Castellum, Inc. Announces Strong Third Quarter Financial Results Including Record Revenue

November 15 2022 - 6:55AM

Castellum, Inc. (the “Company”) (NYSE-American: CTM), a

cybersecurity, electronic warfare, data analytics, software, and IT

services company focused on the federal government, announces

highlights of its operating results for its third quarter ended

September 30, 2022.

Revenue for the three months ended September 30,

2022 was a record $11.12 million. Gross profit was $4.65 million.

U.S. GAAP (“GAAP”) operating loss inclusive of all non-cash and

non-recurring charges was $2.05 million. Full financial results for

the three and nine months ended September 30, 2022 were published

on November 14, 2022 via Form 10-Q at www.sec.gov.

Management uses a Non-GAAP measure, Recurring Cash

Operating Profit, as an important measure of the Company’s

operating performance. This Non-GAAP measure was approximately

$645,000 for the third quarter and excludes non-cash charges, such

as stock option and warrant expense, of $2.55 million and

non-recurring charges principally related to the Company’s

uplisting to the NYSE American of approximately $150,000. Please

see detail in the chart below.

“We are proud to announce another strong quarter

for Castellum,” said Mark Fuller, President and CEO of

Castellum. “Revenue was a record for the quarter, gross margins

remain strong at north of 40%, and recurring cash operating profit

remains solidly in the black. With our recently announced letter of

intent to acquire a $10 million revenue East Coast company, we are

positioned to make 2023 an even stronger year financially than 2022

for our shareholders.”

Forward-Looking Statements:

This release contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended and Section 21E of the Securities Exchange Act of 1934, as

amended. All forward-looking statements are inherently uncertain,

based on current expectations and assumptions concerning future

events or future performance of the company. Readers are cautioned

not to place undue reliance on these forward-looking statements,

which are only predictions and speak only as of the date hereof. In

evaluating such statements, prospective investors should review

carefully various risks and uncertainties identified in Item 1A.

“Risk Factors” section of the Company’s Form 10-Q and other filings

with the Securities and Exchange Commission which can be viewed at

www.sec.gov. These risks and uncertainties could cause the

Company's actual results to differ materially from those indicated

in the forward-looking statements.

Non-GAAP Financial Measures and Key

Performance Metrics

This press release contains Non-GAAP Recurring

Cash Operating Profit, which is a Non-GAAP financial measure that

is used by management to measure the Company’s operating

performance. A reconciliation of this measure to the most directly

comparable GAAP financial measure is contained herein. To the

extent required, statements disclosing the definition, utility, and

purpose of this measure is also set forth herein.

Definition: Non-GAAP Recurring Cash Operating

Profit represents the Company’s GAAP operating loss excluding

non-cash charges such as stock based compensation, depreciation and

amortization, and change in value of contingent earnout as well as

non-recurring charges related to the Company’s uplisting.

Utility and Purpose: The Company discloses

Non-GAAP Recurring Cash Operating Profit because this Non-GAAP

measure is used by management to evaluate our business, measure its

operating performance, and make strategic decisions. We believe

Non-GAAP Recurring Cash Operating Profit is useful for investors

and others in understanding and evaluating our operating results in

the same manner as its management. However, Non-GAAP Recurring Cash

Operating Profit is not a financial measure calculated in

accordance with GAAP and should not be considered as a substitute

for GAAP operating loss or any other operating performance measure

calculated in accordance with GAAP. Using this Non-GAAP measure to

analyze our business would have material limitations because the

calculations are based on the subjective determination of

management regarding the nature and classification of events and

circumstances that investors may find significant. In addition,

although other companies in our industry may report a measure

titled Non-GAAP Recurring Cash Operating Profit, this measure may

be calculated differently from how we calculate this Non-GAAP

financial measure, which reduces its overall usefulness as a

comparative measure. Because of these inherent limitations, you

should consider Non-GAAP Recurring Cash Operating Profit alongside

other financial performance measures, including net loss and our

other financial results presented in accordance with GAAP.

Castellum, Inc.

Reconciliation of unaudited Non-GAAP Recurring Cash

Operating Profit to Operating Loss Three Months

Ended September 30, 2022

|

Revenues |

|

$ |

11,120,712 |

|

|

Gross profit |

|

|

4,646,451 |

|

|

Operating loss |

|

|

(2,053,185 |

) |

| |

|

|

|

|

Non-cash charges: |

|

|

|

| Depreciation

and amortization |

|

|

514,929 |

|

| Stock based

compensation |

|

|

1,169,955 |

|

| Change in

value of contingent earnout |

|

|

864,000 |

|

|

Total non-cash charges |

|

|

2,548,884 |

|

| |

|

|

|

|

Non-recurring charges |

|

|

|

| Uplisting

fees (a) |

|

|

149,938 |

|

| |

|

|

|

|

Non-GAAP Recurring Cash Operating Profit |

|

$ |

645,637 |

|

(a) Represents non-recurring expenses related to

the Company’s public offering which includes accounting, legal, and

consulting fees.

Contact: Skyline Corporate

Communications Group, LLC Lisa Gray, Senior Account Manager One

Rockefeller Plaza, 11th Floor New York, NY 10020 Office:

646.893.5835 x1 Email: lisa@skylineccg.com;

info@castellumus.com

A photo accompanying this announcement is

available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/96108f2f-61bf-4fa4-9fe0-e651b45d324a

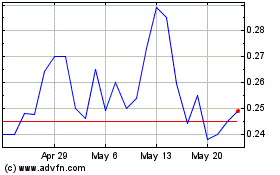

Castellum (AMEX:CTM)

Historical Stock Chart

From Aug 2024 to Sep 2024

Castellum (AMEX:CTM)

Historical Stock Chart

From Sep 2023 to Sep 2024