American Shared Hospital Services (NYSE American: AMS) (the

"Company"), a leading provider of turnkey technology solutions for

stereotactic radiosurgery and advanced radiation therapy cancer

treatment systems and services, today announced financial results

for the second quarter ended June 30, 2024.

Second Quarter 2024 and Recent Highlights

- Total revenue in

the second quarter was $7.1 million, an increase of 27% from the

comparable period in 2023 bolstered by the completion of our

acquisition of 60% of the equity interest of three Rhode Island

radiation therapy facilities in May which accounted for $1.9

million of the increase. Total proton beam radiation therapy

revenue decreased 5% period-over-period; fractions decreased 10%.

Gamma Knife procedures increased 10% due to strong volume at our

international sites, the related Gamma Knife revenue decreased by

9% period-over-period due to lower average reimbursement in the

quarter.

- Gross margin was

$2.5 million, a period-over-period decrease of 2%. The gross margin

percentage was 35% of revenue compared to 45% in the year-ago

period reflecting the expansion in the retail segment.

- Operating income

for the second quarter of 2024 increased by $324,000 compared to

second quarter of 2023 primarily due to reduced impaired assets and

removal costs.

- Net income

attributable to American Shared Hospital Services in the second

quarter of 2024 was $3.6 million, or $0.55 per diluted share,

compared to a net loss of $111,000, or $0.02 per diluted share, for

the second quarter of 2023. The increase was primarily due to the

$3.7 million bargain purchase gain from the acquisition of 60% of

the equity interest of three Rhode Island radiation therapy

facilities.

- Adjusted EBITDA,

a non-GAAP financial measure, was $2,010,000 for the second quarter

of 2024, compared to $1,938,000 for the second quarter of 2023. The

increase was due to the contribution from the Rhode Island

facilities.

- Cash at June 30,

2024 was $14.5 million compared to $13.8 million at December 31,

2023.

- Signed 1 new

order to upgrade an existing customer to a Leksell Gamma Knife

Esprit, the latest model.

- Signed a joint

venture agreement for Gamma Knife facility in Guadalajara, Mexico,

establishes Company’s 4th International Center.

- Announced start

of patient treatments at its Radiation Therapy Facility, A.B.

Radiocirugía y Radioterapia de Puebla, in Puebla, Mexico.

Ray Stachowiak, CEO and Executive Chairman of

American Shared Hospital Services, commented, “With the acquisition

of 60% of three Rhode Island radiation therapy cancer centers now

closed, we are excited to report a gain of $3.7 million that we

were able to realize immediately. This came about from the

valuation of the assets acquired that exceeded our purchase

price.”

“Our Q2’2024 was a strong quarter for AMS with

improvement in operations and a strong focus on continued

execution. Our leasing business also remains solid with the signing

of 5 lease extensions over the last 15 months from our base of ten

domestic Gamma Knife sites and we have several others in

discussion.”

“Additionally, we continue to see international

patient volumes growing nicely with the new state-of-the-art Gamma

Knife ICON firmly in place, the only Gamma Knife in Ecuador for

non-invasive radiosurgery. Our Gamma Knife in Peru, the only Gamma

Knife in the country also showed strong results in the second

quarter. And in addition to our joint venture agreement for Gamma

Knife facility in Guadalajara, Mexico that we recently announced,

our international center in Puebla, Mexico has begun treating

patients which we expect to be another solid revenue contributor

going forward.”

“The second quarter marks a strong start to the

year, with revenue growth of 27% to $7.1 million and we earned $3.6

million in net income or $0.55 per share compared to a net loss of

($111,000) or ($0.02) due to the solid expansion of our retail

segment and the bargain purchase from the Rhode Island acquisition.

Our balance sheet remains strong, and we ended the second quarter

with cash and equivalents of $14.5 million, or approximately $2.24

per share.”

Craig Tagawa, President and Chief Operating

Officer, added, “It is extremely gratifying to see our growth

strategy taking hold as we expanded our product portfolio and

increased our capacity for creative financial solutions. We have

continued to see a significant increase the breadth of

opportunities for consideration and our sales pipeline remains

extremely strong with additional projects in the works. The

traction continues to grow and with the strength of our overall

business supported by our strong balance sheet and consistent cash

flow, we are well positioned for future growth,” concluded Mr.

Tagawa.

Financial Results for the Three Months Ended June 30,

2024

For the three months ended June 30, 2024,

revenue increased 27% to $7,056,000 compared to $5,568,000 in the

year-ago period. Revenue from the Company’s medical equipment

leasing (“leasing”) segment was $3,899,000 for the three months

ended June 30, 2024, compared to $4,812,000 for the same period in

the prior year, a decrease of 19%. Revenue from the Company’s

direct patient services (“retail”) segment was $3,157,000 for the

three months ended June 30, 2024, compared to $756,000 for the same

period in the prior year, an increase of 318%. The

increase was due to the acquisition in Rhode Island and increased

volumes at our existing retail locations.

Second quarter revenue for the Company's proton

beam radiation therapy system installed at Orlando Health in

Florida decreased 5% to $2,420,000 compared to revenue for the

second quarter of 2023 of $2,545,000 due to continued cyclical

volume changes.

Total proton beam radiation therapy fractions in

the second quarter were 1,236 compared to 1,370 proton beam

radiation therapy fractions in the second quarter of 2023, a 10%

decline.

Total revenue for the Company's Gamma Knife

operations decreased by 9% to $2,744,000 for the second quarter of

2024 compared to $3,023,000 for the second quarter of

2023. The decrease in overall Gamma Knife revenue was

primarily due to the expiration of 2 contracts in 2023 partially

offset by a 67% increase in international Gamma Knife

revenue.

Total Gamma Knife procedures increased by 10% to

340 for the second quarter of 2024 compared to 309 in the second

quarter of 2023, reflecting the growth at our international sites,

offset by the two expired contracts in the second and third

quarters of 2023.

Gross margin for the second quarter of 2024

decreased 2% to $2,468,000, or 35% of revenue, compared to gross

margin of $2,518,000 million, or 45% of revenue, for the second

quarter of 2023. The expansion of our retail segment with its

lower gross margin percentages will reduce Company wide margin

percentages going forward.

Selling and administrative costs decreased by 5%

to $1,896,000 for the second quarter of 2024 compared to $1,988,000

for the same period in the prior year, due to the expiration of the

Company’s corporate office space lease, offset by related sublease

income.

Interest expense was $385,000 in the 2024 period

compared to $277,000 in the comparable period of last year. The

increase is due to an increase in the interest rate and borrowings

on the Company’s variable rate debt.

Operating income for the second quarter was

breakeven due to the additional costs related to the closing of the

Rhode Island acquisition and other new business opportunities of

$361,000. In the prior year quarter, the amount of costs incurred

pursuing opportunities in Rhode Island was $250,000, and coupled

with other higher selling expenses led to a second quarter 2023

loss of $325,000. Income tax was a benefit of $31,000 for the

second quarter of 2024 compared to an income tax benefit of $35,000

for the same period in the prior year. The taxes related to the

bargain purchase gain reduce the gain (from $4.9 million to $3.7

million) and do not impact income tax expense.

Net income attributable to American Shared

Hospital Services in the second quarter of 2024 was $3,602,000, or

$0.55 per diluted share, compared to a net loss of $111,000, or

$0.02 per diluted share, for the second quarter of 2023. The

period-over-period increase was primarily due to the bargain

purchase gain generated from the acquisition in Rhode Island. Fully

diluted weighted average common shares outstanding were 6,583,000

and 6,336,000 for the second quarter of 2024 and 2023,

respectively.

Adjusted EBITDA, a non-GAAP financial measure,

was $2,010,000 for the second quarter of 2024, compared to

$1,938,000 for the second quarter of 2023. The increase was due to

the contribution from the recently acquired Rhode Island

facilities.

Financial Results for the Six Months Ended June 30,

2024

For the six months ended June 30, 2024, revenue increased 17% to

$12,272,000 compared to revenue of $10,493,000 for the first six

months of 2023.

Gamma Knife revenue decreased 6% to $5,311,000

for the first half of 2024 compared to $5,634,000 for the first

half of 2023. The number of Gamma Knife procedures in the first six

months of 2024 was 613, an increase of 2% compared to 602 Gamma

Knife procedures in the comparable period of 2023 due to the steady

increase of international procedures. Proton therapy revenue

increased 4% to $5,069,000 for the first half of 2024 compared to

$4,859,000 for the first half of 2023. Total proton therapy

fractions in the first six months of 2024 were 2,512, a decrease of

14% compared to 2,906 proton therapy fractions in the comparable

period of 2023.

Net income attributable to American Shared

Hospital Services for the first six months of 2024 was $3,721,000,

or $0.57 per diluted share, compared to net income of $77,000, or

$0.01 per diluted share, or the first six months of 2023. The

increase was primarily due to the bargain purchase gain generated

from the acquisition in Rhode Island.

Adjusted EBITDA, a non-GAAP financial measure,

was $3,754,000 for the first six months of 2024, compared to

$3,841,000 for the first six months of 2023. The decrease was

primarily due to higher fees associated with new business

opportunities, including the Company’s acquisition in Rhode

Island.

Balance Sheet Highlights

At June 30, 2024, cash, cash equivalents, and

restricted cash was $14,486,000 compared to $13,808,000 at December

31, 2023. American Shared Hospital Services' shareholders’ equity

(excluding non-controlling interests in subsidiaries) at June 30,

2024 and December 31, 2023 was $26,542,000 or $4.17 per outstanding

share and $22,624,000, or $3.59 per outstanding share,

respectively.

Conference Call and Webcast Information

AMS has scheduled a conference call to review

its financial results for Wednesday, August 14th at 6:30 pm ET /

3:30 pm PT.

To participate, domestic callers may dial

844.413.3972 and international callers may dial 412.317.5776 at

least 10 minutes prior to the start of the call and ask to join the

American Shared Hospital Services call. A simultaneous Webcast of

the call may be accessed through the Company's website,

www.ashs.com, or at www.streetevents.com for institutional

investors.

A replay of the call will be available at

877.344.7529 or 412.317.0088, access code 8320435, through August

21, 2024. The call will also be available for replay on the

Company’s website at www.ashs.com.

About American Shared Hospital Services (NYSE American:

AMS)

American Shared Hospital Services (ASHS) is a

leading provider of creative financial and turnkey solutions to

Cancer Treatment Centers, hospitals, and large cancer networks

worldwide. The company works closely with all major global

Original Equipment Manufacturers (OEMs) that provide leading edge

clinical treatment systems and software to treat cancer using

Radiation Therapy and Radiosurgery. The company is vendor agnostic

and provides financial support for a wide range of products

including MR Guided Radiation Therapy Linacs, Advanced Digital

Linear Accelerators, Proton Beam Radiation Therapy Systems,

Brachytherapy systems and suites, and through the Company’s

subsidiary, GK Financing LLC., the Leksell Gamma Knife product and

services. For more information, please visit: www.ashs.com

Safe Harbor Statement

This press release may be deemed to contain

certain forward-looking statements with respect to the financial

condition, results of operations and future plans of American

Shared Hospital Services including statements regarding the

expected continued growth of the Company and the expansion of the

Company’s Gamma Knife, proton therapy and MR/LINAC business, which

involve risks and uncertainties including, but not limited to, the

risks of economic and market conditions, the risks of variability

of financial results between quarters, the risks of the Gamma Knife

and proton therapy businesses, the risks of changes to CMS

reimbursement rates or reimbursement methodology, the risks of the

timing, financing, and operations of the Company’s Gamma Knife,

proton therapy, and MR/LINAC businesses, the risk of expanding

within or into new markets, the risk that the integration or

continued operation of acquired businesses could adversely affect

financial results and the risk that current and future acquisitions

may negatively affect the Company’s financial position. Further

information on potential factors that could affect the financial

condition, results of operations and future plans of American

Shared Hospital Services is included in the filings of the Company

with the Securities and Exchange Commission, including the

Company's Quarterly Report on Form 10-Q for the three month period

ended March 31, 2024, the Annual Report on Form 10-K for the year

ended December 31, 2023, and the definitive Proxy Statement for the

Annual Meeting of Shareholders that was held on June 25, 2024.

Non-GAAP Financial Measure

Adjusted EBITDA, the non-GAAP measure presented

in this press release and supplementary information, is not a

measure of performance under the accounting principles generally

accepted in the United States ("GAAP"). This non-GAAP

financial measure has limitations as an analytical tool, including

that it does not have a standardized meaning. When assessing our

operating performance, this non-GAAP financial measure should not

be considered a substitute for, and investors should also consider,

income before income taxes, income from operations, net income

attributable to the Company, earnings per share and other measures

of performance as defined by GAAP as indicators of the Company's

performance or profitability.

EBITDA is a non-GAAP financial measure

representing our earnings before interest expense, income tax

expense, depreciation, and amortization. We define Adjusted EBITDA

as net income (loss) before interest expense, interest income,

income tax expense, depreciation and amortization expense, loss on

write down of impaired assets and associated removal costs, bargain

purchase gain, and stock-based compensation expense.

We use this non-GAAP financial measure as a

means to evaluate period-to-period comparisons. Our management

believes that this non-GAAP financial measure provides meaningful

supplemental information regarding our performance by excluding

certain expenses and charges that may not be indicative of the

operating results of our recurring core business, such as

stock-based compensation expense. We believe that both

management and investors benefit from referring to this non-GAAP

financial measure in assessing our performance.

Contacts:

American Shared Hospital ServicesRay Stachowiak, Executive

Chairman and CEOrstachowiak@ashs.com

Investor Relations

Kirin Smith, PresidentPCG Advisory,

Inc.ksmith@pcgadvisory.com

|

|

|

|

- Tables Follow – |

|

|

|

|

|

|

|

|

|

|

|

|

|

American Shared Hospital Services |

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Statements of

Operations |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

Summary of Operations Data |

|

| |

|

|

|

(Unaudited) |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

Three months ended June 30, |

|

Six months ended June 30, |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

Revenues |

|

$ |

7,056,000 |

|

|

$ |

5,568,000 |

|

|

$ |

12,272,000 |

|

|

$ |

10,493,000 |

|

|

|

Costs of revenue |

|

|

4,588,000 |

|

|

|

3,050,000 |

|

|

|

7,661,000 |

|

|

|

6,067,000 |

|

|

|

Gross margin |

|

|

2,468,000 |

|

|

|

2,518,000 |

|

|

|

4,611,000 |

|

|

|

4,426,000 |

|

|

|

Selling and administrative expense |

|

|

1,896,000 |

|

|

|

1,988,000 |

|

|

|

3,775,000 |

|

|

|

3,527,000 |

|

|

|

Interest expense |

|

|

385,000 |

|

|

|

277,000 |

|

|

|

734,000 |

|

|

|

548,000 |

|

|

|

Loss on write down of impaired assets and associated removal

costs |

|

|

188,000 |

|

|

|

578,000 |

|

|

|

188,000 |

|

|

|

578,000 |

|

|

|

Operating (loss) |

|

|

(1,000 |

) |

|

|

(325,000 |

) |

|

|

(86,000 |

) |

|

|

(227,000 |

) |

|

|

Bargain purchase gain, net |

|

|

3,679,000 |

|

|

|

- |

|

|

|

3,679,000 |

|

|

|

- |

|

|

|

Interest and other income (loss) |

|

|

59,000 |

|

|

|

113,000 |

|

|

|

165,000 |

|

|

|

183,000 |

|

|

|

Income (loss) before income taxes |

|

|

3,737,000 |

|

|

|

(212,000 |

) |

|

|

3,758,000 |

|

|

|

(44,000 |

) |

|

|

Income tax (benefit) expense |

|

|

(31,000 |

) |

|

|

(35,000 |

) |

|

|

(75,000 |

) |

|

|

33,000 |

|

|

|

Net income (loss) |

|

|

3,768,000 |

|

|

|

(177,000 |

) |

|

|

3,833,000 |

|

|

|

(77,000 |

) |

|

|

(Plus) less: Net loss (income) attributable to non-controlling

interest |

|

|

(166,000 |

) |

|

|

66,000 |

|

|

|

(112,000 |

) |

|

|

154,000 |

|

|

|

Net income (loss) attributable to American Shared Hospital

Services |

|

$ |

3,602,000 |

|

|

$ |

(111,000 |

) |

|

$ |

3,721,000 |

|

|

$ |

77,000 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

Earnings (loss) per common share: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.56 |

|

|

($ |

0.02 |

) |

|

$ |

0.58 |

|

|

$ |

0.01 |

|

|

|

Diluted |

|

$ |

0.55 |

|

|

($ |

0.02 |

) |

|

$ |

0.57 |

|

|

$ |

0.01 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

Weighted Average Shares Outstanding: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

6,482,000 |

|

|

|

6,336,000 |

|

|

|

6,467,000 |

|

|

|

6,482,000 |

|

|

|

Diluted |

|

|

6,583,000 |

|

|

|

6,336,000 |

|

|

|

6,564,000 |

|

|

|

6,465,000 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

American Shared Hospital Services |

|

|

|

|

|

|

|

|

|

|

Balance Sheet Data |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

Balance Sheet Data |

|

|

|

| |

|

(Unaudited) |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

6/30/2024 |

|

12/31/2023 |

|

|

|

|

|

|

Cash, cash equivalents and restricted cash |

|

$ |

14,486,000 |

|

|

$ |

13,808,000 |

|

|

|

|

|

|

|

Current assets |

|

$ |

25,639,000 |

|

|

$ |

20,456,000 |

|

|

|

|

|

|

|

Total assets |

|

$ |

60,825,000 |

|

|

$ |

48,162,000 |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

$ |

13,336,000 |

|

|

$ |

10,779,000 |

|

|

|

|

|

|

|

Shareholders' equity, excluding non-controlling interests |

|

$ |

26,542,000 |

|

|

$ |

22,624,000 |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

American Shared Hospital Services |

|

|

Adjusted EBITDA |

|

| |

|

|

|

|

|

|

|

| |

|

Reconciliation of GAAP to Non-GAAP Adjusted Results |

|

| |

|

|

(Unaudited) |

|

|

| |

|

|

|

|

|

|

|

| |

|

Three months ended June 30, |

|

Six months ended June 30, |

|

|

|

|

|

2024 |

|

|

2023 |

|

|

|

2024 |

|

|

2023 |

|

|

|

Net income (loss) |

$ |

3,602,000 |

|

$ |

(111,000 |

) |

|

$ |

3,721,000 |

|

$ |

77,000 |

|

|

|

Plus (less): |

Income tax (benefit) expense |

|

(31,000 |

) |

|

(35,000 |

) |

|

|

(75,000 |

) |

|

33,000 |

|

|

| |

Interest expense |

|

385,000 |

|

|

277,000 |

|

|

|

734,000 |

|

|

548,000 |

|

|

| |

Interest (income) |

|

(77,000 |

) |

|

(110,000 |

) |

|

|

(189,000 |

) |

|

(197,000 |

) |

|

| |

Depreciation and amortization expense |

|

1,523,000 |

|

|

1,242,000 |

|

|

|

2,857,000 |

|

|

2,609,000 |

|

|

| |

Stock-based compensation expense |

|

99,000 |

|

|

97,000 |

|

|

|

197,000 |

|

|

193,000 |

|

|

| |

Bargain purchase gain, net |

|

(3,679,000 |

) |

|

- |

|

|

|

(3,679,000 |

) |

|

- |

|

|

| |

Loss on write down of impaired assets and associated removal

costs |

|

188,000 |

|

|

578,000 |

|

|

|

188,000 |

|

|

578,000 |

|

|

|

Adjusted EBITDA |

$ |

2,010,000 |

|

$ |

1,938,000 |

|

|

$ |

3,754,000 |

|

$ |

3,841,000 |

|

|

| |

|

|

|

|

|

|

|

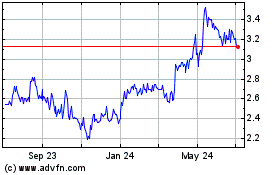

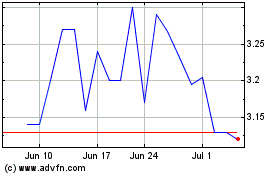

American Shared Hospital... (AMEX:AMS)

Historical Stock Chart

From Jan 2025 to Feb 2025

American Shared Hospital... (AMEX:AMS)

Historical Stock Chart

From Feb 2024 to Feb 2025