The pre-market scene in the United States witnessed significant

movements in various stocks, reflecting investor reactions to

corporate results and future outlooks. Among the highlights,

companies like Beyond Meat, eBay, Coupang, First Solar, Urban

Outfitters, and Annovis Bio showed notable variations in their

quotes, driven by factors such as revenue results, guidance

updates, and analyst revisions.

Beyond Meat’s Surge

Beyond Meat Inc (NASDAQ:BYND) saw its shares soar about 68% in

pre-market trading after reporting quarterly revenue that exceeded

expectations. The growth was largely attributed to increased

international sales, a positive sign for the company’s global

expansion in the plant-based food sector.

eBay Exceeds Expectations

eBay Inc (NASDAQ:EBAY) experienced a rise of over 3% in

pre-market, reflecting the company’s revenue beat in the fourth

quarter. The company also impressed with its gross merchandise

volume, accompanied by an optimistic outlook for the next quarter

and the authorization of a new $2.0 billion share repurchase

program.

Coupang’s Optimistic Results

Coupang Inc (NYSE:CPNG) recorded a gain of more than 6% before

market open, thanks to upbeat fourth-quarter results. The company’s

performance suggests robust and sustainable growth in the Asian

e-commerce market, attracting investor attention.

First Solar’s Advance

First Solar Inc (NASDAQ:FSLR) saw its shares rise more than 4%

in pre-market trading after reporting a better-than-expected

earnings per share (EPS) for the fourth quarter. Moreover, the

company provided in-line guidance for the full year, bolstering

confidence in the solar energy sector.

Urban Outfitters’ Decline

Urban Outfitters Inc (NASDAQ:URBN) experienced a drop of more

than -9% in pre-market, in response to fourth-quarter results that

fell short of expectations. This performance highlights the

challenges faced by the fashion retail sector, including margin

pressures and fluctuating demand.

Annovis Bio’s Downgrade

Annovis Bio Inc (NYSE:ANVS) suffered a drop of more than -8%

before market open, following the downgrade of the stock by

Brookline from Buy to Hold, with a price target adjusted to $9.

This movement reflects uncertainties and potential challenges in

the company’s path to developing therapies for neurodegenerative

diseases.

Pre-market movements provide valuable insights into market

expectations and investor confidence regarding corporate prospects.

The market’s response to these updates highlights the importance of

solid financial results, clear future outlooks, and strategic

evaluations by analysts. While some companies navigate favorable

waters, others face headwinds, reflecting the dynamic nature and

inherent uncertainties of financial markets.

Today’s U.S. Earnings Spotlight: Wednesday – February

28th

Salesforce Inc (CRM), RBC (RY), TJX (TJX), Snowflake (SNOW),

NetEase (NTES), Monster Beverage (MNST), Baidu (BIDU), HP Inc

(HPQ), Vistra Energy (VST), Viatris (VTRS), Nutanix (NTNX), Okta

(OKTA), Sarepta (SRPT), Topbuild Corp (BLD), EMCOR (EME), NRG

(NRG), Endeavor Group (EDR), UWM Holdings (UWMC), Stantec (STN),

Vipshop (VIPS), Natera Inc (NTRA), Api Group Corp (APG), Jazz

Pharma (JAZZ), Duolingo (DUOL), Donaldson (DCI), Icahn Enterprises

(IEP), DoubleVerify Holdings (DV), CCC Intelligent Solutions

Holdings (CCCS), AAON (AAON), Ultrapar Participacoes (UGP),

Marathon Digital (MARA), Nexstar (NXST), Blackstone Secured Lending

Fund (BXSL), Kinetik Holdings (KNTK), Clearwater Analytics Holdings

(CWAN), Iovance Biotherapeutics (IOVA), Stericycle (SRCL), Merit

(MMSI), Squarespace (SQSP), Southwest Gas Hold (SWX), PagSeguro

Digital (PAGS), Chemours Co (CC), National Storage Affiliates Trust

(NSA), Amicus (FOLD), Advance Auto Parts (AAP), Marqeta (MQ),

Cactus (WHD), Dycom Industries (DY), C3.ai (AI), Kontoor Brands

(KTB), Harmony Gold Mining (HMY), Immunocore Holdings (IMCR),

Integra (IART), iQIYI (IQ), Steven Madden (SHOO), Globalstar Inc

(GSAT), EPR Properties (EPR), United Parks Resorts (PRKS), Greif

Bros (GEF), Baytex Energy Corp (BTE), Clear Secure (YOU), MYR Group

(MYRG), Evertec Inc (EVTC), Crinetics Pharma (CRNX), Patterson

(PDCO), Shoals Technologies Group (SHLS), Frontdoor (FTDR),

Lifestance Health Group (LFST), AvidXchange Holdings (AVDX), Alkami

Technology (ALKT), Golden Ocean (GOGL), IONQ (IONQ), Life Time

Holdings (LTH), Schrodinger (SDGR), Sovos Brands (SOVO), Janus

International Group (JBI), Talos Energy (TALO), ODP (ODP), Payoneer

Global Inc (PAYO), TG (TGTX), Kodiak Gas Services (KGS), Compass

Diversified (CODI), Catalyst Pharmaceuticals (CPRX), Warby Parker

(WRBY), Taboola (TBLA), Global Partners (GLP), Magnite (MGNI),

Excelerate Energy (EE), US Physicalrapy (USPH), Kiniksa Pharma

(KNSA), Definitive Healthcare (DH), OneSpaWorld (OSW), Mirum

Pharmaceuticals (MIRM), Acm Research (ACMR).

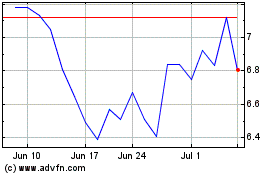

Beyond Meat (NASDAQ:BYND)

Historical Stock Chart

From Mar 2024 to Apr 2024

Beyond Meat (NASDAQ:BYND)

Historical Stock Chart

From Apr 2023 to Apr 2024