U.S. Stocks Close Weak After Cautious Session

March 04 2024 - 5:03PM

IH Market News

After a weak start and a subsequent long spell in negative

territory, U.S. stocks briefly managed to turn positive in the

final hour, but failed to find support and ended marginally down on

Monday.

The mood was cautious right through the day’s session due to a

lack of major U.S. economic data. Traders largely stayed on the

sidelines ahead of a slew of key events this week.

The major averages all ended in negative territory. The Dow

(DOWI:DJI) ended down 97.55 points or 0.25 percent at 38,989.83.

The S&P 500 (SPI:SP500) settled with a loss of 6.13 points or

0.12 percent at 5,130.95, while the Nasdaq (NASDAQI:COMP) ended

lower by 67.43 points or 0.41 percent at 16,207.51.

Federal Reserve Chair Jerome Powell’s congressional testimony

will be in focus for clues about the outlook for interest rates.

Powell is due to testify before the House Financial Services

Committee on Wednesday and the Senate Banking Committee on

Thursday.

On Tuesday, the Institute for Supply Management is due to

release its report on service sector activity in the month of

February.

Later in the week, the Labor Department’s report employment data

is due on Friday. The report is expected to show employment jumped

by 200,000 jobs in February after surging by 353,000 jobs in

January.

Reports on factory orders, private sector employment, weekly

jobless claims and the U.S. trade deficit are also due to be

released this week along with the Fed’s Beige Book.

Tesla (NASDAQ:TSLA) dropped more than 7 percent. Walgreens Boots

Alliance, Target, Alphabet, Pfizer, Apple Inc., Nike and Merck lost

2 to 4 percent.

Intel, Nvidia, IBM, Bank of America, Ford Motor, Qualcomm, eBay,

Walt Disney, General Electric, Wells Fargo, Costco and Citigroup

posted strong gains.

Other Markets

In overseas trading, stock markets across the Asia-Pacific

region moved mostly higher during trading on Monday. Japan’s Nikkei

225 Index climbed by 0.5 percent, while China’s Shanghai Composite

Index rose by 0.4 percent.

Meanwhile, European markets mostly ended lower. While the U.K.’s

FTSE 100 Index ended down by 0.55 percent, the German DAX Index

drifted down 0.11 percent, and France’s CAC 40 gained 0.28 percent.

The pan European Stoxx 600 edged down 0.03 percent.

In the bond market, treasuries gave back ground after moving

notably higher over the past few sessions. The yield on the

benchmark ten-year note, which moves opposite of its price, moved

up to 4.222 percent.

Source: RTTNEWS

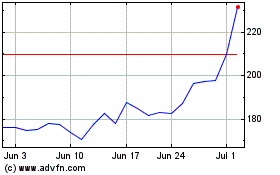

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Apr 2023 to Apr 2024