0001014763false--12-31FY20230false00.0100000.01300000000467778740023200000235047000008702002666660P8Y3M18D000000.04000010147632023-01-012023-12-310001014763aimd:LindFinancingMemberus-gaap:SubsequentEventMember2024-02-290001014763aimd:LindFinancingMemberus-gaap:SubsequentEventMember2024-01-012024-02-290001014763us-gaap:SubsequentEventMemberus-gaap:PrivatePlacementMember2024-01-230001014763us-gaap:SubsequentEventMemberus-gaap:PrivatePlacementMember2024-01-012024-01-230001014763aimd:LindFinancingMemberus-gaap:SubsequentEventMembersrt:MaximumMember2024-01-012024-01-230001014763aimd:LindFinancingMemberus-gaap:SubsequentEventMember2024-01-300001014763aimd:LindFinancingMemberus-gaap:SubsequentEventMember2024-01-012024-01-230001014763aimd:LindFinancingMemberus-gaap:SubsequentEventMember2024-01-230001014763aimd:LindFinancingMemberus-gaap:SubsequentEventMembersrt:MinimumMember2024-01-012024-01-230001014763aimd:TcntMemberus-gaap:SubsequentEventMember2024-01-012024-01-090001014763aimd:TcntMemberus-gaap:SubsequentEventMember2024-01-090001014763aimd:VocAndPoctTechnologiesMemberus-gaap:SubsequentEventMember2024-01-0900010147632024-01-300001014763aimd:COVID19AntigenRapidTestKitsSalesMember2022-12-310001014763aimd:COVID19AntigenRapidTestKitsSalesMember2023-12-310001014763aimd:COVID19AntigenRapidTestKitsSalesMember2022-01-012022-12-310001014763aimd:COVID19AntigenRapidTestKitsSalesMember2023-01-012023-12-310001014763aimd:AinosCOVID19TestKitsSalesandMarketinAgreementwithainosKYMember2022-01-012022-12-310001014763aimd:AinosCOVID19TestKitsSalesandMarketinAgreementwithainosKYMember2023-01-012023-12-310001014763aimd:ProductCoDevelopmentAgreementMember2022-12-310001014763aimd:ProductCoDevelopmentAgreementMember2023-12-310001014763aimd:Chien-HsuanHuangMember2023-01-012023-12-310001014763aimd:ProductCoDevelopmentAgreementMember2022-01-012022-12-310001014763aimd:ProductCoDevelopmentAgreementMember2023-01-012023-12-3100010147632023-04-012023-04-260001014763aimd:MsChienHsuanHuangMember2022-01-012022-12-310001014763aimd:MsChienHsuanHuangMember2023-01-012023-12-310001014763aimd:TwoThousandTwentyOneStockIncentivePlanMember2023-12-310001014763aimd:TwoThousandTwentyOneEmployeeStockPurchasePlanMember2023-12-310001014763aimd:TwoThousandTwentyThreeStockIncentivePlanMember2023-12-310001014763us-gaap:StockOptionMember2023-01-012023-12-310001014763aimd:WarrantsMember2023-01-012023-12-310001014763aimd:RestrictedStockUnitsMember2023-01-012023-12-310001014763aimd:StockOptionsAndWarrantsMember2023-12-310001014763aimd:StockOptionsAndWarrantsMember2022-12-310001014763aimd:StockOptionsAndWarrantsMember2022-01-012022-12-310001014763aimd:StockOptionsAndWarrantsMember2023-01-012023-12-310001014763us-gaap:RestrictedStockUnitsRSUMember2023-12-310001014763us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001014763us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001014763us-gaap:RestrictedStockUnitsRSUMember2022-12-310001014763us-gaap:RestrictedStockUnitsRSUMember2021-12-310001014763aimd:CommonSharesMember2023-02-012023-02-050001014763aimd:CommonSharesMember2022-08-012022-08-110001014763aimd:CommonSharesMember2022-01-012022-12-310001014763us-gaap:PrivatePlacementMember2023-12-310001014763us-gaap:PrivatePlacementMember2023-01-012023-12-310001014763us-gaap:PrivatePlacementMember2023-04-012023-04-260001014763aimd:CommonSharesMember2023-01-012023-12-310001014763aimd:CommonSharesMember2023-12-310001014763aimd:WarrantsMember2022-12-310001014763aimd:WarrantsMember2023-12-310001014763aimd:March2025ConvertibleNotesMember2022-01-012022-12-310001014763aimd:AinosKyMember2023-12-310001014763aimd:SeniorSecuredConvertibleNotesPayableMember2023-01-012023-12-310001014763aimd:ChenMember2023-12-310001014763aimd:AinosKyMember2023-01-012023-12-310001014763aimd:ChenMember2023-01-012023-12-310001014763aimd:ITwoChinaNoteMember2023-12-310001014763aimd:SeniorSecuredConvertibleNotesPayableMember2023-09-250001014763aimd:SeniorSecuredConvertibleNotesPayableMember2023-12-310001014763aimd:LiKuoLeeMember2023-12-310001014763aimd:March2027ConvertibleNotesMember2022-03-012022-04-300001014763aimd:AssetPurchaseAgreementMember2022-01-300001014763aimd:AssetPurchaseAgreementMember2021-11-012021-11-180001014763aimd:SPAMember2023-12-310001014763aimd:SPAMember2023-09-012023-09-250001014763aimd:SeniorSecuredConvertibleNotesPayableMember2023-09-012023-09-250001014763aimd:LiKuoLeeMember2023-01-012023-12-310001014763aimd:APAConvertibleNoteMember2022-03-012022-04-300001014763aimd:March2025ConvertibleNotesMember2023-01-012023-12-310001014763aimd:March2025ConvertibleNotesMember2022-12-310001014763aimd:March2025ConvertibleNotesOneMember2022-12-310001014763aimd:March2025ConvertibleNotesOneMember2023-12-310001014763aimd:March2025ConvertibleNotesMember2023-12-310001014763aimd:FurnitureAndEquipmentMember2022-12-310001014763us-gaap:MachineryAndEquipmentMember2022-12-310001014763aimd:FurnitureAndEquipmentMember2023-12-310001014763us-gaap:MachineryAndEquipmentMember2023-12-310001014763aimd:InventoryMember2023-01-012023-12-310001014763aimd:VeldonaPetcytoproteinMember2023-12-310001014763aimd:VeldonaPetcytoproteinMember2022-12-310001014763aimd:FurnitureAndFixtureMembersrt:MinimumMember2023-01-012023-12-310001014763us-gaap:MachineryAndEquipmentMembersrt:MinimumMember2023-01-012023-12-310001014763aimd:FurnitureAndFixtureMembersrt:MaximumMember2023-01-012023-12-310001014763us-gaap:MachineryAndEquipmentMembersrt:MaximumMember2023-01-012023-12-3100010147632023-01-012023-12-140001014763us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001014763us-gaap:RetainedEarningsMember2023-12-310001014763us-gaap:AdditionalPaidInCapitalMember2023-12-310001014763aimd:CommonStockToBeIssuedMember2023-12-310001014763us-gaap:CommonStockMember2023-12-310001014763us-gaap:PreferredStockMember2023-12-310001014763us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001014763us-gaap:RetainedEarningsMember2023-01-012023-12-310001014763us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001014763aimd:CommonStockToBeIssuedMember2023-01-012023-12-310001014763us-gaap:CommonStockMember2023-01-012023-12-310001014763us-gaap:PreferredStockMember2023-01-012023-12-310001014763us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001014763us-gaap:RetainedEarningsMember2022-12-310001014763us-gaap:AdditionalPaidInCapitalMember2022-12-310001014763aimd:CommonStockToBeIssuedMember2022-12-310001014763us-gaap:CommonStockMember2022-12-310001014763us-gaap:PreferredStockMember2022-12-310001014763us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001014763us-gaap:RetainedEarningsMember2022-01-012022-12-310001014763us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001014763aimd:CommonStockToBeIssuedMember2022-01-012022-12-310001014763us-gaap:CommonStockMember2022-01-012022-12-310001014763us-gaap:PreferredStockMember2022-01-012022-12-3100010147632021-12-310001014763us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001014763us-gaap:RetainedEarningsMember2021-12-310001014763us-gaap:AdditionalPaidInCapitalMember2021-12-310001014763aimd:CommonStockToBeIssuedMember2021-12-310001014763us-gaap:CommonStockMember2021-12-310001014763us-gaap:PreferredStockMember2021-12-3100010147632022-01-012022-12-3100010147632022-12-3100010147632023-12-3100010147632024-03-0700010147632023-06-30iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

U.S. Securities and Exchange Commission

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ | | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the Fiscal Year Ended December 31, 2023 |

| |

☐ | | Transition Report Under Section 13 or 15(d) of the Securities Exchange Act of 1934 For the transition period from _________ to _________ Commission File Number 001-41461 |

AINOS, INC. |

(Exact name of registrant as specified in its charter) |

Texas | | 75-1974352 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

| | |

8880 Rio San Diego Drive, Ste.800, San Diego, CA | | 92108 |

(Address of principal executive offices) | | Zip Code |

| | |

Issuer’s telephone number, including area code: | | (858) 869-2986 |

Securities registered under Section 12(b) of the Exchange Act.

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock | AIMD | The Nasdaq Stock Market LLC (Nasdaq Capital Market) |

Common Stock Purchase Warrants | AIMDW | The Nasdaq Stock Market LLC (Nasdaq Capital Market) |

Securities registered under Section 12(g) of the Exchange Act. None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark whether the issuer is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

As of March 7, 2024, there were issued and outstanding 5,954,317 shares of the registrant’s common stock, par value $0.01, which is the only class of common or voting stock of the registrant. As of June 30, 2023, the aggregate market value of the shares of common stock outstanding, other than shares held by persons who may be deemed affiliates of the Registrant, computed by reference to the closing price of $ 0.6801(before reverse stock split) for the Registrant’s common stock on June 30, 2023, as reported on Nasdaq Capital Market, was approximately $5,219,651.2. Shares of common stock held by officers, directors and each shareholder owning 10% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates.

TABLE OF CONTENTS

PART I

The following contains forward-looking statements that involve risks and uncertainties. The Company’s actual results could differ materially from those discussed in the forward-looking statements as a result of certain factors, including those discussed elsewhere in this Form 10-K. The following discussion should be read in conjunction with the Consolidated Financial Statements and the Notes thereto included elsewhere in this Form 10-K.

ITEM 1. BUSINESS.

Overview

Ainos, Inc. (the “Company”), incorporated in the State of Texas in 1984, is a diversified healthcare company focused on the development of novel point-of-care testing (the “POCT”), therapeutics based on very low-dose interferon alpha (the “VELDONA”), and synthetic RNA-driven preventative medicine. Our product pipeline includes commercial-stage VELDONA Pet cytoprotein supplements, clinical-stage VELDONA human therapeutics and telehealth-friendly POCTs powered by the AI Nose technology platform.

We have historically involved in the research and development of therapeutics based on VELDONA. Building on our research and development on VELDONA since inception, we are focused on commercializing a suite of VELDONA-based products including VELDONA Pet cytoprotein supplements and human related VELDONA therapeutics.

In 2021 and 2022, we acquired certain types of intellectual property from controlling shareholder, Ainos Inc., a Cayman Island corporation (“Ainos KY”), to expand product portfolio into POCTs aimed to provide connected, rapid, and convenient testing for a broad range of health conditions. Pivoting from the sales of COVID-19 POCT, we aim to commercialize POCTs that detect volatile organic compounds (the “VOC”) emitted by the body, powered by our AI Nose technology platform. Our lead VOC POCT candidate, Ainos Flora, aims to test female vaginal health and certain common sexually transmitted infections (the “STIs”) quickly and easily.

We believe the following attributes differentiate us from other diversified life science companies:

- intuitive, telehealth-friendly point-of-care testing

- AI-powered VOC testing platform

- decades of proprietary low-dose oral interferon clinical research

- capital-efficient business model

- outsourced manufacturing

- global distribution relationships

Our Technologies

VELDONA

Interferons are proteins made by host cells in response to the presence of pathogens. Interferons allow for communication between cells to trigger the protective defenses of the immune system. VELDONA formulation, delivered into the oral cavity as a lozenge in low doses, is designed to enhance autoimmunity to resist virus damages, potentially reducing side effects and risks caused by high-dose interferon and other small molecule drugs.

We believe VELDONA has shown to be safe and effective in the clinical studies for treatment of intended human and animal diseases. Since our inception to date, 68 human clinical trials have been conducted with low-dose oral IFNα. 63 studies were Phase 2 trials, and 3 Phase 1 and 2 Phase 3 studies have also been conducted.

In 28 studies performed by Ainos, VELDONA was found to exhibit systemic effects in mice, cats, dogs, ferrets, chickens, rats, guinea pigs, horses, calves/cows, and particularly pigs. VELDONA aided in boosting feed conversion efficiency and fighting deadly viral infections in these species, including canine parvovirus, equine herpesvirus, feline coronavirus, and others. We believe the studies demonstrate VELDONA’s therapeutic or preventive effect via the oral mucosa and shows VELDONA modulates systemic and mucosal immunity without serious side effects.

We have researched VELDONA for a broad range of human disease indications. We intend to prioritize advancing the following candidates: oral warts for HIV-seropositive patients, Sjogren’s Syndrome, mid COVID-19 syndromes, common cold, influenza, aphthous stomatitis, and chemotherapy-induced stomatitis. The United States Food and Drug Administration (the “U.S. FDA”) have granted Orphan Drug Designation (“ODD”) for our VELDONA formulation as a potential treatment for oral warts in HIV-seropositive patients.

Leveraging our VELDONA technology, we have launched a series of health supplements for dogs and cats under the brand name “VELDONA Pet” in Taiwan since the second quarter of 2023 and we intend to explore international sales and marketing opportunities. Our VELDONA Pet product line is formulated to address a variety of health issues, including skin, gum, emotion, discomfort caused by allergies, eye, and weight-related issues. We also intend to conduct clinical studies in Taiwan for the treatment of feline chronic gingivostomatitis (FCGS).

Point-of-Care Tests (POCTs)

Our POCT technologies aim to provide a simple, effective and telehealth-friendly tests that can deliver results within minutes. Our POCT detection technologies consists of VOC sensing, lateral flow immunochromatographic assay and nucleic acid. Currently we prioritize developing products based on VOC sensing. We intend to evaluate our lateral flow and nucleic acid test technologies for potential applications for other disease indication.

VOC Sensing Powered by AI Nose

We believe the analysis of VOC is a powerful, non-invasive option for disease detection and health monitoring. Our VOC sensing technology aims to detect the target VOCs within few minutes. AI Nose, the key enabler of our VOC sensing, consists of three key technologies: 1) a “digital nose” detects the target VOCs; 2) a trained artificial intelligence (“AI”) algorithm analyzes the target VOCs; 3) a “Smell ID” stores the VOC’s digital profile in the cloud.

We believe VOC sensing powered by AI Nose is scalable into a broad range of industries for two reasons. First, digital nose sensors can be made small and at low cost through semiconductor manufacturing technology. Second, as we train our AI with more Smell IDs, our VOC sensing can continue to improve. While health testing is our near-term focus, we believe we can broaden VOC sensing powered by AI Nose to other applications including telehealth, automotive, industrial, and environmental safety.

Our Pipeline

An integral part of our operating strategy is to create multiple revenue streams through sales of commercially ready products, out-licensing or forming strategic relationships to develop and commercialize our products. As of December 31, 2023, we have commercialized the following products:

| · | COVID-19 Antigen Rapid Test Kit. As the first commercialized products we sell, we have marketed COVID-19 antigen rapid test kits in Taiwan under emergency use authorization (“EUA”) issued by the Taiwan Federal and Drug Administration (“TFDA”) to TCNT, the product manufacturer. We are pivoting away from this business. |

| | |

| · | VELDONA Pet. VELDONA Pet is formulated to address a variety of health issues in dogs and cats, including skin, gum, emotion, discomfort caused by allergies, eye, and weight-related issues. We launched VELDONA Pet in Taiwan in the second quarter of 2023. |

From time to time, we assess our development plan based on available resources and market dynamics. Our current pipeline of the products, which are under development, includes the following: |

|

| · | VELDONA human drugs. Our high-priority programs include oral warts for human immunodeficiency virus (HIV) seropositive patients, common cold, influenza, Sjögren’s syndrome and treatment for mild COVID-19 symptoms. Except for COVID-19, we have conducted Phase 2 studies for these programs. |

| | |

| · | VOC POCT – Ainos Flora. Ainos Flora, powered by AI Nose, is intended to perform a non-invasive test for female vaginal health and certain common STIs within a few minutes. A companion app is also being developed that enables users to conveniently manage test results. We believe Ainos Flora can provide connected, convenient, discreet, rapid testing in a point-of-care setting. We are conducting clinical study in Taiwan and exploring strategic opportunities to commercialize the product. |

| | |

| · | VOC platform – NISD co-development. We are co-developing a VOC sensing platform with Nisshinbo Micro Devices Inc. (“NISD”) and Taiwan Inabata Sangyo Co. (“Taiwan Inabata”). The platform under development is intended to be used in applications including telehealth, automotive, industrial, and environmental safety. |

| | |

| · | VOC POCT – Ainos Pen. The device is intended to be a cloud-connected, multi-purpose, portable breath analyzer that is intended to monitor health conditions within minutes, powered by AI Nose. We expect consumers to be empowered to share test results with their physicians through in-person and telehealth medical consultations. |

| | |

| · | VOC POCT – CHS430. The CHS430 device, powered by AI Nose, is intended to provide non-invasive testing for ventilator-associated pneumonia within few minutes, as compared to current standard of care invasive culture tests that typically take more than two days to provide results. |

| | |

| · | Synthetic RNA (“SRNA”). We plan develop a SRNA technology platform in Taiwan with a long-term goal of developing next-generating precision treatments and rapid tests. |

Our Business Model

We believe our business model is capital efficient based on the following:

Operation in Taiwan. We have constructed our operation to be capital efficient by choosing Taiwan as our R&D and operating center. We believe Taiwan has been a key center of the global technology supply chain and it is also home to high-caliber engineers, scientists and healthcare professionals. We believe maintaining operations in Taiwan, at least in the near-term, allows us to access high-caliber talent while staying cost effective, enabling us to develop high quality, affordable, consumer-friendly products.

Outsourced Manufacturing. We believe our outsourced manufacturing strategy potentially saves us the time and resources required to establish our own infrastructure. We outsource manufacturing of our POCT product candidates to Taiwan Carbon Nano Technology (“TCNT”). We outsource manufacturing of VELDONA drugs for human-use to Swiss Pharmaceutical Co., Ltd., a Taiwan-based company. We outsource manufacturing of VELDONA Pet supplements to a Taiwan-based third party and to TCNT.

Distribution Relationships. We work with distributors to sell products. We appointed Inabata & Co. Ltd. (“Inabata”), a Japanese corporation, as our non-exclusive worldwide distributor and preferred distributor for customers based in Japan. Inabata’s Taiwan subsidiary (Taiwan Inabata Sangyo Co.) coordinates business logistics and working capital for our designated programs. Topmed International Biotech Co., Ltd. ("Topmed"), a Taiwanese biotech company, is a distributor of our VELDDONA Pet supplements in Taiwan.

Intellectual Property

We own a portfolio of patents covering various aspects of our core technologies. As of December 31, 2023, we had fifty-four (54) patents issued and sixteen (16) pending patent applications. Forty-seven (47) of the issued patents relate to acquired VOC and POCT technologies, four (4) relate to interferon technologies and three (3) relate to our smart drug injection technology. Forty-seven (47) of the issued patents are foreign patents and seven (7) are U.S. patents. Two (2) issued patents are licensed patents. Of the issued patents, thirty-two (32) are invention patents, fourteen (14) are utility model patents and eight (8) are design patents. Of our issued patents, five (5) shall expire between 2026 and 2029; twenty-two (22) between 2030 and 2034, twenty-seven (27) between 2035 and 2046.

We own a registered trademark for VELDONA as well as certain trademarks for our VELDONA Pet supplement in Taiwan. We also have several trademark applications for certain countries outside of Taiwan.

Employees

As of December 31, 2023, we had 46 full-time employees, of which 26 are in research and development. Majority of our employees are in Taiwan. None of our employees are represented by a labor union or are a party to a collective bargaining agreement. We plan to continue expand our manpower in research development, sales and marketing, and general operations to support our business programs. Please refer to Part 3 Item 10 and 11 for executive profile and compensation.

Additional Information

Under our former name, Amarillo Biosciences, Inc., we completed an initial public offering on the Nasdaq SmallCap Market in August 1996 and have traded on the U.S. over-the-counter market since October 1999. On October 31, 2013, we filed a voluntary petition for reorganization under Chapter 11 of the United States bankruptcy code. We emerged from bankruptcy on January 23, 2015. We established a Taiwan branch office in 2017. We renamed as Ainos, Inc in April 2021.

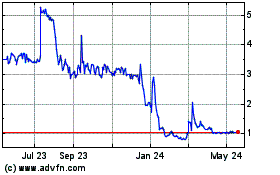

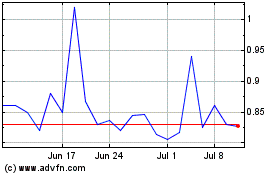

On August 9, 2022, our common stock and warrants began trading on the Nasdaq Capital Market under the trading symbols “AIMD” and “AIMDW,” respectively. We effectuated a 1-for-15 reverse stock split of our common stock on August 8, 2022, and a 1-for-5 reverse stock split on December 14, 2023.

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports are available free of charge on the Company’s website at www.ainos.com as soon as reasonably practicable after such material is electronically filed with, or furnished to, the Securities and Exchange Commission.

Government Regulation

Regulation of Medical Devices in Taiwan

Our product candidates and operations are subject to the Taiwan Medical Devices Act and its implementation regulations (collectively the “Taiwan MDA”), which govern the development, design, pre-clinical and clinical research, manufacturing, safety, efficacy, labeling, packaging, storage, installation, servicing, recordkeeping, premarket clearance or approval, import, export, adverse event reporting, advertising, promotion, marketing and distribution of medical devices. Under the Taiwan MDA, medical devices, depending on the degree of risk associated with each medical device and the extent of manufacturer and regulatory control needed to provide reasonable assurance of its safety and effectiveness, will be subject to differentiated level of review and examination of TFDA before marketing the device. Unless an exemption applies, each medical device requires either (a) an approval granted by TFDA or (b) a registration with TFDA before launching distribution or marketing in Taiwan. The latter is a simplified premarket review process applicable to some medical devices classified as “lower risk level” items listed in the TFDA announcement. Our product candidates are not on the list of “lower risk level” and the approval of TFDA will be required for us to launch distribution or marketing of such products in Taiwan.

Additionally, the TFDA may grant emergency use authorizations (“EUA”) to allow commercial distribution of medical devices intended to address the public health emergency during public emergencies. The TFDA needs to assess the potential effectiveness of such medical device on a case-by-case basis using a risk-benefit analysis and will require the submission of pre-clinical studies and clinical trials. The TFDA also may revise or revoke an issued EUA if the circumstances justifying such granting no longer exist, the criteria for its granting of EUA are no longer met, or other circumstances make a revision or revocation appropriate to protect the public health or safety. The EUA granted by TFDA to TCNT for COVID-19 antigen test kits ended in March 2023.

Concerning the post-marketing regulatory requirements, a company engaging in medical devices business will be required to follow stringent design, testing, control, documentation, and other quality assurance procedures during all aspects of the design and manufacturing process and report to TFDA when the device it markets has or may have caused or contributed to a death or serious injury. The TFDA also has broad discretion to take compliance and enforcement actions, such as requiring a safety surveillance report to be submitted regularly for review, ordering corrections, and conducting on-site inspection if it has any regulatory concerns. Failure to comply with applicable requirements under the Taiwan MDA may subject a device and/or manufacturers to a variety of administrative sanctions, such as the TFDA’s refusal to approve pending premarket applications, mandatory product recalls, import detentions, business suspension or license/listing cancellation, administrative fines, product seizures and destruction, civil monetary penalties and/or criminal prosecution and criminal penalties. Any company engaging in medical devices business may be additionally subject to ten times the criminal fines for each violation made by its authorized representative and/or employees.

Personal Data Protection Laws in Taiwan

Under the Taiwan Personal Data Protection Act (“PDPA”), each individual or governmental or non-governmental agencies, including our affiliate in Taiwan, should be subject to certain requirements and restrictions for collecting, processing or using personal data. The definition of “personal data” is extended to cover a broad scope, including name, birthday, ID, special features, fingerprints, marriage status, family, education, occupation, medical records, medical history, genetic information, sex life, health examination report, criminal records, contact information, financial status, social activities, and any other data which is sufficient to directly or indirectly identify a specific person. Due to the nature of the use of medical devices, our operation and the operation of our partners might collect, process, or use the data pertaining to a person’s medical records and healthcare, genetics (collectively, sensitive data), which is subject to stricter scrutiny. Generally, we can only obtain such sensitive data when the person consents in writing or electronically. Furthermore, in January 2022, the TFDA published the Regulations for the Security and the Maintenance of Personal Information Files in Wholesaling and Retailing Medical Devices authorized under the PDPA, which requires the medical devices wholesalers and retailers to adopt necessary data security/protection measures, and establish prevention and reporting mechanisms in relation to any data breach. The bill also empowers the TFDA to conduct regular inspections and audits. If we fail to comply with the PDPA, we may be subject to punishment for civil claims, criminal offenses and administrative liabilities; the defendant may be subject to an imprisonment; and the penalty for administrative liabilities, and may be imposed consecutively if such violation continues.

Regulation of Veterinary Drugs in Taiwan

Our veterinary product candidates are subject laws and regulations in Taiwan including, but not limited to, the Veterinary Drugs Control Act, Enforcement Rules under the Veterinary Control Act, Guidelines of Good Manufacture Practice for Veterinary Drug Manufacturers, and Taiwan Regulations for Pet Foods and Supplements. The laws and regulations govern, among other things, product design and development, pre-clinical and clinical testing, quality testing, manufacturing, packaging, labeling, storage, record keeping and reporting, clearance or approval, marketing, sales and distribution, promotion and advertising, import and export and post-marketing surveillance.

Under Taiwan law, a “veterinary drug” refers to one of the following substances in the form of bulk chemical compound, formulated preparation, or over the counter drug: Biologics specifically made for preventing and treating animal diseases based on microbiology, immunology or molecular biology; Antibiotics specifically made for preventing and treating animal diseases; Diagnostics announced and designated by the central competent authority for the diagnosis of animal diseases; and drugs that enhance or regulate animal physical functions specifically for preventing and treating animal diseases.

The competent authorities with licensing and enforcement authority under the Veterinary Drugs Control Act include the Council of Agriculture of the central government, the municipal government of a special municipality, or a local city or county.

Regulation of Medical Devices in the United States

Our product candidates and operations are subject to extensive and ongoing regulation by the FDA under the Federal Food, Drug, and Cosmetic Act of 1938 and its implementing regulations, collectively referred to as the FDCA, as well as other federal and state regulatory bodies in the United States. The laws and regulations govern, among other things, product design and development, pre-clinical and clinical testing, manufacturing, packaging, labeling, storage, record keeping and reporting, clearance or approval, marketing, distribution, promotion, import and export and post-marketing surveillance.

The FDA regulates the development, design, pre-clinical and clinical research, manufacturing, safety, efficacy, labeling, packaging, storage, installation, servicing, recordkeeping, premarket clearance or approval, import, export, adverse event reporting, advertising, promotion, marketing and distribution of medical devices in the United States to ensure that medical devices distributed domestically are safe and effective for their intended uses and otherwise meet the requirements of the FDCA. Failure to comply with applicable requirements may subject a device and/or its manufacturer to a variety of administrative sanctions, such as FDA refusal to approve pending premarket applications, issuance of warning letters, mandatory product recalls, import detentions, civil monetary penalties, and/or judicial sanctions, such as product seizures, injunctions, and criminal prosecution.

FDA Premarket Clearance and Approval Requirements

Unless an exemption applies, each medical device commercially distributed in the United States requires either FDA clearance of a 510(k) premarket notification, approval of a premarket approval, or PMA, or grant of a de novo request for classification. During public emergencies, FDA also may grant emergency use authorizations to allow commercial distribution of devices intended to address the public health emergency. Under the FDCA, medical devices are classified into one of three classes—Class I, Class II or Class III—depending on the degree of risk associated with each medical device and the extent of manufacturer and regulatory control needed to provide reasonable assurance of its safety and effectiveness.

Class I devices include those with the lowest risk to the patient and are those for which safety and effectiveness can be reasonably assured by adherence to the FDA’s “general controls” for medical devices. Some Class I or low risk devices also require premarket clearance by the FDA through the 510(k) premarket notification process described below.

Class II devices are moderate risk devices that require premarket review and clearance by the FDA through the 510(k) premarket notification process, though certain Class II devices are exempt from this premarket review process. Unless a specific exemption applies, 510(k) premarket notification submissions are subject to user fees. If the FDA determines that the device, or its intended use, is not substantially equivalent to a legally marketed device, the FDA will place the device, or the particular use of the device, into Class III, and the device sponsor must then fulfill more rigorous premarketing requirements.

Class III devices include devices deemed by the FDA to pose the greatest risk, such as life-sustaining, life-supporting or implantable devices and devices deemed not substantially equivalent to a predicate device following a 510(k) submission. Submission and FDA approval of a PMA application is required before marketing of a Class III device. As with 510(k) submissions, unless an exemption applies, PMA submissions are subject to user fees.

Emergency Use Authorization

In emergency situations, such as a pandemic, the FDA has the authority to allow unapproved medical products or unapproved uses of cleared or approved medical products to be used in an emergency to diagnose, treat, or prevent serious or life-threatening diseases or conditions caused by chemical, biological, radiological, or nuclear warfare threat agents when there are no adequate, approved, and available alternatives.

Under this authority, the FDA may issue an EUA for an unapproved device if the following four statutory criteria have been met: (1) a serious or life-threatening condition exists; (2) evidence of effectiveness of the device exists; (3) a risk-benefit analysis shows that the benefits of the product outweigh the risks; and (4) no other alternatives exist for diagnosing, preventing, or treating the disease or condition.

Once issued, an EUA will remain in effect and generally terminate on the earlier of (1) the determination by the Secretary of Health and Human Services that the public health emergency has ceased or (2) a change in the approval status of the product such that the authorized use(s) of the product are no longer unapproved. After the EUA is no longer valid, the product is no longer considered to be legally marketed and one of the FDA’s non-emergency premarket pathways would be necessary to resume or continue distribution of the subject product.

The FDA also may revise or revoke an EUA if the circumstances justifying its issuance no longer exist, the criteria for its issuance are no longer met, or other circumstances make a revision or revocation appropriate to protect the public health or safety.

510(k) Clearance Marketing Pathway

To obtain 510(k) clearance for a medical device, an applicant must submit to the FDA a 510(k) submission demonstrating that the proposed device is “substantially equivalent” to a legally marketed device, known as a “predicate device.” A showing of substantial equivalence sometimes, but not always, requires clinical data. Once the 510(k) submission is accepted for review, by regulation, the FDA has 90 calendar days to review and issue a determination. As a practical matter, clearance may take and often takes longer. Upon review, the FDA may require additional information, including clinical data, to make a determination regarding substantial equivalence. In addition, the FDA collects user fees for certain medical device submissions and annual fees and for medical device establishments.

Before the FDA will accept a 510(k) submission for substantive review, the FDA will first assess whether the submission satisfies a minimum threshold of acceptability. If the FDA determines that the 510(k) submission is incomplete, the FDA will issue a “Refuse to Accept” letter which generally outlines the information the FDA believes is necessary to permit a substantive review and to reach a determination regarding substantial equivalence. An applicant must submit the requested information within 180 days before the FDA will proceed with additional review of the submission.

If the FDA agrees that the device is substantially equivalent to a predicate device currently on the market, it will grant 510(k) clearance to commercially market the device. If the FDA determines that the device is “not substantially equivalent” to a previously cleared device, for example, due to a finding of a lack of a predicate device, that the device has a new intended use or different technological characteristics that raise different questions of safety or effectiveness when the device is compared to the cited predicate device, the device is automatically designated as a Class III device. The device sponsor must then fulfill more rigorous PMA requirements, or can request a risk-based classification determination for the device in accordance with the “de novo” process, which is a route to market for novel medical devices that are low to moderate risk and are not substantially equivalent to a predicate device. If the FDA determines that the information provided in a 510(k) submission is insufficient to demonstrate substantial equivalence to the predicate device, the FDA generally identifies the specific information that needs to be provided so that the FDA may complete its evaluation of substantial equivalence, and such information may be provided within the time allotted by the FDA or in a new 510(k) submission should the original 510(k) submission have been withdrawn.

After a device receives 510(k) marketing clearance, any modification that could significantly affect its safety or effectiveness, or that would constitute a major change or modification in its intended use, will require a new 510(k) marketing clearance or, depending on the modification, PMA approval. The determination as to whether or not a modification could significantly affect the device’s safety or effectiveness is initially left to the manufacturer using available FDA guidance. Many minor modifications today are accomplished by a “letter to file” in which the manufacturer documents the rationale for the change and why a new 510(k) submission is not required. However, the FDA may review such letters to file to evaluate the regulatory status of the modified product at any time and may require the manufacturer to cease marketing and recall the modified device until 510(k) marketing clearance or PMA approval is obtained. The manufacturer may also be subject to significant regulatory fines or penalties.

Over the last several years, the FDA has proposed reforms to its 510(k) clearance process, and such proposals could include increased requirements for clinical data and a longer review period, or could make it more difficult for manufacturers to utilize the 510(k) clearance process for their products.

PMA Approval Pathway

A PMA must be submitted to the FDA if the device cannot be cleared through the 510(k) process. The PMA must be supported by extensive data, including data from pre-clinical studies and clinical trials. Review may take anywhere from 180 days to several years. An advisory panel of experts from outside the FDA may be convened to review and evaluate the application and provide recommendations to the FDA as to the approvability of the device. The FDA may or may not accept the panel’s recommendation. In addition, the FDA will generally conduct a pre-approval inspection of the applicant or its third-party manufacturers’ or suppliers’ manufacturing facility or facilities to ensure compliance with the QSR.

The FDA will approve the new device for commercial distribution if it determines that the data and information in the PMA constitute valid scientific evidence and that there is reasonable assurance that the device is safe and effective for its intended use(s). The FDA may approve a PMA with post-approval conditions, it may also condition PMA approval on some form of post-market surveillance. Failure to comply with the conditions of approval can result in material adverse enforcement action, including withdrawal of the approval.

As of December 31, 2023, none of our test kits were approved under a PMA. However, we may in the future develop devices which will require the approval of a PMA.

De novo Classification

Medical device types that the FDA has not previously classified as Class I, II or III are automatically classified into Class III regardless of the level of risk they pose. To market low to moderate risk medical devices that are automatically placed into Class III due to the absence of a predicate device, a manufacturer may request a de novo down-classification on the basis that the device presents low or moderate risk, rather than requiring the submission and approval of a PMA application. In the event the FDA determines the data and information submitted demonstrate that general controls or general and special controls are adequate to provide reasonable assurance of safety and effectiveness, the FDA will grant the de novo request for classification. When the FDA grants a de novo request for classification, the device is granted marketing authorization and further can serve as a predicate for future devices of that type, through a 510(k) premarket notification.

As of December 31, 2023, we are not currently seeking a de novo classification for any device in development.

Clinical Trials

Clinical trials are typically required to support a PMA, oftentimes for a de novo request for classification, and are sometimes required to support a 510(k) submission. All clinical investigations of devices to determine safety and effectiveness must be conducted in accordance with the FDA’s investigational device exemption, or IDE, regulations which govern investigational device labeling, prohibit promotion of the investigational device, and specify an array of recordkeeping, reporting and monitoring responsibilities of study sponsors and study investigators. The clinical trials must be approved by, and conducted under the oversight of, an Institutional Review Board, or IRB, for each clinical site. If an IDE application is approved by the FDA and one or more IRBs, clinical trials may begin at a specific number of investigational sites with a specific number of patients, as approved by the FDA.

If the device is considered a ”non-significant risk,” IDE submission to FDA is not required. Instead, only approval from the IRB overseeing the investigation at each clinical trial site is required. After a trial begins, we, the FDA or the IRB could suspend or terminate a clinical trial at any time for various reasons.

Post-market Regulation

After a device is cleared or approved for marketing, numerous and pervasive regulatory requirements continue to apply. These include:

| · | Establishment registration and device listing with the FDA; |

| · | QSR requirements, which require manufacturers and contract manufacturers, including third-party manufacturers, to follow stringent design, testing, control, documentation, and other quality assurance procedures during all aspects of the design and manufacturing process; |

| · | Labeling regulations and FDA prohibitions against the promotion of investigational products, or “off-label” uses of cleared or approved products; |

| · | Clearance or approval of product modifications to 510(k)-cleared devices that could significantly affect safety or effectiveness or that would constitute a major change in intended use of one of our cleared devices; |

| · | Medical device reporting regulations, which require that a manufacturer report to the FDA if a device it markets may have caused or contributed to a death or serious injury, or has malfunctioned and the device or a similar device that it markets would be likely to cause or contribute to a death or serious injury, if the malfunction were to recur; |

| · | Post-market surveillance activities and regulations, which apply when deemed by the FDA to be necessary to protect the public health or to provide additional safety and effectiveness data for the device. |

The FDA has broad regulatory compliance and enforcement powers. If the FDA determines that we failed to comply with applicable regulatory requirements, it can take a variety of compliance or enforcement actions, which may result in any of the following sanctions:

| · | untitled letters, warning letters, fines, injunctions, consent decrees and civil penalties; |

| · | customer notifications for repair, replacement, refunds; |

| · | recall, withdrawal, administrative detention, or seizure of our test kits; |

| · | operating restrictions or partial suspension or total shutdown of production; |

| · | refusal of or delay in granting our requests for 510(k) clearance or PMA approval of new test kits or modified test kits; |

| · | withdrawing 510(k) clearance or PMA approvals that are already granted; |

| · | refusal to grant export approval for our test kits; or |

| · | criminal prosecution. |

U.S. drug and biological product development

In the United States, the FDA regulates drugs under the Federal Food, Drug, and Cosmetic Act (FDCA) and its implementing regulations and biologics under the FDCA, the Public Health Service Act (PHSA), and their implementing regulations. Both drugs and biologics also are subject to other federal, state and local statutes and regulations. Failure to comply with applicable U.S. requirements at any time during the product development process, approval process or following approval may subject us to administrative or judicial sanctions. These sanctions could include, among other actions, the FDA’s refusal to approve pending applications, license revocation, a clinical hold, untitled or warning letters, product recalls, market withdrawals, product seizures, total or partial suspension of production or distribution, injunctions, fines, refusals of government contracts, restitution, disgorgement and civil or criminal penalties.

Our VELDONA product candidates for human use must be approved by the FDA through a BLA or new drug application (NDA), or supplemental BLA or supplemental NDA, process before they may be legally marketed in the United States.

Preclinical studies

Before any of our development candidates may be tested in humans, the development candidate must undergo rigorous preclinical testing. Preclinical studies include laboratory evaluation of product chemistry and formulation, as well as in vitro and animal studies to assess the potential for adverse events and in some cases to establish a rationale for therapeutic use. The conduct of preclinical studies is subject to federal regulations and requirements, including GLP regulations for safety/toxicology studies. An IND sponsor must submit the results of the preclinical tests, together with manufacturing information, analytical data, any available clinical data or literature and plans for clinical studies, among other things, to the FDA as part of an IND. An IND is a request for authorization from the FDA to administer an investigational product to humans and must become effective before human clinical trials may begin. Unless the FDA raises concerns, an IND automatically becomes effective 30 days after receipt by the FDA. In such a case, the IND sponsor and the FDA must resolve any outstanding concerns before the clinical trial can begin.

Clinical trials

The clinical stage of development involves the administration of the investigational medicine to healthy volunteers or patients under the supervision of qualified investigators and in accordance with GCP requirements. Clinical trials are conducted under protocols detailing, among other things, the objectives of the clinical trial, dosing procedures, subject selection and exclusion criteria and the parameters to be used to monitor subject safety and assess efficacy. Each protocol, and any subsequent amendments to the protocol, must be submitted to the FDA as part of the IND. Furthermore, each clinical trial must be reviewed and approved by an Institutional Review Board (IRB) for each institution at which the clinical trial will be conducted to ensure that the risks to individuals participating in the clinical trials are minimized and are reasonable in relation to anticipated benefits. The IRB also approves the informed consent form that must be provided to clinical trial subjects and monitors the clinical trial until completed. Further, progress reports detailing the results of the clinical trials, among other information, must be submitted at least annually to the FDA and more frequently in other situations, including the occurrence of serious adverse events. Information about certain clinical trials must be submitted within specific timeframes for publication on the www.clinicaltrials.gov website.

Foreign studies conducted under an IND must meet the same requirements that apply to studies being conducted in the United States. Data from a foreign study not conducted under an IND may be submitted in support of a BLA if the study was conducted in accordance with GCP requirements, and the FDA is able to validate the data.

Clinical trials generally are conducted in three sequential phases, which may overlap:

| · | Phase 1 clinical trials generally involve a small number of healthy volunteers or disease-affected patients to assess the metabolism, pharmacologic action, side effect tolerability, and safety of the investigational medicine. |

| · | Phase 2 clinical trials generally involve disease-affected patients to evaluate proof of concept and/or determine the dosing regimen(s) for subsequent investigations. At the same time, safety and further pharmacokinetic and pharmacodynamic information is collected, possible adverse effects and safety risks are identified, and a preliminary evaluation of efficacy is conducted. |

| · | Phase 3 clinical trials generally involve a large number of disease-affected patients at multiple sites and are designed to provide the data necessary to demonstrate the effectiveness of the investigational medicine for its intended use, its safety in use and to establish the overall benefit/risk relationship of the investigational medicine, and provide an adequate basis for product labeling. |

The FDA may also require post-approval Phase 4 non-registrational studies to explore scientific questions to further characterize safety and efficacy during commercial use of a drug.

The FDA or the clinical trial site may suspend or terminate a clinical trial at any time on various grounds, including a finding that the patients are being exposed to an unacceptable health risk. Similarly, an IRB can suspend or terminate approval of a clinical trial at its institution if the clinical trial is not being conducted in accordance with the IRB’s requirements or if the drug or biologic has been associated with unexpected serious harm to patients. Additionally, some clinical trials are overseen by an independent group of qualified experts organized by the clinical trial sponsor, known as a data safety monitoring board or committee. This group provides authorization for whether a clinical trial may move forward at designated check points based on access to certain data from the clinical trial.

FDA review process

Following completion of the clinical trials, data are analyzed to assess whether the investigational product is safe and effective for the proposed indicated use or uses. The results of preclinical studies and clinical trials are then submitted to the FDA as part of a BLA or NDA, along with proposed labeling, chemistry, and manufacturing information to ensure product quality and other relevant data. A BLA is a request for approval to market a biologic for one or more specified indications and must contain proof of the biologic’s safety, purity, and potency. An NDA for a new drug must contain proof of the drug’s safety and efficacy. To support marketing approval, the data submitted must be sufficient in quality and quantity to establish the safety and efficacy of the investigational product to the satisfaction of the FDA. FDA approval of a BLA or NDA must be obtained before a biologic or drug may be marketed in the United States.

Before approving a BLA or NDA, the FDA will conduct a pre-approval inspection of the manufacturing facilities for the new product to determine whether the facilities comply with cGMP requirements and are adequate to assure consistent production of the product within required specifications. The FDA also may audit data from clinical trials to ensure compliance with GCP requirements. Additionally, the FDA may refer applications for novel products or products which present difficult questions of safety or efficacy to an advisory committee of expert advisors for review, evaluation and a recommendation as to whether the application should be approved and under what conditions, if any. The committee makes a recommendation to the FDA that is not binding but is generally followed.

After the FDA evaluates a BLA or NDA, it will grant marketing approval, request additional information or issue a complete response letter (CRL) outlining the deficiencies in the submission. The CRL may require additional testing or information, including additional preclinical or clinical data, for the FDA to reconsider the BLA or NDA. Even if such additional information and data are submitted, the FDA may decide that the BLA or NDA still does not meet the standards for approval. If the FDA grants approval, it issues an approval letter that authorizes commercial marketing of the product with specific prescribing information for specific indications.

Orphan drug designation

Under the Orphan Drug Act, the FDA may grant orphan designation to a drug or biologic product intended to treat a rare disease or condition, which is generally a disease or condition that affects fewer than 200,000 individuals in the United States, or more than 200,000 individuals in the United States and for which there is no reasonable expectation that the cost of developing and making the product available in the United States for this type of disease or condition will be recovered from sales of the product.

If a product that has orphan designation subsequently receives the first FDA approval for the disease or condition for which it has such designation, the product is entitled to orphan drug exclusivity, which means that the FDA may not approve any other applications to market the same drug for the same indication for seven years from the date of such approval, except in very limited circumstances, such as if the latter product is shown to be clinically superior to the orphan product.

Health Insurance Portability and Accountability Act

We may be subject to compliance with the federal Health Insurance Portability and Accountability Act of 1996, as amended by the Healthcare Information Technology for Economic and Clinical Health Act of 2009, or HIPAA, among other things, established federal protection for the privacy and security of protected health information, or PHI. The HIPAA privacy regulations protect PHI by limiting its use and disclosure, giving patients the right to access certain information about them, and limiting most disclosures of PHI to the minimum amount necessary to accomplish an intended purpose. The HIPAA security standards require the adoption of administrative, physical, and technical safeguards and the adoption of written security policies and procedures.

In addition, various states, such as California and Massachusetts, have implemented similar privacy and security laws and regulations. The interplay of federal and state laws may be subject to varying interpretations by courts and government agencies, creating complex compliance issues. The compliance requirements of these laws, including additional breach reporting requirements, and the penalties for violation vary widely, and new privacy and security laws in this area are evolving. Requirements of these laws and penalties for violations vary widely.

Failure to comply with HIPAA, Healthcare Information Technology for Economic and Clinical Health Act of 2009 or their implementing regulations, and similar state laws, may result in significant penalties, including civil, criminal and administrative penalties, fines, imprisonment and exclusion from participation in federal or state healthcare programs, and the curtailment or restructuring of our operations.

U.S. Federal, State and Foreign Fraud and Abuse Laws

The U.S. federal and state governments have enacted, and actively enforce, a number of laws to address fraud and abuse in federal healthcare programs. Our business is subject to compliance with these laws.

Anti-Kickback Statutes

The federal Anti-Kickback Statute prohibits, among other things, knowingly and willfully soliciting, offering, receiving or paying remuneration, directly or indirectly, overtly or covertly, in cash or in kind, to induce or reward either the referral of an individual, or the purchase, order, arrangement for, or recommendation of, items or services for which payment may be made, in whole or in part, under a federal healthcare program such as Medicare or Medicaid. Many states have adopted laws similar to the federal Anti-Kickback Statute. Some of these state prohibitions apply to referral of recipients for healthcare products or services reimbursed by any source, not only government healthcare programs, and may apply to payments made directly by the patient.

Government officials have focused their enforcement efforts on the marketing of healthcare services and products, among other activities, and recently have brought cases against companies, and certain individual sales, marketing and executive personnel, for allegedly offering unlawful inducements to potential or existing customers in an attempt to procure their business.

Federal False Claims Laws

The FCA prohibits any person or entity, among other things, to knowingly present, or cause to be presented, a false or fraudulent claim for payment of government funds and knowingly making, using or causing to be made or used, a false record or statement to get a false claim paid or to avoid, decrease or conceal an obligation to pay money to the federal government. The qui tam provisions of the FCA allow a private individual to bring actions on behalf of the federal government alleging that the defendant has violated the FCA and to share in any monetary recovery. In addition, various states have enacted false claims laws analogous to the FCA, and many of these state laws apply where a claim is submitted to any third-party payor and not only a federal healthcare program.

Violations of the FCA may result in treble damages and significant mandatory penalties, civil monetary penalties, and violators may be subject to exclusion from participation in federal healthcare programs such as Medicare and Medicaid. Many medical device manufacturers and healthcare companies have reached substantial financial settlements with the federal government for a variety of alleged improper activities and have entered into corporate integrity agreements with OIG, under which the companies undertake certain compliance, certification and reporting obligations, to avoid exclusion from federal health care program.

Our activities, including those relating to the reporting of discount and rebate information and other information affecting federal, state and third-party reimbursement of our test kits (once approved) and the sale and marketing of our test kits (once approved), may be subject to scrutiny under the federal Anti-Kickback Statute and the FCA. We are also subject to other criminal federal laws that prohibit making false or fictitious claims and false statements to the federal government.

HIPAA Fraud Statute

HIPAA, among other things, imposes criminal liability for knowingly and willfully executing or attempting to execute a scheme to defraud any healthcare benefit program, including private third-party payors, knowingly and willfully embezzling or stealing from a healthcare benefit program, willfully obstructing a criminal investigation of a healthcare offense, and creates federal criminal laws that prohibit knowingly and willfully falsifying, concealing or covering up a material fact or making any materially false, fictitious or fraudulent statement or representation, or making or using any false writing or document knowing the same to contain any materially false, fictitious or fraudulent statement or entry in connection with the delivery of or payment for healthcare benefits, items or services. Similar to the federal healthcare Anti-Kickback Statute, a person or entity does not need to have actual knowledge of the statute or specific intent to violate it to have committed a violation.

Open Payments

The federal Physician Payments Sunshine Act, implemented as the Open Payments Program, requires certain manufacturers of drugs, medical devices, biologics and medical supplies for which payment is available under Medicare, Medicaid or the Children’s Health Insurance Program to report annually to CMS information related to payments and other “transfers of value” to physicians, and teaching hospitals, and requires applicable manufacturers to report annually ownership and investment interests held by physicians and their immediate family members. Beginning in 2022, applicable manufacturers will also be required to report information and transfers of value provided (beginning in 2021) to physician assistants, nurse practitioners, clinical nurse specialists, certified nurse anesthetists, and certified nurse-midwives. Failure to submit timely, accurate and complete reports may result in substantial monetary penalties. We are subject to the Open Payments Program and the information we disclose may lead to greater scrutiny, which may result in modifications to established practices and additional costs. Additionally, similar reporting requirements have also been enacted on the state level domestically, and an increasing number of countries worldwide either have adopted or are considering similar laws requiring transparency of interactions with healthcare professionals.

Foreign Corrupt Practices Act

The Foreign Corrupt Practices Act of 1977, or FCPA, prohibits any U.S. individual or business from paying, offering or authorizing payment or offering of anything of value, directly or indirectly, to any foreign official, political party or candidate for the purpose of influencing any act or decision of the foreign entity in order to assist the individual or business in obtaining or retaining business. The FCPA also obligates companies whose securities are listed in the United States to comply with accounting provisions requiring them to maintain books and records that accurately and fairly reflect all transactions of the corporation, including international subsidiaries, if any, and to devise and maintain an adequate system of internal accounting controls for international operations.

U.S. Health Reform

Changes in healthcare policy could increase our costs, decrease our revenue and impact sales of and reimbursement for our current and future products once approved. The United States and some foreign jurisdictions are considering or have enacted a number of legislative and regulatory proposals to change the healthcare system in ways that could affect our ability to sell our test kits profitably once approved. Among policy makers and payors in the United States and elsewhere, there is significant interest in promoting changes in healthcare systems with the stated goals of containing healthcare costs, improving quality or expanding access. Current and future legislative proposals to further reform healthcare or reduce healthcare costs may limit coverage of or lower reimbursement for the procedures associated with the use of our test kits once approved. The cost containment measures that payors and providers are instituting and the effect of any healthcare reform initiative implemented in the future could impact our revenue from the sale of our test kits once approved.

The implementation of the Affordable Care Act in the United States, for example, has changed healthcare financing and delivery by both governmental and private insurers substantially, and affected medical device manufacturers significantly. In addition, other legislative changes have been proposed and adopted since the Affordable Care Act was enacted.

We believe that there will continue to be proposals by legislators at both the federal and state levels, regulators and third-party payors to reduce costs and potentially affect individual healthcare benefits. Certain of these changes could impose additional limitations on the rates we will be able to charge for our current and future products or the amounts of reimbursement available for our current and future products from governmental agencies or third-party payors.

ITEM 1A. RISK FACTORS.

Investors should carefully consider the following discussion of significant factors, events, and uncertainties that make an investment in our securities risky. The events and consequences discussed in these risk factors could, in circumstances we may or may not be able to accurately predict, recognize, or control, have a material adverse effect on our business, growth, reputation, prospects, financial condition, operating results (including components of our financial results), cash flows, liquidity, and stock price. These risk factors do not identify all risks that we face; our operations could also be affected by factors, events, or uncertainties that are not presently known to us or that we currently do not consider to present significant risks to our operations. In addition, the global economic climate amplifies many of these risks.

Risks related to our limited operating history, financial position, and need for additional capital

We have a history of operating losses that are expected to continue for the foreseeable future, and we are unable to predict the extent of future losses, or whether we will generate significant revenues or achieve or sustain profitability.

We are focused on product development and have generated $102,256 and $3,519,627 in revenues from COVID-19 antigen rapid test kit sales in 2023 and 2022, respectively. We expect to continue to incur operating losses until we are able to commercialize or license our other products. These operating losses have adversely affected and are likely to continue to adversely affect our working capital, total assets and stockholders’ equity. We have generated operating losses of $13,206,396 and $13,976,212 in the years ended December 31, 2023 and 2022, respectively. As of December 31, 2023 and 2022, we had cumulative losses of $37,886,155 and $24,115,606, respectively. We expect to make substantial expenditures and incur increasing operating costs in the future and our accumulated deficit will increase significantly as we expand development and clinical trial activities for our product candidates. Because of the risks and uncertainties associated with product development, we are unable to predict the extent of any future losses, whether we will ever generate significant revenues or if we will ever achieve or sustain profitability.

We believe that our cash on hand, along with the anticipated net proceeds from products sales and additional financing, will enable us to fund our operations over the short and medium terms based on our current plan. We are dependent on obtaining, and are continuing to pursue, necessary funding from outside sources, including obtaining additional funding from the issuance of securities in order to continue our operations. Without adequate funding, we may not be able to meet our obligations. The successful commercialization of any of our products will require us to perform a variety of functions, including:

| · | continuing to undertake preclinical and clinical development; |

| · | engaging in the development of product candidate formulations and manufacturing processes; |

| · | interacting with the applicable regulatory authorities and pursuing other required steps for regulatory approval; |

| · | engaging with payors and other pricing and reimbursement authorities; |

| · | submitting marketing applications to and receiving approval from the applicable regulatory authorities; and |

| · | manufacturing the applicable products and product candidates in accordance with regulatory requirements and, if ultimately approved, conducting sales and marketing activities in accordance with health care, Taiwan Food and Drug Administration, or TFDA, U.S. Food and Drug Administration, or FDA, and similar foreign regulatory authority laws and regulations. |

Our revenue for the fiscal year of 2023 was almost exclusively dependent on sales of the Ainos COVID-19 antigen rapid test kits and we ceased the sale of the Ainos COVID-19 antigen rapid test kits in early 2024. We anticipate that VELDONA Pet will serve as our primary source of our future revenue until we can develop, obtain regulatory clearance or other appropriate authorization for, and commercialize additional product candidates.

Our revenue for the fiscal year of 2023 was almost exclusively dependent on sales of the Ainos COVID-19 antigen rapid test kits and we ceased the sale of the Ainos COVID-19 antigen rapid test kits in early 2024. Until such time as we can commercialize additional products, the discontinuation of sales of the Ainos COVID-19 antigen rapid test kits may adversely affect our business, operating results, and financial condition.

Starting from the year 2024, we anticipate VELDONA Pet to serve as a key source of our future revenue until we can develop, obtain regulatory clearance, or secure other appropriate authorization for additional product candidates and commercialize them. The sales of VELDONA Pet will depend on several factors, including, but not limited to, sales and marketing strategies, affordability, and ease of use compared to other products and competitors of VELDONA Pet. If we cannot expand our customer base or improve our sales and marketing strategies, we may not be able to increase our revenue.

We have generated very little revenue from product sales and may never become profitable.

Our ability to generate product sales and achieve profitability depends on our ability, alone or with collaborative partners, to successfully complete the development of, and obtain the regulatory approvals necessary to commercialize our current and future product candidates. Our product candidates will require additional clinical, manufacturing, and non-clinical development, regulatory approval, commercial manufacturing arrangements, establishment of a commercial organization, significant marketing efforts, and further investment before we generate significant product sales.

We cannot assure you that we will meet our timelines for our development programs, which may be delayed or not completed for a number of reasons. Our ability to generate future revenues from product sales depends heavily on our, or our collaborators’ ability to successfully:

| · | complete research and obtain favorable results from preclinical and clinical development of our current and future product candidates, including addressing any clinical holds that may be placed on our development activities by regulatory authorities; |

| · | seek and obtain regulatory and marketing approvals for any of our product candidates for which we complete clinical trials, as well as their manufacturing facilities; |

| · | launch and commercialize any of our product candidates for which we obtain regulatory and marketing approval by establishing a sales force, marketing, and distribution infrastructure or, alternatively, collaborating with a commercialization partner; |

| · | qualify for coverage and establish adequate reimbursement by government and third-party payors for any of our product candidates for which we obtain regulatory and marketing approval; |

| · | develop, maintain, and enhance a sustainable, scalable, reproducible, and transferable manufacturing process for the product candidates we may develop; |

| · | establish and maintain supply and manufacturing capabilities or capacities internally or with third parties that can provide adequate, in both amount and quality, products, and services to support clinical development and the market demand for any of our product candidates for which we obtain regulatory and marketing approval; |

| · | obtain market acceptance of current or any future product candidates and effectively compete to establish market share; |

| · | maintain a continued acceptable safety and efficacy profile of our product candidates following launch; |

| · | address competing technological and market developments; |

| · | implement internal systems and infrastructure, as needed; |

| · | negotiate favorable terms in any collaboration, licensing, or other arrangements into which we may enter and performing our obligations in such collaborations; |

| · | maintain, protect, enforce, defend, and expand our portfolio of intellectual property rights, including patents, trade secrets, and know-how; |

| · | avoid and defend against third-party interference, infringement, and other intellectual property claims; and |

| · | attract, hire, and retain qualified personnel. |

Even if one or more of our current and future product candidates are approved for commercial sale, we anticipate incurring significant costs associated with commercializing any approved product candidate. Our expenses could increase beyond our expectations if we are required by the TFDA, the FDA or other regulatory authorities to perform clinical and other studies in addition to those that we currently anticipate. If we are required to conduct additional clinical trials or other testing of our product candidates that we develop beyond those that we currently expect, if we are unable to successfully complete clinical trials of our product candidates or other testing, if the results of these trials or tests are not positive or are only modestly positive, or if there are safety concerns, we may be delayed in obtaining marketing approval for our product candidates, not obtain marketing approval at all, or obtain more limited approvals. Even if we are able to generate revenues from the sale of any approved product candidates, we may not become profitable and may need to obtain additional funding to continue operations.

Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. Our failure to become and remain profitable would decrease the value of the Company and could impair our ability to raise capital, maintain our research and development efforts, expand our business or continue our operations. A decline in the value of our Company also could cause you to lose all or part of your investment.

We need to raise additional capital to operate our business. If we fail to obtain the capital necessary to fund our operations, we will be unable to continue or complete our product development.