0001731289FALSE00017312892024-03-032024-03-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 3, 2024

Nikola Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware (State or Other Jurisdiction of Incorporation) | 001-38495 (Commission File Number) | 82-4151153 (I.R.S. Employer Identification No.) |

4141 E Broadway Road

Phoenix, AZ 85040

(Address of principal executive offices) (Zip Code)

(480) 581-8888

(Registrant’s telephone number,

including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240-13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common stock, $0.0001 par value per share | NKLA | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b–2 of the Securities Exchange Act of 1934 (§240.12b–2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On March 3, 2024, the board of directors of Nikola Corporation (the “Company”) appointed Thomas B. Okray to serve as the Company’s Chief Financial Officer, Principal Financial Officer and Principal Accounting Officer, effective March 4, 2024.

Mr. Okray, age 61, served as Executive Vice President and Chief Financial Officer of Eaton Corporation PLC, an intelligent power management technologies company, from March 2021 to February 2024, and prior to that, as its Executive Vice President and Chief Financial Officer-Elect, from January 2021 to March 2021. From April 2018 to December 2020, Mr. Okray served as Senior Vice President and Chief Financial Officer of W.W. Grainger, Inc., an industrial supply distributor. Mr. Okray served as Executive Vice President and Chief Financial Officer of Advance Auto Parts, Inc., an automotive aftermarket parts provider, from October 2016 to April 2018. Prior to that, he served in various capacities at Amazon.com, Inc., an e-commerce company, including as President, Finance, North American Operations, from January 2016 to October 2016, and as Vice President, Finance, Global Customer Fulfillment, from June 2015 to January 2016. From January 2010 to June 2015, Mr. Okray worked at General Motors Company, an automotive company, in a variety of finance and supply chain related roles, including as CFO, Global Product Development, Purchasing & Supply Chain. Mr. Okray has served on the board of directors of Monro, Inc. (Nasdaq: MNRO), an automotive service and tire dealer, since February 2024, and the board of directors of Flowserve Corporation (NYSE: FLS), a manufacturer and aftermarket service provider of comprehensive flow control systems, since April 2023. Mr. Okray received an MBA in Finance from the University of Chicago and a Bachelor of Science degree in Engineering from Michigan State University.

In connection with Mr. Okray’s appointment as Chief Financial Officer, Mr. Okray and the Company entered into an Executive Employment Agreement (the “Employment Agreement”), pursuant to which Mr. Okray will be entitled to receive an annual base salary of $695,000 and, subject to approval of the board of directors, 300,000 restricted stock units and 600,000 performance stock unit awards (“PSUs”). Mr. Okray will be eligible to participate in the Company’s 2024 equity incentive program for executive officers. Mr. Okray will also receive a one-time taxable relocation bonus of $20,000 and reimbursement of certain other expenses associated with Mr. Okray’s relocation, each grossed up for applicable taxes, and subject to repayment if Mr. Okray voluntarily leaves the Company (and not pursuant to an Involuntary Termination (as defined in the Employment Agreement), death or disability) prior to his one-year employment anniversary with the Company. The Employment Agreement contains customary confidentiality and intellectual property assignment provisions.

Pursuant to the Employment Agreement, in the event of an Involuntary Termination (as defined in the Employment Agreement) of Mr. Okray employment and subject to Mr. Okray’s delivery of an effective release of claims and ongoing compliance with certain post-termination restrictive covenants, including two-year noncompete and nonsolicitation covenants and a non-disparagement covenant, Mr. Okray would be entitled to receive: (1) a lump sum cash payment in an amount equal to $1,390,000, less applicable withholding taxes; (2) a lump sum cash payment equal to 18 months of COBRA benefits coverage, less applicable withholding taxes; (3) the acceleration in full of all unvested equity and equity based awards, other than any performance-based awards (and the post termination exercise period for any unexercised stock options would be extended to three years following his termination date); and (4) service will be deemed to have been satisfied and any outstanding PSUs will vest and be settled at the end of the performance period based on final actual performance.

The foregoing summary of the Employment Agreement is qualified in its entirety by reference to the Employment Agreement, a copy of which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

In connection with his appointment, the Company expects to enter into its form of indemnification agreement with Mr. Okray.

Mr. Okray has no family relationships with any of the Company’s directors or executive officers, and he has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL). |

| # Indicates management contract or compensatory plan or arrangement. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Dated: March 4, 2024 | | | |

| | | |

| | NIKOLA CORPORATION |

| | | |

| | | |

| | By: | /s/ Britton M. Worthen |

| | | Britton M. Worthen |

| | | Chief Legal Officer |

| | | |

| | | |

February 29, 2024

Thomas B. Okray

Re: Executive Employment Agreement

Dear Tom:

I am pleased to offer you the position of Chief Financial Officer of Nikola Corporation (the “Company”), reporting to the Company’s Chief Executive Officer (the “CEO”). Your responsibilities include, but are not limited to, such employment duties as are usual and customary for this position and which are commensurate with the duties, authorities, and responsibilities of persons in similar capacities in similar sized companies. At the Company’s request, you shall serve the Company and/or its subsidiaries and affiliates in other capacities in addition to the foregoing, consistent with expectations for your position.

The terms of your employment are as follows:

Employment Period. Your anticipated start date is on or about March 4, 2024. Your employment shall continue indefinitely until terminated in accordance with the terms of this Agreement. Notwithstanding the foregoing, your employment is terminable at will by the Company or by you at any time (for any reason or for no reason), subject to the termination provisions of this Agreement.

Relocation. To assist you with your relocation to the greater Phoenix, Arizona area, the Company will provide a one-time taxable miscellaneous bonus of $20,000 payable with your first regular paycheck; grossed-up reimbursement for the loading, shipping, and unloading of your goods from your current home to your new one after receipts for those services are obtained by the Company; grossed-up reimbursement for any lease-breaking obligations after documented evidence of such is received by the Company; grossed-up reimbursement for the shipping of up to two vehicles to your new home or mileage reimbursement for the driving of up to two vehicles to your new home at the current IRS mileage rate of $0.67 per mile after evidence of the trips or shipments is received by the Company; grossed-up reimbursement for move-related travel, including airfare, lodging, and meals, for you and your spouse for up to two trips back and forth from your current residence to your new one after receipts for such travel are obtained by the Company. You agree to repay in full all the assistance outlined in this Relocation section if you leave the Company voluntarily (and not pursuant to an Involuntary Termination (as defined below), death or disability) prior to your one-year employment anniversary with the Company.

Annual Salary. Your annual salary will be $695,000, paid bi-weekly less payroll deductions and all required withholdings.

Annual Bonus. You have indicated your interest in declining participation in any annual cash bonus program provided by the Company, without regard to your eligibility in any such program. Your signature on this Agreement confirms your election.

Stock Awards. You will be eligible to receive stock awards under the Company’s 2020 Stock Incentive Plan, as in effect from time to time (the “Plan”), subject to approval by the Board of Directors of the Company (the “Board”) and in line with your role and the rubric for other named executive officers of the Company. The terms and conditions of each stock award will be set forth in separate award agreements in forms prescribed by the Company (each, an “Award Agreement”), and all shares underlying the respective awards will contain the right to receive

dividend equivalents, if any, subject to the same vesting conditions as the shares underlying the stock awards. The stock awards shall be governed in all respects by the terms and conditions of the Plan and the applicable Award Agreement.

You are eligible to receive the following new hire stock awards, subject to approval by the Board:

•Restricted Stock Unit Award (RSUs). The Company will award you 300,000 RSUs which will vest in two equal tranches upon the six-month and twelve-month anniversaries of your start date with the Company, subject to your continuous “Service” (as defined in the Plan) through the applicable vesting date.

•Performance Stock Unit Award (PSUs). The Company will award you 600,000 PSUs, reflecting the target number of shares assuming achievement at 100% (the “Target Amount”). The number of PSUs that may ultimately be paid out to you will range from 0% to 200% of the Target Amount as determined (i) based upon the Company’s achievement of certain performance goals occurring during the performance period as outlined in the forthcoming award agreement, and (ii) subject to your continuous Service through the performance period. The performance goals and terms and conditions of the award are consistent with those agreed upon and approved by the Board at the Company’s April 2023 Board meeting and awarded to all other named executive officers.

You will be eligible to participate in the Company’s 2024 equity incentive program for executive officers. The terms and conditions of the program will be consistent with those agreed upon and approved by the Board at the Company’s April 2024 Board meeting and awarded to other executive officers.

In the event of a Change in Control (as defined in the Plan), the achievement of the performance conditions for performance-based stock awards (each a “Performance Award”) will be based on the Company’s performance through the closing of such Change in Control. The amount of the Performance Award that would have been earned based on this measurement will be converted to time-vested restricted stock units immediately prior to such Change in Control (the “Converted Awards”). If the Converted Awards are assumed, substituted or otherwise continued by the successor corporation (or a parent or subsidiary thereof), all vesting restrictions applicable to the Converted Awards will lapse on the earlier of (i) the final day of the applicable performance period subject to your continued employment with the successor corporation (or a parent or subsidiary thereof) through such date, at which time such Converted Awards will be settled, and (ii) subject to your compliance with the Severance Conditions (as defined below), the date of your Involuntary Termination of employment with the successor corporation (or a parent or subsidiary thereof). All Converted Awards that are not assumed, substituted, or otherwise continued by the successor corporation (or a parent or subsidiary thereof) will fully vest and will be settled immediately prior to the consummation of such Change in Control.

Benefits. You (and your spouse and/or eligible dependents to the extent provided in the applicable plans and programs) are eligible to participate in and be covered under the health, welfare and financial benefit plans and programs maintained by the Company for the benefit of its employees, pursuant to the terms of such plans, on the same terms and conditions as those applicable to similarly situated executives. Detailed descriptions of the Company’s benefit plans are available and will be provided to you upon request. Your eligibility to receive such benefits will be subject in each case to the generally applicable terms and conditions for the benefits in question and to the determinations of any person or committee administering such benefits. The Company may modify or terminate any benefits plan or program from time to time in its sole discretion.

Expenses. You are entitled to receive prompt reimbursement for all reasonable business expenses incurred in connection with the performance of your duties in accordance with the policies, practices, and procedures of the Company.

Vacation. You are entitled to paid vacation in accordance with the policies, practices, and procedures of the Company.

Indemnification/Legal Fees. The Company agrees that you will be entitled to the same indemnification rights as the Company grants to other officers of the Company, as in effect from time to time. The Company will

maintain a directors and officers liability policy covering you with coverage comparable or equal to that provided to other officers of the Company. In the event of any dispute over your entitlement to payments or benefits hereunder, the Company shall advance you an amount equal to your monthly legal fees incurred in connection with such dispute until there is a final non-appealable decision by a court that you are not entitled to such payment or benefit.

Termination of Employment. In the event of an Involuntary Termination of your employment at any time, and subject to (i) your execution of a general release of claims in favor of the Company in substantially the form attached as Exhibit A (the “Release”), (ii) your non-revocation of the Release and it becoming effective within sixty (60) days following the date of your termination of employment (the “Termination Date”), and (iii) your faithful observance of the terms of such Release (such conditions, the “Severance Conditions”), then you shall be entitled to the following severance benefits (the “Severance Benefits”):

•Severance Payment. The Company will pay you a cash lump sum in an amount equal to $1,390,000, less applicable withholding.

•Stock Awards.

oRestricted Stock, Restricted Stock Units and Stock Options. All outstanding restricted stock awards, restricted stock units (other than Performance Awards but including the Converted Awards) and stock options will immediately vest in full. Unexercised stock options will remain exercisable for three years following your Termination Date.

oPerformance Awards. Service will be deemed to have been satisfied upon an Involuntary Termination. All outstanding PSUs will vest and be settled at the end of the performance period based on final actual performance.

•Benefits Continuation. The Company will pay to you a cash lump sum equal in value to 18 months of COBRA benefits coverage, less applicable withholding.

The cash Severance Benefits will be paid on the first regular payroll date following the date that your Release becomes effective, subject to compliance with Section 409A of the Internal Revenue Code of 1986, as amended (“Section 409A”).

For the avoidance of doubt, if you independently and unilaterally decide to end your employment at the Company without Good Reason, or if you are terminated for Cause, or if your employment is terminated due to your death or disability, you will not be entitled to receive any Severance Benefits.

You may terminate your employment with the Company at any time and for any reason whatsoever simply by notifying the Company. Likewise, the Company may terminate your employment at any time, with or without cause or advance notice. Your employment at-will status can only be modified in a written agreement signed by you and by an authorized officer of the Company.

Section 409A. Notwithstanding anything to the contrary in this Agreement, no compensation or benefits, including any Severance Benefits, stock awards, consulting payments or other benefits payable due to termination, shall be paid to you during the six-month period following your termination if the Company determines that paying such amounts would be a prohibited distribution under Section 409A. If the payment of any such amounts is so delayed, then on the first day of the seventh month following termination (or such earlier date upon which such amount can be paid under Section 409A without resulting in a prohibited distribution) the Company shall pay to you a lump- sum amount equal to the cumulative amount that would have otherwise been payable during such period. In addition, to the extent required in order to comply with Section 409A, you shall not be considered to have terminated employment with the Company for purposes of this Agreement and no payment of such amounts due pursuant to your termination shall be due until you would be considered to have incurred a “separation from service” from the Company within the meaning of Section 409A. Each such amount which constitutes deferred compensation subject to Section 409A shall be construed as a separate identified payment for purposes of Section 409A. If the period during which you have discretion to execute or revoke the Release straddles two calendar years, then the

Company will make the payment of amounts that are subject to Section 409A and contingent on the effectiveness of such Release starting in the second of such years regardless of which year you actually deliver the Release. You may not, directly or indirectly, designate the calendar year of payment of any amounts subject to Section 409A. The intent of the parties is that the payments and benefits under this Agreement comply with or be exempt from Section 409A and, accordingly, to the maximum extent permitted, this Agreement shall be interpreted to be exempt from or in compliance therewith.

To the extent that any payments or reimbursements provided to you under this Agreement are deemed to constitute compensation to which Treasury Regulation Section 1.409A-3(i)(1)(iv) would apply, such amounts shall be paid or reimbursed reasonably promptly, but not later than December 31 of the year following the year in which the expense was incurred. The amount of any such payments eligible for reimbursement in one year shall not affect the payments or expenses that are eligible for payment or reimbursement in any other taxable year, and your right to such payments or reimbursement of any such expenses shall not be subject to liquidation or exchange for any other benefit.

Work Product. As a condition of employment, you will be expected to abide by Company rules and policies and comply with the Employee Proprietary Information and Inventions Assignment Agreement (PIIA), which prohibits unauthorized use or disclosure of Company proprietary information.

Confidentiality. In your work for the Company, you will be expected not to use or disclose any confidential information, including trade secrets, of any former employer or other person to whom you have an obligation of confidentiality. Rather, you will be expected to use only that information which is generally known and used by persons with training and experience comparable to your own, which is common knowledge in the industry or otherwise legally in the public domain, or which is otherwise provided or developed by the Company.

You agree that you will not bring onto Company premises any unpublished documents or property belonging to any former employer or other person to whom you have an obligation of confidentiality. You represent that you have disclosed to the Company any contract you have signed that may restrict your activities on behalf of the Company. You represent further that you have the ability to perform the essential functions of your job with or without reasonable accommodations.

This Agreement, together with its attached exhibits, forms the complete and exclusive statement of your employment agreement with the Company. The employment terms in this Agreement supersede any other agreements or promises made to you by anyone, whether oral or written. Changes in your employment terms, other than those changes expressly reserved to the Company’s discretion in this Agreement, require a written modification signed by an authorized officer of the Company and by you.

Successors/Assigns. The Company shall assign this Agreement to any successor to all or substantially all of the business and assets of the Company and the Company shall require successor to expressly assume and agree to in the same manner and to the same extent that the Company would be required to perform it if no such succession had taken place.

Governing Law. The terms of this Agreement and the resolution of any dispute as to the meaning, effect, performance or validity of this Agreement or arising out of, related to, or in any way connected with, this Agreement, your employment with the Company (or termination thereof) or any other relationship between you and the Company (a “Dispute”) will be governed by the laws of the State of Arizona, without giving effect to the principles of conflict of laws. To the extent not subject to arbitration as described below, you and the Company consent to the exclusive jurisdiction of, and venue in, the state courts in State of Arizona (or in the event of exclusive federal jurisdiction, the courts of the District of Arizona in connection with any Dispute or any claim related to any Dispute).

Except as prohibited by law, you agree that any Dispute between you and the Company (or between you and any officer, director, employee or affiliates of the Company, each of whom is hereby designated a third party beneficiary of this Agreement regarding arbitration) will be resolved through binding arbitration in Maricopa County, Arizona under the rules of the American Arbitration Association and the Arbitration Rules set forth in Arizona Rules of Civil Procedure. Nothing in this arbitration provision is intended to limit any right you may have

to file a charge with or obtain relief from the National Labor Relations Board or any other state or federal agency. You agree that such arbitration shall be conducted on an individual basis only, not a class, collective or representative basis, and hereby waive any right to bring class-wide, collective or representative claims before any arbitrator or in any forum. THE PARTIES UNDERSTAND THAT BY AGREEING TO ARBITRATE DISPUTES THEY ARE WAIVING ANY RIGHT THEY MIGHT OTHERWISE HAVE TO A JURY TRIAL. This arbitration provision is not intended to modify or limit substantive rights or the remedies available to the parties, including the right to seek interim relief, such as injunction or attachment, through judicial process, which shall not be deemed a waiver of the right to demand and obtain arbitration.

Please sign and date this Agreement if you wish to commence employment at the Company under the terms described above and return it to . For the purposes of this Agreement, a facsimile or electronic signature shall serve as an original.

Certain Definitions. Defined terms in this Agreement are as follows:

Involuntary Termination. Involuntary Termination shall mean a termination of employment by the Company without Cause or by you with Good Reason.

Good Reason. Good Reason shall mean your resignation within thirty (30) days following the expiration of the Cure Period (as defined below) as a result of (i) an adverse change in title, authorities or responsibilities that diminishes your position; (ii) a change in your reporting relationship such that you are no longer reporting to the CEO; (iii) a material reduction in your base salary; or (iv) a material breach by the Company of any of its obligations under this Agreement or any other written agreement between the Company and you, each without your consent. A resignation for Good Reason will not be deemed to have occurred unless you give the Company written notice of the condition within ninety (90) days after the condition comes into existence and the Company fails to remedy the condition within thirty (30) days after receiving your written notice (the “Cure Period”).

Cause. Cause shall mean any of the following: (i) your repeated failure to follow the lawful instructions of the Company’s President or CEO consistent with your title following written notice of any alleged failure and fifteen (15) days to cure such failure; (ii) your material violation of any written Company policy that has been provided to you; (iii) your commission of any act of fraud, embezzlement or any other material misconduct that has caused or is reasonably expected to result in injury to the Company; (iv) your unauthorized use or disclosure of any proprietary information or trade secrets of the Company or any other party to whom you owe an obligation of nondisclosure as a result of your relationship with the Company; or (v) your material breach of any of your material obligations under any written agreement or covenant with the Company.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

I am delighted to confirm the terms of this Agreement to you on behalf of the Company. We look forward to your favorable reply and to building a successful Company together.

Sincerely,

NIKOLA CORPORATION

By: /s/ Stephen J. Girsky________________ 2/29/2024___________

Name: Stephen J. Girsky Date

President and Chief Executive Officer

Accepted:

/s/ Thomas B. Okray__________________ 3/1/2024_____________

Thomas B. Okray Date

Attachments: Exhibit A - Form Severance Agreement and Release

Employee Proprietary Information and Inventions Assignment Agreement

EXHIBIT A

Severance Agreement and Release

1. Release of Claims. In exchange for receipt of the severance benefits (the “Severance Benefits”) described in <insert name>’s (“Executive”) Employment Agreement dated [ ], 2023 (the “Employment Agreement”), Executive hereby releases and discharges and covenants not to sue Nikola Corporation (the “Company”), its subsidiaries, parents, or affiliated corporations, past and present, and each of them, as well as each of its and their assignees, successors, directors, officers, stockholders, partners, representatives, insurers, attorneys, agents or employees, past or present, or any of them (individually and collectively, “Releasees”), from and with respect to any and all claims, agreements, obligations, demands and causes of action, known or unknown, suspected or unsuspected, arising out of or in any way connected with events, acts, conduct, or omissions occurring at any time prior to and including the date Executive signs this release, including without limiting the generality of the foregoing, any claim for severance pay, profit sharing, bonus or similar benefit, equity-based awards and/or dividend equivalents thereon, pension, retirement, life insurance, health or medical insurance or any other fringe benefit, or disability, or any other claims, agreements, obligations, demands and causes of action, known or unknown, suspected or unsuspected resulting from any act or omission by or on the part of Releasees committed or omitted prior to the date of this release, including, without limiting the generality of the foregoing, any claim under Title VII of the Civil Rights Act of 1964, the Americans with Disabilities Act, or any other federal, state or local law, regulation, constitution, ordinance or common law (collectively, the “Claims”). Notwithstanding the above, however, Executive is not releasing (1) any claims that cannot be waived under applicable state or federal law, (2) rights Executive may have to indemnification (including, without limitation, under the Executive’s indemnification agreement with the Company, the Company’s by-laws, the Company’s D&O insurance and otherwise), (3) vested rights or benefits under Executive’s 401k or other plans, (4) Executive’s workers’ compensation rights and, provided further, that nothing in this Agreement shall prevent Executive from filing, cooperating with, or participating in any proceeding before the Equal Employment Opportunity Commission or Department of Labor, or (5) the Severance Benefits. In addition, nothing in this release shall prevent Executive from challenging its validity in a legal or administrative proceeding.

2. ADEA Waiver. Executive expressly acknowledges and agrees that by entering into this release, Executive is waiving any and all rights or claims that Executive may have arising under the Age Discrimination in Employment Act of 1967, as amended (“ADEA”), which have arisen on or before the date of execution of this release. Executive further expressly acknowledges and agrees that:

a.In return for this release, the Executive will receive consideration beyond that which Executive was already entitled to receive before entering into this Release;

b.Executive is hereby advised in writing by this release to consult with an attorney before signing this release;

c.Executive was given a copy of this release on [________ ] and informed that Executive had twenty-one (21) days within which to consider the release and that if Executive executes this release prior to the expiration of such 21-day period, Executive acknowledges that Executive will have done so voluntarily and knowing that Executive is waiving Executive’s right to have 21 days to consider this release;

d.Nothing in this release prevents or precludes Executive from challenging or seeking a determination in good faith of the validity of this waiver under the ADEA, nor does it impose any condition precedent, penalties or costs from doing so, unless specifically authorized by federal law; and

e.Executive was informed that Executive has seven (7) days following the date of execution of this release in which to revoke it, and this release will become null and void if Executive elects revocation during that time. Any revocation must be in writing and must be received by the Company during the seven-day revocation period.

3. Company Release of Executive. Company, on its own behalf and on behalf of its divisions, subsidiaries, parents, or affiliated corporations, past and present, and each of them, as well as each of its and their assignees, successors, directors, officers, stockholders, partners, representatives, insurers, attorneys, agents or employees, past or present, or any of them (individually and collectively), hereby releases Executive from and with respect to any and all claims, agreements, obligations, demands and causes of action, known or unknown, suspected or unsuspected, arising out of or in any way connected with events, acts, conduct, or omissions occurring at any time prior to and including the date Company signs this release; provided, however, that such release shall not include claims for fraud, securities laws violations or intentional criminal acts.

4. Extension of Restrictive Covenants. In exchange for receipt of the Severance Benefits described in the Employment Agreement, the duration of the restrictive covenants included in Section 4(g) (Nonsolicitation of Employees/Contractors), Section 4(h) (No Hire), Section 4(i) (Nonsolicitation of Customers) and Section 4(j) (Noncompete Provision) of Executive’s Employee Proprietary Information and Inventions Assignment Agreement (“PIIA”) will increase from one (1) year to two (2) years following the date of Executive’s termination of employment.

5. Non-Disparagement. Executive will refrain from making any defamatory or disparaging statements about the Company, its board of directors, officers, management, practices, procedures, or business operations to any person or entity. [The Company will instruct its officers and the members of the Board to refrain from making any defamatory or disparaging statements about the Executive to any person or entity.] Nothing in this paragraph shall prohibit Executive[, the Company or its respective officers and directors] from providing truthful information in response to a subpoena or other legal or regulatory process. The foregoing requirement under this paragraph will not apply to any statements that Executive makes in response to any defamatory or disparaging statements made by the Company (in its formal public statements), its executive officers and/or its directors regarding Executive or Executive’s performance as an employee of the Company so long as Executive’s statements are, in the reasonable, good faith judgment of Executive, true and extend no further than addressing such statements by the Company.

6. Forfeiture of Severance Benefits. Executive acknowledges and agrees that any material breach of this Agreement, the Employment Agreement, or the PIIA, including any of the restrictive covenants set forth therein, shall entitle the Company immediately to recover and/or cease providing the Severance Benefits, except as provided by law. All other provisions of this Agreement, the Employment Agreement, and the PIIA shall remain in full force and effect.

7. Waiver of Unknown Claims. Executive and Company understand and agree that the claims released above include not only claims presently known to Executive and Company, but also include all unknown or unanticipated claims, rights, demands, actions, obligations, liabilities, and causes of action of every kind and character that would otherwise come within the scope of the released claims described herein. Executive and Company understand that they may hereafter discover facts different from what they now believe to be true, which if known, could have materially affected their decisions to execute this release, but Executive and Company nevertheless hereby waive any claims or rights based on different or additional facts.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| “EXECUTIVE” | | | | “COMPANY” |

| | |

| | | | NIKOLA CORPORATION |

| | | |

| | | | By: | | |

| <Name> | | | | | | |

| | | | Name: | | |

| Date: | | | | | | |

| | | | Title: | | |

| | | |

| | | | Date: | | |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

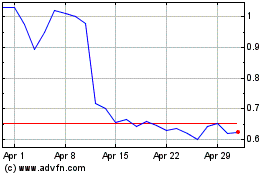

Nikola (NASDAQ:NKLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nikola (NASDAQ:NKLA)

Historical Stock Chart

From Apr 2023 to Apr 2024