0000867773SUNPOWER CORPfalse00008677732024-02-192024-02-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 19, 2024

SunPower Corporation

(Exact name of registrant as specified in its charter)

001-34166

(Commission File Number)

| | | | | |

| Delaware | 94-3008969 |

(State or other jurisdiction

of incorporation) | (I.R.S. Employer

Identification No.) |

880 Harbour Way South, Suite 600, Richmond, California 94804

(Address of principal executive offices, with zip code)

(408) 240-5500

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of exchange on which registered |

| Common Stock, $0.001 par value per share | SPWR | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Appointment of New Directors

On February 19, 2024, pursuant to the bylaws of SunPower Corporation (the “Company”) and the Amended and Restated Affiliation Agreement, dated as of February 14, 2024 (the “Affiliation Agreement”), by and between the Company and Sol Holding, LLC, a Delaware limited liability company (“Sol Holding”), the Company’s Board of Directors (the “Board”) voted to increase the size of the Board from 9 to 11 members, and to appoint Thomas H. Werner and Emmanuel Barrois (collectively, the “New Directors”) to serve as members of the Board, subject to and effective upon their satisfaction of the Company’s director nomination and onboarding procedures.

The New Directors do not have any family relationships with any director or executive officer of the Company, and there are no arrangements or understandings with any persons pursuant to which Mr. Werner has been appointed to his position. Mr. Barrois has been appointed to his position pursuant to the terms of the Affiliation Agreement. In addition, there have been no transactions directly or indirectly involving the New Directors that would be required to be disclosed pursuant to Item 404(a) of Regulation S-K promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Appointment of Thomas H. Werner as Executive Chairman

On February 19, 2024, the Board appointed Thomas H. Werner to the Board to serve as Executive Chairman. In connection with his appointment, Mr. Werner entered into an offer letter with the Company effective as of February 19, 2024 (the “Werner Offer Letter”).

Mr. Werner, 64, previously served as the Company’s chief executive officer from June 2010 to April 2021, as a member of the Board from June 2003 and as chairman of the Board from May 2011 to November 2021. From 2001 to 2003, before joining the Company, he held the position of chief executive officer of Silicon Light Machines, Inc., an optical solutions subsidiary of Cypress Semiconductor Corporation. From 1998 to 2001, Mr. Werner served as vice president and general manager of the Business Connectivity Group of 3Com Corp., a network solutions company. He also held a number of executive management positions at Oak Industries, Inc. and General Electric Co. Mr. Werner currently serves as chair of the board of directors of Wolfspeed, Inc., a power semi-conductor manufacturer, and the Silicon Valley Leadership Group, a non-profit for businesses that operate in Silicon Valley. He is also on the board of trustees of Marquette University. Mr. Werner has been a member of the board of directors of Wolfspeed since March 2006 and served as a member of the board of directors of Silver Spring Networks, a provider of smart grid applications, from March 2009 to January 2018. Mr. Werner holds a bachelor’s degree in industrial engineering from the University of Wisconsin–Madison, a bachelor’s degree in electrical engineering from Marquette University, and a master’s degree in business administration from George Washington University.

As Mr. Werner is an executive officer of the Company, he is not independent under the corporate governance requirements of Nasdaq. Mr. Werner will serve as a Class II director, with a term expiring at the Company’s annual meeting of stockholders to be held in 2025.

Pursuant to the Werner Offer Letter, the Company will pay Mr. Werner an annualized base salary of $180,000. In addition, Mr. Werner will receive upon his start date one-time awards of (i) 250,000 performance-based restricted stock units (the “Sign-On PSUs”) under the SunPower Corporation 2015 Omnibus Incentive Plan (“OIP”) that will vest subject to his continued employment through January 2, 2025, and the Company’s achievement of certain other conditions described in the Werner Offer Letter and (ii) restricted stock units under the OIP with a grant date value of $300,000 that will be immediately vested as of the date of grant (the “Annual RSUs”). The Sign-On PSUs and Annual RSUs will be subject to, and governed by, the terms and conditions of the OIP, filed as Exhibit 10.1 to the Company’s Registration Statement on Form S-8, filed with the Securities and Exchange Commission (“SEC”) on June 25, 2015.

Mr. Werner’s employment is at will, meaning that either he or the Company may terminate his employment at any time and for any reason. Mr. Werner will enter into the Company’s standard confidentiality agreement and the Company’s standard indemnification agreement, a form of which was filed as Exhibit 10.24 to the Company’s Annual Report on Form 10-K on February 19, 2016.

The description of the Werner Offer Letter is qualified in its entirety by the terms of the Werner Offer Letter, a copy of which is attached as Exhibit 10.1 and incorporated by reference herein.

Appointment of Emmanuel Barrois as Director

On February 19, 2024, in accordance with the Affiliation Agreement, Sol Holding designated Emmanuel Barrois, 41, to serve as a director of the Board. The Board approved Mr. Barrois’ appointment to the Board on February 19, 2024. He will serve in this capacity as a Class III director, with a term expiring at the Company’s annual meeting of stockholders to be held in 2026.

Mr. Barrois currently serves as the Head of Renewables Portfolio Management at TotalEnergies SE (“TotalEnergies”), a position to which he was appointed in September of 2022. He has been with TotalEnergies for over 17 years, serving in various roles. Most recently, he served as Senior Vice President of Geosciences & Development from September of 2016 to August of 2019 and Manager of Long Term Plan Organization, Analysis and Presentation from September of 2019 to January of 2023. Mr. Barrois served as a member of the board of directors of Sunzil, a solar solutions company, from October of 2022 to October of 2023, and currently serves as a member of the board of directors of Clearway Energy, Inc., a renewable energy semiconductor manufacturing company, and Clearway Energy Group, a renewable energy company, both since December of 2022. Mr. Barrois holds an industrial engineering degree from Ecole des Ponts ParisTech, a petroleum engineering degree from IFP School and a master’s degree in science from Colorado School of Mines.

Mr. Barrois will enter into the Company’s standard confidentiality and indemnification agreements.

On February 20, 2024, the Company issued a press release announcing matters described in Item 5.02 hereof. A copy of the press release is attached hereto and filed as Exhibit 99.1 and incorporated by reference herein.

The information under this Item 7.01 and Exhibit 99.1 is furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| | | | | |

Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | |

Exhibit No. | Description |

| 10.1 | |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| SUNPOWER CORPORATION |

| | |

| February 20, 2024 | By: | /S/ ELIZABETH EBY |

| Name: | Elizabeth Eby |

| Title: | Executive Vice President and Chief Financial Officer

|

February 19, 2024

Dear Tom:

SunPower Corporation (the “Company” or “SunPower”) is pleased to extend an offer of employment to you on the following terms and conditions:

1.Position. We are pleased to offer you the position of Executive Chairman of SunPower. In your capacity as an executive of the Company, you will report to the Board of Directors of the Company (the “Board”) and will carry out and perform the lawful orders, directions, and policies given to you by the Board. You will devote as much time and attention as is reasonably required to fulfill your responsibilities hereunder and will use good faith efforts to discharge your responsibilities under this agreement to the best of your ability. Subject to Board approval, you will serve as a member of the Board and the Chairman of the Board, and your membership on the Board and your role as its Chair is subject to applicable provisions in the Company’s Certificate of Incorporation, Bylaws, Corporate Governance Principles and other relevant governance policies of the Company in effect from time to time (the “Governance Policies”).

2.Start Date. If you accept this offer, your employment with the Company will begin on or before February 21, 2024 (your “Start Date”). No provision of this document will be construed to create an express or implied employment contract, or a promise of employment for any specific period of time. Any and all employment with the Company is at-will employment, which may be terminated by you or the Company at any time for any reason. No person with the Company has the authority to create any oral agreement modifying the terms of the at-will employment relationship or to make any express or implied promises regarding employment on which you should rely. Any changes to the at-will employment relationship must be in writing from the Board.

3.Compensation and Benefits.

a.Base Salary. The initial base pay will be at a rate of USD $180,000 per year. Salary reviews are performed no more frequently than once per year, and any salary increase is at the sole discretion of the Board.

b.Long-Term Incentive Awards. Subject to approval of the Board, upon your Start Date, you will receive an award of 250,000 performance-based restricted stock units (the “Sign-On PSUs”) under the SunPower Corporation 2015 Omnibus Incentive Plan (the “OIP”). The Sign-On PSUs will vest if (i) you remain employed as Executive Chairman of the Company through January 2, 2025 and (ii) the Company attains positive operating cash flow, as determined in good faith by the Board, in at least one fiscal quarter during the second half of 2024. In addition, upon your Start Date, subject to the approval of the Board, you will be granted an annual award of restricted stock units under the OIP, or any successor thereto, with a grant date value of $300,000, which will be immediately vested as

of the date of grant (the “Annual RSUs”). Subject to, and in addition to the foregoing, the applicable terms and conditions for such Sign-On PSUs and Annual RSUs will be provided in separate award agreements.

c.Benefits. Currently, SunPower benefits include but are not limited to a health and welfare plan, vision plan, dental plan, life and disability and a 401(k) plan. You will be eligible to receive benefits upon commencement of your employment, commensurate with your position. These benefits, of course, may be modified or changed from time to time at the sole discretion of the Company, and the provision of such benefits to you in no way changes or impacts your status as an at-will employee.

i.Business Expenses. Additionally, the Company shall pay or reimburse you for all business and travel expenses reasonably and necessarily incurred by you in the performance of your duties, consistent with the Company’s expense reimbursement policy, as in effect from time to time. You are also entitled to fly in business class for all flights that require cumulative one-way air travel in excess of five (5) hours.

4.Service on Boards. Subject to Board approval and the applicable provisions of the Governance Policies, during the term of your employment, in addition to your role as an employee, you will serve as a member of the Board as the Executive Chairman. For the avoidance of doubt, other than the consideration set forth in Section 3 herein, you will receive no additional consideration for your service on the Board. You may, subject to applicable policies and procedures applicable to Board members from time to time including the Governance Policies, (i) serve on corporate, civic or charitable boards or committees, (ii) manage personal investments, and (iii) with the prior approval of the Board, serve as an employee for other companies where you are currently an employee, so long as these activities, whether individually or in the aggregate, do not interfere or conflict with your performance of your responsibilities under this agreement and do not violate the Confidentiality Agreement.

5.Confidentiality and Other Obligations. In consideration of your employment, you will be required to agree to and comply with customary restrictive covenants, including your agreement to not to use or disclose any confidential information for the benefit of anyone other than SunPower. Should you accept this offer of employment, your employment will be contingent upon you signing the SunPower Agreement Concerning Proprietary Information and Inventions (the “Confidentiality Agreement”) a copy of which is attached as Exhibit A. You acknowledge that your obligations regarding maintaining the confidentiality of SunPower information, including but not limited to those outlined in the Confidentiality Agreement, survive the termination of your employment.

6.Indemnification. The Company will provide you with its standard indemnification agreement for officers and directors, and hereby agrees to indemnify you to the maximum extent provided under the by-laws of the Company for acts taken within the scope of your employment and your service as an officer or director of the Company or any of its subsidiaries or affiliates. To the extent that the Company obtains coverage under a director and officer liability insurance policy, you will be entitled to such coverage on a

basis that is no less favorable than the coverage provided to any other officer or director of the Company.

7.Successors. This agreement is personal to you and without the prior written consent of the Company will not be assignable by you otherwise than by will or the laws of descent and distribution. This agreement will inure to the benefit of, and be enforceable by, your legal representatives. This agreement will inure to the benefit of and be binding upon the Company and its successors and assigns.

8.Governing Law. The validity, interpretation, construction, performance and enforcement of this agreement will be governed by the laws of the State of California, without application of any conflict of laws principles that would result in the application of the laws of any other jurisdiction.

9.Withholding. The Company will be entitled to withhold (or to cause the withholding of) the amount, if any, of all taxes of any applicable jurisdiction required to be withheld by an employer with respect to any amount paid to you hereunder. The Company, in its sole and absolute discretion, will make all determinations as to whether it is obligated to withhold any taxes hereunder and the amount thereof.

10.Before Starting. Any potential employment with the Company is contingent upon your eligibility to work in the United States, and successful completion of a background check. On the first day of employment, if any, you must complete an I-9 form and provide the Company with any of the accepted forms of identification specified on the I-9 form.

11.Section 409A. The intent of the parties is that payments and benefits provided pursuant to this offer be exempt from or comply with Section 409A of the Internal Revenue Code and the regulations and guidance promulgated thereunder and, accordingly, to the maximum extent permitted, this offer will be interpreted to be in compliance therewith.

12.Complete Agreement. This agreement sets forth the entire agreement of the parties hereto in respect of the subject matter contained herein, and supersedes all prior agreements, promises, covenants, arrangements, communications, representations or warranties, whether oral or written, by any officer, employee or representative of any party hereto in respect of the subject matter contained herein.

13.Miscellaneous. This agreement may be executed in any number of counterparts, each of which will constitute an original and all of which together will constitute one agreement. Original signatures transmitted and received via facsimile or other electronic transmission are true and valid signatures for all purposes under this agreement and will bind the parties to the same extent as that of an original signature.

* * * *

Please sign below to confirm your acceptance of the terms of this offer. We are delighted at the prospect of working with you.

Sincerely,

SUNPOWER CORPORATION

By: /s/ Audrey Zibelman

Name: Audrey Zibelman

Title: Member, SunPower Corporation Board of Directors

Chair, Nominating and Governance Committee of the SunPower Corporation Board of

Directors

Agreed and Accepted:

By: /s/ Tom Werner

Tom Werner

Date: February 19, 2024

Tom Werner Joins SunPower’s Board of Directors as Executive Chairman

RICHMOND, Calif., Feb. 20, 2024 -SunPower Corp. (NASDAQ:SPWR) a leading residential solar technology and energy services provider, today announced Tom Werner as Executive Chairman of the Board, effective Feb. 19, 2024.

“As we move forward into our next era, and navigate this critical moment for our industry, we are pleased to welcome Tom Werner back to SunPower,” said Peter Faricy, SunPower’s CEO. “Tom’s unmatched experience in the solar business and his legacy institutional knowledge will be invaluable. We look forward to partnering closely with Tom to shepherd SunPower into the future.”

Werner previously served as SunPower’s CEO and Chairman of the Board for nearly 18 years. After stepping down as CEO, he served in board and investor roles at H2U Technologies, Inc., Mainspring Energy, Flo, Wolfspeed, VIA Sciences, and Kanin. Before joining SunPower, Werner was CEO at Silicon Light Machines, Inc., an optical solutions subsidiary of Cypress Semiconductor Corporation.

“I am pleased to return to SunPower and work hand in hand with the Company and the Board as we change the way our world is powered,” said Werner. “Building on the momentum from the additional capital, we look forward to turning our attention to strengthening SunPower’s core business. Together, we will combine our knowledge and expertise to serve SunPower’s shareholders, partners and customers.”

About SunPower

SunPower (NASDAQ:SPWR) is a leading residential solar, storage and energy services provider in North America. SunPower offers solar + storage solutions that give customers control over electricity consumption and resiliency during power outages while providing cost savings to homeowners. For more information, visit www.sunpower.com.

Media Contact

For further information: Investors, Mike Weinstein, 510-260-8585, Mike.Weinstein@sunpowercorp.com; Media, Sarah Spitz, 512-953-4401, Sarah.Spitz@sunpowercorp.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

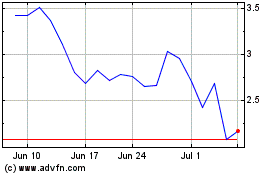

SunPower (NASDAQ:SPWR)

Historical Stock Chart

From Mar 2024 to Apr 2024

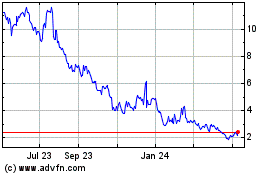

SunPower (NASDAQ:SPWR)

Historical Stock Chart

From Apr 2023 to Apr 2024