Filed Pursuant to Rule 424(b)(3)

Registration No. 333-273319

PROSPECTUS SUPPLEMENT NO. 13

(to Prospectus dated July 28, 2023)

Canopy Growth Corporation

13,218,453 Common Shares

This prospectus supplement supplements the prospectus dated July 28, 2023 (the “Prospectus”), which forms a part of our registration statement on Form S-1 (No. 333-273319). This prospectus supplement is being filed to update and supplement the information in the Prospectus with the information contained in our Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission (the “SEC”) on February 9, 2024 (the “Quarterly Report”). Accordingly, we have attached the Quarterly Report to this prospectus supplement.

The Prospectus and this prospectus supplement relate to the offer and sale, from time to time, of up to 13,218,453 of our common shares (the “Shares”) by the selling securityholders listed in the section of the Prospectus entitled “Selling Securityholders” (the “Selling Securityholders”). The Shares were issued to the Selling Securityholders (i) on May 17, 2022 and May 25, 2022 pursuant to an Option Agreement, dated as of May 17, 2022, by and among us, Canopy Oak LLC (“Canopy Oak”), Lemurian, Inc., a California corporation, and the other parties thereto; (ii) on May 17, 2022 pursuant to an Option Agreement, dated as of May 17, 2022, by and among Canopy Oak and the other parties thereto; and (iii) on November 4, 2022 and March 17, 2023 pursuant to the Third Amendment to Tax Receivable Agreement, dated as of October 24, 2022, by and among us, Canopy USA, LLC, a Delaware limited liability company, Acreage Holdings America, Inc., a Nevada corporation, High Street Capital Partners, LLC, a Delaware limited liability company (“HSCP”), and certain members of HSCP.

Investing in our common shares (“Common Shares”) involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Item 1A. Risk Factors” beginning on page 29 of our Annual Report on Form 10-K for the year ended March 31, 2023 (the “Annual Report”), which is incorporated by reference in the Prospectus, as well as the risk factors discussed in the periodic reports and other documents we file from time to time with the SEC and with applicable Canadian securities regulators, and which we incorporate into the Prospectus by reference. See also “Risk Factors” beginning on page 6 of the Prospectus.

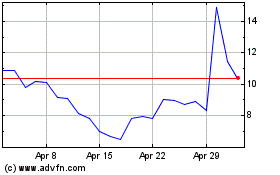

Our Common Shares are listed and posted for trading on the Toronto Stock Exchange under the symbol “WEED” and on the Nasdaq Global Select Market under the symbol “CGC.” On February 8, 2024, the closing price of our Common Shares on the Nasdaq Global Select Market was US$4.11 per share.

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is February 9, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

|

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended December 31, 2023

OR

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-38496

Canopy Growth Corporation

(Exact name of registrant as specified in its charter)

|

|

Canada |

N/A |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer

Identification No.) |

1 Hershey Drive Smiths Falls, Ontario |

K7A 0A8 |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (855) 558-9333

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common shares, no par value |

|

CGC |

|

NASDAQ Global Select Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

Large accelerated filer |

|

☒ |

|

Accelerated filer |

|

☐ |

|

|

|

|

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

☐ |

|

|

|

|

|

|

|

Emerging growth company |

|

☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of February 7, 2024, there were 91,114,604 common shares of the registrant issued and outstanding.

Table of Contents

Unless otherwise noted or the context indicates otherwise, references in this Quarterly Report on Form 10-Q (“Quarterly Report”) to the “Company,” “Canopy Growth,” “we,” “us” and “our” refer to Canopy Growth Corporation and its direct and indirect wholly-owned subsidiaries; the term “cannabis” means the plant of any species or subspecies of genus Cannabis and any part of that plant, including all derivatives, extracts, cannabinoids, isomers, acids, salts, and salts of isomers; and the term “U.S. hemp” has the meaning given to the term “hemp” in the U.S. Agricultural Improvement Act of 2018 (the “2018 Farm Bill”), including hemp-derived cannabidiol (“CBD”).

This Quarterly Report contains references to our trademarks and trade names and to trademarks and trade names belonging to other entities. Solely for convenience, trademarks and trade names referred to in this Quarterly Report may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend our use or display of other companies’ trademarks or trade names to imply a relationship with, or endorsement or sponsorship of us or our business by, any other companies.

All currency amounts in this Quarterly Report are stated in Canadian dollars, which is our reporting currency, unless otherwise noted. All references to “dollars” or “CDN$” are to Canadian dollars and all references to “US$” are to U.S. dollars.

i

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements.

CANOPY GROWTH CORPORATION

CONDENSED INTERIM CONSOLIDATED BALANCE SHEETS

(in thousands of Canadian dollars, except number of shares and per share data, unaudited)

|

|

|

|

|

|

|

|

|

|

|

December 31,

2023 |

|

|

March 31,

2023 |

|

ASSETS |

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

142,745 |

|

|

$ |

667,693 |

|

Short-term investments |

|

|

43,436 |

|

|

|

105,526 |

|

Restricted short-term investments |

|

|

7,275 |

|

|

|

11,765 |

|

Amounts receivable, net |

|

|

63,924 |

|

|

|

68,459 |

|

Inventory |

|

|

86,917 |

|

|

|

83,230 |

|

Assets of discontinued operations |

|

|

29,401 |

|

|

|

116,291 |

|

Prepaid expenses and other assets |

|

|

23,582 |

|

|

|

24,290 |

|

Total current assets |

|

|

397,280 |

|

|

|

1,077,254 |

|

Other financial assets |

|

|

392,324 |

|

|

|

568,292 |

|

Property, plant and equipment |

|

|

340,479 |

|

|

|

471,271 |

|

Intangible assets |

|

|

119,072 |

|

|

|

160,750 |

|

Goodwill |

|

|

85,237 |

|

|

|

85,563 |

|

Noncurrent assets of discontinued operations |

|

|

- |

|

|

|

56,569 |

|

Other assets |

|

|

25,359 |

|

|

|

19,996 |

|

Total assets |

|

$ |

1,359,751 |

|

|

$ |

2,439,695 |

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

25,837 |

|

|

$ |

31,835 |

|

Other accrued expenses and liabilities |

|

|

49,775 |

|

|

|

53,743 |

|

Current portion of long-term debt and convertible debentures |

|

|

91,336 |

|

|

|

556,890 |

|

Liabilities of discontinued operations |

|

|

- |

|

|

|

67,624 |

|

Other liabilities |

|

|

54,397 |

|

|

|

93,750 |

|

Total current liabilities |

|

|

221,345 |

|

|

|

803,842 |

|

Long-term debt |

|

|

520,738 |

|

|

|

749,991 |

|

Noncurrent liabilities of discontinued operations |

|

|

- |

|

|

|

3,417 |

|

Other liabilities |

|

|

73,005 |

|

|

|

122,423 |

|

Total liabilities |

|

|

815,088 |

|

|

|

1,679,673 |

|

Commitments and contingencies |

|

|

|

|

|

|

Canopy Growth Corporation shareholders' equity: |

|

|

|

|

|

|

Common shares - $nil par value; Authorized - unlimited number of shares;

Issued and outstanding - 82,931,963 shares and 51,730,555 shares, respectively1 |

|

|

8,219,747 |

|

|

|

7,938,571 |

|

Additional paid-in capital |

|

|

2,578,519 |

|

|

|

2,506,485 |

|

Accumulated other comprehensive loss |

|

|

(16,049 |

) |

|

|

(13,860 |

) |

Deficit |

|

|

(10,237,693 |

) |

|

|

(9,672,761 |

) |

Total Canopy Growth Corporation shareholders' equity |

|

|

544,524 |

|

|

|

758,435 |

|

Noncontrolling interests |

|

|

139 |

|

|

|

1,587 |

|

Total shareholders' equity |

|

|

544,663 |

|

|

|

760,022 |

|

Total liabilities and shareholders' equity |

|

$ |

1,359,751 |

|

|

$ |

2,439,695 |

|

1 Prior year share amounts have been retrospectively adjusted to reflect the Share Consolidation (as defined below), which became effective on December 15, 2023. See Note 2 for details.

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

1

CANOPY GROWTH CORPORATION

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE LOSS

(in thousands of Canadian dollars, except number of shares and per share data, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended December 31, |

|

|

Nine months ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

(As Restated) |

|

|

|

|

|

(As Restated) |

|

Revenue |

|

$ |

90,061 |

|

|

$ |

96,986 |

|

|

$ |

260,781 |

|

|

$ |

302,397 |

|

Excise taxes |

|

|

11,556 |

|

|

|

12,136 |

|

|

|

36,423 |

|

|

|

37,379 |

|

Net revenue |

|

|

78,505 |

|

|

|

84,850 |

|

|

|

224,358 |

|

|

|

265,018 |

|

Cost of goods sold |

|

|

50,279 |

|

|

|

79,622 |

|

|

|

158,944 |

|

|

|

264,226 |

|

Gross margin |

|

|

28,226 |

|

|

|

5,228 |

|

|

|

65,414 |

|

|

|

792 |

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

|

54,436 |

|

|

|

89,604 |

|

|

|

174,810 |

|

|

|

271,425 |

|

Share-based compensation |

|

|

3,693 |

|

|

|

6,055 |

|

|

|

10,127 |

|

|

|

20,893 |

|

Loss on asset impairment and restructuring |

|

|

30,413 |

|

|

|

22,259 |

|

|

|

2,452 |

|

|

|

1,794,212 |

|

Total operating expenses |

|

|

88,542 |

|

|

|

117,918 |

|

|

|

187,389 |

|

|

|

2,086,530 |

|

Operating loss from continuing operations |

|

|

(60,316 |

) |

|

|

(112,690 |

) |

|

|

(121,975 |

) |

|

|

(2,085,738 |

) |

Other income (expense), net |

|

|

(171,037 |

) |

|

|

(115,490 |

) |

|

|

(253,270 |

) |

|

|

(396,074 |

) |

Loss from continuing operations before income taxes |

|

|

(231,353 |

) |

|

|

(228,180 |

) |

|

|

(375,245 |

) |

|

|

(2,481,812 |

) |

Income tax recovery (expense) |

|

|

1,077 |

|

|

|

1,336 |

|

|

|

(13,762 |

) |

|

|

(10,633 |

) |

Net loss from continuing operations |

|

|

(230,276 |

) |

|

|

(226,844 |

) |

|

|

(389,007 |

) |

|

|

(2,492,445 |

) |

Discontinued operations, net of income tax |

|

|

13,479 |

|

|

|

(37,532 |

) |

|

|

(194,451 |

) |

|

|

(169,492 |

) |

Net loss |

|

|

(216,797 |

) |

|

|

(264,376 |

) |

|

|

(583,458 |

) |

|

|

(2,661,937 |

) |

Net loss from continuing operations attributable to

noncontrolling interests and redeemable noncontrolling

interest |

|

|

- |

|

|

|

(542 |

) |

|

|

- |

|

|

|

(1,336 |

) |

Discontinued operations attributable to noncontrolling

interests and redeemable noncontrolling interest |

|

|

- |

|

|

|

(4,369 |

) |

|

|

(18,526 |

) |

|

|

(22,523 |

) |

Net loss attributable to Canopy Growth Corporation |

|

$ |

(216,797 |

) |

|

$ |

(259,465 |

) |

|

$ |

(564,932 |

) |

|

$ |

(2,638,078 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted loss per share1 |

|

|

|

|

|

|

|

|

|

|

|

|

Continuing operations |

|

$ |

(2.78 |

) |

|

$ |

(4.66 |

) |

|

$ |

(5.56 |

) |

|

$ |

(54.96 |

) |

Discontinued operations |

|

|

0.16 |

|

|

|

(0.68 |

) |

|

|

(2.52 |

) |

|

|

(3.24 |

) |

Basic and diluted loss per share |

|

$ |

(2.62 |

) |

|

$ |

(5.34 |

) |

|

$ |

(8.08 |

) |

|

$ |

(58.20 |

) |

Basic and diluted weighted average common shares

outstanding1 |

|

|

82,919,190 |

|

|

|

48,611,260 |

|

|

|

69,918,744 |

|

|

|

45,323,788 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss from continuing operations |

|

$ |

(230,276 |

) |

|

$ |

(226,844 |

) |

|

$ |

(389,007 |

) |

|

$ |

(2,492,445 |

) |

Other comprehensive income (loss), net of income tax |

|

|

|

|

|

|

|

|

|

|

|

|

Fair value changes of own credit risk of financial liabilities |

|

|

(1,354 |

) |

|

|

4,538 |

|

|

|

(13,824 |

) |

|

|

32,847 |

|

Foreign currency translation |

|

|

10,104 |

|

|

|

14,921 |

|

|

|

575 |

|

|

|

24,694 |

|

Total other comprehensive income (loss), net of income tax |

|

|

8,750 |

|

|

|

19,459 |

|

|

|

(13,249 |

) |

|

|

57,541 |

|

Comprehensive loss from continuing operations |

|

|

(221,526 |

) |

|

|

(207,385 |

) |

|

|

(402,256 |

) |

|

|

(2,434,904 |

) |

Comprehensive income (loss) from discontinued operations |

|

|

13,479 |

|

|

|

(37,532 |

) |

|

|

(194,451 |

) |

|

|

(169,492 |

) |

Comprehensive loss |

|

|

(208,047 |

) |

|

|

(244,917 |

) |

|

|

(596,707 |

) |

|

|

(2,604,396 |

) |

Comprehensive loss from continuing operations

attributable to noncontrolling interests and

redeemable noncontrolling interest |

|

|

- |

|

|

|

(542 |

) |

|

|

- |

|

|

|

(1,336 |

) |

Comprehensive loss from discontinued operations

attributable to noncontrolling interests and redeemable

noncontrolling interest |

|

|

- |

|

|

|

(4,369 |

) |

|

|

(18,526 |

) |

|

|

(22,523 |

) |

Comprehensive loss attributable to Canopy Growth

Corporation |

|

$ |

(208,047 |

) |

|

$ |

(240,006 |

) |

|

$ |

(578,181 |

) |

|

$ |

(2,580,537 |

) |

1 Prior year share and per share amounts have been retrospectively adjusted to reflect the Share Consolidation, which became effective on December 15, 2023. See Note 2 for details.

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

2

CANOPY GROWTH CORPORATION

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

(in thousands of Canadian dollars, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended December 31, 2023 |

|

|

|

|

|

|

Additional paid-in capital |

|

|

Accumulated |

|

|

|

|

|

|

|

|

|

|

|

|

Common shares |

|

|

Share-based reserve |

|

|

Warrants |

|

|

Ownership changes |

|

|

Redeemable noncontrolling interest |

|

|

other comprehensive income (loss) |

|

|

Deficit |

|

|

Noncontrolling interests |

|

|

Total |

|

Balance at September 30, 2023 |

|

$ |

8,219,846 |

|

|

$ |

507,358 |

|

|

$ |

2,590,765 |

|

|

$ |

(522,949 |

) |

|

$ |

- |

|

|

$ |

(24,799 |

) |

|

$ |

(10,020,896 |

) |

|

$ |

139 |

|

|

$ |

749,464 |

|

Other issuances of common

shares and warrants |

|

|

(447 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(447 |

) |

Share-based compensation |

|

|

- |

|

|

|

3,693 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

3,693 |

|

Issuance and vesting of

restricted share units and

performance share units |

|

|

348 |

|

|

|

(348 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

Comprehensive loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

8,750 |

|

|

|

(216,797 |

) |

|

|

- |

|

|

|

(208,047 |

) |

Balance at December 31, 2023 |

|

$ |

8,219,747 |

|

|

$ |

510,703 |

|

|

$ |

2,590,765 |

|

|

$ |

(522,949 |

) |

|

$ |

- |

|

|

$ |

(16,049 |

) |

|

$ |

(10,237,693 |

) |

|

$ |

139 |

|

|

$ |

544,663 |

|

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

3

CANOPY GROWTH CORPORATION

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

(in thousands of Canadian dollars, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine months ended December 31, 2023 |

|

|

|

|

|

|

Additional paid-in capital |

|

|

Accumulated |

|

|

|

|

|

|

|

|

|

|

|

|

Common shares |

|

|

Share-based reserve |

|

|

Warrants |

|

|

Ownership changes |

|

|

Redeemable noncontrolling interest |

|

|

other comprehensive income (loss) |

|

|

Deficit |

|

|

Noncontrolling interests |

|

|

Total |

|

Balance at March 31, 2023 |

|

$ |

7,938,571 |

|

|

$ |

498,150 |

|

|

$ |

2,581,788 |

|

|

$ |

(521,961 |

) |

|

$ |

(51,492 |

) |

|

$ |

(13,860 |

) |

|

$ |

(9,672,761 |

) |

|

$ |

1,587 |

|

|

$ |

760,022 |

|

Private Placement, net of

issuance costs |

|

|

12,836 |

|

|

|

9,820 |

|

|

|

8,977 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

31,633 |

|

Other issuances of common

shares and warrants |

|

|

252,576 |

|

|

|

(80 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

11,060 |

|

|

|

- |

|

|

|

- |

|

|

|

263,556 |

|

Exercise of Previous Equity

Incentive Plan stock options |

|

|

165 |

|

|

|

(165 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

Share-based compensation |

|

|

- |

|

|

|

10,127 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

10,127 |

|

Issuance and vesting of

restricted share units and

performance share units |

|

|

7,149 |

|

|

|

(7,149 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

Changes in redeemable

noncontrolling interest |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(18,526 |

) |

|

|

- |

|

|

|

- |

|

|

|

18,526 |

|

|

|

- |

|

Ownership changes relating to

noncontrolling interests, net |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

70,018 |

|

|

|

- |

|

|

|

- |

|

|

|

(1,436 |

) |

|

|

68,582 |

|

Redemption of redeemable

noncontrolling interest |

|

|

8,450 |

|

|

|

- |

|

|

|

- |

|

|

|

(988 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(12 |

) |

|

|

7,450 |

|

Comprehensive loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(13,249 |

) |

|

|

(564,932 |

) |

|

|

(18,526 |

) |

|

|

(596,707 |

) |

Balance at December 31, 2023 |

|

$ |

8,219,747 |

|

|

$ |

510,703 |

|

|

$ |

2,590,765 |

|

|

$ |

(522,949 |

) |

|

$ |

- |

|

|

$ |

(16,049 |

) |

|

$ |

(10,237,693 |

) |

|

$ |

139 |

|

|

$ |

544,663 |

|

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

4

CANOPY GROWTH CORPORATION

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

(in thousands of Canadian dollars, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended December 31, 2022 |

|

|

|

|

|

|

Additional paid-in capital |

|

|

Accumulated |

|

|

|

|

|

|

|

|

|

|

|

|

Common shares |

|

|

Share-based reserve |

|

|

Warrants |

|

|

Ownership changes |

|

|

Redeemable noncontrolling interest |

|

|

other comprehensive income (loss) |

|

|

Deficit |

|

|

Noncontrolling interests |

|

|

Total |

|

Balance at September 30, 2022

(As Restated) |

|

$ |

7,818,089 |

|

|

$ |

501,455 |

|

|

$ |

2,581,788 |

|

|

$ |

(505,000 |

) |

|

$ |

(40,140 |

) |

|

$ |

(33,707 |

) |

|

$ |

(8,773,216 |

) |

|

$ |

2,956 |

|

|

$ |

1,552,225 |

|

Other issuances of common

shares and warrants |

|

|

22,009 |

|

|

|

(1,379 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

20,630 |

|

Share-based compensation |

|

|

- |

|

|

|

6,054 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

6,054 |

|

Issuance and vesting of

restricted share units and

performance share units |

|

|

706 |

|

|

|

(706 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

Changes in redeemable

noncontrolling interest |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

22,439 |

|

|

|

- |

|

|

|

- |

|

|

|

4,911 |

|

|

|

27,350 |

|

Ownership changes relating to

noncontrolling interests, net |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1,392 |

|

|

|

1,392 |

|

Redemption of redeemable

noncontrolling interest |

|

|

26,506 |

|

|

|

- |

|

|

|

- |

|

|

|

(2,696 |

) |

|

|

(27,350 |

) |

|

|

- |

|

|

|

- |

|

|

|

(1,552 |

) |

|

|

(5,092 |

) |

Comprehensive loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

19,459 |

|

|

|

(259,465 |

) |

|

|

(4,911 |

) |

|

|

(244,917 |

) |

Balance at December 31, 2022

(As Restated) |

|

$ |

7,867,310 |

|

|

$ |

505,424 |

|

|

$ |

2,581,788 |

|

|

$ |

(507,696 |

) |

|

$ |

(45,051 |

) |

|

$ |

(14,248 |

) |

|

$ |

(9,032,681 |

) |

|

$ |

2,796 |

|

|

$ |

1,357,642 |

|

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

5

CANOPY GROWTH CORPORATION

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

(in thousands of Canadian dollars, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine months ended December 31, 2022 |

|

|

|

|

|

|

Additional paid-in capital |

|

|

Accumulated |

|

|

|

|

|

|

|

|

|

|

|

|

Common shares |

|

|

Share-based reserve |

|

|

Warrants |

|

|

Ownership changes |

|

|

Redeemable noncontrolling interest |

|

|

other comprehensive income (loss) |

|

|

Deficit |

|

|

Noncontrolling interests |

|

|

Total |

|

Balance at March 31, 2022

(As Restated) |

|

$ |

7,482,809 |

|

|

$ |

492,041 |

|

|

$ |

2,581,788 |

|

|

$ |

(509,723 |

) |

|

$ |

(42,860 |

) |

|

$ |

(42,282 |

) |

|

$ |

(6,378,199 |

) |

|

$ |

4,341 |

|

|

$ |

3,587,915 |

|

Cumulative effect from adoption

of ASU 2020-06 |

|

|

- |

|

|

|

4,452 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(729 |

) |

|

|

- |

|

|

|

3,723 |

|

Other issuances of common

shares and warrants |

|

|

82,231 |

|

|

|

(1,732 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

80,499 |

|

Exercise of Previous Equity

Incentive Plan stock options |

|

|

1,506 |

|

|

|

(1,236 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

270 |

|

Share-based compensation |

|

|

- |

|

|

|

20,892 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

20,892 |

|

Issuance and vesting of restricted

share units |

|

|

8,993 |

|

|

|

(8,993 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

Changes in redeemable

noncontrolling interest |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

4,723 |

|

|

|

25,159 |

|

|

|

- |

|

|

|

- |

|

|

|

22,015 |

|

|

|

51,897 |

|

Ownership changes relating to

noncontrolling interests, net |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1,851 |

|

|

|

1,851 |

|

Redemption of redeemable

noncontrolling interest |

|

|

26,506 |

|

|

|

- |

|

|

|

- |

|

|

|

(2,696 |

) |

|

|

(27,350 |

) |

|

|

- |

|

|

|

(15,675 |

) |

|

|

(1,552 |

) |

|

|

(20,767 |

) |

Settlement of unsecured

senior notes |

|

|

265,265 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(29,507 |

) |

|

|

- |

|

|

|

- |

|

|

|

235,758 |

|

Comprehensive income (loss) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

57,541 |

|

|

|

(2,638,078 |

) |

|

|

(23,859 |

) |

|

|

(2,604,396 |

) |

Balance at December 31, 2022

(As Restated) |

|

$ |

7,867,310 |

|

|

$ |

505,424 |

|

|

$ |

2,581,788 |

|

|

$ |

(507,696 |

) |

|

$ |

(45,051 |

) |

|

$ |

(14,248 |

) |

|

$ |

(9,032,681 |

) |

|

$ |

2,796 |

|

|

$ |

1,357,642 |

|

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

6

CANOPY GROWTH CORPORATION

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands of Canadian dollars, unaudited)

|

|

|

|

|

|

|

|

|

|

|

Nine months ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

(As Restated) |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(583,458 |

) |

|

$ |

(2,661,937 |

) |

Loss from discontinued operations, net of income tax |

|

|

(194,451 |

) |

|

|

(169,492 |

) |

Net loss from continuing operations |

|

|

(389,007 |

) |

|

|

(2,492,445 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

Depreciation of property, plant and equipment |

|

|

22,485 |

|

|

|

42,674 |

|

Amortization of intangible assets |

|

|

19,396 |

|

|

|

18,058 |

|

Share-based compensation |

|

|

10,127 |

|

|

|

20,893 |

|

(Gain) loss on asset impairment and restructuring |

|

|

(816 |

) |

|

|

1,797,854 |

|

Income tax expense |

|

|

13,762 |

|

|

|

10,633 |

|

Non-cash fair value adjustments and charges related to

settlement of unsecured senior notes |

|

|

188,452 |

|

|

|

325,742 |

|

Change in operating assets and liabilities, net of effects from

purchases of businesses: |

|

|

|

|

|

|

Amounts receivable |

|

|

(14,460 |

) |

|

|

13,143 |

|

Inventory |

|

|

(8,047 |

) |

|

|

(92 |

) |

Prepaid expenses and other assets |

|

|

(843 |

) |

|

|

(2,665 |

) |

Accounts payable and accrued liabilities |

|

|

891 |

|

|

|

(19,084 |

) |

Other, including non-cash foreign currency |

|

|

(47,901 |

) |

|

|

(13,501 |

) |

Net cash used in operating activities - continuing operations |

|

|

(205,961 |

) |

|

|

(298,790 |

) |

Net cash used in operating activities - discontinued operations |

|

|

(53,930 |

) |

|

|

(119,019 |

) |

Net cash used in operating activities |

|

|

(259,891 |

) |

|

|

(417,809 |

) |

Cash flows from investing activities: |

|

|

|

|

|

|

Purchases of and deposits on property, plant and equipment |

|

|

(3,200 |

) |

|

|

(6,176 |

) |

Purchases of intangible assets |

|

|

(716 |

) |

|

|

(1,265 |

) |

Proceeds on sale of property, plant and equipment |

|

|

153,753 |

|

|

|

10,894 |

|

Redemption of short-term investments |

|

|

68,294 |

|

|

|

415,322 |

|

Net cash (outflow) proceeds on sale of subsidiaries |

|

|

(3,719 |

) |

|

|

12,432 |

|

Investment in other financial assets |

|

|

(472 |

) |

|

|

(67,186 |

) |

Other investing activities |

|

|

(9,234 |

) |

|

|

2,051 |

|

Net cash provided by investing activities - operating activities |

|

|

204,706 |

|

|

|

366,072 |

|

Net cash used in investing activities - discontinued operations |

|

|

(2,600 |

) |

|

|

(23,947 |

) |

Net cash provided by investing activities |

|

|

202,106 |

|

|

|

342,125 |

|

Cash flows from financing activities: |

|

|

|

|

|

|

Proceeds from issuance of common shares and warrants |

|

|

33,795 |

|

|

|

856 |

|

Proceeds from exercise of stock options |

|

|

- |

|

|

|

270 |

|

Repayment of long-term debt |

|

|

(480,080 |

) |

|

|

(117,951 |

) |

Other financing activities |

|

|

(27,239 |

) |

|

|

(29,096 |

) |

Net cash used in financing activities |

|

|

(473,524 |

) |

|

|

(145,921 |

) |

Effect of exchange rate changes on cash and cash equivalents |

|

|

(2,953 |

) |

|

|

43,731 |

|

Net decrease in cash and cash equivalents |

|

|

(534,262 |

) |

|

|

(177,874 |

) |

Cash and cash equivalents, beginning of period1 |

|

|

677,007 |

|

|

|

776,005 |

|

Cash and cash equivalents, end of period2 |

|

$ |

142,745 |

|

|

$ |

598,131 |

|

1 Includes cash of our discontinued operations of $9,314 and $13,610 for March 31, 2023 and 2022, respectively.

2 Includes cash of our discontinued operations of $nil and $13,261 for December 31, 2023 and 2022, respectively.

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

7

CANOPY GROWTH CORPORATION

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands of Canadian dollars, unaudited)

|

|

|

|

|

|

|

|

|

|

|

Nine months ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

Supplemental disclosure of cash flow information |

|

|

|

|

|

|

Cash received during the period: |

|

|

|

|

|

|

Income taxes |

|

$ |

4,002 |

|

|

$ |

4,709 |

|

Interest |

|

$ |

14,230 |

|

|

$ |

20,140 |

|

Cash paid during the period: |

|

|

|

|

|

|

Income taxes |

|

$ |

1,551 |

|

|

$ |

1,099 |

|

Interest |

|

$ |

80,108 |

|

|

$ |

95,267 |

|

Noncash investing and financing activities |

|

|

|

|

|

|

Additions to property, plant and equipment |

|

$ |

199 |

|

|

$ |

425 |

|

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

8

CANOPY GROWTH CORPORATION

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

(in thousands of Canadian dollars, unaudited, unless otherwise indicated)

1. DESCRIPTION OF BUSINESS

Canopy Growth Corporation is a publicly traded corporation, incorporated in Canada, with its head office located at 1 Hershey Drive, Smiths Falls, Ontario. References herein to “Canopy Growth” or “the Company” refer to Canopy Growth Corporation and its subsidiaries.

The principal activities of the Company are the production, distribution and sale of a diverse range of cannabis and cannabinoid-based products for both adult-use and medical purposes under a portfolio of distinct brands in Canada pursuant to the Cannabis Act, SC 2018, c 16 (the "Cannabis Act"), which came into effect on October 17, 2018 and regulates both the medical and adult-use cannabis markets in Canada. The Company has also expanded to jurisdictions outside of Canada where cannabis and/or hemp is federally lawful, permissible and regulated, and the Company, through its subsidiaries, operates in the United States, Australia, Germany, and certain other global markets. Additionally, the Company produces, distributes and sells vaporizers and similar cannabis accessories.

2. BASIS OF PRESENTATION

These condensed interim consolidated financial statements have been presented in Canadian dollars and are prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). Canopy Growth has determined that the Canadian dollar is the most relevant and appropriate reporting currency as, despite continuing shifts in the relative size of the Company's operations across multiple geographies, the majority of its operations are conducted in Canadian dollars and its financial results are prepared and reviewed internally by management in Canadian dollars. The Company's condensed interim consolidated financial statements, and the financial information contained herein, are reported in thousands of Canadian dollars, except share and per share amounts or as otherwise stated.

Certain information and footnote disclosures normally included in the audited annual consolidated financial statements prepared in accordance with U.S. GAAP have been omitted or condensed. These condensed interim consolidated financial statements should be read in conjunction with the audited consolidated financial statements included in the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2023 (the “Annual Report”) and have been prepared on a basis consistent with the accounting policies as described in the Annual Report.

These condensed interim consolidated financial statements are unaudited and reflect adjustments (consisting of normal recurring adjustments) that are, in the opinion of management, necessary to provide a fair statement of results for the interim periods in accordance with U.S. GAAP.

The results reported in these condensed interim consolidated financial statements should not be regarded as necessarily indicative of results that may be expected for an entire fiscal year. The policies set out below are consistently applied to all periods presented, unless otherwise noted.

Going Concern

The condensed interim consolidated financial statements have been prepared in accordance with generally accepted accounting principles on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business.

As reflected in the condensed interim consolidated financial statements, the Company has certain material debt obligations coming due in the short-term, has suffered recurring losses from operations and requires additional financing to fund its business and operations. If the Company is unable to raise additional capital, it is possible that it will be unable to meet certain of its financial obligations.

These matters, when considered in the aggregate, raise substantial doubt about the Company’s ability to continue as a going concern for at least twelve months from the issuance of these condensed interim consolidated financial statements.

In view of these matters, continuation as a going concern is dependent upon continued operations of the Company, which in turn is dependent upon the Company’s ability to meet its financial requirements and to raise additional capital, and the success of its future operations. The condensed interim consolidated financial statements do not include any adjustments to the amount and classification of assets and liabilities that may be necessary should the Company not continue as a going concern.

Management plans to fund the operations and debt obligations of the Company through existing cash positions. The Company is also currently evaluating several different strategies and intends to pursue actions that are expected to increase its liquidity position, including, but not limited to, pursuing additional actions under the Company's cost-savings plan, seeking additional financing from both the public and private markets through the issuance of equity and/or debt securities, and monetizing additional assets.

9

The Company's management cannot provide assurances that the Company will be successful in accomplishing any of its proposed financing plans. Management also cannot provide any assurance as to unforeseen circumstances that could occur within the next twelve months or, if the Company raises capital, thereafter, which could increase the Company’s need to raise additional capital on an immediate basis, which capital may not be available to the Company.

Principles of consolidation

These condensed interim consolidated financial statements include the accounts of the Company and all entities in which the Company either has a controlling voting interest or is the primary beneficiary of a variable interest entity. All intercompany accounts and transactions have been eliminated on consolidation. Information on the Company’s subsidiaries with noncontrolling interests is included in Note 22.

Use of estimates

The preparation of these condensed interim consolidated financial statements and notes in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported. Actual results could differ from those estimates.

Share Consolidation

On December 13, 2023, the Company announced that the Company’s board of directors (the “Board”) had approved the consolidation of the Company’s issued and outstanding common shares on the basis of one post-consolidation common share for every 10 pre-consolidation common shares (the “Share Consolidation”). The Share Consolidation was implemented to ensure that the Company continues to comply with the listing requirements of the Nasdaq Global Select Market.

The Share Consolidation was approved by the Company’s shareholders at the annual general and special meeting of shareholders held on September 25, 2023. The Share Consolidation became effective on December 15, 2023. No fractional common shares were issued in connection with the Share Consolidation. Any fractional common shares arising from the Share Consolidation were deemed to have been tendered by its registered owner to the Company for cancellation for no consideration. In addition, the exercise or conversion price and/or the number of common shares issuable under any of the Company’s outstanding convertible securities, were proportionately adjusted in connection with the Share Consolidation.

All issued and outstanding common shares, per share amounts, and outstanding equity instruments and awards exercisable into common shares, as well as the exchange ratios for the Fixed Shares (as defined below) and the Floating Shares (as defined below) in connection with the Acreage Amending Arrangement and the Floating Share Arrangement (as defined below), respectively, contained in the condensed interim consolidated financial statements of the Company and notes thereto have been retroactively adjusted to reflect the Share Consolidation for all prior periods presented.

New accounting policies

Recently Adopted Accounting Pronouncements

Convertible Instruments and Contracts in an Entity’s Own Equity

In August 2020, the Financial Accounting Standards Board (the "FASB") issued ASU 2020-06, Debt—Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging—Contracts in Entity’s Own Equity (Subtopic 815-40):Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity (“ASU 2020-06”), which simplifies the accounting for convertible instruments by removing the separation models for convertible debt instruments and convertible preferred stock with (1) cash conversion features, and (2) beneficial conversion features. In addition, ASU 2020-06 enhances information transparency by making targeted improvements to the disclosures for convertible instruments and earnings-per-share guidance and amends the guidance for the derivatives scope exception for contracts in an entity’s own equity to reduce form-over-substance-based accounting conclusions.

The Company adopted the guidance on April 1, 2022, using the modified retrospective approach with the cumulative effect recognized as an adjustment to the opening deficit balance, and, accordingly, prior period balances and disclosures have not been restated. Upon adoption of ASU 2020-06, the Supreme Debentures (as defined below) will be accounted for under the separation model for a substantial premium instead of a beneficial conversion feature resulting in an increased debt discount to be amortized over the life of the instrument. The adoption of this guidance resulted in increased additional paid-in capital by $4,452, decreased long-term debt by $3,723, and decreased accumulated deficit by $729 for non-cash accretion expense prior to April 1, 2022.

10

Accounting Guidance Not Yet Adopted

Segment Reporting

In November 2023, the FASB issued ASU 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures (“ASU 2023-07”), which expands reportable segment disclosure requirements, primarily through enhanced disclosures about significant segment expenses that are regularly provided to the chief operating decision maker and included within each reported measure of segment profit or loss. ASU 2023-07 is effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024. The Company is evaluating the impact on the consolidated financial statements and expects to implement the provisions of ASU 2023-07 for our fiscal year ending March 31, 2025.

Income Taxes

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures (“ASU 2023-09”), which enhances income tax disclosures, primarily through changes to the rate reconciliation and disaggregation of income taxes paid. ASU 2023-09 is effective for annual periods beginning after December 15, 2024, with early adoption permitted. The Company is evaluating the impact on the consolidated financial statements and expects to implement the provisions of ASU 2023-09 for our fiscal year ending March 31, 2026.

3. CANOPY USA

Reorganization - Creation of Canopy USA

On October 24, 2022, Canopy Growth completed a number of strategic transactions in connection with the creation of Canopy USA, LLC ("Canopy USA"), a new U.S.-domiciled holding company (the “Reorganization”). Following the implementation of the Reorganization, Canopy USA, as of October 24, 2022, holds certain U.S. cannabis investments previously held by Canopy Growth, which is expected to enable Canopy USA, following, among other things, the Meeting (as defined below) and the exercise of the Acreage Option (as defined below), including the issuance of the Fixed Shares to Canopy USA, to consummate the acquisitions of Acreage Holdings, Inc. ("Acreage"), Mountain High Products, LLC, Wana Wellness, LLC and The Cima Group, LLC (collectively, "Wana" and each, a "Wana Entity"), and Lemurian, Inc. ("Jetty"). There were no changes recorded in the estimated fair values of the U.S. cannabis investments described below upon implementation of the Reorganization, and their transfer from Canopy Growth to Canopy USA.

Following the implementation of the Reorganization, as of October 24, 2022, Canopy USA holds an ownership interest in the following assets, among others:

•Wana - The options to acquire 100% of the membership interests of Wana (the "Wana Options"), a leading cannabis edibles brand in North America.

•Jetty - The options to acquire 100% of the shares of Jetty (the "Jetty Options"), a California-based producer of high-quality cannabis extracts and pioneer of clean vape technology.

Canopy Growth currently retains the option to acquire the issued and outstanding Class E subordinate voting shares (the “Fixed Shares”) of Acreage (the “Acreage Option”), representing approximately 70% of the total shares of Acreage, at a fixed share exchange ratio of 0.03048 of a common share of Canopy Growth per Fixed Share. Concurrently with the closing of the acquisition of the Fixed Shares pursuant to the exercise of the Acreage Option, the Fixed Shares will be issued to Canopy USA. In addition, Canopy USA has agreed to acquire all of the issued and outstanding Class D subordinate voting shares of Acreage (the “Floating Shares”) by way of a court-approved plan of arrangement (the “Floating Share Arrangement”) in exchange for 0.045 of a common share of Canopy Growth for each Floating Share held. Acreage is a leading vertically-integrated multi-state cannabis operator, with its main operations in densely populated states across the Northeast U.S. including New Jersey and New York.

In addition, as of October 24, 2022, Canopy USA held direct and indirect interests in the capital of TerrAscend Corp. (“TerrAscend”), a leading North American cannabis operator with vertically integrated operations and a presence in Pennsylvania, New Jersey, Michigan and California as well as licensed cultivation and processing operations in Maryland. Canopy USA’s direct and indirect interests in TerrAscend included: (i) 38,890,570 exchangeable shares in the capital of TerrAscend (the “TerrAscend Exchangeable Shares”), an option to purchase 1,072,450 TerrAscend common shares (the “TerrAscend Common Shares”) for an aggregate purchase price of $1.00 (the “TerrAscend Option”) and 22,474,130 TerrAscend Common Share purchase warrants previously held by Canopy Growth (the “TerrAscend Warrants”); and (ii) the debentures and loan agreement between Canopy Growth and certain TerrAscend subsidiaries.

On December 9, 2022, Canopy USA and certain limited partnerships that are controlled by Canopy USA entered into a debt settlement agreement with TerrAscend, TerrAscend Canada Inc. and Arise BioScience, Inc., whereby $125,467 in aggregate loans, including accrued interest thereon, payable by certain subsidiaries of TerrAscend were extinguished and 22,474,130 TerrAscend Warrants, being all of the previously issued TerrAscend Warrants controlled by Canopy USA (the “Prior Warrants”) were cancelled in

11

exchange for: (i) 24,601,467 TerrAscend Exchangeable Shares at a notional price of $5.10 per TerrAscend Exchangeable Share; and (ii) 22,474,130 new TerrAscend Warrants (the "New Warrants" and, together with the TerrAscend Exchangeable Shares, the "New TerrAscend Securities") with a weighted average exercise price of $6.07 per TerrAscend Common Share and expiring on December 31, 2032. Following the issuance of the New TerrAscend Securities, Canopy USA beneficially owns: (i) 63,492,037 TerrAscend Exchangeable Shares; (ii) 22,474,130 New Warrants; and (iii) the TerrAscend Option. The TerrAscend Exchangeable Shares can be converted into TerrAscend Common Shares at Canopy USA's option, subject to the terms of the A&R Protection Agreement (as defined below).

Following the implementation of the Reorganization, Canopy USA was determined to be a variable interest entity pursuant to ASC 810 - Consolidations ("ASC 810") and prior to the completion of the Reorganization Amendments (as defined below), Canopy Growth was determined to be the primary beneficiary of Canopy USA. As a result of such determination and in accordance with ASC 810, Canopy Growth consolidated the financial results of Canopy USA.

Amendments to Canopy USA Structure

Following the creation of Canopy USA, the Nasdaq Stock Market LLC ("Nasdaq") communicated its position to the Company stating that companies that consolidate “the assets and revenues generated from activities in violation under federal law cannot continue to list on Nasdaq”. Since the Company is committed to compliance with the listing requirements of the Nasdaq, the Company and Canopy USA effectuated certain changes to the initial structure of the Company’s interest in Canopy USA that were intended to facilitate the deconsolidation of the financial results of Canopy USA within the Company’s financial statements. These changes included, among other things, modifying the terms of the Protection Agreement between the Company, its wholly-owned subsidiary and Canopy USA as well as the terms of Canopy USA’s limited liability company agreement and amending the terms of certain agreements with third-party investors in Canopy USA to eliminate any rights to guaranteed returns (collectively, the “Reorganization Amendments”).

On May 19, 2023, the Company and Canopy USA implemented the Reorganization Amendments, which included, entering into the First A&R Protection Agreement (as defined below) and amending and restating Canopy USA’s limited liability company agreement (the “A&R LLC Agreement”) in order to: (i) eliminate certain negative covenants that were previously granted by Canopy USA in favor of the Company as well as delegating to the managers of the Canopy USA Board (as defined below) not appointed by Canopy Growth the authority to approve the following key decisions (collectively, the “Key Decisions”): (a) the annual business plan of Canopy USA; (b) decisions regarding the executive officers of Canopy USA and any of its subsidiaries; (c) increasing the compensation, bonus levels or other benefits payable to any current, former or future employees or managers of Canopy USA or any of its subsidiaries; (d) any other executive compensation plan matters of Canopy USA or any of its subsidiaries; and (e) the exercise of the Wana Options or the Jetty Options, which for greater certainty means that the Company’s nominee on the Canopy USA Board will not be permitted to vote on any Key Decisions while the Company owns Non-Voting Shares (as defined below); (ii) reduce the number of managers on the Canopy USA Board from four to three, including, reducing the Company’s nomination right to a single manager; (iii) amend the share capital of Canopy USA to, among other things, (a) create a new class of Canopy USA Class B Shares (as defined below), which may not be issued prior to the conversion of the Non-Voting Shares or the Canopy USA Common Shares (as defined below) into Canopy USA Class B Shares; (b) amend the terms of the Non-Voting Shares such that the Non-Voting Shares will be convertible into Canopy USA Class B Shares (as opposed to Canopy USA Common Shares); and (c) amend the terms of the Canopy USA Common Shares such that upon conversion of all of the Non-Voting Shares into Canopy USA Class B Shares, the Canopy USA Common Shares will, subject to their terms, automatically convert into Canopy USA Class B Shares, provided that the number of Canopy USA Class B Shares to be issued to the former holders of the Canopy USA Common Shares will be equal to no less than 10% of the total issued and outstanding Canopy USA Class B Shares following such issuance. Accordingly, as a result of the Reorganization Amendments, in no circumstances will the Company, at the time of such conversions, own more than 90% of the Canopy USA Class B Shares.

In connection with the Reorganization Amendments, on May 19, 2023, Canopy USA and Huneeus 2017 Irrevocable Trust (the “Trust”) entered into a share purchase agreement (the “Trust SPA”), which sets out the terms of the Trust’s investment in Canopy USA in the aggregate amount of up to US$20 million (the "Trust Transaction"). Agustin Huneeus, Jr. is the trustee of the Trust and is an affiliate of a shareholder of Jetty. Pursuant to the terms of the Trust SPA, the Trust will, subject to certain terms and conditions contained in the Trust SPA be issued Canopy USA Common Shares in two tranches with an aggregate value of up to US$10 million along with warrants of Canopy USA to acquire additional Canopy USA Common Shares. In addition, subject to the terms of the Trust SPA, the Trust has also been granted options to acquire additional Voting Shares (as defined in the A&R LLC Agreement) with a value of up to an additional US$10 million and one such additional option includes the issuance of additional warrants of Canopy USA.

In addition, subject to the terms and conditions of the A&R Protection Agreement and the terms of the option agreements to acquire Wana and Jetty, as applicable, Canopy Growth may be required to issue additional common shares in satisfaction of certain deferred and/or option exercise payments to the shareholders of Wana and Jetty. Canopy Growth will receive additional Non-Voting Shares from Canopy USA as consideration for any Company common shares issued in the future to the shareholders of Wana and Jetty.

12

On November 3, 2023, the Company received a letter from the staff of the SEC (the “Staff”) in which the Staff indicated that, despite the Reorganization Amendments, it would object to the deconsolidation of the financial results of Canopy USA from the Company's financial statements in accordance with U.S. GAAP once Canopy USA acquires Wana, Jetty or the Fixed Shares of Acreage. The Company subsequently had discussions with the Office of Chief Accountant of the SEC (the "OCA") and determined to make certain additional amendments to the structure of Canopy USA (the “Additional Reorganization Amendments”) to facilitate the deconsolidation of Canopy USA from the financial results of Canopy Growth in accordance with U.S. GAAP upon Canopy USA’s acquisition of Wana, Jetty or Acreage. In that regard, the Company filed a revised preliminary proxy statement with the SEC on each of January 25, 2024 and February 5, 2024 in connection with the Amendment Proposal (as defined below) that discloses these Additional Reorganization Amendments. In connection with the Additional Reorganization Amendments, Canopy USA and its members expect to enter into a second amended and restated limited liability company agreement (the “Second A&R LLC Agreement”) immediately prior to the completion of the first tranche closing of the Trust Transaction. Upon the effective date of the Second A&R LLC Agreement, the terms of the Non-Voting Shares will be amended such that the Non-Voting Shares will only be convertible into Canopy USA Class B Shares following the date that the NASDAQ Stock Market or The New York Stock Exchange permit the listing of companies that consolidate the financial statements of companies that cultivate, distribute or possess marijuana (as defined in 21 U.S.C 802) in the United States (the “Triggering Event Date”). Based on the Company’s discussions with the OCA, upon effectuating the Additional Reorganization Amendments, the Company believes that the Staff would not object to the deconsolidation of the financial results of Canopy USA from the Company’s financial statements in accordance with U.S. GAAP once Canopy USA acquires Wana, Jetty or the Fixed Shares of Acreage.

Ownership of U.S. Cannabis Investments

Following the implementation of the Reorganization, the shares and interests in Acreage, Wana, Jetty and TerrAscend are held, directly or indirectly, by Canopy USA, and Canopy Growth no longer holds a direct interest in any shares or interests in such entities, other than the Acreage Option. Canopy Growth holds non-voting and non-participating shares (the “Non-Voting Shares”) in the capital of Canopy USA. The Non-Voting Shares do not carry voting rights, rights to receive dividends or other rights upon dissolution of Canopy USA. Following the Reorganization Amendments, the Non-Voting Shares are convertible into Class B shares of Canopy USA (the “Canopy USA Class B Shares”), provided that following the execution of the Second A&R LLC Agreement, such conversion shall only be permitted following the Triggering Event Date. The Company also has the right (regardless of the fact that its Non-Voting Shares are non-voting and non-participating) to appoint one member to the Canopy USA board of managers (the "Canopy USA Board").

As of December 31, 2023, a third party investor owned all of the issued and outstanding Class A shares of Canopy USA (the “Canopy USA Common Shares”) and a wholly-owned subsidiary of the Company holds Non-Voting Shares in the capital of Canopy USA, representing approximately more than 99% of the issued and outstanding shares in Canopy USA on an as-converted basis.