TIDMBMN

RNS Number : 0938O

Bushveld Minerals Limited

30 September 2019

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

30 September 2019

Bushveld Minerals Limited

("Bushveld Minerals", the "Group" or the "Company")

Unaudited Interim Results for the Six Months ended 30 June

2019

Bushveld Minerals Limited (AIM: BMN), the AIM listed, integrated

primary vanadium producer, with ownership of high grade vanadium

assets, is pleased to announce its half year unaudited results for

the six months ended 30 June 2019.

Key Highlights

H1 2019 Group financial highlights

-- Revenue of US$78.0 million (H1 2018: US$83.7 million).

-- EBITDA(1) of US$41.0 million (H1 2018: US$42.8 million).

-- Profit after tax of US$30.8 million (H1 2018: US$28.5 million).

-- Free cash flow(2) of US$23.3 million (H1 2018: (US$16.4 million).

-- Net cash balance of US$66.1 million at 30 June 2019 (31 December 2018: US$42.0 million).

-- Earnings per share of 1.92 cents (H1 2018: 1.57 cents).

-- Ferrovanadium price averaged US$56.3/kgV in H1 2019 (H1 2018: US$65.5/kgV).

-- Year to date average ferrovanadium price of US$48.2/kgV(3)

(.)

1. EBITDA comprises operating profit plus depreciation and amortisation.

2. Free cash flow comprises net operating cash flows less net investing cash flows.

3. London Metal Bulletin year to date average as at 20 September 2019.

H1 2019 Group operating highlights

-- On 1 May 2019, the Company announced the conditional

acquisition of Vanchem for a consideration of US$68 million. The

transaction is expected to be completed on 31 October 2019.

H1 2019 Bushveld Vanadium operational highlights

Vametco

-- Transformation programme successfully delivering, with Q2

2019 production being the highest quarter for production in over

two years.

-- Production for H1 2019 was 1,392 mtV, a two per cent increase

relative to H1 2018 (H1 2018: 1,360 mtV).

-- On track to meet 2019 production guidance of 2,800 mtV to 2,900 mtV.

-- On track to meet 2019 unit cash cost guidance of US$18.90/kgV to US$19.50/kgV.

H1 2019 Bushveld Energy operational highlights

Electrolyte Plant

-- The Environmental Impact Assessment ("EIA") for the proposed

plant in East London, South Africa, has passed the public

participation stage and is on track to be completed this year.

-- The first batch of electrolyte was successfully produced

using Vametco's feedstock, with the samples being sent to vanadium

battery companies for testing.

Vanadium electrolyte rental model

-- Implementation of the first rental contract was announced

with Avalon Battery Corporation and its customer, Sandbar, in the

United States.

-- Negotiating larger rental agreements in Africa, Asia, Europe and North America.

-- Negotiations in progress with external commercial debt providers to support the structure.

Eskom Vanadium Redox Flow Battery project

-- The vanadium redox flow battery ("VRFB") installed with Eskom

was commissioned and now operating fully.

Vametco based Solar Mini-Grid Project

-- Commenced a number of activities including an Environmental

Assessment, a grid connection and geotechnical studies. Procurement

for the project commenced in Q3 2019.

Group events post 30 June 2019

Vametco

-- Successfully completed the wages and benefits negotiations

with the Association of Mineworkers and Construction Union ("AMCU")

for the three year period from 1 July 2019 to 30 June 2022.

Vanchem acquisition

-- On 28 August 2019, unconditional approval for the acquisition

was received from the Competition Commission of South Africa.

-- The transaction remains on track to be completed on 31

October 2019. The outstanding conditions precedent, namely, the

cession of specific commercial agreements and South African Reserve

Bank approval, are expected to be satisfied.

-- The Company is making good progress with local banks for debt

facilities and remains confident of completing the transaction

without relying on equity capital markets. Further updates will be

provided as appropriate.

Group Outlook

-- Execution of the transformation programme at Vametco to

increase production rates to 3,400 mtVp.a. during the course of

2020 and then to 4,200 mtVp.a. during 2022, remains on track.

-- Develop a production platform of more than 8,400 mtVp.a. with

a nameplate capacity of 10,000 mtVp.a within the next five

years.

-- On completion of the Vanchem acquisition, the Company will

offer a diverse product offering for the steel, chemicals and

energy storage markets.

-- Continue to reinforce Bushveld Energy's position as a leading

energy storage solutions provider.

-- Invest in the vanadium supply chain individually or through partnerships.

-- Progress workstreams for the Johannesburg Stock Exchange ("JSE") listing.

Appointment of joint broker

-- Appointment of Peel Hunt LLP as joint corporate broker to the Company with immediate effect.

Fortune Mojapelo, CEO of Bushveld Minerals Limited,

commented:

"I am pleased to report that Bushveld Minerals has continued to

build on firm foundations in the first half of 2019, enjoying

progress across the Group and establishing new platforms for

further future growth.

"The Group's EBITDA of US$41million and free cash flow

generation of US$23 million achieved in the period highlights the

mine's robust nature as a low-cost, highly cash generative

operation, and was achieved in a period of weaker vanadium prices,

which averaged 14 per cent less than a year earlier. Even with this

strong result, we will be focusing our efforts at Vametco on

further refining processes to maintain cost control.

"Operational performance has been improved through our

transformation programme at Vametco, which we started to implement

at the beginning of the year. Execution of the transformation

programme is ongoing throughout the rest of this year and into

2020, during which we will reach a steady state of production of

3,400 mtV per annum.

"In August, we were pleased to receive approval from the

Competition Commission of South Africa to acquire the Vanchem

assets, without conditions, which was a key milestone in closing

the transaction on 31 October 2019. We now look forward to

completing the remaining conditions precedent and completing this

important transaction for the Group.

"At Bushveld Energy, the first half of 2019 has seen a broader

and improved understanding of its innovative business model. The

combination of the electrolyte rental product and the current

vanadium price is increasing confidence that VRFBs will become a

long-term feature of energy grids both in Africa and globally. We

expect these events to increase vanadium consumption from VRFBs

during second half of 2019 and beyond."

Enquiries: info@bushveldminerals.com

+27 (0) 11 268

Bushveld Minerals 6555

Fortune Mojapelo, Chief Executive

Officer

Chika Edeh, Head of Investor

Relations

SP Angel Corporate Finance Nominated Adviser +44 (0) 20 3470

LLP & Broker 0470

Ewan Leggat / Richard Morrison

Abigail Wayne / Richard Parlons

+44 (0) 20 7236

BMO Capital Markets Limited Joint Broker 1010

Jeffrey Couch / Tom Rider

Michael Rechsteiner / Neil

Elliot

+44 (0) 20 7418

Peel Hunt LLP Joint Broker 8900

Ross Allister / James Bavister

David McKeown

Tavistock Financial PR

+44 (0) 207 920

Charles Vivian / Gareth Tredway 3150

Brunswick Financial PR (South

Africa)

+27 (0) 11 502

Miyelani Shikwambana 7300

ABOUT BUSHVELD MINERALS LIMITED

Bushveld Minerals is a low cost, integrated, primary vanadium

producer, with ownership of high grade vanadium assets.

The Company's flagship vanadium platform includes a 74 per cent

controlling interest in Bushveld Vametco Alloys (Pty) Ltd, a

primary vanadium mining and processing company; the Mokopane

Vanadium Project and the Brits Vanadium Project.

Bushveld's vision is to become a significant, low cost,

integrated primary vanadium producer through owning high grade

assets. This incorporates development and promotion of the role of

vanadium in the growing global energy storage market through

Bushveld Energy, the Company's energy storage solutions provider.

Whilst the demand for vanadium remains largely anchored in the

steel industry, Bushveld Minerals believes there is strong

potential for an imminent and significant global vanadium demand

surge from the fast-growing energy storage market, particularly

through the use and adoption of Vanadium Redox Flow Batteries.

While the Company's focus is on vanadium operations and the

development and promotion of VRFBs, it has additional investments

in coal, power and tin.

The Company's approach to project development recognises that,

whilst attractive project economics are imperative, they are

insufficient to secure capital to bring them to account. A clear

path to production within a visible timeframe, low capital

expenditure requirements and scalability are important factors in

ensuring a positive return on investment. This philosophy is core

to the Company's strategy in developing projects.

Detailed information on the Company and progress to date can be

accessed on the website www.bushveldminerals.com.

About Vametco

Vametco is located near Brits on the Western Limb of the

Bushveld Complex. The integrated operation comprises a vanadium ore

mine and a processing plant that produces Nitrovan(TM) , a

trademark product sold in major steel markets across the world. The

mine lies adjacent to the Brits Vanadium Project, which will in

future serve as an alternative source of near surface run of mine

(ROM) ore feed to the Vametco plant.

The Vametco mining operation uses open pit bench mining methods

to mine a well-defined orebody. The deposit is continuous with

limited faulting and dips in a northerly direction at approximately

19 degrees.

ROM ore is fed into a primary, secondary and tertiary crushing

circuit, followed by milling and magnetic separation to produce

magnetite concentrates. The magnetite concentrates are fed into the

extraction process which includes the kiln for roasting followed by

leaching and precipitation. Thereafter the precipitated vanadium as

ammonium metavanadate is converted to modified vanadium oxide

("MVO") in rotary calciners. MVO is fed into the mixplant and

finally into the shaft furnaces to produce Nitrovan(TM) .

About Bushveld Energy Limited

Bushveld Energy is a leading energy storage solutions provider,

focusing on the African market. Bushveld Energy recognises that

electricity in Africa intersects paramount potential for social

transformation with an immense commercial opportunity.

Launched in 2016, Bushveld Energy is focused on developing and

promoting the role of vanadium in the growing global energy storage

market through application in vanadium redox flow batteries. Its

near term strategy is to deploy several VRFB systems as part of its

longer term vision to become a significant electricity storage

provider in Africa by 2020, meeting the demand for utility scale

energy storage in Africa by leveraging South Africa-mined and

beneficiated vanadium.

http://www.bushveldenergy.com

Chief Executive Report

Dear Shareholder,

I am pleased to report back on a successful first half of the

2019 financial year. The Company is on track with its strategic

initiatives to deliver a truly integrated and leading low-cost

vanadium platform characterised by large high-grade vanadium

deposits and mines; scalable, low-cost, cash generating vanadium

primary processing assets and a downstream energy storage business,

positioned to play a leading role in the growing stationary energy

storage market.

VANADIUM PRODUCTION OPERATIONS

Bushveld has one of the largest high-grade primary vanadium

resource base in the world. The Company's vanadium resource base

currently consists of three mineral assets, Vametco, Brits and

Mokopane. Bushveld's processing facilities consist of Vametco and

Vanchem (conditional acquisition). The Company's mineral resources

and processing facilities are situated within the Bushveld Complex

in South Africa.

Vametco (74% ownership)

At the core of this strategy is Vametco, located in Brits,

Northwest Province. Vametco is a low cost primary vanadium mining

and processing company which produces a trademark vanadium product,

Nitrovan(TM) , as well as Modified Vanadium Oxide.

On 22 May 2019, following a significant amount of exploration

work, including a 2018 drilling campaign comprising 13 drill holes

over a total of 1,506m, the Company announced a doubling of its Ore

Resources and a significant increase in the total mineral resource.

Vametco has a 186.7 Mt JORC compliant resource averaging 1.98 per

cent V(2) O(5) in magnetite grades (including 48.4 Mt in reserves),

and a life of mine of 27 years.

Table 1: Vametco operational and financial overview

Unit H1 2019 H1 2018 Variance

Vanadium produced (mtV) 1,392 1,360 2.4%

---------------- -------- -------- ---------

Vanadium sold (mtV) 1,115 1,403 -20.5%

---------------- -------- -------- ---------

LMB Prices w.a. US$/ kgV 56.3 65.5 -13.9%

---------------- -------- -------- ---------

Revenue USD (millions) 74.3 81.2 -8.6%

---------------- -------- -------- ---------

EBITDA USD (millions) 42.3 42.4 0%

---------------- -------- -------- ---------

Production cash

costs USD/ kgV 19.2 20.2 -5%

---------------- -------- -------- ---------

While Vametco had a stellar financial performance in 2018

(Revenue of US$183 million and EBITDA of US$108 million), the

Company recognised that continued success requires improvement on

several fronts, not least, lowering Vametco's already low

production costs even further, by increasing throughputs and thus

production volumes, while also, ensuring a conducive working

environment with a motivated workforce.

Following a diagnostic exercise in Q4 2018, the Company

successfully implemented its operational improvement programme,

which is starting to bear fruit. This transformation programme will

complement the Company's capacity expansion project to increase

vanadium production at Vametco to more than 4,200 mtVp.a. The

diagnostic review undertaken in Q4 2018 identified a number of

initiatives to improve operational performance focusing on

stabilising and improving production, cost and capital efficiencies

and improving overall organisational health.

During this half the Company made several changes to the

management structure, which were designed to build greater depth in

the leadership team, improve coordination with the greater Bushveld

Group and create dedicated capacity to coordinate the development

and implementation of the many initiatives forming part of the

transformation programme. These changes included the appointment of

Ms Bertina Symonds into the role of General Manager, created from

combining the CEO and COO roles into one. Bertina brings over 20

years of mining and beneficiation experience, strong leadership and

a solid production and commercial background. William Steinberg,

former Vametco's Works Manager, was appointed Chief Transformation

officer, to drive the Operations Transformation programme, while Mr

Taff Williams, former Vametco's COO, was appointed Group Vanadium

Specialist to provide technical support to the Group's global

vanadium sales as well as supporting integration efforts for

Vanchem.

As a result of the initiatives undertaken in the first half of

2019, the Company has already seen improvements in all key areas,

being: a) production scheduling; b) vanadium grade in the kiln

feed; c) the hourly feed rate to the kiln; and d) recoveries, all

contributing to improved throughput at higher grades. This resulted

in material improvements in production, where the 742 mtV

Nitrovan(TM) produced in Q2 2019 was up 14 per cent on Q1 2019 and

up 18 per cent on the comparable quarter last year. The Company is

therefore pleased to report that Vametco remains on target to meet

its production guidance for this year of 2,800 mtV to 2,900

mtV.

Vametco sold 1,115 mtV Nitrovan (TM) , generating revenues of

US$74.3 million in the first half. Vametco's realised price is

based on the prior month's average price, which is higher than the

quoted LMB weighted average price for the period of US$56.3/kgV.

These higher realised prices offset the lower sales in the

period.

Vametco is in the lowest quartile on the cost curve for global

vanadium producers and, therefore, enjoys robust economics and

remains highly profitable even in weaker price environments. The

Company is pleased to report that Vametco generated an EBITDA of

US$42.3 million achieving an EBITDA margin of 57 per cent.

The Company had previously reported a first half unit cash cost

of US$17.40/kgV and an EBITDA of US$48.6 million for Vametco. These

figures have subsequently changed to US$19.20/kgV and US$42.3

million, as a result of intercompany costs introduced from January

2019 which should have been eliminated, however they were instead

incorrectly capitalised to the cost of inventory. The impact of the

adjustment increased the value of cost of sales as well as the

reduction in the inventory value of work in progress and finished

goods. Vametco's 2019 cash cost guidance remains unchanged at

US$18.90/kgV to US$19.50/kgV.

Looking forward, the continued implementation of initiatives

identified in the diagnostic review will support Vametco in

achieving a steady state production of 3,400 mtVp.a. during

2020.

The Phase III expansion programme, to be undertaken after the

above initiatives are completed, will focus on improving kiln

availability and increasing kiln and leach recoveries targeting

steady state production of 4,200 mtVp.a during 2022.

Health and safety

Health and safety remain a top priority for the Company. I am

pleased to report that Vametco recorded 5.376 million Fatality Free

Shifts by the end of June 2019.

Employee relations

Good relationships between management, the Company's employees

and the local communities in which we operate are an essential part

of any successful mining business. The Company is delighted to have

successfully completed wages and benefits negotiations with AMCU,

which represents approximately 70 per cent of Vametco's workforce.

The resulting three year agreement is an important step in

bolstering the Company's corporate social responsibility and

maintaining operational excellence. Pleasingly, the costs of the

agreement do not necessitate a revision to Vametco's 2019

production cost guidance.

Furthermore, the Company has embarked upon and progressed a

number of initiatives, including negotiating an Employee Share

Ownership Scheme ("ESOP") which is aimed at closely aligning the

interests of Vametco's workforce with its operational targets, as

well as an Employees' Financial Wellness Programme. Pending the

implementation of the ESOP, expected in 2020, Vametco will pay

during 2019 a special ESOP bonus calculated on the same basis as

the ESOP payment made for the period 1 July 2018 to 31 December

2018.

Environmental

Bushveld Minerals takes its environmental obligations and

responsibilities seriously. Several environmental initiatives

underway include construction of a new tailings dam to prevent

groundwater contamination, rehabilitation of current tailings dams

to eliminate fall-out dust. Furthermore, during the first half of

the year, Vametco embarked on the installation of an off-gas

scrubber to reduce dust emissions. The Company's environmental

objectives are to align the Company's Environmental Management

Systems with international standards, including those of the

International Finance Corporation and ISO 14001:2015 (an

international standard for environmental management systems). The

Company is targeting ISO 14001 certification by Q3 2020.

Brits (62.5% ownership)

The Brits Project is located in Portion 3 of the farm

Uitvalgrond 431 JQ, near the town of Brits in the North West

Province of South Africa and is directly along strike from the

Bushveld Vametco Alloys Mine (Bushveld-Vametco). The Company

announced a maiden JORC Mineral Resource on 21 June 2019 which

incorporated data from the 2018 drilling campaign comprising 26

drill holes over a total of 2,967m of diamond drilling.

Brits has an Indicated and Inferred Resource of 66.8 Mt (100 per

cent Gross Basis) at an average grade of 1.58 per cent V(2) O(5) in

magnetite for 175,400 tonnes of contained vanadium across the three

seams. Pleasingly, the Indicated Mineral Resource tonnages account

for 67 per cent of the total combined Mineral Resource and stand at

44.9Mt with an average grade of 1.59 per cent V(2) O(5) in

magnetite for 115,600 tonnes of contained vanadium across the three

seams. Brits provides the optionality for additional ore feed for

the Vametco plant, and, if required, feed for the Vanchem

plant.

Vanchem (conditional acquisition)

Meanwhile, Bushveld's strategy of growing its production

platform through targeted brownfield processing assets is also

bearing fruit. On 01 May 2019, the Company announced the

conditional acquisition of Vanchem, a primary vanadium processing

plant that includes three kilns, two ferrovanadium converters. Post

completion of a US$45 million refurbishment programme, Vanchem has

the potential to produce more than 4,200 mtVp.a. in the form of

vanadium pentoxide, vanadium trioxide, vanadium chemicals and

ferrovanadium. This acquisition, in addition to Vametco, sets the

platform for Bushveld to increase its overall vanadium production

to more than 8,400 mtVp.a. with a name plate capacity in excess of

10,000 mtVp.a.

The Company is delighted to have received unconditional approval

of the transaction by the Competition Commission of South Africa

and now look forward to completing the transaction on 31 October

2019, following the fulfilment of remaining conditions

precedent.

As communicated to the market, the Company expects to fund the

acquisition from its strong cash position as well as debt

facilities that it is in negotiations for.

Mokopane (64% ownership)

Mokopane is one of the world's largest primary vanadium

resources, with a 298 Mt JORC compliant resource and a weighted

average V(2) O(5) grade of 1.41 per cent in-situ and 1.75 per cent

in magnetite.

Mokopane is positioned to become a primary source of feedstock

for Vanchem, creating a fully integrated vanadium producing

business in a shorter time frame and at a lower cost, as opposed to

a standalone operation. The Company engaged MSA to undertake a

definitive feasibility study in September 2019 for the development

of the Mokopane mine. The expedited Mokopane development, as a

possible primary feedstock supply to Vanchem, does not remove the

optionality of supplying ore to other primary or secondary

producers worldwide, and/or to develop Mokopane into an integrated

mine and processing plant.

BUSHVELD ENERGY (86% ownership)

This sound, scalable and low cost production base gives Bushveld

a solid platform to implement its vertically integrated business

model, through the development of a downstream vanadium-based

energy storage business, Bushveld Energy. Bushveld Energy was

created to establish a significant position for VRFBs in the

stationary energy storage industry thereby achieving the twin

objectives of a) diversifying and strengthening the vanadium demand

profile and b) capturing a compelling commercial opportunity in a

multi-billion dollar industry.

During the first half of 2019, Bushveld Energy made significant

progress across all its key areas of focus - development of

electrolyte production capacity, deployment of its electrolyte

rental model, which is expected to play an important role in

promoting deployment of VRFBs, development of energy storage

mandates and developing a sound partnership model for VRFB

assembly/manufacturing.

The Company is encouraged to see greater coverage and a broader

and improved understanding by the market of stationary energy

storage and the Bushveld Energy business model. Moreover, the

combination of the Company's electrolyte rental model and

Bushveld's ability to scale up vanadium production will support

VRFBs becoming a long-term feature of energy grids globally.

GROWTH STRATEGY

Strategic acquisitions are a key part of the Company's growth

plans, as demonstrated by the successful acquisition of Vametco and

soon to be completed acquisition of Vanchem.

Following the acquisition of Vanchem, Bushveld's growth strategy

will focus on realising the potential of its assets, focusing on

production throughput, cost control and realising the downstream

opportunities under development through Bushveld Energy. These

opportunities will see the Company continue investing across the

vanadium supply chain individually or through partnerships.

As previously communicated, the Company's investment proposition

remains primarily capital growth on the back of the Company

delivering on its ambitious growth targets. The Company is

nevertheless confident that when fully implemented, its vertically

integrated platform will generate sufficient cash to return some to

its shareholders through dividends.

VANADIUM MARKET

The Company believes that the vanadium market fundamentals

remain attractive. Demand in steel making is expected to continue

growing, notwithstanding a subdued steel market outlook in the

medium term. This demand increase is driven by growing intensity of

use of vanadium in steel, which is in turn driven largely by new

regulations introduced in China. Meanwhile the momentum behind

energy storage applications of vanadium continues to grow as the

energy transition towards cleaner energy sources takes root.

Vanadium prices have seen a 50 per cent fall during the first

half of 2019. The Company believes that the price fall has been

heavily influenced by largely temporary factors and retains its

positive outlook on the vanadium market going forward. These

factors include:

China's rebar standard

The new rebar standards introduced in China in November 2018

were expected, when fully complemented, to see an uplift in Chinese

vanadium demand of approximately 30 per cent. This uplift has,

however, not been realised, mostly due to a lacklustre enforcement

regime for the standards which effectively provided a "tolerance

window" for the mills in relation to the new standard. A

nation-wide inspection launched in July and expected to be

completed in September is anticipated to drive greater compliance

with the new standards and in turn support demand growth going

forward.

Substitution

Increased niobium imports into China suggest greater

substitution of vanadium in rebar when vanadium prices were over

US$100/kgV. The majority of the substitution is price elastic. At

current vanadium prices the incentive to substitute niobium with

ferrovanadium is significantly diminished, as vanadium continues to

have several advantages over niobium in steel applications.

Opportunistic producers

Abnormally high vanadium prices such as those seen in November

2018, will always encourage new supply, particularly opportunistic

swing supply, such as secondary production or stone coal production

in China. Furthermore, the increased global steel production during

2019, and the return of near US$100/t prices for iron ore amid a

tight iron ore supply/demand balance as a result of the supply

disruptions in Brazil, brought back to life previously marginal

magnetite mines from China, increasing vanadium supply via

co-production. As steel margins normalise and iron ore market

returns to a balance, the Company excepts a reduction in vanadium

production from co-producers.

The medium term outlook for supply, however, remains

constrained. This outlook is informed by the significant hurdles to

greenfield vanadium supply growth, while co-producers capacity is

capped resulting in a modest outlook for sustainable new supply

growth going forward.

Outlook

While the medium to long term outlook for vanadium remains

positive, the Company's low cost curve position means that it is

well positioned to address the recent weakness in commodity prices.

Bushveld Minerals' high-grade, long-life and low cost assets put

the Company in a strong position throughout the commodity cycle

(year to date average ferrovanadium price of US$48.2/kgV[1]).

Moreover, the Company's vertical integration strategy provides a

natural hedge to vanadium price volatility as well as a diversified

revenue stream. The normalisation of the vanadium price is

increasing confidence that VRFBs will become a long-term global

feature of energy grids.

[1]London Metal Bulletin year to date average as at 20 September

2019.

FINANCIAL PERFORMANCE

In this report, Bushveld Minerals is pleased to report a strong

set of financial results for the first half of the year,

underpinned by operational improvements and effective cost control

initiatives.

The Group generated revenue of US$78.0 million (H1 2018: US$83.7

million), representing a decrease of seven per cent from the prior

corresponding period. The lower revenue reflects lower sales

volumes.

The Group generated an EBITDA of US$41.0 million (H1 2018:

US$42.8 million), representing a decrease of four per cent from the

prior corresponding period, however the EBITDA margin was higher at

53 per cent (H1 2018: 51 per cent), as a result of the Group

reducing its operating costs at Vametco.

Cash generated by the operating activities of the business was

US$34.7 million (H1 2018 US$21.4 million). The investing activities

of the business resulted in an outflow of US$11.4 million, with the

majority relating to the initial US$6.8 million paid as part of the

aggregate cash consideration of US$68 million for the Vanchem

acquisition. The cash and cash equivalent balance for the six

months ended 30 June 2019 is US$66.1 million (31 December 2018:

US$42.0 million).

ORGANISATIONAL AND ADVISER CHANGES

The Company is pleased to announce the appointment of Peel Hunt

LLP as joint corporate broker to the Company with immediate effect.

SP Angel Corporate Finance LLP remains the Company's nominated

adviser and joint corporate broker, along with BMO Capital Markets

Limited, which remains joint corporate broker.

Finally, I would like to make a special mention of Geoff

Sproule, Bushveld's long serving finance director, who will be

stepping down with effect from 30 September 2019 and will

simultaneously resign from the board of directors of the Company.

Geoff has been an integral part of the team that has helped

Bushveld Minerals achieve so much since starting out as a junior

explorer and rapidly transforming into the significant vanadium

player it is now. I wish him all the best.

The Company will be announcing the new finance director this

week, the management team and the board strongly believe fulfils

all the criteria that Bushveld Minerals requires for the next phase

of its growth.

It has been a productive year to date and the Company is

steadily executing its strategy to grow its low-cost production

base and build up the Bushveld Energy business. I look forward to

the second half during which Bushveld Minerals will keep

strengthening its position as a leading primary vanadium producer,

offering a diverse range of products for the steel, chemicals and

energy storage markets.

I thank you for all of your support.

Fortune Mojapelo

Consolidated Income Statement

For the six months ended 30 June 2019

6 Months ended 6 Months ended Year ended

30 June 2019 30 June 2018 31 December

2018

(unaudited) (unaudited) (audited)

$ $ $

Continuing operations

Revenue 78,001,182 83,744,182 192,089,845

Cost of sales (22,879,458) (32,421,693) (65,273,543)

Gross profit 55,121,724 51,322,489 126,816,302

Other operating income 412,905 4,648,360 7,420,109

Selling and distribution

costs (8,451,397) (5,168,892) (10,661,706)

Other mine operating costs (1,565,719) (1,098,381) (2,508,971)

Idle plant costs (284,266) (546,623) (2,688,422)

Administration expenses (7,687,433) (6,969,320) (23,202,234)

Operating profit 37,545,814 42,187,632 95,175,078

Finance income 2,679,963 1,097,335 1,987,333

(1,448,801) (1,819,397) (1,233,406)

Finance costs - (3,232,425)

Share based payment economic

empowerment transaction -

Movement in earnout estimate 5,912,435 (6,091,514)

Profit before tax 44,689,411 41,465,580 86,605,066

Taxation (13,877,341) (12,936,872) (37,604,907)

Profit after taxation 30,812,070 28,528,709 49,000,159

Attributable to:

Owners of the parent 21,542,145 15,108,930 30,215,509

Non-controlling interests 9,269,925 13,419,779 18,784,650

============== ============== ============

Profit per ordinary share (note

4)

Basic and diluted profit per share

(in cents) 1.92 1.57 2.9

All results relate to continuing activities.

Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2019

6 Months ended 6 Months ended Year ended

30 June 2019 30 June 2018 31 December

2018

$ $ $

(unaudited) (unaudited) (audited)

Profit for the period

/ year 30,812,070 28,528,709 49,000,159

Other comprehensive

income, net of tax:

Items that may be subsequently

reclassified to profit

or loss:

Currency translation

differences 3,687,039 (10,787,074) (13,715,270)

Available-for-sale financial

assets - net change

in fair value (2,679) - 659,007

Other fair value movements - 276,781 21,796

Total comprehensive

income for the period

/ year 34,496,430 18,018,416 35,965,692

=============== =================== =================

Attributable to:

Owners of the parent 24,267,874 10,648,883 21,941,346

Non-controlling interests 10,228,556 7,369,533 14,024,346

Total comprehensive

income for the period

/ year 34,496,430 18,018,416 35,965,692

=============== =================== =================

Consolidated Statement of Financial Position

As at 30 June 2019

Company number: 54506

30 June 31 December

2018

2019 $

Note $

(unaudited) (audited)

Assets

Non-current assets

Intangible

assets:

exploration and

evaluation 5 60,629,669 57,150,425

Property, plant and

equipment 6 58,647,894 47,881,162

Investment

properties 2,868,332 2,816,007

Deferred tax asset 3,646,004 3,004,141

Total Non-Current

assets 125,791,899 110,851,735

Current assets

Inventories 7 24,358,804 17,193,018

Trade and other

receivables 8 17,274,273 32,586,185

Restricted

investment 6,200,384 5,388,953

Income tax

receivable 2,538,283 251,382

Available-for-sale

financial assets 2,308,594 2,311,272

Cash and cash

equivalents 9 66,130,719 42,019,123

Total Current

assets 118,811,057 99,749,933

Total assets 244,602,956 210,601,668

=========== ===========

Equity and

liabilities

Share capital 12 14,921,079 14,921,079

Share premium 12 101,003,256 101,003,256

Accumulated profit 42,989,282 21,447,137

Foreign exchange

translation

reserve (4,344,979) (7,073,387)

Fair value reserve (374,158) (371,479)

----------- -----------

Equity

attributable

to owners of the

parent 154,194,480 129,926,606

Non-controlling

interests 39,941,002 29,712,446

Total Equity 194,135,482 159,639,052

Non-Current

liabilities

Post-retirement

medical

liability 2,440,278 2,377,737

Environmental

rehabilitation

liability 6,918,762 6,632,60

Deferred

consideration 11,441,175 17,427,512

Borrowings - -

Lease liability -

IFRS 16 11 4,524,958 -

Total Non-Current

liabilities 25,325,173 26,437,856

Current liabilities

Trade and other

payables 10 20,543,207 20,203,795

Provisions 3,734,243 4,320,965

Leases liability -

IFRS 16 11 864,851 -

Total Current

liabilities 25,142,301 24,524,760

Total Equity and

liabilities 244,602,956 210,601,668

=========== ===========

Consolidated Statement of Changes in Equity

For the six months ended 30 June 2019 Attributable to owners of

the parent company

Foreign

Warrant exchange Non-

Share Share Accumulated reserve translation Fair value controlling Total

capital premium deficit reserve reserve Total interests equity

$ $ $ $ $ $ $ $ $

Total equity at 1 January

2018 (audited) 11,817,573 69,222,661 (13,121,418) 2,113,866 1,881,579 (1,052,282) 70,861,979 36,371,168 107,233,147

---------------------------- ---------- ----------- ------------ ----------- ----------- ----------- ----------- ------------ ------------

Profit for the period - - 15,108,93 - - - 15,108,930 13,419,779 28,528,709

Other comprehensive income:

Fair value movements on

investments 276,782 276,782 276,782

Currency translation

differences - - - - (4,736,828) - (4,736,828) (6,050,246) (10,787,074)

Total comprehensive income

for the period - - 15,108,930 - (4,736,828) 276,782 10,648,883 7,369,533 18,081,416

Transactions with owners:

Grant of warrants - - - 849,220 - - 849,220 - 849,220

Issue of shares 2,700,150 23,714,999 - - - - 26,415,149 - 26,415,149

Share issue expenses - (1,080,161) - - - - (1,080,161) - (1,080,161)

Non-controlling interest - - - - - - - - -

Total equity at 30 June

2018 (unaudited) 14,517,723 91,857,499 1,987,512 2,963,086 (2,855,249) (775,500) 107,695,071 43,740,701 151,435,771

---------------------------- ---------- ----------- ------------ ----------- ----------- ----------- ----------- ------------ ------------

Profit for the period - - 15,106,579 - - - 15,106,579 5,364,871 20,471,450

Other comprehensive income:

Fair value movement on

investments - - - - - 404,021 404,021 - 404,021

Currency translation

differences - - - - (4,218,138) - (4,218,138) 1,289,942 (2,928,196)

---------------------------- ---------- ----------- ------------ ----------- ----------- ----------- ----------- ------------ ------------

Total comprehensive income

for the period - - 15,106,579 - (4,218,138) 404,021 11,292,463 6,654,813 17,947,276

Transactions with owners: - - - - - - -

Grant of warrants - - - (849,220) - - (849,220) - (849,220)

Exercise of warrants 547,453 4,232,445 - - - - 4,779,898 - 4,779,898

Issue of shares (144,097) 4,913,312 - - - - 4,769,215 - 4,769,215

Reserve transfer - - 2,113,866 (2,113,866) - - - - -

Change in non-controlling

interest - - 2,239,180 - - - 2,239,180 (19,739,180) (17,500,000)

Dividends paid to

non-controlling

interest - - - - - - - (943,888) (943,888)

---------------------------- ---------- ----------- ------------ ----------- ----------- ----------- ----------- ------------ ------------

Total equity at 31 December

2018

(audited) 14,921,079 101,003,256 21,447,137 - (7,073,387) (371,479) 129,926,606 29,712,446 159,639,052

Profit for the period - - 21,542,145 - - - 21,542,145 9,269,925 30,812,070

Other comprehensive income:

Fair value movement on

investments - - - - - (2,679) (2,679) - (2,679)

Currency translation

differences - - - - 2,728,407 - 2,728,407 958,630 3,687,037

Total comprehensive income

for the period - - 21,542,145 - 2,728,407 (2,679) 24,267,873 10,228,556 34,496,429

Transactions with owners:

Issue of shares - - - - - - - - -

Share issue costs - - - - - - - - -

Non-controlling interest - - - - - - - - -

Total equity at 30 June

2019 (unaudited) 14,921,079 101,003,256 42,989,282 - (4,344,979) (374,158) 154,194,480 39,941,002 194,135,482

---------------------------- ---------- ----------- ------------ ----------- ----------- ----------- ----------- ------------ ------------

Consolidated Statement of Cash Flows

For the six months ended 30 June 2019

6 Months ended 6 Months ended Year ended

30 June 2019 30 June 2018 31 December

2018

$ $ $

(unaudited) (unaudited) (audited)

Profit before taxation 44,689,412 41,465,580 86,605,066

Adjustments for:

Depreciation

property, plant

and equipment 3,483,155 624,093 6,039,339

Fair value

economic

empowerment

transaction - - 3,232,425

Movement in

earnout estimate (5,912,435) - 6,091,514

Finance income (2,679,963) (1,097,335) (1,987,333)

Finance costs 1,448,801 1,819,387 1,233,406

Changes in

working capital 4,803,162 (8,457,041) (25,350,569)

Income taxes paid (11,147,542) (12,936,871) (30,923,733)

Net cash

generated from

operating

activities 34,684,591 21,417,813 44,940,115

------------------ ----------------------- ---------------------

Cash flows from investing

activities

Finance income 2,679,963 1,097,335 1,987,333

Purchase of exploration

and evaluation assets (895,402) (20,567) (1,553,219)

Purchase of property,

plant

and equipment (5,807,169) (6,055,346) (11,205,702)

Acquisition of

non-controlling

interest - - (17,500,000)

Payment of Deferred

Consideration (600,000) - -

Payment in advance for

acquisition

of Vanchem (6,800,000) - -

Net cash (used

in)/generated

from investing activities (11,422,608) (4,978,578) (28,271,588)

------------------ ----------------------- ---------------------

Cash flows from financing

activities

Finance costs (1,448,801) (1,819,387) -

Lease payments (305,688) - -

Net proceeds of capital

raise - 20,615,493 19,006,177

Net proceeds from issue

of shares and warrants - 1,578,851 4,139,825

Net repayments of other

borrowings - (6,902,380) (6,907,035)

------------------ ----------------------- ---------------------

Net cash (used

in)/generated

from financing activities (1,754,489) 13,472,577 16,238,967

------------------ ----------------------- ---------------------

Net increase in cash and

cash equivalents 21,507,494 29,911,812 32,907,494

Cash and cash equivalents

at the beginning of the

period 42,019,123 9,739,632 9,739,632

Effect of foreign

exchange

rates 2,604,102 (4,333 831) (628,003)

Cash and cash

equivalents

at end of the

period 66,130,719 35,317,613 42,019,123

================== ======================= =================

1. Corporate information and principal activities

Bushveld Minerals Limited ("Bushveld") was incorporated and

domiciled in Guernsey on 5 January 2012 and admitted to the AIM

market in London on 26 March 2012.

The company's reporting date is 31 December. These unaudited

interim financial statements are for the six months ended 30 June

2019 with comparatives to 30 June 2018. The twelve months to 31

December 2018 are audited.

2. Basis of preparation

The results presented in this report are unaudited and they have

been prepared in accordance with the recognition and measurement

principles of International Financial Reporting Standards ('IFRS")

as adopted by the EU that are expected to be applicable to the next

set of financial statements and on the basis of the accounting

policies to be used in those financial statements.

The interim financial information does not include all of the

information required for full annual financial statements and

accordingly, whilst the interim financial information has been

prepared in accordance with the recognition and measurement

principles of IFRS, it cannot be construed as being in full

compliance with IFRS. The financial information contained in this

announcement does not constitute statutory accounts as defined by

the Companies (Guernsey) Law 2008.

On the instructions of the directors, the Group's auditor has

performed specific procedures in accordance with International

Standard on Related Services ('ISRS') 4400 'Engagements to Perform

Agreed-upon Procedures Regarding Financial Information', on the

financial information, solely for the purpose of providing a report

of factual findings in respect of the financial information to the

directors. The specific procedures performed do not constitute

either an audit or a review.

The audited financial information for the period ended 31

December 2018 is based on the statutory accounts for the financial

period ended 31 December 2018 The auditors reported on those

accounts: their report was unqualified and did not contain

statements where the auditor is required to report by

exception.

IFRS 16 has been adopted in the interim financial statements and

the impact is disclosed in note 11.

3. Use of estimates and judgements

In the application of the group's accounting policies, the

directors are required to make judgements, estimates and

assumptions about the carrying amounts of assets and liabilities

that are not readily apparent from other sources. The estimates and

associated assumptions are based on historical experience and other

factors that are considered to be relevant. Actual results may

differ from these estimates In particular, information about

significant areas of estimation uncertainty considered by

management in preparing the financial statements is described

below:

i. Decommissioning and rehabilitation obligations

Estimating the future costs of environmental and rehabilitation

obligations is complex and requires management to make estimates

and judgements as most of the obligations will be fulfilled in the

future and contracts and laws are often not clear regarding what is

required. The resulting provisions are further influenced by

changing technologies, political, environmental, safety, business

and statutory considerations.

ii. Asset lives and residual values

Property, plant and equipment are depreciated over its useful

life taking into account residual values, where appropriate. The

actual lives of the assets and residual values are assessed

annually and may vary depending on a number of factors. In

reassessing asset lives, factors such as technological innovation,

product life cycles and maintenance programmes are taken into

account. Residual value assessments consider issues such as future

market conditions, the remaining life of the asset and projected

disposal values.

iii. Post-retirement employee benefits

Post-retirement medical aid liabilities are provided for certain

existing employees. Actuarial valuations are based on assumptions

which include employee turnover, mortality rates, the discount

rate, health care inflation costs and rates of increase in

costs.

iv. Surface rights liabilities

The group has provided for surface lease costs that would accrue

to the owners of the land on which the mine is built. The quantum

of the amounts due post implementation of the MPRDA and the

granting of the new order mining right to the group is somewhat

uncertain and need to be negotiated with such owners. The group has

conservatively accrued for possible costs in this regard, but the

actual obligation may be materially different when negotiations

with the relevant parties are completed.

v. Revaluation of investment properties

The group carries its residential investment properties at fair

value. The group engaged an independent valuation specialist to

assess the fair value as at 31 December 2018 for residential

properties. For residential properties, it measures land and

buildings at revalued amounts with changes in fair value being

recognised in other comprehensive income. Land and buildings were

valued by reference to market-based evidence, using comparable

prices adjusted for specific market factors such as nature,

location and condition of the property.

vi. Impairment of exploration and evaluation assets

Determining whether an exploration and evaluation asset is

impaired requires an assessment of whether there are any indicators

of impairment, including by reference to specific impairment

indicators prescribed in IFRS 6 - Exploration for and Evaluation of

Mineral Resources. If there is any indication of potential

impairment, an impairment test is required based on value in use of

the asset. The valuation of intangible exploration assets is

dependent upon the discovery of economically recoverable deposits

which, in turn, is dependent on future iron ore and tin prices,

future capital expenditures and environmental and regulatory

restrictions. The directors have concluded that there are no

indications of impairment in respect of the carrying value of

intangible assets at 30 June 2019 based on planned future

development of the projects and current and forecast commodity

prices.

4. Profit/Loss per share

From continuing operations

The calculation of a basic profit per share of 1.92 cents (year

ended 31 December 2018: 2.9 cents), is calculated using the total

profit for the six months attributable to the owners of the company

of $21,542,145 (year ended 31 December 2018: $30,215,509) and the

weighted average number of shares in issue during the six months of

1,119,727,953 (June 2018: 1,043,907,922). The dilutive effect of

other shares in issue would be immaterial to the profit per

share.

5. Intangible exploration and evaluation assets

Vanadium

and Iron Coal Total

ore $ $

$

As at 1 January 2018 60,862,691 - 60,862,691

Exchange differences (5,265,485) - (5,265,485)

Additions 41,861 1,511,358 1,553,219

As at 31 December 2018

(audited) 55,639,067 1,511,358 57,150,425

Additions to at June 2019 741,867 153,535 895,402

Exchange differences 2,583,842 - 2,583,842

-------------------------------- ------------ ------------ ------------

As at 30 June 2019 (unaudited) 58,964,776 1,664,893 60,629,669

-------------------------------- ------------ ------------ ------------

Vanadium and iron ore

The Company's subsidiary, Bushveld Resources Limited has a 64%

interest in Pamish Investment

No 39 (Proprietary) Limited ("Pamish") which holds an interest

in Prospecting right 95 ("Pamish 39"). Bushveld Resources Limited

also has a 68.5% interest in Amaraka Investment No 85 (Proprietary)

Limited ("Amaraka") which holds an interest in Prospecting right

438 ("Amaraka 85").

Under the agreements to acquire the licences within Bushveld

Resources, the group is required to fully fund the exploration

activities up to the issue of the corresponding mining licences. As

the non-controlling interest party retains their equity interest,

the funding of their interest is accounted as deemed purchase

consideration and is included in the additions in the year to

exploration activities. A corresponding increase is credited to

non-controlling interest.

Brits Vanadium Project

The Company is in a process to secure regulatory approval in

terms of section 11 of the Mineral and Petroleum Resources

Development Act (MPRDA) for change of control in respect of the

acquired Sable Metals & Mining Ltd subsidiaries. Following

approval, Bushveld Minerals will commence with activities to

delineate the shallow resource on the Uitvalgrond farm portion.

-- NW 30/5/1/1/2/11069 PR - held through Great Line 1 (Pty) Ltd

-- NW 30/5/1/1/2/11124 PR - held through Great Line 1 (Pty) Ltd

-- GP 30/5/1/1/02/10142 PR - held through Gemsbok Magnetite (Pty) Ltd

Coal

Coal Exploration licences have been issued to Coal Mining

Madagascar SARL a 99% subsidiary of Lemur Investments Limited.

The exploration is in South West Madagascar covering 11

concession blocks in the Imaloto Coal basin known as the Imaloto

Coal Project and Extension.

6. Property, plant and equipment

Buildings Plant and Motor Decommissioning Assets under Right Total

and other machinery vehicles assets construction of use

improvements furniture assets

and

equipment

$ $ $ $ $ $ $

Cost at 1

January 2018 610,789 42,147,393 28,670 1,507,013 934,379 - 45,228,234

Disposals - (1,180,001) (30,017) - - - (1,210,018)

Additions - - - 271,518 10,934,184 - 11,205,702

Asset under

construction

capitalised 730,388 3,310,376 246,498 - (4,287,262) - -

Exchange

differences (82,128) (1,398,908) (3,856) (202,636) (125,639) - (1,813,167)

----------------------- -------------------- -------------------- -------------------------- ----------------------- ----------------- -----------------------------------

At 31

December

2018

(audited) 1,259,049 42,878,860 241,295 1,575,895 7,455,662 - 53,410,751

======================= ==================== ==================== ========================== ======================= ================= ===================================

Additions to

30 June

2019 - 26,991 65,056 - 5,715,122 5,396,776 11,203,944

Disposals - - (1,337) - - - (1,337)

Assets under - - - - - - -

construction

capitalised

Exchange

differences 64,761 2,205,544 12,411 81,059 384,773 298,721 3,047,270

======================= ==================== ==================== ========================== ======================= ================= ===================================

At 30 June

2019

(unaudited) 1,323,810 45,111,395 317,425 1,656,954 13,555,557 5,695,497 67,660,638

======================= ==================== ==================== ========================== ======================= ================= ===================================

Depreciation

1 January

2018 - 809,055 - - - - 809,055

Depreciation

charge for

the year 237,758 5,508,585 209,890 83,106 - - 6,039,339

Disposals - (1,180,001) (30,017) - - - (1,210,018)

Exchange

differences - (108,787) - - - - (108,787)

----------------------- -------------------- -------------------- -------------------------- ----------------------- ----------------- -----------------------------------

At 31

December

2018

(audited) 237,758 5,028,852 179,873 83,106 - - 5,529,589

======================= ==================== ==================== ========================== ======================= ================= ===================================

Charge for

the six

months

to 30 June

2019 282,011 2,842,373 53,083 - - 305,688 3,483,155

Exchange - - - - - - -

differences

----------------------- -------------------- -------------------- -------------------------- ----------------------- ----------------- -----------------------------------

At 30 June

2019

(unaudited) 519,769 7,871,225 232,956 83,106 - 305,688 9,012,744

======================= ==================== ==================== ========================== ======================= ================= ===================================

Net book

value 31

December

2018

(audited) 1,021,291 37,850,008 61,422 1,492,789 7,455,662 - 47,881,162

======================= ==================== ==================== ========================== ======================= ================= ===================================

Net book

value 30

June

2019

(unaudited) 804,041 37,240,170 84,469 1,573,848 13,555,557 5,389,809 58,647,894

======================= ==================== ==================== ========================== ======================= ================= ===================================

7. Inventories

30 June 2019 31 December

2018

$ $

Unaudited Audited

Finished goods 11,617,574 6,094,274

Work in progress 6,149,775 4,489,189

Raw materials 1,888,247 2,157,296

Consumable stores 4,703,208 4,452,259

----------------- ----------------

Inventories 24,358,804 17,193,018

================= ==================

The amount of write-down of inventories due to net realisable

value provision requirement is nil.

8. Trade and other receivables

30 June 2019 31 December 2018

$ $

Unaudited Audited

Trade receivables 7,971,371 27,454,540

Other receivables 9,302,902 5,131,645

--------------------- ---------------------

Trade and other

receivables 17,274,273 32,586,185

===================== =====================

Trade receivables are non-interest bearing and are generally on

15 - 90-day terms. At 30 June 2019 the group had one customer which

accounted for approximately 90% of trade receivables.

The directors consider that the carrying amount of trade and

other receivables approximates to their fair value due to their

short-term nature. As at the year end, no receivables are past

their due date, hence no allowance for doubtful receivables is

provided on the basis that expected credit losses are nil

9. Cash and cash equivalents

30 June 2019 31 December

2018

$ $

(unaudited) (audited)

Cash at hand and

in bank 66,130,719 42,019,123

===================== ================

Cash and cash equivalents (which are presented as a single class

of assets on the face of the Statement of Financial Position)

comprise cash at bank and other short-term highly liquid

investments with an original maturity of three months or less. The

directors consider that the carrying amount of cash and cash

equivalents approximates their fair value.

10. Trade and other payables

30 June 2019 31 December 2018

$ $

(unaudited) (audited)

Trade payables 19,903,313 12,140,084

Accruals 639,894 8,063,711

20,543,207 20,203,795

================= =====================

Trade and other payables principally comprise amounts

outstanding for trade purchases and on-going costs. The average

credit year taken for trade purchases is 30 days.

11. IFRS 16 - Leases

The Group has applied IFRS 16 for the first time in the period.

IFRS 16 introduces new or amended requirements with respect to

lease accounting. It introduces significant changes to lessee

accounting by removing the distinction between operating and

finance leases and requiring the recognition of a right-of-use

asset and a lease liability at the lease commencement for all

leases, except for short-term leases and leases of low value

assets.

This note explains the impact of the adoption of IFRS 16

'Leases' on the Group's condensed consolidated interim report and

discloses the new accounting policies that have been applied from 1

January 2019. The Group has adopted IFRS 16 using the modified

retrospective approach from 1 January 2019 and has not restated

comparatives for the 2018 reporting period, as permitted under the

specific transitional provisions in the standard. The

reclassifications and adjustments arising from the new leasing

rules are therefore recognised in the opening balance sheet on 1

January 2019.

Applying IFRS 16, for all leases (except as noted below), the

Group:

a) recognises right-of-use assets and lease liabilities in the

Statement of Financial Position, initially measured at the present

value of future lease payments;

b) recognises depreciation of right-of-use assets and interest

on lease liabilities in the Income Statement; and

c) separates the total amount of cash paid into a principal

portion (presented within financing activities) and interest

(presented within operating activities) in the Statement of Cash

Flows.

Lease incentives (e.g. free rent period) are recognised as part

of the measurement of the right-of-use assets and lease liabilities

whereas under IAS 17 they resulted in the recognition of a lease

incentive liability, amortised as a reduction of rental expense on

a straight-line basis. Under IFRS 16, right-of-use assets are

tested for impairment in accordance with IAS 36 Impairment of

Assets. This replaces the previous requirement to recognise a

provision for onerous lease contracts. For short--term leases

(lease term of 12 months or less) and leases of low-value assets

(such as personal computers and office furniture), the Group has

opted to recognise a lease expense on a straight-line basis as

permitted by IFRS 16. This expense is presented within net

operating expenses in the Income Statement.

The Group assesses whether a contract is or contains a lease, at

inception of a contract. The Group recognises a right-of-use asset

and a corresponding lease liability with respect to all lease

agreements in which it is the lessee, except for short-term leases

(defined as leases with a lease term of 12 months or less) and

leases of low value assets. For these leases, the Group recognises

the lease payments as an operating expense on a straight-line basis

over the term of the lease unless another systematic basis is more

representative of the time pattern in which economic benefits from

the leased asset are consumed.

The lease liability is initially measured at the present value

of the lease payments that are not paid at the commencement date,

discounted by using the rate implicit in the lease. If this rate

cannot be readily determined, the Group uses its incremental

borrowing rate.

Lease payments included in the measurement of the lease

liability comprise:

-- fixed lease payments (including in-substance fixed payments),

less any lease incentives;

-- variable lease payments that depend on an index or rate,

initially measured using the index or rate at the commencement

date;

-- the amount expected to be payable by the lessee under

residual value guarantees;

-- the exercise price of purchase options, if the lessee is

reasonably certain to exercise the options; and

-- payments of penalties for terminating the lease, if the lease

term reflects the exercise of an option to terminate the lease.

The lease liability is presented as a separate line in the

Statement of Financial Position. The lease liability is

subsequently measured by increasing the carrying amount to reflect

interest on the lease liability (using the effective interest

method) and by reducing the carrying amount to reflect the lease

payments made.

The Group remeasures the lease liability (and makes a

corresponding adjustment to the related right-of-use asset)

whenever:

-- the lease term has changed or there is a change in the

assessment of exercise of a purchase option, in which case the

lease liability is remeasured by discounting the revised lease

payments using a revised discount rate.

-- the lease payments change due to changes in an index or rate

or a change in expected payment under a guaranteed residual value,

in which cases the lease liability is remeasured by discounting the

revised lease payments using the initial discount rate (unless the

lease payments change is due to a change in a floating interest

rate, in which case a revised discount rate is used).

-- a lease contract is modified and the lease modification is

not accounted for as a separate lease, in which case the lease

liability is remeasured by discounting the revised lease payments

using a revised discount rate.

The Group did not make any such adjustments during the periods

presented.

The right-of-use assets comprise the initial measurement of the

corresponding lease liability, lease payments made at or before the

commencement day and any initial direct costs.

They are subsequently measured at cost less accumulated

depreciation and impairment losses.

Whenever the Group incurs an obligation for costs to dismantle

and remove a leased asset, restore the site on which it is located

or restore the underlying asset to the condition required by the

terms and conditions of the lease, a provision is recognised and

measured under IAS 37. The costs are included in the related

right-of-use asset, unless those costs are incurred to produce

inventories.

Right-of-use assets are depreciated over the shorter period of

lease term and useful life of the underlying asset. If a lease

transfers ownership of the underlying asset or the cost of the

right-of-use asset reflects that the Group expects to exercise a

purchase option, the related right-of-use asset is depreciated over

the useful life of the underlying asset. The depreciation starts at

the commencement date of the lease. The right-of-use assets are

presented as a separate line in the Statement of Financial

Position. The Group applies IAS 36 Impairment of Assets to

determine whether a right-of-use asset is impaired and accounts for

any identified impairment loss.

A reconciliation of total operating lease commitments to the

IFRS 16 lease liability at 30 June 2019 is as follows:

$

Operating lease commitments disclosed at 31 December 2018

10,709,178

Less: short term leases recognised on a straight-line basis as

expense (191,010)

Less: discount effect using incremental borrowing rate

(5,121,392)

Lease liability recognised at 1 January 2019 5,396,776

Of which:

Current lease liabilities 724,944

Non-current lease liabilities 4,671,832

Total 5,396,776

In addition to the recognition of right-of-use assets, lease

liabilities and adjustments to net operating expenses for operating

lease costs and depreciation coupled with adjustments to finance

expenses and have been remeasured under the new standard.

12. Share capital and share premium

Share Number Share Capital Share Total share

premium capital and

$ $ premium

$

Balance brought down 1 January 2018

(Audited) 875,894,905 11,817,573 69,222,661 81,040,234

Conversion of convertible bonds 32,499,147 413,649 2,991,090 3,404,739

Warrants exercised 33,737,419 429,409 3,710,416 4,139,825

Shares issued 152,749,172 1,944,191 18,080,981 20,025,172

Shares issued to directors and staff 24,847,310 316,257 8,017,103 8,333,360

Share issue expenses - - (1,018,995) (1,018,995)

Balance at 31 December 2018 (Audited) 1,119,727,953 14,921,079 101,003,256 115,924,335

-------------- --------------- ----------- -------------

Balance brought down 1 January 2019

(Audited) 1,119,727,953 14,921,079 101,003,256 115,924,335

Balance at 30 June 2019 (unaudited) 1,119,727,953 14,921,079 101,003,256 115,924,335

------------- ---------- ----------- -----------

The Board may, subject to Guernsey Law, issue shares or grant

rights to subscribe for or convert securities into shares. It may

issue different classes of shares ranking equally with existing

shares. It may convert all or any classes of shares into redeemable

shares. The Company may also hold treasury shares in accordance

with the law. Dividends may be paid in proportion to the amount

paid up on each class of shares.

As at the 30 June 2019 the Company owns 670,000 (31 December

2018: 670,000) treasury shares with a nominal value of 1 penny.

13. Events after the reporting period

On 1 May 2019, Bushveld announced a conditional agreement to

acquire the primary vanadium processing assets of Vanchem Vanadium

plant, the ferrovanadium production business of SAJV as a going

concern, and a 100 per cent of the outstanding shares of Ivanti

Resources (Pty) Limited, a subsidiary of Duferco Participations

Holding S.A, (collectively "Vanchem").

On 28 August 2019, it received approval from the Competition

Commission of South Africa to acquire the Vanchem assets, without

conditions. The transaction remains on track to be completed on 31

October 2019 and we expect the outstanding conditions precedent,

being the cession of specific commercial agreements and South

African Reserve Bank approval, to be satisfied.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR EASNEDDENEEF

(END) Dow Jones Newswires

September 30, 2019 02:03 ET (06:03 GMT)

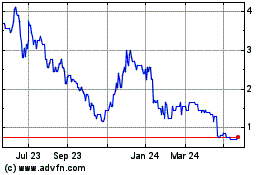

Bushveld Minerals (AQSE:BMN.GB)

Historical Stock Chart

From Sep 2024 to Oct 2024

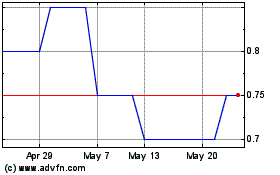

Bushveld Minerals (AQSE:BMN.GB)

Historical Stock Chart

From Oct 2023 to Oct 2024