false

0001038074

0001038074

2024-02-21

2024-02-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

February 21, 2024

SILICON LABORATORIES INC.

(Exact Name of Registrant as Specified in

Charter)

| Delaware |

|

000-29823 |

|

74-2793174 |

| (State or Other Jurisdiction |

|

(Commission File Number) |

|

(IRS Employer |

| of Incorporation) |

|

|

|

Identification No.) |

| 400 West Cesar Chavez, Austin, TX |

|

78701 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (512) 416-8500

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

¨ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, $0.0001 par value |

|

SLAB |

|

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Securities Exchange Act of

1934. ¨

Item 5.02 Departure of Directors or Certain Officers; Election of

Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On

February 27, 2024, Silicon Laboratories Inc. (the “Company”) announced the appointment of Dean Butler as Senior

Vice President and Chief Financial Officer, effective May 15, 2024 (the “Effective Date”). As of the Effective Date, Mark Mauldin will cease serving as Interim Chief Financial

Officer and will continue to serve in his role as Chief Accounting Officer.

Mr. Butler, age 41, joins Silicon Labs from Synaptics Incorporated,

where he has served as Senior Vice President and Chief Financial Officer since October 2019. Prior to joining Synaptics, Mr. Butler

served as Vice President of Finance at Marvell Technology, Inc. from July 2016 to October 2019, served as Controller of

the Ethernet Switching Division at Broadcom, Inc. from January 2015 through July 2016, and served in senior finance positions

at Maxim Integrated from May 2007 to December 2014. Mr. Butler received his bachelor’s degree in finance from the

University of Minnesota Duluth and is a graduate of Stanford University's Strategic Financial Leadership Program. Mr. Butler has

served on the Board of Directors of Pixelworks, Inc., a leading provider of innovative video and display processing solutions, since

May 2022.

In connection with his appointment as Senior Vice President and Chief

Financial Officer, Mr. Butler will be entitled to an annual base salary of $475,000 and eligible for an annual target bonus of 100%

of his base salary, prorated for 2024, pursuant to the Company’s 2024 Bonus Plan. Additionally, subject to the approval of the Compensation

Committee of the Company’s Board of Directors, Mr. Butler will receive the following equity awards (the “Equity Awards”):

(a) a new-hire grant of performance stock units, expected to be made on May 15, 2024, with a grant date value of $1,500,000

(which will vest on January 17, 2027 contingent upon Mr. Butler’s continued service through such date and the achievement

of applicable performance criteria), (b) a new-hire grant of restricted stock units, expected to be made on May 15, 2024, with

a grant date value of $1,500,000 (which will vest in three equal annual installments contingent upon Mr. Butler’s continued

service through each such date), and (c) a one-time grant of restricted stock units, expected to be made on May 15, 2024, with

a grant date value of $2,000,000 (which will vest in two equal annual installments contingent upon Mr. Butler’s continued service

through each such date). The Equity Awards will be granted pursuant to the Company’s 2009 Stock Incentive Plan and subject to the

terms and conditions of the Company’s standard form of award agreements for such awards. Mr. Butler will also receive a cash

sign-on bonus of $1,000,000, one-half of which will be paid within 30 days of the Effective Date and one-half of which will be paid on

the first anniversary of the Effective Date, which must be repaid by Mr. Butler under certain circumstances if his employment with

the Company ends on or before the second anniversary of the Effective Date. Mr. Butler will also be entitled to reimbursement of

certain relocation expenses. The Company will enter into an executive severance agreement and an indemnification agreement with Mr. Butler,

each substantially in the form as applicable to other similarly situated executive officers of the Company.

There are no family relationships between Mr. Butler and any of

the Company’s directors or executive officers and he has no direct or indirect material interest in any transaction required to

be disclosed pursuant to Item 404(a) of Regulation S-K. There are no arrangements or understandings between Mr. Butler and any

other persons pursuant to which he was selected as an executive officer.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

SILICON LABORATORIES INC.

|

| February 27, 2024 |

|

/s/ Néstor Ho |

| |

|

|

Date |

|

Néstor

Ho

Vice

President and

Chief Legal Officer |

Exhibit 99.1

Silicon Labs Names Dean Butler as Chief Financial

Officer

AUSTIN,

Texas – February 27, 2024 – Silicon Labs (NASDAQ: SLAB), a leader in secure, intelligent wireless

technology for a more connected world, today announced that Dean Butler will join the company as Senior Vice President and Chief Financial

Officer (CFO), effective May 15, 2024. Butler will be responsible for Silicon Labs’ financial strategy and lead the global

finance organization. Butler will succeed Mark Mauldin, currently serving as interim CFO.

Butler joins Silicon Labs from Synaptics Incorporated, where he has

served as Senior Vice President and CFO since October 2019. He previously held financial leadership positions at Marvell Technology, Inc.,

where he led a number of strategic initiatives during a period of rapid growth, and at Broadcom, Inc., where he led the finance

organization of a multibillion-dollar division. Butler began his career at Wells Fargo and Maxim Integrated. He received his bachelor’s

degree in finance from the University of Minnesota Duluth and is a graduate of Stanford University's Strategic Financial Leadership Program.

He also serves on the Board of Directors of Pixelworks, a leading provider of innovative video and display processing solutions.

“Dean is an accomplished CFO and well-respected financial leader

who has deep experience in the semiconductor industry. He brings a proven track record of driving strong financial results, instilling

financial and operational discipline, and demonstrating outstanding leadership,” said Matt Johnson, President and Chief Executive

Officer, Silicon Labs. “Most of all, Dean embodies our corporate values, and we are thrilled to have him join the team as we focus

on capturing the incredible growth opportunities ahead of us. I want to express my gratitude to Mark Mauldin for his critical contributions

during his time as interim CFO and for leading the finance team during the transition.”

“Without question, Silicon Labs has become the world’s

leading IoT pure-play company with a demonstrated track record of success across a broad wireless technology portfolio,” said Dean

Butler. “I’m excited to join Matt and the entire Silicon Labs team to build upon their incredible design win momentum to

further accelerate market share expansion and drive earnings growth for all stakeholders.”

About Silicon Labs

Silicon

Labs (NASDAQ: SLAB) is a leader in secure, intelligent wireless technology for a more connected world. Our integrated

hardware and software platform, intuitive development tools, thriving ecosystem, and robust support make us an ideal long-term

partner in building advanced industrial, commercial, home and life applications. We make it easy for developers to solve

complex wireless challenges throughout the product lifecycle and get to market quickly with innovative solutions that

transform industries, grow economies, and improve lives. silabs.com

Forward-Looking Statements

This press release contains forward-looking statements based on Silicon

Labs’ current expectations. The words “believe”, “estimate”, “expect”, “intend”,

“anticipate”, “plan”, “project”, “will”, and similar phrases as they relate to Silicon

Labs are intended to identify such forward-looking statements. These forward-looking statements reflect the current views and assumptions

of Silicon Labs and are subject to various risks and uncertainties that could cause actual results to differ materially from expectations.

Among the factors that could cause actual results to differ materially from those in the forward-looking statements are the following:

risks that the Form 10-K filing, earnings release, and/or earnings conference call may be delayed; the competitive and cyclical

nature of the semiconductor industry; the challenging macroeconomic environment, including disruptions in the financial services industry;

geographic concentration of manufacturers, assemblers, test service providers and customers in Asia that subjects Silicon Labs’

business and results of operations to risks of natural disasters, epidemics or pandemics, war and political unrest; risks that demand

and the supply chain may be adversely affected by military conflict (including in the Middle East, and between Russia and Ukraine), terrorism,

sanctions or other geopolitical events globally (including in the Middle East, and conflict between Taiwan and China); risks that Silicon

Labs may not be able to maintain its historical growth; quarterly fluctuations in revenues and operating results; difficulties developing

new products that achieve market acceptance; risks associated with international activities (including trade barriers, particularly with

respect to China); intellectual property litigation risks; risks associated with acquisitions and divestitures; product liability risks;

difficulties managing and/or obtaining sufficient supply from Silicon Labs’ distributors, manufacturers and subcontractors; dependence

on a limited number of products; absence of long-term commitments from customers; inventory-related risks; difficulties managing international

activities; risks that Silicon Labs may not be able to manage strains associated with its growth; credit risks associated with its accounts

receivable; dependence on key personnel; stock price volatility; the impact of COVID-19 on the U.S. and global economy; debt-related

risks; capital-raising risks; the timing and scope of share repurchases and/or dividends; average selling prices of products may decrease

significantly and rapidly; information technology risks; cyber-attacks against Silicon Labs’ products and its networks; risks associated

with any material weakness in our internal controls over financial reporting; and other factors that are detailed in the SEC filings

of Silicon Laboratories Inc. Silicon Labs disclaims any intention or obligation to update or revise any forward-looking statements, whether

as a result of new information, future events, or otherwise. References to Silicon Labs in this press release shall mean Silicon Laboratories

Inc.

Note to editors: Silicon Laboratories, Silicon Labs, the “S”

symbol, and the Silicon Labs logo are trademarks of Silicon Laboratories Inc. All other product names noted herein may be trademarks

of their respective holders.

CONTACT: Thomas Haws, Investor Relations Manager, (512) 416-8500,

investor.relations@silabs.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

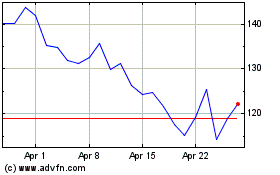

Silicon Labs (NASDAQ:SLAB)

Historical Stock Chart

From Apr 2024 to May 2024

Silicon Labs (NASDAQ:SLAB)

Historical Stock Chart

From May 2023 to May 2024