false000109634300010963432024-02-202024-02-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________________________________

FORM 8-K

_______________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 20, 2024

_______________________________________________

MARKEL GROUP INC.

(Exact name of registrant as specified in its charter)

_______________________________________________

| | | | | | | | |

| Virginia | 001-15811 | 54-1959284 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

4521 Highwoods Parkway, Glen Allen, Virginia 23060-6148

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (804) 747-0136

Not Applicable

(Former name or former address, if changed since last report)

_______________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| | |

| Common Stock, no par value | MKL | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Appointment of Chief Operating Officer

On February 21, 2024, the Board of Directors (the Board) of Markel Group Inc. (the Company) appointed Michael R. Heaton as the Company’s Executive Vice President and Chief Operating Officer. In this expanded role, he will oversee the day-to-day operations of the holding company and continue developing the system that supports Markel Group’s family of companies. Mr. Heaton, age 47, has served as the Company’s Executive Vice President since May 2022 and previously served as: President, Markel Ventures from January 2016 to May 2022; President and Chief Executive Officer, Markel Ventures, Inc., a subsidiary of the Company, from May 2020 to May 2022; President and Chief Operating Officer, Markel Ventures, Inc., from January 2016 to May 2020; and Chief Operating Officer, Markel Ventures, Inc., from September 2013 to December 2015.

Mr. Heaton has no direct or indirect material interest in any transaction required to be disclosed under Item 404(a) of Regulation S-K of the Exchange Act, nor are any such transactions currently proposed. There are no family relationships between Mr. Heaton and any director or executive officer of the Company.

A copy of a press release announcing Mr. Heaton's appointment as the Company’s Executive Vice President and Chief Operating Officer is furnished as Exhibit 99.1.

Compensation Changes for Certain Executive Officers

On February 20, 2024, the Compensation Committee (the Committee) of the Board approved certain changes in executive compensation, including for: Thomas S. Gayner, Chief Executive Officer; Micheal R. Heaton, Executive Vice President and Chief Operating Officer; Jeremy A. Noble, President, Insurance; Richard R. Grinnan, Senior Vice President, Chief Legal Officer and Secretary; and Brian J. Costanzo, Chief Financial Officer (collectively, the Executives).

Over the course of the last year, the Compensation Committee conducted a fulsome review of the Company’s incentive compensation plan design. In an effort to further align the executive officers’ incentives with the Company’s financial performance, the Committee approved two plan design changes.

First, the Committee replaced one of the two metrics used to evaluate Company performance. For the 2024 performance year, the five-year average of the Company’s operating income will replace the five-year compounded annual growth (CAGR) in book value. No changes were made to the second metric, the five-year compounded annual growth in the Company’s closing stock price.

Second, beginning in 2024, the Committee created/added a new long-term service award for its executive officers that requires an additional five-year holding period after the three-year vesting period is satisfied.

Through its review and deliberations of plan design change considerations, the Committee concluded that the five-year average of the Company’s operating income will provide a better proxy to evaluate the Company’s performance than the five-year CAGR in the Company’s book value. The change relates to the continued development and growth of the Company’s three engine system, which has added strength to the business and broadened its streams of income beyond the original balance sheet-oriented business of insurance underwriting. As the Company has discussed for the past several years, that shift in business has rendered its traditional measure of book value growth less relevant. Operating income provides a reasonable proxy for the performance of each engine, and the target for operating income, which is set taking into consideration capital within the system, more closely aligns with the overall financial goal of growing intrinsic value. In addition to this change, the addition of the new long-term service award further reinforces alignment between the executive officers and the Company’s goal of increasing shareholder value over the long-term.

The Company’s executive compensation program includes base salary and incentive compensation, which generally consists of (i) annual cash incentive awards (each, a cash award), paid under the Company’s Executive Bonus Plan (the Non-Equity Incentive Plan), and (ii) annual equity incentive awards (each, an equity award), payable in restricted stock units (RSUs), granted under the Company’s 2016 Equity Incentive Compensation Plan (the Equity Incentive Plan).

In addition to the changes discussed above, compensation changes effective beginning in the 2024 performance year include base salary increases for Messrs. Gayner, Heaton, Noble and Grinnan and an increase in target potential, expressed as a percentage of base salary, for equity awards for all the Executives. See “Annual equity awards,” “Compensation table” and “Performance criteria” below.

Annual equity awards. Equity awards for the Executives for the 2024 performance year will include performance-based annual equity awards (each, a performance-based equity award) and the new service-based annual equity awards (each, a service-based equity award).

•For equity awards for the 2024 performance year, (i) 75% of the total equity award target will be allocated to a performance-based equity award, and (ii) the remaining 25% of the total equity award target will be allocated to a service-based equity award.

•Performance-based equity awards and service-based equity awards will be subject to three-year cliff vesting schedules. Service-based equity awards also will be subject to the additional five-year holding period, to reinforce alignment between the Company’s leadership team and the goal of building an enduring enterprise.

Cash awards payable under the Non-Equity Incentive Plan remain unchanged for the 2024 performance year and will be subject to performance criteria described below.

Compensation table. The base salary, the target potential for cash awards under the Non-Equity Incentive Plan and the target potential and equity award allocation for equity awards under the Equity Incentive Plan for the Executives for the 2024 performance year are as follows: | | | | | | | | | | | | | | | | | |

| | Target Potential Expressed as a Percentage of Base Salary | Equity Award Allocation d |

Name and Principal Position | Base Salary a | Cash Award b | Equity Award c | Performance-Based | Service-Based |

Thomas S. Gayner Chief Executive Officer | $1,100,000 | 200% | 550% | 75% | 25% |

Michael R. Heaton Executive Vice President and Chief Operating Officer | $815,000 | 150% | 225% | 75% | 25% |

Jeremy A. Noble President, Insurance | $815,000 | 150% | 225% | 75% | 25% |

Richard R. Grinnan Senior Vice President, Chief Legal Officer and Secretary | $620,000 | 100% | 175% | 75% | 25% |

Brian J. Costanzo Chief Financial Officer | $500,000 | 100% | 125% | 75% | 25% |

a As compared to the 2023 performance year, the amount shown represents: a $50,000 increase for Mr. Gayner; a $40,000 increase for Mr. Heaton; a $40,000 increase for Mr. Noble; a $20,000 increase for Mr. Grinnan; and no change for Mr. Costanzo. |

b As compared to the 2023 performance year, the amount shown represents no changes for the Executives |

c As compared to the 2023 performance year, the amount shown represents: an increase from 500% for Mr. Gayner; an increase from 200% for Mr. Heaton; an increase from 200% for Mr. Noble; an increase from 150% for Mr. Grinnan; and an increase from 100% for Mr. Costanzo. |

d Service-based equity awards are new for the 2024 performance year, and, therefore, there was no Equity Award Allocation for the 2023 performance year. |

Additional information regarding the compensation changes for the Executives for the 2024 performance year, including an example of potential cash and equity awards for 2024 performance, is provided below.

Performance criteria. Cash awards and performance-based equity awards for the Executives for the 2024 performance year will require the achievement of pre-established performance goals based on two equally-weighted performance metrics: (1) the Company’s average operating income, which replaces the five-year CAGR in book value per share as a performance metric to better capture and communicate Company performance, and (2) the CAGR in the Company’s closing stock price (total shareholder return), both over the five-year period from 2020 to 2024, as set forth in the grid below. The total award percentage will be calculated by dividing the sum of the combined average operating income and total shareholder return percentages by two.

| | | | | | | | | | | | | | |

Operating Income | Total Shareholder Return | Total Award |

5-Year Average a | As a % of Target Potential | 5-Year CAGR | As a % of Target Potential | As a % of Target Potential |

| A | | B | (A+B)/2 |

Under $900 b | 0 - 40% | Under 6% b | 0 - 40% | 0 - 40% |

$900 | 40% | 6% | 40% | 40% |

$1,100 | 60% | 7% | 60% | 60% |

$1,300 | 80% | 8% | 80% | 80% |

$1,500 | 90% | 9% | 90% | 90% |

$1,700 | 100% | 10% | 100% | 100% |

$1,900 | 110% | 11% | 110% | 110% |

$2,100 | 120% | 12% | 120% | 120% |

$2,350 | 140% | 13% | 140% | 140% |

$2,600 | 160% | 14% | 160% | 160% |

$2,800 | 180% | 15% | 180% | 180% |

$3,050 | 200% | 16% | 200% | 200% |

Over $3,391 c | Discretionary | 17% or more c | Discretionary | Discretionary |

| | | | |

a Dollars in million |

b In the case of performance in this range, the Compensation Committee, in its sole discretion, will determine if an award is merited based upon relevant facts and circumstances |

c In the case of performance in this range, the Compensation Committee, in its sole discretion, will determine if an additional award is merited based upon relevant facts and circumstances. |

Example of Potential Cash and Equity Awards to Executives for 2024 Performance. Referring to the compensation information set forth above, if, for example, the Company’s five-year average operating income for the 2024 performance year is $1,500,000,000, and the Company’s five-year CAGR in total shareholder return for the 2024 performance year is 11%, then:

Performance Modifiers. The performance modifiers used to determine cash awards and performance-based equity awards for the Executives under the Non-Equity Incentive Plan and the Equity Incentive Plan, respectively, for the 2024 performance year would be as follows:

| | | | | | | | | | | |

Performance Criteria | Amount | Performance Modifier Expressed as a Percentage of Target Potential |

5-Year Average Operating Income: | $1,500,000,000 | 90% | A |

5-Year CAGR in Total Shareholder Return: | 11% | 110% | B |

| Total Performance Modifier: | 100% | (A+B)/2 |

Awards. Based on a 100% performance modifier, cash awards and equity awards for the Executives under the Non-Equity Incentive Plan and the Equity Incentive Plan, respectively, for the 2024 performance year would be as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Target Potential Expressed as a Percentage of Base Salary |

Equity Award Allocation | Example Award Expressed as a Percentage of Base Salary (calculation below) |

| Cash Award | Equity Award | Performance-Based | Service-Based | | Equity Award |

| Cash Payout | Performance-Based | Service-Based |

| Thomas S. Gayner | 200% | 550% | 75% | 25% | 200% (200% * 100%) | 412.5% (550% * 75% * 100%) | 137.5% (550% * 25%) |

| Michael R. Heaton | 150% | 225% | 75% | 25% | 150% (150% * 100%) | 168.75% (225% * 75% * 100%) | 56.25% (225% * 25%) |

| Jeremy A. Noble | 150% | 225% | 75% | 25% | 150% (150% * 100%) | 168.75% (225% * 75% * 100%) | 56.25% (225% * 25%) |

| Richard R. Grinnan | 100% | 175% | 75% | 25% | 100% (100% * 100%) | 131.25% (175% * 75% * 100%) | 43.75% (175% * 25%) |

| Brian J. Costanzo | 100% | 125% | 75% | 25% | 100% (100% * 100%) | 93.75% (125% * 75% * 100%) | 31.25% (125% * 25%) |

In each case, the actual amounts of cash awards and performance based-equity awards, if any, for the Executives, under the Non-Equity Incentive Plan and the Equity Incentive Plan, respectively, for the 2024 performance year will be based on the Company’s actual five-year average operating income and actual five-year CAGR in total shareholder return for the 2024 performance year as certified by the Compensation Committee.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| MARKEL GROUP INC. |

| | | |

| February 26, 2024 | By: | | /s/ Richard R. Grinnan |

| Name: | | Richard R. Grinnan |

| Title: | | Senior Vice President, Chief Legal Officer and Secretary |

| | | | | |

| For more information contact: Media Chelsea Rarrick +1 804 864 1618 Chelsea.Rarrick@markel.com

Investors Investor Relations Markel Group Inc. IR@markel.com

|

FOR IMMEDIATE RELEASE

Mike Heaton named Chief Operating Officer of Markel Group

RICHMOND, VA, February 26, 2024 — Markel Group Inc. (NYSE: MKL) announced that Mike Heaton will become Executive Vice President and Chief Operating Officer effective today. In this expanded role, he will oversee the day-to-day operations of the holding company and continue developing the system that supports Markel Group’s family of companies.

Heaton has a substantial track record supporting the businesses in Markel Group. Most recently, he was Executive Vice President, where he led the transformation from Markel Corporation to Markel Group Inc. by establishing a more formal holding company identity, structure, and team. From 2016 to 2022, Heaton served as President of Markel Ventures, and he was Chief Operating Officer of Markel Ventures before that.

“Mike has been by my side for close to two decades now,” said Chief Executive Officer Tom Gayner. “He is an incredible operator and thought partner who played a huge role in building the team, structure, and processes that made Markel Group into a great home for businesses. Operating with this level of autonomy, accountability, and love for our companies is not easy, but the system that Mike and the team created, and will continue to evolve, makes it possible.”

As Executive Vice President and Chief Operating Officer, Heaton will oversee the day-to-day operations for Markel Group with an intentional focus on three core priorities: pursuing the best capital allocation opportunities, attracting and supporting top company leaders, and amplifying the cultural values in the Markel Style. He will continue to report to Gayner from Markel Group’s global headquarters in Glen Allen, Virginia.

“There is always more work to be done, but I really do think that we can be the best home in the world for businesses,” said Heaton. “A place where people with shared values have the space and support that they need to win. To have the opportunity to help build something like this is the honor of a lifetime, and I’m going to give everything I can to make it happen.”

About Markel Group

Markel Group Inc. (NYSE: MKL) is a diverse family of companies that includes everything from insurance to bakery equipment, building supplies, houseplants, and more. The leadership teams of these businesses operate with a high degree of independence, while at the same time living the values that we call the Markel Style. Our specialty insurance business sits at the core of our company. Through decades of sound underwriting, the insurance team has provided the capital base from which we built a system of businesses and investments that collectively increase Markel Group’s durability and adaptability. It’s a system that provides diverse income streams, access to a wide range of investment opportunities, and the ability to efficiently move capital to the best ideas across the company. Most importantly though, this system enables each of our businesses to advance our shared goal of helping our customers, associates, and shareholders win over the long term. Visit mklgroup.com to learn more.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

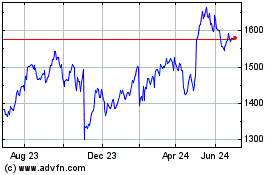

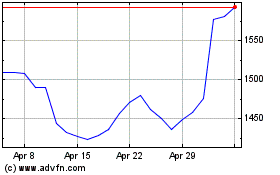

Markel (NYSE:MKL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Markel (NYSE:MKL)

Historical Stock Chart

From Apr 2023 to Apr 2024