Futures Pointing To Extended Rebound On Wall Street

February 15 2024 - 9:05AM

IH Market News

The major U.S. index futures are currently pointing to a

modestly higher open on Thursday, with stocks likely to extend the

rebound from Tuesday’s sell-off seen during Wednesday’s

session.

The futures edged higher following the release of a slew of U.S.

economic data, including a Commerce Department report showing

retail sales fell by much more than expected in the month of

January.

The Commerce Department said retail sales slid by 0.8 percent in

January after climbing by a downwardly revised 0.4 percent in

December.

Economists had expected retail sales to edge down by 0.1 percent

compared to the 0.6 percent increase originally reported for the

previous month.

Excluding sales by motor vehicle and parts dealers, retail sales

fell by 0.6 percent in January after rising by 0.4 percent in

December. Ex-auto sales were expected to rise by 0.2 percent.

Treasury yields have moved lower following the release of the

report, potentially signaling renewed optimism about the

possibility of near-term interest rate cuts.

Meanwhile, the Labor Department released a separate report

showing an unexpected decline in first-time claims for unemployment

benefits in the week ended February 10th.

The report said initial jobless claims fell to 212,000, a

decrease of 8,000 from the previous week’s revised level of

220,000.

Economists had expected initial jobless claims to inch up to

220,000 from the 218,000 originally reported for the previous

week.

The Labor Department also released a separate report this

morning showing an unexpected increase U.S. import prices in the

month of January.

Stocks showed a strong move back to the upside during trading on

Wednesday, partly offsetting the sell-off seen during Tuesday’s

session. The major averages all moved higher on the day, with the

tech-heavy Nasdaq leading the rebound.

After plunging by 1.8 percent Tuesday’s trading, the Nasdaq

surged 203.55 points or 1.3 percent to 15,859.15. The S&P 500

also jumped 47.45 points or 1.0 percent to 5,000.62, while the Dow

climbed 151.52 points or 0.4 percent at 38,424.27.

The rebound on Wall Street partly reflected bargain hunting,

with some traders seeing the sharp pullback on Tuesday as a buying

opportunity amid ongoing optimism about the outlook for the

markets.

While hotter-than expected inflation data further pushed back

interest rate cut expectations, signs of continued strength in the

economy is still expected to benefit the markets in the longer

term.

The Federal Reserve is also still likely to begin lower interest

rates sometime in the coming months even if traders have to wait

until June.

Nonetheless, the major averages remained well off their recent

highs ahead of the release of an avalanche of data before the start

of trading on Thursday.

Among individual stocks, shares of Lyft (NASDAQ:LYFT)

skyrocketed by 35.1 after the ride-hailing company reported better

than expected fourth quarter results and provided upbeat

guidance.

Investing platform Robinhood (NASDAQ:HOOD) also spiked by 13.0

percent after reporting fourth quarter results that exceeded

analyst estimates on both the top and bottom lines.

On the other hand, shares of Akamai Technologies (NASDAQ:AKAM)

plunged by 8.2 percent after the server network provider reported

better than expected fourth quarter earnings but weaker than

expected revenues.

Computer hardware stocks showed a strong move back to the upside

on the day, with the NYSE Arca Computer Hardware Index soaring by

3.4 percent to a record closing high.

Substantial strength also emerged among tobacco stocks, as

reflected by the 3.3 percent spike by the NYSE Arca Tobacco

Index.

Semiconductor, networking and biotechnology stocks also saw

considerable strength, contributing to the rebound by the

tech-heavy Nasdaq.

Most of the other major sectors also rebounded on the day, with

notable strength visible among steel, housing and airline

stocks.

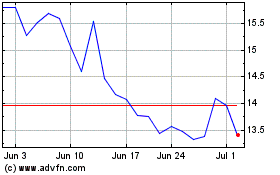

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Apr 2023 to Apr 2024