false0000827876CLEANSPARK, INC.00008278762024-02-082024-02-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 08, 2024 |

CleanSpark, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Nevada |

001-39187 |

87-0449945 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

10624 S. Eastern Ave. Suite A -638 |

|

Henderson, Nevada |

|

89052 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (702) 989-7692 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.001 per share |

|

CLSK |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 8, 2024, the Company announced financial results for its fiscal quarter ended December 31, 2023. The full text of the press release issued in connection with the announcement is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Item 2.02 of this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

CLEANSPARK, INC. |

|

|

|

|

Date: |

February 8, 2024 |

By: |

/s/ Gary Vecchiarelli |

|

|

|

Gary Vecchiarelli, Chief Financial Officer |

CleanSpark Reports First Quarter FY2024 Financial Results

FY2024 First Quarter Revenue of $73.8 million, net income of $25.9 million and Adjusted EBITDA of $69.1 million

Revenue grows 165% year over year

Current hashrate surpasses 12.5 EH/s

LAS VEGAS—CleanSpark, Inc. (Nasdaq: CLSK) (the "Company"), America's Bitcoin Miner™, today reported financial results for the three months ended December 31, 2023.

“This quarter's performance is a powerful reminder of what we're capable of when we channel our collective efforts towards a common goal. Importantly, it sets the stage for what's to come,” said Chief Executive Officer Zach Bradford. “In a single quarter we have covered nearly half the distance to reach our total revenue from last year. We beat all consensus estimates across the board, including revenue, EPS, and profitability. This achievement is not just a number—it's a reflection of our growing efficiency, our strategic acquisitions, and our deep commitment to smart growth. It underscores our position as leaders in the bitcoin mining industry and fortifies the trust our investors place in us. As we move forward, our eyes are set on harnessing our momentum to further accelerate our growth and continue delivering unmatched value to our stakeholders as we work to execute on our commitment of 20 exahashes per second in the first half of this year.”

“We’ve frequently emphasized the three efficiencies that we believe are imperative to our continued success, efficiency of our equipment fleet, efficiency of our facilities, and efficient use of capital. The results this quarter are the culmination of that focus,” said Chief Financial Officer Gary A. Vecchiarelli. “To present these results, to have demonstrated exponential growth, and to have secured our path to 50 exahashes per second while exceeding all market expectations is proof that the CleanSpark Way is working. I’m extremely proud of the growth that we’ve accomplished as a team. We’re well positioned for the halving, and we have the liquidity and balance sheet strength to enable us to continue to not only survive, but to thrive into the halving and beyond.”

Q1 Financial Highlights

Financial Results for the Three Months Ended December 31, 2023

•The Company increased its quarterly revenues to $73.8 million, an increase of $46.0 million, or 165% from $27.8 million for the same prior year period.

•Net income for the three months ended December 31, 2023, was $25.9 million or $0.14 basic income per share compared to a loss of ($29.0) million or ($0.46) loss per share for the same prior year period.

•Adjusted EBITDA increased to $69.1 million, reversing from ($2.0) million in the same prior year period.

Balance Sheet Highlights as of December 31, 2023

Assets

•Total Current assets: $181.7 million

•Total Mining assets (including prepaid deposits & deployed miners): $484.0 million

•Total Assets: $862.7 million

Liabilities and Stockholders' Equity

•Current Liabilities: $42.4 million

•Total Liabilities: $52.2 million

•Total Stockholders' Equity: $810.6 million

The Company had working capital of $139.3 million and $14.5 million of debt as of December 31, 2023.

Investor Conference Call and Webcast

The Company will hold its first quarter FY2024 earnings presentation and business update for investors and analysts today, February 8, 2024, at 1:30p.m. PT / 4:30p.m. ET.

Webcast URL: https://investors.cleanspark.com

The webcast will be accessible for at least 30 days on the Company's website and a transcript of the call will be available on the Company's website following the call.

About CleanSpark

CleanSpark (Nasdaq: CLSK) is America’s Bitcoin Miner™. We own and operate data centers that primarily run on low-carbon power. Our infrastructure responsibly supports Bitcoin, the world’s most important digital commodity and an essential tool for financial independence and inclusion. We cultivate trust and transparency among our employees and the communities we operate in. Visit our website at www.cleanspark.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In this press release, forward-looking statements include, but may not be limited to, statements regarding the Company’s expectations, beliefs, plans, intentions, and strategies. In some cases, you can identify forward-looking statements by terms such as "may," "will," "should," "expects," "plans," "anticipates," "could," "intends,"

"targets," "projects," "contemplates," "believes," "estimates," "forecasts," "predicts," "potential" or "continue" or the negative of these terms or other similar expressions. The forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to: the Company achieving growth or increasing growth rates; the Company achieving 20 EH/s growth targets and when growth targets will be reached; the Company achieving 50 EH/s growth targets and when growth targets will be reached; the risk that the electrical power available to our facilities decreases or does not increase as expected; the risk that electrical power price increases; the success of its digital currency mining activities; the volatile and unpredictable cycles in the emerging and evolving industries in which we operate; increasing difficulty rates for bitcoin mining; bitcoin halving; new or additional governmental regulation; the anticipated delivery dates of new miners; the ability to successfully deploy new miners; the dependency on utility rate structures and government incentive programs; dependency on third-party power providers for expansion efforts; the expectations of future revenue growth may not be realized; and other risks described in the Company's prior press releases and in its filings with the Securities and Exchange Commission (SEC), including under the heading "Risk Factors" in the Company's Annual Report on Form 10-K for the fiscal year ended September 30, 2023, and any subsequent filings with the SEC. Forward-looking statements contained herein are made only as to the date of this press release, and we assume no obligation to update or revise any forward-looking statements as a result of any new information, changed circumstances or future events or otherwise, except as required by applicable law.

Non-GAAP Measure

The Company presents adjusted EBITDA, which is not a measurement of financial performance under generally accepted accounting principles in the United States("GAAP"). The Company's non-GAAP "Adjusted EBITDA" excludes (i) impacts of interest, taxes, and depreciation; (ii) the Company's share-based compensation expense, unrealized gains/losses on securities, and, changes in the fair value of contingent consideration with respect to previously completed acquisitions, all of which are non-cash items that the Company believes are not reflective of the Company's general business performance, and for which the accounting requires management judgment, and the resulting expenses could vary significantly in comparison to other companies; (iii) non-cash impairment losses related to long-lived assets (including goodwill); (iv) realized gains and losses on sales of equity securities, the amounts of which are directly related to the unrealized gains and losses that are also excluded; (v) legal fees related to litigation and various transactions, which fees management does not believe are reflective of the Company's ongoing operating activities; (vi) gains and losses on disposal of assets, the majority of which are related to obsolete or unrepairable machines that are no longer deployed; (vii) gains and losses related to discontinued operations that would not be applicable to the Company's future business activities; and (viii) severance expenses. The Company previously excluded non-cash impairment losses related to digital assets and realized gains and losses on sales of bitcoin from our calculation of adjusted

EBITDA, but has determined such items are part of the Company's normal ongoing operations and will no longer be excluding them from our calculation of adjusted EBITDA.

We have not excluded our net gain on fair value of bitcoin ($36,041 in the quarter ended December 31, 2023), which we now record in our statement of operations, as provided for in ASC 350-60 and as discussed elsewhere in our Form 10-Q.

Management believes that providing this non-GAAP financial measure that excludes these items allows for meaningful comparisons between the Company's core business operating results and those of other companies, and provides the Company with an important tool for financial and operational decision making and for evaluating its own core business operating results over different periods of time. In addition to management's internal use of non-GAAP adjusted EBITDA, management believes that adjusted EBITDA is also useful to investors and analysts in comparing the Company's performance across reporting periods on a consistent basis. Management believes the foregoing to be the case even though some of the excluded items involve cash outlays and some of them recur on a regular basis (although management does not believe any of such items are normal operating expenses necessary to generate our bitcoin related revenues). For example, the Company expects that share-based compensation expense, which is excluded from adjusted EBITDA, will continue to be a significant recurring expense over the coming years and is an important part of the compensation provided to certain employees, officers, and directors. Additionally, management does not consider any of the excluded items to be expenses necessary to generate the Company's bitcoin related revenue.

The Company's adjusted EBITDA measure may not be directly comparable to similar measures provided by other companies in our industry, as other companies in the Company's industry may calculate non-GAAP financial results differently. The Company's adjusted EBITDA is not a measurement of financial performance under GAAP and should not be considered as an alternative to operating (loss) income or any other measure of performance derived in accordance with GAAP. Although management utilizes internally and presents adjusted EBITDA, the Company only utilizes that measure supplementally and does not consider it to be a substitute for, or superior to, the information provided by GAAP financial results.

Accordingly, adjusted EBITDA is not meant to be considered in isolation of, and should be read in conjunction with, the information contained in the Company's Consolidated Financial Statements, which have been prepared in accordance with GAAP.

CLEANSPARK, INC.

CONSOLIDATED BALANCE SHEETS

($ in thousands, except par value and share amounts)

|

|

|

|

|

|

|

|

|

|

|

December 31,

2023 |

|

|

September 30,

2023 |

|

|

|

(Unaudited) |

|

|

|

|

ASSETS |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalents, including restricted cash |

|

$ |

48,458 |

|

|

$ |

29,215 |

|

Accounts receivable, net |

|

|

— |

|

|

|

5 |

|

Inventory |

|

|

732 |

|

|

|

809 |

|

Prepaid expense and other current assets |

|

|

2,971 |

|

|

|

12,034 |

|

Bitcoin (See Note 2 and Note 5) |

|

|

126,951 |

|

|

|

56,241 |

|

Derivative investment asset |

|

|

1,454 |

|

|

|

2,697 |

|

Investment in debt security, AFS, at fair value |

|

|

755 |

|

|

|

726 |

|

Current assets held for sale |

|

|

384 |

|

|

|

445 |

|

Total current assets |

|

$ |

181,705 |

|

|

$ |

102,172 |

|

|

|

|

|

|

|

|

Property and equipment, net |

|

$ |

637,481 |

|

|

$ |

564,395 |

|

Operating lease right of use asset |

|

|

647 |

|

|

|

688 |

|

Intangible assets, net |

|

|

4,089 |

|

|

|

4,603 |

|

Deposits on miners and mining equipment |

|

|

25,048 |

|

|

|

75,959 |

|

Other long-term asset |

|

|

5,718 |

|

|

|

5,718 |

|

Goodwill |

|

|

8,043 |

|

|

|

8,043 |

|

Total assets |

|

$ |

862,731 |

|

|

$ |

761,578 |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

$ |

33,415 |

|

|

$ |

65,577 |

|

Current portion of operating lease liability |

|

|

176 |

|

|

|

181 |

|

Current portion of finance lease liability |

|

|

96 |

|

|

|

130 |

|

Current portion of long-term loans payable |

|

|

7,421 |

|

|

|

6,992 |

|

Dividends payable |

|

|

579 |

|

|

|

— |

|

Current liabilities held for sale |

|

|

706 |

|

|

|

1,175 |

|

Total current liabilities |

|

$ |

42,393 |

|

|

$ |

74,055 |

|

Long-term liabilities |

|

|

|

|

|

|

Operating lease liability, net of current portion |

|

|

474 |

|

|

|

519 |

|

Finance lease liability, net of current portion |

|

|

— |

|

|

|

9 |

|

Loans payable, net of current portion |

|

|

7,047 |

|

|

|

8,911 |

|

Deferred income taxes |

|

|

2,256 |

|

|

|

857 |

|

Total liabilities |

|

$ |

52,170 |

|

|

$ |

84,351 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' equity |

|

|

|

|

|

|

Common stock; $0.001 par value; 300,000,000 shares authorized; 185,554,611 and 160,184,921 shares issued and outstanding, respectively |

|

|

186 |

|

|

|

160 |

|

Preferred stock; $0.001 par value; 10,000,000 shares authorized; Series A shares; 2,000,000 authorized; 1,750,000 and 1,750,000 issued and outstanding, respectively |

|

|

2 |

|

|

|

2 |

|

Additional paid-in capital |

|

|

1,113,248 |

|

|

|

1,009,482 |

|

Accumulated other comprehensive income |

|

|

255 |

|

|

|

226 |

|

Accumulated deficit |

|

|

(303,130 |

) |

|

|

(332,643 |

) |

Total stockholders' equity |

|

|

810,561 |

|

|

|

677,227 |

|

|

|

|

|

|

|

|

Total liabilities and stockholders' equity |

|

$ |

862,731 |

|

|

$ |

761,578 |

|

CLEANSPARK, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(Unaudited, in thousands, except per share and share amounts)

|

|

|

|

|

|

|

|

|

|

|

For the three months ended |

|

|

|

December 31,

2023 |

|

|

December 31,

2022 |

|

Revenues, net |

|

|

|

|

|

|

Bitcoin mining revenue, net |

|

$ |

73,786 |

|

|

$ |

27,746 |

|

Other services revenue |

|

|

— |

|

|

|

73 |

|

Total revenues, net |

|

$ |

73,786 |

|

|

$ |

27,819 |

|

|

|

|

|

|

|

|

Costs and expenses |

|

|

|

|

|

|

Cost of revenues (exclusive of depreciation and amortization shown below) |

|

|

28,896 |

|

|

|

20,416 |

|

Professional fees |

|

|

1,572 |

|

|

|

2,831 |

|

Payroll expenses |

|

|

15,321 |

|

|

|

9,802 |

|

General and administrative expenses |

|

|

5,003 |

|

|

|

3,724 |

|

Loss on disposal of assets |

|

|

677 |

|

|

|

— |

|

Gain on fair value of bitcoin, net (see Note 2 and Note 5) |

|

|

(36,041 |

) |

|

|

— |

|

Other impairment expense (related to bitcoin) |

|

|

— |

|

|

|

83 |

|

Realized loss on sale of bitcoin |

|

|

— |

|

|

|

517 |

|

Depreciation and amortization |

|

|

29,847 |

|

|

|

19,329 |

|

Total costs and expenses |

|

$ |

45,275 |

|

|

$ |

56,702 |

|

|

|

|

|

|

|

|

Income (loss) from operations |

|

|

28,511 |

|

|

|

(28,883 |

) |

|

|

|

|

|

|

|

Other income (expense) |

|

|

|

|

|

|

Change in fair value of contingent consideration |

|

|

— |

|

|

|

485 |

|

Unrealized loss on derivative security |

|

|

(1,243 |

) |

|

|

(1,271 |

) |

Interest income |

|

|

586 |

|

|

|

70 |

|

Interest expense |

|

|

(546 |

) |

|

|

(889 |

) |

Total other (expense) income |

|

$ |

(1,203 |

) |

|

$ |

(1,605 |

) |

|

|

|

|

|

|

|

Income (loss) before income tax expense |

|

|

27,308 |

|

|

|

(30,488 |

) |

Income tax expense |

|

|

1,399 |

|

|

|

— |

|

Income (loss) from continuing operations |

|

$ |

25,909 |

|

|

$ |

(30,488 |

) |

|

|

|

|

|

|

|

Discontinued operations |

|

|

|

|

|

|

Income from discontinued operations |

|

$ |

— |

|

|

$ |

1,457 |

|

Income tax expense |

|

|

— |

|

|

|

— |

|

Income on discontinued operations |

|

$ |

— |

|

|

$ |

1,457 |

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

25,909 |

|

|

$ |

(29,031 |

) |

|

|

|

|

|

|

|

Preferred stock dividends |

|

|

579 |

|

|

|

— |

|

|

|

|

|

|

|

|

Net income (loss) attributable to common shareholders |

|

$ |

25,330 |

|

|

$ |

(29,031 |

) |

|

|

|

|

|

|

|

Other comprehensive income |

|

|

29 |

|

|

|

29 |

|

|

|

|

|

|

|

|

Total comprehensive income (loss) attributable to common shareholders |

|

$ |

25,359 |

|

|

$ |

(29,002 |

) |

CLEANSPARK, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS) (Continued)

(Unaudited, in thousands, except per share and share amounts)

|

|

|

|

|

|

|

|

|

|

|

For the three months ended |

|

|

|

December 31,

2023 |

|

|

December 31,

2022 |

|

Income (loss) from continuing operations per common share - basic |

|

$ |

0.14 |

|

|

$ |

(0.46 |

) |

|

|

|

|

|

|

|

Weighted average common shares outstanding - basic |

|

|

178,809,264 |

|

|

|

66,395,174 |

|

|

|

|

|

|

|

|

Income (loss) from continuing operations per common share - diluted |

|

$ |

0.14 |

|

|

$ |

(0.46 |

) |

|

|

|

|

|

|

|

Weighted average common shares outstanding - diluted |

|

|

180,783,535 |

|

|

|

66,395,174 |

|

|

|

|

|

|

|

|

Income (loss) on discontinued operations per common share - basic |

|

$ |

- |

|

|

$ |

0.02 |

|

|

|

|

|

|

|

|

Weighted average common shares outstanding - basic |

|

|

178,809,264 |

|

|

|

66,395,174 |

|

|

|

|

|

|

|

|

Income (loss) on discontinued operations per common share - diluted |

|

$ |

- |

|

|

$ |

0.02 |

|

|

|

|

|

|

|

|

Weighted average common shares outstanding - diluted |

|

|

180,783,535 |

|

|

|

67,400,334 |

|

CLEANSPARK, INC.

RECONCILIATION OF ADJUSTED EBITDA

(Unaudited, in thousands)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

Net income (loss) |

|

$ |

25,909 |

|

|

$ |

(29,031 |

) |

Adjustments: |

|

|

|

|

|

|

|

|

Loss on discontinued operations |

|

$ |

— |

|

|

$ |

(1,457 |

) |

Depreciation and amortization |

|

|

29,847 |

|

|

|

19,329 |

|

Share-based compensation expense |

|

|

9,953 |

|

|

|

5,878 |

|

Change in fair value of contingent consideration |

|

|

— |

|

|

|

(485 |

) |

Unrealized loss on derivative security |

|

|

1,243 |

|

|

|

1,271 |

|

Interest income |

|

|

(586 |

) |

|

|

(70 |

) |

Interest expense |

|

|

546 |

|

|

|

889 |

|

Loss on disposal of assets |

|

677 |

|

|

— |

|

Income tax expense |

|

1,399 |

|

|

— |

|

Other2 |

|

102 |

|

|

1,705 |

|

Total Adjusted EBITDA |

|

$ |

69,090 |

|

|

$ |

(1,971 |

) |

|

|

|

|

|

|

|

We have not excluded our net gain on fair value of bitcoin ($36,041 in the quarter ended December 31, 2023), which we now record in our statement of operations, as provided for in ASC 350-60 and as discussed elsewhere in our Form 10-Q.

2 Includes legal fees related to litigation & settlement related expenses, financing & business development transactions

Investor Relations Contact

Brittany Moore

702-989-7693

ir@cleanspark.com

Media Contact

Eleni Stylianou

702-989-7694

pr@cleanspark.com

v3.24.0.1

Document And Entity Information

|

Feb. 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 08, 2024

|

| Entity Registrant Name |

CLEANSPARK, INC.

|

| Entity Central Index Key |

0000827876

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-39187

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Tax Identification Number |

87-0449945

|

| Entity Address, Address Line One |

10624 S. Eastern Ave.

|

| Entity Address, Address Line Two |

Suite A -638

|

| Entity Address, City or Town |

Henderson

|

| Entity Address, State or Province |

NV

|

| Entity Address, Postal Zip Code |

89052

|

| City Area Code |

(702)

|

| Local Phone Number |

989-7692

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

CLSK

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

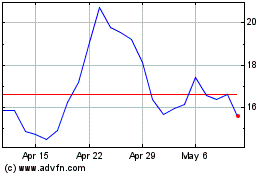

CleanSpark (NASDAQ:CLSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

CleanSpark (NASDAQ:CLSK)

Historical Stock Chart

From Apr 2023 to Apr 2024