Barnwell Industries, Inc. Reports Results for its Third Quarter Ended June 30, 2024

August 13 2024 - 6:00AM

Barnwell Industries, Inc. (NYSE American: BRN) today reported

financial results for its third fiscal quarter ended June 30, 2024.

For the quarter, the Company had revenue of $5,527,000 and a net

loss of $1,246,000 or $0.12 per share. In the three months ended

June 30, 2023, the Company reported quarterly revenue of $5,675,000

and a net loss of $717,000 or $0.07 per share. The Company remains

debt free and ended the quarter with $3,292,000 in working capital,

including $4,393,000 in cash and cash equivalents.

Continuing Optimization Program is

Showing Positive Results

Corporate oil and gas production for the current

quarter has remained level to the quarter a year ago without any

new drilling activity or acquisitions. Production operating costs

declined by $772,000, or 26%, from $3,006,000 in the three months

ended June 30, 2023 to $2,234,000 in the three months ended June

30, 2024. This performance underscores the quality, consistency and

long-term viability of Barnwell’s Twining assets.

Twining Drilling Program is

Underway

In July 2024, the Company commenced drilling one

100%-owned and operated development oil well in the Twining area.

The well is currently cased pending completion. The Company’s

expectation is to have the well completed and on production in

early September 2024.

US Oil and Gas Assets

The Company’s oil and gas assets in Texas and

Oklahoma continue to perform well. The Texas cash flows have been

adversely affected by the low realized gas prices in the area, but

production declines are moderating.

Non-Cash Impairment

The net loss (GAAP) for the three months ended

June 30, 2024, was primarily due to a $599,000 non-cash impairment

of our oil and natural gas properties during the quarter. This

impairment was largely due to the changing backward-looking rolling

average pricing used along with optimization capital expenditures

for which there is insufficient operating history to assign a

determinable increase in future cash flows from reserves at

period-end. Additionally, the increase in our loss for the

three-month period as compared to the prior year included the

negative impact of $61,000 foreign currency loss recorded in the

current year period as compared to a $121,000 gain in the prior

year period due to the weakening of the Canadian dollar against the

U.S. dollar.

Contract Drilling Segment

As previously reported, the Company continues to

investigate the appropriate strategic, business and financial

alternatives for Water Resources which may include, among other

things, a sale of its stock or assets, or an orderly wind-down of

its operations and liquidation of equipment.

Summary and Outlook

Craig D. Hopkins, CEO, commented, “We continue

to be pleased with the operating performance of our oil and gas

assets. The impairment related to pricing does not alter our

enthusiasm for the long-term potential of Twining. We are excited

to bring our new Twining development well online to further improve

results. We continue to work to simplify Barnwell’s businesses and

reduce the corresponding administrative costs. This should free up

cash for additional drilling in Twining and acquisition

opportunities to increase our corporate scale and further dilute

fixed costs.”

The information contained in this press release

contains “forward-looking statements,” within the meaning of the

Private Securities Litigation Reform Act of 1995, Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. A forward-looking

statement is one which is based on current expectations of future

events or conditions and does not relate to historical or current

facts. These statements include various estimates, forecasts,

projections of Barnwell’s future performance, statements of

Barnwell’s plans and objectives, and other similar statements.

Forward-looking statements include phrases such as “expects,”

“anticipates,” “intends,” “plans,” “believes,” “predicts,”

“estimates,” “assumes,” “projects,” “may,” “will,” “will be,”

“should,” or similar expressions. Although Barnwell believes that

its current expectations are based on reasonable assumptions, it

cannot assure that the expectations contained in such

forward-looking statements will be achieved. Forward-looking

statements involve risks, uncertainties and assumptions which could

cause actual results to differ materially from those contained in

such statements. The risks, uncertainties and other factors that

might cause actual results to differ materially from Barnwell’s

expectations are set forth in the “Forward-Looking Statements,”

“Risk Factors” and other sections of Barnwell’s annual report on

Form 10-K for the last fiscal year and Barnwell’s other filings

with the Securities and Exchange Commission. Investors should not

place undue reliance on the forward-looking statements contained in

this press release, as they speak only as of the date of this press

release, and Barnwell expressly disclaims any obligation or

undertaking to publicly release any updates or revisions to any

forward-looking statements contained herein.

| |

|

COMPARATIVE OPERATING RESULTS |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

Nine months ended |

|

|

|

June 30, |

|

June 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

5,527,000 |

|

|

$ |

5,675,000 |

|

|

$ |

17,456,000 |

|

|

$ |

18,425,000 |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to Barnwell Industries, Inc. |

|

$ |

(1,246,000 |

) |

|

$ |

(717,000 |

) |

|

$ |

(3,682,000 |

) |

|

$ |

(865,000 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net loss per |

|

|

|

|

|

|

|

|

|

share – basic and diluted |

|

$ |

(0.12 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.37 |

) |

|

$ |

(0.09 |

) |

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares and equivalent shares

outstanding: |

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

10,028,090 |

|

|

|

9,975,044 |

|

|

|

10,014,609 |

|

|

|

9,962,806 |

|

|

|

|

|

|

|

|

|

|

|

|

CONTACT: |

Craig D. HopkinsChief Executive Officer and PresidentPhone: (403)

531-1560Email: info@bocl.ca |

This press release was published by a CLEAR® Verified

individual.

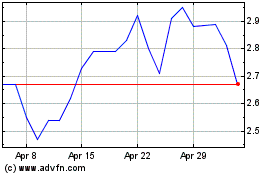

Barnwell Industries (AMEX:BRN)

Historical Stock Chart

From Oct 2024 to Nov 2024

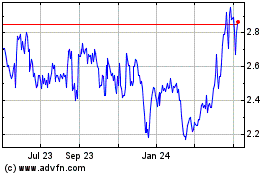

Barnwell Industries (AMEX:BRN)

Historical Stock Chart

From Nov 2023 to Nov 2024