TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) (the “Company”

or “TRX Gold”) today announced that Buckreef Gold Limited

(“Buckreef Gold”) has entered into its first ever credit agreement

with Stanbic Bank Tanzania Limited (“Stanbic”) and a Gold

Prepayment Facility with Auramet International, Inc. (“Auramet”).

TRX Gold has also renewed its At The Market Offering Agreement

(“ATM”) with H.C. Wainwright & Co., LLC (“H.C. Wainwright”) as

Lead Agent and Roth Capital Partners, LLC (“Roth Capital”) as

Co-Agent. The combination of these facilities provides the Company

with access to supplementary capital, strengthened liquidity, and

additional financial flexibility to help accelerate growth in the

short to medium term.

Credit Facility with

Stanbic

The credit agreement consists of a $5 million

revolving credit facility and a $4 million vehicle and asset

financing (“VAF”) facility that may be used at the Company’s

discretion. The $5 million revolving credit facility has a maximum

tenor of twelve months and the $4 million VAF facility has a

maximum tenor of thirty-six months. The revolving credit facility

provides the Company with access to supplementary liquidity and may

be used to support the working capital requirements of the business

at the Company’s discretion. This facility will allow the Company

to make cost effective decisions for deployment of capital across

its operations to support continued expansion and growth.

The revolving credit facility and VAF facility

include standard and customary financing terms and conditions,

including those related to security, fees, representations,

warranties, covenants, and conditions. This is the first credit

facility entered into by Buckreef Gold.

Stanbic Bank Tanzania is a leading financial

services provider in Tanzania, offering a comprehensive range of

products and services to personal, business, and corporate clients.

As a subsidiary of Standard Bank Group, Stanbic Bank Tanzania

leverages its deep local knowledge and expertise with the global

reach and capabilities of Standard Bank to support the growth and

development of its clients.

Bankable Tanzania Limited served as Buckreef

Gold's Transaction Advisor, responsible for structuring,

negotiating, placing, and finalizing the Credit Facility with

Stanbic, following a market sounding and

competitive RFP process.

Gold Prepayment Facility with

Auramet

Buckreef Gold has also entered into a new

unsecured Gold Prepayment Facility with Auramet through which

Buckreef Gold may, at its discretion, sell to Auramet up to a

maximum, aggregate amount of 1,000 troy ounces of London good

delivery gold bullion, up to a maximum of 21 calendar days prior to

delivery. This facility revolves on a 21-day basis for a term of

one year. At current gold spot prices, this facility can

provide access to approximately US$2.75 million for working capital

purposes. The Auramet Gold Prepayment Facility replaces the

Gold Doré Purchase Agreement with OCIM Metals and Mining S.A. This

facility will help provide increased financial flexibility to help

manage working capital fluctuations and to accelerate growth.

Auramet is one of the largest physical precious

metals merchants in the world with over $25 billion in annual

revenues and provides a full range of services to all participants

in the precious metals supply chain, including physical metals

trading, metals merchant banking (including direct lending,

royalties and streams) and project finance advisory services.

ATM Agreement with H.C. Wainwright and Roth

Capital

The Company renewed its At The Market Offering

Agreement with H.C. Wainwright & Co., LLC as Lead Agent and

Roth Capital Partners, LLC as Co-Agent, pursuant to which the

Company, at its discretion, may offer and sell, from time to time,

through the Lead Agent, common shares without par value (the

“Shares”) having an aggregate offering price of up to US$25 million

(the “Offering”). The renewed ATM facility replaces a prior $10

million ATM facility with H.C. Wainwright and Roth Capital and a

$10 million purchase agreement with Lincoln Park Capital Fund, LLC

(“Lincoln Park”), which expired in mid-January 2025 pursuant to its

terms.

The Offering is being made in the United States

pursuant to a registration statement on Form F-10 (File No.

333-283907) filed with and declared effective by the United States

Securities and Exchange Commission.

Sales of Shares will be made in transactions

that are deemed to be “at-the-market distributions” as defined in

National Instrument 44-102 - Shelf Distributions, including sales

made directly on the NYSE American. The Shares will be distributed

at the market prices prevailing at the time of sale. As a result,

prices may vary as between purchasers and during the period of

distribution. No Shares in this Offering will be sold on the

Toronto Stock Exchange or any other trading market in Canada. The

Company is relying on section 602.1 of the TSX Company Manual for

an exemption for eligible interlisted issuers from TSX

requirements.

The Company intends to use the ATM prudently

based on prevailing market conditions. If TRX Gold chooses to sell

Shares under the ATM Offering, the Company intends to use the net

proceeds of this offering for drilling, exploration and technical

work for the development of the sulphide mineralized material at

our Buckreef Gold Project, and for working capital and other

general corporate purposes.

You can review the Company’s SEC filings and the

Registration Statement by accessing the SEC’s internet site

at http://www.sec.gov. The Company also maintains a website

at http://www.trxgold.com, through which you can access the

Company’s SEC filings.

TRX Gold’s CEO, Stephen Mullowney comments: “The

Stanbic and Auramet facilities demonstrate a progression of the

banking facilities available to the Company after having matured

from an operation with a small test plant in 2021 to a 2,000 tonne

per day commercial operation today. We have benefitted from having

supportive partners in building out the expanded processing plant,

and these new facilities provide the Company with added options and

increased financial flexibility to assist us in managing working

capital fluctuations, deploy capital more effectively and

accelerate growth in the short to medium term. The renewed ATM

facility replaces a prior $10 million ATM facility and a $10

million purchase agreement and is a prudent, normal corporate

facility to have in place. It is also worth noting that the prior

ATM facility was not utilized.”

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be

any sale of these securities in any state or jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

Forward-Looking and Cautionary Statements

This press release contains certain

forward-looking statements as defined in the applicable securities

laws. All statements, other than statements of historical facts,

are forward-looking statements. Forward-looking statements are

frequently, but not always, identified by words such as “expects”,

“anticipates”, “believes”, “hopes”, “intends”, “estimated”,

“potential”, “possible” and similar expressions, or statements that

events, conditions or results “will”, “may”, “could” or “should”

occur or be achieved. Forward-looking statements relate to future

events or future performance and reflect TRX Gold management’s

expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to continued operating

cash flow, expansion of its process plant, estimation of mineral

resources, ability to develop value creating activities,

recoveries, subsequent project testing, success, scope and

viability of mining operations, the timing and amount of estimated

future production, and capital expenditure.

Although TRX Gold believes the expectations

expressed in such forward-looking statements are based on

reasonable assumptions, such statements are not guarantees of

future performance. The actual achievements of TRX Gold or other

future events or conditions may differ materially from those

reflected in the forward-looking statements due to a variety of

risks, uncertainties and other factors. These risks, uncertainties

and factors include general business, legal, economic, competitive,

political, regulatory and social uncertainties; actual results of

exploration activities and economic evaluations; fluctuations in

currency exchange rates; changes in costs; future prices of gold

and other minerals; mining method, production profile and mine

plan; delays in exploration, development and construction

activities; changes in government legislation and regulation; the

ability to obtain financing on acceptable terms and in a timely

manner or at all; contests over title to properties; employee

relations and shortages of skilled personnel and contractors; the

speculative nature of, and the risks involved in, the exploration,

development and mining business. These risks are set forth in

reports that TRX Gold files with the SEC and the various Canadian

securities authorities. You can review and obtain copies of these

filings from the SEC's website at

http://www.sec.gov/edgar.shtml and the Company’s profile on

the System for Electronic Document Analysis and Retrieval

(“SEDAR+”) at www.sedarplus.ca.

The information contained in this press release

is as of the date of the press release and TRX Gold assumes no duty

to update such information.

For investor or shareholder inquiries,

please contact:

Investors Investor RelationsTRX

Gold CorporationIR@TRXgold.comwww.TRXgold.com

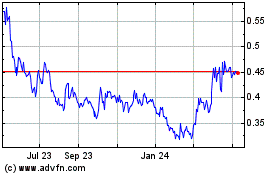

TRX Gold (AMEX:TRX)

Historical Stock Chart

From Jan 2025 to Feb 2025

TRX Gold (AMEX:TRX)

Historical Stock Chart

From Feb 2024 to Feb 2025