent

years; Consultant headcount grew by 15%.

-- The UK delivered an 8% increase in Consultant headcount; more

challenging market conditions later in the year, following the

September mini-budget and subsequent changes in government.

-- Global Consultant utilisation rate(4) was 97.5%, in line with the prior year (97.3%).

-- Global Consultant training completions during the year were

3,179 (2021: 2,410), up 32% and the highest in FDM's history.

-- We secured 74 new clients globally (2021: 78), of which 59%

were outside the financial services sector, with good progress made

in the e nergy and utilities , insurance and commercial and

professional services sectors.

-- We made a number of significant investments during the year

in recruitment, training and other mid to long-term programmes

which will help underpin the future growth of the business.

-- Group revenue increased 23% against the prior year (up 19% on

a constant currency basis); adjusted operating profit(1) increased

by 10% to GBP52.2 million (2021: GBP47.3 million).

-- We maintain our robust balance sheet, with GBP45.5 million of

cash at year end (2021: GBP53.1 million) and no debt.

-- Cash conversion of 108.3% (2021: 124.1%), is in line with the

Board's expectations and reflects the continued close management of

working capital.

-- We propose a Final Dividend of 19.0 pence per share,

following an interim dividend of 17.0 pence per share declared in

July 2022, which would give a total dividend for the year of 36.0

pence per share (2021: 33.0 pence per share).

-- We are committed to reducing our carbon footprint; annual

Scope 1, 2 and 3 greenhouse gas emissions per employee were 0.48

tCO(2) e (2021: 0.49 tCO(2) e) .

-- 2023 has started positively, with encouraging levels of

client engagement against an uncertain macro-economic backdrop.

(1) Adjusted operating profit and adjusted profit before tax are

calculated before Performance Share Plan expenses (including social

security costs) of GBP6,356,000 (2021: GBP5,261,000). Adjusted

basic earnings per share are calculated before the impact of

Performance Share Plan expenses (including social security costs

and associated deferred tax). The adjusted cash conversion is

calculated by dividing cash flow generated from operations by

adjusted operating profit.

(2) Cash conversion is calculated by dividing cash flow

generated from operations by operating profit.

(3) Week 52 in 2022 commenced on 19 December 2022 (2021: week 52 commenced on 20 December 2021).

(4) Utilisation is calculated as the ratio of cost of utilised

Consultants to the total Consultant payroll cost.

Rod Flavell, Chief Executive Officer, said:

"We delivered a good performance in 2022, with strong growth in

Consultant numbers and accelerated investment in recruitment,

training and other programmes that will help to underpin the future

of the Group.

The early months of 2023 have seen continued macro-economic

uncertainty in many of the regions in which we operate. Against

this background, I am pleased that we continue to see encouraging

levels of client engagement and that we continue our client-led

expansion with the recent openings of offices in Tampa, Florida;

Melbourne, Australia; and Limerick, Ireland.

In all of the geographies in which we operate there remain

structural and systemic skills-shortages, which we are well placed

to assist our clients in overcoming.

Our scalable and flexible business model and diversified

portfolio of clients, sectors and operating regions mean that we

are appropriately positioned to weather current global

uncertainties and to continue to deliver long-term growth for all

of our stakeholders."

Enquiries

For further information:

FDM Rod Flavell - CEO 0203 056 8240

Mike McLaren - CFO 0203 056 8240

Nick Oborne

(financial public relations) 07850 127526

Forward-looking statements

This Annual Report contains statements which constitute

"forward-looking statements". Although the Group believes that the

expectations reflected in these forward-looking statements are

reasonable, it can give no assurance that these expectations will

prove to be correct. Because these statements involve risks and

uncertainties, actual results may differ materially from those

expressed or implied by these forward-looking statements.

We are FDM

FDM Group (Holdings) plc ("the Company" or "FDM") and its

subsidiaries (together " the Group" or "FDM") form a global

professional services provider with a focus on IT. Our mission is

to bring people and technology together, creating and inspiring

exciting careers that shape our digital future.

The Group's principal business activities involve recruiting,

training and deploying its own permanent IT and business

Consultants to clients, either on site or remotely. FDM specialises

in a range of technical and business disciplines including

Development, Testing, IT Service Management, Project Management

Office, Data Engineering, Cloud Computing, Risk, Regulation and

Compliance, Business Analysis, Business Intelligence,

Cybersecurity, AI (Artificial Intelligence), Machine Learning and

Robotic Process Automation.

The FDM Careers Programme bridges the gap for graduates,

ex-Forces, returners to work and apprentices, providing the

training and experience required to make a success of launching or

relaunching their careers. We have dedicated training centres and/

or sales operations located in London, Leeds, Glasgow, Limerick,

New York NY, Arlington VA, Charlotte NC, Austin TX, Tampa FL,

Toronto, Montreal, Frankfurt, Kraków, Singapore, Hong Kong,

Shanghai, Sydney and Melbourne. We also operate in Luxembourg, the

Netherlands, Switzerland, Austria, Spain, South Africa, and New

Zealand.

The physical and mental wellbeing of our people and stakeholders

is central to who we are and what we do. As such, our outreach

programmes for our Consultants and in-house staff have grown and

broadened during 2022, becoming key to our support and care for all

of our people globally.

FDM is a collective of around 7,000 people, with a multitude of

differing backgrounds, life experiences and cultures. We are a

strong advocate of diversity, equity and inclusion in the workplace

and the strength of our brand arises from the talent within.

INTRODUCTION

The Group performed well in 2022, with strong levels of trading

from all our principal regions and high levels of client demand.

North America in particular delivered good growth, with pleasing

contributions from both the US and Canada. We made good progress in

APAC, where we are now gaining the critical mass to take advantage

of our upfront investment over recent years.

The Group delivered an adjusted profit before tax(1) of GBP52.0

million (2021: GBP46.7 million). The balance sheet remains robust

with closing cash balances of GBP45.5 million (2021: GBP53.1

million) and no debt. The Group made dividend payments during the

year of GBP38.2 million (2021: GBP46.8 million).

During the year we continued with our plan of accelerating and

enhancing investment in recruitment of both Consultants and

internal staff, and in our complementary development programmes.

These initiatives reflect the high level of client demand during

the year and will help underpin the future growth of our business.

3,179 Consultants were trained during the year (2021: 2,410

training completions), the highest in the Group's history.

We ended the year with 4,905 Consultants placed with clients

(2021: 4,033), recorded revenue of GBP330.0 million (2021: GBP267.4

million) and delivered an adjusted operating profit(1) of GBP52.2

million (2021: GBP47.3 million).

We maintain a strong focus on cash management and collection,

ending the year with GBP45.5 million of cash (2021: GBP53.1

million) and no debt.

(1) The adjusted operating profit and adjusted profit before tax

is calculated before Performance Share Plan expenses (including

social security costs).

Our strategy

FDM's strategy is straightforward: to deliver customer-led,

sustainable and profitable growth on a consistent basis through our

well-established and proven business model. This model has enabled

us to deliver a strong performance in the year by working to fulfil

our four key strategic objectives: attract, train, and develop

high-calibre Consultants; invest in leading-edge training

capabilities; grow and diversify our client base; and expand and

consolidate our geographic presence through sustainable and

efficient means.

Our strategy requires that all activities and investments

produce the appropriate level of return on investment, that they

deliver sustained and measurable improvements for all our

stakeholders including customers, staff and shareholders, and that

they further our objective of launching the careers of talented

people worldwide, which remains core to everything we do.

Strategic objectives

Attract, train and develop high-calibre Consultants

Recruitment was a key area of focus during the year as we

responded to high levels of client demand across all our regions.

The overall number of recruitment events decreased as we changed

the mix of events to attend more face-to-face and fewer virtual

events in 2022. Face-to-face events are more personal to potential

candidates and more impactful. We generated a marked increase in

the number of applications across all our operating locations, most

notably in the UK, with applicants seeking the benefits of FDM's

market-leading, flexible training. We believe our training and

deployment offering d ifferentiates us from our competitors and is

more attractive than ever to candidates. We use recruitment and

assessment processes which are designed to spot a candidate's full

potential. This helps us to build an inclusive workforce and to

increase social mobility by opening doors to careers in tech with

our blue-chip clients for individuals from the broadest range of

backgrounds.

Our new global applicant tracking system, Eploy, was rolled out

in 2022, enabling us to process applications more efficiently while

offering a much improved user experience.

We delivered a record year of training completions. In total,

there were 3,179 training completions in 2022, an increase of 32%

on the previous year (2021: 2,410).

Our Group-wide spend on paid training in 2022 totalled over

GBP21.5 million (2021: GBP12.5 million), an investment that will

help underpin our targets for 2023 and beyond. In response to the

higher inflationary operating conditions, we increased salary

packages for Consultants across all regions.

We continue to invest in our Ex-Forces and Returners programmes,

which remain an important source of talent for the business, and

increased our investment in our apprenticeships and school leavers

programmes, to further diversify our talent pipeline.

Invest in leading-edge training capabilities

During the year we continued to advance our Academy

Transformation Programme, as detailed in our Annual Report 2021,

and enhanced our hybrid training model as we work to identify the

best training delivery solution for the post pandemic world of

work.

We are focussed on optimising both the appeal of our training

programmes to candidates and of our Consultants to clients. For

example, through our partnership with TechSkills, we have now

achieved Tech Industry Gold standard accreditation for eight

programmes, through which a total of 548 trainees attained their

certification in 2022. Accreditation provides to candidates and

clients external validation of FDM's programme content, delivery,

approach and assessment.

During the year many of our trainers enhanced their

qualifications by gaining industry certifications such as AWS Cloud

Practitioner, Agile Scrum Master, SAFe Scrum, and certifications in

Google Cloud. We also have trainer certifications with CompTIA CTT+

Certified Technical Trainer, Scrum.org PSM, IIBA ECBA&CBAP and

ITIL. These certifications demonstrate that we can offer high

quality training in the technologies which are of key importance to

our clients.

Grow and diversify our client base

We continue to deliver the highest level of service to our

clients and have worked closely with them to meet their

requirements. We se cured 74 new clients in the year (2021: 78), of

which 38 were in the UK, 14 in North America, 14 in APAC and 8 in

EMEA. Of these new clients, 59 % were secured from outside the

financial services sector, as we made good progress in the e nergy

and utilities , insurance and commercial and professional services

sectors. The number of new clients does not include those clients

re-engaging with us during 2022, post pandemic.

Expand and consolidate our geographic presence through

sustainable and efficient means

Our North America operations increased headcount by 48% to 1,618

(2021: 1,095) with excellent growth delivered in both the US and

Canada. The UK increased headcount by 8% to 1,958 (2021: 1,806)

with a very strong performance in the first half of 2022 followed

by a slower second half, reflecting political and economic

uncertainties. APAC Consultant headcount increased to 1,011

compared to 880 in 2021, an increase of 15%. EMEA closed with 318

Consultants deployed, up 26% compared to 252 in 2021 with strong

activity levels in our newer location, Poland.

We will continue to grow our international footprint in 2023 and

to consolidate our operations in our existing territories.

Our service offerings

We continually enhance our service offerings in response to our

clients' current and future requirements, developing a partner-led

consultancy that provides clients with scalable and sustainable

support. Extensive collaboration with clients has led to the

co-creation of programmes to provide better solutions to complex

challenges, such as a multi-year global internal audit programme

for a banking client and a specialist test team supporting the

rollout of a complex global platform for a media client. We have

seen the first deployment of both "Robotic Process Automation As A

Service" and "Business Analysis As A Service" specialist Data and

Business Analysis teams to public sector customers undertaking

significant transformation programmes. Each Consulting project is

now underpinned by experienced Delivery Consultants who provide a

management capability to reduce the burden on our clients. Having

successfully deployed significant numbers of Consultants to work on

KYC (Know Your Customer) projects with our clients in the banking

sector, we have built on our experience to begin working with

clients with similar requirements in the charity, insurance and

consultancy sectors.

In 2022 we continued strengthening our strategic alliances with

some of the world's most innovative organisations to fuel the

growth of our client services and ensure that we are at the

forefront of technological advancements. This further adds to the

support we now provide to clients, particularly with technologies

that are increasingly in demand and with

hard-to-source-skillsets.

Our strategic alliances ecosystem includes:

-- Microsoft - Workforce Development & Learn Career Connected Partner

-- Salesforce - Workforce Development & Trailhead Academy Authorised Learning Partner

-- ServiceNow - Placement & Authorised Training Partner

-- AWS - AWS Approved Training Partner & AWS reStart Collaboration

-- Appian - Education Partner

-- nCino - Workforce Development Partner

GROUP RESULTS

Summary income statement

Year ending Year ending

31 December 31 December

2022 2021 % change

GBP 330.0

Revenue m GBP 267.4m +23%

------------- ------------- ---------

Adjusted operating

profit(1) GBP52.2 m GBP 47.3m +10%

------------- ------------- ---------

Operating profit GBP45.8 m GBP42.0 m +9%

------------- ------------- ---------

Adjusted profit

before tax(1) GBP52.0 m GBP 46.7m +11 %

------------- ------------- ---------

Profit before

tax GBP45.7m GBP41.4m +10 %

------------- ------------- ---------

Adjusted basic

EPS(1) 37.3 p 33.2p +12%

------------- ------------- ---------

Basic EPS 32.0 p 29.1p +10%

------------- ------------- ---------

Overview

The Group delivered a good performance in 2022. Revenue

increased to GBP330.0 million, up 23% (2021: GBP 267.4 million),

adjusted operating profit(1) increased by 10% to GBP52.2 million

(2021: GBP47.3 million), with adjusted basic earnings per share(1)

up 12%, to 37.3 pence (2021: 33.2 pence). On a constant-currency

basis (2) revenue increased by 19%, or GBP52.3 million, with GBP7.7

million of the GBP10.3 million exchange differences relating to the

North American operations. We ended the year with a robust balance

sheet, including cash balances of GBP45.5 million (2021: GBP53.1

million), having converted 108% of our operating profit into

operating cash flow. We remain well positioned for future growth

with a proven and agile business model that allows us to respond

rapidly and effectively to market fluctuations.

Consultants assigned to clients at week 52 of 2022 increased by

22 %, totalling 4,905 (week 52 of 2021: 4,033). At week 52 of 2022

our Ex-Forces Programme ac counted for 211 Consultants dep loyed

worldw ide (week 52 of 2021: 196 ). Our Returners Programme had 220

Consultants deployed at week 52 of 2022 (week 52 of 2021: 156). The

Consultant utilisation rate settled at 97.5% (2021: 97.3%).

An analysis of revenue and headcount by region is set out in the

table below:

Year ending Year ending 2022 2021

31 December 31 December Consultants Consultants

2022 2021 assigned assigned

Revenue Revenue to clients to clients

GBPm GBPm at week 52(3) at week 52(3)

UK 139.6 121.8 1,958 1,806

------------- ------------- --------------- ---------------

North America 116.9 81.4 1,618 1,095

------------- ------------- --------------- ---------------

EMEA 19.7 25.0 318 252

------------- ------------- --------------- ---------------

APAC 53.8 39.2 1,011 880

------------- ------------- --------------- ---------------

330.0 267.4 4,905 4,033

------------- ------------- --------------- ---------------

Adjusted Group operating profit margin decreased to 15.8 %

(2021: 17.7%) with administrative expenses increasing to GBP 109.8

million (2021: GBP 84.7 million). The decrease in adjusted

operating margin is due primarily to the costs associated with

record levels of paid training in the period (including the impact

of the first full year of paid training costs for the UK),

investments in our Train the Trainer programme, our Sales

Development Programme; and upgrades to a number of our IT

systems.

(1) Adjusted operating profit and adjusted profit before tax are

calculated before Performance Share Plan expenses (including social

security costs). Adjusted basic earnings per share are calculated

before the impact of Performance Share Plan expenses (including

social security costs and associated deferred tax).

(2) The constant-currency basis is calculated by translating

current year and prior year reported amounts into comparable

amounts using the 2022 average exchange rate for each currency. The

presentation of the constant-currency basis provides a better

understanding of the Group's trading performance by removing the

impact on revenue of movements in foreign exchange.

(3) Week 52 in 2022 commenced on 19 December 2022 (2021: week 52

commenced on 2 0 December 2021).

Adjusting items

The Group presents adjusted results, in addition to the

statutory results, as the Directors consider that they provide a

useful indication of underlying trading performance. The adjusted

results are stated before Performance Share Plan expenses including

associated taxes which totalled GBP6,356,000 (2021: GBP5,261,000 ).

The Directors believe that excluding these costs provides a more

meaningful comparison of the trading performance. These expenses

are based on estimates relating to a vesting which occurs up to

three years in advance and the assumptions underpinning those

estimates can change from year to year.

Net finance expense

The finance expense costs include lease liability inter est of

GBP0.5 million (2021: GBP0.6 million). The Group has no debt.

Taxation

The Group's total tax charge for the year was GBP10.8 million,

equivalent to an effective tax rate of 23.5%, on profit before tax

of GBP45.7 million (2021: effective tax rate of 23.2% based on a

tax charge of GBP 9.6 million and a profit before tax of GBP41.4

million). The effective tax rate in 2022 is higher than the

underlying UK tax rate of 19% primarily due to Group profits earned

in higher tax jurisdictions. The effective tax rate reflects the

Group's geographical mix of profits and the impact of items

considered to be non-taxable or non-deductible for tax purposes,

with the increase year-on-year primarily due to changes in these

factors.

Earnings per share

Basic earnings per share increased in the year to 32.0 pence

(2021: 29.1 pence), whilst adjusted basic earnings per share were

37.3 pence (2021: 33.2 pence). Diluted earnings per share were 31.8

pence (2021: 28.8 pence).

Dividend

During the year, the Group paid two dividends totalling GBP 38.2

million, representing in aggregate 35.0 pence per share.

At the AGM held on 24 May 2022, a final dividend of 18.0 pence

per share for 2021 was approved by shareholders and was paid on 10

June 2022. On 27 July 2022, an interim dividend of 17.0 pence per

share for 2022 was declared and was paid on 30 September 2022.

The Board has recommended a final dividend of 19.0 pence per

share, subject to shareholder approval at the 2023 AGM, taking the

total dividend arising from the 2022 financial year to 36.0 pence

per share .

The Board has set a minimum consistent cash buffer at a Group

level and will always consider the ongoing needs for the funding of

organic growth across the business and the distributable reserves

available to the Group when considering dividend levels. As at 31

December 2022, the Company had distributable reserves of GBP59.4

million. This statement does not form part of the audited financial

statements and the distributable reserves figure of GBP59.4 million

is therefore not audited by PwC or otherwise.

Cash flow and Statement of Financial Position

The Group's cash balance decreased to GBP45.5 million (2021 :

GBP53.1 million). Cash conversion was 108.3 % (2021: 124.1%)

reflecting good working capital management and is in line with our

normal parameters. Dividends paid in the year totalled GBP 38.2

million (2021: GBP46.8 million, including the deferred 2019 Final

Dividend of GBP16.3 million arising from the pandemic). Net capital

expenditure was GBP1.2 million (2021: GBP0.4 million) and tax paid

was GBP13.7 million (2021: GBP10.6 million).

SEGMENTAL PERFORMANCE

UK

UK Consultant headcount at week 52 of 2022 was 1,958, an

increase of 152 (8%) on the prior year (2021: 1,806). Revenue

increased by 15% to GBP139.6 million (2021: GBP121.8 million); this

increase was higher than the 8% increase in Consultant headcount at

week 52 due to the phasing of headcount, more challenging market

conditions later in the year following uncertainty arising from

September's mini-budget and the subsequent changes in UK

government, which impacted certain customers' decision-making.

During the year we added 38 new clients compared with the 33 that

we added in 2021.

The tenure profile of our Consultants has now rebalanced to more

normal levels, with the proportion of Consultants who have

completed their first two years with FDM having been unusually high

through the pandemic. We ended the year with 46% (2021: 49%) within

their first year, 36% (2021: 19%) within their second year and 18%

(2021: 33%, 2020: 41%) having completed more than two years.

Adjusted operating profit(1) increased 7% to GBP30.3 million

(2021: GBP28.4 million). Training completions were broadly in line

with the prior year as we trained 1,063 Consultants (2021: 1,035).

In July 2021 we introduced paid training, paying trainees from

their first day in training, in line with our operations elsewhere

in the world. The full year cost of trainee wages pre-deployment

was GBP7.2 million in 2022 (2021: GBP3.8 million).

North America

North America experienced strong growth in Consultant headcount

closing the year on 1,618, an increase of 523 (48%) on the prior

year (2021: 1,095). Revenue increased by 44% to GBP116.9 million

(2021: GBP81.4 million). We saw strong Consultant growth in both

Canada and the US, with the initiatives we introduced to help us

meet growing demand proving successful.

Adjusted operating profit(1) increased by 18% to GBP15.4 million

(2021: GBP13.1 million), less than the increase in headcount and

revenue, a reflection of our upfront investment in training and

salaries to deliver the Consultant headcount growth. During the

year we trained a record 1,319 Consultants, almost double the

number we trained in 2021 (661).

EMEA

EMEA Consultant headcount at week 52 of 2022 was 318, an

increase of 66 (26%) on the prior year (2021: 252). Revenue

decreased by 21% to GBP19.7 million (2021: GBP25.0 million) and

adjusted operating profit(1) decreased by 32% to GBP2.3 million

(2021: GBP3.4 million). The reduction in revenue and operating

profit reflects the phasing of Consultant headcount and the

regional mix of Consultant placements. In 2021, headcount decreased

towards the end of the year, whereas in 2022 headcount increased

towards the end of the year. The mix of locations has changed; in

2022, we saw strong growth in Poland and South Africa, two markets

with lower sell-rates; whilst in 2021 we completed a large project

delivery in Luxembourg. Training completions were 223, an increase

of 26 (13%) on prior year (2021: 197).

APAC

APAC Consultant headcount exceeded 1,000, closing the year on

1,011, an increase of 131 (15%) on the prior year (2021: 880).

Revenue increased by 37% to GBP53.8 million (2021: GBP39.2 million)

and adjusted operating profit(1) increased by 75% to GBP4.2 million

(2021: GBP2.4 million) as the region benefited from strong

headcount growth. During the year we hit milestones in two of the

regions, with Australia surpassing 400 Consultants and Singapore

surpassing 300 Consultants. Across the region, we continued to grow

our client base, adding 14 new clients in the year (2021: 17).

During the year we trained 574 Consultants, an increase of 57 (11%)

on the prior year (2021: 517).

(1) The adjusted operating profit is calculated before

Performance Share Plan expenses (including social security

costs).

THE BOARD

There have been no changes to the Board or any of its Committees

since the publication of our last Annual Report.

OUR PEOPLE AND OTHER STAKEHOLDERS

FDM is a people business, and I am very proud of the passion and

commitment demonstrated by our people across all of our operating

regions. Our results reflect their dedication, hard work and

commitment.

Our people strategy has been designed to enable FDM to maintain

its position as a high-performing and impactful global organisation

with a clear orientation towards sustainability, scalability,

commercial efficiency and flexibility. Our people strategy aims to

ensure we deliver the following measures: successful deployments;

an inclusive culture; a proactive business whereby we are

constantly reviewing the needs of our people and clients; quality

and clarity of purpose, ensuring all our employees embody and

promote our values; and recognised leadership.

We remain committed to embracing diversity, equity and inclusion

in the workplace. I am pleased to report that in 2022 we

established a new Consultant Experience team whose purpose is to

deliver a desirable, inclusive and engaging experience to all our

Consultants whilst focussing on career enhancement. This initiative

will help ensure our Consultants continue to progress, develop and

have a positive experience throughout their time at FDM.

The Board extends its thanks to every FDM employee for the

quality of their work during 2022, which has enabled us to continue

to deliver for all our stakeholders.

THE ENVIRONMENT

During the year we published our Carbon Reduction Plan, which

aims to reduce our carbon footprint in all appropriate areas whilst

building carbon efficiencies into our ways of working. We have

committed to:

-- reduce our absolute Scope 1 and 2 greenhouse gas emissions by

50% by 2030 from a 2020 base year; and

-- reduce Scope 3 greenhouse gas emissions by 62% per employee within the same timeframe.

In June 2022, SBTi validated that these targets conform with the

SBTi Criteria and Recommendations (version 4.2). The SBTi's Target

Validation Team has determined that our targets are in line with

seeking to keep a rise in global temperature to below 1.5(o) C.

CURRENT TRADING AND OUTLOOK

The early months of 2023 have seen continued macro-economic

uncertainty in many of the regions in which we operate. Against

this background, I am pleased that we continue to see good levels

of client engagement and that we continue our client-led expansion

with the recent openings of offices in Tampa, Florida; Melbourne,

Australia; and Limerick, Ireland.

In all of the geographies in which we operate there remain

structural and systemic skills-shortages which we are well placed

to assist our clients in overcoming. Our scalable and flexible

business model and diversified portfolio of clients, sectors and

operating regions mean that we are appropriately positioned to

weather current global uncertainties and to continue to deliver

long-term growth for all of our stakeholders.

Consolidated Income Statement

for the year ended 31 December 2022

Note 2022 2021

GBP000 GBP000

Revenue 3 329,972 267,356

Cost of sales (174,353) (140,641)

Gross profit 155,619 126,715

( 84,700

Administrative expenses (109,772) )

Operating profit 4 45,847 42,015

Finance income 5 418 58

Finance expense 5 (604) (650)

( 592

Net finance expense (186) )

Profit before income tax 45,661 41,423

( 9,594

Taxation 6 (10,753) )

Profit for the year 34,908 31,829

Earnings per ordinary share

2022 2021

pence pence

Basic 7 32.0 29.1

Diluted 7 31.8 28.8

Consolidated Statement of Comprehensive Income

for the year ended 31 December 2022

2022 2021

GBP000 GBP000

Profit for the year 34,908 31,829

Other comprehensive income/ (expense)

Items that may be subsequently reclassified

to profit or loss

Exchange differences on retranslation of

foreign operations (net of tax) 2,148 (47)

Total other comprehensive income/ ( expense) 2,148 (47)

Total comprehensive income for the year 37,056 31,782

Consolidated Statement of Financial Position

as at 31 December 2022

2022 2021

Note GBP000 GBP000

Non-current assets

Right-of-use assets 10,073 11,631

Property, plant and equipment 3,666 4,069

Intangible assets 19,729 19,597

Deferred income tax assets 2,316 2,484

35,784 37,781

Current assets

Trade and other receivables 8 48,923 35,841

Cash and cash equivalents 9 45,523 53,120

94,446 88,961

Total assets 130,230 126,742

Current liabilities

Trade and other payables 10 32,962 31,235

Lease liabilities 4,643 5,413

Current income tax liabilities 1,172 2,147

38,777 38,795

Non-current liabilities

Lease liabilities 8,250 9,817

Total liabilities 47,027 48,612

Net assets 83,203 78,130

Equity attributable to owners

of the parent

Share capital 11 1,092 1,092

Share premium 9,705 9,705

All Other reserves 13,525 5,126

Retained earnings 58,881 62,207

Total equity 83,203 78,130

Consolidated Statement of Cash Flows

for the year ended 31 December 2022

Note 2022 2021

GBP000 GBP000

Cash flows from operating activities

Group profit before tax for the

year 45,661 41,423

Adjustments for:

Depreciation and amortisation 4 6,423 6,160

Loss on disposal of non-current

assets 130 2

Finance income 5 (418) (58)

Finance expense 5 604 650

Share-based payment charge (including

associated social security costs) 6,727 5,622

Increase in trade and other receivables (11,334) (5,123)

Increase in trade and other payables 1,872 3,471

Cash flows generated from operations 49,665 52,147

Interest received 418 58

Income tax paid (13,665) (10,606)

Net cash inflow from operating

activities 36,418 41,599

Cash flows from investing activities

Acquisition of property, plant

and equipment (1,204) (368)

Net cash used in investing activities (1,204) (368)

Cash flows from financing activities

Proceeds from sale of shares

from EBT 484 450

Principal elements of lease payments (5,470) (5,294)

Interest elements of lease payments (472) (564)

Proceeds from sale of own shares 24 50

Finance costs paid (132) (85)

Dividends paid 12 (38,153) (46,820)

Net cash used in financing activities (43,719) (52,263)

Exchange gains/ (losses) on cash

and cash equivalents 908 (573)

Net decrease in cash and cash

equivalents (7,597) (11,605)

Cash and cash equivalents at

beginning of year 53,120 64,725

Cash and cash equivalents at

end of year 9 45,523 53,120

Consolidated Statement of Changes in Equity

for the year ended 31 December 2022

Share Share All Retained Total

capital premium Other earnings equity

reserves

GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1 January 2022 1,092 9,705 5,126 62,207 78,130

Profit for the year - - - 34,908 34,908

Other comprehensive income

for the year - - 2,148 - 2,148

Total comprehensive income

for the year - - 2,148 34,908 37,056

Share-based payments - - 5,844 - 5,844

Transfer to retained earnings - - (454) 454 -

Own shares sold - - 861 (353) 508

Recharge of net settled

share options - - - (182) (182)

Dividends (note 12 ) - - - (38,153) (38,153)

Total transactions with

owners, recognised directly

in equity - - 6,251 (38,234) (31,983)

Balance at 31 December

2022 1,092 9,705 13,525 58,881 83,203

All

Share Share Other Retained Total

capital premium reserves earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1 January 2021 1,092 9,705 (57) 77,224 87,964

Profit for the year - - - 31,829 31,829

Other comprehensive expense ( 47

for the year - - (47) - )

Total comprehensive income

for the year - - (47) 31,829 31,782

Share-based payments - - 5,320 - 5,320

Transfer to retained earnings - - (1,530) 1,530 -

Own shares sold - - 1,440 (938) 502

Recharge of net settled

share options - - - (618) (618)

Dividends (note 12 ) - - - (46,820) (46,820)

Total transactions with

owners, recognised directly

in equity - - 5,230 (46,846) (41,616)

Balance at 31 December

2021 1,092 9,705 5,126 62,207 78,130

Notes to the Consolidated Financial Statements

1. General information

The Group is an international professional services provider

focussing principally on IT, specialising in the recruitment,

training and deployment of its own permanent IT and business

Consultants.

The Company is limited by shares, incorporated and domiciled in

the UK and registered as a public limited company in England and

Wales with a Premium Listing on the London Stock Exchange. The

Company's registered office is 3rd Floor, Cottons Centre, Cottons

Lane, London, SE1 2QG and its registered number is 07078823.

2. Basis of preparation

The financial information set out in this preliminary

announcement does not constitute statutory accounts for the years

ended 31 December 2022 and 31 December 2021, for the purpose of the

Companies Act 2006, but is derived from those accounts. The audited

statutory accounts for 2021 have been delivered to the Registrar of

Companies and those for 2022 were approved for issue on 14 March

2023. The Group's auditor reported on the Annual Report and

Accounts for the year ended 31 December 2022 on 14 March 2023.

Their report was unqualified, did not draw attention to any matters

by way of emphasis without qualifying their report and did not

contain statements under Section 498(2) or (3) of the Companies Act

2006.

Whilst the financial information included in this preliminary

announcement has been prepared in accordance with UK-adopted

International Financial Reporting Standards, this announcement does

not itself contain sufficient information to comply with UK-adopted

International Financial Reporting Standards. The accounting

policies applied in preparing this financial information are

consistent with the Group's financial statements for the year ended

31 December 2021 with the exception of the following standards and

amendments which were effective from 1 January 2022 and were

adopted by the Group in preparing the financial statements. The

adoption of these standards and amendments has not had a material

impact on the Group's financial statements in the year:

-- Amendment to Annual Improvements to IFRS Standards 2018-2021

-- Amendment to Onerous Contracts - Cost of Fulfilling a

Contract - Amendments to IAS 37 1 January 2022

-- Amendment to Property, Plant and Equipment: Proceeds before

intended use - Amendments to IAS 16

-- Amendment to Reference to the Conceptual Framework (Amendments to IFRS 3)

3. Segmental reporting

Management has determined the operating segments based on the

operating reports reviewed by the Board of Directors that are used

to assess both performance and strategic decisions. Management has

identified that the Executive Directors are the chief operating

decision-maker in accordance with the requirements of IFRS 8

'Operating segments'.

As of 31 December 2022, the Board of Directors consider that the

Group is organised on a worldwide basis into four core geographical

operating segments:

(1) UK;

(2) North America;

(3) Europe, Middle East and Africa, excluding UK ("EMEA"); and

(4) Asia Pacific ("APAC").

Each geographical segment is engaged in providing services

within a particular economic environment and is subject to risks

and returns that are different from those of segments operating in

other economic environments.

All segment revenue, profit before taxation, assets and

liabilities are attributable to the principal activity of the

Group, being a global professional services provider with a focus

on IT .

For the year ended 31 December 2022

North

UK America EMEA APAC Total

GBP000 GBP000 GBP000 GBP000 GBP000

Revenue 139,560 116,937 19,665 53,810 329,972

Depreciation and amortisation 2,599 1,698 291 1,835 6,423

Segment operating profit 25,856 14,111 2,039 3,841 45,847

Finance income(1) 515 152 2 5 674

Finance costs(1) (196) (59) (86) (519) (860)

Profit before income

tax 26,175 14,204 1,955 3,327 45,661

As at 31 December 2022

Total assets 69,706 26,915 11,983 21,626 130,230

Total liabilities (8,602) (9,775) (4,906) (23,744) (47,027)

(1) Finance income and finance costs include intercompany

interest which is eliminated upon consolidation

Included in total assets above are non-current assets (excluding

deferred tax) as follows:

North

UK America EMEA APAC Total

GBP000 GBP000 GBP000 GBP000 GBP000

31 December 2022 23,124 1,654 1,112 7,578 33,468

For the year ended 31 December 2021

North

UK America EMEA APAC Total

GBP000 GBP000 GBP000 GBP000 GBP000

Revenue 121,846 81,387 24,963 39,160 267,356

Depreciation and amortisation 2,489 1,714 241 1,716 6,160

Segment operating profit 24,570 12,215 3,237 1,993 42,015

Finance income(1) 159 174 - 4 337

Finance costs(1) (231) (60) (88) (550) (929)

Profit before income tax 24,498 12,329 3,149 1,447 41,423

As at 31 December 2021

Total assets 75,995 21,038 11,937 17,772 126,742

Total liabilities (13,053) (8,669) (6,193) (20,697) (48,612)

(1) Finance income and finance costs include intercompany

interest which is eliminated upon consolidation

Included in total assets above are non-current assets (excluding

deferred tax) as follows:

North

UK America EMEA APAC Total

GBP000 GBP000 GBP000 GBP000 GBP000

31 December 2021 24,839 2,144 1,030 7,284 35,297

Information about major customers

Customers A and B represent 10% or more of the Group's 2022 and

2021 revenues. Revenue from c ustomer A is attributed across all

four operating segments, revenue from customer B is attributed to

North America .

2022 2021

GBP000 GBP000

Revenue from customer A 40,297 35,942

Revenue from customer B 37,227 16,010

4 Operating profit

Operating profit for the year has been arrived at after

(crediting)/ charging:

2022 2021

GBP000 GBP000

Net foreign exchange differences (415) 39

Loss on disposal of property, plant and equipment 95 -

Depreciation of right-of-use assets 4,533 4,294

Depreciation of property, plant and equipment

and amortisation of software and software

licences 1,890 1,866

Expense relating to short-term leases 13 78

5 Finance income and expense

2022 2021

GBP000 GBP000

Bank interest 418 58

Finance income 418 58

2022 2021

GBP000 GBP000

Interest on lease liabilities (472) (564)

Finance fees and charges (132) (86)

Finance expense (604) (650)

6 Taxation

The major components of income tax expense for the years ended

31 December 2022 and 2021 are:

2022 2021

GBP000 GBP000

Current income tax:

Current income tax charge 11,699 9,904

Adjustments in respect of prior periods (592) (418)

Total current income tax 11,107 9,486

Deferred tax:

Relating to origination and reversal of

temporary differences (354) 108

Total deferred tax (354) 108

Total tax expense reported in the income

statement 10,753 9,594

The standard rate of corporation tax in the UK is 19% (2021:

19%). Accordingly, the profits for 2021 and 2022 are taxed at 19%.

The tax charge for the year is higher (2021: higher) than the

standard rate of corporation tax in the UK. The differences are set

out below:

2022 2021

GBP000 GBP000

Profit before income tax 45,661 41,423

Profit before income tax multiplied by UK standard rate of corporation tax of 19% (2021: 19%) 8,676 7,870

Effect of different tax rates on overseas earnings 2,090 1,695

Effect of expenses not deductible for tax purposes 579 143

Adjustments in respect of prior periods (592) (418)

Effect of unused tax losses not recognised for deferred tax assets - 304

Total tax charge 10,753 9,594

7 Earnings per ordinary share

Basic earnings per share are calculated by dividing the profit

attributable to ordinary equity holders of the Parent Company by

the weighted average number of ordinary shares in issue during the

year.

2022 2021

GBP0

Profit for the year 00 34,908 31,829

Average number of ordinary shares in

issue (thousands) 109,192 109,192

Basic earnings per share Pence 32.0 29.1

Adjusted basic earnings per share are calculated by dividing the

profit attributable to ordinary equity holders of the Parent

Company, excluding Performance Share Plan expense (including social

security costs and associated deferred tax), by the weighted

average number of ordinary shares in issue during the year.

2022 2021

Profit for the year (basic

earnings) GBP000 34,908 31,829

Share-based payment expense

(including social security

costs) GBP000 6,356 5,261

Tax effect of share-based

payment expense GBP000 (522) (837)

Adjusted profit for the

year GBP000 40,742 36,253

Average number of ordinary shares in issue

(thousands) 109,192 109,192

Adjusted basic earnings per share Pence 37.3 33.2

Diluted earnings per share

Diluted earnings per share are calculated by adjusting the

weighted average number of ordinary shares outstanding to assume

conversion of all dilutive potential ordinary shares. The Company

has one type of dilutive potential ordinary shares in the form of

share options; the number of shares in issue has been adjusted to

include the number of shares that would have been issued assuming

the exercise of the share options.

2022 2021

Profit for the year (basic

earnings) GBP000 34,908 31,829

Average number of ordinary

shares in issue (thousands) 109,192 109,192

Adjustment for share options

(thousands) 594 1,386

Diluted number of ordinary

shares in issue (thousands) 109,786 110,578

Diluted earnings per share Pence 31.8 28.8

8 Trade and other receivables

Due to their short-term nature, the Directors consider that the

carrying amount of trade receivables approximates to their fair

value. The standard credit terms are 30 days.

2022 2021

GBP000 GBP000

Trade receivables 34,892 26,727

Prepayments and accrued

income 9,389 5,650

Tax receivables 3,450 1,997

Other receivables 1,192 1,467

48,923 35,841

Included within prepayments and accrued income is GBP3,862,000

of accrued income (2021: GBP2,883,000).

9 Cash and cash equivalents

2022 2021

GBP000 GBP000

Cash at bank and in hand 45,523 53,120

10 Trade and other payables

Due to their short-term nature, the Directors consider that the

carrying amount of trade payables approximates to their fair

value.

2022 2021

GBP000 GBP000

Trade payables 2,184 1,113

Other payables 1,856 1,725

Other taxes and social

security 9,309 8,444

Accruals 19,613 19,953

32,962 31,235

11 Share capital

Authorised, called-up, allotted and fully-paid

share capital

2022 2022 2021 2021

Number of GBP000 Number GBP000

shares of

shares

Ordinary shares of

GBP0.01 each

At 1 January and 31

December 109,191,669 1,092 109,191,669 1,092

Ordinary shares

All ordinary shares rank equally for all dividends and

distributions that may be declared on such shares. At general

meetings of the Company, each shareholder who is present (in

person, by proxy or by representative) is entitled to one vote on a

show of hands and, on a poll, to one vote per share.

There were no changes in the authorised, called-up, allotted and

fully-paid share capital during the year.

12 Dividends

2022 2021

GBP000 GBP000

Dividends paid

Paid to shareholders 38,153 46,820

2022

An interim dividend of 17.0 pence per ordinary share was

declared by the Directors on 27 July 2022 and was paid on 30

September 2022 to holders of record on 26 August 2022, the amount

payable was GBP18,533,000.

The Board is proposing a final dividend of 19.0 pence per share

in respect of the year to 31 December 2022, for approval by

shareholders at the AGM on 16 May 2023, the amount payable will be

GBP20,746,000. Subject to shareholder approval the dividend will be

paid on 30 June 2023 to shareholders of record on 9 June 2023.

This brings the Company's total dividend for the year to 36.0

pence per share (2021: 33.0 pence per share).

The Board continues to operate a progressive dividend policy;

the Group will retain sufficient capital to fund ongoing operating

requirements, maintain an appropriate level of dividend cover and

sufficient funds to invest in the Group's longer-term growth.

2021

An interim dividend of 15.0 pence per ordinary share was

declared by the Directors on 27 July 2021 and was paid on 3

September 2021 to holders of record on 6 August 2021, the amount

payable was GBP16,327,000.

The Board paid a final dividend of 18.0 pence per share on 10

June 2022, to shareholders on record on 20 May 2022, the amount

payable was GBP19,620,000.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR NKQBPNBKBBND

(END) Dow Jones Newswires

March 15, 2023 03:00 ET (07:00 GMT)

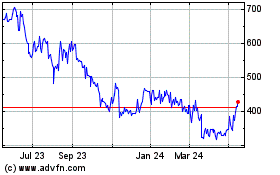

FDM (AQSE:FDM.GB)

Historical Stock Chart

From Oct 2024 to Nov 2024

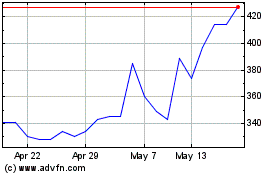

FDM (AQSE:FDM.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024