0001275158false00012751582024-03-062024-03-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15 (d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): March 6, 2024

NOODLES & COMPANY

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | |

| Delaware | 001-35987 | 84-1303469 |

| (State or Other Jurisdiction of | (Commission File Number) | (I.R.S. Employer |

| Incorporation) | | Identification No.) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 520 Zang Street, Suite D | | | | | | | | | | | | | | | |

| | | Broomfield, | CO | | | | | | | | | | | | | | | 80021 |

| | | (Address of principal executive offices) | | | | | | | | | | | | | | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (720) 214-1900

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

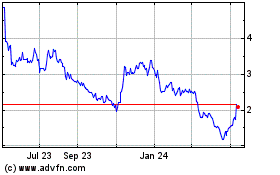

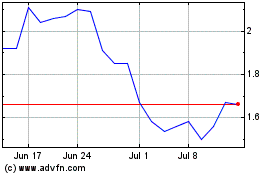

| Class A common stock | NDLS | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On March 7, 2024, Noodles & Company (the "Company") issued a press release disclosing earnings and other financial results for its fiscal quarter and fiscal year ended January 2, 2024, and that as previously announced, its management would review these results in a conference call at 4:30 p.m. (EST) on March 7, 2024.

A copy of the Company’s press release is included as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference. The information contained in this Item 2.02, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 5.02. Departure of Directors of Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Effective March 6, 2024, the Board of Directors (the “Board”) of the Company appointed Drew Madsen, 67, as the Company’s Chief Executive Officer. Mr. Madsen had served as the Company’s interim Chief Executive Officer since November 2023. He has served as a member of the Board since September 2017 and will continue to serve as a member of the Board.

In connection with his appointment as Chief Executive Officer, the Company entered into an employment agreement with Mr. Madsen, dated March 6, 2024 (the “Madsen Employment Agreement”), with an initial term of three years. Mr. Madsen will receive an annual base salary of $800,000 and is eligible to receive an annual bonus in an amount targeted at 100% of his base salary, subject to the achievement of performance conditions that will be established by the Board or the Compensation Committee in their discretion. In addition, on March 6, 2024, Mr. Madsen was granted nonqualified stock options under the Company’s 2023 Stock Incentive Plan (the “2023 Plan”) to purchase 250,000 shares of the Company’s common stock, par value $0.01, of the Company (the “Common Stock”), which options are scheduled to vest on March 6, 2027, subject to the terms of the grant agreement, including with respect to pro rata vesting upon certain conditions. In addition, on March 6, 2024, Mr. Madsen is entitled to receive the following equity awards pursuant to the Company’s 2023 Plan: (i) time-vesting restricted stock units with respect to shares of Common Stock with a grant date fair value of $500,000, which units are scheduled to vest in three annual ratable installments; and (ii) performance-vesting restricted stock units with respect to shares of Common Stock with a target grant date fair value of $1,000,000, which units are scheduled to vest upon achievement of certain performance conditions, in each case subject to the terms of the grant agreements, including with respect to accelerated vesting or pro rata vesting upon certain conditions. Mr. Madsen is further entitled to the standard benefits available to the Company’s executives generally, including health insurance, life and disability coverage and the option to participate in the Company’s 401(k) Savings Plan. If Mr. Madsen’s employment is terminated by the Company without cause, or he voluntarily terminates his employment for good reason, Mr. Madsen will be entitled to receive (i) 18 months of base salary following the date of termination (or 24 months of base salary if terminated within 60 days prior to, or 12 months following, a change in control of the Company), (ii) a pro rata portion of his annual bonus for the year in which the date of termination occurs, based on the number of full months employed in such fiscal year and actual performance for such year; and (iii) an amount equal to the “COBRA” premium for as long as he and, if applicable, his dependents are eligible for COBRA from the Company, in each case subject to his execution and non-revocation of a release of claims in favor of the Company and compliance with certain covenants. If Mr. Madsen’s employment is terminated as a result of death or disability, he (or his estate) will be entitled to receive any accrued payments and benefits through the termination date and a pro-rated portion of his annual bonus for the year in which a termination due to death or disability occurs.

The Madsen Employment Agreement prohibits Mr. Madsen from competing with the Company or soliciting its employees during the course of his employment and for 12 months following his termination of employment for any reason. Mr. Madsen is also subject to confidentiality, cooperation, return of business records and equipment, and non-disparagement covenants. The Madsen Employment Agreement supersedes and replaces the offer letter, dated November 9, 2023, between the Company and Mr. Madsen.

The preceding summary of the Madsen Employment Agreement and related equity grant agreements are qualified in their entirety by reference to the complete terms and conditions of such agreements, which are filed as Exhibits 10.1, 10.2, 10.3, and 10.4, respectively, to this Current Report on Form 8-K.

A description of Mr. Madsen’s business experience is included in the Company’s proxy statement on Schedule 14A for its 2023 annual stockholders’ meeting filed with the SEC on March 31, 2023, and is incorporated herein by reference. There were no arrangements or understandings between Mr. Madsen and any other person pursuant to which Mr. Madsen was selected as an officer. There are no family relationships between Mr. Madsen and any director or executive officer of the Company required to

be disclosed under Item 401(d) of Regulation S-K, and he does not have any direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Item 7.01. Regulation FD Disclosure.

On March 7, 2024, the Company issued a press release announcing the appointment of Mr. Madsen as Chief Executive Officer.

A copy of the Company’s press release is included as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated herein by reference. The information contained in this Item 7.01, including Exhibit 99.2, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | | | | |

Exhibit No. | | Description |

| 10.1* | | | |

| 10.2* | | | |

| 10.3* | | | |

| 10.4* | | | |

| 99.1 | | | |

| 99.2 | | | |

| 104 | | Cover Page Interactive Data File. The cover page XBRL tags are embedded within the Inline XBRL document. | |

*Indicates management contract or compensatory plan or arrangement.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | Noodles & Company |

| | |

| | |

| By: | /s/ MIKE HYNES |

| Name: | Mike Hynes |

| Title: | Chief Financial Officer |

DATED: March 7, 2024

EMPLOYMENT AGREEMENT

This Employment Agreement (the “Agreement”) is entered into as of March 6, 2024, by and between Noodles & Company, a Delaware corporation (the “Company”), and Drew Madsen, an individual (the “Executive”).

INTRODUCTION

1. The Executive currently serves as the interim Chief Executive Officer of the Company.

2. The Company and the Executive wish for the Executive to serve as the Company’s permanent Chief Executive Officer.

3. The Executive desires to be employed by the Company as its Chief Executive Officer, pursuant to the terms and conditions set forth herein.

AGREEMENT

In consideration of the premises and mutual promises herein below set forth, the parties hereby agree as follows:

1.Employment Period

The term of the Executive’s employment by the Company pursuant to this Agreement shall commence on March 6, 2024 (the “Effective Date”) and shall continue until the third anniversary thereof (the “Employment Period”), provided that (i) the parties may extend the Employment Period by mutual written agreement, and (ii) either the Company or the Executive may earlier terminate the Employment Period pursuant to Section 5.

2.Employment

(a)Title; Duties. The Executive shall serve as Chief Executive Officer of the Company during the Employment Period, and the Executive hereby accepts such employment. The duties assigned and authority granted to the Executive shall be as determined by the Company’s Board of Directors (the “Board”) from time to time, and such duties shall be consistent with the Executive’s position and status as Chief Executive Officer. The Board shall also nominate the Executive to continue to serve as a member of the Board during the Employment Period. The Executive agrees to perform his duties for the Company diligently, competently, and in a good faith manner.

(b)Exclusive Employment. During the Employment Period, the Executive shall devote his full business time to his duties and responsibilities set forth above, and may not, without the prior written consent of the Board or its designee, operate, participate in the management, board of directors, operations or control of, or act as an employee, officer, consultant, agent or representative of, any type of business or service (other than as an employee

of the Company); provided, however, that the Executive may (i) engage in civic and charitable activities, (ii) participate in industry associations, deliver lectures or fulfill speaking engagements, (iii) make and maintain outside personal investments, and (iv) serve on one board of directors consented to in writing by the Board (which consent shall not be unreasonably withheld or delayed), provided that none of the foregoing activities and service significantly interfere with the Executive’s performance of his duties hereunder.

(c)Location. The Executive primary work location will be in the Orlando, Florida area, subject to reasonable required travel. The Executive is expected to spend significant time at the Company’s headquarters.

3.Compensation

(a)Base Salary. The Executive shall be entitled to receive a base salary from the Company during the Employment Period at the rate of $800,000 per year. The Executive’s base salary shall be reviewed annually by the Board or the Compensation Committee of the Board (the “Committee”), and may be increased (but not decreased). The base salary shall be paid in accordance with the Company’s payroll procedures as in effect from time-to-time.

(b)Annual Bonus. The Executive shall be eligible to receive an annual bonus (the “Annual Bonus”) for each calendar year during the Employment Period in an amount targeted at one hundred percent (100%) of the Executive’s then-effective annual base salary, contingent upon the Executive achieving certain targeted goals that will be established by the Board or the Committee. For the avoidance of doubt, the Annual Bonus for 2024 shall not be prorated. Any Annual Bonus to which the Executive may be entitled under this Section 3(b) shall be paid in cash in the form of a lump sum as soon as practicable following the completion of the financial audit for the applicable fiscal year, and in no event later than April 30 after the end of the fiscal year to which such Annual Bonus relates. Whether and to what degree the Executive has met the performance goals described in this Section 3(b) shall be determined by the Board in its reasonable discretion in accordance with the applicable bonus/performance goals document for that bonus year described in the first sentence of this Section 3(b).

(c)Equity Incentives.

(A)Effective as of the Effective Date, the Executive shall be granted nonqualified stock options (the “Options”) under the Company’s 2023 Stock Incentive Plan (the “2023 Plan”, which term includes any successor plan) to purchase 250,000 shares of the Company’s common stock, par value $0.01, of the Company (the “Common Shares”). The exercise price per Common Share for the Options shall be the greater of $2.50 or the fair market value of a Common Share on the Effective Date (as determined in accordance with the Company’s standard procedures). The Options shall be subject to the 2023 Plan and a grant agreement substantially in the form attached as Exhibit B.

(B)Effective as of the Effective Date, the Company shall grant the Executive equity incentives under the 2023 Plan with a target value of $1,500,000.

One-third of the equity grant (i.e., $500,000 value) shall be in the form of time-vesting restricted stock units (“RSUs”) subject to a grant agreement substantially in the form attached as Exhibit C, and two-thirds of the equity grant (i.e., target $1,000,000 value) shall be in the form of performance-based restricted stock units subject to a grant agreement substantially in the form attached as Exhibit D (“PSUs”). The number of RSUs and PSUs to be granted on the grant date shall equal the quotient of (i) the applicable target grant amount for the RSUs or PSUs, as applicable, and (ii) the fair market value of the Common Shares on the grant date as determined pursuant to the Company’s standard procedures; provided in no event shall clause (ii) be less than $2.50.

(C)Executive shall be eligible for annual equity grants in subsequent years, with an intended target grant value of $1,500,000, subject to share availability under the 2023 Plan and approval from the Board or its Compensation Committee.

4.Other Benefits; Location

(a)Insurance. During the Employment Period, the Executive and the Executive’s dependents shall be eligible for coverage under the group insurance plans made available from time to time to Company’s executive employees. The premiums for the coverage of the Executive and the Executive’s dependents under that plan shall be paid by the Company pursuant to the formula in place for other executive employees covered by Company’s group insurance plans.

(b)Savings and Retirement Plans. During the Employment Period, the Executive shall be entitled to participate in all other savings and retirement plans, practices, policies and programs, in each case on terms and conditions no less favorable than the terms and conditions generally applicable to the Company’s other executive employees.

(c)Vacation. During the Employment Period, the Executive shall be entitled to an annual vacation pursuant to the Company’s Time Away From Work policy, as in effect from time to time.

(d)Reimbursement of Expenses. The Company shall promptly reimburse the Executive for all reasonable out of pocket travel, entertainment, and other expenses incurred or paid by the Executive in connection with, or related to, the performance of his responsibilities or services under this Agreement upon the submission of appropriate documentation pursuant to the Company’s policies in effect from time to time. Without limitation, subject to the foregoing documentation requirements, the Company shall reimburse the reasonable travel and lodging expenses for the Executive’s travel to the Company headquarters from his office in Florida.

5.Termination

(a)Termination by the Company with Cause. Upon written notice to the Executive, the Company may terminate the Executive’s employment for Cause (as defined below) during the Employment Period. In the event that the Executive’s employment is

terminated for Cause, the Executive shall receive from the Company payments for (i) any and all earned and unpaid portion of his then-effective base salary (on or before the first regular payroll date following the Date of Termination in accordance with applicable law); (ii) any and all unreimbursed business expenses (in accordance with the Company’s reimbursement policy); (iii) any and all accrued and unused vacation time through the Date of Termination (on or before the first regular payroll date following the Date of Termination in accordance with applicable law); and (iv) any other benefits the Executive is entitled to receive as of the Date of Termination under the employee benefit plans of the Company, less standard withholdings (items (i) through (iv) are hereafter referred to as “Accrued Benefits”). Except for the Accrued Benefits or as required by law, after the Date of Termination, the Company shall have no obligation to make any other payment, including severance or other compensation of any kind on account of the Executive’s termination of employment or to make any payment in lieu of notice to the Executive in the event of a termination pursuant to this Section 5(a). Except as required by law or as otherwise provided herein, all benefits provided by the Company to the Executive under this Agreement or otherwise shall cease as of the Date of Termination in the event of a termination pursuant to this Section 5(a).

(b)Termination by the Company Without Cause. The Company may, at any time and without prior written notice, terminate the Executive’s employment without Cause. In the event that the Executive’s employment with the Company is terminated without Cause during the Employment Period, the Executive shall receive the Accrued Benefits and any unpaid portion of the Annual Bonus from a prior year (payable when other senior executives receive their annual bonuses for such year, and in no event later than March 15 of the year following the year for which the Annual Bonus was earned). In addition, the Executive shall be entitled to receive from the Company the following: (i) severance payments totaling (A) if the termination does not occur during the CIC Protection Period (as defined below), eighteen (18) months of base salary, paid in equal installments according to the Company’s regular payroll schedule over the eighteen (18) months following the Date of Termination (the “Severance Period”), or (B) if the termination occurs during the CIC Protection Period, twenty-four (24) months of base salary, paid in a lump sum within five (5) days following the release of claims specified in Exhibit A becoming irrevocable, (ii) (A) if the termination does not occur during the CIC Protection Period, a pro rata portion of the Annual Bonus for the year in which the Date of Termination occurs, based on the number of full months employed in such fiscal year and actual performance for such year, paid when other senior executives receive their annual bonuses for such year (and in no event later than March 15 of the year following the year in which the Date of Termination occurs), or (B) if the termination occurs during the CIC Protection Period, a pro rata Target Bonus (with the proration determined in the same manner as in clause (ii)(A)), paid in a lump sum within five (5) days following the release of claims specified in Exhibit A becoming irrevocable; and (iii) a cash payment equal to the “COBRA” premium for Executive’s elected coverage as of the Date of Termination for eighteen (18) months, payable in a lump sum within five (5) days following the release of claims specified in Exhibit A becoming irrevocable. The Executive’s entitlement to the severance payments and benefits in the foregoing sentence is conditioned on (A) the Executive’s executing and delivering to the Company of a release of claims substantially in the form attached hereto as Exhibit A within forty-five (45) days following the Date of Termination, and on such release becoming effective, and (B) the

Executive’s continued compliance with the restrictive covenants set forth in Sections 6, 7 and 8; provided, that if such forty-five (45) day period begins in one taxable year and ends in the following taxable year, the payments described in (i) of the preceding sentence shall commence in the second taxable year (and any payments that would have been made in the first taxable year shall be paid in a lump sum at the time payments commence pursuant hereto). Except as specifically provided in this Section 5(b) or in another section of this Agreement, or except as required by law, all benefits provided by the Company to the Executive under this Agreement or otherwise shall cease as of the Date of Termination in the event of a termination pursuant to this Section 5(b). For the avoidance of doubt, a Change in Control shall not, standing alone, make the Executive eligible for any severance benefits pursuant to this Section 5(b) or Section 5(c); rather, this Agreement includes a “double-trigger” pursuant to which a termination without Cause or a resignation for Good Reason is a prerequisite for any such benefits following a Change in Control.

(c)Termination by the Executive for Good Reason. The Executive may voluntarily terminate his employment with the Company during the Employment Period and receive the severance payments, bonus payments, and other benefits detailed in Section 5(b) following the occurrence of an event constituting Good Reason (as defined below) that has not been cured by the Company within the timeframe specified in the definition of Good Reason.

(d)Voluntary Termination. If the Executive terminates employment with the Company without Good Reason during the Employment Period, the Executive agrees to provide the Company with ninety (90) days’ prior written notice. In the event that the Executive’s employment is terminated under this Section 5(d), the Executive shall receive from the Company payment for all Accrued Benefits described in Section 5(a) above at the times specified in Section 5(a) above. Except as required by law, after the Date of Termination, the Company shall have no obligation to make any other payment, including severance or other compensation, of any kind to the Executive on account of the Executive’s termination of employment pursuant to this Section 5(d).

(e)Termination Upon Death or Disability. If the Executive’s employment is terminated as a result of death or Disability during the Employment Period, the Executive (or the Executive’s estate, or other designated beneficiary(s) as shown in the records of the Company in the case of death) shall be entitled to receive from the Company (i) payment for the Accrued Benefits described in Section 5(a) above at the times specified in Section 5(a) above and any unpaid portion of the Annual Bonus from a prior year (payable when other senior executives receive their annual bonuses for such year, and in no event later than March 15 of the year following the year for which the Annual Bonus was earned), and (ii) a portion of the Annual Bonus that the Executive would have been eligible to receive for days employed by the Company in the year in which the Executive’s death or Disability occurs, determined by multiplying (x) the Annual Bonus based on the actual level of achievement of the applicable performance goals for such year, by (y) a fraction, the numerator of which is the number of full months the Executive employed hereunder in such fiscal year up to and including the Date of Termination in the year in which the Date of Termination occurs, and the denominator of which is 12, such amount to be paid in the same time and the same form as the Annual Bonus otherwise would be paid. Except as required by law, after the Date of Termination, the Company shall have no obligation to make

any other payment, including severance or other compensation, of any kind to the Executive (or the Executive’s estate, or other designated beneficiary(s), as applicable) upon a termination of employment by death or Disability.

(f)Certain Definitions. For purposes of this Agreement, the following terms shall have the meanings set forth below.

(A)“Cause” shall mean (i) the Executive breaches this Agreement or any material Company policy or procedure that, if curable, is not cured by the Executive to the reasonable satisfaction of the Board within 10 days following the Company notifying the Executive of such breach; (ii) the Executive commits a felony or any other crime involving dishonesty or moral turpitude; (iii) the Executive engages in fraudulent, dishonest or illegal conduct in the performance of services for or on behalf of Company; (iv) the Executive fails to follow lawful directions of the Board or the person to whom the Executive reports; (v) a harassment allegation against the Executive that the Board reasonably determines to be credible; (vi) any willful misconduct or gross negligence by the Executive with respect to his performance of duties for the Company; (vii) the Executive materially violates any material Company policy (including with respect to discrimination, harassment, data security and retaliation); or (viii) the Executive reports to or is present at work under the influence of alcohol or engages in the unlawful use or possession of drugs or illegal drugs (whether or not in the workplace).

(B)“Change in Control” means the occurrence of any of the following events: (i) during any 12-month period, the members of the Board (the “Incumbent Directors”) cease for any reason other than due to death or disability to constitute at least a majority of the members of the Board, provided that any director whose election, or nomination for election by the Company's stockholders, was approved by a vote of at least a majority of the members of the Board who are at the time Incumbent Directors shall be considered an Incumbent Director, other than any such individual whose initial assumption of office occurs as a result of an actual or threatened election contest with respect to the election or removal of directors or other actual or threatened solicitation of proxies or consents by or on behalf of a person other than the Board; (ii) the acquisition or ownership by any individual, entity or "group" (within the meaning of Section 13(d)(3) of the Securities Exchange Act of 1934 (the “Exchange Act”), other than the Company or any of its affiliates or subsidiaries, or any employee benefit plan (or related trust) sponsored or maintained by the Company or any of its Affiliates or Subsidiaries, of beneficial ownership (within the meaning of Rule 13d-3 promulgated under the Exchange Act) of 50% or more of the combined voting power of the Company's then outstanding voting securities entitled to vote generally in the election of directors (excluding for this purpose any ownership or additional acquisition of Common Stock by any person (or any affiliate thereof) that owns more than 10% of the Common Stock as of the Effective Date); (iii) the merger, consolidation or other similar transaction of the Company, as a result of which the stockholders of the Company immediately prior to such merger, consolidation or other transaction, do not, immediately thereafter, beneficially own, directly or indirectly, more than 50% of the combined voting power of the voting securities entitled to vote generally in the election of directors of the

merged, consolidated or other surviving company; or (iv) the sale, transfer or other disposition of all or substantially all of the assets of the Company to one or more persons or entities that are not, immediately prior to such sale, transfer or other disposition, affiliates of the Company. However, a “Change in Control” shall not be deemed to occur if the Company undergoes a bankruptcy, liquidation or reorganization under the United States Bankruptcy Code.

(C)“CIC Protection Period” means the period beginning sixty (60) days prior to a Change in Control and ending twelve (12) months following such Change in Control.

(D)“Date of Termination” shall mean (i) if the Executive is terminated by the Company for Disability, thirty (30) days after written notice of termination is given to the Executive (provided that the Executive shall not have returned to the performance of his duties on a full-time basis during such 30-day period); (ii) if the Executive’s employment is terminated by the Company for any other reason, the date on which a written notice of termination is given or such other date specified in the notice, specifying in reasonable detail the facts and circumstances claimed to provide a basis for termination of the Executive’s employment is given, and in the case of termination for Cause, after compliance with the notice and cure provisions in the definition of Cause; (iii) if the Executive terminates employment for Good Reason, the date of the Executive’s resignation; provided that the notice and cure provisions in the definition of Good Reason have been complied with; (iv) if the Executive terminates employment for other than a Good Reason, the date specified in the Executive’s notice in compliance with Section 5(f); or (v) in the event of the Executive’s death, the date of death.

(E)“Disability” shall mean the absence of the Executive from the Executive's duties with the Company on a full-time basis for 180 consecutive business days as a result of incapacity due to mental or physical illness, which is determined to be total and permanent by a physician selected by the Company or its insurers and reasonably acceptable to the Executive or the Executive's legal representative.

(F) “Good Reason” shall mean, in the absence of written consent of the Executive, (i) the Board requiring the Executive to relocate the Executive’s principal place of employment by more than fifty (50) miles from Orlando, Florida, (ii) the Executive’s removal from the position of Chief Executive Officer of the Company; (iii) a reduction in the annualized base salary or the target Annual Bonus; or (iv) material breach by the Company of this Agreement. If circumstances arise giving the Executive the right to terminate this Agreement for Good Reason, the Executive must within thirty (30) days notify the Company in writing of the existence of such circumstances, describing such circumstances with particularity and specifically citing this Section 5(f)(F), and the Company shall have thirty (30) days from receipt of such notice within which to investigate and remedy any such circumstances; if such circumstances exist and are not remedied within such 30-day period, then Executive shall thereafter have a period

of thirty (30) days within which to exercise the right to terminate for Good Reason. If the Executive does not timely do so the right to terminate for Good Reason shall lapse and be deemed waived, and the Executive shall not thereafter have the right to terminate for Good Reason unless further circumstances occur giving rise independently to a right to terminate for Good Reason under this Section 5(f)(F).

(g)Notice of Termination. Any termination of the Executive’s employment by the Company or by the Executive under this Section 5 (other than in the case of death) shall be communicated by a written notice (the “Notice of Termination”) to the other party hereto, indicating the specific termination provision in this Agreement relied upon, setting forth as appropriate in reasonable detail any facts and circumstances claimed to provide a basis for termination of the Executive’s employment under the provision so indicated, and specifying a Date of Termination which notice shall be delivered within the time periods set forth in the various subsections of this Section 5, as applicable (the “Notice Period”); provided, however, that the Company may pay to the Executive all base salary, benefits and other rights due to the Executive during the Notice Period instead of employing the Executive during such Notice Period.

(h)Resignation from All Positions. Upon the Executive’s termination of employment for any reason, the Executive shall immediately resign from all other positions with the Company and its affiliates (including, to the extent applicable, as a member of the Board).

6.Non-Competition; General Provisions Applicable to Restrictive Covenants

(a)Covenant not to Compete. For the duration of the Employment Period and for twelve (12) months thereafter, the Executive shall not, directly or indirectly, own any interest in, manage, control, participate in, consult with, advise, render services for, or be employed in an executive, managerial or administrative capacity by (i) any entity engaged in the fast or quick-casual restaurant business or (ii) any other entity that engages in or plans to engage in a business that directly competes with the business of the Company, in each case within North America (a “Competing Business”). Nothing herein shall prohibit the Executive from being a passive owner of not more than 5% of the outstanding stock of any class of a corporation which is publicly traded, so long as the Executive has no active participation in the business of such corporation.

(b)Specific Performance. The Executive recognizes and agrees that a violation by him of his obligations under this Section 6, or under Section 7, or subparts (a) or (d) of Section 8 may cause irreparable harm to the Company that would be difficult to quantify and that money damages may be inadequate. As such, the Executive agrees that the Company shall have the right to seek injunctive relief (in addition to, and not in lieu of any other right or remedy that may be available to it) to prevent or restrain any such alleged violation without the necessity of posting a bond or other security and without the necessity of proving actual damages. However, the foregoing shall not prevent the Executive from contesting the Company’s request for the issuance of any such injunction on the grounds that no violation or threatened violation of the aforementioned Sections has occurred and that the Company has not suffered irreparable harm. If a court of competent jurisdiction determines that the Executive has violated the

obligations of any covenant for a particular duration, then the Executive agrees that such covenant will be extended by that duration.

(c)Scope and Duration of Restrictions. The Executive expressly agrees that the character, duration and geographical scope of the restrictions imposed under this Section 6, and under Section 7, and all of Section 8 are reasonable in light of the circumstances as they exist at the date upon which this Agreement has been executed. However, should a determination nonetheless be made by a court of competent jurisdiction at a later date that the character, duration or geographical scope of any of the covenants contained herein is unreasonable in light of the circumstances as they then exist, then it is the intention of both the Executive and the Company that such covenant shall be construed by the court in such a manner as to impose only those restrictions on the conduct of the Executive which are reasonable in light of the circumstances as they then exist and necessary to assure the Company of the intended benefit of such covenant.

7.Confidentiality Covenants

The Executive acknowledges that the confidential business information generated by the Company and its subsidiaries, whether such information is written, oral or graphic, including, but not limited to, financial plans and records, marketing plans, business strategies and relationships with third parties, present and proposed products, present and proposed patent applications, trade secrets, information regarding customers and suppliers, strategic planning and systems and contractual terms obtained by the Executive while employed by the Company and its subsidiaries concerning the business or affairs of the Company or any subsidiary of the Company (collectively, the “Confidential Information”) is the property of the Company or such subsidiary. The Executive agrees that he shall not disclose to any Person or use for the Executive’s own purposes any Confidential Information or any confidential or proprietary information of other persons in the possession of the Company and its subsidiaries (“Third Party Information”), without the prior written consent of the Board, unless and to the extent that (i) the Confidential Information or Third Party Information becomes generally known to and available for use by the public, other than as a result of the Executive’s acts or omissions or (ii) the disclosure of such Confidential Information is required by law, in which case the Executive shall give notice to and the opportunity to the Company to comment on the form of the disclosure and only the portion of Confidential Information that is required to be disclosed by law shall be disclosed. In addition, nothing in this Section 7 or any other provision of this Agreement prohibits the Executive from voluntarily communicating, without notice to or approval by the Company, with any federal government agency about a potential violation of federal law or regulation.

Pursuant to 18 U.S.C. § 1833(b), Executive will not be held criminally or civilly liable under any Federal or State trade secret law for the disclosure of a trade secret of the Company or any of its subsidiaries that—(i) is made—(A) in confidence to a Federal, State, or local government official, either directly or indirectly, or to Executive’s attorney and (B) solely for the purpose of reporting or investigating a suspected violation of law; or (ii) is made in a complaint or other document that is filed under seal in a lawsuit or other proceeding. If Executive files a lawsuit for retaliation by the Company or any of its subsidiaries for reporting a suspected violation of law, Executive may disclose the trade secret to the Executive’s attorney and use the

trade secret information in the court proceeding, if Executive files any document containing the trade secret under seal and does not disclose the trade secret except under court order. Nothing in this Agreement is intended to conflict with 18 U.S.C. § 1833(b) or create liability for disclosures of trade secrets that are expressly allowed by such section.

Nothing in the Agreement shall prohibit or restrict the Company or any of its subsidiaries, Executive or their respective attorneys from: (i) making any disclosure of relevant and necessary information or documents in any action, investigation, or proceeding relating to Executive’s employment, or as required by law or legal process, including with respect to possible violations of law; (ii) participating, cooperating, or testifying in any action, investigation, or proceeding with, or providing information to, any governmental agency or legislative body, any self-regulatory organization, and/or pursuant to the Sarbanes-Oxley Act; or (iii) accepting any U.S. Securities and Exchange Commission awards. In addition, nothing in this Agreement prohibits or restricts the Company or any of its subsidiaries or Executive from initiating communications with, or responding to any inquiry from, any regulatory or supervisory authority regarding any good faith concerns about possible violations of law or regulation.

8.Other Covenants

(a)Non-Solicitation. For the duration of the Employment Period and for twelve (12) months thereafter, other than in the course of performing his duties, the Executive shall not, directly or indirectly through another person, induce or attempt to induce any employee of the Company or any of its subsidiaries (other than restaurant-level employees who are not managers) to leave the employ of the Company or such subsidiary, or in any way interfere with the relationship between the Company or any of its subsidiaries and any such employee.

(b)Compliance with Company Policies. The Executive agrees that, during the Employment Period, he shall comply in all material respects with the Company’s employee manual and other policies and procedures reasonably established by the Company from time to time, including but not limited to policies addressing matters such as management, supervision, recruiting and diversity.

(c)Cooperation. For a period of eighteen (18) months following the end of the Employment Period, the Executive shall, upon the Company’s reasonable request and in good faith and with the Executive’s commercially reasonable efforts and subject to the Executive’s reasonable availability, cooperate and assist the Company in any dispute, controversy, or litigation in which the Company may be involved and with respect to which the Executive obtained knowledge while employed by the Company or any of its affiliates, successors, or assigns, including, but not limited to, participation in any court or arbitration proceedings, giving of testimony, signing of affidavits, or such other personal cooperation as counsel for the Company shall request. Any such activities shall be scheduled, to the extent reasonably possible, to accommodate the Executive’s business and personal obligations at the time. The Company shall pay the Executive’s reasonable travel and incidental out-of-pocket expenses incurred in connection with any such cooperation.

(d)Return of Business Records and Equipment. Upon termination of the Executive’s employment hereunder, the Executive shall promptly return to the Company: (i) all documents, records, procedures, books, notebooks, and any other documentation in any form whatsoever, including but not limited to written, audio, video or electronic, containing any information pertaining to the Company which includes Confidential Information, including any and all copies of such documentation then in the Executive’s possession or control regardless of whether such documentation was prepared or compiled by the Executive, Company, other employees of the Company, representatives, agents, or independent contractors, and (ii) all equipment or tangible personal property entrusted to the Executive by the Company. The Executive acknowledges that all such documentation, copies of such documentation, equipment, and tangible personal property are and shall at all times remain the sole and exclusive property of the Company.

9.Nondisparagement. During the Executive’s employment with the Company and thereafter, the Executive agrees, to the fullest extent permissible by law, not to make, directly or indirectly, any public or private statements, gestures, signs, signals or other verbal or nonverbal, direct or indirect communications that the Executive, using reasonable judgment, should have known would be harmful to or reflect negatively on the Company or are otherwise disparaging of the Company or its past, present or future officers, board members, employees, shareholders, and their affiliates. Nothing in this Section 9 shall prohibit either party from truthfully responding to an accusation from the other party or require either party to violate any subpoena or law.

10.Governing Law. This Agreement and any disputes or controversies arising hereunder shall be construed and enforced in accordance with and governed by the internal laws of the State of Florida, without reference to principles of law that would apply the substantive law of another jurisdiction.

11.Entire Agreement. This Agreement, together with the agreements granting to the Executive the stock options specified in Section 3(c), constitutes the entire agreement between the parties hereto with respect to the subject matter hereof and thereof and supersedes and cancels any and all previous agreements, written and oral, regarding the subject matter hereof. Without limiting the generality of the foregoing this Agreement supersedes the letter agreement dated November 9, 2023. This Agreement shall not be changed, altered, modified or amended, except by a written agreement that (i) explicitly states the intent of both parties hereto to supplement this Agreement and (ii) is signed by both parties hereto.

12.Notices. All notices, requests, demands and other communications called for or contemplated hereunder shall be in writing and shall be deemed to have been sufficiently given if personally delivered or if sent by registered or certified mail, return receipt requested to the parties, their successors in interest, or their assignees at the following addresses, or at such other addresses as the parties may designate by written notice in the manner aforesaid, and shall be deemed received upon actual receipt:

(a)to the Company at:

Noodles & Company

520 Zang Street, Suite D

Broomfield, CO 80021

Attention: General Counsel

with a copy to:

Gibson, Dunn & Crutcher LLP

One Embarcadero Center Suite 2600

San Francisco, CA 94111-3715

Attention: Branden Berns, Esq.

(b)to the Executive at the address reflected in the Company’s payroll records

13.Severability. If any term or provision of this Agreement, or the application thereof to any person or under any circumstance, shall to any extent be invalid or unenforceable, the remainder of this Agreement, or the application of such terms to the persons or under circumstances other than those as to which it is invalid or unenforceable, shall be considered severable and shall not be affected thereby, and each term of this Agreement shall be valid and enforceable to the fullest extent permitted by law.

14.Waiver. The failure of any party to insist in any one instance or more upon strict performance of any of the terms and conditions hereof, or to exercise any right or privilege herein conferred, shall not be construed as a waiver of such terms, conditions, rights or privileges, but same shall continue to remain in full force and effect. Any waiver by any party of any violation of, breach of or default under any provision of this Agreement by the other party shall not be construed as, or constitute, a continuing waiver of such provision, or waiver of any other violation of, breach of or default under any other provision of this Agreement.

15.Successors and Assigns. This Agreement shall be binding upon the Company and any successors and assigns of the Company, including any corporation with which, or into which, the Company may be merged or which may succeed to the Company’s assets or business. In the event that the Company sells or transfers all or substantially all of the assets of the Company, or in the event of any merger or consolidation of the Company, the Company shall use reasonable efforts to cause such assignee, transferee, or successor to assume the liabilities, obligations and duties of the Company hereunder. Neither this Agreement nor any right or obligation hereunder may be assigned by the Executive; provided, however, that this provision shall not preclude the Executive from designating one or more beneficiaries to receive any amount that may be payable after his death and shall not preclude his executor or administrator from assigning any right hereunder to the person or persons entitled hereto.

16.Counterparts. This Agreement may be executed in multiple counterparts, each of which shall be deemed an original, and all of which together shall constitute one and the same instrument.

17.Headings. Headings in this Agreement are for reference only and shall not be deemed to have any substantive effect.

18.Opportunity to Seek Advice; Warranties and Representations. The Executive acknowledges and confirms that he has had the opportunity to seek such legal, financial and other advice and representation as he has deemed appropriate in connection with this Agreement. The Executive hereby represents and warrants to the Company that he is not under any obligation of a contractual or quasi-contractual nature known to him that is inconsistent or in conflict with this Agreement or that would prevent, limit or impair the performance by the Executive of his obligations hereunder.

19.Withholdings. All salary, severance payments, bonuses or benefits provided by the Company under this Agreement shall be net of any tax or other amounts required to be withheld by the Company under applicable law.

20.Section 409A. The parties intend that any compensation, benefits and other amounts payable or provided to the Executive under this Agreement be paid or provided in compliance with Section 409A of the Internal Revenue Code and all regulations, guidance, and other interpretative authority issued thereunder (collectively, “Section 409A”) such that there will be no adverse tax consequences, interest, or penalties for the Executive under Section 409A as a result of the payments and benefits so paid or provided to him. The parties agree to modify this Agreement, or the timing (but not the amount) of the payment hereunder of severance or other compensation, or both, to the extent necessary to comply with and to the extent permissible under Section 409A. In addition, notwithstanding anything to the contrary contained in any other provision of this Agreement, the payments and benefits to be provided the Executive under this Agreement shall be subject to the provisions set forth below.

(a)The date of the Executive’s “separation from service,” as defined in the regulations issued under Section 409A, shall be treated as Executive’s Date of Termination for purpose of determining the time of payment of any amount that becomes payable to the Executive pursuant to Section 5 hereof upon the termination of his employment and that is treated as an amount of deferred compensation for purposes of Section 409A.

(b)In the case of any amounts that are payable to the Executive under this Agreement, or under any other “nonqualified deferred compensation plan” (within the meaning of Section 409A) maintained by the Company in the form of installment payments, (i) the Executive’s right to receive such payments shall be treated as a right to receive a series of separate payments under Treas. Reg. §1.409A-2(b)(2)(iii), and (ii) to the extent any such plan does not already so provide, it is hereby amended as of the date hereof to so provide, with respect to amounts payable to the Executive thereunder.

(c)If the Executive is a “specified employee” within the meaning of Section 409A at the time of his “separation from service” within the meaning of Section 409A, then any payment otherwise required to be made to him under this Agreement on account of his separation from service, to the extent such payment (after taking in to account all exclusions applicable to such payment under Section 409A) is properly treated as deferred compensation subject to

Section 409A, shall not be made until the first business day after (i) the expiration of six months from the date of the Executive’s separation from service, or (ii) if earlier, the date of the Executive’s death (the “Delayed Payment Date”). On the Delayed Payment Date, there shall be paid to the Executive or, if the Executive has died, to the Executive’s estate, in a single cash lump sum, an amount equal to aggregate amount of the payments delayed pursuant to the preceding sentence.

(d)To the extent that the reimbursement of any expenses or the provision of any in-kind benefits pursuant to this Agreement is subject to Section 409A, (i) the amount of such expenses eligible for reimbursement, or in-kind benefits to be provided hereunder during any one calendar year shall not affect the amount of such expenses eligible for reimbursement or in-kind benefits to be provided hereunder in any other calendar year; provided, however, that the foregoing shall not apply to any limit on the amount of any expenses incurred by the Executive that may be reimbursed or paid under the terms of the Company’s medical plan, if such limit is imposed on all similarly situated participants in such plan; (ii) all such expenses eligible for reimbursement hereunder shall be paid to the Executive as soon as administratively practicable after any documentation required for reimbursement for such expenses has been submitted, but in any event by no later than December 31 of the calendar year following the calendar year in which such expenses were incurred; and (iii) the Executive’s right to receive any such reimbursements or in-kind benefits shall not be subject to liquidation or exchange for any other benefit.

21.Clawback Policy. The Executive expressly acknowledges and agrees that (a) all incentive compensation the Executive received or may receive from the Company, including, without limitation, any compensation under this Agreement, any equity incentives, any annual bonus or performance bonus program (including any annual bonus) and any other short-term or long-term incentive program, shall be subject to the terms and conditions of the written clawback and compensation recoupment policy that the Company has adopted (as it may be revised in the future), to the extent the Company determines that such policy should apply to such compensation, and (b) in connection with the enforcement of any such policy, the Company shall have the right to reduce, cancel or withhold against outstanding, unvested, vested or future cash or equity-based compensation owed or due to the Executive, and the Executive agrees to repay to the Company any incentive compensation previously paid to the Executive that is subject to such policy, in each case, to the maximum extent permitted under applicable law. No recovery of compensation under such policy will be an event giving rise to a right to resign for Good Reason or similar term under this Agreement or any other agreement between the Executive and the Company.

[The next page is the signature page]

IN WITNESS WHEREOF, the parties have executed this Agreement as of the Effective Date.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | NOODLES & COMPANY | | | |

| | a Delaware corporation | | | |

| | | | | | |

| | | | | | |

| | By: | /s/ MELISSA HEIDMAN | | | |

| | | Melissa Heidman | | | |

| | | | | | |

| | EXECUTIVE: | | | |

| | | | | | |

| | | | | | |

| | /s/ DREW MADSEN | | | |

| | Drew Madsen | | | |

| | | | | | |

[Signature Page to Employment Agreement]

Exhibit A

RELEASE AGREEMENT

1. Executive, individually and on behalf of his heirs and assigns, hereby releases, waives and discharges Company, and all subsidiary, parent or affiliated companies and corporations, and their present, former or future respective subsidiary, parent or affiliated companies or corporations, and their respective present or former directors, officers, shareholders, trustees, managers, supervisors, employees, partners, attorneys, agents, representatives and insurers, and the respective successors, heirs and assigns of any of the above described persons or entities (hereinafter referred to collectively as “Released Parties”), from any and all claims, causes of action, losses, damages, costs, and liabilities of every kind and character, whether known or unknown (“Claims”), that Executive may have or claim to have, in any way relating to or arising out of, in whole or in part, (a) any event or act of omission or commission occurring on or before the Date of Termination, including Claims arising by reason of the continued effects of any such events or acts, which occurred on or before the Date of Termination, or (b) Executive’s employment with Company or the termination of such employment with Company, including but not limited to Claims arising under federal, state, or local laws prohibiting disability, handicap, age, sex, race, national origin, religion, retaliation, or any other form of discrimination, such as the Americans with Disabilities Act, 42 U.S.C.§§ 12101 et seq.; the Age Discrimination in Employment Act, as amended, 29 U.S.C. §§ 621 et seq.; and Title VII of the 1964 Civil Rights Act, as amended, 42 U.S.C. §§ 2000e et seq.; Claims for intentional infliction of emotional distress, tortious interference with contract or prospective advantage, and other tort claims; and Claims for breach of express or implied contract; with the exception of Employee’s vested rights, if any, under Company retirement plans. Executive hereby warrants that he has not assigned or transferred to any person any portion of any claim that is released, waived and discharged above. Executive understands and agrees that by signing this Agreement he is giving up his right to bring any legal claim against any Released Party concerning, directly or indirectly, Executive’s employment relationship with the Company, including his separation from employment, and/or any and all contracts between Executive and Company, express or implied. Executive agrees that this legal release is intended to be interpreted in the broadest possible manner in favor of the Released Parties, to include all actual or potential legal claims that Executive may have against any Released Party, except as specifically provided otherwise in this Agreement. This release does not cover Claims relating to the validity or enforcement of this Agreement. Further, Executive has not released any claim for indemnity or legal defense available to him due to his service as a board member, officer or director of the Company, as provided by the certificate of incorporation or bylaws of the Company, or by any applicable insurance policy, or under any applicable corporate law.

2. Executive agrees and acknowledges that he: (i) understands the language used in this Agreement and the Agreement’s legal effect; (ii) understands that by signing this Agreement he is giving up the right to sue the Company for age discrimination; (iii) will receive compensation under this Agreement to which he would not have been entitled without signing this Agreement; (iv) has been advised by Company to consult with an attorney before signing this Agreement; and (v) was given no less than twenty-one days to consider whether to sign this Agreement. For a period of seven days after the effective date of this Agreement, Executive

may, in his sole discretion, rescind this Agreement, by delivering a written notice of rescission to the Board. If Executive rescinds this Agreement within seven calendar days after the effective date, this Agreement shall be void, all actions taken pursuant to this Agreement shall be reversed, and neither this Agreement nor the fact of or circumstances surrounding its execution shall be admissible for any purpose whatsoever in any proceeding between the parties, except in connection with a claim or defense involving the validity or effective rescission of this Agreement. If Executive does not rescind this Agreement within seven calendar days after the Effective Date, this Agreement shall become final and binding and shall be irrevocable.

3. Nothing herein affects Executive’s obligations under the Employment Agreement between the Company and the Executive dated March 6, 2024 (the “Employment Agreement”) that survive Executive’s termination of employment.

4. Capitalized terms not defined herein have the meaning specified in the Employment Agreement.

Exhibit B

NOODLES & COMPANY

AMENDED AND RESTATED

2023 STOCK INCENTIVE PLAN

Exhibit C

Drew Madsen Form of RSU Grant Agreement

Exhibit D

Drew Madsen Form of PSU Agreement

STOCK OPTION AGREEMENT

(NONQUALIFIED STOCK OPTIONS)

This STOCK OPTION AGREEMENT (this “Agreement”) is made as of March 6, 2024 (the “Grant Date”), by and between Noodles & Company, a Delaware corporation (the “Company”), and Drew Madsen (the “Participant”).

RECITALS

A. The Company has adopted the Noodles & Company Amended and Restated 2023 Stock Incentive Plan (the “Plan”), a copy of which is attached hereto as Exhibit 1.

B. The Company desires to grant the Participant the opportunity to acquire a proprietary interest in the Company to encourage the Participant’s contribution to the success and progress of the Company.

C. In accordance with the Plan, the Administrator (as defined in the Plan) has granted to the Participant an option to purchase 250,000 shares of the Common Stock of the Company, par value $0.01 per share (“Shares”), subject to the terms and conditions of the Plan and this Agreement.

AGREEMENTS

NOW, THEREFORE, in consideration of the mutual terms, conditions and other covenants and agreements set forth herein, the parties hereto hereby agree as follows:

1. Definitions. Capitalized terms used herein shall have the following meanings, and capitalized terms not otherwise defined herein shall have the meaning specified in the Plan:

“Agreement” has the meaning set forth in the Preamble.

“Business Day” means a day other than Saturday, Sunday or any day on which banks located in the State of New York are authorized or obligated to close.

“Cause” has the meaning in the Participant's employment or severance protection agreement with the Company or, if there is no such agreement or definition, means that the Participant (a) is convicted of, or pleads guilty or nolo contendere to, a felony (other than a traffic-related felony) or any other crime involving dishonesty or moral turpitude; or (b) willfully engages in illegal conduct or gross misconduct that is materially and demonstrably injurious to the Company; or (c) willfully violates any nonsolicitation covenant between the Participant and the Company. The determination of “Cause” shall be in the reasonable discretion of the Administrator.

“Change in Control Price” means the price per Share on a fully-diluted basis offered in conjunction with any transaction resulting in a Change in Control as determined in good faith by the Administrator as constituted before the Change in Control, or in the case of a

Change in Control that does not result in a payment for Shares, the average Fair Market Value of a Share on the 30 trading days immediately preceding the date on which the Change in Control occurs.

“Company” has the meaning set forth in the Preamble.

“Employer” means the Company and/or any of its subsidiaries with which the Participant is employed.

“Exercise Price” means, for each Share subject to the Option, $______, as such amount may be adjusted pursuant to Section 12(a) of the Plan.

“Good Reason” has the meaning specified in the employment between the Employer and the Participant.

“Grant Date” has the meaning set forth in the Preamble.

“Option” has the meaning set forth in Section 2.

“Option Shares” has the meaning set forth in Section 2.

“Participant” has the meaning set forth in the Preamble.

“Person” means and includes an individual, a partnership, a corporation, a limited liability company, a trust, a joint venture, an unincorporated organization and any governmental or regulatory body or agency or other authority.

“Plan” has the meaning set forth in the Recitals.

“Pro Rata Portion” equals the product of (i) the amount (if any) of the Option that would have vested on the Vesting Date, multiplied by (ii) a fraction, (a) the numerator of which is the number of days from the Grant Date through the Termination Date, and (Y) the denominator of which is 1,095.

“Qualifying Termination” means (i) the Participant’s termination of employment for Good Reason or (ii) the Participant's termination of employment by the Company without Cause.

“Shares” has the meaning set forth in the Recitals.

“Termination Date” means the date on which the Participant experiences a Termination of Employment (as defined in the Plan).

“Withholding Obligation” means the amount determined in the Administrator’s sole discretion to be the minimum sufficient to satisfy all federal, state, local and other withholding tax obligations that the Administrator determines may arise with respect to the issuance of Shares or payment of income earned in respect of any Option.

2. Grant of Option. The Company grants to the Participant the right and option (the “Option”) to purchase, on the terms and conditions set forth herein, all or any part of 250,000 Shares (the “Option Shares”) at the Exercise Price, on the terms and conditions set forth herein. The Option is not intended to be an incentive stock option under Section 422 of the Code.

3. Vesting and Exercisability.

(a) The Option shall become fully vested and exercisable on the third anniversary of the Grant Date (the “Vesting Date”) if and only if (i) the Participant remains continuously employed by the Employer through the Vesting Date, and (ii) the Company Stock Price as of the Vesting Date is no less than $5.00 (as adjusted in the manner set forth in Section 12(a) of the Plan if an event described in Section 12(a) of the Plan occurs after the Grant Date). For purposes hereof, “Company Stock Price” means the higher of (A) the closing price of the Shares on the trading day immediately preceding the Vesting Date, or (B) the volume-weighted average stock price for the Shares for the 45 consecutive trading days ending immediately prior to the Vesting Date (provided that the Company Stock Price calculation shall be adjusted in the manner set forth in Section 12(a) of the Plan if an event described in Section 12(a) of the Plan occurs after the Grant Date).

(b) Notwithstanding Section 3(a), upon receipt of a release of claims acceptable to the Company within forty-five days following the Participant's Termination Date (which, for any Participant subject to an employment agreement with an attached release of claims, shall be such attached release of claims), if the Participant's termination of employment was due to a Qualifying Termination or due to the Participant's death or Disability prior to the Vesting Date, the Pro Rata Portion of the Option shall be eligible to vest on the Vesting Date to the extent it otherwise would have vested pursuant to Section 3(a).

(c) Notwithstanding Sections 3(a) and 3(b), if a Change in Control occurs prior to the Vesting Date (i) while the Participant is employed by the Employer or (ii) following the Participant’s Qualifying Termination, then the date of such Change in Control shall be treated as the Vesting Date and the Option shall vest (with respect to the Pro Rata Portion only if Section 3(b) applies) if the Change in Control Price is no less than $5.00 (as adjusted in the manner set forth in Section 12(a) of the Plan if an event described in Section 12(a) of the Plan occurs after the Grant Date).

(d) In addition, the Administrator may, at any time in its sole discretion, accelerate the vesting and exercisability of all or any portion of the Option.

4. Expiration.

(a) The exercisable portion of the Option shall expire on the earliest of (i) the tenth (10th) anniversary of the Grant Date, or (ii) the ninetieth (90th) day after the Termination Date (or, if Section 3(b) or Section 3(c) applies, ninety (90) days after the Vesting Date).

(b) Subject to Sections 3(b) and 3(c), the unexercisable portion of the Option that has not previously expired pursuant to this Agreement shall immediately expire on the Termination Date.

5. Nontransferability of the Option. Except as permitted by the Administrator or as permitted under the Plan, the Participant may not assign or transfer the Option to anyone other than by will or the laws of descent and distribution and the Option shall be exercisable only by the Participant during his or her lifetime. The Company may cancel the Participant’s Option if the Participant attempts to assign or transfer it in a manner inconsistent with this Section 5.

6. Adjustments. In the event that any dividend or other distribution (whether in the form of cash, Shares, other securities or other property, but excluding regular, quarterly and other periodic cash dividends), stock split or a combination or consolidation of the outstanding Shares into a lesser number of shares, is declared with respect to the Shares, then the Option shall be subject to adjustment as provided in Section 12(a) of the Plan.

7. Exercise of the Option.

(a) Prior to the expiration or termination of the Option, the Participant may exercise the exercisable portion of the Option from time to time in whole or in part. Upon electing to exercise the Option, the Participant shall deliver to the Company a written and signed notice of such election, substantially in the form attached hereto as Exhibit 2, setting forth the number of Option Shares the Participant has elected to purchase and shall at the time of delivery of such notice tender cash or a cashier’s or certified bank check to the order of the Company in the amount (the “Cost”) of the aggregate Exercise Price of such Option Shares plus any amount required pursuant to Section 13; provided, however, that the Participant may pay the Cost, plus any amount required pursuant to Section 13, in whole or in part with previously-owned Shares or withheld Option Shares. The Administrator may, in its sole discretion, permit payment of the Cost in such other form or in such other manner as may be permissible under the Plan and applicable law.

(b) The Option may only be exercised (i) during the life of the Participant, only by the Participant, and (ii) in the event of the Participant’s death or disability, by his or her executor, guardian or legal representative.

8. No Interest in Shares Subject to Option. Neither the Participant (individually or as a member of a group) nor any beneficiary or other Person claiming under or through the Participant shall have any right, title, interest, or privilege in or to any Shares allocated or reserved for the purpose of the Plan or subject to this Agreement except as to such Shares, if any, as shall have been issued to such Person upon exercise of the Option or any part of it.

9. Clawback Policy. The Option and any Shares issued in connection therewith are subject to the Company’s clawback policy as in effect from time to time.

10. Plan Controls. The Option hereby granted is subject to, and the Company and the Participant agree to be bound by, all of the terms and conditions of the Plan as the same may be

amended from time to time in accordance with the terms thereof; provided, however, that no such amendment shall be effective as to the Option without the Participant’s consent insofar as it adversely affects the Participant’s material rights under this Agreement, which consent will not be unreasonably withheld by the Participant.

11. Not an Employment Contract. Nothing in the Plan, this Agreement or any other instrument executed pursuant hereto or thereto shall confer upon the Participant any right to continue in the employment or other service of the Company or any affiliate thereof or shall affect the right of the Company to terminate the service of the Participant at any time and for any reason.

12. Governing Law. This Agreement, and any disputes or controversies arising hereunder, shall be construed and enforced in accordance with and governed by the internal laws of the State of Delaware other than principles of law that would apply the law of another jurisdiction.

13. Taxes. The Administrator may, in its sole discretion, make such provisions and take such steps as it may deem necessary or appropriate to satisfy the Withholding Obligations with respect to the issuance of Option Shares or the exercise of the Option, including deducting the amount of any such Withholding Obligations from any other amount then or thereafter payable to the Participant, requiring the Participant to pay to the Company the amount of such Withholding Obligations or to execute such documents as the Administrator deems necessary or desirable to enable it to satisfy the Withholding Obligations, or any other means provided in the Plan; provided, however, that, the Participant may satisfy any Withholding Obligations by (i) directing the Company to withhold that number of Option Shares with an aggregate fair market value equal to the amount of the Withholding Obligations or (ii) delivering to the Company such number of previously held Shares that have been owned by the Participant with an aggregate fair market value equal to the amount of the Withholding Obligations.

14. Notices. All notices, requests, demands and other communications called for or contemplated hereunder shall be in writing and shall be deemed to have been given when delivered to the party to whom addressed or when sent by telecopy (if promptly confirmed by registered or certified mail, return receipt requested, prepaid and addressed) to the parties, their successors in interest, or their assignees at the following addresses, or at such other addresses as the parties may designate by written notice in the manner aforesaid:

If to the Company to:

Noodles & Company

520 Zang Street, Suite D

Broomfield, CO 80021

Fax: (720) 214-1921

Attention: General Counsel

If to the Participant to the address set forth below the Participant’s signature below.

All such notices, requests and other communications will (i) if delivered personally to the address as provided in this Section 14 be deemed given upon delivery, (ii) if delivered by facsimile transmission to the facsimile number as provided for in this Section 14, be deemed given upon facsimile confirmation, (iii) if delivered by mail in the manner described above to the address as provided for in this Section 14, be deemed given on the earlier of the third Business Day following mailing or upon receipt, and (iv) if delivered by overnight courier to the address as provided in this Section 14, be deemed given on the earlier of the first Business Day following the date sent by such overnight courier or upon receipt (in each case regardless of whether such notice, request or other communication is received by any other Person to whom a copy of such notice is to be delivered pursuant to this Section 14). Any party from time to time may change its address, facsimile number or other information for the purpose of notices to that party by giving notice specifying such change to the other parties hereto.

Either party may, by notice given to the other party in accordance with this Section 14, designate another address or Person for receipt of notices hereunder.

15. Amendments and Waivers. This Agreement shall not be changed, altered, modified or amended, except by a written agreement signed by both parties hereto. The failure of any party to insist in any one instance or more upon strict performance of any of the terms and conditions hereof, or to exercise any right or privilege herein conferred, shall not be construed as a waiver of such terms, conditions, rights or privileges, but same shall continue to remain in full force and effect. Any waiver by any party of any violation of, breach of or default under any provision of this Agreement by the other party shall not be construed as, or constitute, a continuing waiver of such provision, or waiver of any other violation of, breach of or default under any other provision of this Agreement. Any waiver by any party of any provision hereof shall be effective only by a writing signed by the party to be charged.

16. Entire Agreement. This Agreement, together with the Plan, sets forth the entire agreement and understanding between the parties hereto as to the subject matter hereof and thereof and supersedes all prior oral and written and all contemporaneous oral discussions, agreements and understandings of any kind or nature, regarding the subject matter hereof and thereof between the parties hereto.

17. Separability. If any term or provision of this Agreement shall to any extent be invalid, illegal or incapable of being enforced by any rule of law, or public policy, all other conditions and provisions of this Agreement nevertheless shall remain in full force and effect so long as the economic or legal substance of the transactions contemplated hereby is not affected in any manner adverse to any party. Upon such determination that any term or provision is invalid, illegal or incapable of being enforced, the invalid or unenforceable provisions, to the extent permitted by law, shall be deemed amended and given such interpretation so as to effect the original intent of the parties as closely as possible in an acceptable manner to the end that transactions contemplated hereby are fulfilled to the maximum extent possible.

18. Headings; Construction. Headings in this Agreement are for reference purposes only and shall not be deemed to have any substantive effect. The words “include,” “includes”

and “including” when used herein shall be deemed in each case to be followed by the words “without limitation.”