0001333274false00013332742024-02-152024-02-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 15, 2024

MERCER INTERNATIONAL INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

Washington |

000-51826 |

47-0956945 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

Suite 1120, 700 West Pender Street, Vancouver, British Columbia, Canada, V6C 1G8

(Address of Principal Executive Offices)

Registrant’s Telephone Number, Including Area Code: (604) 684-1099

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, par value $1.00 per share |

|

MERC |

|

NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

The information furnished under Item 2.02 of this Current Report shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

On February 15, 2024, Mercer International Inc. (the “Company”) announced by press release the Company’s results for its fourth quarter ended December 31, 2023. A copy of such press release is furnished as Exhibit 99.1 to this Current Report.

Item 8.01. Other Events

On February 15, 2024, the Company announced by press release that its board of directors had authorized a quarterly cash dividend of $0.075 per share to be paid on April 4, 2024 to all shareholders of record on March 27, 2024. A copy of such press release is furnished as Exhibit 99.1 to this Current Report.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

MERCER INTERNATIONAL INC. |

|

|

|

|

Date: February 15, 2024 |

By: |

|

/s/ Richard Short |

|

|

|

Richard Short |

|

|

|

Chief Financial Officer |

EXHIBIT 99.1

For Immediate Release

MERCER INTERNATIONAL INC. REPORTS FOURTH QUARTER AND YEAR END 2023 RESULTS AND ANNOUNCES QUARTERLY CASH DIVIDEND OF $0.075

Selected Highlights

•Fourth quarter Operating EBITDA* of $21.1 million and net loss of $87.2 million

•Full year 2023 Operating EBITDA of $17.5 million and net loss of $242.1 million

•Continued to ramp up and build out the order book of our mass timber business in 2023

•Quarterly cash dividend of $0.075 per share

NEW YORK, NY, February 15, 2024 ‑ Mercer International Inc. (Nasdaq: MERC) today reported that Operating EBITDA in the fourth quarter of 2023 was $21.1 million compared to $96.1 million in the same quarter of 2022 and $37.5 million in the third quarter of 2023.

In the fourth quarter of 2023, net loss was $87.2 million (or $1.31 per share), which included a non-cash impairment of $33.7 million (or $0.51 per share) relating to the classification of our sandalwood business as held for sale, compared to net income of $20.0 million (or $0.30 per share) in the fourth quarter of 2022 and net loss of $26.0 million (or $0.39 per share) in the third quarter of 2023.

In 2023, Operating EBITDA was $17.5 million compared to $536.5 million in 2022. Net loss was $242.1 million (or $3.65 per share) in 2023 compared to net income of $247.0 million (or $3.74 per basic share and $3.71 per diluted share) in 2022.

Mr. Juan Carlos Bueno, the Chief Executive Officer, stated: “In the fourth quarter, our operating results were positively impacted by an improved pulp pricing environment. However, our results decreased relative to the preceding

____________________

*Operating EBITDA is not a measure of financial performance under accounting principles generally accepted in the United States ("GAAP") and should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. See page 6 of the financial tables included in this press release for a reconciliation of net income (loss) to Operating EBITDA.

quarter because of greater planned maintenance downtime in the fourth quarter and because in the third quarter there were positive impacts from the recognition of non-cash items and sales of previously impaired inventory.

In the fourth quarter, we saw improved pulp pricing for both NBSK and NBHK across all our markets as customers restocked inventories. We currently believe this pricing momentum will continue into 2024 with modest price increases expected in the first quarter. We continued to be negatively impacted by the overall weakness in the lumber market as slightly higher prices in the U.S. were offset by lower prices in Europe.

We recognized a non‐cash impairment of $33.7 million against our sandalwood business in the fourth quarter of 2023 as we made the strategic decision to pursue a sale of this business to focus on our core strategy, resulting in these assets and associated liabilities being valued at fair market value and classified as held for sale as at the end of 2023.

In the fourth quarter of 2023, all our mills ran very efficiently and we had 23 days of scheduled maintenance downtime (approximately 31,600 ADMTs) at our pulp mills. In the first quarter of 2024, we have no scheduled maintenance downtime at our pulp mills.

Overall per unit fiber costs for our pulp segment were stable in the fourth quarter compared to the third quarter. Per unit fiber costs for our solid wood segment decreased due to the availability of lower cost beetle damaged wood in Germany.

In 2023, we saw strong growth in our mass timber business as we secured major customer contracts and continued to build out our order book. We began 2024 with a mass timber order book of almost $100 million. We are pleased that this business has exceeded our expectations to date, including by contributing positively to our Operating EBITDA in the fourth quarter.”

Mr. Bueno concluded: “We have seen pulp pricing and fiber supply conditions improve and currently expect this to continue in 2024. While market conditions have improved, our team remains disciplined on controlling costs, including by limiting discretionary spending and managing working capital to ensure our cash and liquidity levels remain healthy. We finished 2023 with approximately $610 million in aggregate liquidity and believe we are well positioned to ensure the integrity of our balance sheet through the business cycle.”

Current Market Environment

We currently expect improved pulp pricing in 2024, led by Europe, where third-party quoted list prices for NBSK pulp increased to $1,350 per ADMT in January 2024 with additional modest increases expected to continue in the first half of 2024 as a result of stronger demand due to the easing of inflationary pressures. For China and North America we currently expect prices to be generally stable in the first part of 2024, with reduced supply offset by continued weak demand. For NBHK pulp we currently expect stable prices in the first half of 2024.

In our solid wood segment, we currently expect a modest increase in U.S. lumber prices in the first half of 2024 driven by increased housing activity and low customer inventory levels. In Europe, we expect lumber prices to be relatively flat as demand remains weak due to continued high interest rates and economic uncertainty. We currently expect mass timber prices to be stable in the first half of 2024.

Consolidated Financial Results

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q4 |

|

|

Q3 |

|

|

Q4 |

|

|

YTD |

|

|

YTD |

|

|

|

2023 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022(1) |

|

|

|

(in thousands, except per share amounts) |

|

|

Revenues |

$ |

470,494 |

|

|

$ |

470,821 |

|

|

$ |

583,056 |

|

|

$ |

1,993,844 |

|

|

$ |

2,280,937 |

|

|

Operating income (loss) |

$ |

(56,395 |

) |

|

$ |

(3,426 |

) |

|

$ |

47,263 |

|

|

$ |

(188,774 |

) |

|

$ |

392,368 |

|

|

Operating EBITDA |

$ |

21,145 |

|

|

$ |

37,527 |

|

|

$ |

96,128 |

|

|

$ |

17,462 |

|

|

$ |

536,521 |

|

|

Net income (loss) |

$ |

(87,216 |

) |

|

$ |

(25,956 |

) |

|

$ |

20,024 |

|

|

$ |

(242,056 |

) |

|

$ |

247,039 |

|

|

Net income (loss) per common share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(1.31 |

) |

|

$ |

(0.39 |

) |

|

$ |

0.30 |

|

|

$ |

(3.65 |

) |

|

$ |

3.74 |

|

|

Diluted |

$ |

(1.31 |

) |

|

$ |

(0.39 |

) |

|

$ |

0.30 |

|

|

$ |

(3.65 |

) |

|

$ |

3.71 |

|

|

(1)Includes results of the Torgau facility since September 30, 2022.

Consolidated – Three Months Ended December 31, 2023 Compared to Three Months Ended December 31, 2022

Total revenues in the fourth quarter of 2023 decreased by approximately 19% to $470.5 million from $583.1 million in the same quarter of 2022 primarily due to lower pulp and energy sales realizations partially offset by higher pulp sales volumes.

Costs and expenses in the fourth quarter of 2023 decreased modestly to $526.9 million from $535.8 million in the same quarter of 2022 primarily as a result of lower per unit fiber, energy, freight and chemical costs partially offset by a $33.7 million non-cash impairment recognized in connection with the classification of our sandalwood business as held for sale and higher pulp sales volumes.

In the fourth quarter of 2023, Operating EBITDA was $21.1 million compared to $96.1 million in the same quarter of 2022 primarily due to lower pulp and energy sales realizations partially offset by lower per unit production and freight costs.

Segment Results

Pulp

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

|

(in thousands) |

|

|

Pulp revenues |

$ |

340,687 |

|

|

$ |

425,421 |

|

|

Energy and chemical revenues |

$ |

23,495 |

|

|

$ |

37,804 |

|

|

Operating income |

$ |

1,245 |

|

|

$ |

68,972 |

|

|

In the fourth quarter of 2023, pulp segment operating income was $1.2 million compared to $69.0 million in the same quarter of 2022 primarily as a result of lower pulp and energy sales realizations partially offset by lower per unit fiber, energy, chemical and freight costs.

Our pulp segment revenues decreased by approximately 21% to $364.2 million in the fourth quarter of 2023 from $463.2 million in the same quarter of 2022 primarily due to the relatively weaker pulp market and lower energy revenues.

Pulp revenues in the fourth quarter of 2023 decreased by approximately 20% to $340.7 million from $425.4 million in the same quarter of 2022 due to lower sales realizations partially offset by higher sales volumes.

In the fourth quarter of 2023, third party industry quoted average list prices for NBSK pulp were materially lower in all our markets compared to the same quarter of 2022. Our average NBSK pulp sales realizations decreased by approximately 22% to $709 per ADMT in the fourth quarter of 2023 from $913 per ADMT in the same quarter of 2022. In the fourth quarter of 2023, our average NBHK pulp sales realizations decreased by approximately 34% to $593 per ADMT from $896 per ADMT in the same quarter of 2022.

Total pulp sales volumes increased by approximately 6% to 491,156 ADMTs in the fourth quarter of 2023 from 465,318 ADMTs in the same quarter of 2022 primarily because of higher production.

Energy and chemical revenues decreased by approximately 38% to $23.5 million in the fourth quarter of 2023 from $37.8 million in the same quarter of 2022 as a result of lower sales realizations partially offset by higher sales volumes.

Costs and expenses in the fourth quarter of 2023 decreased by approximately 8% to $363.2 million from $394.3 million in the same quarter of 2022 primarily due to lower per unit fiber, energy, chemical and freight costs partially offset by higher pulp sales volumes.

In the fourth quarter of 2023, per unit fiber costs decreased by approximately 7% from the same quarter of 2022 driven by stable supply and the benefits from our Peace River woodroom. We currently expect modestly lower

per unit fiber costs in the first quarter of 2024 due to stable supply.

Solid Wood

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

|

(in thousands) |

|

|

Lumber revenues |

$ |

47,821 |

|

|

$ |

45,041 |

|

|

Energy revenues |

$ |

4,928 |

|

|

$ |

7,310 |

|

|

Manufactured products revenues(1) |

$ |

16,252 |

|

|

$ |

5,583 |

|

|

Pallet revenues |

$ |

23,767 |

|

|

$ |

36,063 |

|

|

Biofuels revenues(2) |

$ |

10,916 |

|

|

$ |

17,691 |

|

|

Wood residuals revenues |

$ |

1,759 |

|

|

$ |

6,722 |

|

|

Operating loss |

$ |

(18,411 |

) |

|

$ |

(14,281 |

) |

|

______________

(1)Manufactured products primarily includes cross-laminated timber, glulam and finger joint lumber.

(2)Biofuels includes pellets and briquettes.

In the fourth quarter of 2023, solid wood segment operating loss was $18.4 million compared to $14.3 million in the same quarter of 2022 primarily due to lower solid wood products' sales realizations, with the exception of manufactured products, partially offset by lower per unit fiber costs.

In the fourth quarter of 2023, solid wood segment revenues decreased by approximately 11% to $105.4 million from $118.4 million in the same quarter of 2022 primarily as a result of lower pallet, biofuels, energy and wood residuals sales realizations partially offset by higher manufactured products revenues.

In the fourth quarter of 2023, lumber revenues increased by approximately 6% to $47.8 million from $45.0 million in the same quarter of 2022 as higher sales volumes were only partially offset by modestly lower sales realizations. Average lumber sales realizations decreased by approximately 6% to $427 per Mfbm in the fourth quarter of 2023 from approximately $454 per Mfbm in the same quarter of 2022 as a result of weaker demand in the European market driven by higher interest rates and an uncertain economic outlook. In the U.S. market, sales realizations were flat in the fourth quarter of 2023 compared to the same quarter of 2022. The U.S. market accounted for approximately 49% of our lumber revenues and approximately 39% of our lumber sales volumes in the fourth quarter of 2023. The remaining balance of our lumber sales were primarily to Europe.

Lumber sales volumes increased by approximately 13% to 112.0 MMfbm in the fourth quarter of 2023 from 99.2 MMfbm in the same quarter of 2022 primarily due to the timing of sales.

In the fourth quarter of 2023, we continued to ramp up our mass timber operations and manufactured products revenues increased to $16.3 million from $5.6 million in the same quarter of 2022 as a result of both higher sales realizations and sales volumes. Manufactured products sales realizations increased to $1,234 per m3 in the fourth quarter of 2023 from $561 per m3 in the same quarter of 2022 as a result of higher cross-laminated timber and glulam

sales volumes.

Energy and wood residuals revenues in the fourth quarter of 2023 decreased by approximately 52% to $6.7 million from $14.0 million in the same quarter of 2022 primarily due to lower sales realizations.

Pallet revenues in the fourth quarter of 2023 decreased by approximately 34% to $23.8 million from $36.1 million in the same quarter of 2022 primarily due to lower sales realizations and sales volumes. Biofuels in the fourth quarter of 2023 decreased by approximately 38% to $10.9 million from $17.7 million in the same quarter of 2022 primarily due to lower sales volumes and realizations.

In the fourth quarter of 2023, lumber production decreased by approximately 5% to 111.6 MMfbm from 117.3 MMfbm in the same quarter of 2022 as a result of maintenance downtime.

Fiber costs were approximately 70% of our lumber cash production costs in the fourth quarter of 2023. In the fourth quarter of 2023, per unit fiber costs for lumber production decreased by approximately 19% compared to the same quarter of 2022 due to an increased supply of beetle damaged wood in Germany. We currently expect modestly lower per unit fiber costs in the first quarter of 2024 as a result of the continuing availability of beetle damaged wood partially offset by stronger demand.

Consolidated – Year Ended December 31, 2023 Compared to Year Ended December 31, 2022

Total revenues in 2023 decreased by approximately 13% to $1,993.8 million from $2,280.9 million in 2022 primarily due to lower pulp, lumber and energy sales realizations partially offset by the inclusion of Torgau for a full year and higher sales volumes.

Costs and expenses in 2023 increased by approximately 16% to $2,182.6 million from $1,888.6 million in 2022 primarily as a result of the inclusion of Torgau for a full year, higher per unit fiber costs, a $33.7 million impairment recognized in connection with the classification of our sandalwood business as held for sale and higher sales volumes. These increases were partially offset by lower per unit energy and freight costs and the receipt of $46.4 million of insurance proceeds in 2023 relating to the 2021 turbine downtime at the Rosenthal mill and the July 2022 fire at the Stendal mill. In 2022, we received insurance proceeds of $17.3 million related to the Stendal fire.

In 2023, Operating EBITDA was $17.5 million compared to $536.5 million in 2022 primarily due to lower pulp, lumber and energy sales realizations and higher per unit fiber costs partially offset by lower per unit energy and freight costs and higher insurance proceeds received.

Liquidity

As of December 31, 2023, we had cash and cash equivalents of $314.0 million and approximately $296.3 million available under our revolving credit facilities and as a result aggregate liquidity of about $610 million.

The following table is a summary of selected financial information as of the dates indicated:

|

|

|

|

|

|

|

|

|

|

As of December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

|

(in thousands) |

|

|

Cash and cash equivalents |

$ |

313,992 |

|

|

$ |

354,032 |

|

|

Working capital |

$ |

806,468 |

|

|

$ |

800,114 |

|

|

Total assets |

$ |

2,662,578 |

|

|

$ |

2,725,037 |

|

|

Long-term liabilities |

$ |

1,740,731 |

|

|

$ |

1,508,192 |

|

|

Total shareholders' equity |

$ |

635,410 |

|

|

$ |

838,784 |

|

|

Quarterly Dividend

A quarterly dividend of $0.075 per share will be paid on April 4, 2024 to all shareholders of record on March 27, 2024. Future dividends will be subject to Board approval and may be adjusted as business and industry conditions warrant.

Earnings Release Call

In conjunction with this release, Mercer International Inc. will host a conference call, which will be simultaneously broadcast live over the Internet. Management will host the call, which is scheduled for February 16, 2024 at 10:00 AM ET. Listeners can access the conference call live and archived for 30 days over the Internet at https://edge.media-server.com/mmc/p/6gsbsf2n or through a link on the company's home page at https://www.mercerint.com. Please allow 15 minutes prior to the call to visit the website and download and install any necessary audio software.

Mercer International Inc. is a global forest products company with operations in Germany, USA and Canada with consolidated annual production capacity of 2.3 million tonnes of pulp, 960 million board feet of lumber, 210 thousand cubic meters of cross-laminated timber, 45 thousand cubic meters of glulam, 17 million pallets and 230,000 metric tonnes of biofuels. To obtain further information on the company, please visit its website at https://www.mercerint.com.

The preceding includes forward looking statements which involve known and unknown risks and uncertainties which may cause our actual results in future periods to differ materially from forecasted results. Words such as "expects", "anticipates", "are optimistic that", "projects", "intends", "designed", "will", "believes", "estimates", "may", "could" and variations of such words and similar expressions are intended to identify such forward-looking statements. Among those factors which could cause actual results to differ materially are the following: the highly cyclical nature of

our business, raw material costs, our level of indebtedness, competition, foreign exchange and interest rate fluctuations, our use of derivatives, expenditures for capital projects, environmental regulation and compliance, disruptions to our production, market conditions and other risk factors listed from time to time in our SEC reports.

APPROVED BY:

Jimmy S.H. Lee

Executive Chairman

(604) 684-1099

Juan Carlos Bueno

Chief Executive Officer

(604) 684-1099

-FINANCIAL TABLES FOLLOW-

Summary Financial Highlights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q4 |

|

|

Q3 |

|

|

Q4 |

|

|

YTD |

|

|

YTD |

|

|

|

2023 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022(1) |

|

|

|

(in thousands, except per share amounts) |

|

|

Pulp segment revenues |

$ |

364,182 |

|

|

$ |

348,853 |

|

|

$ |

463,225 |

|

|

$ |

1,516,130 |

|

|

$ |

1,866,117 |

|

|

Solid wood segment revenues |

|

105,443 |

|

|

|

119,547 |

|

|

|

118,410 |

|

|

|

472,054 |

|

|

|

408,458 |

|

|

Corporate and other revenues |

|

869 |

|

|

|

2,421 |

|

|

|

1,421 |

|

|

|

5,660 |

|

|

|

6,362 |

|

|

Total revenues |

$ |

470,494 |

|

|

$ |

470,821 |

|

|

$ |

583,056 |

|

|

$ |

1,993,844 |

|

|

$ |

2,280,937 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pulp segment operating income (loss) |

$ |

1,245 |

|

|

$ |

21,181 |

|

|

$ |

68,972 |

|

|

$ |

(48,262 |

) |

|

$ |

340,664 |

|

|

Solid wood segment operating income (loss) |

|

(18,411 |

) |

|

|

(19,690 |

) |

|

|

(14,281 |

) |

|

|

(87,663 |

) |

|

|

70,642 |

|

|

Corporate and other operating loss |

|

(39,229 |

) |

|

|

(4,917 |

) |

|

|

(7,428 |

) |

|

|

(52,849 |

) |

|

|

(18,938 |

) |

|

Total operating income (loss) |

$ |

(56,395 |

) |

|

$ |

(3,426 |

) |

|

$ |

47,263 |

|

|

$ |

(188,774 |

) |

|

$ |

392,368 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pulp segment depreciation and amortization |

$ |

30,783 |

|

|

$ |

28,186 |

|

|

$ |

29,199 |

|

|

$ |

114,151 |

|

|

$ |

112,058 |

|

|

Solid wood segment depreciation and amortization |

|

12,779 |

|

|

|

12,517 |

|

|

|

19,451 |

|

|

|

57,320 |

|

|

|

31,170 |

|

|

Corporate and other depreciation and amortization |

|

244 |

|

|

|

250 |

|

|

|

215 |

|

|

|

1,031 |

|

|

|

925 |

|

|

Total depreciation and amortization |

$ |

43,806 |

|

|

$ |

40,953 |

|

|

$ |

48,865 |

|

|

$ |

172,502 |

|

|

$ |

144,153 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating EBITDA |

$ |

21,145 |

|

|

$ |

37,527 |

|

|

$ |

96,128 |

|

|

$ |

17,462 |

|

|

$ |

536,521 |

|

|

Impairment of sandalwood business held for sale |

$ |

33,734 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

33,734 |

|

|

$ |

— |

|

|

Income tax recovery (provision) |

$ |

(1,084 |

) |

|

$ |

(3,984 |

) |

|

$ |

(8,608 |

) |

|

$ |

27,767 |

|

|

$ |

(98,264 |

) |

|

Net income (loss) |

$ |

(87,216 |

) |

|

$ |

(25,956 |

) |

|

$ |

20,024 |

|

|

$ |

(242,056 |

) |

|

$ |

247,039 |

|

|

Net income (loss) per common share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(1.31 |

) |

|

$ |

(0.39 |

) |

|

$ |

0.30 |

|

|

$ |

(3.65 |

) |

|

$ |

3.74 |

|

|

Diluted |

$ |

(1.31 |

) |

|

$ |

(0.39 |

) |

|

$ |

0.30 |

|

|

$ |

(3.65 |

) |

|

$ |

3.71 |

|

|

Common shares outstanding at period end |

|

66,525 |

|

|

|

66,525 |

|

|

|

66,167 |

|

|

|

66,525 |

|

|

|

66,167 |

|

|

(1)Includes results of the Torgau facility since September 30, 2022.

Summary Operating Highlights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q4 |

|

|

Q3 |

|

|

Q4 |

|

|

YTD |

|

|

YTD |

|

|

|

2023 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022(1) |

|

|

Pulp Segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pulp production ('000 ADMTs) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NBSK |

|

436.2 |

|

|

|

397.5 |

|

|

|

390.9 |

|

|

|

1,714.4 |

|

|

|

1,607.6 |

|

|

NBHK |

|

71.5 |

|

|

|

82.5 |

|

|

|

80.6 |

|

|

|

251.2 |

|

|

|

271.0 |

|

|

Annual maintenance downtime ('000 ADMTs) |

|

31.6 |

|

|

|

13.3 |

|

|

|

39.5 |

|

|

|

82.9 |

|

|

|

111.0 |

|

|

Annual maintenance downtime (days) |

|

23 |

|

|

|

13 |

|

|

|

21 |

|

|

|

71 |

|

|

|

80 |

|

|

Pulp sales ('000 ADMTs) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NBSK |

|

411.8 |

|

|

|

425.1 |

|

|

|

393.4 |

|

|

|

1,689.0 |

|

|

|

1,660.8 |

|

|

NBHK |

|

79.4 |

|

|

|

62.1 |

|

|

|

72.0 |

|

|

|

262.2 |

|

|

|

257.0 |

|

|

Average NBSK pulp prices ($/ADMT)(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Europe |

|

1,245 |

|

|

|

1,160 |

|

|

|

1,442 |

|

|

|

1,257 |

|

|

|

1,427 |

|

|

China |

|

748 |

|

|

|

680 |

|

|

|

920 |

|

|

|

747 |

|

|

|

949 |

|

|

North America |

|

1,312 |

|

|

|

1,293 |

|

|

|

1,745 |

|

|

|

1,448 |

|

|

|

1,704 |

|

|

Average NBHK pulp prices ($/ADMT)(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

China |

|

643 |

|

|

|

530 |

|

|

|

837 |

|

|

|

592 |

|

|

|

794 |

|

|

North America |

|

1,083 |

|

|

|

1,023 |

|

|

|

1,608 |

|

|

|

1,227 |

|

|

|

1,514 |

|

|

Average pulp sales realizations ($/ADMT)(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NBSK |

|

709 |

|

|

|

666 |

|

|

|

913 |

|

|

|

729 |

|

|

|

876 |

|

|

NBHK |

|

593 |

|

|

|

530 |

|

|

|

896 |

|

|

|

627 |

|

|

|

869 |

|

|

Energy production ('000 MWh)(4) |

|

544.6 |

|

|

|

524.4 |

|

|

|

515.8 |

|

|

|

2,142.0 |

|

|

|

2,028.1 |

|

|

Energy sales ('000 MWh)(4) |

|

213.2 |

|

|

|

214.8 |

|

|

|

183.4 |

|

|

|

832.6 |

|

|

|

751.7 |

|

|

Average energy sales realizations ($/MWh)(4) |

|

92 |

|

|

|

108 |

|

|

|

156 |

|

(5) |

|

107 |

|

|

|

214 |

|

(5) |

Solid Wood Segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lumber |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Production (MMfbm) |

|

111.6 |

|

|

|

94.4 |

|

|

|

117.3 |

|

|

|

462.3 |

|

|

|

442.2 |

|

|

Sales (MMfbm) |

|

112.0 |

|

|

|

114.7 |

|

|

|

99.2 |

|

|

|

500.5 |

|

|

|

409.9 |

|

|

Average sales realizations ($/Mfbm) |

|

427 |

|

|

|

443 |

|

|

|

454 |

|

|

|

435 |

|

|

|

703 |

|

|

Energy |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Production and sales ('000 MWh) |

|

38.7 |

|

|

|

39.0 |

|

|

|

39.0 |

|

|

|

160.2 |

|

|

|

109.6 |

|

|

Average sales realizations ($/MWh) |

|

127 |

|

|

|

140 |

|

|

|

159 |

|

(5) |

|

134 |

|

|

|

224 |

|

(5) |

Manufactured products(6) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Production ('000 cubic meters) |

|

10.2 |

|

|

|

10.9 |

|

|

|

8.3 |

|

|

|

25.1 |

|

|

|

36.3 |

|

|

Sales ('000 cubic meters) |

|

12.1 |

|

|

|

11.0 |

|

|

|

6.1 |

|

|

|

33.4 |

|

|

|

28.8 |

|

|

Average sales realizations ($/cubic meters) |

|

1,234 |

|

|

|

1,752 |

|

|

|

561 |

|

|

|

1,514 |

|

|

|

715 |

|

|

Pallets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Production ('000 units) |

|

2,184.7 |

|

|

|

2,895.1 |

|

|

|

2,568.4 |

|

|

|

10,707.2 |

|

|

|

2,568.4 |

|

|

Sales ('000 units) |

|

2,450.7 |

|

|

|

2,765.3 |

|

|

|

2,646.3 |

|

|

|

11,041.2 |

|

|

|

2,646.3 |

|

|

Average sales realizations ($/unit) |

|

10 |

|

|

|

10 |

|

|

|

14 |

|

|

|

11 |

|

|

|

14 |

|

|

Biofuels(7) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Production ('000 tonnes) |

|

38.9 |

|

|

|

52.1 |

|

|

|

45.7 |

|

|

|

167.2 |

|

|

|

45.7 |

|

|

Sales ('000 tonnes) |

|

39.9 |

|

|

|

38.7 |

|

|

|

49.8 |

|

|

|

144.8 |

|

|

|

49.8 |

|

|

Average sales realizations ($/tonne) |

|

274 |

|

|

|

294 |

|

|

|

355 |

|

|

|

281 |

|

|

|

355 |

|

|

Average Spot Currency Exchange Rates |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ / €(8) |

|

1.0761 |

|

|

|

1.0884 |

|

|

|

1.0218 |

|

|

|

1.0817 |

|

|

|

1.0534 |

|

|

$ / C$(8) |

|

0.7347 |

|

|

|

0.7458 |

|

|

|

0.7366 |

|

|

|

0.7412 |

|

|

|

0.7691 |

|

|

______________

(1) Includes results of the Torgau facility since September 30, 2022.

(2)Source: RISI pricing report. Europe and North America are list prices. China are net prices which include discounts, allowances and rebates.

(3)Sales realizations after customer discounts, rebates and other selling concessions. Incorporates the effect of pulp price variations occurring between the order and shipment dates.

(4)Does not include our 50% joint venture interest in the Cariboo mill, which is accounted for using the equity method.

(5)Energy sales realizations for the year ended December 31, 2022 are net of the German energy windfall tax of $6.7 million for the pulp segment and $1.1 million for the solid wood segment.

(6)Manufactured products includes cross-laminated timber, glulam and finger joint lumber.

(7)Biofuels includes pellets and briquettes.

(8)Average Federal Reserve Bank of New York Noon Buying Rates over the reporting period.

MERCER INTERNATIONAL INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(In thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, |

|

|

For the Year Ended

December 31, |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Revenues |

$ |

470,494 |

|

|

$ |

583,056 |

|

|

$ |

1,993,844 |

|

|

$ |

2,280,937 |

|

Costs and expenses |

|

|

|

|

|

|

|

|

|

|

|

Cost of sales, excluding depreciation and amortization |

|

422,677 |

|

|

|

451,196 |

|

|

|

1,853,482 |

|

|

|

1,638,672 |

|

Cost of sales depreciation and amortization |

|

43,738 |

|

|

|

48,841 |

|

|

|

172,223 |

|

|

|

144,064 |

|

Selling, general and administrative expenses |

|

26,740 |

|

|

|

35,756 |

|

|

|

123,179 |

|

|

|

105,833 |

|

Impairment of sandalwood business held for sale |

|

33,734 |

|

|

|

— |

|

|

|

33,734 |

|

|

|

— |

|

Operating income (loss) |

|

(56,395 |

) |

|

|

47,263 |

|

|

|

(188,774 |

) |

|

|

392,368 |

|

Other income (expenses) |

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

(27,245 |

) |

|

|

(18,768 |

) |

|

|

(88,246 |

) |

|

|

(71,499 |

) |

Other income (expenses) |

|

(2,492 |

) |

|

|

137 |

|

|

|

7,197 |

|

|

|

24,434 |

|

Total other expenses, net |

|

(29,737 |

) |

|

|

(18,631 |

) |

|

|

(81,049 |

) |

|

|

(47,065 |

) |

Income (loss) before income taxes |

|

(86,132 |

) |

|

|

28,632 |

|

|

|

(269,823 |

) |

|

|

345,303 |

|

Income tax recovery (provision) |

|

(1,084 |

) |

|

|

(8,608 |

) |

|

|

27,767 |

|

|

|

(98,264 |

) |

Net income (loss) |

$ |

(87,216 |

) |

|

$ |

20,024 |

|

|

$ |

(242,056 |

) |

|

$ |

247,039 |

|

Net income (loss) per common share |

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(1.31 |

) |

|

$ |

0.30 |

|

|

$ |

(3.65 |

) |

|

$ |

3.74 |

|

Diluted |

$ |

(1.31 |

) |

|

$ |

0.30 |

|

|

$ |

(3.65 |

) |

|

$ |

3.71 |

|

Dividends declared per common share |

$ |

0.075 |

|

|

$ |

0.075 |

|

|

$ |

0.300 |

|

|

$ |

0.300 |

|

MERCER INTERNATIONAL INC.

CONSOLIDATED BALANCE SHEETS

(Unaudited)

(In thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

ASSETS |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

313,992 |

|

|

$ |

354,032 |

|

Accounts receivable, net |

|

|

306,166 |

|

|

|

351,993 |

|

Inventories |

|

|

414,161 |

|

|

|

450,470 |

|

Prepaid expenses and other |

|

|

23,461 |

|

|

|

21,680 |

|

Assets classified as held for sale |

|

|

35,125 |

|

|

|

— |

|

Total current assets |

|

|

1,092,905 |

|

|

|

1,178,175 |

|

Property, plant and equipment, net |

|

|

1,409,937 |

|

|

|

1,341,322 |

|

Investment in joint ventures |

|

|

41,665 |

|

|

|

45,635 |

|

Amortizable intangible assets, net |

|

|

52,641 |

|

|

|

61,497 |

|

Goodwill |

|

|

35,381 |

|

|

|

30,937 |

|

Operating lease right-of-use assets |

|

|

11,725 |

|

|

|

15,049 |

|

Pension asset |

|

|

5,588 |

|

|

|

4,397 |

|

Other long-term assets |

|

|

12,736 |

|

|

|

48,025 |

|

Total assets |

|

$ |

2,662,578 |

|

|

$ |

2,725,037 |

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts payable and other |

|

$ |

278,986 |

|

|

$ |

377,306 |

|

Pension and other post-retirement benefit obligations |

|

|

826 |

|

|

|

755 |

|

Liabilities associated with assets held for sale |

|

|

6,625 |

|

|

|

— |

|

Total current liabilities |

|

|

286,437 |

|

|

|

378,061 |

|

Long-term debt |

|

|

1,609,425 |

|

|

|

1,346,508 |

|

Pension and other post-retirement benefit obligations |

|

|

12,483 |

|

|

|

12,178 |

|

Operating lease liabilities |

|

|

7,755 |

|

|

|

9,475 |

|

Other long-term liabilities |

|

|

13,744 |

|

|

|

14,072 |

|

Deferred income tax |

|

|

97,324 |

|

|

|

125,959 |

|

Total liabilities |

|

|

2,027,168 |

|

|

|

1,886,253 |

|

Shareholders’ equity |

|

|

|

|

|

|

Common shares $1 par value; 200,000,000 authorized; 66,525,000 issued and outstanding (2022 – 66,167,000) |

|

|

66,471 |

|

|

|

66,132 |

|

Additional paid-in capital |

|

|

359,497 |

|

|

|

354,495 |

|

Retained earnings |

|

|

336,113 |

|

|

|

598,119 |

|

Accumulated other comprehensive loss |

|

|

(126,671 |

) |

|

|

(179,962 |

) |

Total shareholders’ equity |

|

|

635,410 |

|

|

|

838,784 |

|

Total liabilities and shareholders’ equity |

|

$ |

2,662,578 |

|

|

$ |

2,725,037 |

|

MERCER INTERNATIONAL INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2021 |

|

Cash flows from (used in) operating activities |

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

(242,056 |

) |

|

$ |

247,039 |

|

|

$ |

170,988 |

|

Adjustments to reconcile net income (loss) to cash flows from operating activities |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

172,502 |

|

|

|

144,153 |

|

|

|

132,199 |

|

Deferred income tax provision (recovery) |

|

|

(36,392 |

) |

|

|

7,003 |

|

|

|

18,791 |

|

Inventory impairment |

|

|

58,600 |

|

|

|

— |

|

|

|

— |

|

Impairment of sandalwood business held for sale |

|

|

33,734 |

|

|

|

— |

|

|

|

— |

|

Loss on early extinguishment of debt |

|

|

— |

|

|

|

— |

|

|

|

30,368 |

|

Defined benefit pension plans and other post-retirement benefit plan expense |

|

|

5,214 |

|

|

|

1,708 |

|

|

|

2,831 |

|

Stock compensation expense |

|

|

5,922 |

|

|

|

6,737 |

|

|

|

2,394 |

|

Foreign exchange transaction losses (gains) |

|

|

3,905 |

|

|

|

(16,802 |

) |

|

|

(16,597 |

) |

Other |

|

|

(5,092 |

) |

|

|

(1,241 |

) |

|

|

384 |

|

Defined benefit pension plans and other post-retirement benefit plan contributions |

|

|

(1,152 |

) |

|

|

(2,942 |

) |

|

|

(4,258 |

) |

Changes in working capital |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

52,507 |

|

|

|

(20,476 |

) |

|

|

(121,579 |

) |

Inventories |

|

|

(15,836 |

) |

|

|

(63,184 |

) |

|

|

(96,442 |

) |

Accounts payable and accrued expenses |

|

|

(98,182 |

) |

|

|

66,796 |

|

|

|

75,589 |

|

Other |

|

|

(2,679 |

) |

|

|

(8,131 |

) |

|

|

(12,454 |

) |

Net cash from (used in) operating activities |

|

|

(69,005 |

) |

|

|

360,660 |

|

|

|

182,214 |

|

Cash flows from (used in) investing activities |

|

|

|

|

|

|

|

|

|

Purchase of property, plant and equipment |

|

|

(136,324 |

) |

|

|

(178,742 |

) |

|

|

(159,440 |

) |

Acquisition, net of cash acquired |

|

|

(82,100 |

) |

|

|

(256,604 |

) |

|

|

(51,258 |

) |

Property insurance proceeds |

|

|

12,203 |

|

|

|

8,616 |

|

|

|

21,540 |

|

Proceeds from government grants |

|

|

5,569 |

|

|

|

1,067 |

|

|

|

9,333 |

|

Purchase of term deposit |

|

|

— |

|

|

|

(75,000 |

) |

|

|

— |

|

Proceeds from sale of term deposit |

|

|

— |

|

|

|

75,519 |

|

|

|

— |

|

Other |

|

|

785 |

|

|

|

534 |

|

|

|

2,031 |

|

Net cash from (used in) investing activities |

|

|

(199,867 |

) |

|

|

(424,610 |

) |

|

|

(177,794 |

) |

Cash flows from (used in) financing activities |

|

|

|

|

|

|

|

|

|

Redemption of senior notes |

|

|

— |

|

|

|

— |

|

|

|

(824,557 |

) |

Proceeds from issuance of senior notes |

|

|

200,000 |

|

|

|

— |

|

|

|

875,000 |

|

Proceeds from (repayment of) revolving credit facilities, net |

|

|

61,272 |

|

|

|

115,330 |

|

|

|

(33,396 |

) |

Dividend payments |

|

|

(19,950 |

) |

|

|

(19,847 |

) |

|

|

(17,167 |

) |

Payment of debt issuance costs |

|

|

(4,865 |

) |

|

|

(3,871 |

) |

|

|

(14,483 |

) |

Payment of finance lease obligations |

|

|

(7,785 |

) |

|

|

(10,003 |

) |

|

|

(7,850 |

) |

Other |

|

|

(48 |

) |

|

|

(711 |

) |

|

|

3,616 |

|

Net cash from (used in) financing activities |

|

|

228,624 |

|

|

|

80,898 |

|

|

|

(18,837 |

) |

Effect of exchange rate changes on cash and cash equivalents |

|

|

208 |

|

|

|

(8,526 |

) |

|

|

(1,071 |

) |

Net increase (decrease) in cash and cash equivalents |

|

|

(40,040 |

) |

|

|

8,422 |

|

|

|

(15,488 |

) |

Cash and cash equivalents, beginning of year |

|

|

354,032 |

|

|

|

345,610 |

|

|

|

361,098 |

|

Cash and cash equivalents, end of year |

|

$ |

313,992 |

|

|

$ |

354,032 |

|

|

$ |

345,610 |

|

MERCER INTERNATIONAL INC.

COMPUTATION OF OPERATING EBITDA

(Unaudited)

(In thousands)

Operating EBITDA is defined as operating income (loss) plus depreciation and amortization and non-recurring capital asset impairment charges. Management uses Operating EBITDA as a benchmark measurement of its own operating results, and as a benchmark relative to its competitors. Management considers it to be a meaningful supplement to operating income (loss) as a performance measure primarily because depreciation expense and non-recurring capital asset impairment charges are not an actual cash cost, and depreciation expense varies widely from company to company in a manner that management considers largely independent of the underlying cost efficiency of our operating facilities. In addition, we believe Operating EBITDA is commonly used by securities analysts, investors and other interested parties to evaluate our financial performance.

Operating EBITDA does not reflect the impact of a number of items that affect our net income (loss), including financing costs and the effect of derivative instruments. Operating EBITDA is not a measure of financial performance under GAAP, and should not be considered as an alternative to net income (loss) or operating income (loss) as a measure of performance, nor as an alternative to net cash from (used in) operating activities as a measure of liquidity. The following tables set forth the net income (loss) to Operating EBITDA:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q4 |

|

|

Q3 |

|

|

Q4 |

|

|

YTD |

|

|

YTD |

|

|

|

2023 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022(1) |

|

|

Net income (loss) |

$ |

(87,216 |

) |

|

$ |

(25,956 |

) |

|

$ |

20,024 |

|

|

$ |

(242,056 |

) |

|

$ |

247,039 |

|

|

Income tax provision (recovery) |

|

1,084 |

|

|

|

3,984 |

|

|

|

8,608 |

|

|

|

(27,767 |

) |

|

|

98,264 |

|

|

Interest expense |

|

27,245 |

|

|

|

21,863 |

|

|

|

18,768 |

|

|

|

88,246 |

|

|

|

71,499 |

|

|

Other expenses (income) |

|

2,492 |

|

|

|

(3,317 |

) |

|

|

(137 |

) |

|

|

(7,197 |

) |

|

|

(24,434 |

) |

|

Operating income (loss) |

|

(56,395 |

) |

|

|

(3,426 |

) |

|

|

47,263 |

|

|

|

(188,774 |

) |

|

|

392,368 |

|

|

Add: Depreciation and amortization |

|

43,806 |

|

|

|

40,953 |

|

|

|

48,865 |

|

|

|

172,502 |

|

|

|

144,153 |

|

|

Add: Impairment of sandalwood business held for sale |

|

33,734 |

|

|

|

— |

|

|

|

— |

|

|

|

33,734 |

|

|

|

— |

|

|

Operating EBITDA |

$ |

21,145 |

|

|

$ |

37,527 |

|

|

$ |

96,128 |

|

|

$ |

17,462 |

|

|

$ |

536,521 |

|

|

______________

(1) Includes results of the Torgau facility since September 30, 2022.

v3.24.0.1

Document and Entity Information

|

Feb. 15, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 15, 2024

|

| Entity Registrant Name |

MERCER INTERNATIONAL INC.

|

| Entity Central Index Key |

0001333274

|

| Entity File Number |

000-51826

|

| Entity Tax Identification Number |

47-0956945

|

| Entity Incorporation, State or Country Code |

WA

|

| Entity Emerging Growth Company |

false

|

| Entity Address, Address Line One |

Suite 1120

|

| Entity Address, Address Line Two |

700 West Pender Street

|

| Entity Address, City or Town |

Vancouver

|

| Entity Address, State or Province |

BC

|

| Entity Address, Country |

CA

|

| Entity Address, Postal Zip Code |

V6C 1G8

|

| City Area Code |

(604)

|

| Local Phone Number |

684-1099

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $1.00 per share

|

| Trading Symbol |

MERC

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

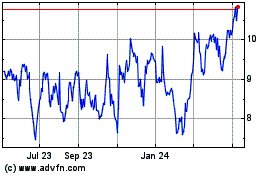

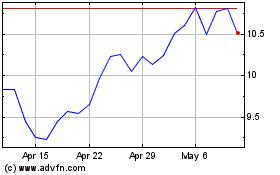

Mercer (NASDAQ:MERC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mercer (NASDAQ:MERC)

Historical Stock Chart

From Apr 2023 to Apr 2024