More Trouble for Oil Services ETFs? - ETF News And Commentary

April 18 2013 - 9:00AM

Zacks

The recent crash in the precious metal space has rocked

commodity investors. Metals like gold and silver have faced the

wrath of the vicious sell-off in the commodity space earlier in the

week, losing double digits in many cases (read Brutal Trading

Continues in Gold Mining ETFs).

Unfortunately, along with precious metals, other commodities as

well as commodity producers have seen a vicious plunge in prices as

well. This has created a huge dent in what was until recently ever

increasing positive sentiment.

Speaking of energy commodities, these have had a good start to

the year, particularly after a forgetful year in 2012. In fact the

energy commodities for long have been plagued by falling prices on

account of oversupply as well as reduced industrial demand.

It was also reflected in the top and bottom lines of energy

companies as the energy sector proved to be one of the laggards for

the S&P 500. However, after a good start to the year, it seems

that the energy commodities, especially oil – is most likely to

continue its weak trend from the previous fiscal year (see Two

Niche ETFs Beating SPY).

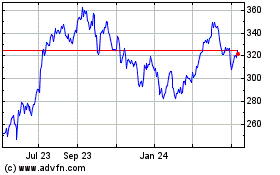

Nevertheless, a closer look at the chart of Market

Vectors Oil Services ETF (OIH) reveals that oil services

companies might be in for a tough time ahead. OIH tracks the

performance of 26 oil services stocks and thus provides great

exposure to the broad segment.

The chart above represents a one year daily price chart of OIH.

As we can see, after a brief surge upwards initially in 2013, the

ETF found a top around the middle of February. Since then the

trading action has been pretty choppy, to say the least (read Gold

ETFs in Focus: When to Consider GLDI).

Although the ETF still continues to be in a long term uptrend as

indicated by the upward rising support line, the short term picture

is pretty bleak. Since reaching the top, the near term weakness has

well and truly crept into the ETF and is seen to make lower highs

and lows.

Furthermore, the recent downward momentum is most likely to take

the ETF further down. In fact the long and short term trend has

caused a triangle formation in the ETF which it has very recently

broken to the downside.

And the downward momentum on this occasion seems to be pretty

strong as the ETF has seen significantly higher trading volumes

(encircled portion in the volumes chart) while the breakout

occurred (see Small Cap Japan ETFs: Overlooked Winners?).

Downward pressure in oil prices coupled with a strong U.S.

dollar will surely take a toll on the ETF. Still, after the recent

volatile trading sessions, it is unlikely that the ETF will plunge

very soon.

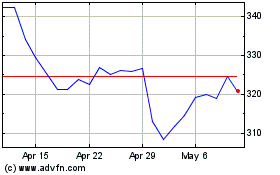

Instead a more realistic course of action would be a brief

consolidation at current levels since the ETF seems to be quite

oversold. Though we think that the fund could plunge further after

this consolidation period. The same is concurred by the RSI and

Williams R data which show an oversold reading.

Bottom Line

As is quite evident, the ETF is extremely correlated with prices

of oil, therefore any weakness in the energy commodity is likely to

show up in the ETF as well. This is particularly important

considering the fact that oil prices have also been facing downward

pressure for quite a long time.

Also, the investment case for oil remains rather bleak in the

near term. This explains that the weakness in the ETF is here to

stay for some more time.

Furthermore, OIH has a Zacks ETF Rank of 3 or ‘Hold’; therefore

we are not looking for great things from the ETF in the near term

either. The ETF has a ‘High’ risk outlook as well, so investors

should probably avoid this volatile and uncertain oil fund for the

time being.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

MKT VEC-OIL SVC (OIH): ETF Research Reports

US-OIL FUND LP (USO): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

VanEck Oil Services ETF (AMEX:OIH)

Historical Stock Chart

From Sep 2024 to Oct 2024

VanEck Oil Services ETF (AMEX:OIH)

Historical Stock Chart

From Oct 2023 to Oct 2024