false

0000884887

0000884887

2024-02-21

2024-02-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

To Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 21, 2024

ROYAL CARIBBEAN CRUISES LTD.

|

| (Exact Name of Registrant as Specified in Charter) |

| |

Republic of Liberia

|

| (State or Other Jurisdiction of Incorporation) |

| 1-11884 |

|

98-0081645 |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

| |

|

|

1050

Caribbean Way, Miami,

Florida |

|

33132 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant's telephone number, including area code: 305-539-6000

Not

Applicable |

| (Former Name or Former Address, if Changed Since Last Report) |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Title of each class |

|

Trading Symbol(s) |

|

Name

of each exchange on which registered |

| Common stock, par value $0.01 per share |

|

RCL |

|

New York Stock Exchange |

Indicate by check

mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of

this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 | Regulation FD Disclosure |

On February 21, 2024, Royal Caribbean Cruises Ltd. (the “Company”) issued a press release providing updated guidance regarding

financial results for the fiscal year ended December 31, 2024. A copy of this press release is furnished as exhibit 99.1 to this report.

This information shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and shall

not be incorporated by reference into any filing by the Company, whether made before or after the filing of this report, regardless of

any general incorporation language in the filing, except as expressly set forth by specific reference in such a filing.

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

|

ROYAL CARIBBEAN CRUISES LTD. |

| |

|

|

| Date: |

February 21, 2024 |

By: |

/s/ Naftali Holtz |

| |

|

Name: |

Naftali Holtz |

| |

|

|

Chief Financial Officer |

Exhibit 99.1

FOR IMMEDIATE RELEASE

ROYAL CARIBBEAN GROUP INCREASES 2024 GUIDANCE

ON

ACCELERATING DEMAND

Since last earnings call, demand and bookings

have exceeded expectations

Adjusted EPS in 2024 is now expected to be

$9.90 - $10.10

The company expects to achieve all Trifecta

goals in 2024

MIAMI –

February 21, 2024 – Royal Caribbean Group (NYSE: RCL) today provided an update on demand and updated its 2024 guidance.

The company continues to be very encouraged about

the demand and pricing environment for 2024. Since its most recent update on its Q4 2023 earnings call, the WAVE booking

season has exceeded the company’s initial expectations, with the first 5 weeks of the year resulting in the best WAVE booking weeks

in the company’s history. Bookings have been significantly higher than during the same period last year, with the back half of the

year up by more than the front half. For 2024, all four quarters and all key products are booked ahead of the same time last year in both

rate and volume. Consumer spending for onboard purchases continue to exceed prior years driven by greater participation at higher prices,

indicating quality and healthy future demand.

"Since our last earnings call, robust demand

for our vacation experiences has significantly exceeded our initial expectations,” said Jason Liberty, president and CEO of Royal

Caribbean. “As a result, we are increasing our 2024 guidance on stronger revenue outlook, and we expect to achieve all Trifecta

goals in 2024. Trifecta marks an important milestone as we remain intensely focused on delivering a lifetime of vacations

and priceless memories for our guests while delivering exceptional long-term shareholder value.”

As a result of the strong WAVE season, the company

is increasing its 2024 Adjusted EPS guidance by $0.40 compared to its February guidance. For the full year, Adjusted EPS is now expected

to be $9.90 to $10.10 driven by an increase in constant currency net yield growth of approximately 100 bps compared to the February guidance.

Approximately $0.15 of the full year increase in adjusted EPS is driven by an improved revenue outlook for the first quarter of 2024.

The company now expects to achieve all Trifecta goals in 2024.

About Royal Caribbean Group

Royal Caribbean Group (NYSE: RCL) is one of the

leading cruise companies in the world with a global fleet of 65 ships traveling to approximately

1,000 destinations around the world. Royal Caribbean Group is the owner and operator of three award winning cruise brands: Royal Caribbean

International, Celebrity Cruises, and Silversea Cruises and it is also a 50% owner of a joint venture that operates TUI Cruises and Hapag-Lloyd

Cruises. Together, the brands have an additional 8 ships on order as of December 31, 2023.

Learn more at www.royalcaribbeangroup.com or www.rclinvestor.com.

Cautionary Statement Concerning Forward-Looking

Statements

Certain statements in this press release relating

to, among other things, our future performance estimates, forecasts and projections constitute forward-looking statements under the Private

Securities Litigation Reform Act of 1995. These statements include, but are not limited to: statements regarding financial results for

2024; demand for our brands; and our progress towards achievement of our Trifecta goals. Words such as “anticipate,” “believe,”

“could,” “driving,” “estimate,” “expect,” “goal,” “intend,” “may,”

“plan,” “project,” “seek,” “should,” “will,” “would,” “considering,”

and similar expressions are intended to help identify forward-looking statements. Forward-looking statements reflect management’s

current expectations, are based on judgments, are inherently uncertain and are subject to risks, uncertainties and other factors, which

could cause our actual results, performance or achievements to differ materially from the future results, performance or achievements

expressed or implied in those forward-looking statements. Examples of these risks, uncertainties and other factors include, but are not

limited to, the following: the impact of contagious illnesses on economic conditions and the travel industry in general and the financial

position and operating results of our Company in particular, such as: governmental and self-imposed travel restrictions and guest cancellations;

our ability to obtain sufficient financing, capital or revenues to satisfy liquidity needs, capital expenditures, debt repayments and

other financing needs; the impact of the economic and geopolitical environment on key aspects of our business, such as the demand for

cruises, passenger spending, and operating costs; incidents or adverse publicity concerning our ships, port facilities, land destinations

and/or passengers or the cruise vacation industry in general; concerns over safety, health and security of guests and crew; further impairments

of our goodwill, long-lived assets, equity investments and notes receivable; an inability to source our crew or our provisions and supplies

from certain places; an increase in concern about the risk of illness on our ships or when traveling to or from our ships, all of which

reduces demand; unavailability of ports of call; growing anti-tourism sentiments and environmental concerns; changes in U.S. foreign

travel policy; the uncertainties of conducting business internationally and expanding into new markets and new ventures; our ability

to recruit, develop and retain high quality personnel; changes in operating and financing costs; our indebtedness, any additional indebtedness

we may incur and restrictions in the agreements governing our indebtedness that limit our flexibility in operating our business; the

impact of foreign currency exchange rates, the impact of higher interest rate and food and fuel prices; vacation industry competition

and changes in industry capacity and overcapacity; the risks and costs related to cyber security attacks, data breaches, protecting our

systems and maintaining integrity and security of our business information, as well as personal data of our guests, employees and others;

the impact of new or changing legislation and regulations (including environmental regulations) or governmental orders on our business;

pending or threatened litigation, investigations and enforcement actions; the effects of weather, natural disasters and seasonality on

our business; the impact of issues at shipyards, including ship delivery delays, ship cancellations or ship construction cost increases;

shipyard unavailability; the unavailability or cost of air service; and uncertainties of a foreign legal system as we are not incorporated

in the United States.

More information about factors that could affect

our operating results is included under the caption “Risk Factors” in our most recent quarterly report on Form 10-K,

as well as our other filings with the SEC, copies of which may be obtained by visiting our Investor Relations website at www.rclinvestor.com

or the SEC’s website at www.sec.gov. Undue reliance should not be placed on the forward-looking statements in this release, which

are based on information available to us on the date hereof. We undertake no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise.

Selected Operational and Financial Metrics

Adjusted EBITDA

is a non-GAAP measure that represents EBITDA (as defined below) excluding certain items that we believe adjusting for is meaningful

when assessing our profitability on a comparative basis.

Adjusted Earnings

(Loss) per Share ("Adjusted EPS") is a non-GAAP measure that represents

Adjusted Net Income (Loss) attributable to Royal Caribbean Cruises Ltd. (as defined below) divided by weighted average shares outstanding

or by diluted weighted average shares outstanding, as applicable. We believe that this non-GAAP measure is meaningful when assessing our

performance on a comparative basis.

Adjusted Net

Income (Loss) attributable to Royal Caribbean Cruises Ltd. is a non-GAAP measure that represents net income (loss) less net

income attributable to noncontrolling interest, excluding certain items that we believe adjusting for is meaningful when assessing our

performance on a comparative basis.

Constant Currency

is a significant measure for our revenues and expenses, which are denominated in currencies other than the U.S. Dollar. Because our reporting

currency is the U.S. Dollar, the value of these revenues and expenses in U.S. Dollar will be affected by changes in currency exchange

rates. Although such changes in local currency prices are just one of many elements impacting our revenues and expenses, it can be an

important element. For this reason, we also monitor our revenues and expenses in "Constant Currency" - i.e., as if the current

period's currency exchange rates had remained constant with the comparable prior period's rates.

We do not make predictions about future exchange rates and use current exchange rates for calculations of future periods. It should

be emphasized that the use of Constant Currency is primarily used by us for comparing short-term changes and/or projections. Over the

longer term, changes in guest sourcing and shifting the amount of purchases between currencies can significantly change the impact of

the purely currency-based fluctuations.

EBITDA

is a non-GAAP measure that represents of Net Income (Loss) attributable to Royal Caribbean Cruises Ltd. excluding (i) interest income;

(ii) interest expense, net of interest capitalized; (iii) depreciation and amortization expenses; and (iv) income tax expense.

We believe that this non-GAAP measure is meaning when assessing our operating performance on a comparative basis.

Invested Capital represents

the most recent five-quarter average of total debt (i.e., Current portion of long-term debt plus Long-term debt) plus the most recent

five-quarter average of Total shareholders' equity. We use this measure to calculate ROIC (as defined below).

Return on Invested Capital ("ROIC")

represents Adjusted Operating Income (Loss) divided by Invested Capital. We believe ROIC is a meaningful measure because it quantifies

how efficiently we generated operating income relative to the capital we have invested in the business. ROIC is also used as a key metric

in our long-term incentive compensation program for our executive officers.

Adjusted

Gross Margin represent Gross Margin, adjusted for payroll and related, food, fuel, other

operating, and depreciation and amortization expenses. Gross Margin is calculated pursuant to GAAP as total revenues less total cruise

operating expenses, and depreciation and amortization.

Net

Yields represent Adjusted Gross Margin per APCD. We utilize Adjusted Gross Margin and

Net Yields to manage our business on a day-to-day basis as we believe that they are the most relevant measures of our pricing performance

because they reflect the cruise revenues earned by us net of our most significant variable costs, which are commissions, transportation

and other expenses, and onboard and other expenses.

Trifecta refers

to the multi-year Adjusted EBITDA per APCD, Adjusted EPS and ROIC goals we publicly announced in November 2022 and seeking to

achieve by the end of 2025. We designed this program to help us better execute and achieve our business goals by clearly

articulating longer-term financial objectives. Under the Trifecta Program, we are targeting Adjusted EBITDA per APCD of at lease

$100, Adjusted EPS of at least $10, and ROIC of 13% or higher by the end of 2025.

Adjusted Measures of Financial Performance

We have not provided in this

press release a quantitative reconciliation of the projected non-GAAP financial measures to the most comparable GAAP financial measures

because preparation of meaningful U.S. GAAP projections would require unreasonable effort. Due to significant uncertainty, we are unable

to predict, without unreasonable effort, the future movement of foreign exchange rates, fuel prices and interest rates inclusive of our

related hedging programs. In addition, we are unable to determine the future impact of non-core business related gains and losses which

may result from strategic initiatives. These items are uncertain and could be material to our results of operations in accordance with

U.S. GAAP. Due to this uncertainty, we do not believe that reconciling information for such projected figures would be meaningful.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

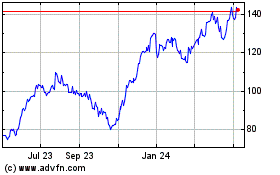

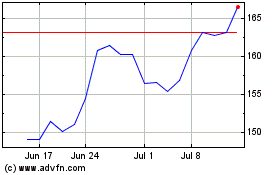

Royal Caribbean (NYSE:RCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Royal Caribbean (NYSE:RCL)

Historical Stock Chart

From Apr 2023 to Apr 2024