false000071595700007159572024-03-012024-03-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): March 01, 2024 |

DOMINION ENERGY, INC

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Virginia |

001-08489 |

54-1229715 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

120 Tredegar Street |

|

Richmond, Virginia |

|

23219 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (804) 819-2284 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, no par value |

|

D |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On March 1, 2024, Dominion Energy, Inc. (Dominion Energy) is hosting an investor meeting to discuss the conclusion of the previously announced business review. In connection with this meeting, Dominion Energy posted a presentation about the conclusion of business review and the investor meeting to its investor relations website. The presentation is attached as Exhibit 99.1 and is incorporated herein by reference. The presentation includes a video message from certain members of Dominion Energy’s Board of Directors. A transcript of that message is attached as Exhibit 99.2 and is incorporated herein by reference.

Please continue to regularly check Dominion Energy’s website at http://investors.dominionenergy.com/ for additional information regarding Dominion Energy and this presentation.

The information in this Item 7.01 and Exhibits 99.1 and 99.2 furnished herewith shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the Exchange Act), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

*Furnished herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

DOMINION ENERGY, INC.

Registrant |

|

|

|

|

|

|

|

|

|

|

|

|

Date: |

March 1, 2024 |

By: |

/s/ Steven D. Ridge |

|

|

|

Steven D. Ridge

Executive Vice President and

Chief Financial Officer |

Business review investor meeting March 1, 2024

Important note for investors This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 regarding Dominion Energy. The statements relate to, among other things, expectations, estimates and projections concerning the business and operations of Dominion Energy. We have used the words “path”, "anticipate", "believe", "could", "estimate", "expect", "intend", "may", "plan", “outlook”, "predict", "project", “should”, “strategy”, “target”, "will“, “potential” and similar terms and phrases to identify forward-looking statements in this presentation. Such forward-looking statements, including operating earnings per share information and guidance, projected dividends, projected debt and equity issuances, projected cash flow, capital expenditures, operating expenses and debt information, shareholder return, and long-term growth or value, are subject to various risks and uncertainties. As outlined in our SEC filings, factors that could cause actual results to differ include, but are not limited to: the direct and indirect impacts of implementing recommendations from the business review announced in November 2022; unusual weather conditions and their effect on energy sales to customers and energy commodity prices; extreme weather events and other natural disasters; extraordinary external events, such as the pandemic health event resulting from COVID-19; federal, state and local legislative and regulatory developments; changes to regulated rates collected by Dominion Energy; timing and receipt of regulatory approvals necessary for planned construction or expansion projects and compliance with conditions associated with such regulatory approvals; the inability to complete planned construction projects within time frames initially anticipated; risks and uncertainties that may impact the ability to develop and construct the Coastal Virginia Offshore Wind (CVOW) Commercial Project within the currently proposed timeline, or at all, and consistent with current cost estimates along with the ability to recover such costs from customers; changes to federal, state and local environmental laws and regulations, including those related to climate change; cost of environmental strategy and compliance, including cost related to climate change; changes in implementation and enforcement practices of regulators relating to environmental standards and litigation exposure for remedial activities; changes in operating, maintenance and construction costs; additional competition in Dominion Energy’s industries; changes in demand for Dominion Energy’s services; receipt of approvals for, and timing of, closing dates for acquisitions and divestitures; impacts of acquisitions, divestitures, transfers of assets by Dominion Energy to joint ventures, and retirements of assets based on asset portfolio reviews; the expected timing and likelihood of the completion of the proposed sales of The East Ohio Gas Company, Public Service Company of North Carolina, Incorporated, Questar Gas Company, and Wexpro Company, and their consolidated subsidiaries and related entities, as applicable, including the ability to obtain the requisite regulatory approvals and the terms and conditions of such approvals; the expected timing and likelihood of the completion of the proposed sale of a 50% noncontrolling interest in the CVOW Commercial Project, including the ability to obtain the requisite regulatory approvals and the terms and conditions of such approvals; adverse outcomes in litigation matters or regulatory proceedings; fluctuations in interest rates; the effectiveness to which existing economic hedging instruments mitigate fluctuations in currency exchange rates of the Euro and Danish Krone associated with certain fixed price contracts for the major offshore construction and equipment components of the CVOW Commercial Project; changes in rating agency requirements or credit ratings and their effect on availability and cost of capital; and capital market conditions, including the availability of credit and the ability to obtain financing on reasonable terms. Other risk factors are detailed from time to time in Dominion Energy’s quarterly reports on Form 10-Q and most recent annual report on Form 10-K filed with the U.S. Securities and Exchange Commission. The information in this presentation was prepared as of March 1, 2024. Dominion Energy undertakes no obligation to update any forward-looking information statement to reflect developments after the statement is made. Projections or forecasts shown in this document are based on the assumptions listed in this document and are subject to change at any time. This presentation shall not constitute an offer to sell or the solicitation of an offer to buy securities. Any offers to sell or solicitations of offers to buy securities will be made in accordance with the requirements of the Securities Act of 1933, as amended. This presentation has been prepared primarily for security analysts and investors in the hope that it will serve as a convenient and useful reference document. The format of this document may change in the future as we continue to try to meet the needs of security analysts and investors. This document is not intended for use in connection with any sale, offer to sell or solicitation of any offer to buy securities. This presentation includes certain financial measures that have not been prepared in accordance with U.S. generally accepted accounting principles (GAAP) as discussed on slide 3. Please continue to regularly check Dominion Energy’s website at http://investors.dominionenergy.com/.

Important note for investors, cont. This presentation includes certain financial measures that have not been prepared in accordance with GAAP. A listing of such non-GAAP measures with their GAAP equivalents are as follows: Operating earnings per share (non-GAAP) which has a GAAP equivalent of reported net income per share Operating earnings (non-GAAP) which has a GAAP equivalent of reported net income FFO to debt (non-GAAP) which has a GAAP equivalent of reported net cash provided by operating activities to reported long-term debt, short-term debt, supplemental credit facility borrowings and securities due within one year FFO (non-GAAP) which has a GAAP equivalent of reported net cash provided by operating activities Total adjusted debt (non-GAAP) which has a GAAP equivalent of reported long-term debt, short-term debt, supplemental credit facility borrowings, securities due within one year and preferred stock Parent debt (non-GAAP) which has a GAAP equivalent of reported long-term debt, short-term debt, supplemental credit facility borrowings, securities due within one year and preferred stock Parent debt ratio (non-GAAP) which has a GAAP equivalent of reported long-term debt, short-term debt, supplemental credit facility borrowings, securities due within one year and preferred stock to reported long-term debt, short-term debt, supplemental credit facility borrowings, securities due within one year and preferred stock Normalized other operations and maintenance (O&M) expense (non-GAAP) which has a GAAP equivalent of reported other operations and maintenance expense Reconciliations of such non-GAAP measures to their GAAP equivalents have been made available to the extent possible in the Investor Meeting Supplemental Materials or Fourth Quarter 2023 Earnings Release Kit on our investor relations website. With regards to projections, estimates or guidance included in this presentation related to such non-GAAP measures, reconciliations of such projected or estimated non-GAAP measures to applicable GAAP measures are not provided, because the company cannot, without unreasonable effort, estimate or predict with certainty various components of net income, including O&M expense, net cash provided by operating activities, long-term debt, short-term debt, supplemental credit facility borrowings, securities due within one year or preferred stock. Please continue to regularly check Dominion Energy’s website at http://investors.dominionenergy.com/.

Bob Blue�Chair, President and Chief Executive Officer

¹ Subject to regulatory approval “The business review can’t be a series of partial solutions that leave key elements and risks unaddressed.”—Bob Blue, Q3 2023 earnings call Dividend security — 100% committed to current dividend Stable state regulatory constructs to the benefit of customers and capital providers Reduced offshore wind risk — �On time & on budget + attractive financing partner with robust �cost-sharing¹ Narrowed strategic focus —�Premier pure-play state-regulated electric utility profile Continued best practice board refreshment Steadfast focus on industry-leading cost efficiency while meeting high customer service standards Improved shareholder alignment + transparency High quality and durable earnings The business review has delivered a comprehensively positive result�Repositioned to provide compelling long-term value for shareholders, customers & employees Robust and sustainable credit profile —�Credit metrics that exceed downgrade thresholds

Joseph M. Rigby Chair—Audit Committee Robert H. Spilman, Jr. Lead Independent Director Chair Elect—Compensation, Talent and Development Committee�(effective May 2024) Susan N. Story Chair—Sustainability and Corporate Responsibility Committee Lead Independent Director Elect (effective May 2024) A message from the Dominion Energy Board of Directors

90% State-regulated �utility operations Simple strategy: Operate exceptional utilities in the Southeast U.S. Reliable and affordable service Stable and constructive regulatory frameworks Attractive resiliency, sustainability, and demand growth drivers Compelling financial profile: Durable and high-quality growth Secure dividend + attractive dividend yield Robust and sustainable credit profile Attractive rate base growth O&M discipline Enhanced disclosure and transparency ¹ 2025E—2029E ² Year-end 2024E through year-end 2029E ³ Expected consolidated average annual FFO to debt between 2025 and 2029 Strategic and financial profile Strategic and financial metrics $43B Five-year capital investment plan¹ 15% Consolidated�FFO to debt³ 5%—7% Annual operating�EPS growth rate¹ ~6% �dividend yield ~11%—13% Total shareholder �return The business review has delivered a comprehensively positive result�Repositioned to provide compelling long-term value for shareholders, customers & employees 7.5% Consolidated �rate base CAGR² + =

Premier state-regulated utility profile�Business mix ¹ Excludes corporate segment and RNG 45Z income included in Contracted Energy; includes illustrative allocation of parent-level debt to unlevered Contracted Energy assets using a 25% FFO to debt assumption (see slide 72) ² Includes open Millstone margin, Renewable Natural Gas, Charybdis, long-term contracted solar Average annual earnings contribution: 2025—2029¹ “Pure play” utility profile with ~90% of earnings from regulated utility operations “Regulated-like” earnings of ~95% inclusive of Millstone PPA/hedged/capacity DESC: 15% Millstone PPA/hedged/capacity: 5% Other²: 5% 90%�state-regulated utility operations (VA, NC, SC) 95%�state-regulated utility operations�+ Millstone PPA/hedged/capacity DEV: 75%

Contracted Energy: 6% Low operating risk�Diverse, constructive regulatory jurisdictions with strong support for timely recovery Percentage of total investment base¹ Renewable²: 16% Nuclear: 12% Electric �transmission/ distribution: 48% DEV: 55% Other DESC: 19% ~76% zero-carbon� + wires VA rider: 43% Other DEV: FERC electric transmission: 21% VA biennial³: 30% Reduced regulatory lag ¹ Figures may not sum due to rounding; total investment base reflects regulated rate base at DEV and DESC, plus approximate net book value of Contracted Energy and non-rate base DEV ringfenced solar ² Includes solar, wind, biomass, hydro (ex pumped storage) ³ Includes forward-looking two-year view for Virginia rate base and other wholesale and non-jurisdictional customers Coal 6% Regulatory diversity Increasingly clean

Dominion Energy Virginia (DEV)�Overview ¹ Includes impact of 50% non-controlling equity partner funding 50% of CVOW project costs ² Year-end 2024E through year-end 2029E ³ Includes weighted average of transmission, generation and distribution Electric utility customers 2.8M Owned generation (MW) 18,802 Distribution miles 60,300 Transmission miles 6,700 5-yr capital plan ($B)¹ $35.5 2024E utility rate base ($B) $41.2 5-yr utility rate base CAGR² 9.0% Weighted average allowed ROE³ 10.2% Weighted average allowed equity³ 52.1% Electric service area Key stats

Robust demand growth �Driven by economic growth, electrification, data center expansion DEV weather normal electric sales by revenue class PJM DOM Zone summer peak (GW) 46% 2033E 2023A 71% PJM DOM Zone summer peak annual load growth (10-year avg.) Commercial: 47% Commercial: 59% Residential: 26% Residential: 33% Industrial: 5% Industrial: 6% Gov/other: 10% Gov/other: 14% Data center development in Virginia Access to affordable and sustainable energy Connectivity to world class fiber networks Attractive business climate Access to largest data center workforce (U.S.) Data �centers Low industrial, high data center = �lower recession risk

Dominion Energy South Carolina (DESC)�Overview ¹ Year-end 2024E through year-end 2029E. Excludes the impact of the 20-year amortization of rate base associated with the Capital Cost Rider (CCR). Inclusive of CCR, 5-yr utility rate base CAGR = 5.1% Electric utility customers 0.8M Gas distribution utility customers 0.4M Owned generation (MW) 5,594 Electric distribution miles 19,000 Electric transmission miles 3,900 Gas distribution pipeline miles 18,800 5-yr capital plan ($B) $5.9 2024E rate base ($B) $10.7 5-yr utility rate base CAGR¹ 6.6% Weighted average allowed ROE 9.6% Weighted average allowed equity 52.2% Electric and gas service areas Key stats Electric Gas Electric and gas

Contracted Energy (CE)�Overview ¹ Includes long-term contracted volume via PPA, hedged volume and capacity revenue ² Excludes RNG 45Z income Charybdis Millstone Asset Solar RNG Significantly de-risked—% Millstone total revenue de-risked:¹ ~9M MWh (~55% of annual output) fixed price contracted Residual output (~45%) significantly de-risked by hedging program Capacity market revenue (typically known 3 years in advance) ~90% �of CE earnings� in 2025E under long-term contract or hedged 15-to-20-year PPAs with high-quality counterparties ~1.3 GWs Wholly-owned Dairy RNG portfolio and Swine RNG JV with Smithfield Capital invested through year-end 2023: $0.9B 2024—2029 capital investment: $0.3B First Jones Act compliant wind turbine installation vessel Expected completion date: Late 2024/early 2025 Supportive of CVOW schedule inclusive of any 3rd party charter �agreements in 2025 ~60—70% ~15% ~10% ~10%² Highly contracted, zero/negative carbon assets critical to the energy transition—�significant cash flow generation (~$500M+/year on average) supports regulated utility investment and growth CE earnings profile: Risk reduction 2024E 2025E 2026E 2027E 100% 98% 82% 63% % of CE earnings Commentary Millstone, solar, and RNG are unlevered

Diversified and robust rate base growth�Consolidated 5-year capital plan Note: Figures above include impact of 50% non-controlling equity partner funding 50% of CVOW project costs ¹ Includes additional electric generation, DESC gas distribution and other ² Includes maintenance, environmental and fuel for existing nuclear units at DEV, DESC and CE ³ Total investment base reflects regulated rate base at DEV and DESC, plus approximate net book value of CE and non-rate base DEV ringfenced solar Significant investments in decarbonization and reliability�with strong cash conversion given significant rider-eligible capital By function Total investment base³ ($B) 82% �DEV 14% �DESC ~$43B 2025E—2029E 19%�Other¹ 31% �Electric �transmission ~80% zero-carbon generation + wires ~64% rider-eligible 22% �Electric �distribution 9%�Solar 5%�Offshore wind 6%�Nuclear² 5%�Nuclear�relicensing 3%�Storage ~7.5% CAGR

Continuous cost control is the way we do business…�O&M performance ¹ Assumes estimated CPI of 3% ² See Dominion Energy’s investor relations website investors.dominionenergy.com for supporting information and a reconciliation to GAAP Effective cost control to mitigate inflation impacts and preserve customer affordability Best-in-class O&M control D’s electric non-fuel O&M per sales ($/MWh) vs peers Normalized O&M ($B) O&M control initiatives Dynamic cost cutting program through business process improvements and innovation Sustained O&M management supports EPS growth by creating capacity for growth capital spend within customer bills ~1—2% CAGR expected from 2025E to 2029E Cumulative savings of ~$300M (’22A—’25E) vs. rate of inflation¹ Includes $55M from targeted corporate cost reductions by 2025E 5-year average (2018—2022) 2022 ▼Lower is better Note: Source of electric non-fuel O&M per sales ($/MWh) data is FERC Form 1 for respective annual period. Aggregated amounts for each electric utility subsidiary. Data above $200/MWh not shown on chart. Includes DEV and DESC and South Carolina Generating Company (GENCO) for all periods shown, including periods prior to Dominion Energy’s acquisition of DESC & GENCO. 2019 excludes impact of Virginia SB 1355 to D. Peer group: AEE, AEP, CMS, CNP, ED, DUK, EIX, ETR, ES, EXC, FE, NEE, NI, PEG, SO, WEC, XEL

…As is keeping our customer bills low�Typical residential electric customer bills LT avg. rate vs. US avg. current rate vs. US avg. DEV 11.71 (12%) 13.36 (17%) DESC 12.93 (9%) 14.63 (10%) Preserving affordability for energy transition Incumbent that we preserve customer affordability for energy transition Bill CAGR 2019—2035 Bill CAGR 2023—2037 History of low rates¹ (cents/kWh) ¹ LT avg. rate reflects 11-year average rate for DEV (2013-2023) and 5-year average rate for DESC (2019-2023) to reflect customer benefits realized after SCANA merger; current D rates as of 12/31/2023; current US rates as of 11/30/2023; US rates per EIA ² Source: December 2023 CPI Index https://www.bls.gov/news.release/archives/cpi_01112024.htm ³ Source: DEV 2023 IRP (company methodology) and DESC 2023 IRP D/SCANA merger

Summary On a path to deliver maximum long-term value for shareholders and other stakeholders Investing to provide the reliable, affordable, and increasingly clean energy that powers our customers every day 100% focused on execution

Steven Ridge�Executive Vice President and�Chief Financial Officer

Business review�CFO observations The Dominion Energy plan is premised on five key tenets: Strategic simplicity Consistent long-term financial execution Balance sheet conservatism Dividend security Exceptional customer experience that enables us to advocate for and achieve balanced policy constructs and reasonable regulatory outcomes

Guidance�2025 operating earnings per share guidance midpoint (non-GAAP)¹ ¹ 2025 operating earnings guidance range of $3.17—$3.42 (excluding RNG 45Z) (midpoint of $3.30) and $3.25—$3.54 (midpoint of $3.40). See slide 36 2025 operating earnings per share guidance midpoint = $3.40 Per Federal legislation, RNG 45Z credit applies to gas production in 2025—2027 Highlighting for investors due to current legislative expiration after 2027 Financial plan does not assume extension beyond 2027 Final Treasury credit value regulations expected during 2024 Long-term operating earnings growth rate applied to this figure $3.40 includes the impact of illustrative 100 bps reduction in EROA (reduction to operating earnings of ~$0.10) $3.30 $3.40 2025E operating EPS excluding RNG 45Z = $3.30 2025E RNG 45Z operating EPS = ~$0.10 ~$0.10

7% annual growth ~6% �long-term CAGR 5% annual growth $3.30�Midpoint�(Ex. RNG 45Z) Guidance�Long-term operating earnings per share growth rate Bias to midpoint of ~6% over the long-range plan Within the 5%—7% growth range every year including Millstone planned double outage years (2026, 2029) 5%—7% growth rate off 2025 operating EPS midpoint excluding RNG 45Z ($3.30) (+) RNG 45Z credit operating earnings in 2025—2027 Expected to generate operating EPS in 2025—2027 (~$0.10/year) Excluded from long-term EPS growth rate due to current legislative expiration after 2027 Long-term growth rate RNG 45Z +

¹ Dividend declarations are subject to customary Board approval Guidance�Common dividend per share¹ Committed to dividend at current level Expect to maintain the current dividend level of $2.67 per share annually until such time as we achieve our targeted payout-ratio (“60s percent range”) $2.67

Note: Figures include impact of 50% non-controlling equity partner funding 50% of CVOW project costs ¹ 20-year amortization of rate base associated with the Capital Cost Rider (CCR) ² For DESC, represents growth capital under the Natural Gas Rate Stabilization Act ³ Total investment base CAGR reflects regulated rate base at DEV and DESC, plus approximate net book value of CE and non-rate base DEV ringfenced solar Guidance�Five-year capital summary Dominion Energy South Carolina Dominion Energy Virginia Contracted Energy Corporate & Other Total³ 2025 – 2029 capital plan ($B) 5-yr utility rate base CAGR YE’24 – YE’29 Primary drivers % rider eligible² $35.5 Economic growth Zero-carbon generation Grid transformation Generation reliability Transmission and distribution resiliency $5.9 $1.2 $0.6 $43.2 Economic growth Grid transformation Electric generation Maintenance, environmental and fuel for Millstone 9.0% 6.6%—5.1%�(without and with CCR¹) – 75% 15% – – 64% – 7.8%—7.5%�(without and with CCR) Information technology and other

Credit�Significant quantitative and qualitative improvements to our credit profile Note: Figures may not sum due to rounding ¹ Includes the termination of related interest rate derivatives ² 2023E ($B) Status After-tax proceeds Debt transferred² Total debt reduction Est. closing Cove Point LNG¹ Completed $3.3 – $3.3 Closed Deferred fuel securitization (DEV) Completed 1.3 – 1.3 Closed The East Ohio Gas Company Announced 4.2 2.3 6.5 ~Q1 2024 Questar & Wexpro Announced 2.7 1.3 4.0 ~Q2 2024 Public Service Company of North Carolina Announced 1.8 1.0 2.8 ~Q3 2024 CVOW noncontrolling equity financing Announced 3.0 – 3.0 ~Q4 2024 Total $16.3 $4.6 $20.9 100% of after-tax proceeds will be used to reduce parent-level debt; pending transactions subject to regulatory approvals Pure-play state regulated electric utility profile across diverse geography Stable regulatory foundation for utilities Reduced offshore wind project risk via strong execution and CVOW partner 50/50 cost sharing, subject to regulatory approval Lower parent debt ratio (+) qualitative improvements

Credit�Expect to significantly reduce parent debt ratio (non-GAAP) Note: Debt balances include 50% equity credit for hybrids. ¹ See Dominion Energy’s investor relations website investors.dominionenergy.com for supporting information and a reconciliation to GAAP ² Includes illustrative allocation of parent-level debt to unlevered operating assets (Millstone, solar and RNG) using a 25% FFO to debt assumption (see slide 72) ~$49.3B�2023A¹ Adj. total �debt ~$38.8B�2024E Adj. total debt Significant deleveraging expected from �business review Parent debt, ~$20.4B Parent debt, ~$10.6B Debt allocated to unlevered�operating assets², ~$2.0B Debt allocated to unlevered operating assets², ~$2.0B 41% 27%

Credit�Guidance Committed to our improved, robust and sustainable credit profile Credit ratings Parent: Target “mid BBB range” unsecured debt ratings DEV: Target “single A range” unsecured debt ratings DESC: Target “single A range” first mortgage bond ratings FFO to debt Parent debt ratio Expect 30% or less parent debt as % of total adjusted debt annually 2024E—2029E Expected consolidated average annual FFO to debt of ~15% Expected Moody’s consolidated downgrade threshold: 14% (unchanged) Expected S&P downgrade threshold: 13% (unchanged) ~15% <30% Parent debt Debt allocated to unlevered�operating assets

STD = Short term debt, Hybrid = JSN and preferred stock ¹ Includes common & preferred dividends ² Includes intangibles and net of CVOW noncontrolling interest financing cash flows Cumulative: 2025—2029 ($B) Financing guidance�Illustrative sources and uses

Dividend reinvestment (“DRIP”) At-the-market�(“ATM”) Midpoint of guidance 2024E $200M $400 – $600M $700M 2025E 200M 400 – 600M 700M 2026E 200M 400 – 600M 700M 2027E 200M 400 – 600M 700M 2028E 200M 400 – 600M 700M 2029E 200M 400 – 600M 700M 2025—2029 total $1.0B $2.0 – $3.0B $3.5B Financing guidance�Common equity capital raising activities Expected annual issuance

90% State-regulated �utility operations Simple strategy: Operate exceptional utilities in the Southeast U.S. Reliable and affordable service Stable and constructive regulatory frameworks Attractive resiliency, sustainability, and demand growth drivers Compelling financial profile: Durable and high-quality growth Secure dividend + attractive dividend yield Robust and sustainable credit profile Attractive rate base growth O&M discipline Enhanced disclosure and transparency ¹ 2025E—2029E ² Year-end 2024E through year-end 2029E ³ Expected consolidated average annual FFO to debt between 2025 and 2029 Strategic and financial profile Strategic and financial metrics $43B Five-year capital investment plan¹ 15% Consolidated�FFO to debt³ 5%—7% Annual operating�EPS growth rate¹ ~6% �dividend yield ~11%—13% Total shareholder �return The business review has delivered a comprehensively positive result�Repositioned to provide compelling long-term value for shareholders, customers & employees 7.5% Consolidated �rate base CAGR² + =

Appendix

¹ Additional events to be announced Key events Dates Wolfe Research NDR (NYC) March 4—5 BMO Capital Markets NDR (Boston) March 6 Barclays NDR (West Coast) March 7—8 Guggenheim Partners (CVOW site visit) ~Spring Wells Fargo NDR (Midwest) ~Summer J.P. Morgan Energy, Power & Renewables Conference June 17 Investor relations schedule¹ More events to be added throughout the year

Dominion Energy Virginia�Regulated offshore wind: CVOW video update from key suppliers and partners Jochen Eickholt CEO, Siemens Gamesa Renewable Energy Steen Brødbæk CEO, Semco Maritime Robert Dreves CEO Rostock Facility, EEW Søren Schlott Mikkelsen COO, Bladt Industries Chris Ong CEO, Seatrium Hakan Ozmen EVP Transmission & CEO Powerlink, Prysmian Group Luc Vandenbulcke CEO, DEME

Financial guidance supplement Consolidated guidance Dominion Energy Virginia Dominion Energy South Carolina Contracted Energy Corporate and Other Fixed income 1 4 2 3 5 6

Consolidated guidance 1

Guidance�2024 and 2025 operating earnings per share (non-GAAP) Note: Figures may not sum due to rounding ¹ Pending final order from SCC ² See Dominion Energy’s investor relations website investors.dominionenergy.com for supporting information and a reconciliation to GAAP 3 2023 to 2025 CAGR excluding 2025 RNG 45Z EPS = 7.6% ~$2.85 ~$0.85 ~$0.31 ~$3.06 ~$3.40 Adjustments ▲ Historically mild weather +$0.18 ▲ Interest savings from announced asset sales +$0.50 ▲ Millstone unplanned outage +$0.11 ▲ Millstone planned double outage +$0.10 ▲ MBR¹/fuel securitization +$0.15 ▼ DEV rider rate reduction ($0.18) ~$2.75 $1.99 ~9% CAGR from 2023 to 20253 1 Adjustments ▲ Net impact from announced asset sales +$0.30 ▲ Fuel securitization +$0.01

Consolidated guidance�Operating earnings per share (non-GAAP) Operating EPS guidance ranges ¹ Corporate and Other & Eliminations Operating EPS guidance includes the impact of preferred dividends ² RNG 45Z included in Contracted Energy ³ Excludes corporate segment and RNG 45Z income included in Contracted Energy; includes illustrative allocation of parent-level interest expense (~$0.10) associated with debt allocated to unlevered Contracted Energy assets using a 25% FFO to debt assumption (see slide 72) 1 2024E 2025E Dominion Energy Virginia $2.24—$2.43 $2.49—$2.67 Dominion Energy South Carolina $0.42—$0.46 $0.53—$0.56 Contracted Energy $0.47—$0.48 $0.55—$0.56 Corporate and Other & Elims¹ ($0.52)—($0.50) ($0.40)—($0.37) Operating EPS guidance range (excluding RNG 45Z²) $2.62—$2.87 �(midpoint: $2.75) $3.17—$3.42 �(midpoint: $3.30) RNG 45Z² — $0.08—$0.12 Operating EPS guidance range $2.62—$2.87 (midpoint: $2.75) $3.25—$3.54 (midpoint: $3.40) % state-regulated utility operations³ ~88% ~87% % state-regulated utility operations + Millstone PPA/hedges/capacity³ ~99% ~96%

Q2 Q1 Illustrative quarterly distribution of 2024E EPS Q3 Q4 ▲ Return to normal weather ▲ Sales ▲ Regulated investment ▼ Rider roll in to base ▼ Interest expense ▼ DD&A/O&M/other Drivers by quarter (YoY) ¹ Relative to 2023 planned and unplanned outages ▲ Return to normal weather ▲ Sales ▲ Regulated investment ▲ Lack of Millstone outages¹ ▼ Rider roll in to base ▼ DD&A/O&M/other ▲ Sales ▲ Regulated investment ▲ Margins ▲ Interest expense ▼ Return to normal weather ▼ DD&A/O&M/other ▲ Return to normal weather ▲ Sales ▲ Regulated investment ▲ Margins ▲ Lack of Millstone outages ▲ Interest expense ▼ DD&A/O&M/other Consolidated guidance�2024 operating earnings per share 1

Consolidated guidance�2024 illustrative sources and uses ($B) ¹ Pre-tax proceeds. Includes Gas LDC sale proceeds and CVOW noncontrolling equity interest ² Includes common & preferred dividends ³ Includes intangibles and CVOW capex at 100% 1

Note: Figures above reflect 50% funding of CVOW and may not sum due to rounding Consolidated guidance�Five-year capital summary 1 2025E 2026E 2027E 2028E 2029E Total Dominion Energy Virginia $7.6 $6.9 $7.3 $6.7 $7.0 $35.5 Dominion Energy South Carolina 1.1 1.0 1.2 1.3 1.3 5.9 Contracted Energy 0.3 0.2 0.3 0.2 0.2 1.2 Corporate and Other 0.1 0.1 0.2 0.1 0.1 0.6 Total $9.1 $8.3 $8.9 $8.2 $8.7 $43.2 $B

¹ 2025E—2029E CAGR ² Excludes impact of RNG 45Z ³ Average 2026E—2029E Driver 2024E assumption 2025E assumption Long-term assumption Weather 15-year normal 15-year normal 15-year normal Normalized O&M expense ($B) / growth rate $2.4 $2.3 ~1%—2%¹ Consolidated operating earnings effective tax rate² 18%—19% 15%—17% 13%—15%³ Consolidated cash tax benefit / (payable) ($M) ~($700)—($800) ~$150—$250 2026E: ~$50—$150 2027E: ~$200—$300 2028E: ~$0—$150 2029E: ~($100)—($200) Credits generated and monetized via carryback, sale and reduction in cash tax liability Consolidated guidance�Key assumptions 1

Asset Credit type Segment 2024E 2025E 2026E 2027E 2028E 2029E DEV regulated PTC DEV $25 $75 $140 $225 $275 $300 DEV regulated ITC DEV 10 25 25 5 125 85 RNG PTC CE — 70—100 90—125 90—125 — — RNG ITC CE 80 280 — — — — Solar PTC CE 10 20 20 20 20 20 Total ~$125 ~$470—$500 ~$275—$310 ~$340—$375 ~$420 ~$405 Note: Figures above reflect 50% funding of CVOW ¹ Reflects timing of gross credit generation and not indicative of earnings impact Cash generation by type ($M)¹ ITC credits will be recognized in income over useful life of project No change to prior guidance of $0.03—$0.04 on ITC operating EPS annually, on average, between 2025—2029 Consolidated guidance�Tax credits 1

Driver Change 2024E operating EPS impact 2025E operating EPS impact DEV: Electric load - residential +/- 1% +/- $0.018 +/- $0.018 DEV: Electric load - commercial +/- 1% +/- $0.014 +/- $0.014 DEV: Electric load - industrial +/- 1% +/- $0.002 +/- $0.002 DEV: Electric load - government/other +/- 1% +/- $0.004 +/- $0.004 DESC: Electric load - residential +/- 1% +/- $0.007 +/- $0.008 DESC: Electric load - commercial +/- 1% +/- $0.005 +/- $0.005 DESC: Electric load - industrial +/- 1% +/- $0.002 +/- $0.002 DESC: Electric load - government/other +/- 1% +/- $0.000 +/- $0.000 Consolidated guidance�Operating EPS impact for change in key financial plan inputs 1

Driver Change 2024E operating EPS impact 2025E operating EPS impact RNG: LCFS, RIN and biogas prices +/- 10% +/- $0.002 +/- $0.008 Open market Millstone prices +/- 10% +/- $0.000 +/- $0.002 Normalized O&M Expense +/- 1% +/- $0.022 +/- $0.022 DEV earned ROE (Base) +/- 25bps +/- $0.024 +/- $0.026 DESC earned ROE +/- 25bps +/- $0.011 +/- $0.011 Effective tax rate +/- 25bps +/- $0.010 +/- $0.011 Interest rates +/- 25bps +/- $0.022 +/- $0.021 Consolidated guidance�Operating EPS impact for change in key financial plan inputs 1

Dominion Energy Virginia 2

¹ 2025E—2029E CAGR ² Impacted by one-time “pause” on new data center connections in eastern Loudoun County in 2022 Driver 2024E assumption 2025E assumption Long-term assumption Weather 15-year normal 15-year normal 15-year normal W/N annual retail electric sales growth rate – DEV 4.5%—5.5% 1.0%—2.0%² 3.5%—4.5%¹ Segment normalized O&M expense growth rate Decrease Decrease 2.0%—2.5%¹ Dominion Energy Virginia�Key assumptions 2

Source: 2024 PJM Load Forecast Report DOM Zone peak demand forecasts Previous Summer Peak Aug. 9, 2022 21,156 MW New Winter Peak Dec. 24, 2022 22,189 MW New Summer Peak Jul. 28, 2023 21,993 MW Dominion Energy Virginia�2024 PJM DOM Zone forecasts 2 Dom Zone Actual Daily Peak

Top U.S. markets (MW capacity) Top global markets (MW capacity) Source: JLL Data Centers 2023 Global Outlook Northern Virginia data center market is larger than next five US markets combined and larger than next four world markets combined Dominion Energy Virginia�Data center markets 2

Source: Data Center Market Assessment conducted by a third-party consulting firm on behalf of Dominion Energy, dated November 9, 2023 Benefits Description Impact Fiber backbone Northern Virginia has densely packed fiber backbones and access to 4 subsea fiber cables near Virginia Beach (MAREA, BRUSA, SAEx, Dunant) ◕ Affordable energy Data center electricity costs are ~30% cheaper than the U.S. average in Northern Virginia, driving data center providers to Virginia due to significant cost savings ◕ Attractive business climate Virginia enacted tax subsidies and fast track approval processes for data center business ◕ Ideal location Proximity to economic centers on East Coast and Federal government; located near water sources plus limited risk of natural disasters ◑ Technical workforce Around 25% of jobs in Northern Virginia’s largest county are tech related ◑ Network effects Loudoun County hosts more than 3,500 companies in their data centers. Others likely to follow due to the benefit of network effects ◑ Lower ○●Higher Dominion Energy Virginia�Benefits for data centers in Virginia 2

Typical data center without A.I. demand Data center supporting A.I. in Training phase Data center supporting A.I. in Inference phase Description CPU-based servers High-powered GPU-based servers CPU/GPU-based servers Rack power density 6-12 kW 26-80 kW 12-40 kW Processors used CPUs (Intel Xeon) Nvidia H100 + Google TPU Nvidia H100 + Nvidia L40s, Intel Xeon Power load variability Limited Higher Limited Share of Gen AI market N/A Today: ~80% End State: ~20% Today: ~20% End State: ~80% Latency requirements Varies Minimal requirements Stringent requirements Likelihood to be deployed in Northern Virginia High Medium High Source: Data Center Market Assessment conducted by a third-party consulting firm on behalf of Dominion Energy, dated November 9, 2023 Key: relative power usage vs. typical workloads: Well above Above Comparable Dominion Energy Virginia�Generative A.I. power consumption 2

Source: https://www.scc.virginia.gov/docketsearch/DOCS/7%25wk01!.PDF ¹ Reflects Electric Service Agreements and Construction Letters of Authorization Contracted capacity¹ Data center actual/forecast demand Dominion Energy Virginia�Data center contracted capacity vs. data center actual/forecast demand (July 2023) 2 ...In addition, over 8,500MW (not shown) of requests for detailed engineering (at customer expense) are underway 2017 Existing contracted capacity fulfills projected demand growth through 2031...

Note: Figures above reflect 50% funding of CVOW and may not sum due to rounding ¹ Includes maintenance, environmental and other generation capital Program 2025E 2026E 2027E 2028E 2029E Total Electric transmission $2.3 $2.5 $2.5 $2.5 $2.5 $12.2 Electric distribution 0.9 0.9 1.0 1.0 1.1 4.9 Solar/storage/OSW 2.5 1.4 1.0 1.0 1.1 6.8 Nuclear/SLR 0.9 0.7 0.7 0.5 0.7 3.6 Grid transformation 0.6 0.7 0.7 0.6 0.7 3.4 Other¹ 0.6 0.8 1.3 1.0 1.0 4.7 Total $7.6 $6.9 $7.3 $6.7 $7.0 $35.5 $B Dominion Energy Virginia�5-year capital summary 2

VA base Electric Transmission rider VA riders Dominion Energy North Carolina Other Total Rate base ($B) ~13.3¹ ~10.1² ~7.5³ ~1.54 ~$3.15 $35.5 Common equity 52.1%7 52.2%8 52.1%7 52.0%9 N/A 52.1% Allowed ROE 9.70%6 11.40%10 9.70%11 9.75% N/A 10.2% Authority VA SCC FERC VA SCC NCUC Wholesale / retail contracts Note: Excludes deferred fuel and non-rate base ringfenced solar. ¹ Estimated 2023 end of period rate base for Virginia jurisdictional customers 2 Estimated 2023 end of period rate base for Virginia’s transmission rider inclusive of non-jurisdictional (wholesale/retail contracts) 3 Estimated 2023 end of period rate base for Virginia’s legacy A6 riders: Biomass conversions, Brunswick County, Greensville County, Strategic Underground, US-2 solar and US-3 solar inclusive of non-jurisdictional (wholesale/retail contracts) and estimated 2023 end of period rate base for other solar, wind, nuclear, battery storage and grid modernization riders inclusive of non-jurisdictional (wholesale/retail contracts) 4 Includes NC’s allocated portion of total system generation, transmission, and distribution rate base 5 Various other non-jurisdictional base rates (wholesale/retail contracts) 6 As per 2023 Virginia legislation and as stipulated with intervening parties. An order is expected from VA SCC in March 2024 7 Through year-end 2024, DEV is directed to undertake reasonable efforts to maintain a common equity capitalization to total capitalization ratio of 52.1% 8 Based on 2022 ATRR filing 9 Stipulated equity ratio from DENC’s 2019 base rate case (Docket No. E-22, Sub 562) 10 Electric transmission rider includes 50 bps RTO adder 11 Rider Brunswick County has ROE incentives Dominion Energy Virginia�Regulatory summary (as of December 31, 2023) 2 Rate base figures include impact of non-controlling equity partner funding 50% of CVOW project costs (transaction pending regulatory approval)

2024E 2025E 2026E 2027E 2028E 2029E Virginia base¹ $13.8 $14.2 $14.6 $15.3 $15.9 $16.6 Electric transmission rider² 11.8 13.5 15.4 17.3 19.0 20.7 Virginia riders³ 10.5 13.5 15.4 16.8 17.7 18.6 Dominion Energy North Carolina4 1.7 1.9 2.1 2.2 2.4 2.5 Other5 3.4 3.9 4.2 4.4 4.6 4.9 Total $41.2 $46.9 $51.6 $56.0 $59.6 $63.4 Illustrative rate base ($B) Note: Excludes deferred fuel and non-rate base ringfenced solar; figures may not sum due to rounding ¹ Estimated end of period rate base for Virginia jurisdictional customers ² Estimated end of period rate base for Virginia’s transmission rider inclusive of CWIP and non-jurisdictional (wholesale/retail contracts) ³ Estimated end of period rate base for Virginia’s legacy A6 riders: Biomass conversions, Brunswick County, Greensville County, Strategic Underground, US solar inclusive of non-jurisdictional (wholesale/retail contracts) and estimated end of period rate base for other solar, wind, nuclear, battery storage and grid modernization riders inclusive of non-jurisdictional (wholesale/retail contracts) 4 This includes NC’s allocated portion of total system generation, transmission, and distribution rate base 5 Various other non-jurisdictional base rates (wholesale/retail contracts) Dominion Energy Virginia�Rate base 2 Rate base figures include impact of non-controlling equity partner funding 50% of CVOW project costs (transaction pending regulatory approval)

¹ The Commission will have discretion to adjust Dominion Energy’s authorized return upward/downward by up to 0.50%, based on criteria such as reliability, generating plant performance and customer service beginning in 2025 or 2027 biennial ² Through year-end 2024, DEV is directed to undertake reasonable efforts to maintain a common equity capitalization to total capitalization ratio of 52.1% Second biennial Third biennial Fourth biennial Initial filing March 2025 March 2027 March 2029 Final order Late 2025 Late 2027 Late 2029 Investment under review “Base” only — Rider investment outside scope Years reviewed 2023—2024 2025—2026 2027—2028 Authorized return 9.70% (To be set during B2) (To be set during B3) Equity ratio 52.1%² End of year End of year Collar None None None Earnings sharing 85% to customers 15% to shareholders 85% to customers 15% to shareholders 85% to customers 15% to shareholders Earnings sharing cap 1.5% above ROE 1.5% above ROE 1.5% above ROE Forward test years 2026—2027 2028—2029 2030—2031 Performance-based adjustment¹ +/- 0.50% +/- 0.50% +/- 0.50% Dominion Energy Virginia�Biennial review summary 2

Financial summary 2024E 2025E 2026E 2027E 2028E 2029E Total generation (GWh) 1.9 1.9 1.9 1.9 1.9 1.9 EBITDA ($M) $50 $48 $46 $46 $44 $43 Business summary Included in DEV reporting segment Represents solar investments not included in DEV’s utility rate base summary 17 projects representing 0.9 GW Weighted average remaining PPA life: ~16 years Dominion Energy Virginia�Ringfenced solar 2

Dominion Energy South Carolina 3

¹ 2025E—2029E CAGR ² Excluding lost wholesale customer. Including the lost wholesale customer, W/N sales growth rate would be (~1.0%) Driver 2024E assumption 2025E assumption Long-term assumption Weather 15-year normal 15-year normal 15-year normal W/N annual retail electric sales growth rate – DESC 1.5%—2.5%² 0%—1% 1%—2%¹ Segment normalized O&M expense growth rate Increase Decrease 2.0%—2.5%¹ Dominion Energy South Carolina�Key assumptions 3

Electric Gas Capital Cost Rider (CCR) Total Rate base ($B) $7.4¹ $1.2¹ $1.4¹ $10.0 Common equity 51.62%² 54.78%³ 52.8% 52.2% Allowed ROE 9.5%² 9.49%³ 9.9% 9.6% ¹ Estimated 2023 end of period rate base ² Approved SC PSC Order 2021-570 ³ Approved SC PSC Order 2023-737 Dominion Energy South Carolina�Regulatory summary (as of December 31, 2023) 3

Note: Excludes deferred fuel; figures may not sum due to rounding 2024E 2025E 2026E 2027E 2028E 2029E Electric $8.1 $8.7 $9.2 $9.7 $10.3 $11.0 Gas 1.2 1.4 1.5 1.7 1.8 1.9 Capital Cost Rider 1.3 1.1 1.0 0.9 0.9 0.8 Total $10.7 $11.3 $11.7 $12.3 $13.0 $13.7 Illustrative rate base ($B) Dominion Energy South Carolina�Rate base 3

Note: Figures may not sum due to rounding Program 2025E 2026E 2027E 2028E 2029E Total Electric transmission $0.3 $0.2 $0.2 $0.2 $0.2 $1.1 Electric distribution 0.2 0.2 0.3 0.2 0.3 1.3 Gas distribution 0.2 0.2 0.2 0.2 0.2 0.9 Nuclear 0.0 0.0 0.0 0.1 0.0 0.2 Electric generation/other 0.5 0.3 0.4 0.6 0.6 2.4 Total $1.1 $1.0 $1.2 $1.3 $1.3 $5.9 $B Dominion Energy South Carolina�5-year capital summary 3

The capital cost rider was approved under terms of the South Carolina PSC merger approval in late 2018 Allows recovery of and return on ~$2.8B of New Nuclear Development costs Disallowed recovery/permanently impaired the other ~$2B of such costs (+) ~$2B Dominion Energy-funded refunds & restitution over 20-year amortization period Authorized equity capitalization 52.8% Authorized return on equity 9.9% Authorized recovery period 20 years (amortized by Feb 2039) 2023 year-end rate base $1.4B (accounting for net DTL and accumulated depreciation) Annual depreciation ~$140M Dominion Energy South Carolina�Capital Cost Rider (“CCR”) 3

Contracted Energy 4

¹ Includes long-term contracted volume via PPA, hedged volume and capacity revenue ² Excludes RNG 45Z income Charybdis Millstone Asset Solar RNG Significantly de-risked—% Millstone total revenue de-risked:¹ ~9M MWh (~55% of annual output) fixed price contracted Residual output (~45%) significantly de-risked by hedging program Capacity market revenue (typically known 3 years in advance) ~90% �of CE earnings� in 2025E under long-term contract or hedged 15-to-20-year PPAs with high-quality counterparties ~1.3 GWs Wholly-owned Dairy RNG portfolio and Swine RNG JV with Smithfield Capital invested through year-end 2023: $0.9B 2024—2029 capital investment: $0.3B First Jones Act compliant wind turbine installation vessel Expected completion date: Late 2024/early 2025 Supportive of CVOW schedule inclusive of any 3rd party charter �agreements in 2025 ~60—70% ~15% ~10% ~10%² Highly contracted, zero/negative carbon assets critical to the energy transition—�significant cash flow generation (~$500M+/year on average) supports regulated utility investment and growth CE earnings profile: Risk reduction 2024E 2025E 2026E 2027E 100% 98% 82% 63% % of CE earnings Commentary Millstone, solar, and RNG are unlevered Contracted Energy�Overview 4

Note: Figures may not sum due to rounding Asset 2025E 2026E 2027E 2028E 2029E Total Millstone Nuclear Power Station $0.2 $0.2 $0.3 $0.2 $0.2 $1.0 RNG 0.1 0.0 0.0 0.0 0.0 0.1 Solar 0.0 0.0 0.0 0.0 0.0 0.1 Total $0.3 $0.2 $0.3 $0.2 $0.2 $1.2 $B Contracted Energy�5-year capital summary 4

1 2026 and 2029 are double outage years 2 Millstone PPA expires in September of 2029 ³ Actual clearing prices through May 2027 (FCA 17) 2024E 2025E 2026E¹ 2027E 2028E 2029E¹,² Long-term contracted volume (GWh) 8,562 8,688 8,703 8,715 8,806 8,847 Long-term contracted price ($/MWh) $49.99 $49.99 $49.99 $49.99 $49.99 $49.99 Hedged volume (GWh) 7,745 7,133 3,953 1,752 220 — Weighted average hedge price ($/MWh) $68.46 $64.79 $62.46 $59.35 $60.00 — Open volume (GWh) — 365 2,856 6,013 7,422 6,923 Total volume (GWh) 16,307 16,186 15,511 16,481 16,448 15,770 Capacity prices ($ / kw – month)³ $2.36 $2.60 $2.59 $2.59 – – % revenue contracted + hedged + capacity 100% 98% 82% 63% 50% 50% Assumptions Contracted Energy�Millstone 4

Financial summary ¹ Previously disclosed solar project. Expect to claim PTC on the energy generated and sold 2024E 2025E 2026E 2027E 2028E 2029E Total generation (GWh) 2.3 2.6 2.5 2.5 2.5 2.5 EBITDA ($M) $72 $76 $76 $77 $76 $74 Capital expenditures ($M) $266¹ $4 $11 $11 $11 $11 Business summary 31 projects representing ~1.3 GW Weighted average remaining PPA life: ~13 years Contracted Energy�Solar 4

Financial summary (excludes impact of RNG 45Z and ITC tax credits) 2024E 2025E 2026E 2027E 2028E 2029E Capital expenditures ($B) $0.2 $0.1 — — — — Cumulative capital expenditures ($B) 1.1 1.2 1.2 1.2 1.2 1.2 EBITDA ($B) — 0.1 0.1 0.1 0.1 0.1 Volume (BcF) 1.7 3.1 3.5 3.6 3.6 3.6 Business summary Targeting low-teens, pre-tax unlevered IRRs Minimal ongoing capex (additional capital investment opportunities exist under commercial agreements but not assumed in plan) Financial summary below excludes tax credits RNG generates revenues through sales of LCFS and RIN credits as well as sale of the bio-gas Contracted Energy�RNG 4

Charybdis—�Jones Act compliant installation vessel Completion status (updated): 82% compared to previous update of 77% Expected completion date (no change): Late 2024/early 2025 Supportive of CVOW schedule inclusive of any 3rd party charter agreements in 2025 (no change) Seatrium (no change) Extensive relevant experience Charybdis is strategically important to Seatrium management Added senior and experienced project leadership from Singapore to Texas to support Workforce (updated) Increased to over 1,200 in February compared to 1,000 last October and 800 last August Continuing to augment workforce Milestones (updated) All four legs have been installed Engine start-up completed Jack-up system commissioning underway Expect the vessel to be floated in coming weeks Cost Total project costs (including financing costs): $625M (no change) Contracted Energy�Charybdis 4

Corporate and Other 5

Financial summary After-tax ($M) 2023A Interest expense, net ($564) Pension and OPEB 264 Corporate service company costs (126) Other 9 Operating earnings (non-GAAP)¹ ($417) Operating EPS² ($0.59) Note: totals may not sum due to rounding ¹ See Dominion Energy’s investor relations website investors.dominionenergy.com for supporting information and a reconciliation to GAAP ² The calculation of operating earnings per share includes the impact of preferred dividends Overview Operating earnings for corporate and other includes items not attributable to Dominion Energy’s primary operating segments, DEV, DESC, and Contracted Energy Segment includes: Interest expense, net including interest income from funds loaned to operating segments Pension and OPEB Corporate service company costs Consolidated tax adjustments The calculation of operating earnings per share includes the impact of preferred dividends 5 Corporate and Other�Overview

¹ Based on reported earnings and other information disclosed in the employee benefit plans note in our quarterly and annual reports on Form 10-Q and Form 10-K Robust plan funding levels: 117% at year-end 2023 Dominion Energy is evaluating reducing retirement benefit plan risk by rebalancing asset allocation towards lower risk asset classes Would result in lower EROA assumption/pension related income Evaluation will take place during 2024 with final reallocation of assets occurring in 2025 A reallocation that results in a 100-basis point reduction in EROA would: Move the company in line with peers Reduce operating earnings each year by ~$0.08 to $0.10 per share No impact to cash flow (non-cash income) Looking forward, including the impact of a 100-basis point reduction in EROA, we expect retirement-plan related annual operating earnings (non-GAAP)¹ to be, on average, ~20 cents per share from 2025 to 2029 Responding to investor feedback around perceived earnings quality and plan assumption risk levels Expected return on asset (EROA) assumption Illustrative: Assumes 100 basis point reduction as a result of increased allocation to lower risk asset classes By way of comparison to our current EROA assumption, DE pension trust’s 30-year historical compounded annual return as of year-end 2023 = 8.3% 5 Corporate and Other�Retirement benefit plans update: Evaluating plan asset rebalancing

¹ See Dominion Energy’s investor relations website investors.dominionenergy.com for supporting information and a reconciliation to GAAP ² Parent debt allocated to unlevered operating assets assumes leverage equal to ~25% FFO to debt Non-GAAP measures of adjusted total debt, parent debt and parent debt ratio ($B) 2022A 2023A 2024E Adjusted total debt¹ $45.9 $49.3 $38.8 Less: DEV total debt (17.1) (18.0) (20.4) Less: DESC total debt (4.0) (4.5) (5.7) Less: Gas utility total debt (4.3) (4.5) – Less: Allocated debt to unlevered operating assets² (2.0) (2.0) (2.0) Parent debt $18.5 $20.4 $10.6 Parent debt ratio 40% 41% 27% 5 Corporate and Other�Parent debt

Fixed income 6

¹ Excludes short-term debt activity as well as potential opportunistic financings including liability management. Excludes $300M planned issuance at PSNC in June 2024 and certain tax-free re-marketings Issuance range Issued YTD Remaining Dominion Energy Virginia $2.0 – 2.5 $1.0 $1.0 – $1.5 Dominion Energy South Carolina 0.0 0.0 0.0 Contracted Energy 0.0 0.0 0.0 DEI hybrid 0.7—1.5 0.0 0.7—1.5 Consolidated $2.7—$4.0 $1.0 $1.7 —$3.0 6 Fixed income�2024 fixed income financing activities ($B)¹

Estimated FFO impact¹ ¹ As of year-end 2023 ² Significant portion of DEI interest rate hedges have been offset to mitigate future cash flow volatility driven by interest rate changes 2024E 2025E 2026E 2027E 2028E 2029E DEI² $124 $173 $111 ($10) ($25) ($27) VEPCO 103 40 0 0 0 0 Total $227 $213 $111 ($10) ($25) ($27) 6 Fixed income�Interest rate derivative portfolio

Series and link to term sheet Issued Maturity Outstanding ($M) Dividend rate¹ Rating agency equity credit treatment Optional 100% redemption dates Series B preferred stock 12/13/2019 Perpetual $800 4.65% 50% 12/15/24 or any subsequent 5th anniversary of reset date Series C preferred stock 12/9/2021 Perpetual $1,000 4.35% 50% 1/15/27 – 4/15/27 or any subsequent 5th anniversary of reset date Preferred stock Junior subordinated notes ¹ Reset every five years ² At 10/1/2024 rate resets to a floating rate of SOFR + 332bps Junior subordinated notes (JSN) and link to term sheet Issued Maturity Outstanding ($M) Fixed interest rate Rating agency equity credit treatment Optional 100% redemption dates Enhanced 2014 A 10/3/2014 10/1/2054 $685 5.75%² 50% On or after 10/1/2024 Series A 6/27/2019 8/15/2024 $700 3.071% 0% N/A 6 Fixed income�Hybrid overview as of December 31, 2023

Dominion Energy, Inc. Moody’s S&P Fitch Corporate/Issuer Baa2 BBB+ BBB+ Senior Unsecured Debt Securities Baa2 BBB BBB+ Junior Subordinated Notes Baa3 BBB BBB Enhanced Junior Subordinated Notes Baa3 BBB- BBB- Preferred Stock Ba1 BBB- BBB- Short-Term/Commercial Paper P-2 A-2 F2 Outlook Stable Negative Stable VEPCO Moody’s S&P Fitch Corporate/Issuer A2 BBB+ A- Senior Unsecured Debt Securities A2 BBB+ A Short-Term/Commercial Paper P-1 A-2 F2 Outlook Stable Negative Stable DESC Moody’s S&P Fitch Corporate/Issuer Baa1 BBB+ A- First Mortgage Bonds A2 A A+ Short-Term/Commercial Paper P-2 A-2 F2 Outlook Stable Negative Stable 6 Fixed income�Credit ratings as of February 29, 2024

¹ The secured senior notes were prepaid in February 2024 ² Includes debt previously issued by CNG 3 Excludes debt of Dominion Energy's three natural gas distribution companies totaling $4.6B which is presented in held for sale in Dominion Energy's Consolidated Balance Sheets at December 31, 2023 and VEPCO’s January 2024 issuance of $500M 5.0% senior notes and $500M 5.35% senior notes that mature in 2034 and 2054, respectively 6 Fixed income�Preliminary and unaudited schedule of long-term debt as of December 31, 2023 ($M)

¹ In January 2024, the loan was amended to mature on July 12, 2024 ² In February 2024, the secured senior notes were prepaid. The notes were scheduled to mature in 2042 6 Fixed income�Schedule of debt maturities as of December 31, 2023 ($M)

¹ Excludes finance leases and other long-term debt. Also excludes debt of Dominion Energy's three natural gas distribution companies which is presented in held for sale in Dominion Energy's Consolidated Balance Sheets at December 31, 2023 6 Fixed income�Schedule of debt maturities as of December 31, 2023 ($M)

Exhibit 99.2

Transcript of A Message from the Dominion Energy Board of Directors

Robert H. Spilman, Jr.

Lead Independent Director

On behalf of the Dominion Energy’s Board of Directors, thank you for attending today's investor meeting.

I’d like to begin by expressing our excitement for the future of the company. Today marks the start of a new era for Dominion Energy. The entire board believes the top-to-bottom review has delivered a result that solidly positions the company to create maximum long-term value for all stakeholders.

Joseph M. Rigby

Independent Director

Chair of the Audit Committee

Thanks, Rob. It’s important that you, our owners, know that the Board has been intensely involved throughout the review process. We've received frequent and comprehensive updates from management and our advisors.

We’ve rigorously questioned critical assumptions, analyses, and conclusions. We’ve met with investors directly and taken their feedback to heart. We’ve met without management: asking hard questions and challenging each other and ourselves.

Under the Board’s oversight, management guided the review, attacked issues that in the past challenged the company’s performance, and maintained unwavering focus and effort throughout. We commend Bob and his team for the transparent and thorough manner in which they have conducted the review.

As a result, we have great conviction in the leadership team and strategic and financial plan you are learning about today.

Susan N. Story

Independent Director

Chair of Sustainability and Corporate Responsibility Committee

That’s exactly right. The company is positioned to deliver a durable, predictable, and high-quality growth profile based on strong regulatory frameworks, improved financial positioning, and optimal capital allocation. The Board has better aligned management compensation with financial performance, and we’ve continued best-practice Board refreshment. Since 2019, we’ve added 6 new directors which will represent more than 50% of the Board. It is also worth noting that over the past year, the company has settled multiple rate cases, continued to be one of the industry's most efficient and cost-effective operators, significantly advanced the Coastal

Offshore Wind project, and had one of its safest years for our employees in the company's history.

Notwithstanding how much has been accomplished during the review, the hard work continues. Great assets, great people, and a great financial plan are not enough. For the business review to be successful, we must now consistently execute. You've heard Bob say clearly that he is personally accountable for the company's performance. Let us, the Board, also be clear. We will hold Bob and the management team accountable, and we expect that you, the company's owners, will hold us to account as well.

We assure you that the rigor of our oversight will not wane now that we enter a new chapter. As stewards of investors’ capital, we take our responsibility seriously and realize our obligations are to maximize shareholder value.

Robert H. Spilman, Jr.

Thank you, Susan.

I'll conclude our remarks where we started: Emphasizing the Board’s excitement for and confidence in this strategy, this plan, this management team, and the company's future. Please enjoy the rest of today's meeting. Thank you.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

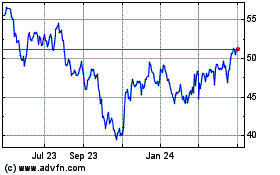

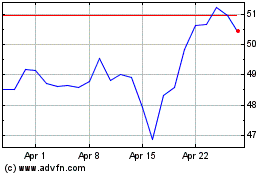

Dominion Energy (NYSE:D)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dominion Energy (NYSE:D)

Historical Stock Chart

From Apr 2023 to Apr 2024