false

0001690080

0001690080

2024-02-28

2024-02-28

0001690080

ATNF:CommonStockParValue0.0001PerShareMember

2024-02-28

2024-02-28

0001690080

ATNF:WarrantsToPurchaseSharesOfCommonStockMember

2024-02-28

2024-02-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM 8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): February 28, 2024

180 LIFE SCIENCES CORP.

(Exact

Name of Registrant as Specified in Charter)

| Delaware |

|

001-38105 |

|

90-1890354 |

(State

or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

3000 El Camino Real, Bldg. 4, Suite 200

Palo Alto, CA |

|

94306 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (650) 507-0669

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

ATNF |

|

The NASDAQ Stock

Market LLC |

| Warrants to purchase shares of Common Stock |

|

ATNFW |

|

The NASDAQ Stock

Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

(d)

Appointment of New Director

Effective

February 28, 2024, the Board of Directors of 180 Life Sciences Corp. (the “Company”, “we” and “us”),

appointed Blair Jordan as a member of the Board of Directors (“Board”), to fill one of the vacancies on the Board

(the “Appointee” and the “Appointment”), which Appointment was effective as of the same date. Mr.

Jordan was appointed as a Class II director, and will serve until the Company’s 2024 Annual Meeting of Stockholders, until his

successor has been duly elected and qualified, or until his earlier death, resignation or removal.

At

the same time, the Board, pursuant to the power provided to the Board by the Company’s Second Amended and Restated Certificate

of Incorporation, as amended, set the number of members of the Board at four (4) members, temporarily, while the Board continues to look

for qualified independent members of the Board to fill prior director vacancies.

The

Board of Directors determined that Mr. Jordan was “independent” pursuant to the rules of the Nasdaq Capital Market

and pursuant to Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended.

Mr.

Jordan is not party to any material plan, contract or arrangement (whether or not written) with the Company, except for the Offer Letter

(discussed and described below), and there are no arrangements or understandings between Mr. Jordan and any other person pursuant to

which Mr. Jordan was selected to serve as a director of the Company, nor is Mr. Jordan a participant in any related party transaction

required to be reported pursuant to Item 404(a) of Regulation S-K.

The

Company plans to enter into a standard form of Indemnity Agreement (the “Indemnification Agreement”) with Mr. Jordan

in connection with his appointment to the Board. The Indemnification Agreement provides, among other things, that the Company will indemnify

Mr. Jordan under the circumstances and to the extent provided for therein, for certain expenses he may be required to pay in connection

with certain claims to which he may be made a party by reason of his position as director of the Company, and otherwise to the fullest

extent permitted under Delaware law and the Company’s governing documents. The foregoing is only a brief description of the Indemnification

Agreement, does not purport to be complete and is qualified in its entirety by the Company’s standard form of indemnification agreement,

previously filed as Exhibit 10.8 to the Company’s Registration Statement on Form S-1 (No. 333-217475), as amended, on

April 26, 2017. The Indemnification Agreement will be identical in all material respects to the indemnification agreements entered into

with other Company directors.

There

are no family relationships between any director or executive officer of the Company, including Mr. Jordan.

Mr.

Jordan was also appointed by the Board as a member of the Board’s (a) Audit Committee; (b) Compensation Committee; (c) Nominating

and Corporate Governance Committee; and (d) Risk, Safety and Regulatory Committee, as Chairperson of the Company’s Strategy and

Alternatives Committee, and as Lead Independent Director.

In

connection with his appointment to the Board and on February 24, 2024, to be effective upon his appointment to the Board, the Company

entered into an offer letter with Mr. Jordan (the “Offer Letter”). The Offer Letter provides for Mr. Jordan to be

paid $40,000 per year as an annual retainer fee for serving on the Board, $10,000 per year for serving as the Chairman of the Strategic

and Alternatives Committee, and $15,000 per year for serving as the Lead Director. The Company agreed to make an initial fee payment

of $7,500 (the “Initial Payment”) to Mr. Jordan in connection with his appointment to the Board, and subsequent fee

payments quarterly in arrears, and pro-rated for partial quarters. A total of one half of such aggregate cash compensation will be accrued

until such time as the Company raises an aggregate of $1 million from any source, including but not limited to debt and/or equity raises,

quasi-equity raises, receipt of insurance proceeds, litigation proceeds, and corporate transactions.

The

foregoing summary of the material terms of the Offer Letter is not complete and is qualified in its entirety by reference to the Offer

Letter, a copy of which is filed herewith as Exhibit 10.1, and incorporated by reference in this Item 5.02.

Biographical

information for Mr. Jordan is provided below:

Blair

Jordan, age 55

Mr.

Jordan is an experienced senior executive and corporate director with experience in both private and public companies across a variety

of sectors. Mr. Jordan currently serves as Co-Founder and Chief Executive Officer of HighMont Advisors Inc., a Vancouver-based, globally

focused strategy and finance consulting company, specializing in helping clients facing corporate transition; advisory services offered

include mergers and acquisitions (M&A), public and private financing, turnaround and restructuring, corporate and business development,

positions he has held since January 2020. Mr. Jordan also serves as a senior advisor at Evans & Evans, Inc., a Vancouver based strategic

finance consulting and advisory firm, a position he has held since October 2023.

Mr.

Jordan has extensive public company Board of Directors experience, including in his current roles as a member of the Board of Directors

and Audit Committee of Minas Metals Ltd. (CSE:MINA); a member of the Board of Directors and Audit Committee, Governance Committee and

Compensation Committee of Goldgroup Mining Inc. (TSX:GG); a member of the Board of Directors, Chairman of the Audit Committee and Governance

Committee, and member of the Compensation Committee of Standard Uranium Ltd. (TSXV:STND); and a member of the Board of Directors and

Audit Committee of Timeless Capital Corp. (TSXV:TMC). Mr. Jordan also serves on various private company Board of Directors.

Mr.

Jordan served as Chief Financial Officer of HeyBryan Media Inc. (CSE: HEY), a peer-to-peer marketplace app connecting independent contractors

to consumers with everyday home maintenance needs, from October 2019 to November 2020. Prior to that he served in several roles with

Ascent Industries Corp. (“Ascent”), including Vice President of Corporate Development (January 2018 – July 2018);

Chief Financial Officer (August 2018 – April 2019); and Interim Chief Executive Officer (November 2018 – April 2019), where

he led the company’s go-public listing and financing transactions. Mr. Jordan was Interim CEO, CFO, and a director of Ascent, when

on March 1, 2019, the Supreme Court of British Columbia issued an order granting Ascent’s application for creditor protection under

the Companies’ Creditors Arrangement Act (Canada) (“CCAA”). On April 26, 2019, Mr. Jordan resigned as an officer

and director of Ascent. On May 5, 2020, the receivership was terminated by the court.

Between

2012 and 2017, Mr. Jordan served as Managing Director and Corporate Director with Echelon Wealth Partners Inc., an investment banking

fund in the technology, biotech and diversified industries fields. Mr. Jordan also worked for Credit Suisse Group for nearly ten years

in roles that included Leveraged Finance/Restructuring in Europe, Principal Investing in New York, as well as Special Situations and

Convertible Bonds in Asia. Prior to Credit Suisse, Mr. Jordan was a corporate and securities lawyer with Bennett Jones LLP.

His

management experience also includes working as CFO and CEO of public companies, and director at a global investment bank. His board experience

includes roles at a Canadian investment bank, health sciences companies, mineral exploration and production companies (uranium and gold),

an ultra-low cost airline and a Capital Pool Corporation.

Mr.

Jordan holds an MBA from The University of Chicago Booth School of Business, with concentrations in Accounting, Finance, Entrepreneurship

and International Business. He also has an LL.B from the University of British Columbia where he focused on corporate and securities

law, and a BA from the University of Victoria in British Columbia.

We

have concluded that Mr. Jordan is well qualified to serve on our Board of Directors based upon his significant business experience, including

his background in restructuring, mergers and acquisitions.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

180 LIFE SCIENCES CORP. |

| |

|

|

| Date: February 29, 2024 |

By: |

/s/ James

N. Woody, M.D., Ph.D. |

| |

|

James N. Woody, M.D., Ph.D. |

| |

|

Chief Executive Officer |

4

Exhibit 10.1

Dear Blair:

On

behalf of 180 Life Sciences Corp., a Delaware corporation (the “Company”), I am pleased to extend to you

an offer to join the Company’s Board of Directors (the “Board”), effective upon approval of your

appointment by the Board of Directors. This offer is contingent upon (i) your completion of the enclosed Officers, Directors,

Managers and Principal Stockholders Questionnaire and Supplemental Questionnaire for Director Nominees, (ii) receipt of a background

check satisfactory to the Company, (iii) your confirmation of the enclosed Policy on Insider Trading and Policy on Control and

Disclosure of Confidential Information, and (iv) formal approval of your appointment by the Board.

The Company’s

current schedule includes approximately four regular meetings of the Board, which are currently held via Zoom, plus additional special

meetings as called by the Board from time to time which usually take place via Zoom. In addition to your attendance at Board meetings,

we expect to take advantage of your expertise by reaching out to you for advice and counsel between meetings. To the extent that you are

appointed as a member of the Audit Committee, you will need to meet at least quarterly with the other members of the committee. It is

anticipated that you will serve as the Chair of the Strategy and Alternatives Committee.

As a member

of the Board, you will owe fiduciary duties to the Company and its stockholders, such as the duty of care, duty of loyalty and the duty

of disclosure, which include protecting Company proprietary information from unauthorized use or disclosure.

The following

summarizes the compensation that will be provided to you effective upon your appointment to the Board, and subject to approval by the

Board:

| ● | Cash Fees: Initially,

your cash compensation will consist of $40,000 per year as an annual retainer fee for serving on the Board, $10,000 per year for serving

as the Chairman of the Strategic and Alternatives Committee, and $15,000 per year for serving as the Lead Director. It is contemplated

that you will serve on one or more of the Compensation Committee, Audit Committee and/or Nominating and Corporate Governance Committee.

All such appointments are subject to the Board’s discretion. The Company will make an initial fee payment of $7,500 (the “Initial

Payment”) within three business days of execution of this letter agreement by you, and subsequent fee payments will be made

one quarter in arrears, and will be pro-rated for partial quarters. The Initial Payment will be deducted from the fees owing to you when

your service as a Board member concludes. The Company does not pay incremental fees for attendance of Board meetings or telephone/Zoom

conferences but will reimburse you for reasonable travel expenses for attending in-person Board meetings and other Board related expenses,

subject to compliance with the Company’s reimbursement policies. It is agreed and understood that half of such cash compensation

will be accrued until such time as the Company raises an aggregate of $1 million from any source (for greater certainty, such sources

being cumulative and not discrete), including but not limited to debt and/or equity raises, quasi- equity raises, receipt of insurance

proceeds, litigation proceeds, and corporate transactions. |

The compensation

set forth above is subject to change from time to time in the future as determined by the Board. In addition, the Company’s option

plan outlines change in control provisions, termination rights, and other matters related to the option grants.

Enclosed are the following documents for your completion:

| ● | Officers, Directors, Managers and Principal Stockholders

Questionnaire and Supplemental Questionnaire for Director Nominees; and |

| ● | Policy on Insider Trading and Policy on Control and Disclosure

of Confidential Information |

This offer is

submitted to you with the understanding that you will tender your resignation as a member of the Board in the event that you are not in

compliance with the Company’s then applicable policies, codes or charters (including those set forth above). Should you accept this

offer, you are representing to us that you (i) do not know of any conflict which would restrict your ability to serve on the Board and

(ii) will not provide the Company with any documents, records, or other confidential information in violation of the rights of other parties.

Consistent with

the Company’s governing documents, while the Board has authority to appoint you as a member of the Board, your continued service

on the Board will be subject to stockholder approval at the next annual meeting of stockholders relating to the applicable Class of Directors

to which you are appointed. Nothing in this offer should be construed to interfere with or otherwise restrict in any way the rights of

the Company and the Company’s stockholders to remove any individual from the Board at any time in accordance with the provisions

of applicable law.

You will also

be entitled to indemnification for your services as a Board member in accordance with the Company’s standard form of indemnification

agreement, a copy of which will be provided to you upon your appointment, and the governing documents of the Company.

You are free

to end your relationship as a member of the Board at any time and for any reason. In addition, your right to serve as a member of the

Board is subject to the provisions of the Company’s charter documents.

The terms in

this letter agreement supersede any other agreements or promises made to you by anyone, whether oral or written, and comprise the final,

complete and exclusive agreement between you and the Company regarding your service on the Board. Nothing in this letter should be construed

as an offer of employment.

While you serve

on the Board, you will be expected to notify the Company’s legal department of any conflicts of interests that may arise with respect

to the Company.

I hope that

you will accept our offer to join the Company’s Board of Directors and look forward to a productive future relationship. If you

agree with the above, please indicate your agreement with these terms and accept this offer by signing and dating this letter below.

Sincerely,

/s/ James N. Woody, M.D., Ph.D.

James N. Woody, M.D., Ph.D.

Acknowledged and Agreed:

| /s/

Blair Jordan |

|

| Board member name: Blair Jordan |

|

| Date: 2/24/2024 |

|

v3.24.0.1

Cover

|

Feb. 28, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 28, 2024

|

| Entity File Number |

001-38105

|

| Entity Registrant Name |

180 LIFE SCIENCES CORP.

|

| Entity Central Index Key |

0001690080

|

| Entity Tax Identification Number |

90-1890354

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

3000 El Camino Real

|

| Entity Address, Address Line Two |

Bldg. 4

|

| Entity Address, Address Line Three |

Suite 200

|

| Entity Address, City or Town |

Palo Alto

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94306

|

| City Area Code |

650

|

| Local Phone Number |

507-0669

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

ATNF

|

| Security Exchange Name |

NASDAQ

|

| Warrants to purchase shares of Common Stock |

|

| Title of 12(b) Security |

Warrants to purchase shares of Common Stock

|

| Trading Symbol |

ATNFW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ATNF_CommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ATNF_WarrantsToPurchaseSharesOfCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

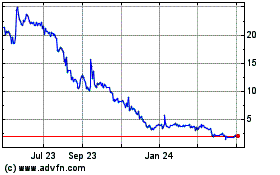

180 Life Sciences (NASDAQ:ATNF)

Historical Stock Chart

From Mar 2024 to Apr 2024

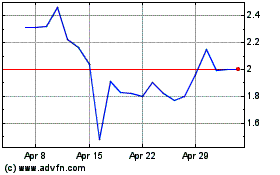

180 Life Sciences (NASDAQ:ATNF)

Historical Stock Chart

From Apr 2023 to Apr 2024