0000842717false00008427172024-11-062024-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 06, 2024 |

BLUE RIDGE BANKSHARES, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Virginia |

001-39165 |

54-1838100 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1801 Bayberry Court Suite 101 |

|

Richmond, Virginia |

|

23226 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (888) 331-6521 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, no par value |

|

BRBS |

|

NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On November 6, 2024, members of the management of Blue Ridge Bankshares, Inc. (the “Company”) updated its investor presentation in connection with meetings with investors. A copy of the Company’s presentation materials is attached as Exhibit 99.1 to this Current Report on Form 8-K and is being furnished, not filed, under Item 7.01 of this report.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

BLUE RIDGE BANKSHARES, INC. |

|

|

|

|

Date: |

November 6, 2024 |

By: |

/s/ Judy C. Gavant |

|

|

|

Judy C. Gavant

Executive Vice President and

Chief Financial Officer |

© 2024 Blue Ridge Bank, N.A. All Rights Reserved. Blue Ridge Bankshares, Inc.�(NYSE American: BRBS)��Building A Foundation for Value �and Growth���November 2024 MYBRB.BANK Exhibit 99.1

Forward Looking Statements Forward Looking Statements This presentation of Blue Ridge Bankshares, Inc. (the “Company” or “Blue Ridge”) contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements represent plans, estimates, objectives, goals, guidelines, expectations, intentions, projections, and statements of the Company’s beliefs concerning future events, business plans, objectives, expected operating results and the assumptions upon which those statements are based. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance or achievements, and are typically identified with words such as “may,” “could,” “should,” “will,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “aim,” “intend,” “plan,” or words or phases of similar meaning. The Company cautions that the forward-looking statements are based largely on its expectations and are subject to a number of known and unknown risks and uncertainties that are subject to change based on factors which are, in many instances, beyond the Company’s control. Actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements. The following factors, among others, could cause the Company’s financial performance to differ materially from that expressed in such forward-looking statements: (i) the strength of the United States economy in general and the strength of the local economies in which the Company conducts operations; (ii) the effects of, and changes in, the macroeconomic environment and financial market conditions, including monetary and fiscal policies, interest rates and inflation; (iii) the impact of, and the ability to comply with, the terms of the Consent Order with the OCC, including the heightened capital requirements and other restrictions therein, and other regulatory directives; (iv) the imposition of additional regulatory actions or restrictions for noncompliance with the Consent Order or otherwise; (v) the Company’s involvement in, and the outcome of, any litigation, legal proceedings or enforcement actions that may be instituted against the Company; (vi) reputational risk and potential adverse reactions of the Company’s customers, suppliers, employees, or other business partners; (vii) the Company’s ability to manage its fintech relationships, including implementing enhanced controls and procedures, complying with OCC directives and applicable laws and regulations, maintaining deposit levels and the quality of loans associated with these relationships and, in certain cases, winding down certain of these partnerships; (viii) the quality and composition of the Company’s loan and investment portfolios, including changes in the level of the Company’s nonperforming assets and charge-offs; (ix) the Company’s management of risks inherent in its loan portfolio, the credit quality of its borrowers, and the risk of a prolonged downturn in the real estate market, which could impair the value of the Company’s collateral and its ability to sell collateral upon any foreclosure; (x) the ability to maintain adequate liquidity by retaining deposits and secondary funding sources, especially if the Company's or the banking industry's reputation becomes damaged; (xi) the ability to maintain capital levels adequate to support the Company's business and to comply with OCC directives; (xii) the timely development of competitive new products and services and the acceptance of these products and services by new and existing customers; (xiii) changes in consumer spending and savings habits; (xiv) the willingness of users to substitute competitors’ products and services for the Company’s products and services; (xv) deposit flows; (xvi) changes in technological and social media; (xvii) potential exposure to fraud, negligence, computer theft, and cyber-crime; (xviii) adverse developments in the banking industry generally, such as recent bank failures, responsive measures to mitigate and manage such developments, related supervisory and regulatory actions and costs, and related impacts on customer and client behavior; (xix) changing bank regulatory conditions, policies or programs, whether arising as new legislation or regulatory initiatives, that could lead to restrictions on activities of banks generally, or Blue Ridge Bank in particular, more restrictive regulatory capital requirements, increased costs, including deposit insurance premiums, regulation or prohibition of certain income producing activities or changes in the secondary market for loans and other products; (xx) the impact of changes in financial services policies, laws, and regulations, including laws, regulations, and policies concerning taxes, banking, securities, real estate, and insurance, and the application thereof by regulatory bodies; (xxi) the effect of changes in accounting standards, policies, and practices as may be adopted from time to time; (xxii) estimates of the fair value and other accounting values, subject to impairment assessments, of certain of the Company’s assets and liabilities; (xxiii) geopolitical conditions, including acts or threats of terrorism and/or military conflicts, or actions taken by the United States or other governments in response to acts or threats of terrorism and/or military conflicts, which could impact business and economic conditions in the United States and abroad; (xxiv) the occurrence or continuation of widespread health emergencies or pandemics, significant natural disasters, severe weather conditions, floods and other catastrophic events; and (xxv) other risks and factors identified in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” sections and elsewhere in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, Quarterly Report on Form 10-Q for the most recently ended fiscal quarter and in filings the Company makes from time to time with the U.S. Securities and Exchange Commission (“SEC”). The foregoing factors should not be considered exhaustive and should be read together with other cautionary statements that are included in filings the Company makes from time to time with the SEC. Any one of these risks or factors could have a material adverse impact on the Company’s results of operations or financial condition, or cause the Company’s actual results, performance or achievements to differ materially from those expressed in, or implied by, forward-looking information and statements contained in this presentation. Moreover, new risks and uncertainties emerge from time to time, and it is not possible for the Company to predict all risks and uncertainties that could have an impact on its forward-looking statements. Therefore, the Company cautions not to place undue reliance on its forward-looking information and statements, which speak only as of the date of this presentation. The Company does not undertake to, and will not, update or revise these forward-looking statements after the date hereof, whether as a result of new information, future events, or otherwise. Non-GAAP Financial Measures The accounting and reporting policies of the Company conform to U.S. generally accepted accounting principles (“GAAP”) and prevailing practices in the banking industry. However, management uses certain non-GAAP measures, including tangible common equity and tangible book value per share, to supplement the evaluation of the Company’s financial condition and performance. Management believes presentations of these non-GAAP financial measures provide useful supplemental information that is essential to a proper understanding of the financial condition, capital position and operating results of the Company’s core businesses. These non-GAAP disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Reconciliations of GAAP to non-GAAP measures are included at the end of this presentation.

Enterprise Value Proposition Deposit market share data as of June 30, 2024 CNBC’s 2024 annual state competitiveness rankings Core deposits exclude fintech-related and brokered deposits Virginia named Best State for Business, its third victory in five years. 2 Attractive Growth Market Executive leaders with diverse expertise and proven success. Highly Experienced Leadership Limited number of statewide community focused franchises in Virginia. Unique Franchise Multiple revenue streams from commercial and consumer banking, wealth management, and mortgage banking. Diversified Income Stream Ranked 5th in Virginia deposit market share of banks without regional or national focus. 1 Strong Market Position Sticky core deposits and solid capital levels. 3 Resilient Balance Sheet

Deposit market share data as of June 30, 2024 Virginia Deposit Market Share (Top 20)¹ Strong Market Position Enterprise Value Proposition Ranked 5th in Virginia deposit market share of banks headquartered in Virginia without a regional or national focus Ranked 9th in Virginia deposit market share of banks headquartered in Virginia Ranked 17th in Virginia deposit market share overall

Enterprise Value Proposition Attractive Growth Market (27 branches, 3 LPOs) (10 offices) Winchester Luray Harrisonburg Charlottesville Richmond Northern Neck Virginia Beach Durham Greensboro Charlotte Wilmington Fredericksburg Martinsville Bank Branch Mortgage Office LPO Norfolk Virginia North Carolina Number of Small Businesses¹ Projected Population Growth (2024 - 2029) Median Household Income Suffolk Gastonia Orange Small business as defined by the US Small Business Association. Data reflects the US Census Bureau Statistic of US Businesses (“SUSB”) data set. Source: S&P Capital IQ Pro; U.S. Census Bureau; Company Website, November 2024.

President and Chief Executive Officer of Blue Ridge Bankshares, Inc. since July 2023 and Chief Executive Officer of Blue Ridge Bank since May 2023 President and Chief Executive Officer of Community Bankers Bank from November 2018 to July 2020 Chief Executive Officer of Union Bank & Trust (now known as Atlantic Union Bank) from 1991 until 2017 Executive and commercial lender for Capital Bank and Security Bank from 1971 to 1989 Graduated from the Southwestern Graduate School of Banking at Southern Methodist University in 1981 and received a Bachelor of Science in Business Administration from The Citadel in 1971 G. William Beale, President & CEO President and Board Member of Blue Ridge Bank since April 2022 and EVP and Chief Financial Officer of the Company since February 2021. Previously was EVP and Chief Financial Officer of Bay Banks of Virginia, Inc. from 2018 until its acquisition by Blue Ridge SVP, Chief Accounting Officer of Xenith Bankshares, Inc. from 2010 to 2018, from start-up to sale, and through numerous mergers and acquisitions Held leadership roles with Fortune 500 companies and startups, and served in the audit and tax practices of PricewaterhouseCoopers LLP Received a B.S. in Accounting, Louisiana State University; Masters of Taxation, Virginia Commonwealth University Judy C. Gavant, Chief Financial Officer Senior Operations and Technology Officer of Blue Ridge Bank since August 2023 Previously was a Managing Partner with a professional services company, providing interim and fractional C-suite services focused on digital transformation and cyber-security management Oversaw the enterprise operations and information technology functions at a local regional bank helping them grow from $6B to $20B over 7 years Over 30 years dedicated to building and managing enterprise level Information systems and operations Dean Brown, Senior Operations & Technology Officer Chief Credit Officer of Blue Ridge Bank since January 2024 38 year Commercial Banking career with Wachovia (7), SunTrust (18) , and Capital One (13) in North Carolina, Virginia and Maryland markets. 30+ years in senior level Credit Risk leadership roles covering Credit Policy, Portfolio Management, Problem Loan workouts, and Underwriting for CRE and C&I lending. Graduated Cum Laude from Washington & Lee University with a B.S. in Business Administration and completed the Advanced Risk Management Program at Wharton Harry Golliday, Chief Credit Officer Ray Knott, Deputy Commercial Banking Executive Previously served as Senior Vice President Market President for Atlantic Union Bank where he led the commercial banking teams for Northern Virginia and the Northern Valley. Held roles in commercial banking leadership with BB&T and F&M National covering multiple markets of Virginia. Over 30 years of commercial banking experience. Graduated from the Graduate School of Banking at Louisiana State University in 2006 and received a Bachelor of Science in Business Administration – Finance form Longwood University in 1991. Enterprise Value Proposition Highly Experienced Leadership

Deposit Composition (9/30/2024 - $000) Total Deposits ($000): $2,346,491 Q3 2024 Cost of Deposits1 : 2.91% Annualized Well-capitalized minimum ratios as defined by Prompt Corrective Action: Tier 1 Leverage ratio of 5.0%, CET1 ratio of 6.5%, Tier 1 ratio of 8.0%, and Total Capital ratio of 10.0%. See the Company’s Quarterly Report on Form 10-Q for the period ended September 30, 2024 for information regarding enhanced capital requirements applicable to the Bank. Bank Level Capital Ratios 2 (9/30/2024) Resilient Balance Sheet Enterprise Value Proposition

Strategic Focus Two fundamental pillars: Strengthen the Foundation and Grow the Community Bank.

Strategic Focus Remediate Regulatory Order Delivered Strategic Plan Delivered Capital Plan Delivered BSA lookback Implementing enhanced BSA monitoring system Re-scoping and accelerating internal audits in areas of regulatory concern Establish a Strong Credit Culture Worked through problem specialty finance loans in portfolio Hired new Chief Credit Officer Established revised Loan Policy Established a Credit Policy & Risk Committee Restructured reporting relationships in Credit and Lending Refine the Fintech Line of Business Exiting Banking-as-a-Service (“BaaS”) deposit channel Active BaaS subpartners reduced from 45 to 1 during 2024 year-to-date BaaS deposit balances reduced from $371 million to $64 million during 2024 year-to-date Reviewing fintech lending relationships for risk appetite Create an ERM Structure Hired new Chief Risk Officer Hired new Bank Secrecy Act (BSA) Officer Hired new Chief Compliance Officer Established revised Third Party Risk Management (TPRM) Policy & Procedures Strengthen the Foundation

Refine the Fintech Line of Business Exiting Banking-as-a-Service (“BaaS”) deposit channel Active BaaS subpartners reduced from 45 to 1 during 2024 year-to-date BaaS deposit balances reduced from $371 million to $64 million during 2024 year-to-date Reviewing fintech lending relationships for risk appetite Strategic Focus Strengthen the Foundation Fintech BaaS Deposits Trend Fintech BaaS Partners Trend

Establish a Strong Credit Culture Worked through problem specialty finance loans in portfolio Hired new Chief Credit Officer Established revised Loan Policy Established a Credit Policy & Risk Committee Restructured reporting relationships in Credit and Lending Note: Peer group represents Peer Group 3 from the FFIEC’s Uniform Bank Performance Report As of September 30, 2023, two large relationships within specialty finance comprised the majority of nonperforming loans: a commercial loan with $32.8 million outstanding a relationship consisting of similarly structured loans with $15.4 million outstanding. As of September 30, 2024, these relationships have been fully paid off/charged off. The $32.8 million commercial loan was reclassified to held for sale in Q2 2024, as the Company entered into an agreement to sell the loan. In Q3 2024, all amounts owed pursuant to the loan sale agreement were received and the Company recorded an $8.4 million recovery. Strategic Focus Strengthen the Foundation Nonperforming Loans Trend Allowance for Credit Losses Trend

Grow the Core Banking Business Purposely and selectively reduced out-of-footprint loans and transactional lending relationships Grew in-market customer deposits Hired new commercial banking leader Reduced certain assets to reposition and enhance future earnings Conducted customer survey to establish baseline for brand acceptance and marketing strategy Streamline the Business Mix Narrowed lending scope from national government guaranteed lending, middle market lending, and specialty finance to traditional commercial lending to communities within the Bank’s footprint Project to streamline deposit product offerings and align fees with market Streamlining other noninterest income businesses Achieve Operational Excellence Process efficiency project underway Headcount reductions through re-alignment of business lines Multi-year plan to significantly reduce noninterest expense with steering committee oversight Noninterest expense goal of 2.5% of assets Invest in our People Hired a new Chief Human Resource Officer Established job architecture Improved transparency around roles and responsibilities Established training department Strategic Focus Grow the Community Bank

Grow the Core Banking Business Purposely and selectively reduced out-of-footprint loans and transactional lending relationships Grew in-market customer deposits Hired new commercial banking leader Reduced certain assets to reposition and enhance future earnings Conducted customer survey to establish baseline for brand acceptance and marketing strategy Strategic Focus Grow the Community Bank Total Assets & Loans, Held For Investment Trend Deposit Composition Trend

Achieve Operational Excellence Process efficiency project underway Headcount reductions through re-alignment of business lines Multi-year plan to significantly reduce noninterest expense with steering committee oversight Noninterest expense goal of 2.5% of assets Strategic Focus Grow the Community Bank Expected Noninterest Expenses 1,2 Actuals for 2023 exclude goodwill impairment charge of $26.8 million, which was the entirety of the goodwill balance Actuals for 2024 represent total noninterest expenses for the nine months ended September 30, 2024

APPENDIX

CEO of Rainbow Station, Inc. and PRISM, LLC. Previously held positions at NationsBank Capital Markets, First Union/Wheat First Securities, and Shockoe Capital, LLC (Managing Partner & Founder) Previously served on the board of directors of Bay Banks of Virginia, Inc. Chief Financial Officer of Bio-Cat, Inc., a high-quality enzyme manufacturer based in Virginia since 2009 Previously spent over 20 years in commercial banking, including as SVP and Area Executive for the Charlottesville market for StellarOne Bank (now Atlantic Union Bank) Private investor and real estate developer based in North Carolina Previously served on the board of directors of River Bancorp, Inc. Spent over 10 years at Electra Partners, Merrill Lynch, and Price Waterhouse (now PwC) MBA from MIT and a Master of Public Administration from Harvard University Retired partner from the accounting firm FORVIS LLP Certified Public Accountant licensed in North Carolina Member of the American Institute of Certified Public Accountants and the National Association of Corporate Directors Served as President of Rappahannock Community College (“RCC”) and is President Emerita of RCC Member of the boards of directors of Bon Secours Mercy Richmond Health System, Lilian Lumber Company, and Northern Neck Insurance Company Founder and Managing Member of West Potomac Capital LLC Over 20 years experience in investment banking and portfolio management focused on the financial services sector, including 3 years in public service as the Chief Investment Officer at the U.S. Department of the Treasury from 2014-2017 Serves as a member of the Economic Club of Washington D.C. and Board of Trustees for the George Mason University Foundation, Inc. Chairman and CEO of Bancorp 34, Inc. since April 2024 Served in various chief executive and chief financial officer roles for domestic and international and multinational financial institutions Currently on the board of the Greater Phoenix Economic Council See Overview of the Management Team Vance H. Spillman Chairman of the Board Hunter H. Bost Director William S. Stokes Vice Chairman of the Board G. William Beale President, CEO, & Director Heather M. Cozart Director Ciaran McMullan Director Elizabeth H. Crowther Director Trevor Montano Director Board of Directors

President of Woodruff Family Law Group in North Carolina CPA licensed in the state of North Carolina and an expert in the area of business valuation Frequent writer and lecturer on business valuation and federal taxation Managing Principal and Investment Committee member of Castle Creek Capital, LLC Director of various financial institutions including McGregor Bancshares, First Bancshares of Texas, Texas Community Bancshares, and Central Payments, LLC Member of Board of Trustees for the Dallas Police and Fire Pension System and CFA Society of Dallas/Fort Worth Sales Director of the Southeast Financial Services unit at ServiceNow Over 30 years of financial services experience, primarily as a sales leader helping financial services clients leverage technology to transform business operations Previously held many roles at IBM over 36 years, including as the Client Unit Director of the Mid-Atlantic Financial Services business Started his security career with the CIA, where he designed security training programs and led training teams Founded the security company OMNIPLEX World Services Corp., where he was Chairman of the Board Served on many other business’ boards, including that of Northern Neck Insurance Company and the Virginia Chamber of Commerce (Chairman) Partner at Reynolds Development Company, a private real estate management and development company Serves on the boards of Longwood College School of Business and the 1-800 Got Junk Virginia Advisory Board Tony Scavuzzo Director Julien G. Patterson Director Otis S. Jones Director Carolyn J. Woodruff Director Randolph N. Reynolds Jr. Director Board of Directors

Quarterly Summary of Select Financial Data Annualized

Reconciliation of Non-GAAP Measures

v3.24.3

Document And Entity Information

|

Nov. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 06, 2024

|

| Entity Registrant Name |

BLUE RIDGE BANKSHARES, INC.

|

| Entity Central Index Key |

0000842717

|

| Entity Emerging Growth Company |

true

|

| Entity File Number |

001-39165

|

| Entity Incorporation, State or Country Code |

VA

|

| Entity Tax Identification Number |

54-1838100

|

| Entity Address, Address Line One |

1801 Bayberry Court

|

| Entity Address, Address Line Two |

Suite 101

|

| Entity Address, City or Town |

Richmond

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

23226

|

| City Area Code |

(888)

|

| Local Phone Number |

331-6521

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(b) Security |

Common Stock, no par value

|

| Trading Symbol |

BRBS

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

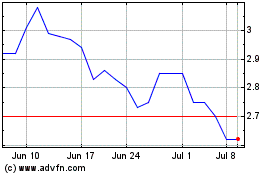

Blue Ridge Bancshares (AMEX:BRBS)

Historical Stock Chart

From Oct 2024 to Nov 2024

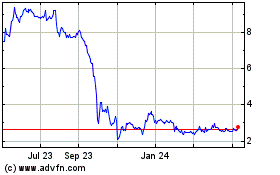

Blue Ridge Bancshares (AMEX:BRBS)

Historical Stock Chart

From Nov 2023 to Nov 2024