The first quarter of 2013 has been quite rewarding for the ETF

industry, wherein some funds witnessed tremendous asset

accumulation driven by growing investor confidence.

In fact, ETFs saw massive inflows of $54.73 billion in the

quarter, marking the third biggest quarter inflows in the 20-year

history of the industry. With this, total AUM reached the $1.467

trillion mark, which is 21% higher than the year-ago quarter.

In terms of funds driving this total, investors should note that

equity products experienced the heaviest inflows followed by fixed

income funds. Meanwhile, commodities lost over $6.6 billion in

assets, due in large part to the terrible performance by gold and

gold ETFs (read: Have We Seen the Bottom in Gold ETFs?).

Let us have a look at the top 10 most popular ETFs that

witnessed a combined inflow of $19.91 billion in the quarter:

|

Fund

|

Category

|

Inflows ($ in millions)

|

Expense Ratio

|

1st Quarter Returns

|

|

DXJ

|

Japan Equities

|

3,946.88

|

0.48%

|

11.71%

|

|

IVV

|

Large Cap Equities

|

2,358.67

|

0.07%

|

9.57%

|

|

BSV

|

Total Bonds Market

|

2,230.97

|

0.11%

|

-0.17%

|

|

VTI

|

All Cap Equities

|

2,154.40

|

0.06%

|

9.89%

|

|

USMV

|

All Cap Equities

|

1,680.53

|

0.15%

|

12.60%

|

|

VNQ

|

REITs ETF

|

1,677.29

|

0.10%

|

7.51%

|

|

VOO

|

Large Cap Equities

|

1,528.79

|

0.05%

|

9.59%

|

|

BKLN

|

High Yield Bonds

|

1,500.85

|

0.76%

|

0.85%

|

|

EWJ

|

Japan Equities

|

1,453.27

|

0.51%

|

6.46%

|

|

XLF

|

Financial Equities

|

1,380.13

|

0.18%

|

10.56%

|

*Source: Indexuniverse

Japan ETF: Rising Star

One segment that stands out on this list is Japan ETFs. Assets

have been flowing into the nation at a robust rate, suggesting high

levels of demand for these securities. Investors have flocked into

the funds to take advantage of the surging economy and rising stock

market as well as the declining yen.

Unsurprisingly, WisdomTree Japan Hedged Equity Fund

(DXJ) is the top ETF of

Q1, having gathered over $3.9 billion, propelling the fund’s asset

base to nearly $5.6 billion. The ETF follows the WisdomTree Japan

Hedged Equity Index while provides a hedge against any fall in the

yen against the U.S. dollar. The fund charges a fee of 48 basis

points on an annual basis (read: DXJ--Best ETF to Play the Japan

Rally).

Another Japanese ETF – the iShares MSCI Japan ETF

(EWJ) – tracking the

MSCI Japan Index has also gained strong momentum as it pulled in

roughly $1.5 billion in the quarter. The product has amassed about

$7.3 billion in AUM so far while charging an expense ratio of

0.51%.

DXJ is up 11.71% during the quarter while EWJ has gained a bit

less at 6.46%.

U.S. ETFs: Broad Rally, Broad Market

ETFs

As broad markets are approaching their all-time highs, investors

are gaining confidence over the riskier asset classes. As such, a

number of domestic broad market funds have made it to the top 10

list, showing heavy inflows in Q1 on the heels of improving global

economic conditions.

The iShares Core S&P 500 ETF

(IVV) and the

Vanguard S&P 500 ETF

(VOO) have accumulated

roughly $2.3 billion and $1.5 billion, respectively. These inflows

have propelled the funds’ asset bases to $41.0 billion and $8.8

billion, respectively.

Both funds track the S&P 500 index and are the low cost

choices in the space charging 0.07% and 0.05% in annual fees,

respectively, from investors. Both products gained about 9.6% in

the quarter (read: 3 Ways to Play the S&P 500 Rally with

ETFs).

Beyond the S&P 500 funds, other broad market ETFs tracking

other indexes have featured in this elite list. The

Vanguard Total Stock Market ETF

(VTI) tracking the MSCI

US Broad Market Index and iShares MSCI USA Minimum

Volatility ETF (USMV)

tracking MSCI USA Minimum Volatility index have made it to the top

10 list.

The former is a total market ETF which comprises stocks from the

entire spectrum of market capitalization, while the latter measures

the performance of the U.S. securities that have lower absolute

volatility.

VTI pulled in about $2.1 billion in Q1, reaching over $29

billion in total assets while USMV attracted about $1.7 billion,

accumulating $2.6 billion in AUM so far. Both the products are

cheap, charging 6 bps and 15 bps in annual fees, respectively.

However, USMV leads in terms of returns by fetching investors

12.60% followed by VTI returning 9.89%.

Fixed Income ETFs: Mixed Bag

Given the threats of interest rate hikes later this year or in

the next, investors are seeking safe exposure to fixed income. As

such, some investors are back to the short-term bond markets, where

default risk and interest rate sensitivity are low.

The PowerShares Senior Loan Portfolio Fund

(BKLN) gathered $1.5

billion in the quarter, sending its asset base to $3.0 billion. The

product provides exposure to the senior loan market and focuses on

intermediate term investment grade corporate bonds.

The expense ratio is 76 bps a year, which is three times the low

cost junk bond ETFs. The ETF gained 0.85% in the first quarter (see

more ETFs in the Zacks ETF Center).

The Vanguard Short Term Bond ETF

(BSV) is the only ETF in

this list which has posted negative returns for the first quarter

in spite of accumulating nearly $2.2 billion. The ETF zeroes in on

the U.S. government, high-quality corporate, and investment-grade

international dollar-denominated bonds having maturity of 1–5

years. It charges 11 bps per year in annual fees and has amassed

$11.5 billion in AUM.

Real Estate ETFs: Winners of 2013

The real estate sector has been gaining immense popularity of

late, thanks to a gradual recovery in the U.S. economy. Stronger

commercial as well as residential real estate fundamentals, upbeat

housing data and higher home prices are making securities in this

segment attractive at present.

The Vanguard REIT ETF

(VNQ) is the most

popular ETF of Q1 in this segment tracking the MSCI US REIT Index.

The fund gathered over $1.7 billion so far this year, leading to an

asset base over $18.3 billion. The product added 7.51% in the

quarter and is one of the low cost choices in the space, charging

only 10 bps in annual fees from investors.

Financial ETFs: Top Sector of 2013

The only financial ETF that made to the top 10 list is

Financial Select Sector SPDR

(XLF), which follows the S&P

Financial Select Sector Index. The fund has seen inflows of $1.3

billion in the same time frame, accumulating roughly $11.6 billion

in its asset base.

The product generated double-digit returns in the quarter buoyed

by an impressive comeback by bank stocks (read: Two Sector ETFs

Posting Incredible Gains).

The strong performance was attributable to sound balance sheets,

an uptick in mortgage activity, lesser credit loss provisions,

expanding consumer credit, improved lending activity and good

credit quality. Further, solid economic data such as higher

consumer spending and GDP, an improving housing market as well as

declining unemployment rate point towards optimism in Q2.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

PWRSH-SNR LN PR (BKLN): ETF Research Reports

VANGD-SHT TRM B (BSV): ETF Research Reports

WISDMTR-J HEF (DXJ): ETF Research Reports

ISHARS-JAPAN (EWJ): ETF Research Reports

ISHARS-SP500 (IVV): ETF Research Reports

ISHARS-MS US MV (USMV): ETF Research Reports

VIPERS-REIT (VNQ): ETF Research Reports

VANGD-SP5 ETF (VOO): ETF Research Reports

VIPERS-TOT STK (VTI): ETF Research Reports

SPDR-FINL SELS (XLF): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

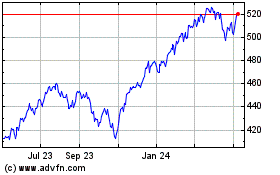

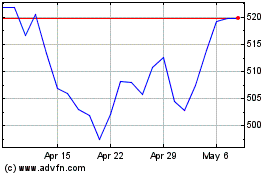

S&P 500 (AMEX:IVV)

Historical Stock Chart

From Nov 2024 to Dec 2024

S&P 500 (AMEX:IVV)

Historical Stock Chart

From Dec 2023 to Dec 2024