false

0001158114

0001158114

2024-02-22

2024-02-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 22, 2024

Applied Optoelectronics, Inc.

(Exact name of registrant as specified

in its charter)

| Delaware |

001-36083 |

76-0533927 |

(State of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

13139

Jess Pirtle Blvd.

Sugar

Land, Texas 77478

(Address

of principal executive offices and zip code)

(281) 295-1800

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Trading

Name of each exchange on which registered |

| Common Stock, Par value $0.001 |

AAOI |

NASDAQ Global Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

| ITEM 2.02. | RESULTS OF OPERATIONS AND FINANCIAL CONDITION. |

On February 22,

2024 Applied Optoelectronics, Inc. (the “Company”) issued a press release regarding the Company’s financial results

for the fourth quarter ended December 31, 2023. A copy of the Company’s press release is attached as Exhibit 99.1 to this Form 8-K.

The information

furnished in this Current Report under this Item 2.02 and the exhibits attached hereto shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any

filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference

in such a filing.

| ITEM 9.01. | FINANCIAL STATEMENTS AND EXHIBITS. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

APPLIED OPTOELECTRONICS, INC. |

| |

|

| |

|

| |

By: |

/s/ STEFAN J. MURRY |

| |

Name: |

STEFAN J. MURRY |

| |

Title: |

Chief Financial Officer |

| February 22, 2024 |

|

|

| |

|

|

Exhibit 99.1

Applied Optoelectronics

Reports Fourth Quarter and Full Year 2023 Results

Sugar Land, Texas, February 22, 2024 – Applied Optoelectronics,

Inc. (NASDAQ: AAOI), a leading provider of fiber-optic access network products for the internet datacenter, cable broadband, telecom

and fiber-to-the-home (FTTH) markets, today announced financial results for its fourth quarter and full year ended December 31, 2023.

“We’re pleased by the continued progress we have made in

improving our gross margin, which combined with expense management, allowed us to generate a small non-GAAP net income in the fourth quarter

for the first time in many years,” said Dr. Thompson Lin, Applied Optoelectronics Inc. Founder, President and Chief Executive Officer.

“While our fourth quarter revenue came in below our expectations, our gross margin outperformed our projections, and we generated

non-GAAP EPS at the high end of our guidance range. Looking ahead, we expect to see some revenue decline in Q1 due to the Lunar New Year

combined with some price reductions, with substantial improvement expected in Q2.”

Fourth Quarter 2023 Financial Summary

| · | GAAP revenue was $60.5 million, compared $61.6 million in the fourth quarter

of 2022 and $62.5 million in the third quarter of 2023. |

| · | GAAP gross margin was 35.7%, compared with 10.1% in the fourth quarter of

2022 and 32.3% in the third quarter of 2023. Non-GAAP gross margin was 36.4%, compared with 21.4% in the fourth quarter of 2022 and 32.5%

in the third quarter of 2023. |

| · | GAAP net loss was $13.9 million, or $0.38 per basic share, compared with

net loss of $20.3 million, or $0.71 per basic share in the fourth quarter of 2022, and a net loss of $9.0 million, or $0.27 per basic

share in the third quarter of 2023. |

| · | Non-GAAP net income was $1.6 million, or $0.04 per diluted share, compared

with non-GAAP net loss of $5.4 million, or $0.19 per basic share in the fourth quarter of 2022, and a non-GAAP net loss of $1.7 million,

or $0.05 per basic share in the third quarter of 2023. |

Full Year 2023 Financial Summary

| · | GAAP revenue was $217.6 million, compared with $222.8 million in

2022. |

| · | GAAP gross margin was 27.1%, compared with 15.1% in 2022. Non-GAAP gross

margin was 29.8% compared to 18.5% in 2022. |

| · | GAAP net loss was $56.0 million, or $1.75 per basic share, compared

with net loss of $66.4 million, or $2.38 per basic share in 2022. |

| · | Non-GAAP net loss was $13.3 million, or $0.42 per basic share,

compared with non-GAAP net loss of $28.0 million, or $1.01 per basic share in 2022. |

A reconciliation between all GAAP and non-GAAP information referenced

above is contained in the tables below. Please also refer to “Non-GAAP Financial Measures” below for a description of these

non-GAAP financial measures.

First Quarter 2024 Business Outlook (+)

For first quarter of 2024, the company currently expects:

| · | Revenue in the range of $41 million to $46 million. |

| | | |

| · | Non-GAAP gross margin in the range of 21% to 23%. |

| | | |

| · | Non-GAAP net profit in the range of a loss of $18.9 million to a loss of

$20.8 million, and non-GAAP earnings per share in the range of a loss of $0.28 to loss of $0.33 using approximately 38.4 million shares.

|

(+) Please refer to the note below on forward-looking statements

and the risks involved with such statements as well as the note on non-GAAP financial measures.

Conference Call Information

The company will host a conference call and webcast for analysts and

investors on today, February 22, 2024 to discuss its fourth quarter and full year 2023 financial results and outlook for its first quarter

2024 at 4:30 p.m. Eastern time / 3:30 p.m. Central time. This call will be open to the public, and investors may access the call by dialing

844-890-1794 (domestic) or 412-717-9586 (international). A live audio webcast of the conference call along with supplemental financial

information will also be accessible on the company's website at investors.ao-inc.com. Following the webcast, an archived version will

be available on the website for one year. A telephonic replay of the call will be available one hour after the call and will run for five

business days and may be accessed by dialing 877-344-7529 (domestic) or 412-317-0088 (international) and entering passcode 8106099.

Forward-Looking Information

This press release contains forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by terminology such

as "believe," "may," "estimate," "continue," "anticipate," "intend," "should,"

"could," "would," "target," "seek," "aim," "predicts," "think,"

"objectives," "optimistic," "new," "goal," "strategy," "potential," "is

likely," "will," "expect," "plan" "project," "permit" or by other similar expressions

that convey uncertainty of future events or outcomes. These statements include management’s beliefs and expectations related to

our outlook for the first quarter of 2024. Such forward-looking statements reflect the views of management at the time such statements

are made. These forward-looking statements involve risks and uncertainties, as well as assumptions and current expectations, which could

cause the company's actual results to differ materially from those anticipated in such forward-looking statements. These risks and uncertainties

include but are not limited to: the impact of the COVID-19 pandemic on our business and financial results; reduction in the size or quantity

of customer orders; change in demand for the company's products due to industry conditions; changes in manufacturing operations; volatility

in manufacturing costs; delays in shipments of products; disruptions in the supply chain; change in the rate of design wins or the rate

of customer acceptance of new products; the company's reliance on a small number of customers for a substantial portion of its revenues;

potential pricing pressure; a decline in demand for our customers' products or their rate of deployment of their products; general conditions

in the internet datacenter, cable television (CATV) broadband, telecom, or fiber-to-the-home (FTTH) markets; changes in the world economy

(particularly in the United States and China); changes in the regulation and taxation of international trade, including the imposition

of tariffs; changes in currency exchange rates; the negative effects of seasonality; and other risks and uncertainties described more

fully in the company's documents filed with or furnished to the Securities and Exchange Commission, including our Annual Report on Form

10-K for the year ended December 31, 2022 and our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023. More information

about these and other risks that may impact the company's business are set forth in the "Risk Factors" section of the company's

quarterly and annual reports on file with the Securities and Exchange Commission. You should not rely on forward-looking statements as

predictions of future events. All forward-looking statements in this press release are based upon information available to us as of the

date hereof, and qualified in their entirety by this cautionary statement. Except as required by law, we assume no obligation to update

forward-looking statements for any reason after the date of this press release to conform these statements to actual results or to changes

in the company's expectations.

Non-GAAP Financial Measures

We provide non-GAAP gross margin, non-GAAP net income (loss), adjusted

EBITDA, and non-GAAP earnings per share to eliminate the impact of items that we do not consider indicative of our overall operating performance.

To arrive at our non-GAAP gross margin, we exclude stock-based compensation expense, expenses associated with discontinued products, and

non-recurring (income) expenses, if any, from our GAAP gross margin. To arrive at our non-GAAP net income (loss), we exclude all amortization

of intangible assets, stock-based compensation expense, non-recurring expenses, unrealized foreign exchange loss (gain), losses from the

disposal of idle assets, if any, non-GAAP tax benefit (expenses), and expenses associated with discontinued products, from our GAAP net

income (loss). Included in our non-recurring expenses in Q4 2023, Q4 2022 and Q3 2023 are certain non-recurring expenses related to pandemic

events (if any), non-recurring tax expenses or benefits (if any), certain non-recurring legal expenses associated with litigation and

certain legal and advisory expenses associated with the termination of the purchase agreement with Yuhan Optoelectronic Technology (Shanghai)

Co., Ltd and employee severance expenses (if any). Also included in our non-recurring expenses in Q4 2023, but not in Q4 2022 or Q3 2023

are bank fees associated with early repayment of bank loans and non-cash loss on extinguishment of convertible notes. In computing our

non-GAAP income tax benefit (expense), we have applied an estimate of our annual effective income tax rate and applied it to our net income

before income taxes. Our adjusted EBITDA is calculated by excluding depreciation expense, non-GAAP tax benefit (expense), and interest

(income) expense from our non-GAAP net income (loss). Our non-GAAP diluted net loss per share is calculated by dividing our non-GAAP net

loss by the fully diluted share count (for periods in which non-GAAP net income is positive) or basic share count (for periods in which

our non-GAAP net income is negative). We believe that our non-GAAP measures are useful to investors in evaluating our operating performance

for the following reasons:

| · | We believe that elimination of items such as amortization of intangible assets, stock-based compensation expense, non-recurring revenue

and expenses, losses from the disposal of idle assets, unrealized foreign exchange gain or loss, and depreciation on certain equipment

undergoing reconfiguration is appropriate because treatment of these items may vary for reasons unrelated to our overall operating performance; |

| · | We believe that elimination of expenses associated with discontinued products, including depreciation and inventory obsolescence is

appropriate because these expenses are not indicative of our ongoing operations; |

| · | We believe that estimating non-GAAP income taxes allows comparison with prior periods and provides additional information regarding

the generation of potential future deferred tax assets; |

| · | We believe that non-GAAP measures provide better comparability with our past financial performance, period-to-period results and with

our peer companies, many of which also use similar non-GAAP financial measures; and |

| · | We anticipate that investors and securities analysts will utilize non-GAAP measures as a supplement

to GAAP measures to evaluate our overall operating performance. |

A reconciliation of our GAAP net income (loss) and GAAP earnings (loss)

per share for Q4 2023 and FY 2023 to our non-GAAP net income (loss) and earnings (loss) per share is provided below, together with corresponding

reconciliations for Q4 2022 and FY 2022. A reconciliation of our GAAP net income (loss) and GAAP earnings (loss) per share for Q3 2023

to our non-GAAP net income (loss) and earnings (loss) per share was provided in our Q3 2023 earnings release.

Non-GAAP measures should not be considered

as an alternative to net income (loss), earnings (loss) per share, or any other measure of financial performance calculated and presented

in accordance with GAAP. Our non-GAAP measures may not be comparable to similarly titled measures of other organizations because other

organizations may not calculate such other non-GAAP measures in the same manner. We have not reconciled the non-GAAP measures included

in our guidance to the appropriate GAAP financial measures because the GAAP measures are not readily determinable on a forward-looking

basis. GAAP measures that impact our non-GAAP financial measures may include stock-based compensation expense, non-recurring expenses,

amortization of intangible assets, unrealized exchange loss (gain), asset impairment charges, and loss (gain) from disposal of idle assets.

These GAAP measures cannot be reasonably predicted and may directly impact our non-GAAP gross margin, our non-GAAP net income and our

non-GAAP fully-diluted earnings per share, although changes with respect to certain of these measures may offset other changes. In addition,

certain of these measures are out of our control. Accordingly, a reconciliation of the non-GAAP financial measure guidance to the corresponding

GAAP measures is not available without unreasonable effort.

About Applied Optoelectronics

Applied Optoelectronics Inc. (AOI) is a leading developer and manufacturer

of advanced optical products, including components, modules and equipment. AOI's products are the building blocks for broadband fiber

access networks around the world, where they are used in the internet datacenter, CATV broadband, telecom and FTTH markets. AOI supplies

optical networking lasers, components and equipment to tier-1 customers in all four of these markets. In addition to its corporate headquarters,

wafer fab and advanced engineering and production facilities in Sugar Land, TX, AOI has engineering and manufacturing facilities in Taipei,

Taiwan and Ningbo, China. For additional information, visit www.ao-inc.com.

# # #

Investor Relations Contacts:

The Blueshirt Group, Investor Relations

Lindsay Savarese

+1-212-331-8417

ir@ao-inc.com

Cassidy Fuller

+1-415-217-4968

ir@ao-inc.com

Applied Optoelectronics, Inc.

Preliminary Condensed Consolidated Balance Sheets

(In thousands)

(Unaudited)

| | |

December 31, 2023 | | |

December 31, 2022 | |

| ASSETS | |

| | | |

| | |

| CURRENT ASSETS | |

| | | |

| | |

| Cash, Cash Equivalents and Restricted Cash | |

$ | 55,097 | | |

$ | 35,587 | |

| Accounts Receivable, Net | |

| 48,071 | | |

| 61,175 | |

| Notes receivable | |

| 219 | | |

| 339 | |

| Inventories | |

| 63,866 | | |

| 79,679 | |

| Prepaid Income Tax | |

| 3 | | |

| – | |

| Prepaid Expenses and Other Current Assets | |

| 5,349 | | |

| 6,384 | |

| Total Current Assets | |

| 172,605 | | |

| 183,164 | |

| | |

| | | |

| | |

| Property, Plant And Equipment, Net | |

| 200,317 | | |

| 210,184 | |

| Land Use Rights, Net | |

| 5,030 | | |

| 5,238 | |

| Operating Right of Use Asset | |

| 5,026 | | |

| 5,566 | |

| Financing Right of Use Asset | |

| – | | |

| 26 | |

| Intangible Assets, Net | |

| 3,628 | | |

| 3,699 | |

| Other Assets | |

| 2,580 | | |

| 386 | |

| TOTAL ASSETS | |

$ | 389,186 | | |

$ | 408,263 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| Accounts Payable | |

$ | 32,892 | | |

$ | 47,845 | |

| Bank Acceptance Payable | |

| 15,482 | | |

| 12,337 | |

| Accrued Expenses | |

| 18,549 | | |

| 17,222 | |

| Deferred Revenue | |

| 1,803 | | |

| 3,000 | |

| Current Lease Liability-Operating | |

| 1,149 | | |

| 1,041 | |

| Current Lease Liability-Financing | |

| – | | |

| 63 | |

| Current Portion of Notes Payable and Long Term Debt | |

| 23,197 | | |

| 57,074 | |

| Current Portion of Convertible Debt | |

| 286 | | |

| – | |

| Total Current Liabilities | |

| 93,358 | | |

| 138,582 | |

| | |

| | | |

| | |

| Convertible Senior Notes | |

| 76,233 | | |

| 79,506 | |

| Other Long-Term Liabilities | |

| 4,726 | | |

| 5,505 | |

| TOTAL LIABILITIES | |

| 174,317 | | |

| 223,593 | |

| | |

| | | |

| | |

| STOCKHOLDERS' EQUITY | |

| | | |

| | |

| Total Preferred Stock | |

| | | |

| | |

| Common Stock | |

| 38 | | |

| 29 | |

| Additional Paid-in Capital | |

| 478,972 | | |

| 391,526 | |

| Cumulative Translation Adjustment | |

| 975 | | |

| 2,183 | |

| Retained Earnings | |

| (265,116 | ) | |

| (209,068 | ) |

| TOTAL STOCKHOLDERS' EQUITY | |

| 214,869 | | |

| 184,670 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | |

$ | 389,186 | | |

$ | 408,263 | |

Applied Optoelectronics, Inc.

Preliminary Condensed Consolidated Statements of Operations

(In thousands, except per share data)

(Unaudited)

| | |

Three Months Ended

December 31, | | |

Twelve Months Ended

December 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenue | |

| | | |

| | | |

| | | |

| | |

| CATV | |

$ | 12,551 | | |

$ | 38,216 | | |

$ | 59,942 | | |

$ | 118,169 | |

| Datacenter | |

| 44,481 | | |

| 16,485 | | |

| 141,213 | | |

| 77,094 | |

| Telecom | |

| 2,818 | | |

| 6,365 | | |

| 13,831 | | |

| 24,727 | |

| FTTH | |

| – | | |

| 4 | | |

| 56 | | |

| 129 | |

| Other | |

| 603 | | |

| 514 | | |

| 2,604 | | |

| 2,699 | |

| Total Revenue | |

$ | 60,453 | | |

$ | 61,584 | | |

$ | 217,646 | | |

$ | 222,818 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total Cost of Goods Sold | |

$ | 38,849 | | |

$ | 55,359 | | |

$ | 158,725 | | |

$ | 189,191 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total Gross Profit | |

$ | 21,604 | | |

$ | 6,225 | | |

$ | 58,921 | | |

$ | 33,627 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and Development | |

$ | 9,341 | | |

$ | 9,224 | | |

$ | 35,975 | | |

$ | 36,244 | |

| Sales and Marketing | |

| 3,438 | | |

| 2,616 | | |

| 11,069 | | |

| 9,723 | |

| General and Administrative | |

| 13,356 | | |

| 12,749 | | |

| 53,226 | | |

| 46,658 | |

| Total Operating Expenses | |

$ | 26,135 | | |

$ | 24,589 | | |

$ | 100,270 | | |

$ | 92,625 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Loss | |

$ | (4,531 | ) | |

$ | (18,364 | ) | |

$ | (41,349 | ) | |

$ | (58,998 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other Income (Expense): | |

| | | |

| | | |

| | | |

| | |

| Interest Income | |

$ | 475 | | |

$ | 36 | | |

$ | 609 | | |

$ | 126 | |

| Interest Expense | |

| (3,127 | ) | |

| (1,888 | ) | |

| (9,428 | ) | |

| (6,319 | ) |

| Other Income (Expense), net | |

| (6,674 | ) | |

| (34 | ) | |

| (5,871 | ) | |

| (1,205 | ) |

| Total Other Income (Expense): | |

$ | (9,326 | ) | |

$ | (1,886 | ) | |

$ | (14,690 | ) | |

$ | (7,398 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss before Income Taxes | |

$ | (13,857 | ) | |

$ | (20,250 | ) | |

$ | (56,039 | ) | |

$ | (66,396 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income Tax Expense | |

| (1 | ) | |

| (1 | ) | |

| (9 | ) | |

| (1 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (13,858 | ) | |

$ | (20,251 | ) | |

$ | (56,048 | ) | |

$ | (66,397 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share attributable to common stockholders | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.38 | ) | |

$ | (0.71 | ) | |

$ | (1.75 | ) | |

$ | (2.38 | ) |

| Diluted | |

$ | (0.38 | ) | |

$ | (0.71 | ) | |

$ | (1.75 | ) | |

$ | (2.38 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted-average shares used to compute net loss per share attributable to common stockholders | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 36,549 | | |

| 28,460 | | |

| 31,944 | | |

| 27,846 | |

| Diluted | |

| 36,549 | | |

| 28,460 | | |

| 31,944 | | |

| 27,846 | |

Applied Optoelectronics, Inc.

Reconciliation of Statements of Operations under GAAP and Non-GAAP

(In thousands, except per share data)

(Unaudited)

| | |

Three Months Ended

December 31, | | |

Twelve Months Ended

December 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| GAAP revenue | |

$ | 60,453 | | |

$ | 61,584 | | |

$ | 217,646 | | |

$ | 222,818 | |

| Non-recurring customer credit | |

| – | | |

| – | | |

| – | | |

| – | |

| Non-GAAP revenue | |

$ | 60,453 | | |

$ | 61,584 | | |

$ | 217,646 | | |

$ | 222,818 | |

| | |

| | | |

| | | |

| | | |

| | |

| GAAP total gross profit (a) | |

$ | 21,604 | | |

$ | 6,225 | | |

$ | 58,921 | | |

$ | 33,627 | |

| Share-based compensation expense | |

| 131 | | |

| 118 | | |

| 524 | | |

| 489 | |

| Non-recurring expense | |

| – | | |

| 5 | | |

| – | | |

| 261 | |

| Expenses associated with discontinued products | |

| 275 | | |

| 6,802 | | |

| 5,520 | | |

| 6,858 | |

| Non-GAAP total gross profit (a) | |

$ | 22,010 | | |

$ | 13,150 | | |

$ | 64,965 | | |

$ | 41,235 | |

| | |

| | | |

| | | |

| | | |

| | |

| GAAP net loss | |

$ | (13,858 | ) | |

$ | (20,251 | ) | |

$ | (56,048 | ) | |

$ | (66,397 | ) |

| Share-based compensation expense | |

| 3,297 | | |

| 2,357 | | |

| 11,885 | | |

| 9,602 | |

| Expenses associated with discontinued products | |

| 274 | | |

| 6,802 | | |

| 5,519 | | |

| 6,859 | |

| Non-cash expenses associated with discontinued products | |

| 816 | | |

| 1,147 | | |

| 3,990 | | |

| 4,625 | |

| Amortization of intangible assets | |

| 171 | | |

| 157 | | |

| 659 | | |

| 616 | |

| Non-recurring (income) expense | |

| 9,603 | | |

| 15 | | |

| 11,907 | | |

| 233 | |

| Unrealized exchange loss (gain) | |

| (635 | ) | |

| (434 | ) | |

| (1,387 | ) | |

| 1,809 | |

| Non-GAAP tax benefit | |

| 1,908 | | |

| 4,793 | | |

| 10,146 | | |

| 14,638 | |

| Non-GAAP net loss | |

$ | 1,576 | | |

$ | (5,414 | ) | |

$ | (13,329 | ) | |

$ | (28,015 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| GAAP net loss | |

$ | (13,858 | ) | |

$ | (20,251 | ) | |

$ | (56,048 | ) | |

$ | (66,397 | ) |

| Share-based compensation expense | |

| 3,297 | | |

| 2,358 | | |

| 11,885 | | |

$ | 9,602 | |

| Expenses associated with discontinued products | |

| 274 | | |

| 6,802 | | |

| 5,519 | | |

$ | 6,859 | |

| Non-cash expenses associated with discontinued products | |

| 816 | | |

| 1,147 | | |

| 3,990 | | |

$ | 4,625 | |

| Amortization of intangible assets | |

| 171 | | |

| 158 | | |

| 659 | | |

$ | 616 | |

| Non-recurring expense (income) | |

| 9,603 | | |

| 14 | | |

| 11,907 | | |

$ | 233 | |

| Unrealized exchange loss (gain) | |

| (635 | ) | |

| (434 | ) | |

| (1,387 | ) | |

$ | 1,809 | |

| Tax (benefit) expense related to the above | |

| – | | |

| (1 | ) | |

| 8 | | |

| (1 | ) |

| Depreciation expense | |

| 3,894 | | |

| 4,200 | | |

| 15,730 | | |

$ | 17,960 | |

| Interest (income) expense, net | |

| 1,206 | | |

| 1,852 | | |

| 7,373 | | |

$ | 6,191 | |

| Adjusted EBITDA | |

$ | 4,768 | | |

$ | (4,155 | ) | |

$ | (364 | ) | |

$ | (18,503 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| GAAP diluted net loss per share | |

$ | (0.31 | ) | |

$ | (0.71 | ) | |

$ | (1.75 | ) | |

$ | (2.38 | ) |

| Share-based compensation expense | |

| 0.07 | | |

| 0.08 | | |

| 0.37 | | |

| 0.34 | |

| Expenses associated with discontinued products | |

| 0.01 | | |

| 0.24 | | |

| 0.17 | | |

| 0.24 | |

| Non-cash expenses associated with discontinued products | |

| 0.02 | | |

| 0.04 | | |

| 0.12 | | |

| 0.17 | |

| Amortization of intangible assets | |

| 0.01 | | |

| 0.01 | | |

| 0.02 | | |

| 0.02 | |

| Non-recurring (income) expense | |

| 0.21 | | |

| – | | |

| 0.37 | | |

| 0.01 | |

| Unrealized exchange loss (gain) | |

| (0.01 | ) | |

| (0.02 | ) | |

| (0.04 | ) | |

| 0.07 | |

| Non-GAAP tax benefit | |

| 0.04 | | |

| 0.17 | | |

| 0.32 | | |

| 0.53 | |

| Non-GAAP diluted net gain/(loss) per share | |

$ | 0.04 | | |

$ | (0.19 | ) | |

| (0.42 | ) | |

| (1.01 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Shares used to compute diluted loss per share | |

| 44,778 | | |

| 28,460 | | |

| 31,944 | | |

| 27,846 | |

| Shares used to compute diluted earnings per share | |

| 44,778 | | |

| 28,460 | | |

| 31,944 | | |

| 27,846 | |

(a) Provided for the purpose of calculating gross profit

as a percentage of revenue (gross margin).

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

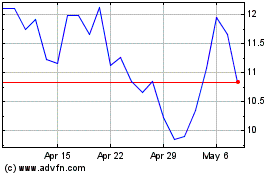

Applied Optoelectronics (NASDAQ:AAOI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Applied Optoelectronics (NASDAQ:AAOI)

Historical Stock Chart

From Apr 2023 to Apr 2024