false

0000009389

0000009389

2024-02-14

2024-02-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934

February 14, 2024

Date of Report (Date of

earliest event reported)

| |

BALL CORPORATION |

|

| |

(Exact name of Registrant as specified in its charter) |

|

| Indiana |

|

001-07349 |

|

35-0160610 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File No.) |

|

Identification No.) |

9200

W. 108th Circle, P.O. Box 5000, Westminster, CO 80021-2510

(Address of principal executive offices,

including ZIP Code)

(303) 469-3131

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

| Securities registered pursuant to Section 12(b) of the Act: |

|

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common Stock, without par value |

BALL |

NYSE |

Item 8.01. Other Events.

On

February 14, 2024, Ball Corporation (“Ball”) announced the commencement of cash tender offers (the “Tender Offers”)

to purchase (i) any and all of the $1,000,000,000 aggregate principal amount of Ball’s outstanding 5.25% Senior Notes due

2025 (CUSIP No. 058498AT3) and (ii) any and all of the $750,000,000 aggregate principal amount of Ball’s outstanding

4.875% Senior Notes due 2026 (CUSIP No. 058498AV8). A copy of the press release announcing the Tender Offers, and which describes

the Tender Offers in greater detail, is attached hereto as Exhibit 99.1 and incorporated by reference herein.

This report does not constitute

an offer to sell, or a solicitation of an offer to buy, any security. No offer, solicitation or sale will be made in any jurisdiction

in which such an offer, solicitation or sale would be unlawful.

Item 9.01. Financial Statements and Exhibits.

Exhibits.

The following are furnished as exhibits to this report:

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

BALL CORPORATION |

| |

(Registrant) |

| |

|

|

| |

By: |

/s/ Hannah Lim-Johnson |

| |

|

Name: |

Hannah Lim-Johnson |

| |

|

Title: |

Senior Vice President, Chief Legal Officer and Corporate Secretary |

| |

|

|

| Date: February 14, 2024 |

|

|

Exhibit 99.1

|

News Release

For Immediate Release |

Investor Contact:

Ann T. Scott

(303) 460-3537, ascott@ball.com

Media Contact:

Bradford Walton

(415) 254-7168, bradford.walton@ball.com |

Ball Corporation

Announces Cash Tender Offers for Certain Outstanding Debt Securities

WESTMINSTER, Colo., February

14, 2024—Ball Corporation (“Ball”) (NYSE: BALL) announced today its offers to purchase for cash (i) any and

all of the $1,000,000,000 aggregate principal amount of its outstanding 5.25% Senior Notes due 2025 (the “2025 Notes”)

and (ii) any and all of the $750,000,000 aggregate principal amount of its outstanding 4.875% Senior Notes due 2026 (the “2026

Notes” and, together with the 2025 Notes, the “Notes”). Such offers to purchase are referred to collectively

herein as the “Tender Offers” and each, a “Tender Offer.”

The following table summarizes the material

pricing terms of the Tender Offers:

Title of

Security |

CUSIP

Number |

Principal

Amount

Outstanding |

U.S. Treasury

Reference

Security |

Bloomberg

Reference

Page(1) |

Fixed

Spread

(basis

points) |

Early Tender

Premium

(per $1,000)(2) |

Hypothetical

Total

Consideration(3) |

| 5.25% Senior Notes due 2025 |

058498AT3 |

$1,000,000,000 |

4.625% UST due June 30, 2025 |

FIT4 |

50 bps |

$30 |

$1,000.00 |

| 4.875% Senior Notes due 2026 |

058498AV8 |

$750,000,000 |

4.625% UST due March 15, 2026 |

FIT5 |

70 bps |

$30 |

$992.09 |

| (1) | The applicable page on Bloomberg from which

the Dealer Managers named below will quote the bid side prices of the U.S. Treasury Reference

Security. In the above table, “UST” denotes a U.S. Treasury Security. |

| (2) | The Total Consideration (as defined below)

for Notes validly tendered prior to or at the Early Tender Time (as defined below) and accepted

for purchase is calculated using the applicable fixed spread and is inclusive of the applicable

Early Tender Premium (as defined below). |

| (3) | Hypothetical Total Consideration per $1,000

principal amount of Notes validly tendered at or prior to the Early Tender Time and accepted

for purchase, based on the hypothetical applicable yield determined as of 10:00 a.m. New

York City time on February 14, 2024; excludes Accrued Interest (as defined below); and assumes

an early settlement date of February 29, 2024. The applicable yield used to determine actual

consideration is expected to be calculated on February 28, 2024. See Schedule A of

the Offer to Purchase (as defined below) for the calculation formula for determining the

Total Consideration (as defined below). Notwithstanding the foregoing, with respect to

the 2025 Notes, the Total Consideration (as defined below) shall in no case be less than

100% of the principal amount of the 2025 Notes validly tendered and accepted for purchase. |

The Tender Offers are being made upon

the terms and subject to conditions described in the Offer to Purchase, dated February 14, 2024 (as it may be amended or supplemented

from time to time, the “Offer to Purchase”), which sets forth a detailed description of the Tender Offers.

Each Tender Offer will expire at 5:00

p.m., New York City Time, on March 14, 2024, unless such Tender Offer is extended or earlier terminated (the “Expiration Time”).

Holders of Notes must validly tender and not validly withdraw their Notes prior to or at 5:00 p.m., New York City time, on February 28,

2024 (such time and date, as it may be extended with respect to a Tender Offer, the “Early Tender Time”), and such

holders’ Notes must be accepted for purchase, to be eligible to receive the applicable Total Consideration (as defined below).

If a holder validly tenders Notes after the applicable Early Tender Time but prior to or at the applicable Expiration Time, and such

holder’s Notes are accepted for purchase, such holder will only be eligible to receive the applicable Tender Offer Consideration

(as defined below). Tendered Notes may be withdrawn prior to or at, but not after, 5:00 p.m., New York City Time, on February 28, 2024

(such time and date, as it may be extended with respect to a Tender Offer, the “Withdrawal Deadline”).

The total consideration for each $1,000

principal amount of the Notes validly tendered (and not validly withdrawn) prior to the Early Tender Time and accepted for purchase pursuant

to each Tender Offer will be calculated in the manner described in the Offer to Purchase by reference to the applicable fixed spread

for such Notes specified in the table above plus the applicable yield based on the bid-side price of the applicable U.S. Treasury Reference

Security specified in the table above at 10:00 a.m., New York City time, on February 28, 2024 (excluding Accrued Interest (as defined

below) with respect to each series of Notes, the “Total Consideration”); provided that, with respect to the 2025

Notes, the Total Consideration as described herein shall in no case be less than 100% of the principal amount of the 2025 Notes validly

tendered and accepted for purchase. The Total Consideration includes an applicable early tender premium per $1,000 principal amount

of Notes accepted for purchase as set forth in the table above (with respect to each series of Notes, the “Early Tender Premium”).

Notes validly tendered after the Early Tender Time but prior to the Expiration Time and accepted for purchase will receive the Total

Consideration minus the Early Tender Premium (with respect to each series of Notes, the “Tender Offer Consideration”).

In addition to the Total Consideration

or the Tender Offer Consideration, as applicable, all holders of Notes accepted for purchase will also receive accrued and unpaid interest

on Notes validly tendered and accepted for purchase from the applicable last interest payment date up to, but excluding, the applicable

settlement date (“Accrued Interest”).

The Total Consideration, Accrued Interest

and the costs and expenses of the Tender Offers are expected to be paid with funds provided by the net cash proceeds from the closing

of the previously announced sale of Ball’s aerospace business (the “Disposition”).

Each Tender Offer will expire at the

applicable Expiration Time. Except as set forth below, payment for the Notes that are validly tendered prior to or at the Expiration

Time and that are accepted for purchase will be made on a date promptly following the Expiration Time, which is currently anticipated

to be March 15, 2024, the business day after the Expiration Time. Ball reserves the right, in its sole discretion, to make payment for

Notes that are validly tendered prior to or at the Early Tender Time and that are accepted for purchase on an earlier settlement date,

which, if applicable, is currently anticipated to be February 29, 2024, provided that the conditions to the satisfaction of the applicable

Tender Offer are satisfied. Ball is not obligated to conduct any early settlement or have any early settlement occur on any particular

date.

Each Tender Offer is contingent upon

the satisfaction of certain conditions, including the completion of the Disposition on terms satisfactory to Ball. If any of the conditions

are not satisfied, Ball is not obligated to accept for payment, or pay for, and may delay the acceptance for payment of, any tendered

Notes and may even terminate one or both Tender Offers. Ball reserves the right to amend, extend, terminate or waive any condition with

respect to one Tender Offer without taking a similar action with respect to the other Tender Offer. Full details of the terms and conditions

of the Tender Offers are included in the Offer to Purchase.

Information Relating to the Tender

Offers

The Offer to Purchase is being distributed

to holders beginning today. Requests for documents relating to the Tender Offers should be directed to D.F. King & Co., Inc., the

tender agent and information agent, by telephone at +1 (866) 796-1271 (toll-free) or by email at ball@dfking.com. BNP Paribas Securities

Corp. and Morgan Stanley & Co. LLC are serving as dealer managers in connection with the Tender Offers. Investors with questions

regarding the terms and conditions of the Tender Offers may contact the dealer managers as follows:

BNP

Paribas Securities Corp.

787 Seventh Avenue

New York, New York 10019

Attention: Liability Management Group

Email: dl.us.liability.management@us.bnpparibas.com

Call Collect: +1 (212) 841-3059

Call Toll Free: +1 (888) 210-4358 |

Morgan

Stanley & Co. LLC

1585 Broadway, 6th Floor

New York, New York 10036

Attention: Liability Management Group

Email: debt_advisory@morganstanley.com

Call Collect: +1 (212) 761-1057

Call Toll Free: +1 (800) 624-1808 |

This press release is for informational

purposes only and does not constitute an offer to sell or purchase, or a solicitation of an offer to sell or purchase, or the solicitation

of tenders with respect to, the Notes. No offer, solicitation, purchase or sale will be made in any jurisdiction in which such an offer,

solicitation or sale would be unlawful. Each Tender Offer is being made solely pursuant to the Offer to Purchase made available to holders

of the Notes. None of Ball or its affiliates, their respective boards of directors, the dealer managers, the tender agent and information

agent or the trustee with respect to any series of Notes is making any recommendation as to whether or not holders should tender or refrain

from tendering all or any portion of their Notes in response to each Tender Offer. Holders are urged to evaluate carefully all information

in the Offer to Purchase, consult their own investment and tax advisors and make their own decisions whether to tender Notes in each

Tender Offer, and, if so, the principal amount of Notes to tender.

About Ball Corporation

Ball Corporation supplies innovative,

sustainable aluminum packaging solutions for beverage, personal care and household products customers, as well as aerospace and other

technologies and services primarily for the U.S. government. Ball Corporation and its subsidiaries employ 21,000 people worldwide and

reported 2023 net sales of $14.03 billion.

Cautionary Statement Regarding Forward-Looking

Statements

This release contains “forward-looking”

statements concerning future events and financial performance. Words such as “expects,” “anticipates,” “estimates,”

“believes,” and similar expressions typically identify forward looking statements, which are generally any statements other

than statements of historical fact. Such statements are based on current expectations or views of the future and are subject to risks

and uncertainties, which could cause actual results or events to differ materially from those expressed or implied. You should therefore

not place undue reliance upon any forward-looking statements, and they should be read in conjunction with, and qualified in their entirety

by, the cautionary statements referenced below. Ball undertakes no obligation to publicly update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise. Key factors, risks and uncertainties that could cause actual outcomes

and results to be different are summarized in filings with the Securities and Exchange Commission, including Exhibit 99 in Ball’s

Form 10-K, which are available on Ball’s website and at www.sec.gov. Additional factors that might affect: a) Ball’s packaging

segments include product capacity, supply, and demand constraints and fluctuations and changes in consumption patterns; availability/cost

of raw materials, equipment, and logistics; competitive packaging, pricing and substitution; changes in climate and weather and related

events such as drought, wildfires, storms, hurricanes, tornadoes and floods; footprint adjustments and other manufacturing changes, including

the startup of new facilities and lines; failure to achieve synergies, productivity improvements or cost reductions; unfavorable mandatory

deposit or packaging laws; customer and supplier consolidation; power and supply chain interruptions; changes in major customer or supplier

contracts or loss of a major customer or supplier; inability to pass through increased costs; war, political instability and sanctions,

including relating to the situation in Russia and Ukraine and its impact on Ball’s supply chain and its ability to operate in Europe,

the Middle East and Africa regions generally; changes in foreign exchange or tax rates; and tariffs, trade actions, or other governmental

actions, including business restrictions and orders affecting goods produced by Ball or in its supply chain, including imported raw materials;

b) Ball’s aerospace segment include funding, authorization, availability and returns of government and commercial contracts; and

delays, extensions and technical uncertainties affecting segment contracts; failure to obtain, or delays in obtaining, required regulatory

approvals or clearances for the Disposition; any failure by the parties to satisfy any of the other conditions to the Disposition; the

possibility that the Disposition is ultimately not consummated; potential adverse effects of the announcement or results of the Disposition

on the ability to develop and maintain relationships with personnel and customers, suppliers and others with whom it does business or

otherwise on the business, financial condition, results of operations and financial performance; risks related to diversion of management’s

attention from ongoing business operations due to the Disposition; the impact of the Disposition on the ability to retain and hire key

personnel; and c) Ball as a whole include those listed above plus: the extent to which sustainability-related opportunities arise and

can be capitalized upon; changes in senior management, succession, and the ability to attract and retain skilled labor; regulatory actions

or issues including those related to tax, environmental, social and governance reporting, competition, environmental, health and workplace

safety, including U.S. Federal Drug Administration and other actions or public concerns affecting products filled in Ball’s containers,

or chemicals or substances used in raw materials or in the manufacturing process; technological developments and innovations; the ability

to manage cyber threats; litigation; strikes; disease; pandemic; labor cost changes; inflation; rates of return on assets of Ball’s

defined benefit retirement plans; pension changes; uncertainties surrounding geopolitical events and governmental policies, including

policies, orders, and actions related to COVID-19; reduced cash flow; interest rates affecting Ball’s debt; successful or unsuccessful

joint ventures, acquisitions and divestitures, and their effects on Ball’s operating results and business generally; and potential

adverse effects of the announcement or results of the Disposition on the market price of Ball Corporation’s common stock.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

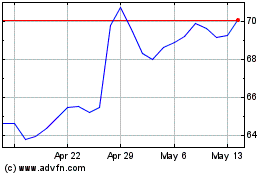

Ball (NYSE:BALL)

Historical Stock Chart

From Mar 2024 to Apr 2024

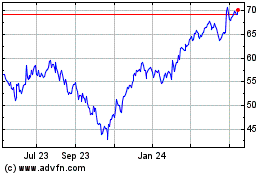

Ball (NYSE:BALL)

Historical Stock Chart

From Apr 2023 to Apr 2024