As filed with the Securities and Exchange Commission on February 29, 2024

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

GoDaddy Inc.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Delaware |

| 46-5769934 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (I.R.S. Employer

Identification Number) |

| 2155 E. GoDaddy Way Tempe, Arizona 85284

(480) 505-8800 | |

| (Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices) |

| | | | | | | | |

| Aman Bhutani Chief Executive Officer

2155 E. GoDaddy Way Tempe, Arizona 85284

(480) 505-8800 | |

| (Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service) |

| Copy to: | |

| Alan F. Denenberg

Davis Polk & Wardwell LLP

1600 El Camino Real Menlo Park, CA 94025

(650) 752-2000 | |

Approximate date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☒ Accelerated filer ☐

Non-accelerated filer ☐ Smaller reporting company ☐

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

PROSPECTUS

270,508 Shares

Class A Common Stock

___________________________

This prospectus relates to the resale from time to time by the selling stockholders named in this prospectus (the “selling stockholders”) of up to 270,508 shares of Class A common stock of GoDaddy Inc. The selling stockholders acquired shares of Class A common stock from us in connection with the merger of our subsidiary, Desert Newco, LLC (“Desert Newco”), with a newly-formed subsidiary of Desert Newco (the “Merger”).

We are not selling any shares of our Class A common stock under this prospectus and we will not receive any of the proceeds from the sale of shares by the selling stockholders. The selling stockholders named herein may sell the shares of Class A common stock described in this prospectus in a number of different ways and at varying prices. We provide more information about how the selling stockholders may sell their shares of Class A common stock in the section titled “Plan of Distribution.” We will pay the expenses incurred in registering the resale of the shares, including legal and accounting fees.

Our common stock is listed on The New York Stock Exchange (the “NYSE”) under the symbol “GDDY.” On February 28, 2024, the last reported sale price for our common stock on the NYSE was $113.01 per share.

___________________________

Investing in our Class A common stock involves risks. You should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 4 of this prospectus and under similar headings in the other documents filed with the Securities and Exchange Commission that are incorporated by reference in this prospectus.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

___________________________

The date of this prospectus is February 29, 2024.

TABLE OF CONTENTS

___________________________

We are responsible for the information contained and incorporated by reference in this prospectus, any accompanying prospectus supplement and in any related free writing prospectus we prepare or authorize. Neither we nor the selling stockholders have authorized anyone to provide you with any other information, and we take no responsibility for any other information that others may provide you. This prospectus and any accompanying prospectus supplement do not constitute an offer to sell, or a solicitation of an offer to purchase, any securities other than the registered securities to which they relate, nor do this prospectus and any accompanying prospectus supplement constitute an offer to sell, or a solicitation of an offer to purchase, the securities offered hereby, or thereby in any jurisdiction to or from any person whom or from whom it is unlawful to make such offer or solicitation of an offer in such jurisdiction. The information appearing or incorporated by reference in this prospectus, any accompanying prospectus supplement, and any related free writing prospectus, is accurate only as of the date thereof, regardless of the time of delivery of this prospectus, any accompanying prospectus supplement, or any related free writing prospectus, or of any sale of our securities. Our business, financial condition, and results of operations may have changed since those dates. It is important for you to read and consider all the information contained in this prospectus and in any accompanying prospectus supplement, including the documents incorporated by reference herein or therein, before making your investment decision.

ABOUT THIS PROSPECTUS

This prospectus is part of an automatic shelf registration statement that we filed with the SEC, as a “well-known seasoned issuer” as defined in Rule 405 under the Securities Act of 1933, as amended (the “Securities Act”), utilizing a “shelf” registration process. Under this process, selling stockholders named in this prospectus or in one or more supplements to this prospectus may offer or sell shares of our common stock, as described in this prospectus, in one or more offerings from time to time. Each time any selling stockholder not named in this prospectus (or in any supplement to this prospectus) sells shares of common stock under the registration statement of which this prospectus is a part, such selling stockholder must provide a copy of this prospectus and a prospectus supplement naming such selling stockholder as a selling stockholder, to a potential purchaser, as required by law.

We may also authorize one or more free writing prospectuses or prospectus supplements to be provided to you in connection with these offerings. Any related free writing prospectus or prospectus supplement may also add, update or change information contained in this prospectus or in any documents that we have incorporated by reference into this prospectus and, accordingly, to the extent inconsistent, information in this prospectus is superseded by the information in any prospectus supplement or any related free writing prospectus and any documents incorporated by reference.

The selling stockholders may offer and sell shares of our common stock directly to purchasers through agents selected by the selling stockholders, or to or through underwriters or dealers. A prospectus supplement, if required, may describe the terms of the plan of distribution and set forth the names of any agents, underwriters or dealers involved in the sale of shares of our common stock. See “Plan of Distribution.”

You should read this prospectus together with any applicable prospectus supplement, as well as additional information described under the heading “Where You Can Find More Information.” You should only rely on the information contained or incorporated by reference in this prospectus, and any applicable prospectus supplement or any related free writing prospectus that we may authorize to be provided to you. We have not authorized, and no selling stockholder has authorized, any other person to provide you with different or additional information. If anyone provides you with different or inconsistent information, you should not rely on it. No offer of shares of common stock is being made in any jurisdiction where the offer or sale is not permitted.

You should not assume that the information in this prospectus, any applicable prospectus supplement, any related free writing prospectus or any document incorporated by reference herein or therein is accurate as of any date other than the date on the cover of the applicable document. Our business, financial condition, results of operations and prospects may have changed since those dates. We urge you to read carefully this prospectus, the documents incorporated by reference in this prospectus, any applicable prospectus supplement and any applicable free writing prospectus before making an investment decision.

Unless expressly indicated or the context suggests otherwise, references to “GoDaddy,” “Company,” “company,” “we,” “us” and “our” refer to GoDaddy Inc. and its consolidated subsidiaries, including Desert Newco and its subsidiaries.

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere or incorporated by reference into this prospectus and does not contain all the information that you should consider before investing in our Class A common stock. You should carefully read the entire prospectus, including the risks of investing in our Class A common stock discussed under the heading “Risk Factors” on page 4 of this prospectus and under similar headings in the other documents that are incorporated by reference herein.

About GoDaddy

GoDaddy is a global leader serving a large market of entrepreneurs, developing and delivering easy-to-use products in a one-stop shop solution alongside, personalized guidance. We serve small businesses, individuals, organizations, developers, designers and domain investors. Our vision is to radically shift the global economy toward life-fulfilling entrepreneurial ventures. Our mission is to empower entrepreneurs everywhere, making opportunity more inclusive for all. We are passionate about our mission and honored that entrepreneurs trust their ideas with us. Our 21.0 million customers are passionate and determined to transform their ideas into something meaningful. They often face a complex road to success, and our ability to evolve and build products to meet our customers’ needs uniquely positions us to help our customers navigate their journey.

Corporate Information

GoDaddy Inc. is a corporation organized under the laws of the state of Delaware. Our principal executive offices are located at 2155 E. GoDaddy Way, Tempe, AZ 85284. Our telephone number at that address is (480) 505-8800. Our website address is www.godaddy.com. The information on, or that can be accessed through, our website is not part of this prospectus or any accompanying prospectus supplement.

THE OFFERING

| | | | | |

Class A Common Stock Offered by the Selling Stockholders | Up to 270,508 shares |

Use of Proceeds | All shares of Class A common stock offered hereby are being sold by the selling stockholders. Accordingly, we will not receive any proceeds from the sale of these shares. |

Risk Factors | An investment in our common stock involves a high degree of risk. See the information contained in or incorporated by reference under “Risk Factors” on page 4 of this prospectus and under similar headings in the other documents that are incorporated by reference herein, as well as the other information included in or incorporated by reference in this prospectus. |

NYSE Symbol | Our common stock is quoted and traded on the NYSE under the symbol “GDDY.” |

RISK FACTORS

Investing in our Class A common stock involves risks. Prior to making a decision about investing in our securities, you should carefully consider the specific factors discussed below and any factors discussed under the heading “Risk Factors” in any prospectus supplement, together with all of the other information contained or incorporated by reference in this prospectus or any prospectus supplement. You should also consider the risks, uncertainties and assumptions discussed under the heading “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which is incorporated herein by reference, and may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future. The risks and uncertainties we have described therein and below are not the only risks that we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our operations.

CAUTIONARY STATEMENT ON FORWARD-LOOKING STATEMENTS

This prospectus, including the documents incorporated by reference herein, contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), involving substantial risks and uncertainties. The words “believe,” “may,” “will,” “potentially,” “plan,” “could,” “should,” “predict,” “ongoing,” “estimate,” “continue,” “anticipate,” “intend,” “project,” “expect,” “seek,” or the negative of these words, or terms or similar expressions conveying uncertainty of future events or outcomes, or that concern our expectations, strategy, plans or intentions, are intended to identify forward-looking statements. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those projected, anticipated, or expected. When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements discussed under the heading “Risk Factors” and in our publicly available filings and press releases. These statements include, among other things, those regarding:

•our ability to continue to add new customers and increase sales to our existing customers;

•our ability to develop new solutions and bring them to market in a timely manner;

•our ability to timely and effectively scale and adapt our existing solutions;

•our ability to deploy new and evolving technologies, such as artificial intelligence, machine learning, data analytics and similar tools (collectively, AI), in our offerings;

•our dependence on establishing and maintaining a strong brand;

•the occurrence of service interruptions and security or privacy breaches and related remediation efforts and fines;

•system failures or capacity constraints;

•the rate of growth of, and anticipated trends and challenges in, our business and in the market for our products;

•our future financial performance, including our expectations regarding our revenue, cost of revenue, operating expenses, including changes in technology and development, marketing and advertising, general and administrative and customer care expenses, and our ability to maintain future profitability;

•our ability to continue to efficiently acquire customers, maintain our high customer retention rates and grow the level of our customers' lifetime spend;

•our ability to provide high quality customer care;

•the effects of increased competition in our markets and our ability to compete effectively;

•our ability to grow internationally;

•the impact of fluctuations in foreign currency exchange rates on our business and our ability to effectively manage the exposure to such fluctuations;

•our ability to effectively manage our growth and associated investments, including the migration of applications and services to the public cloud;

•our ability to integrate acquisitions, our entry into new lines of business and our ability to achieve expected results from our integrations and new lines of business;

•our ability to complete desired or proposed divestitures;

•our ability to maintain our relationships with our partners;

•adverse consequences of our level of indebtedness and our ability to repay our debt;

•our ability to maintain, protect and enhance our intellectual property;

•our ability to maintain or improve our market share;

•sufficiency of cash and cash equivalents to meet our needs for at least the next 12 months;

•beliefs and objectives for future operations;

•our ability to stay in compliance with laws and regulations currently applicable to, or which may become applicable to, our business both in the United States (U.S.) and internationally;

•economic and industry trends or trend analysis;

•our ability to attract and retain qualified employees and key personnel;

•anticipated income tax rates, tax estimates and tax standards;

•our future taxable income and ability to realize our deferred tax assets;

•interest rate changes;

•the future trading prices of our Class A common stock;

•our expectations regarding the outcome of any regulatory investigation or litigation;

•the amount and timing of future repurchases of our Class A common stock under any share repurchase program;

•the potential impact of shareholder activism on our business and operations;

•our expectations regarding the effectiveness of our 2023 restructuring efforts;

•our ability to remediate the identified material weakness in our internal control over financial reporting and to maintain effective internal control over financial reporting;

as well as other statements regarding our future operations, financial condition, growth prospects and business strategies.

We operate in very competitive and rapidly-changing environments, and new risks emerge from time-to-time. It is not possible for us to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this prospectus may not occur, and actual results could differ materially and adversely from those implied in our forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. Although we believe the expectations reflected in our forward-looking statements are reasonable, we cannot guarantee the future results, levels of activity, performance or events and circumstances described in the forward-looking statements will be achieved or occur. Neither we, nor any other person, assume responsibility for the accuracy and completeness of the forward-looking statements. We undertake no obligation to publicly update any forward-looking statements for any reason after the date of this prospectus to conform such statements to actual results or to changes in our expectations, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

USE OF PROCEEDS

The selling stockholders may make offers and sales of our Class A common stock pursuant to this prospectus and any applicable prospectus supplement. We will not receive any proceeds from the sale or other disposition by the selling stockholders of the shares of our Class A common stock covered hereby, or interests therein. The selling stockholders will pay any expenses incurred for brokerage, accounting, tax or legal services or any other expenses incurred by the selling stockholders in disposing of these shares. We will bear all other costs, fees and expenses incurred in effecting the registration statement of which this prospectus forms a part, including, without limitation, all registration fees, listing fees of the NYSE and fees and expenses of our counsel and our accountants.

SELLING STOCKHOLDERS

We are registering for resale an aggregate of 270,508 shares of our Class A common stock that may be sold by the selling stockholders set forth herein. The shares of common stock registered hereby were issued pursuant to the Merger in a transaction not subject to the registration requirements of the Securities Act. In connection with the Merger, the limited liability company units of Desert Newco held by the selling stockholders, which were exchangeable into shares of our Class A common stock, were cancelled. We currently intend to maintain the effectiveness of the registration statement of which this prospectus forms a part until such time as all such shares of Class A common stock issued in the Merger can be freely sold without volume limitations pursuant to Rule 144 of the Securities Act.

Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to our Class A common stock. Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the persons named in the table below have sole voting and investment power with respect to all shares of Class A common stock that they beneficially own, subject to applicable community property laws.

The selling stockholders may sell some, all or none of their shares of Class A common stock offered by this prospectus from time to time. We cannot advise you as to whether the selling stockholders will in fact sell any or all of such shares of Class A common stock. In addition, the selling stockholders may sell, transfer or otherwise dispose of, at any time and from time to time, the shares of Class A common stock in transactions exempt from the registration requirements of the Securities Act after the date of this prospectus, subject to applicable law, including Rule 144 of the Securities Act. See “Plan of Distribution.”

The table below is based on 142,478,402 shares of Class A common stock outstanding as of February 23, 2024 and assumes the selling stockholders dispose of all the shares of Class A common stock covered by this prospectus and do not acquire beneficial ownership of any additional shares. The registration of these shares does not necessarily mean that the selling stockholders will sell all or any portion of the shares covered by this prospectus.

Unless otherwise indicated, the address of each selling stockholder listed in the table below is c/o GoDaddy Inc., 2155 E GoDaddy Way, Tempe, AZ 85284.

Any prospectus supplement may add, update, substitute, or change the information contained in this prospectus, including the identity of each selling stockholder and the number of shares registered on its behalf. A selling stockholder may sell all, some or none of such securities in this offering.

None of the selling stockholders hold any position or office with us, or have or have had any other material relationship with us within the past three years.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class A Common Stock

Beneficially Owned | | Class A Common Stock

Registered

Hereby | | Class A Common Stock

Beneficially Owned

After Sale of All Common

Stock Offered Hereby |

| Name of Selling Stockholder | Shares | Percentage | | | | Shares | Percentage |

James Lenhart | 45,010 | * | | 15,010 | | 30,000 | * |

Angel Carradus | 150,852 | * | | 150,000 | | 852 | * |

Hector Acencio | 25,118 | * | | 25,000 | | 118 | * |

Keir Mierle | 44,689 | * | | 44,689 | | — | * |

Scott Gerlach | 654 | * | | 654 | | — | * |

Wei Cheng Lai | 21,979 | * | | 3,500 | | 18,479 | * |

Todd Redfoot | 40,637 | * | | 18,500 | | 22,137 | * |

Ahmed Elmalki | 10 | * | | 10 | | — | * |

Marianne Curran | 10,500 | * | | 10,500 | | — | * |

Brian Cayne | 2,645 | * | | 2,645 | | — | * |

| * | Less than one percent. |

PLAN OF DISTRIBUTION

The selling stockholders and any of their pledgees, assignees and successors-in-interest may, from time to time in one or more transactions on the NYSE or any other organized market where our shares of common stock may be traded, sell any or all of their shares of our Class A common stock offered hereby through underwriters, dealers or agents, directly to one or more purchasers or through a combination of any such methods of sale. The selling stockholders may distribute the shares of our Class A common stock offered hereby from time to time in one or more transactions:

•at a fixed price or prices, which may be changed;

•at market prices prevailing at the time of sale;

•at prices related to such prevailing market prices; or

•at negotiated prices.

The selling stockholders may use any one or more of the following methods when selling the shares offered hereby:

•on any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale;

•in the over-the-counter market;

•in transactions otherwise than on these exchanges or systems or in the over-the-counter market;

•through the writing or settlement of options, whether such options are listed on an options exchange or otherwise;

•ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

•one or more block trades in which the broker-dealer will attempt to sell the shares as agent or principal of all such shares held by the selling stockholders;

•purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

•an exchange distribution in accordance with the rules of the applicable exchange;

•privately negotiated transactions;

•short sales;

•agreements between broker-dealers and the selling stockholders to sell a specified number of such shares at a stipulated price per share; and

•any other method or combination of methods of sale permitted pursuant to applicable law.

The selling stockholders may also sell shares pursuant to Rule 144 under the Securities Act, if available, rather than under this prospectus.

If the selling stockholders effect such transactions by selling shares of Class A common stock offered hereby to or through underwriters, broker-dealers or agents, such underwriters, broker-dealers or agents may receive commissions in the form of discounts, concessions or commissions from the selling stockholders or commissions from purchasers of the shares of Class A common stock offered hereby for whom they may act as agent or to whom they may sell as principal (which discounts, concessions or commissions as to particular underwriters, broker-dealers or agents may be in excess of those customary in the types of transactions involved). In connection with sales of the shares of Class A common stock offered hereby or otherwise, the selling stockholders may enter into hedging transactions with broker-dealers, which may in turn engage in short sales of the shares of Class A common stock offered hereby in the course of hedging in positions they assume. The selling stockholders may also sell shares of Class A common stock offered hereby short and deliver shares of Class A common stock covered by this

prospectus to close out short positions and to return borrowed shares in connection with such short sales. The selling stockholders may also loan or pledge shares of Class A common stock offered hereby to broker-dealers that in turn may sell such shares.

The selling stockholders may from time to time pledge or grant a security interest in some or all of the shares of Class A common stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of Class A common stock from time to time under this prospectus or any amendment to this prospectus under Rule 424(b)(3), or other applicable provision of the Securities Act, supplementing or amending, if necessary, the list of selling stockholders to include the pledgee, transferee or other successors in interest as selling stockholders under this prospectus. The selling stockholders also may transfer the shares of Class A common stock in other circumstances, in which case the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

The selling stockholders and any broker-dealer participating in the distribution of the shares of Class A common stock offered hereby may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares of Class A common stock purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. Any such discounts, concessions, commissions and similar selling expenses, if any, attributable to the sale of shares will be borne by the selling stockholders. The selling stockholders may agree to indemnify any agent, dealer or broker-dealer that participates in transactions involving sales of the shares if liabilities are imposed on that person under the Securities Act. At the time a particular offering of the shares of Class A common stock offered hereby is made, a prospectus supplement, if required, will be distributed which will set forth the aggregate amount of shares of Class A common stock being offered and the terms of the offering, including the name or names of any broker-dealers or agents, any discounts, commissions and other terms constituting compensation from the selling stockholders and any discounts, commissions or concessions allowed or reallowed or paid to broker-dealers.

Underwriters, dealers and agents may engage in transactions with, or perform services for, us or our subsidiaries in the ordinary course of their businesses.

In order to facilitate the offering of the securities, any underwriters or agents, as the case may be, involved in the offering of such securities may engage in transactions that stabilize, maintain or otherwise affect the price of such securities or other securities the prices of which may be used to determine payments on the securities. Specifically, the underwriters or agents, as the case may be, may overallot in connection with the offering, creating a short position in such securities for their own account. In addition, to cover overallotments or to stabilize the price of the securities or of such other securities, the underwriters or agents, as the case may be, may bid for, and purchase, such securities in the open market. Finally, in any offering of such securities through a syndicate of underwriters, the underwriting syndicate may reclaim selling concessions allotted to an underwriter or a dealer for distributing such securities in the offering if the syndicate repurchases previously distributed securities in transactions to cover syndicate short positions, in stabilization transactions or otherwise. Any of these activities may stabilize or maintain the market price of the securities above independent market levels. The underwriters or agents, as the case may be, are not required to engage in these activities, and may end any of these activities at any time.

The selling stockholders may solicit offers to purchase securities directly from, and may sell securities directly to, institutional investors or others. The terms of any of those sales, including the terms of any bidding or auction process, if utilized, will be described in the applicable prospectus supplement.

We cannot and will not give any assurances as to the liquidity of the trading market for any of our securities.

Under the securities laws of some states, the shares of Class A common stock offered hereby may be sold in such states only through registered or licensed brokers or dealers. In addition, in some states the shares of Class A common stock offered hereby may not be sold unless such shares have been registered or qualified for sale in such state or an exemption from registration or qualification is available and is complied with.

There can be no assurance that any selling stockholder will sell any or all of the shares of Class A common stock registered pursuant to the registration statement of which this prospectus forms a part. Once sold under the shelf registration statement, of which this prospectus forms a part, such shares of Class A common stock will be freely tradable in the hands of persons other than our affiliates.

VALIDITY OF SECURITIES

The validity of the shares of Class A common stock offered by this prospectus has been passed upon for us by Davis Polk & Wardwell LLP, Menlo Park, California.

EXPERTS

The consolidated financial statements of GoDaddy Inc. appearing in GoDaddy Inc.’s Annual Report (Form 10-K) for the year ended December 31, 2023, and the effectiveness of GoDaddy Inc.’s internal control over financial reporting as of December 31, 2023 have been audited by Ernst & Young LLP, independent registered public accounting firm, as set forth in their reports thereon, which conclude, among other things, that GoDaddy Inc. did not maintain effective internal control over financial reporting as of December 31, 2023, based on Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission “(2013 framework)”, because of the effects of the material weakness described therein, included therein, and incorporated herein by reference. Such financial statements have been incorporated herein by reference in reliance upon such reports given on the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus is part of the registration statement on Form S-3 we filed with the SEC under the Securities Act and does not contain all the information set forth in the registration statement. Whenever a reference is made in this prospectus to any of our contracts, agreements or other documents, the reference may not be complete and you should refer to the exhibits that are a part of the registration statement or the exhibits to the reports or other documents incorporated herein by reference for a copy of such contract, agreement or other document.

We file annual, quarterly and current reports, proxy statements and other information with the SEC. You can read our SEC filings, including the registration statement, over the Internet at the SEC’s website at www.sec.gov. We also maintain a website at investors.godaddy.net, at which you may access these materials free of charge as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC. Information contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus, and you should not consider such information contained on, or accessed through, our website as part of this prospectus.

In addition, you may request copies of these filings at no cost, by writing or telephoning us at the following address or telephone number:

Investor Relations Department

GoDaddy Inc.

2155 E. GoDaddy Way

Tempe, AZ 85284

INCORPORATION BY REFERENCE

The SEC allows us to “incorporate by reference” information into this prospectus. This means that we can disclose important information to you by referring you to other documents we have filed separately with the SEC, without actually including the specific information in this prospectus. The information incorporated by reference is considered to be part of this prospectus, and information that we file later with the SEC (and that is deemed to be “filed” with the SEC) will automatically update, and may supersede, information in this prospectus. We incorporate by reference into this prospectus and the registration statement of which this prospectus is a part the information or documents listed below that we have filed with the SEC (Commission File No. 001-36904):

•our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 29, 2024;

•our current Reports on Form 8-K filed with the SEC on January 11, 2024, January 23, 2024 and February 8, 2024, to the extent the information in such reports is filed and not furnished; and

•the description of our common stock contained in our Registration Statement on Form 8-A (File No. 001-36904), filed with the SEC on April 1, 2015, including any amendments or reports filed for the purpose of updating such description.

We also incorporate by reference any future filings (except as specifically enumerated above, other than any filings or portions of such reports that are not deemed “filed” under the Exchange Act in accordance with the Exchange Act and applicable SEC rules, including current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are related to such items unless such Form 8-K expressly provides to the contrary) made with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, including those made after the date of the initial filing of the registration statement of which this prospectus forms a part, until the selling stockholders identified herein sell all of the Class A common stock covered by this prospectus and will become a part of this prospectus from the date that such documents are filed with the SEC. Information in such future filings updates and supplements the information provided in this prospectus. Any statements in any such future filings will automatically be deemed to modify and supersede any information in any document we previously filed with the SEC that is incorporated or deemed to be incorporated herein by reference to the extent that statements in the later filed document modify or replace such earlier statements.

To obtain copies of these filings, see “Where You Can Find More Information.”

270,508 Shares

Class A Common Stock

PROSPECTUS

February 29, 2024

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following table sets forth the costs and expenses payable in connection with the sale of the securities being registered hereby, all of which will be paid by GoDaddy Inc. (“GoDaddy”) (except any underwriting discounts and commissions and expenses incurred by the selling stockholders in disposing of the securities). All amounts are estimates except the Securities and Exchange Commission (the “SEC”) registration fee.

| | | | | |

| | Amount to

be paid |

SEC registration fee | $4,570 |

Legal fees and expenses (including Blue Sky fees) | 50,000 |

Accounting fees and expenses | 35,000 |

Miscellaneous | 10,430 |

TOTAL | $100,000 |

Item 15. Indemnification of Directors and Officers

Registrants Incorporated Under the Delaware General Corporation Law

GoDaddy is a Delaware corporation. Section 102(b)(7) of the Delaware General Corporation Law (the “DGCL”) enables a corporation to eliminate or limit the personal liability of its directors and “officers” (as defined in accordance with such section) to the corporation or its stockholders for monetary damages for breach of a director’s or officer’s fiduciary duty, except:

•for any breach of the director’s or officer’s duty of loyalty to the corporation or its stockholders;

•for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law;

•for liability of a director pursuant to Section 174 of the DGCL (providing for liability of directors for unlawful payment of dividends or unlawful stock purchases or redemptions);

•for any transaction from which the director or officer derived an improper personal benefit; or

•for liability of an officer in any action by or in the right of the corporation.

In accordance with Section 102(b)(7) of the DGCL, GoDaddy’s restated certificate of incorporation includes a provision eliminating, to the fullest extent permitted by the DGCL, the liability of each corporation’s directors to such corporation or its stockholders for monetary damages for breach of fiduciary as director. GoDaddy’s restated certificate of incorporation does not include a provision eliminating or limiting the liability of any officer of the corporation to the corporation or its stockholders.

Section 145(a) of the DGCL empowers a corporation to indemnify any present or former director, officer, employee or agent of the corporation, or any individual serving at the corporation’s request as a director, officer, employee or agent of another organization, who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of the corporation), against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by the person in connection with such action, suit or proceeding provided that such person acted in good faith and in a manner he or she reasonably believed to be in, or not opposed to, the best interests of the corporation, and, with respect to any criminal action or proceeding, provided further that such person had no reasonable cause to believe his or her conduct was unlawful.

Section 145(b) of the DGCL empowers a corporation to indemnify any present or former director, officer, employee or agent of the corporation, or any individual serving at the corporation’s request as a director, officer, employee or agent of another organization, who was or is a party or is threatened to be made a party to any threatened, pending or

completed action, suit or proceeding by or in the right of the corporation to procure a judgment in its favor against expenses (including attorneys’ fees) actually and reasonably incurred by such person in connection with such action, suit or proceeding; provided that such person acted in good faith and in a manner he or she reasonably believed to be in, or not opposed to, the best interests of the corporation; provided further that a corporation may not indemnify such person in respect of any claim, issue or matter as to which such person shall have been adjudged to be liable to the corporation unless and only to the extent that the court in which such action or suit was brought shall determine upon application that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses which such court shall deem proper.

Under Section 145(c)(1) of the DGCL, if a present or former director or “officer” (as defined in accordance with such) of a corporation has been successful on the merits or otherwise in defense of any action, suit or proceeding referred to in Section 145(a) or (b) of the DGCL (or any claim, issue or matter therein), such corporation is required to indemnify such person against expenses (including attorneys’ fees) actually and reasonably incurred by such person in connection therewith. In addition, Section 145(c)(2) empowers, but does not require, a corporation to indemnify any person who is not a present or former director or “officer” (as defined in accordance with Section 145(c)(1)) of the corporation against expenses (including attorneys’ fees) actually and reasonably incurred by such person to the extent he or she has been successful on the merits or otherwise in defense of any action, suit or proceeding referred to in Section 145(a) or (b) of the DGCL (or any claim, issue or matter therein).

The DGCL provides that the indemnification described above shall not be deemed exclusive of any other indemnification that may be granted by a corporation pursuant to its by-laws, disinterested directors’ vote, stockholders’ vote, agreement or otherwise. The DGCL also provides corporations with the power to purchase and maintain insurance on behalf of any person who is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation in a similar capacity for another corporation, partnership, joint venture, trust or other enterprise, against any liability asserted against him or her in any such capacity, or arising out of his or her status as such, whether or not the corporation would have the power to indemnify him or her against such liability as described above.

In accordance with Section 145 of the DGCL, GoDaddy’s second amended and restated by-laws provide that every person who was or is a party or is threatened to be made a party to or is involved in any action, suit, or proceeding, whether civil, criminal, administrative or investigative, by reason of the fact that such person is or was serving as a director or “officer” (as defined by Rule 16a-1(f) promulgated under the Exchange Act) of the corporation or, while a director or “officer,” is or was serving at the request of the corporation as a director or officer of another corporation, or as its representative in a joint venture, trust or other enterprise, shall be indemnified and held harmless to the fullest extent legally permissible under the DGCL against all expenses, liabilities and losses (including attorneys’ fees, judgments, fines and amounts paid or to be paid in settlement) reasonably incurred or suffered by such person in connection therewith; provided that (i) the corporation shall not indemnify such person in connection with a proceeding (or part thereof) initiated by such person (other than a proceeding to enforce indemnification or advancement rights or with respect to any compulsory counterclaim brought by such person), unless such proceeding (or part thereof) was authorized by the Board of Directors; (ii) the provisions of our second amended and restated bylaws do not require the corporation to indemnify (a) a current or former “officer” for any amounts paid in settlement of any indemnifiable proceeding unless the corporation has consented to such settlement (which consent may not be unreasonably withheld, delayed or conditioned) or (b) any such person for any disgorgement of profits made from the purchase or sale by such person of securities of the corporation under Section 16(b) of the Exchange Act. Expenses incurred by a present or former director or “officer” in defending such an action, suit or proceeding (or in any compulsory counterclaim brought by such person) shall be paid by the corporation in advance of the final disposition of such action, suit or proceeding upon receipt of, if required by the DGCL, an undertaking by or on behalf of such person to repay any amount if it is ultimately determined that such director or officer is not entitled to indemnification by the corporation as authorized by the relevant sections of the DGCL; provided that the corporation is entitled to assume the defense of such action, suit or proceeding, with counsel reasonably acceptable to such person, upon the delivery to such person of written notice of its election to do so.

Pursuant to GoDaddy’s by-laws, GoDaddy may maintain a directors’ and officers’ insurance policy which insures the directors or officers of such corporation and those serving at the request of such corporation as a director, officer, employee or agent of another enterprise, against liability asserted against such persons in such capacity whether or not such directors or officers have the right to indemnification pursuant to Delaware law. GoDaddy currently has a policy providing directors and officers liability insurance in certain circumstances.

In addition, GoDaddy has entered into separate indemnification agreements with certain of its current and former directors and executive officers. The indemnification agreements provide generally that GoDaddy will indemnify its directors and executive officers against liabilities that may arise by reason of their status or service. These

indemnification agreements also require GoDaddy to advance all expenses incurred by directors and executive officers in investigating or defending any such action, suit or proceeding.

Item 16. Exhibits and Financial Statement Schedules

Reference is hereby made to the attached Exhibit Index, which is incorporated herein by reference.

Item 17. Undertakings

| | | | | | | | |

| | (a) | The undersigned Registrant hereby undertakes: |

| | | | | | | | |

| | (1) | To file, during any period in which offers or sales are being made of securities registered hereby, a post-effective amendment to this registration statement: |

| | | | | | | | |

| | (i) | To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933; |

| | | | | | | | |

| | (ii) | To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Securities and Exchange Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; |

| (iii) | To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement; |

provided, however, that paragraphs (i), (ii) and (iii) above do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in periodic reports filed with or furnished to the Securities and Exchange Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in this registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

| | | | | | | | |

| | (2) | That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered herein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| | | | | | | | |

| | (3) | To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering. |

| | | | | | | | |

| | (4) | That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser: |

| | | | | | | | |

| | (A) | Each prospectus filed by the registrant pursuant to Rule 424(b )(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and |

| | | | | | | | |

| | (B) | Each prospectus required to be filed pursuant to Rule 424(b)(2), (b )(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(l)(i), (vii), or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date. |

| | | | | | | | |

| | (5) | That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser: |

| | | | | | | | |

| | (i) | Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424; |

| | | | | | | | |

| | (ii) | Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant; |

| | | | | | | | |

| | (iii) | The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and |

| | | | | | | | |

| | (iv) | Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser. |

| | | | | | | | |

| | (b) | The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| | | | | | | | |

| | (c) | Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrants pursuant to the foregoing provisions, or otherwise, the registrants have been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrants will, unless in the opinion of their counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue. |

EXHIBIT INDEX

| | | | | | | | |

| | |

Exhibit

No. | | Document |

| |

| 3.1 | | |

| |

| 4.1 | | |

| |

| 5.1* | | |

| |

| 23.1* | | |

| |

| 23.2* | | Consent of Davis Polk & Wardwell LLP (included in Exhibit 5.1) |

| |

| 24.1* | | Power of Attorney (included on the signature pages of the Registration Statement) |

| |

| 107.1* | | |

| | |

* Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Tempe, State of Arizona, on February 29, 2024.

| | | | | | | | |

| | | |

| GODADDY INC. |

| |

| By: | | /s/ Mark McCaffrey |

| | Name: Mark McCaffrey |

| | Title: Chief Financial Officer |

KNOW ALL MEN BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Aman Bhutani and Mark McCaffrey, and each of them, his or her true and lawful attorney-in-fact and agent, with full power to act separately and full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this registration statement and to file the same, with all exhibits thereto, and all other documents in connection therewith, with the Securities and Exchange Commission, granting unto each said attorney-in-fact and agent full power and authority to do and perform each and every act in person, hereby ratifying and confirming all that said attorney-in-fact and agent or his or her substitute may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, as amended, this registration statement has been signed by the following persons in the capacities, in the locations and on the dates indicated.

| | | | | | | | | | | | | | |

| | | | |

| Signature | | Title | | Date |

| /s/ Aman Bhutani | | Chief Executive Officer and Director (Principal Executive Officer) | | February 29, 2024 |

| Aman Bhutani | | |

| /s/ Mark McCaffrey | | Chief Financial Officer (Principal Financial Officer) | | February 29, 2024 |

Mark McCaffrey | | |

| /s/ Nick Daddario | | Chief Accounting Officer (Principal Accounting Officer) | | February 29, 2024 |

Nick Daddario | | |

| /s/ Caroline Donahue | | Director | | February 29, 2024 |

| Caroline Donahue | | | | |

| /s/ Mark Garrett | | Director | | February 29, 2024 |

| Mark Garrett | | | | |

| /s/ Srinivas Tallapragada | | Director | | February 29, 2024 |

| Srinivas Tallapragada | | | | |

| /s/ Sigal Zarmi | | Director | | February 29, 2024 |

| Sigal Zarmi | | | | |

| /s/ Herald Chen | | Director | | February 29, 2024 |

| Herald Chen | | | | |

| /s/ Leah Sweet | | Director | | February 29, 2024 |

| Leah Sweet | | | | |

| /s/ Brian Sharples | | Director | | February 29, 2024 |

| Brian Sharples | | | | |

Exhibit 107.1

Calculation of Filing Fee Table

Form S-3

(Form Type)

GoDaddy Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities and Carry Forward Securities

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Security

Type | Security Class

Title | Fee

Calculation

or Carry

Forward Rule | Amount

Registered(1)(2) | Proposed

Maximum

Offering

Price Per

Unit(3) | Maximum

Aggregate

Offering Price | Fee Rate | Amount of

Registration

Fee |

| Newly Registered Securities |

| Fees to Be Paid | Equity | Class A Common Stock, par value $0.001 per share | Rule 457(c) | 270,508 | $114.45 | $30,959,640.60 | 0.00014760 | $4,569.64 |

| Fees Previously Paid | N/A | N/A | N/A | N/A | N/A | N/A | | N/A |

| Carry Forward Securities |

| Carry Forward Securities | N/A | N/A | N/A | N/A | N/A | N/A | | N/A |

| | Total Offering Amounts | | $30,959,640.60 | | |

| | Total Fees Previously Paid | | | | N/A |

| | Total Fee Offsets | | | | N/A |

| | Net Fee Due | | | | $4,569.64 |

(1) Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement also covers an indeterminate number of additional shares of common stock issuable with respect to the shares being registered hereunder as a result of a stock split, stock dividend, recapitalization or other similar event.

(2) This registration registers the resale of 270,508 shares of outstanding shares of Class A common stock of the Registrant held by the selling stockholders.

(3) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act, based upon the average of the high and low prices of the Registrant’s common stock as reported on the Nasdaq Global Select Market on February 23, 2024.

| | | | | | | | | | | |

| | | Exhibit 5.1 |

Davis Polk & Wardwell llp 450 Lexington Avenue

New York, NY 10017 davispolk.com | | | |

| | | |

| | | |

February 29, 2024

GoDaddy Inc.

2155 E. GoDaddy Way

Tempe, Arizona 85284

Ladies and Gentlemen:

GoDaddy Inc., a Delaware corporation (the “Company”), is filing with the Securities and Exchange Commission a Registration Statement on Form S-3 (the “Registration Statement”) under the Securities Act of 1933, as amended (the “Securities Act”). The Registration Statement relates to the registration for resale by the selling stockholders named in the Registration Statement (the “Selling Stockholders”) of up to an aggregate of 270,508 shares (the “Shares”) of the Company’s Class A common stock, par value $0.001 per share (the “Class A Common Stock”), which Shares may be sold from time to time by the Selling Stockholders.

We, as your counsel, have examined originals or copies of such documents, corporate records, certificates of public officials and other instruments as we have deemed necessary or advisable for the purpose of rendering this opinion.

In rendering the opinion expressed herein, we have, without independent inquiry or investigation, assumed that (i) all documents submitted to us as originals are authentic and complete, (ii) all documents submitted to us as copies conform to authentic, complete originals, (iii) all documents filed as exhibits to the Registration Statement that have not been executed will conform to the forms thereof, (iv) all signatures on all documents that we reviewed are genuine, (v) all natural persons executing documents had and have the legal capacity to do so, (vi) all statements in certificates of public officials and officers of the Company that we reviewed were and are accurate and (vii) all representations made by the Company as to matters of fact in the documents that we reviewed were and are accurate.

Based upon the foregoing, and subject to the additional assumptions and qualifications set forth below, we advise you that, in our opinion, as of the date hereof, the shares of Class A Common Stock have been validly issued and fully-paid and are non-assessable.

We are members of the Bars of the States of New York and California and the foregoing opinion is limited to the General Corporation Law of the State of Delaware.

We hereby consent to the filing of this opinion as an exhibit to the Registration Statement referred to above and further consent to the reference to our name under the caption “Validity of Securities” in the

prospectus, which is a part of the Registration Statement. In giving this consent, we do not admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act.

Very truly yours,

/s/ Davis Polk & Wardwell LLP

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the reference to our firm under the caption "Experts" in this Registration Statement (Form S-3) and related Prospectus of GoDaddy Inc. for the registration for resale of an aggregate of 270,508 shares of its Class A common stock and to the incorporation by reference therein of our reports dated February 29, 2024, with respect to the consolidated financial statements of GoDaddy Inc., and the effectiveness of internal control over financial reporting of GoDaddy Inc., included in its Annual Report (Form 10-K) for the year ended December 31, 2023, filed with the Securities and Exchange Commission.

/s/ Ernst & Young LLP

Phoenix, Arizona

February 29, 2024

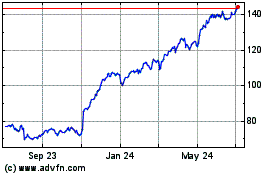

GoDaddy (NYSE:GDDY)

Historical Stock Chart

From Mar 2024 to Apr 2024

GoDaddy (NYSE:GDDY)

Historical Stock Chart

From Apr 2023 to Apr 2024