Cohen & Company Reports Second Quarter 2019 Financial Results

August 02 2019 - 8:00AM

Cohen & Company Inc. (NYSE American: COHN), a financial

services firm specializing in fixed income markets, today reported

financial results for its second quarter ended June 30, 2019.

Summary Operating Results

| |

Three Months Ended |

|

Six Months Ended |

| ($ in thousands) |

6/30/19 |

|

3/31/19 |

|

6/30/18 |

|

6/30/19 |

|

6/30/18 |

| |

|

|

|

|

|

|

|

|

|

|

Total revenues |

$ |

11,169 |

|

|

$ |

11,145 |

|

|

$ |

12,190 |

|

|

$ |

22,309 |

|

|

$ |

21,528 |

|

| Compensation and benefits |

|

6,432 |

|

|

|

6,364 |

|

|

|

6,589 |

|

|

|

12,796 |

|

|

|

11,783 |

|

| Non-compensation operating

expenses |

|

4,219 |

|

|

|

4,844 |

|

|

|

4,226 |

|

|

|

9,063 |

|

|

|

8,730 |

|

| Operating income |

|

518 |

|

|

|

(63 |

) |

|

|

1,375 |

|

|

|

450 |

|

|

|

1,015 |

|

| Interest expense, net |

|

(1,939 |

) |

|

|

(1,859 |

) |

|

|

(2,201 |

) |

|

|

(3,793 |

) |

|

|

(4,020 |

) |

| Income (loss) from equity

method affiliates |

|

(248 |

) |

|

|

(8 |

) |

|

|

- |

|

|

|

(256 |

) |

|

|

- |

|

| Income (loss) before income

tax expense (benefit) |

|

(1,669 |

) |

|

|

(1,930 |

) |

|

|

(826 |

) |

|

|

(3,599 |

) |

|

|

(3,005 |

) |

| Income tax expense

(benefit) |

|

(641 |

) |

|

|

(106 |

) |

|

|

(636 |

) |

|

|

(747 |

) |

|

|

(664 |

) |

| Net income (loss) |

|

(1,028 |

) |

|

|

(1,824 |

) |

|

|

(190 |

) |

|

|

(2,852 |

) |

|

|

(2,341 |

) |

| Less: Net income (loss)

attributable to the noncontrolling interest |

|

(618 |

) |

|

|

(622 |

) |

|

|

(270 |

) |

|

|

(1,240 |

) |

|

|

(947 |

) |

| Net income (loss) attributable

to Cohen & Company Inc. |

$ |

(410 |

) |

|

$ |

(1,202 |

) |

|

$ |

80 |

|

|

$ |

(1,612 |

) |

|

$ |

(1,394 |

) |

| Fully diluted net income

(loss) per share |

$ |

(0.36 |

) |

|

$ |

(1.06 |

) |

|

$ |

0.07 |

|

|

$ |

(1.42 |

) |

|

$ |

(1.19 |

) |

| |

- Revenues during the three months

ended June 30, 2019 increased $24 thousand from the prior quarter

and decreased $1.0 million from the prior year quarter. - The

decrease from the prior year quarter was comprised primarily of (i)

a decrease of $1.5 million in asset management revenue due

primarily to the successful auction and liquidation of one of the

Company’s European CDOs in June 2018 as well as one-time incentive

fees received from our European accounts in the prior-year quarter,

and (ii) a decrease of $0.9 million in principal transactions due

to less revenue from the Company’s CLO equity and EuroDekania

investments; partially offset by (iii) an increase of $1.5 million

in net trading from higher trading activity primarily in

municipals, mortgages, and GCF matched book repo.

- Compensation and benefits expense

as a percentage of revenue was 58% for the three months ended June

30, 2019, compared to 57% for the three months ended March 31,

2019, and 54% for the three months ended June 30, 2018. The number

of Cohen & Company employees was 91 as of June 30, 2019,

compared to 88 as of March 31, 2019, and 87 as of June 30,

2018.

- Non-compensation operating expenses

during the three months ended June 30, 2019 decreased $625 thousand

from the prior quarter and were comparable to the prior year

quarter. The decrease from the prior quarter was primarily due to

higher professional fees in the prior quarter.

- Interest expense during the three

months ended June 30, 2019 increased $80 thousand from the prior

quarter and decreased $262 thousand from the prior year quarter.

The changes in both periods were due to interest on redeemable

financial instruments, which is driven by certain groups’ revenue

or profit.

- Income (loss) from equity method

investments relates to the Company-sponsored insurance SPAC, which

completed its initial public offering in March 2019, and has

eighteen months from its initial public offering to consummate a

business combination.

Total Equity and Dividend Suspension

- As of June 30, 2019, total equity

was $41.6 million, compared to $42.4 million as of December 31,

2018.

- The Company’s Board of Directors

has suspended the quarterly dividend. The Board of Directors will

continue to evaluate the dividend policy each quarter, and future

decisions as to whether to pay a dividend will be impacted by

quarterly operating results and the Company’s capital needs.

Lester Brafman, Chief Executive Officer of Cohen

& Company, said, “Although our overall results during the

second quarter fell short of our expectations, we are pleased with

the growth of our TBA, Gestational Repo, and GCF Repo businesses.

The Board’s decision to suspend the quarterly dividend will allow

the Company to focus on preserving its cash and deploying its

capital on new business initiatives, which we believe will generate

long-term value for our shareholders.”

Conference Call

Management will hold a conference call this

morning at 10:00 a.m. Eastern Time to discuss these results. The

conference call will also be available via webcast. Interested

parties can access the webcast by clicking the webcast link on the

Company’s website at www.cohenandcompany.com. Those wishing to

listen to the conference call with operator assistance can dial

(877) 686-9573 (domestic) or (706) 643-6983 (international),

participant pass code 1399022, or request the Cohen & Company

earnings call. A replay of the call will be available for two weeks

following the call by dialing (800) 585-8367 (domestic) or (404)

537-3406 (international), participant pass code 1399022.

About Cohen & Company

Cohen & Company is a financial services

company specializing in fixed income markets. It was founded in

1999 as an investment firm focused on small-cap banking

institutions but has grown to provide an expanding range of capital

markets and asset management services. Cohen & Company’s

operating segments are Capital Markets, Asset Management, and

Principal Investing. The Capital Markets segment consists of fixed

income sales, trading, and matched book repo financing as well as

new issue placements in corporate and securitized products, and

advisory services, operating primarily through Cohen &

Company’s subsidiaries, J.V.B. Financial Group, LLC in the United

States and Cohen & Company Financial Limited in Europe. The

Asset Management segment manages assets through collateralized debt

obligations, managed accounts, and investment funds. As of June 30,

2019, the Company managed approximately $2.8 billion in fixed

income assets in a variety of asset classes including US and

European trust preferred securities, subordinated debt, and

corporate loans. As of June 30, 2019, 82.7% of the Company’s assets

under management were in collateralized debt obligations that Cohen

& Company manages, which were all securitized prior to 2008.

The Principal Investing segment is comprised primarily of

investments that we have made for the purpose of earning an

investment return rather than investments made to support our

trading, matched book repo, or other capital markets business

activity. For more information, please visit

www.cohenandcompany.com.

Forward-looking Statements

This communication contains certain statements,

estimates, and forecasts with respect to future performance and

events. These statements, estimates, and forecasts are

“forward-looking statements.” In some cases, forward-looking

statements can be identified by the use of forward-looking

terminology such as “may,” “might,” “will,” “should,” “expect,”

“plan,” “anticipate,” “believe,” “estimate,” “predict,”

“potential,” “seek,” or “continue” or the negatives thereof or

variations thereon or similar terminology. All statements other

than statements of historical fact included in this communication

are forward-looking statements and are based on various underlying

assumptions and expectations and are subject to known and unknown

risks, uncertainties, and assumptions, and may include projections

of our future financial performance based on our growth strategies

and anticipated trends in our business. These statements are based

on our current expectations and projections about future events.

There are important factors that could cause our actual results,

level of activity, performance, or achievements to differ

materially from the results, level of activity, performance, or

achievements expressed or implied in the forward-looking statements

including, but not limited to, those discussed under the heading

“Risk Factors” and “Management’s Discussion and Analysis of

Financial Condition” in our filings with the Securities and

Exchange Commission (“SEC”), which are available at the SEC’s

website at www.sec.gov and our website at

www.cohenandcompany.com/investor-relations/sec-filings. Such risk

factors include the following: (a) a decline in general economic

conditions or the global financial markets, (b) losses caused by

financial or other problems experienced by third parties, (c)

losses due to unidentified or unanticipated risks, (d) a lack of

liquidity, i.e., ready access to funds for use in our businesses,

(e) the ability to attract and retain personnel, (f) litigation and

regulatory issues, (g) competitive pressure, (h) an inability to

generate incremental income from new or expanded businesses, (i)

unanticipated market closures due to inclement weather or other

disasters, (j) losses (whether realized or unrealized) on our

principal investments, including on our CLO investments, (k) the

possibility that payments to the Company of subordinated management

fees from its European CLO will continue to be deferred or will be

discontinued, and (l) the possibility that the stockholder rights

plan may fail to preserve the value of the Company’s deferred tax

assets, whether as a result of the acquisition by a person of 5% of

the Company’s common stock or otherwise. As a result, there can be

no assurance that the forward-looking statements included in this

communication will prove to be accurate or correct. In light of

these risks, uncertainties, and assumptions, the future performance

or events described in the forward-looking statements in this

communication might not occur. Accordingly, you should not rely

upon forward-looking statements as a prediction of actual results

and we do not undertake any obligation to update any

forward-looking statements, whether as a result of new information,

future events, or otherwise.

Cautionary Note Regarding Quarterly Financial

Results

Due to the nature of our business, our revenue

and operating results may fluctuate materially from quarter to

quarter. Accordingly, revenue and net income in any

particular quarter may not be indicative of future results.

Further, our employee compensation arrangements are in large part

incentive-based and, therefore, will fluctuate with revenue. The

amount of compensation expense recognized in any one quarter may

not be indicative of such expense in future periods. As a

result, we suggest that annual results may be the most meaningful

gauge for investors in evaluating our business performance.

|

COHEN & COMPANY INC. |

|

CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited) |

|

(in thousands, except per share data) |

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

|

|

6/30/19 |

|

3/31/19 |

|

6/30/18 |

|

6/30/19 |

|

6/30/18 |

|

|

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net trading |

$ |

8,670 |

|

|

$ |

8,729 |

|

|

$ |

7,186 |

|

|

$ |

17,394 |

|

|

$ |

13,377 |

|

|

|

|

Asset management |

|

1,745 |

|

|

|

2,002 |

|

|

|

3,205 |

|

|

|

3,747 |

|

|

|

5,009 |

|

|

|

|

New issue and advisory |

|

- |

|

|

|

- |

|

|

|

177 |

|

|

|

- |

|

|

|

873 |

|

|

|

|

Principal transactions |

|

585 |

|

|

|

350 |

|

|

|

1,443 |

|

|

|

935 |

|

|

|

1,892 |

|

|

|

|

Other revenue |

|

169 |

|

|

|

64 |

|

|

|

179 |

|

|

|

233 |

|

|

|

377 |

|

|

|

|

Total revenues |

|

11,169 |

|

|

|

11,145 |

|

|

|

12,190 |

|

|

|

22,309 |

|

|

|

21,528 |

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Compensation and benefits |

|

6,432 |

|

|

|

6,364 |

|

|

|

6,589 |

|

|

|

12,796 |

|

|

|

11,783 |

|

|

|

|

Business development, occupancy, equipment |

|

895 |

|

|

|

811 |

|

|

|

644 |

|

|

|

1,706 |

|

|

|

1,511 |

|

|

|

|

Subscriptions, clearing, and execution |

|

2,056 |

|

|

|

2,273 |

|

|

|

2,151 |

|

|

|

4,329 |

|

|

|

3,985 |

|

|

|

|

Professional services and other operating |

|

1,190 |

|

|

|

1,679 |

|

|

|

1,379 |

|

|

|

2,869 |

|

|

|

3,121 |

|

|

|

|

Depreciation and amortization |

|

78 |

|

|

|

81 |

|

|

|

52 |

|

|

|

159 |

|

|

|

113 |

|

|

|

|

Total operating expenses |

|

10,651 |

|

|

|

11,208 |

|

|

|

10,815 |

|

|

|

21,859 |

|

|

|

20,513 |

|

|

|

|

Operating income (loss) |

|

518 |

|

|

|

(63 |

) |

|

|

1,375 |

|

|

|

450 |

|

|

|

1,015 |

|

|

|

|

Non-operating income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

(1,939 |

) |

|

|

(1,859 |

) |

|

|

(2,201 |

) |

|

|

(3,793 |

) |

|

|

(4,020 |

) |

|

|

|

Income (loss) from equity method affiliates |

|

(248 |

) |

|

|

(8 |

) |

|

|

- |

|

|

|

(256 |

) |

|

|

- |

|

|

|

|

Income (loss) before income tax expense (benefit) |

|

(1,669 |

) |

|

|

(1,930 |

) |

|

|

(826 |

) |

|

|

(3,599 |

) |

|

|

(3,005 |

) |

|

|

|

Income tax expense (benefit) |

|

(641 |

) |

|

|

(106 |

) |

|

|

(636 |

) |

|

|

(747 |

) |

|

|

(664 |

) |

|

|

|

Net income (loss) |

|

(1,028 |

) |

|

|

(1,824 |

) |

|

|

(190 |

) |

|

|

(2,852 |

) |

|

|

(2,341 |

) |

|

|

|

Less: Net income (loss) attributable to the noncontrolling

interest |

|

(618 |

) |

|

|

(622 |

) |

|

|

(270 |

) |

|

|

(1,240 |

) |

|

|

(947 |

) |

|

|

|

Net income (loss) attributable to Cohen & Company Inc. |

$ |

(410 |

) |

|

$ |

(1,202 |

) |

|

$ |

80 |

|

|

$ |

(1,612 |

) |

|

$ |

(1,394 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share |

|

|

Basic |

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to Cohen & Company Inc. |

$ |

(410 |

) |

|

$ |

(1,202 |

) |

|

$ |

80 |

|

|

$ |

(1,612 |

) |

|

$ |

(1,394 |

) |

|

|

|

Basic shares outstanding |

|

1,144 |

|

|

|

1,133 |

|

|

|

1,173 |

|

|

|

1,139 |

|

|

|

1,173 |

|

|

|

|

Net income (loss) attributable

to Cohen & Company Inc. per share |

$ |

(0.36 |

) |

|

$ |

(1.06 |

) |

|

$ |

0.07 |

|

|

$ |

(1.42 |

) |

|

$ |

(1.19 |

) |

|

|

|

Fully Diluted |

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to Cohen & Company Inc. |

$ |

(410 |

) |

|

$ |

(1,202 |

) |

|

$ |

80 |

|

|

$ |

(1,612 |

) |

|

$ |

(1,394 |

) |

|

|

|

Net income (loss) attributable to the convertible noncontrolling

interest |

|

(491 |

) |

|

|

(618 |

) |

|

|

(270 |

) |

|

|

(1,109 |

) |

|

|

(947 |

) |

|

|

|

Income tax and conversion adjustment |

|

298 |

|

|

|

53 |

|

|

|

306 |

|

|

|

351 |

|

|

|

313 |

|

|

|

|

Enterprise net income (loss) |

$ |

(603 |

) |

|

$ |

(1,767 |

) |

|

$ |

116 |

|

|

$ |

(2,370 |

) |

|

$ |

(2,028 |

) |

|

|

|

Basic shares outstanding |

|

1,144 |

|

|

|

1,133 |

|

|

|

1,173 |

|

|

|

1,139 |

|

|

|

1,173 |

|

|

|

|

Unrestricted Operating LLC membership units exchangeable into COHN

shares |

|

532 |

|

|

|

532 |

|

|

|

532 |

|

|

|

532 |

|

|

|

532 |

|

|

|

|

Additional dilutive shares |

|

- |

|

|

|

- |

|

|

|

14 |

|

|

|

- |

|

|

|

- |

|

|

|

|

Fully diluted shares outstanding |

|

1,676 |

|

|

|

1,665 |

|

|

|

1,719 |

|

|

|

1,671 |

|

|

|

1,705 |

|

|

|

|

Fully diluted net income (loss) per share |

$ |

(0.36 |

) |

|

$ |

(1.06 |

) |

|

$ |

0.07 |

|

|

$ |

(1.42 |

) |

|

$ |

(1.19 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COHEN & COMPANY INC. |

|

CONSOLIDATED BALANCE SHEETS |

|

(in thousands) |

|

|

|

|

|

|

|

June 30, 2019 |

|

|

|

|

|

(unaudited) |

|

December 31, 2018 |

|

|

|

Assets |

|

|

|

|

Cash and cash equivalents |

$ |

13,077 |

|

|

$ |

14,106 |

|

|

|

|

Receivables from brokers, dealers, and clearing agencies |

|

123,865 |

|

|

|

129,812 |

|

|

|

|

Due from related parties |

|

495 |

|

|

|

793 |

|

|

|

|

Other receivables |

|

7,271 |

|

|

|

12,072 |

|

|

|

|

Investments - trading |

|

237,950 |

|

|

|

301,235 |

|

|

|

|

Other investments, at fair value |

|

7,402 |

|

|

|

13,768 |

|

|

|

|

Receivables under resale agreements |

|

6,054,821 |

|

|

|

7,632,230 |

|

|

|

|

Investment in equity method affiliate |

|

3,519 |

|

|

|

- |

|

|

|

|

Goodwill |

|

7,992 |

|

|

|

7,992 |

|

|

|

|

Right-of-use asset - operating leases |

|

7,773 |

|

|

|

- |

|

|

|

|

Other assets |

|

4,916 |

|

|

|

3,621 |

|

|

|

|

Total assets |

$ |

6,469,081 |

|

|

$ |

8,115,629 |

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

Payables to brokers, dealer, and clearing agencies |

$ |

126,433 |

|

|

$ |

201,598 |

|

|

|

|

Accounts payable and other liabilities |

|

12,663 |

|

|

|

11,452 |

|

|

|

|

Accrued compensation |

|

2,755 |

|

|

|

5,254 |

|

|

|

|

Trading securities sold, not yet purchased |

|

107,636 |

|

|

|

120,122 |

|

|

|

|

Securities sold under agreements to repurchase |

|

6,104,767 |

|

|

|

7,671,764 |

|

|

|

|

Deferred income taxes |

|

1,270 |

|

|

|

2,017 |

|

|

|

|

Lease liability - operating leases |

|

8,338 |

|

|

|

- |

|

|

|

|

Redeemable financial instruments |

|

18,638 |

|

|

|

17,448 |

|

|

|

|

Debt |

|

45,002 |

|

|

|

43,536 |

|

|

|

|

Total liabilities |

|

6,427,502 |

|

|

|

8,073,191 |

|

|

|

|

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

Voting nonconvertible preferred stock |

|

5 |

|

|

|

5 |

|

|

|

|

Common stock |

|

12 |

|

|

|

12 |

|

|

|

|

Additional paid-in capital |

|

68,819 |

|

|

|

68,591 |

|

|

|

|

Accumulated other comprehensive loss |

|

(904 |

) |

|

|

(908 |

) |

|

|

|

Accumulated deficit |

|

(34,077 |

) |

|

|

(31,926 |

) |

|

|

|

Total stockholders' equity |

|

33,855 |

|

|

|

35,774 |

|

|

|

|

Noncontrolling interest |

|

7,724 |

|

|

|

6,664 |

|

|

|

|

Total equity |

|

41,579 |

|

|

|

42,438 |

|

|

|

|

Total liabilities and equity |

$ |

6,469,081 |

|

|

$ |

8,115,629 |

|

|

|

|

|

|

|

|

|

|

Contact: |

|

| |

|

| Investors - |

Media - |

| Cohen & Company Inc. |

Joele Frank, Wilkinson Brimmer Katcher |

| Joseph W. Pooler, Jr. |

James Golden or Andrew Squire |

| Executive Vice President and Chief Financial Officer |

212-355-4449 |

| 215-701-8952 |

jgolden@joelefrank.com or asquire@joelefrank.com |

| investorrelations@cohenandcompany.com |

|

| |

|

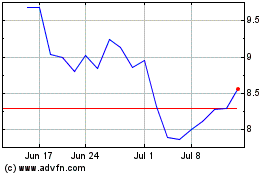

Cohen & (AMEX:COHN)

Historical Stock Chart

From Aug 2024 to Sep 2024

Cohen & (AMEX:COHN)

Historical Stock Chart

From Sep 2023 to Sep 2024