IGC Pharma, Inc. (“IGC” or the “Company”) (NYSE American: IGC)

today announced its financial results for the first fiscal quarter

of 2025 ended June 30, 2024.

Q1 FY2025 Company’s Highlights

- On April 9, 2024, the Company welcomed Pablo Arbelaez, Ph.D., a

renowned AI expert and researcher, to support the development of

the Phase 2 clinical trial of IGC-AD1, the lead therapeutic

candidate addressing agitation in Alzheimer’s disease.

- On April 16, 2024, the Company announced that interim data from

its Phase 2 clinical trial demonstrates a clinically significant

reduction, approaching statistical significance, in agitation in

Alzheimer’s at week two compared to placebo.

- On May 28, 2024, the Company announced patient enrollment at

Neurostudies, Inc. in Port Charlotte, Florida, for its ongoing

Phase 2 clinical trial investigating IGC-AD1, the lead

investigational drug, as a potential treatment for agitation in

Alzheimer’s disease.

- On June 25, 2024, the Company shared positive pre-clinical

results for TGR-63, showing its potential in combating Alzheimer’s

disease in an Alzheimer’s mouse model.

- The Company and O-Bank, Co. Ltd. extended the Master Loan and

Security Agreement for $12 Million, by one year. The Extension is

effective July 8, 2024. The Company paid a facility fee of $84,000

for the facility as set out in Form 8-K filed on July 29,

2024.

Ram Mukunda, CEO of IGC Pharma, commented, “The first quarter of

fiscal 2025 was marked by significant milestones in our Alzheimer’s

research portfolio, underscoring our strategic focus on our

innovations. The progress in our Phase 2 clinical trial for

IGC-AD1, highlighted by interim data demonstrating a clinically

significant reduction in agitation, validates the immense potential

of our lead investigational drug. Additionally, the positive

pre-clinical outcomes for TGR-63 underscore its promise as a

transformative therapy for Alzheimer’s, advancing us closer to

delivering a novel solution for this critical unmet need. We are

strategically positioned to continue expanding our clinical trial

footprint and patient enrollment throughout fiscal 2025 as we

continue to drive toward commercialization while maximizing

operational efficiency and leveraging our unique vertically

integrated model.”

Financial Summary

During the three months ended June 30, 3024, the Company

generated approximately $272 thousand in revenue, representing a

decrease of 51% compared to the approximately $555 thousand

generated during the three months ended June 30, 2023. The decrease

in revenue is attributed to the completion of our legacy

Infrastructure project in India as well as some white-label project

in the U.S., both of which comprised approximately 50% of the June

2023 revenue. The Company is committed to its current strategy of

driving sales in formulations in the Life Science segment.

The Company reported Selling, General, and Administrative

(“SG&A”) expenses during the three months ended June 30, 2024,

of approximately $1.7 million, representing an increase of

approximately $23 thousand, or 1%, compared to the three months

ended June 30, 2023.

During the three months ended June 30, 2024, the Company

reported Research and Development (“R&D”) expenses of

approximately $889 thousand, representing an increase of

approximately $142 thousand or 19% compared to the three months

ended June 30, 2023. The increase is primarily attributable to the

progression of Phase 2 trials on IGC-AD1 and pre-clinical studies

on the other small molecule assets. We anticipate increased R&D

expenses as the development of our other small molecule assets

targeting Alzheimer’s and the Phase 2 trial on Alzheimer’s

expand.

The net loss for the three months ended June 30, 2024, was

approximately $2.4 million or $0.03 per share, compared to

approximately $2.1 million or $0.04 per share for three months

ended June 30, 2023.

As of June 30, 2024, the Company has not used any of the $12

million available under the Credit Agreement with O-Bank.

About IGC Pharma (dba IGC):

IGC Pharma is an AI-powered, clinical-stage biotechnology

company focused on developing innovative treatments for Alzheimer's

disease with the mission to transform patient care with

fast-acting, safe, and effective solutions. Our portfolio includes

the TGR family, including TGR-63, which targets amyloid plaques, a

hallmark of Alzheimer's. The IGC-C and IGC-M platforms are

advancing in preclinical stages, focusing on tau proteins, early

plaque formation, and multiple disease hallmarks. Our lead

therapeutic candidate, IGC-AD1, is a cannabinoid-based treatment

currently in a Phase 2 trial for agitation in dementia associated

with Alzheimer’s (clinicaltrials.gov, NCT05543681). Interim data

for IGC-AD1 demonstrated that it has the potential to transform

patient care by offering faster-acting and more effective relief

compared to traditional medications. Additionally, our AI models

are designed to predict potential biomarkers for the early

detection of Alzheimer's, optimize clinical trials, and predict

affinity to other neurological disorders, GLP-1, GIP, CB1

receptors, among others. With 28 patent filings and a commitment to

innovation, IGC Pharma is dedicated to advancing pharmaceutical

treatments and improving the lives of those affected by Alzheimer’s

and related conditions.

Forward-looking Statements

This press release contains forward-looking statements. These

forward-looking statements are based largely on IGC Pharma’s

expectations and are subject to several risks and uncertainties,

certain of which are beyond IGC Pharma’s control. Actual results

could differ materially from these forward-looking statements as a

result of, among other factors, the Company’s failure or inability

to commercialize one or more of the Company’s products or

technologies, including the products or formulations described in

this release, or failure to obtain regulatory approval for the

products or formulations, where required, or government regulations

affecting AI or the AI algorithms not working as intended or

producing accurate predictions; general economic conditions that

are less favorable than expected; the FDA’s general position

regarding cannabis- and hemp-based products; and other factors,

many of which are discussed in IGC Pharma’s U.S. Securities and

Exchange Commission (“SEC”) filings. IGC incorporates by reference

its Annual Report on Form 10-K filed with the SEC on June 24, 2024,

and on Form 10-Q filed with the SEC on August 07, 2024, as if fully

incorporated and restated herein. Considering these risks and

uncertainties, there can be no assurance that the forward-looking

information contained in this release will occur.

IGC Pharma, Inc.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands, except share

data)

(Unaudited)

June 30, 2024

($)

March 31, 2024 ($)

ASSETS

Current assets:

Cash and cash equivalents

1,824

1,198

Accounts receivable, net

28

39

Inventory

1,510

1,540

Asset held for sale

720

720

Deposits and advances

325

208

Total current assets

4,407

3,705

Non-current assets:

Intangible assets, net

1,720

1,616

Property, plant, and equipment, net

3,586

3,695

Claims and advances

688

688

Operating lease asset

193

198

Total non-current assets

6,187

6,197

Total assets

10,594

9,902

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current liabilities:

Accounts payable

771

773

Accrued liabilities and others

1,718

1,567

Total current liabilities

2,489

2,340

Non-current liabilities:

Long-term loans

136

137

Other liabilities

20

20

Operating lease liability

69

84

Total non-current liabilities

225

241

Total liabilities

2,714

2,581

Commitments and Contingencies –

See Note 12

Stockholders’ equity:

Preferred stock, $0.0001 par value:

authorized 1,000,000 shares, no shares issued or outstanding as of

June 30, 2024, and March 31, 2024.

Common stock and additional paid-in

capital, $0.0001 par value: 150,000,000 shares authorized;

75,636,419 and 66,691,195 shares issued and outstanding as of June

30, 2024, and March 31, 2024, respectively.

127,349

124,409

Accumulated other comprehensive loss

(3,426

)

(3,423

)

Accumulated deficit

(116,043

)

(113,665

)

Total stockholders’

equity

7,880

7,321

Total liabilities and stockholders’

equity

10,594

9,902

These financial statements should be read in

connection with the accompanying notes on Form 10-Q for the quarter

ended June 30, 2024, filed with the SEC on August 07, 2024.

IGC Pharma, Inc.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(in thousands, except loss per

share and share data)

(Unaudited)

Three months ended June

30,

2024

($)

2023

($)

Revenue

272

555

Cost of revenue

(109

)

(300

)

Gross profit

163

255

Selling, general and administrative

expenses

(1,670

)

(1,647

)

Research and development expenses

(889

)

(747

)

Operating loss

(2,396

)

(2,139

)

Other income, net

18

64

Loss before income taxes

(2,378

)

(2,075

)

Income tax expense/benefit

-

-

Net loss attributable to common

stockholders

(2,378

)

(2,075

)

Foreign currency translation

adjustments

(3

)

9

Comprehensive loss

(2,381

)

(2,066

)

Loss per share attributable to common

stockholders:

Basic and diluted

$

(0.03

)

$

(0.04

)

Weighted-average number of shares used in

computing loss per share amounts:

72,813,538

53,077,436

These financial statements should be read in

connection with the accompanying notes on Form 10-Q for the quarter

ended June 30, 2024, and was filed with the SEC on August 07,

2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240808215193/en/

Rosalyn Christian IMS Investor Relations (203) 972-9200

igc@imsinvestorrelations.com

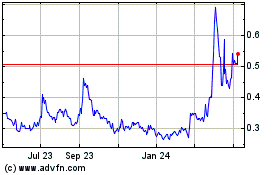

IGC Pharma (AMEX:IGC)

Historical Stock Chart

From Jan 2025 to Feb 2025

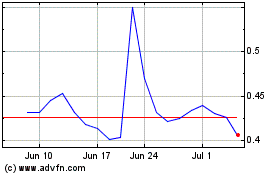

IGC Pharma (AMEX:IGC)

Historical Stock Chart

From Feb 2024 to Feb 2025