false

0000726728

0000726728

2024-02-12

2024-02-12

0000726728

us-gaap:CommonStockMember

2024-02-12

2024-02-12

0000726728

o:Series6.000PercentACumulativeRedeemablePreferredStock0.01ParValueMember

2024-02-12

2024-02-12

0000726728

o:Notes1.125PercentDue2027Member

2024-02-12

2024-02-12

0000726728

o:Notes1.875PercentDue2027Member

2024-02-12

2024-02-12

0000726728

o:Notes1.625PercentDue2030Member

2024-02-12

2024-02-12

0000726728

o:Notes4.875PercentDue2030Member

2024-02-12

2024-02-12

0000726728

o:Notes5.750PercentDue2031Member

2024-02-12

2024-02-12

0000726728

o:Notes1.750PercentDue2033Member

2024-02-12

2024-02-12

0000726728

o:Notes5.125PercentDue2034Member

2024-02-12

2024-02-12

0000726728

o:Notes6.000PercentDue2039Member

2024-02-12

2024-02-12

0000726728

o:Notes2.500PercentDue2042Member

2024-02-12

2024-02-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

United States

Securities

and Exchange Commission

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report: February 12, 2024

(Date of Earliest Event Reported)

REALTY

INCOME CORPORATION

(Exact name of registrant as specified in

its charter)

| Maryland |

|

1-13374 |

|

33-0580106 |

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(Commission File Number) |

|

(IRS

Employer Identification No.) |

11995 El Camino Real, San Diego, California 92130

(Address of principal executive offices)

(858) 284-5000

(Registrant’s telephone number, including area code)

N/A

(former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title

of each class |

|

Trading

symbol |

|

Name

of Each Exchange On Which

Registered |

| Common

Stock, $0.01 Par Value |

|

O |

|

New York Stock Exchange |

| 6.000% Series A Cumulative Redeemable Preferred Stock, $0.01 Par Value |

|

OPR |

|

New York Stock Exchange |

| 1.125% Notes due 2027 |

|

O27A |

|

New York Stock Exchange |

| 1.875% Notes due 2027 |

|

O27B |

|

New York Stock Exchange |

| 1.625% Notes due 2030 |

|

O30 |

|

New York Stock Exchange |

| 4.875% Notes due 2030 |

|

O30A |

|

New York Stock Exchange |

| 5.750% Notes due 2031 |

|

O31A |

|

New York Stock Exchange |

| 1.750% Notes due 2033 |

|

O33A |

|

New York Stock Exchange |

| 5.125% Notes due 2034 |

|

O34 |

|

New York Stock Exchange |

| 6.000% Notes due 2039 |

|

O39 |

|

New York Stock Exchange |

| 2.500% Notes due 2042 |

|

O42 |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure of

Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Departure of Ronald L. Merriman as Director

On February 12, 2024, Ronald L. Merriman,

a member of the Board of Directors (the “Board”) of Realty Income Corporation (the “Company”) notified the Board

of his decision to retire and not stand for reelection at the Company’s 2024 annual meeting of stockholders. Mr. Merriman’s

resignation was not the result of any disagreement with management, the Company or its operations, policies or practices. He intends to

continue to serve on the Board and on the Company’s Audit and Nominating/Corporate Governance Committees until the expiration of

his current term at the 2024 annual meeting. Mr. Merriman has served on the Company’s Board since July 2005.

Appointment of Jeff A. Jacobson as Director

On February 12, 2024, the Board

appointed Jeff A. Jacobson to the Board, effective as of February 21, 2024, to serve as a director on the Board until the

Company’s 2024 annual meeting of stockholders and until his successor is duly elected and qualified. The Company’s Board

has affirmatively determined that Mr. Jacobson is “independent” after applying the Company’s categorical

standards contained in its Corporate Governance Guidelines and under the applicable New York Stock Exchange (“NYSE”)

rules. With Mr. Jacobson’s appointment, the total number of directors on the Board will be 12, which will be reduced to

11 upon Mr. Merriman’s retirement. Mr. Jacobson is expected to serve on the Audit Committee following his

appointment to the Board.

Pursuant to the terms of the Company’s 2021

Incentive Award Plan (the “Incentive Award Plan”), as amended, upon election to the Board, Mr. Jacobson automatically

will receive a grant of 4,000 restricted shares of the Company’s common stock, which will vest as to one-third of the restricted

shares on each of the first three anniversaries of the applicable grant date, subject to Mr. Jacobson’s continued service on

the Board. In addition, Mr. Jacobson will be eligible to receive an annual equity award of 4,000 restricted shares of the Company’s

common stock, at each annual meeting of the Company’s stockholders following his appointment to the Board, provided that he continues

to serve on the Board as of the date of such meeting (each an “annual equity award”). Annual equity awards will be subject

to vesting based on Mr. Jacobson’s years of service on the Board in accordance with the Incentive Award Plan. Mr. Jacobson

will also receive an annual fee of $35,000 for serving on the Board.

There are no understandings or arrangements

between Mr. Jacobson or any other person and the Company or any of its subsidiaries pursuant to which Mr. Jacobson was

selected to serve as a director of the Company. There are also no transactions involving Mr. Jacobson that would warrant

disclosure pursuant to Item 404 of Regulation S-K.

Mr. Jacobson is a retired Global Chief Executive

Officer of LaSalle Investment Management (“LaSalle”), the real estate investment arm of Jones Lang LaSalle Inc. (NYSE: JLL),

serving in such role from 2007 to 2021. Prior to this, he served as LaSalle’s European Chief Executive Officer from 2000 to 2006.

During the period between 1986 and 1998, Mr. Jacobson served in various positions with LaSalle. From 1998 to 2000 he served in leadership

positions with Security Capital Group, Inc., a real estate holding company. Mr. Jacobson has over 30 years of real estate investment

experience, including that during his tenure at LaSalle he sat on three regional investment committees in North America, Europe and Asia.

He has investment expertise in a variety of geographic markets, asset sectors, investment structures, and risk/return strategies. Since

2022, he has served on the board of directors of Cadillac Fairview Corporation, an owner, operator, investor and developer of office,

retail, multi-family residential, industrial and mixed-use properties in North America and is wholly-owned by the Ontario Teachers’

Pension Plan. Mr. Jacobson is also a Senior Adviser to The Vistria Group, a private investment firm focused on investing in essential

industries such as healthcare, financial services and housing. Mr. Jacobson holds both a Bachelor of Arts degree in economics and

a Master of Arts degree from the Food Research Institute of Stanford University.

| Item 7.01 | Regulation of FD Disclosure. |

On February 14, 2024, the Company issued

a press release announcing the anticipated retirement of Mr. Merriman as a director, and the anticipated appointment of Mr. Jacobson

as a director. A copy of this press release is furnished herewith as Exhibit 99.1.

Item 9.01 Financial Statements

and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: February 14, 2024 |

REALTY INCOME CORPORATION |

| |

|

|

| |

By: |

|

| |

|

/s/ Bianca Martinez |

| |

|

Bianca Martinez |

| |

|

Senior Vice President, Associate General Counsel and Assistant Secretary |

Exhibit 99.1

REALTY INCOME

ANNOUNCES APPOINTMENT OF JEFF A. JACOBSON TO BOARD OF DIRECTORS AND RETIREMENT OF BOARD MEMBER RONALD L. MERRIMAN

SAN

DIEGO, CALIFORNIA, February 14, 2024….Realty

Income Corporation (Realty Income, NYSE: O), The Monthly Dividend Company®, today announced that Jeff A. Jacobson will

be joining Realty Income’s Board of Directors (the “Board”), effective February 21, 2024. Ronald L. Merriman has

also announced his intention to retire from the Board and to not stand for reelection at Realty Income’s 2024 annual meeting

of stockholders.

“On behalf

of the Board, I want to recognize Ron for his countless contributions to Realty Income, spanning nearly two decades,” said

Michael D. McKee, Realty Income’s Non-Executive Chairman of the Board. “Realty Income has achieved many significant milestones

since Ron joined the Board in 2005, including being added to the S&P 500 Dividend Aristocrats Index®, expanding into

Europe, and surpassing $10 billion in dividends paid. These accomplishments were supported by Ron’s leadership and guidance throughout

a range of economic cycles and evolution for the company. We are deeply grateful for Ron’s dedication, his commitment to effective

oversight, and his unwavering focus on building value for our stockholders.”

"Realty Income

owes a debt of gratitude for Ron’s impact to the foundation of the company. His extensive knowledge and adaptable approach to our

business’s development has added immeasurable value,” said Sumit Roy, President and Chief Executive Officer. “I am

also delighted to welcome Jeff to our Board. Jeff’s experience leading premier global real estate asset management firms and his

extensive relationships in the industry will be a tremendous asset as we continue our path of thoughtful growth.”

Jeff A. Jacobson

is a retired Global Chief Executive Officer of LaSalle Investment Management, (“LaSalle”), the real estate investment arm

of Jones Lang LaSalle Inc. (NYSE: JLL) serving in the role from 2007 to 2021. Prior to this, he served as LaSalle’s European Chief

Executive Officer from 2000 to 2006. Previously, Mr. Jacobson served in various leadership positions with LaSalle and Security Capital

Group, Inc., a real estate holding company. Mr. Jacobson has over 35 years of real estate investment experience. Specifically,

during his tenure at LaSalle, he sat on three regional investment committees in North America, Europe and Asia. He has investment expertise

in a variety of geographic markets, asset sectors, investment structures, and risk-return strategies. He currently serves as Chairman

of the Board of Cadillac Fairview Corporation, which he joined in 2022. Cadillac Fairview is an owner, operator, investor and developer

of office, retail, multi-family residential, industrial and mixed-use properties in North America and is wholly-owned by the Ontario

Teachers’ Pension Plan. Mr. Jacobson is also a Senior Adviser to The Vistria Group, a private investment firm focused on investing

in essential industries such as healthcare, financial services and housing. Mr. Jacobson holds both a Bachelor of Arts degree in

economics and a Master of Arts degree from the Food Research Institute from Stanford University. Once Mr. Jacobson joins the Board,

he is expected to serve as a member of Realty Income’s Audit Committee.

“I am excited

to announce Jeff’s addition to our Board,” said Michael D. McKee, Realty Income’s Non-Executive Chairman of the Board.

“This appointment represents Realty Income’s commitment to maintaining a Board with skills that are relevant to our growing

business. Jeff’s global real estate expertise will be invaluable as Realty Income continues to expand its footprint as a real estate

partner to the world’s leading companies."

About Realty

Income

Realty Income,

The Monthly Dividend Company®, is an S&P 500 company and member of the S&P 500 Dividend Aristocrats®

index. We invest in people and places to deliver dependable monthly dividends that increase over time. The company is structured

as a REIT, and its monthly dividends are supported by the cash flow from over 13,250 real estate properties primarily owned under long-term

net lease agreements with commercial clients. To date, the company has declared 644 consecutive common stock monthly dividends throughout

its 55-year operating history and increased the dividend 123 times since Realty Income's public listing in 1994 (NYSE: O). Additional

information about the company can be obtained from the corporate website at www.realtyincome.com.

Forward-Looking

Statements

This press release

contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the Exchange Act of 1934, as amended. When used in this press release, the

words "estimated," "anticipated," "expect," "believe," "intend," "continue,"

"should," "may," "likely," "plans," and similar expressions are intended to identify forward-looking

statements. Forward-looking statements include discussions of our business and portfolio (including our growth strategies, our intention

to acquire or dispose of properties including anticipated partners); future operations and results; plans and the intentions of management

and the Board; trends in our business, including trends in the market for long-term net leases of freestanding, single-client properties.

Forward-looking statements are subject to risks, uncertainties, and assumptions about us which may cause our actual future results to

differ materially from expected results. Some of the factors that could cause actual results to differ materially are, among others,

our continued qualification as a real estate investment trust; general domestic and foreign business, economic, or financial conditions;

competition; fluctuating interest and currency rates; inflation and its impact on our clients and us; access to debt and equity capital

markets and other sources of funding; continued volatility and uncertainty in the credit markets and broader financial markets; other

risks inherent in the real estate business including our clients' defaults under leases, increased client bankruptcies, potential liability

relating to environmental matters, illiquidity of real estate investments, and potential damages from natural disasters; impairments

in the value of our real estate assets; changes in domestic and foreign income tax laws and rates; our clients' solvency; property ownership

through joint ventures and partnerships which may limit control of the underlying investments; current or future epidemics or pandemics,

measures taken to limit their spread, the impacts on us, our business, our clients (including those in the theater and fitness industries),

and the economy generally; the loss of key personnel; the outcome of any legal proceedings to which we are a party or which may occur

in the future; acts of terrorism and war; the realization of the anticipated benefits from the merger with Spirit Realty Capital, Inc.;

and those additional risks and factors discussed in our reports filed with the U.S. Securities and Exchange Commission. Readers

are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements are not guarantees of future plans

and performance and speak only as of the date of this press release. Actual plans and operating results may differ materially from what

is expressed or forecasted in this press release. We do not undertake any obligation to update forward-looking statements or publicly

release the results of any forward-looking statements that may be made to reflect events or circumstances after the date these statements

were made.

Realty Income

Contact:

Steve Bakke, CFA

Senior Vice President,

Corporate Finance

(858) 284-5425

sbakke@realtyincome.com

v3.24.0.1

Cover

|

Feb. 12, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 12, 2024

|

| Entity File Number |

1-13374

|

| Entity Registrant Name |

REALTY

INCOME CORPORATION

|

| Entity Central Index Key |

0000726728

|

| Entity Tax Identification Number |

33-0580106

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

11995 El Camino Real

|

| Entity Address, City or Town |

San Diego

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92130

|

| City Area Code |

858

|

| Local Phone Number |

284-5000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common

Stock, $0.01 Par Value

|

| Trading Symbol |

O

|

| Security Exchange Name |

NYSE

|

| 6.000% Series A Cumulative Redeemable Preferred Stock, $0.01 Par Value [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

6.000% Series A Cumulative Redeemable Preferred Stock, $0.01 Par Value

|

| Trading Symbol |

OPR

|

| Security Exchange Name |

NYSE

|

| 1.125% Notes due 2027 [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.125% Notes due 2027

|

| Trading Symbol |

O27A

|

| Security Exchange Name |

NYSE

|

| 1.875% Notes due 2027 [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.875% Notes due 2027

|

| Trading Symbol |

O27B

|

| Security Exchange Name |

NYSE

|

| 1.625% Notes due 2030 [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.625% Notes due 2030

|

| Trading Symbol |

O30

|

| Security Exchange Name |

NYSE

|

| 4.875% Notes due 2030 [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

4.875% Notes due 2030

|

| Trading Symbol |

O30A

|

| Security Exchange Name |

NYSE

|

| 5.750% Notes due 2031 [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

5.750% Notes due 2031

|

| Trading Symbol |

O31A

|

| Security Exchange Name |

NYSE

|

| 1.750% Notes due 2033 [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.750% Notes due 2033

|

| Trading Symbol |

O33A

|

| Security Exchange Name |

NYSE

|

| 5.125% Notes due 2034 [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

5.125% Notes due 2034

|

| Trading Symbol |

O34

|

| Security Exchange Name |

NYSE

|

| 6.000% Notes due 2039 [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

6.000% Notes due 2039

|

| Trading Symbol |

O39

|

| Security Exchange Name |

NYSE

|

| 2.500% Notes due 2042 [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

2.500% Notes due 2042

|

| Trading Symbol |

O42

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=o_Series6.000PercentACumulativeRedeemablePreferredStock0.01ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=o_Notes1.125PercentDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=o_Notes1.875PercentDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=o_Notes1.625PercentDue2030Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=o_Notes4.875PercentDue2030Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=o_Notes5.750PercentDue2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=o_Notes1.750PercentDue2033Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=o_Notes5.125PercentDue2034Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=o_Notes6.000PercentDue2039Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=o_Notes2.500PercentDue2042Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

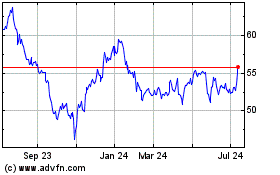

Realty Income (NYSE:O)

Historical Stock Chart

From Mar 2024 to Apr 2024

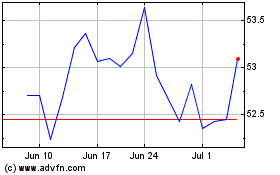

Realty Income (NYSE:O)

Historical Stock Chart

From Apr 2023 to Apr 2024